Clinical Trial Supplies Market Report

Published Date: 31 January 2026 | Report Code: clinical-trial-supplies

Clinical Trial Supplies Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Clinical Trial Supplies market, offering insights into market dynamics, segmentation, regional performance, and future forecasts for the period from 2023 to 2033.

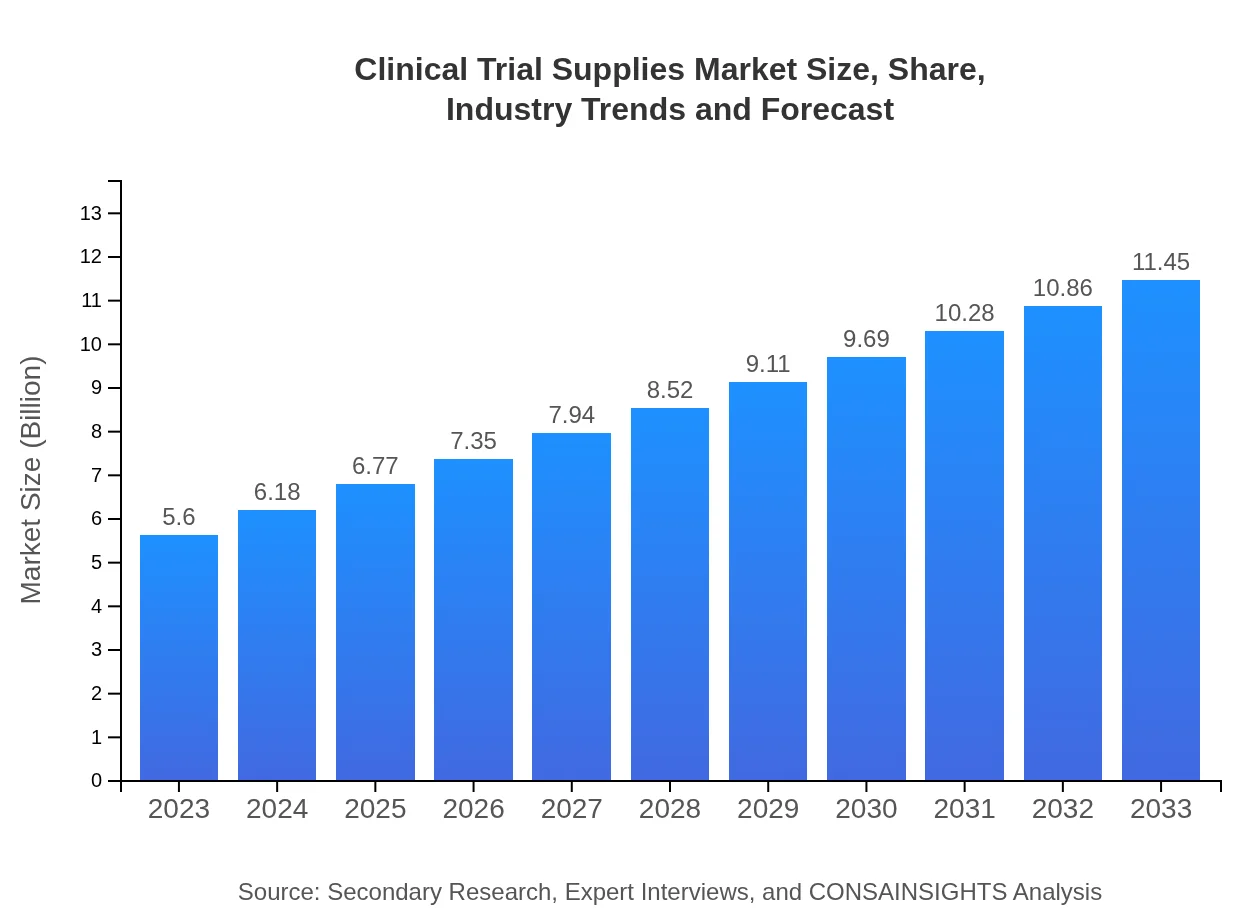

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $11.45 Billion |

| Top Companies | Thermo Fisher Scientific, Parexel International, Covance, IQVIA |

| Last Modified Date | 31 January 2026 |

Clinical Trial Supplies Market Overview

Customize Clinical Trial Supplies Market Report market research report

- ✔ Get in-depth analysis of Clinical Trial Supplies market size, growth, and forecasts.

- ✔ Understand Clinical Trial Supplies's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Clinical Trial Supplies

What is the Market Size & CAGR of Clinical Trial Supplies market in 2023?

Clinical Trial Supplies Industry Analysis

Clinical Trial Supplies Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Clinical Trial Supplies Market Analysis Report by Region

Europe Clinical Trial Supplies Market Report:

The European market for Clinical Trial Supplies is forecasted to grow from USD 1.44 billion in 2023 to USD 2.93 billion by 2033. Growth in this region is attributed to stringent regulatory requirements that enhance trial integrity, increased collaboration between biotech companies and CROs, and the ongoing modernization of clinical trials towards digital and decentralized methods.Asia Pacific Clinical Trial Supplies Market Report:

In the Asia Pacific region, the Clinical Trial Supplies market is projected to grow from USD 1.07 billion in 2023 to USD 2.19 billion by 2033. This growth is fueled by increasing investment in clinical research, favorable regulatory frameworks, and a higher number of clinical trials being conducted in emerging markets. The region's large patient population and cost-effective trial execution are further enhancing its attractiveness to global pharmaceutical companies.North America Clinical Trial Supplies Market Report:

North America stands as the largest market for Clinical Trial Supplies, with projections increasing from USD 2.16 billion in 2023 to USD 4.43 billion by 2033. Strong growth drivers include high R&D spending, technological advancements, and a robust healthcare ecosystem. The presence of numerous pharmaceutical companies and CROs in the U.S. also plays a significant role in the expansion of this market.South America Clinical Trial Supplies Market Report:

The market in South America is expected to expand from USD 0.39 billion in 2023 to USD 0.81 billion by 2033. Factors contributing to this growth include improving healthcare infrastructure, increasing investments in R&D, and the rising prevalence of chronic diseases. However, challenges related to regulatory processes and logistical issues still need addressing to fully realize the market's potential.Middle East & Africa Clinical Trial Supplies Market Report:

In the Middle East and Africa, the market is expected to rise from USD 0.53 billion in 2023 to USD 1.09 billion by 2033. This growth is driven by a burgeoning pharmaceutical market, increasing participation in clinical trials, and a growing awareness of international clinical standards. However, barriers such as insufficient infrastructure and regulatory complexities remain significant hurdles.Tell us your focus area and get a customized research report.

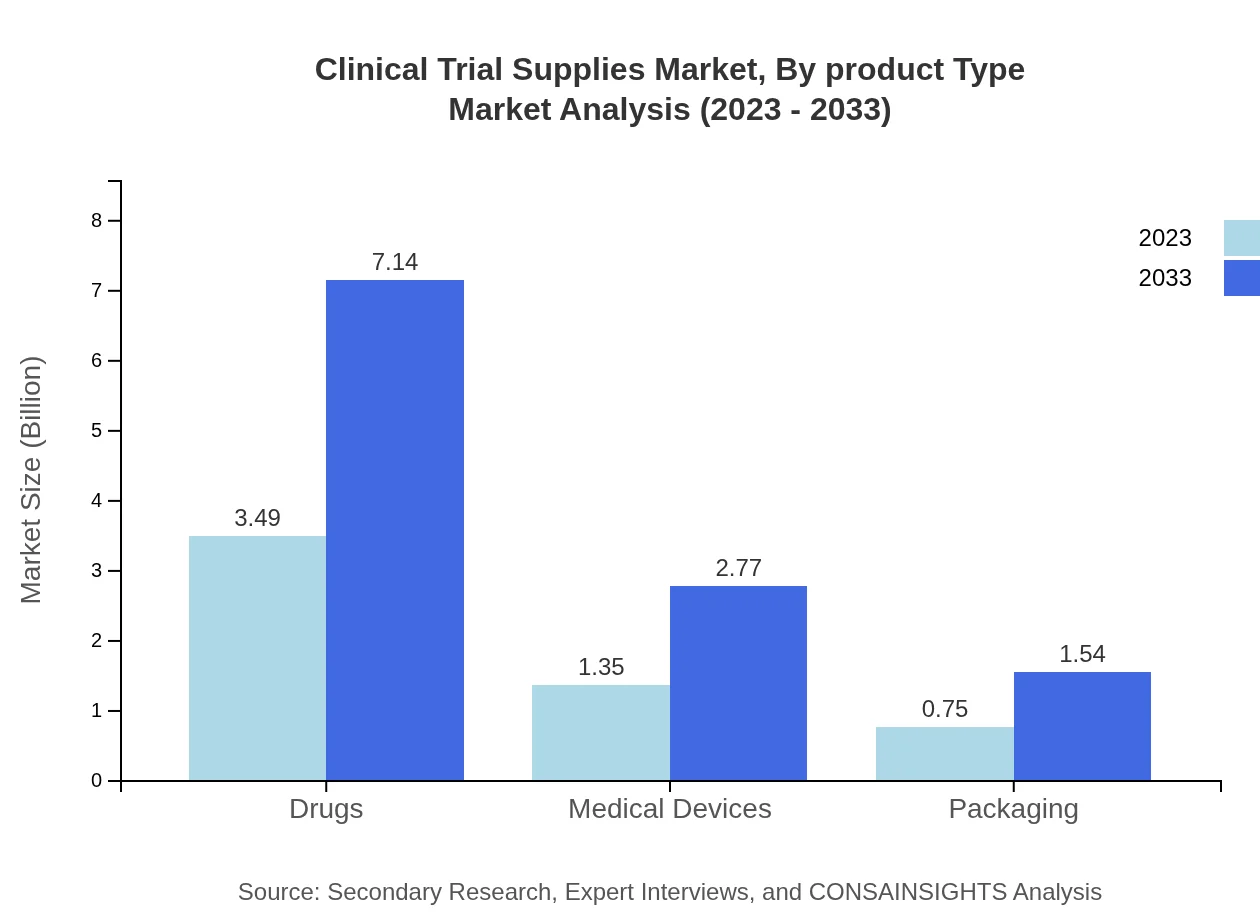

Clinical Trial Supplies Market Analysis By Product Type

The product type segment of the Clinical Trial Supplies market is dominated by investigational drugs, which represent a substantial share due to their critical role in clinical trials. In 2023, the market size for pharmaceutical companies is USD 3.49 billion, with a share of 62.38%. Academic institutions and CROs also contribute significantly, with sizes of USD 1.35 billion and USD 0.75 billion, respectively. By 2033, all segments are expected to continue their upward trajectory, driven by innovations and increasing trial activities.

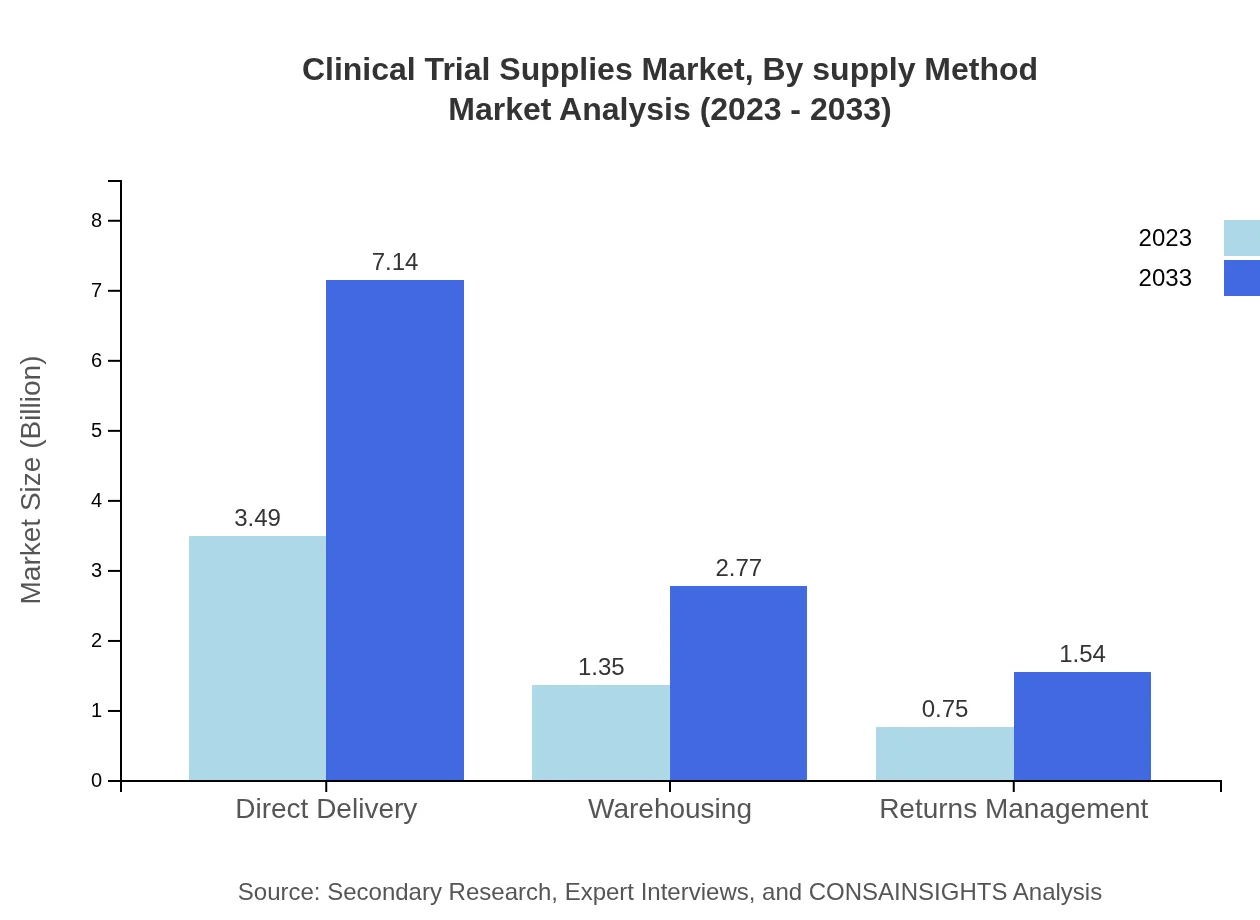

Clinical Trial Supplies Market Analysis By Supply Method

The supply method segment includes options such as direct delivery and warehousing. Direct delivery holds the largest market share, with a size of USD 3.49 billion in 2023, maintaining a share of 62.38%. This emphasizes the trend towards expedited and efficient supply chains in clinical trial management. Other methods, including returns management and packaging, also hold significant shares that show promising growth trajectories through to 2033.

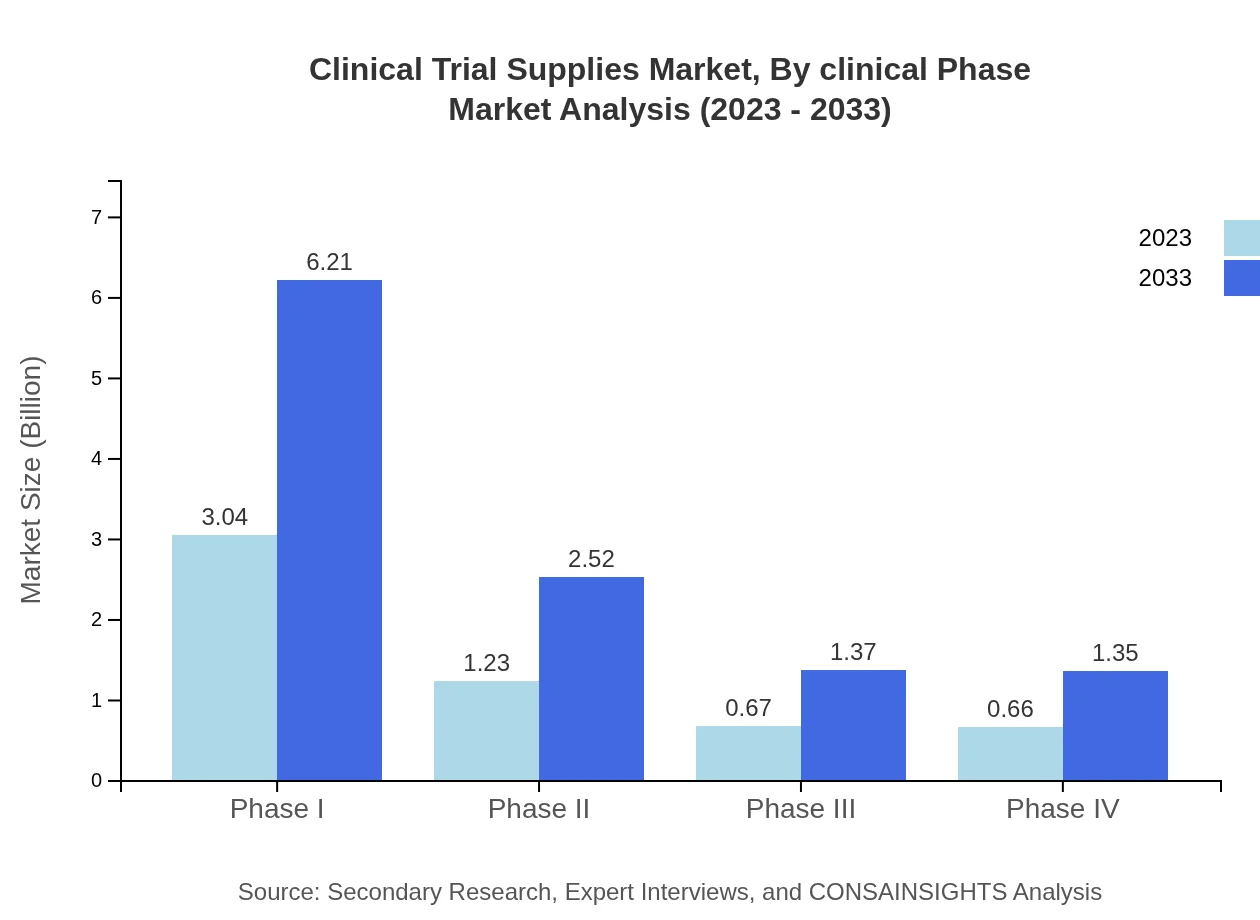

Clinical Trial Supplies Market Analysis By Clinical Phase

In the clinical phase segmentation, Phase I trials lead with a market size of USD 3.04 billion in 2023, representing 54.26% of the share. This dominance reflects the extensive requirements during early-stage trials where extensive supply management is critical. Subsequent phases, especially Phase II, are also seeing consistent growth, projected to reach USD 2.52 billion by 2033, demonstrating the increasing complexity and necessities of later-stage trials.

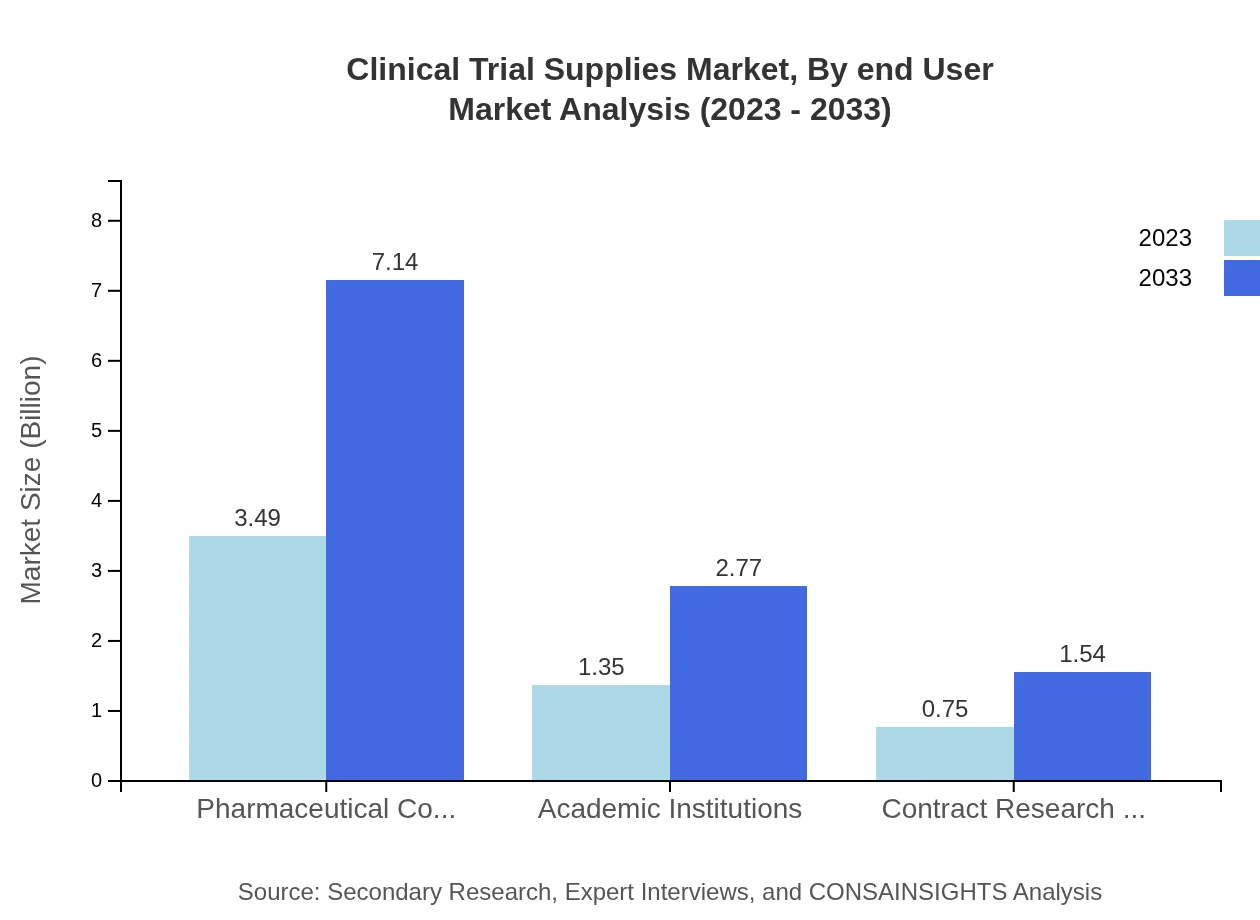

Clinical Trial Supplies Market Analysis By End User

The Clinical Trial Supplies market, analyzed by end-user, shows pharmaceutical companies as the primary consumers with a market size enlarging from USD 3.49 billion in 2023 to USD 7.14 billion by 2033. Academic institutions and CROs retain significant market shares, highlighting their critical roles in conducting clinical trials and fostering innovation in the pharmaceutical landscape.

Clinical Trial Supplies Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Clinical Trial Supplies Industry

Thermo Fisher Scientific:

Thermo Fisher Scientific is a leading provider of analytical instruments, reagents, and consumables for use in clinical trials, known for its commitment to quality and innovation in laboratory and logistical services.Parexel International:

A global leader in clinical research, Parexel offers a full range of services in clinical trial management, significant for its expertise in optimizing the clinical supply chain.Covance:

Covance is known for its comprehensive drug development services and is a key player in ensuring effective management of clinical trial supplies, especially in clinical logistics.IQVIA :

IQVIA merges technology and analytics with deep insights into the healthcare sector, providing extensive resources for managing clinical trial supplies effectively.We're grateful to work with incredible clients.

FAQs

What is the market size of clinical Trial Supplies?

The clinical trial supplies market is valued at $5.6 billion in 2023 and is projected to grow at a CAGR of 7.2%, reaching substantial growth by 2033.

What are the key market players or companies in this clinical trial supplies industry?

Key players in the clinical trial supplies industry include major pharmaceutical companies, specialized contract research organizations, and suppliers of clinical trial materials, which drive innovations and ensure compliance with regulatory standards.

What are the primary factors driving the growth in the clinical trial supplies industry?

Growth in the clinical trial supplies market is driven by increasing demand for novel therapies, rising investments in drug development, and a focus on efficiency in clinical trials through advanced supply chain management.

Which region is the fastest Growing in the clinical trial supplies?

The fastest-growing region in the clinical trial supplies market is North America, projected to grow from $2.16 billion in 2023 to $4.43 billion by 2033, followed closely by the Asia Pacific region.

Does ConsaInsights provide customized market report data for the clinical trial supplies industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the clinical trial supplies industry, enabling clients to gain deeper insights based on unique requirements.

What deliverables can I expect from this clinical trial supplies market research project?

Deliverables from the clinical trial supplies market research project typically include detailed market analysis reports, insights on trends, competitor profiles, and forecasts segmented by region and type.

What are the market trends of clinical trial supplies?

Current trends in the clinical trial supplies market include the rise of decentralized trials, the use of technology for supply chain automation, and an increasing emphasis on minimizing waste during clinical trials.