Cloud Based Pos Market Report

Published Date: 31 January 2026 | Report Code: cloud-based-pos

Cloud Based Pos Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Cloud Based POS market, including market size, growth trends, segmentation, and regional insights for the forecast period 2023 to 2033.

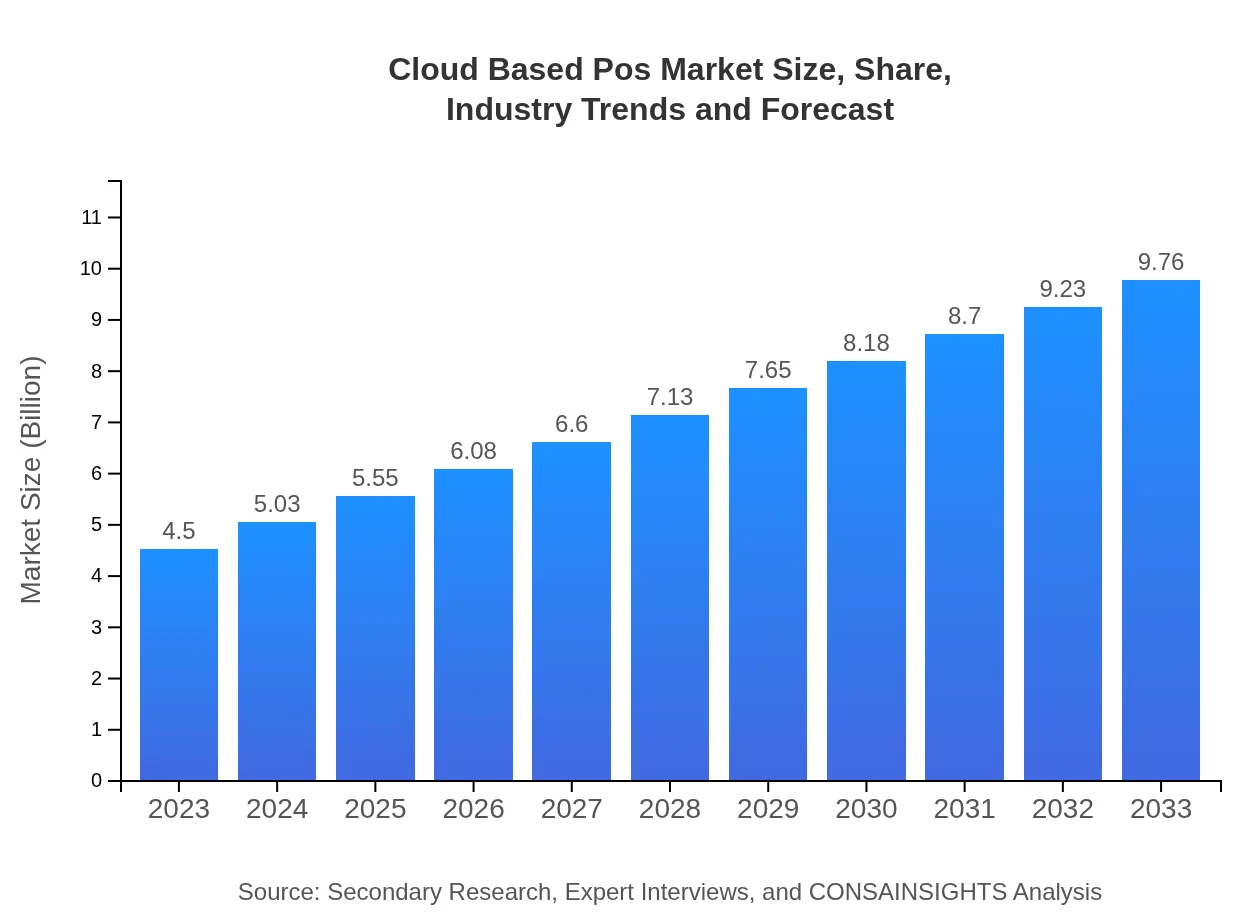

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $9.76 Billion |

| Top Companies | Square, Inc., Clover Network, Inc., Lightspeed POS |

| Last Modified Date | 31 January 2026 |

Cloud Based Pos Market Overview

Customize Cloud Based Pos Market Report market research report

- ✔ Get in-depth analysis of Cloud Based Pos market size, growth, and forecasts.

- ✔ Understand Cloud Based Pos's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cloud Based Pos

What is the Market Size & CAGR of Cloud Based Pos market in 2023 and 2033?

Cloud Based Pos Industry Analysis

Cloud Based Pos Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cloud Based Pos Market Analysis Report by Region

Europe Cloud Based Pos Market Report:

In Europe, the Cloud Based POS market is estimated to be $1.26 billion in 2023 and is expected to grow to $2.74 billion by 2033. The growth drivers include increasing internet penetration, as well as supportive regulations favoring cloud technology. Markets in the UK, Germany, and France are particularly dynamic, showing a keen interest in integrated POS solutions to enhance customer experience.Asia Pacific Cloud Based Pos Market Report:

In 2023, the Asia-Pacific Cloud Based POS market is valued at $0.85 billion and is projected to grow to $1.85 billion by 2033, reflecting a strong CAGR driven by rapid urbanization and increased smartphone penetration. Countries like China and India are leading this growth, with significant investments in technology infrastructure and a booming retail sector. The rising trend of digital payments is expected to further broaden market access.North America Cloud Based Pos Market Report:

North America leads the Cloud Based POS market with a valuation of $1.71 billion in 2023, expected to reach $3.71 billion by 2033, showcasing a strong growth trend. The region is characterized by early technology adoption and a high demand for innovative business solutions. The presence of leading market players, coupled with favorable investment climates, boosts this market's growth.South America Cloud Based Pos Market Report:

The South American market for Cloud Based POS is expected to expand from $0.40 billion in 2023 to $0.87 billion by 2033. The region's growth is propelled by increasing retail modernization and the shift towards digital payment solutions amidst a growing middle class. Key markets in Brazil and Argentina are anticipated to set this trend as local vendors embrace cloud solutions.Middle East & Africa Cloud Based Pos Market Report:

The Middle East and Africa market for Cloud Based POS is valued at $0.27 billion in 2023 and anticipated to reach $0.60 billion by 2033. This market is driven by a young, tech-savvy population and growing investments in retail and hospitality sectors. Countries like UAE and South Africa are exploring cloud-based solutions to modernize their business operations.Tell us your focus area and get a customized research report.

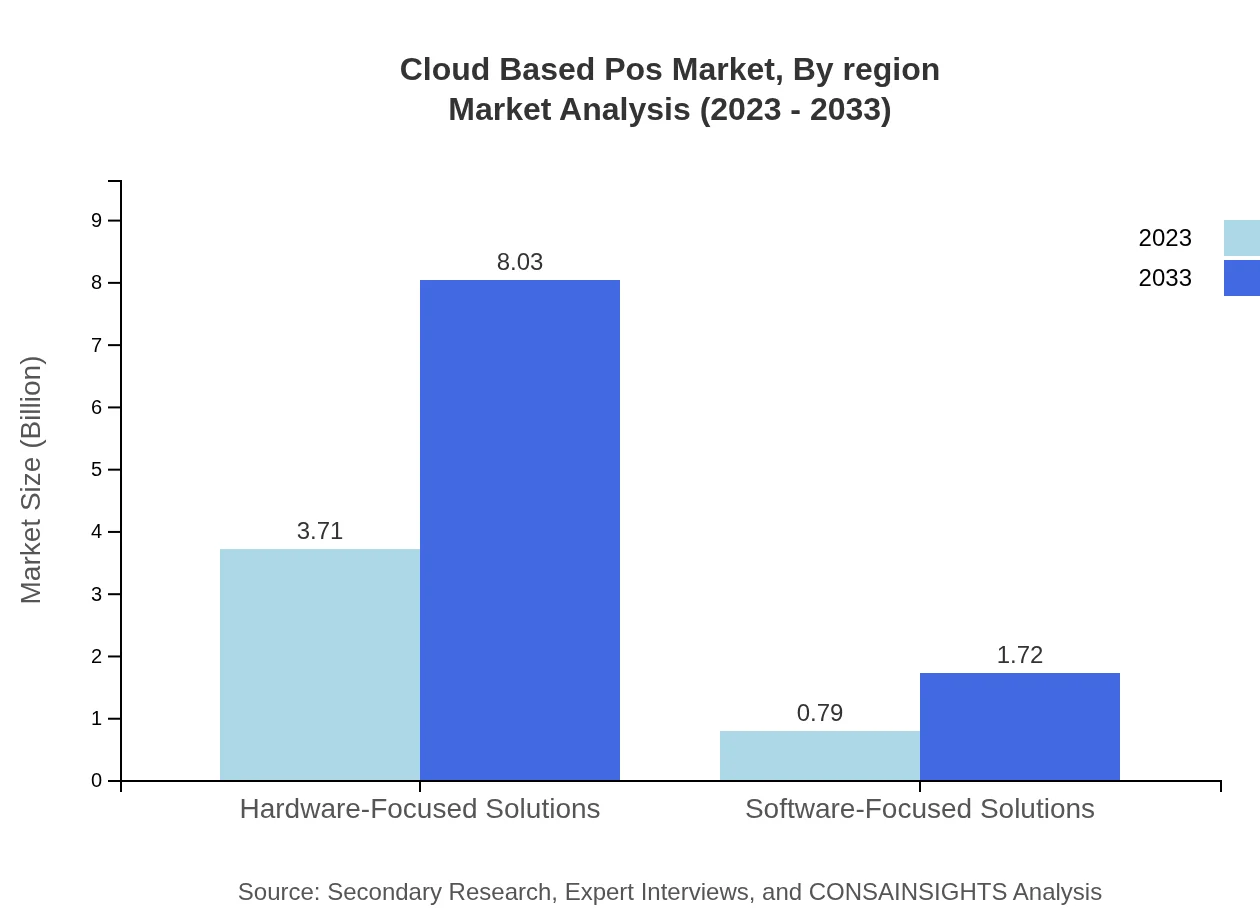

Cloud Based Pos Market Analysis By Product

The Cloud-Based POS market is segmented into Hardware-Focused Solutions and Software-Focused Solutions. Hardware-Focused Solutions dominate the market, valued at $3.71 billion in 2023 and expected to grow to $8.03 billion by 2033, holding an 82.35% market share. Software-Focused Solutions, while smaller at $0.79 billion in 2023, show potential growth to $1.72 billion, retaining a share of 17.65% as more businesses adopt software solutions for enhanced operational efficiency.

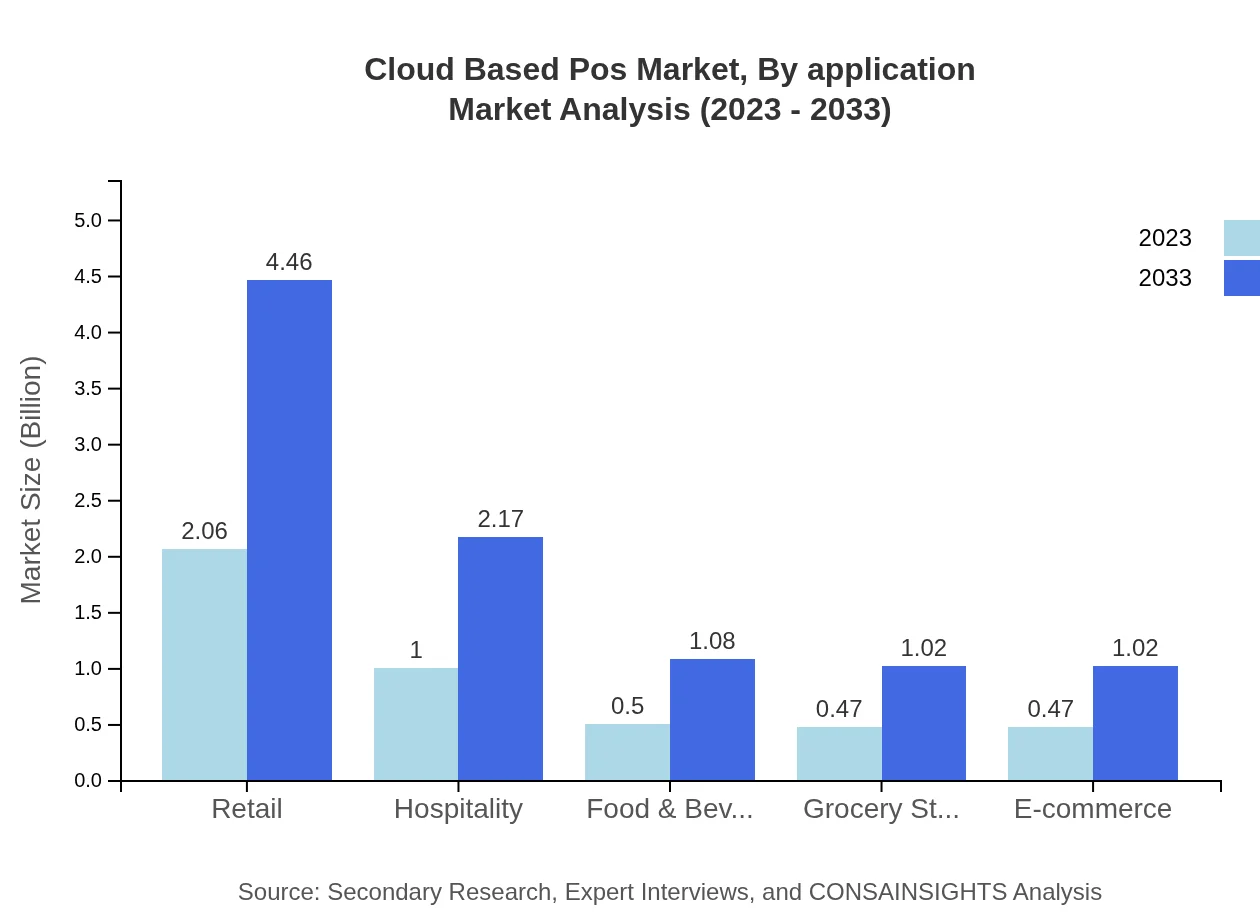

Cloud Based Pos Market Analysis By Application

The applications of Cloud-Based POS systems span various end-user industries including retail, hospitality, food & beverage, and e-commerce. Retail holds a significant share with a market size of $2.06 billion in 2023 and is projected to grow to $4.46 billion by 2033. Each of these segments is critical as they contribute uniquely to the overall market, driven by varying consumer demands.

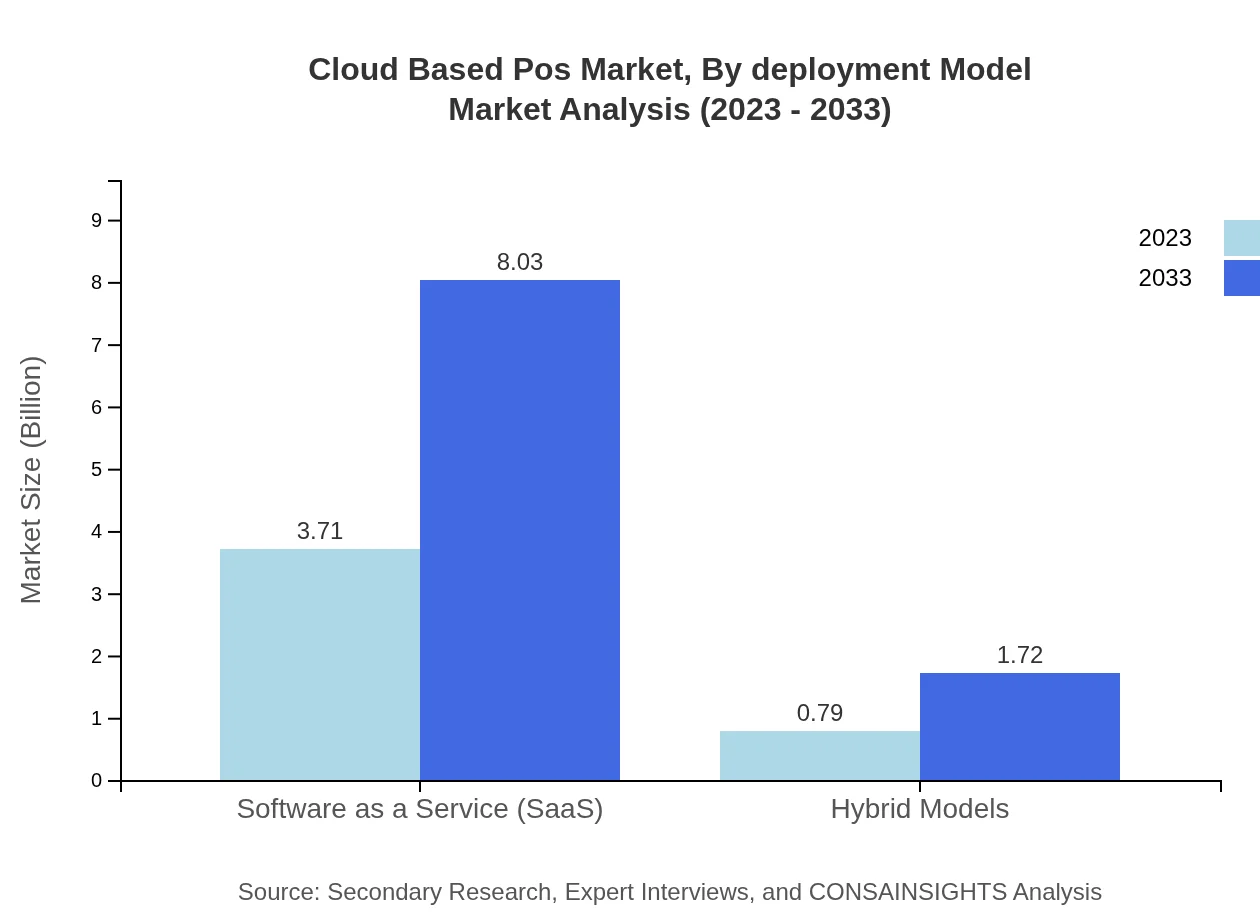

Cloud Based Pos Market Analysis By Deployment Model

The deployment model segment includes Software as a Service (SaaS) and Hybrid Models. SaaS remains the market leader, with a market size of $3.71 billion in 2023, expanding to $8.03 billion by 2033. SaaS's scalability and cost-effectiveness appeal to a myriad of businesses, while Hybrid Models, valued at $0.79 billion in 2023, are predicted to grow to $1.72 billion as businesses look for flexible solutions.

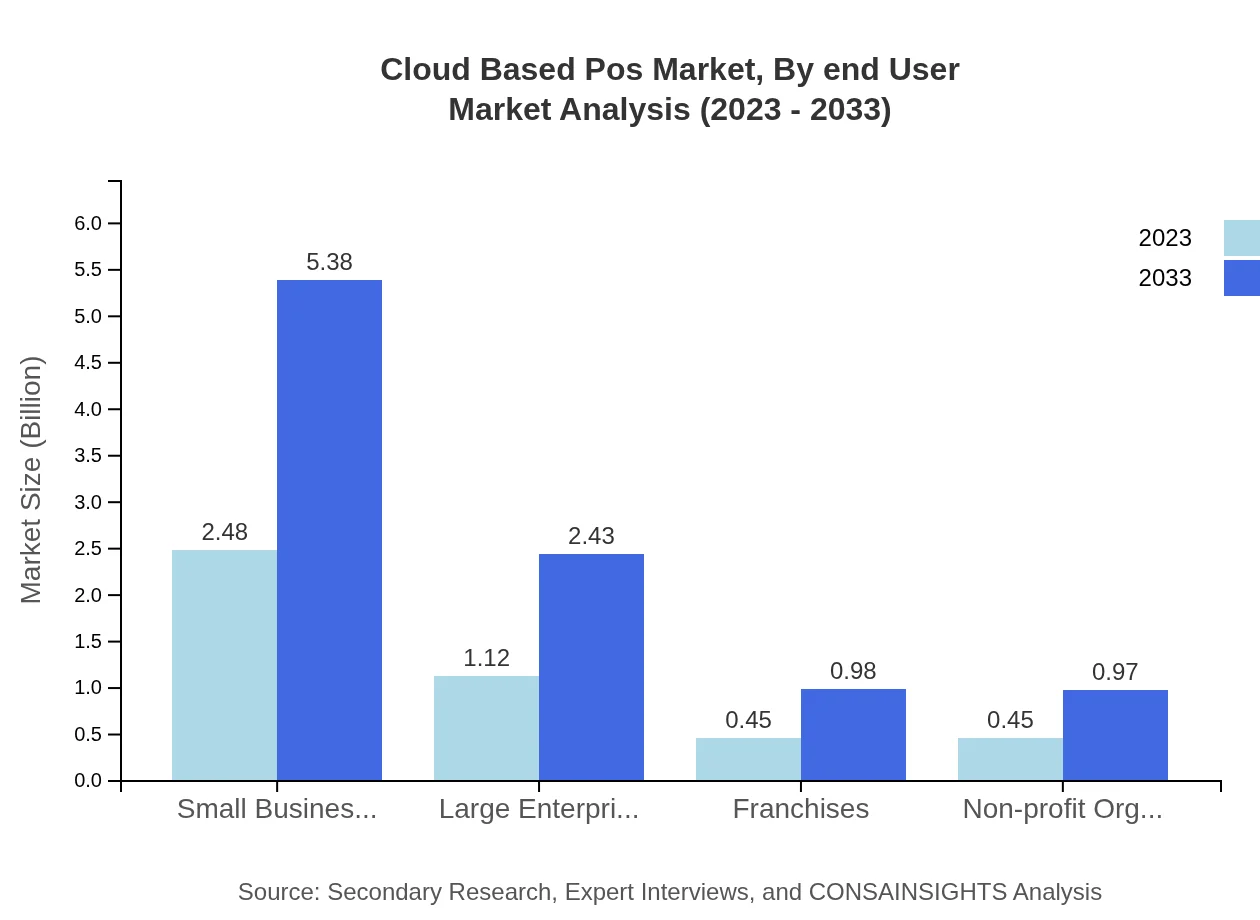

Cloud Based Pos Market Analysis By End User

The end-user segmentation includes Small Businesses, Large Enterprises, and Franchises. Small Businesses are the largest segment, with a market size of $2.48 billion in 2023, expected to reach $5.38 billion by 2033. The agility and affordability of Cloud Based POS solutions cater well to small businesses, making them more accessible and appealing.

Cloud Based Pos Market Analysis By Region

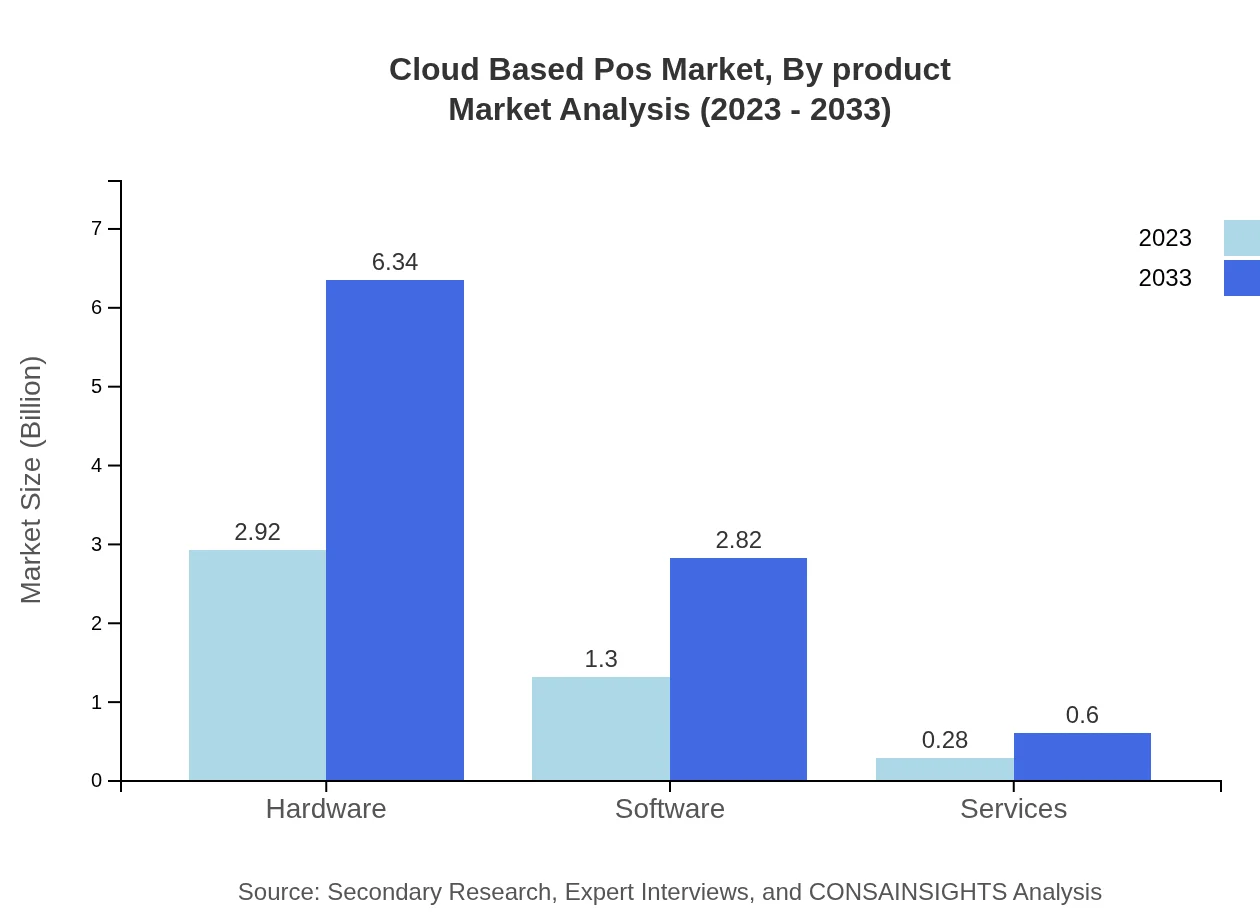

The Cloud Based POS market is also analyzed by types categorized into Hardware and Software. Hardware possesses a significant market size of $2.92 billion in 2023 growing to $6.34 billion by 2033, while Software shows a gradual growth from $1.30 billion to $2.82 billion during the same period, showcasing the ongoing transition towards software-driven solutions.

Cloud Based Pos Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cloud Based Pos Industry

Square, Inc.:

Square, Inc. is a leading player in the Cloud Based POS space, offering inclusive payment solutions tailored for small businesses. Known for their user-friendly interface and robust analytics, they create tools that help manage finances effectively.Clover Network, Inc.:

Clover Network provides cloud-based POS systems designed for restaurants and retail sectors, allowing enhanced customer engagement. Their ecosystem includes diverse applications that cater to various business needs.Lightspeed POS:

Lightspeed POS is recognized for its powerful cloud-based solutions that serve medium-sized businesses, offering comprehensive tools for inventory management and customer relationship.We're grateful to work with incredible clients.

FAQs

What is the market size of cloud Based POS?

The cloud-based POS market is valued at approximately $4.5 billion in 2023, with a projected CAGR of 7.8% from 2023 to 2033, indicating significant growth potential in this sector.

What are the key market players or companies in this cloud Based POS industry?

Key players in the cloud-based POS market include Square, Toast, Shopify, Lightspeed, and NCR Corporation. These companies lead through innovative technology solutions that enhance transaction processing and customer engagement.

What are the primary factors driving the growth in the cloud Based POS industry?

Growth in the cloud-based POS industry is driven by the increasing adoption of digital payments, the rising demand for integrated business solutions, and the necessity for real-time data analytics to improve customer experience and operational efficiency.

Which region is the fastest Growing in the cloud Based POS?

North America is the fastest-growing region in the cloud-based POS market, expanding from $1.71 billion in 2023 to $3.71 billion by 2033, driven by technological advancements and high consumer demand for seamless transaction solutions.

Does ConsaInsights provide customized market report data for the cloud Based POS industry?

Yes, ConsaInsights offers customized market report data for the cloud-based POS industry, catering to specific client needs and providing insights tailored to various business sectors and regional markets.

What deliverables can I expect from this cloud Based POS market research project?

Deliverables from the cloud-based POS market research project include comprehensive reports on market size, trends, competitive analysis, regional segmentation, and growth forecasts, offering crucial insights for strategic business decisions.

What are the market trends of cloud Based POS?

Current trends in the cloud-based POS market include the rise of Software as a Service (SaaS) models, the integration of AI for enhanced customer experiences, and the growing focus on mobile payment solutions among retailers and service providers.