Cloud Encryption Software Market Report

Published Date: 31 January 2026 | Report Code: cloud-encryption-software

Cloud Encryption Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Cloud Encryption Software market, offering insights on market conditions, forecasts from 2023 to 2033, and details on segment performance and regional dynamics.

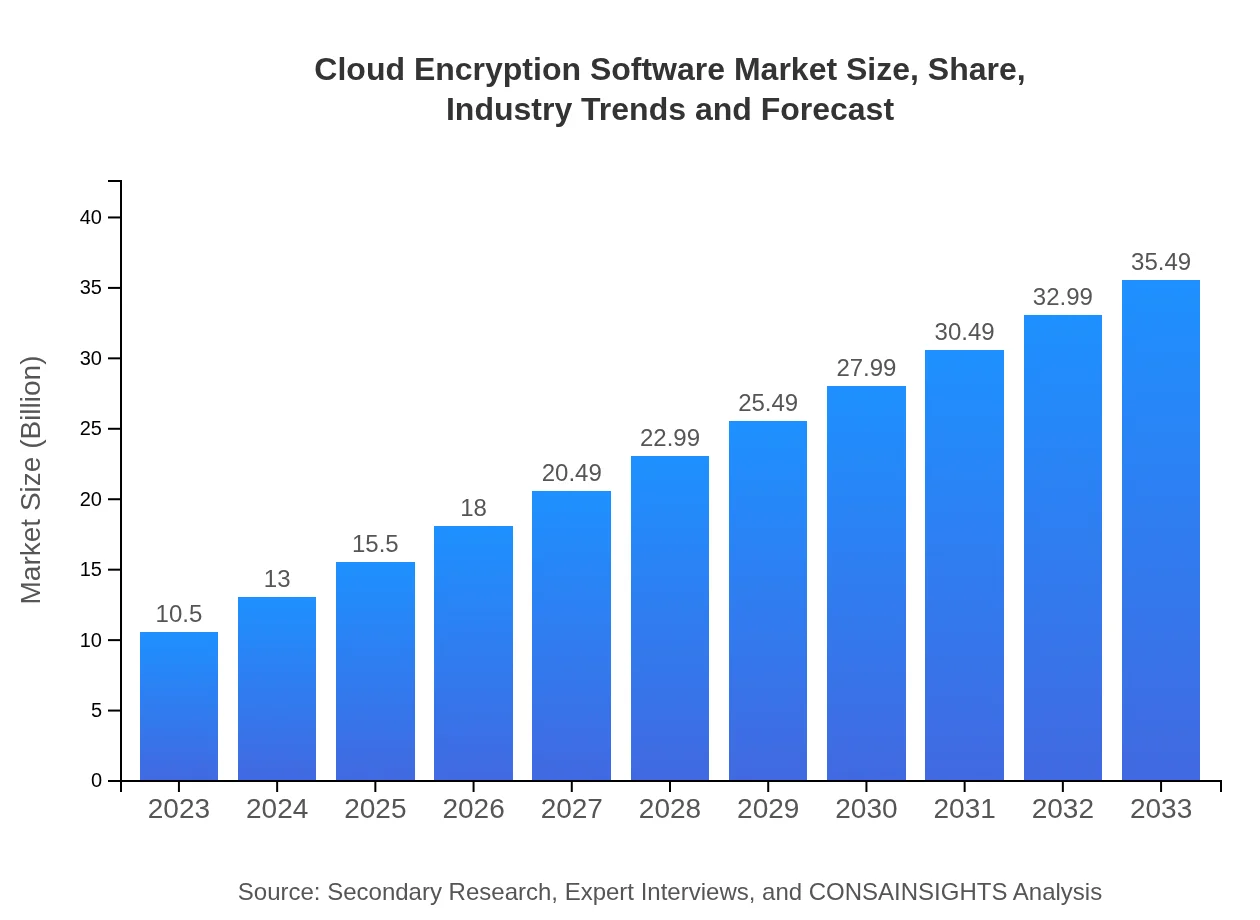

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 12.4% |

| 2033 Market Size | $35.49 Billion |

| Top Companies | Thales e-Security, McAfee, Symantec, IBM |

| Last Modified Date | 31 January 2026 |

Cloud Encryption Software Market Overview

Customize Cloud Encryption Software Market Report market research report

- ✔ Get in-depth analysis of Cloud Encryption Software market size, growth, and forecasts.

- ✔ Understand Cloud Encryption Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cloud Encryption Software

What is the Market Size & CAGR of Cloud Encryption Software market in 2023?

Cloud Encryption Software Industry Analysis

Cloud Encryption Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cloud Encryption Software Market Analysis Report by Region

Europe Cloud Encryption Software Market Report:

In Europe, the market is forecasted to increase from $3.47 billion in 2023 to $11.72 billion by 2033. The region is a strong advocate of data protection regulations such as GDPR, prompting organizations to prioritize encryption in their compliance strategies. The rise of tech startups focusing on cybersecurity further enriches the competitive landscape.Asia Pacific Cloud Encryption Software Market Report:

The Asia Pacific region is witnessing robust growth in the Cloud Encryption Software market, with projections estimating the market to grow from $2.00 billion in 2023 to $6.75 billion by 2033. The rise in cloud adoption by businesses across sectors, coupled with increasing cyber threats, is driving market growth in this region. Advancements in technology and a surge in data privacy regulations are paving the way for new encryption investments.North America Cloud Encryption Software Market Report:

North America holds a significant share of the Cloud Encryption Software market, expected to grow from $3.42 billion in 2023 to $11.55 billion in 2033. This growth is driven by the presence of numerous key players, heightened awareness of data security, and stringent regulatory mandates. Companies are investing heavily to enhance their cybersecurity frameworks, including the implementation of advanced encryption solutions.South America Cloud Encryption Software Market Report:

The South American market is anticipated to grow from $0.82 billion in 2023 to $2.78 billion in 2033. The demand for cloud encryption solutions is gaining momentum due to increasing internet penetration and the growing reliance on cloud services among enterprises. Security concerns about data handling and legislative changes are influencing organizations to adopt encryption technologies.Middle East & Africa Cloud Encryption Software Market Report:

The Middle East and Africa market is projected to grow from $0.80 billion in 2023 to $2.69 billion by 2033. The increasing focus on digital transformation and the subsequent demand for data security are key factors driving growth in this region. Investments from both private and government sectors toward securing cloud environments provide a significant boost to the market.Tell us your focus area and get a customized research report.

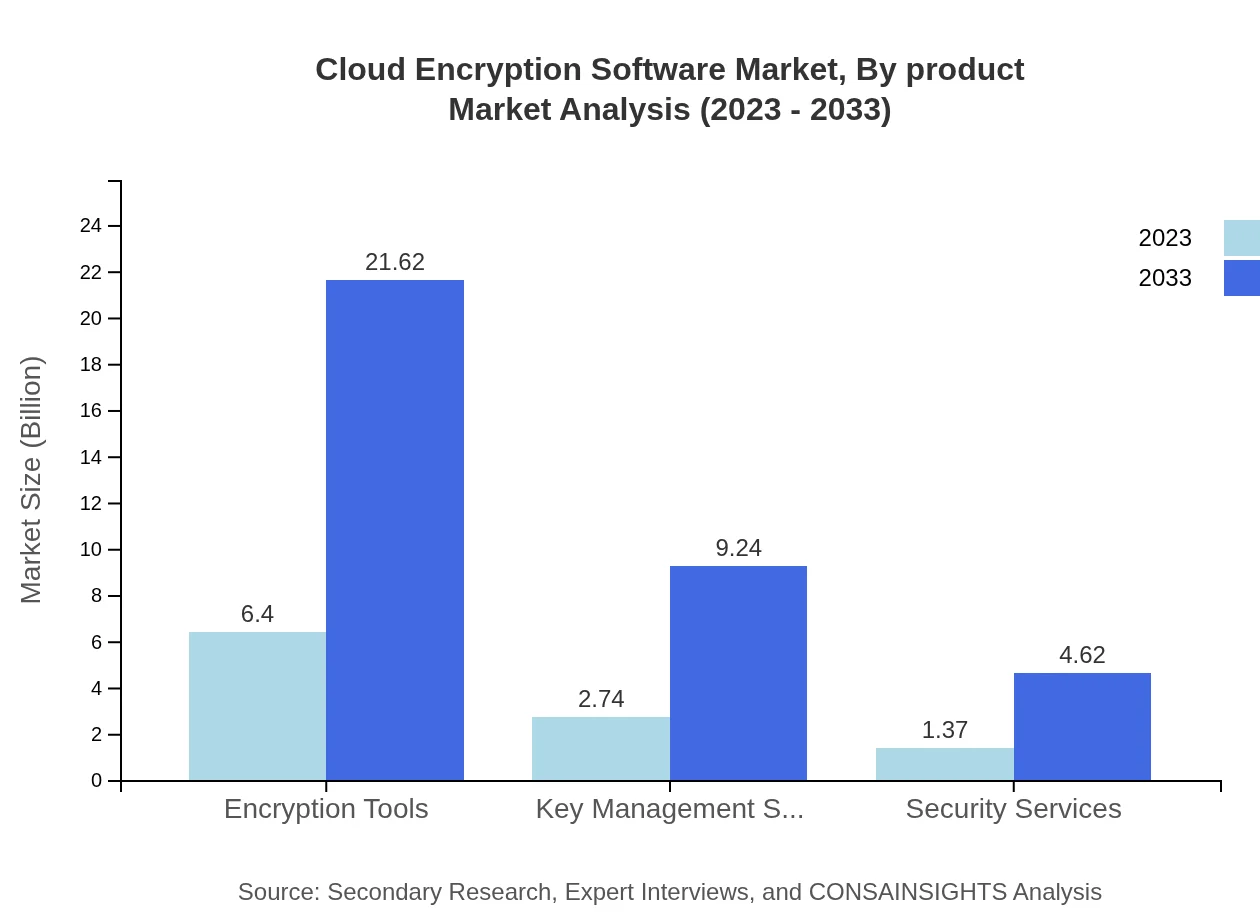

Cloud Encryption Software Market Analysis By Product

In 2023, Encryption Tools dominate the product category with a market size of $6.40 billion, expected to reach $21.62 billion by 2033, holding a 60.93% market share throughout the forecast period. Key Management Solutions follow with a size of $2.74 billion in 2023, anticipated to grow to $9.24 billion by 2033, accounting for 26.05% of the market share. Security Services, while smaller at $1.37 billion in 2023, will grow to $4.62 billion by 2033, holding a 13.02% market share.

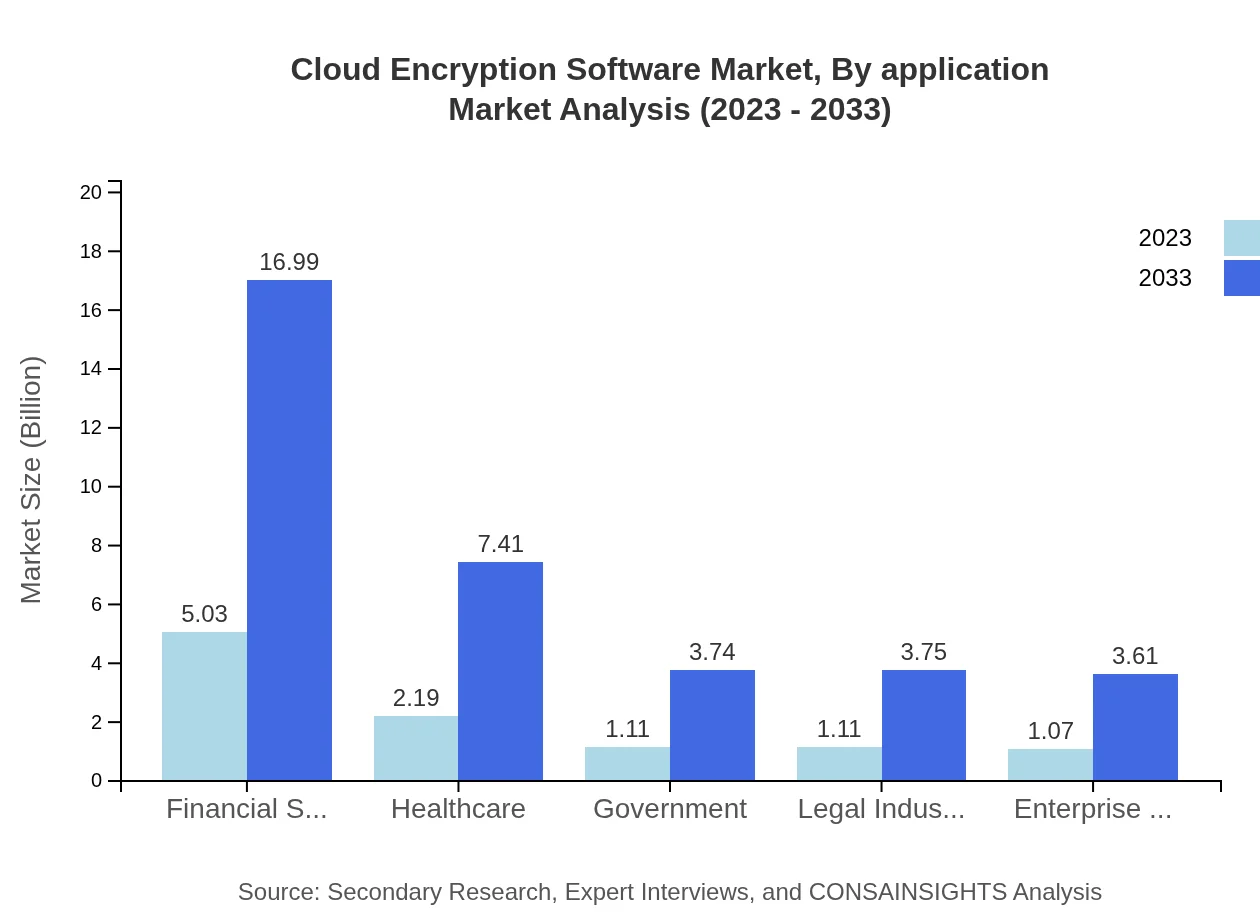

Cloud Encryption Software Market Analysis By Application

Applications in Financial Services lead the segment with a market size of $5.03 billion in 2023, projected to advance to $16.99 billion by 2033, representing a substantial share of 47.88%. Other sectors, such as Healthcare and Government, are set to experience parallel growth, with the Healthcare segment growing from $2.19 billion to $7.41 billion and Government from $1.11 billion to $3.74 billion, maintaining shares of 20.87% and 10.53% respectively.

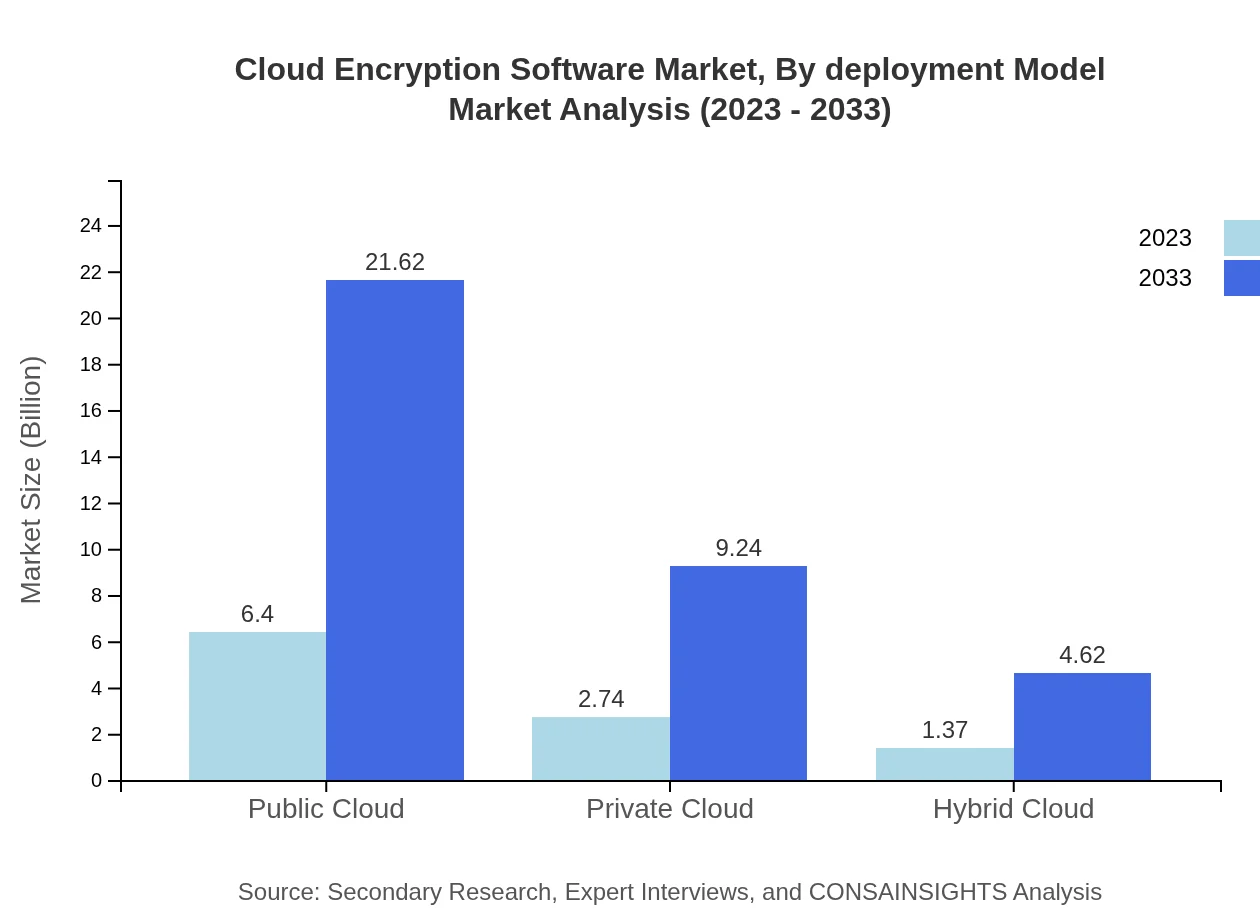

Cloud Encryption Software Market Analysis By Deployment Model

The Public Cloud deployment model retains the largest market share, valued at $6.40 billion in 2023 and expected to reach $21.62 billion by 2033. The Private Cloud model is also noteworthy with a size increase from $2.74 billion to $9.24 billion, while Hybrid Cloud models show slower growth from $1.37 billion to $4.62 billion with stable share percentages, catering to varying enterprise needs.

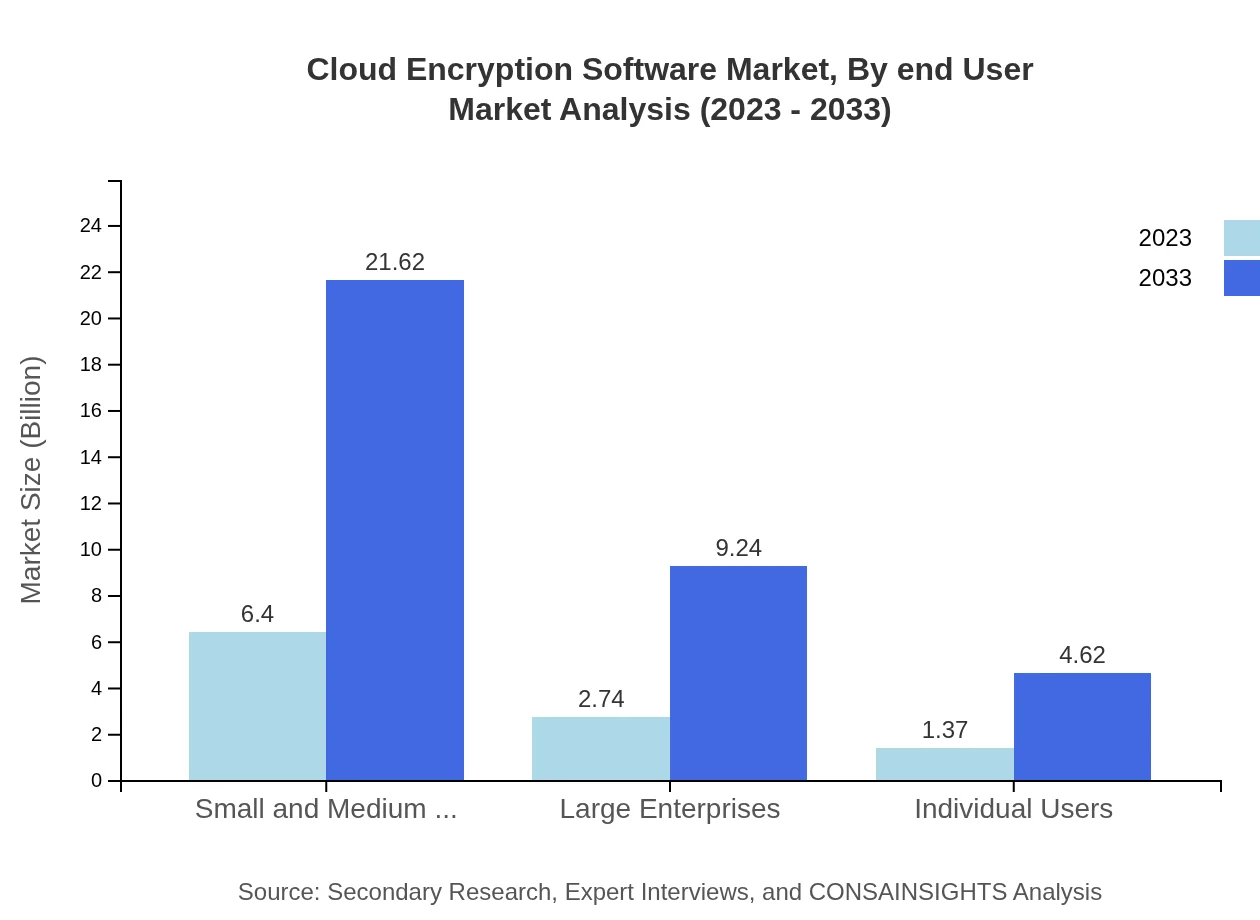

Cloud Encryption Software Market Analysis By End User

Small and Medium Enterprises are substantial contributors to the Cloud Encryption Software market, valued at $6.40 billion in 2023. This segment is projected to expand significantly to $21.62 billion by 2033. Conversely, Large Enterprises are also engaging more in this space, increasing their investment from $2.74 billion to $9.24 billion over the forecast period.

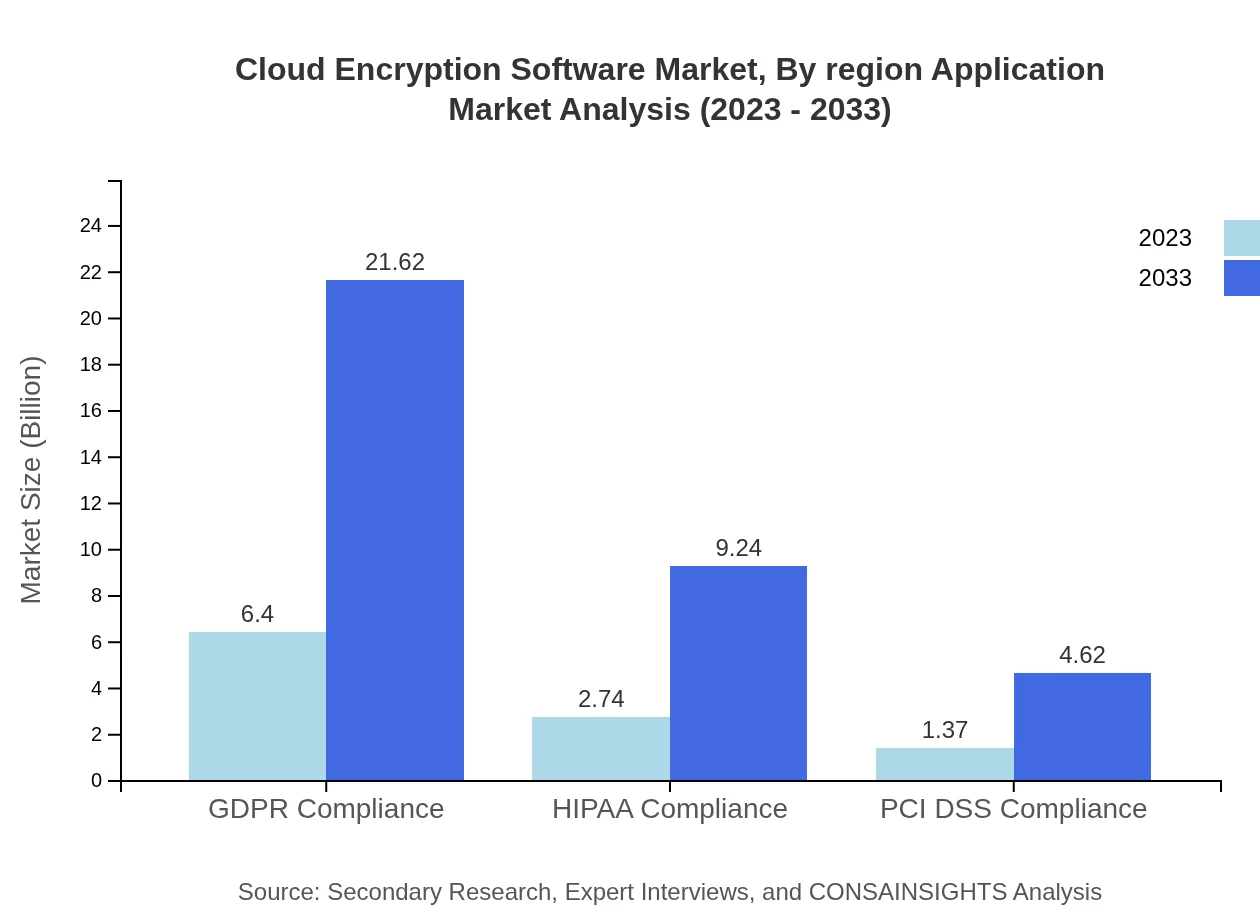

Cloud Encryption Software Market Analysis By Region Application

Compliance with GDPR is a key driver within the market, showcasing a market size of $6.40 billion in 2023 and anticipated growth to $21.62 billion by 2033. HIPAA and PCI DSS Compliance segments also exhibit compelling growth rates driven by sustained regulatory scrutiny and the imperative for organizations to secure sensitive information.

Cloud Encryption Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cloud Encryption Software Industry

Thales e-Security:

Thales e-Security specializes in data protection solutions, offering robust encryption services to secure sensitive information stored in the cloud.McAfee:

McAfee provides comprehensive security solutions, including cloud encryption, to ensure data privacy and compliance across various platforms.Symantec:

Symantec is a leader in the cybersecurity realm, offering innovative cloud encryption solutions tailored to meet regulatory requirements.IBM:

IBM combines artificial intelligence and encryption technologies to provide cutting-edge cloud security solutions for enterprises.We're grateful to work with incredible clients.

FAQs

What is the market size of cloud Encryption Software?

The cloud encryption software market is currently valued at approximately $10.5 billion in 2023, with an impressive compound annual growth rate (CAGR) of 12.4%. This growth is expected to reach significantly higher valuations by 2033, reflecting increasing adoption across various sectors.

What are the key market players or companies in the cloud Encryption Software industry?

Key players in the cloud encryption software industry include major technology companies like IBM, Microsoft, AWS, and Oracle. These leaders are recognized for their strong product portfolios, innovative solutions, and extensive resources to address diverse customer needs in cloud security.

What are the primary factors driving the growth in the cloud encryption software industry?

Factors driving growth in the cloud encryption industry include rising cyber threats, the need for regulatory compliance, increased cloud adoption, and the need for enhanced data security. Organizations are investing more in robust encryption solutions to protect sensitive information.

Which region is the fastest Growing in the cloud encryption software market?

North America is currently the fastest-growing region in the cloud encryption software market, with a projected growth from $3.42 billion in 2023 to $11.55 billion by 2033. This is due to high adoption rates among enterprises and stringent data protection regulations.

Does ConsaInsights provide customized market report data for the cloud encryption software industry?

Yes, ConsaInsights offers customized market report data for the cloud encryption software industry. Clients can request tailored analyses that align with their specific requirements, focusing on areas like market trends, emerging technologies, and competitive landscapes.

What deliverables can I expect from this cloud encryption software market research project?

From this market research project, you can expect detailed reports, data insights, segment analysis, competitive landscape evaluation, and forecasts. Our findings will provide actionable strategies for navigating the cloud encryption software market efficiently.

What are the market trends of cloud encryption software?

Current trends in the cloud encryption software market include increasing focus on GDPR and HIPAA compliance, rising demand for key management solutions, and a shift toward hybrid cloud environments. Innovations in AI and machine learning are also playing pivotal roles.