Cloud Integration Software Market Report

Published Date: 31 January 2026 | Report Code: cloud-integration-software

Cloud Integration Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Cloud Integration Software market, covering key insights, segmentation, regional analysis, and market forecasts through 2033. It highlights market trends, technology advancements, and key players shaping the future of cloud integration solutions.

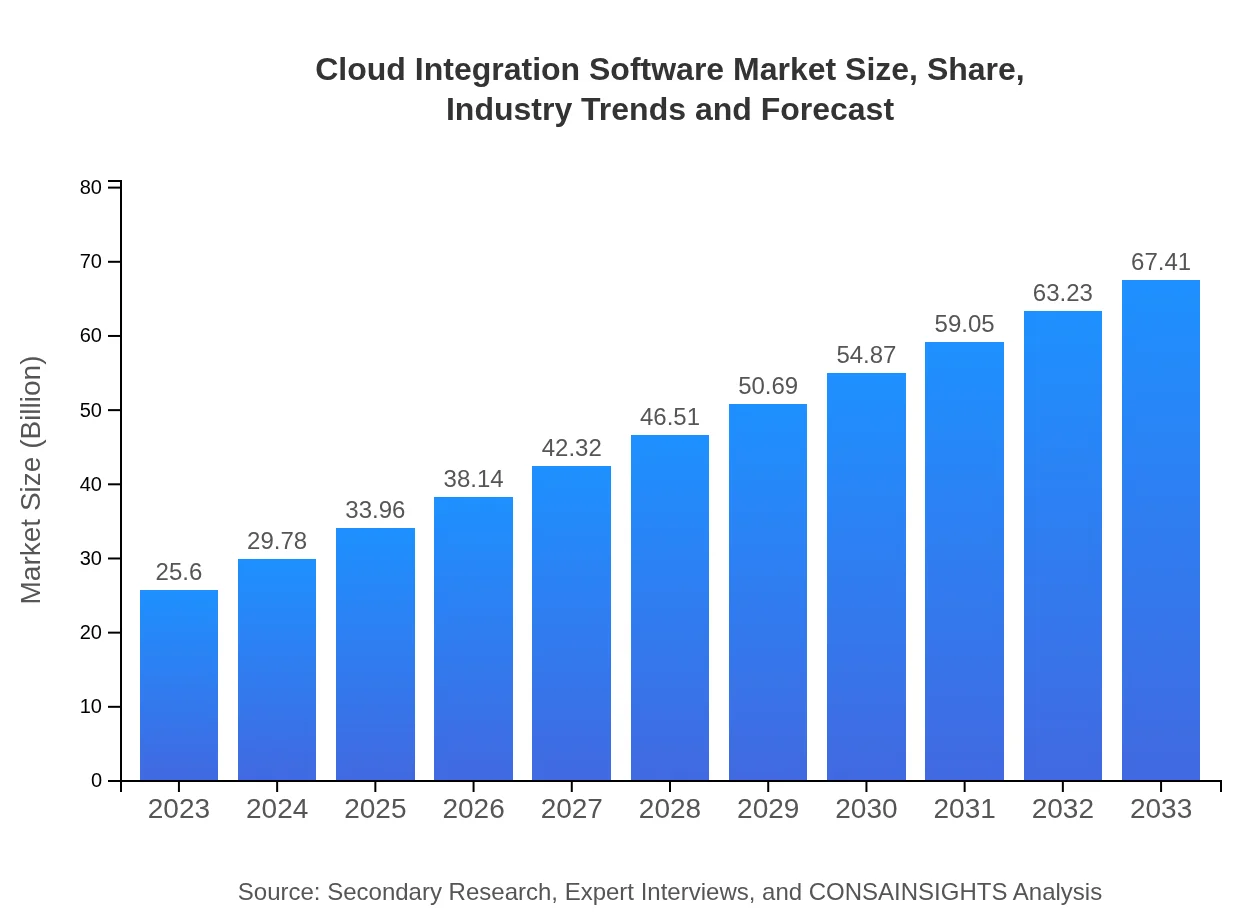

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.60 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $67.41 Billion |

| Top Companies | Dell Boomi, MuleSoft, Microsoft Azure Logic Apps, Informatica, IBM Cloud Pak for Integration |

| Last Modified Date | 31 January 2026 |

Cloud Integration Software Market Overview

Customize Cloud Integration Software Market Report market research report

- ✔ Get in-depth analysis of Cloud Integration Software market size, growth, and forecasts.

- ✔ Understand Cloud Integration Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cloud Integration Software

What is the Market Size & CAGR of Cloud Integration Software market in 2023?

Cloud Integration Software Industry Analysis

Cloud Integration Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cloud Integration Software Market Analysis Report by Region

Europe Cloud Integration Software Market Report:

The European Cloud Integration Software market is projected to grow from $6.81 billion in 2023 to $17.94 billion by 2033. Factors such as stringent data privacy regulations and a growing number of cloud users are influencing the rapid adoption and deployment of integration solutions in this region.Asia Pacific Cloud Integration Software Market Report:

In 2023, the Asia Pacific Cloud Integration Software market is valued at approximately $5.26 billion and is expected to grow to around $13.86 billion by 2033. This growth is driven by substantial investments in cloud infrastructure by countries like China and India, coupled with the rapid digital transformation of businesses across the region.North America Cloud Integration Software Market Report:

North America leads the market, with a valuation of $8.27 billion in 2023, expected to rise to $21.77 billion by 2033. The region is a hub for innovation and advanced technology adoption, with numerous enterprises investing in integration solutions to optimize their cloud strategies and facilitate digital transformation.South America Cloud Integration Software Market Report:

The South America market, valued at $1.70 billion in 2023, is forecasted to reach $4.48 billion by 2033. This region is increasingly embracing cloud technologies, with small and medium enterprises (SMEs) playing a significant role in adoption, seeking cost-effective integration solutions to enhance their operations.Middle East & Africa Cloud Integration Software Market Report:

Valued at $3.56 billion in 2023, the Middle East and Africa Cloud Integration Software market is set to expand to $9.36 billion by 2033. Rapid urbanization and the increasing shift towards digitization among governments and businesses are driving the need for effective integration solutions.Tell us your focus area and get a customized research report.

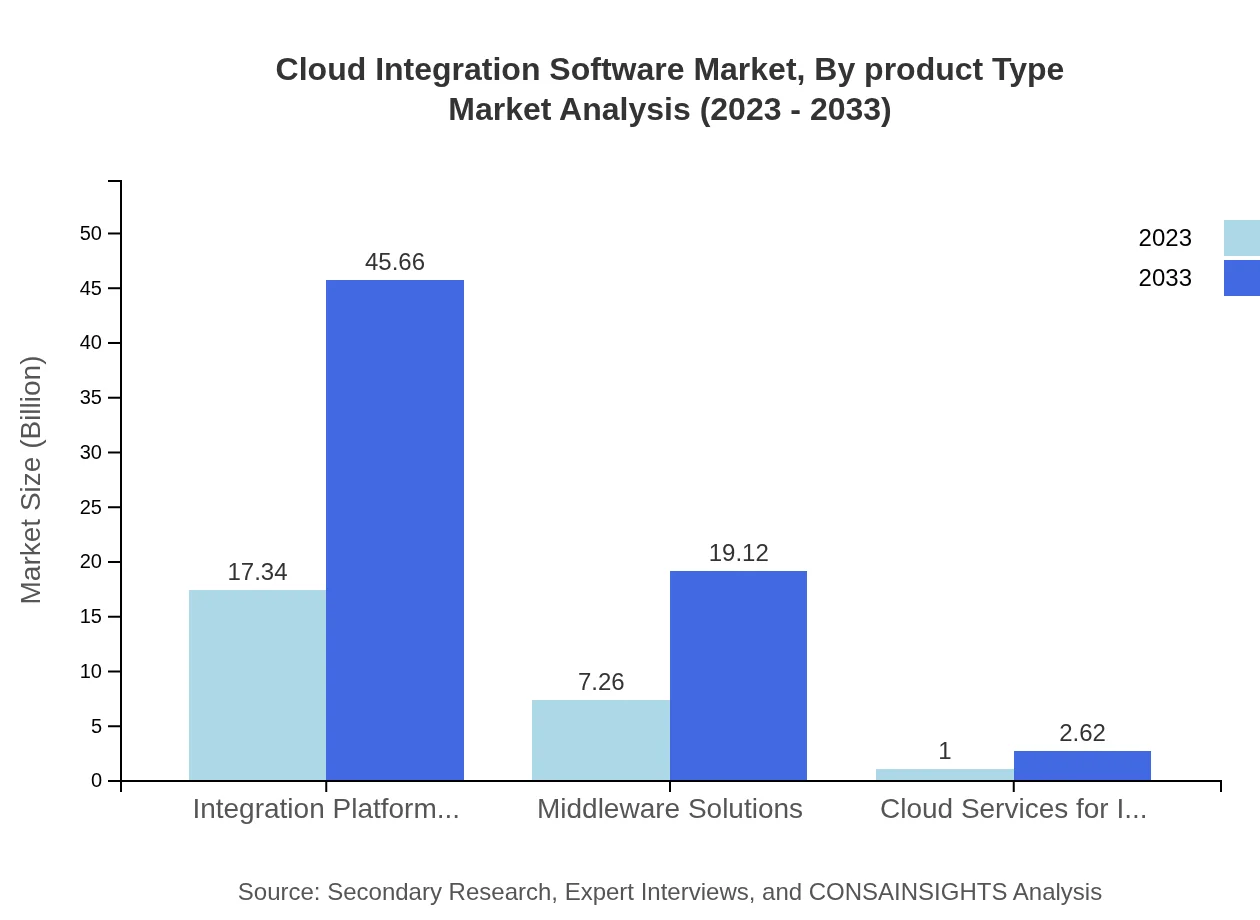

Cloud Integration Software Market Analysis By Product Type

The product type analysis shows that Integration Platform as a Service (iPaaS) accounts for a significant market share, with a size of $17.34 billion in 2023, expected to reach $45.66 billion by 2033. Middleware solutions follow, valued at $7.26 billion in 2023 and projected to grow to $19.12 billion. The growing importance of application integration to ensure seamless business operations underlines the significance of these solutions in the market.

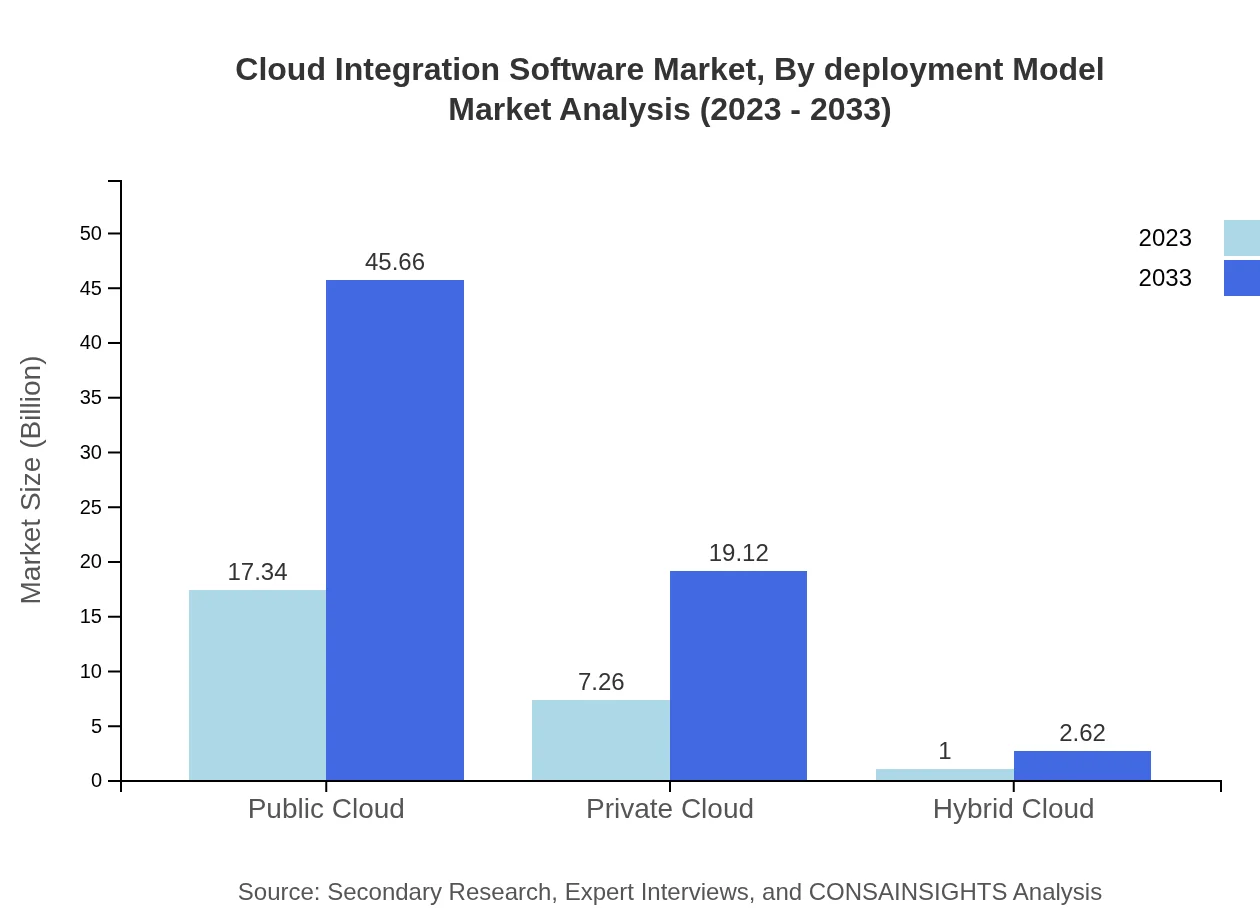

Cloud Integration Software Market Analysis By Deployment Model

In terms of deployment models, Public Cloud solutions form the largest segment, with a market size of $17.34 billion in 2023, expected to grow to $45.66 billion by 2033. Private Cloud solutions are also important, showing significant growth from $7.26 billion in 2023 to $19.12 billion in 2033. The growth of hybrid cloud models is also noteworthy, as many organizations seek flexible and scalable integration solutions.

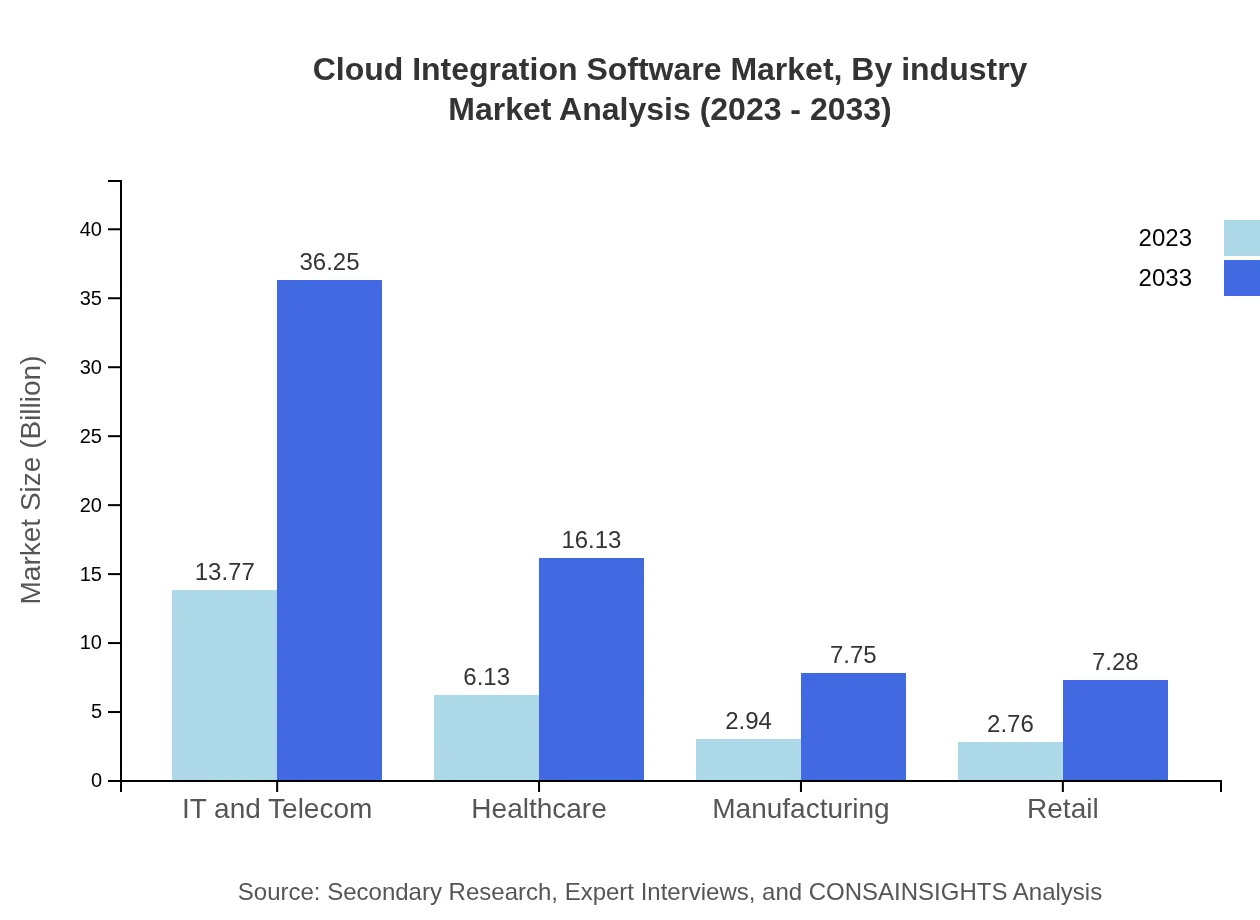

Cloud Integration Software Market Analysis By Industry

The industry analysis reveals that the IT and Telecom sector dominates with a market size of $13.77 billion in 2023, projected to reach $36.25 billion by 2033. Healthcare and manufacturing sectors follow, with market sizes of $6.13 billion and $2.94 billion in 2023, respectively. Each industry segment reflects unique integration needs that are met by tailored solutions.

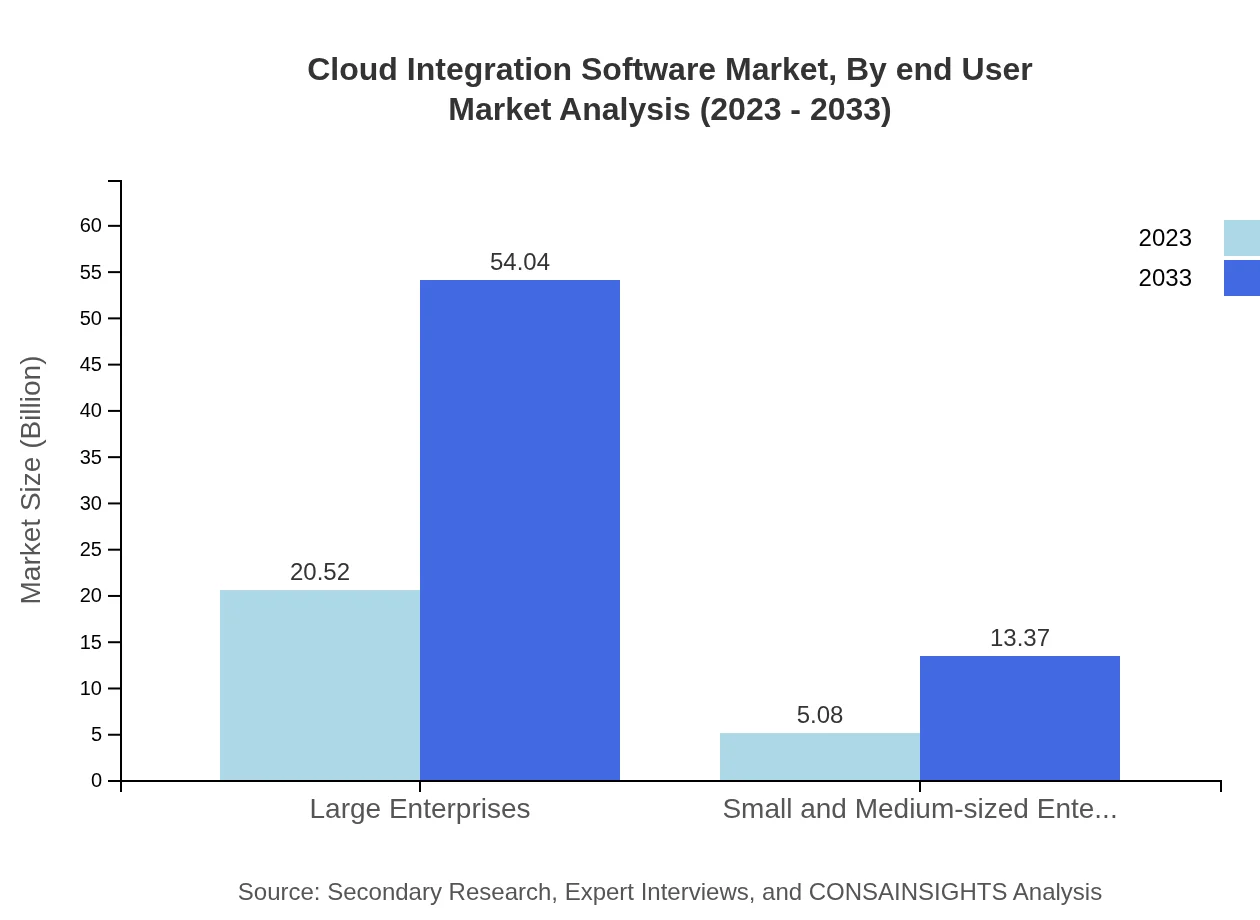

Cloud Integration Software Market Analysis By End User

The end-user analysis indicates that large enterprises hold a substantial market share with $20.52 billion in 2023, expected to grow to $54.04 billion. SMEs represent a growing segment with a market size of $5.08 billion in 2023, projected at $13.37 billion by 2033, highlighting the increasing need for affordable integration solutions among smaller businesses.

Cloud Integration Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cloud Integration Software Industry

Dell Boomi:

Dell Boomi is a leading provider of cloud integration solutions that empowers organizations to connect applications and data, utilizing a flexible and scalable integration platform known for its ease of use.MuleSoft:

MuleSoft offers a powerful integration platform, Anypoint, that enables companies to design, deploy, and manage APIs and integrations across any cloud and on-premise environment.Microsoft Azure Logic Apps:

Part of Microsoft Azure, Logic Apps is a service that helps organizations automate workflows and integrate apps and data across cloud and on-premise services.Informatica:

Informatica specializes in data integration and management solutions, providing robust tools that help businesses achieve seamless connectivity between applications and data across multiple environments.IBM Cloud Pak for Integration:

IBM offers an integrated solution platform that combines capabilities for API management, application integration, and data integration, facilitating seamless interactions in diverse business landscapes.We're grateful to work with incredible clients.

FAQs

What is the market size of cloud Integration Software?

The cloud integration software market is valued at approximately $25.6 billion in 2023, with a projected compound annual growth rate (CAGR) of 9.8% from 2023 to 2033, indicating significant expansion in this essential technological sector.

What are the key market players or companies in this cloud Integration Software industry?

Key players in the cloud integration software industry include major tech giants like Microsoft, IBM, and SAP, who dominate the market with their robust platforms, alongside innovative startups that provide niche solutions, ensuring a competitive landscape.

What are the primary factors driving the growth in the cloud Integration Software industry?

Driving factors include the increasing demand for efficient data management, the rise of cloud adoption across industries, and the need for seamless integration of applications and services, which promotes overall business agility and efficiency.

Which region is the fastest Growing in the cloud Integration Software?

The fastest-growing region in the cloud integration software market is North America, which is projected to grow from $8.27 billion in 2023 to $21.77 billion by 2033, showcasing strong adoption rates among businesses.

Does ConsaInsights provide customized market report data for the cloud Integration Software industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the cloud integration software industry, ensuring clients receive insights that cater precisely to their strategic goals and market conditions.

What deliverables can I expect from this cloud Integration Software market research project?

Deliverables include comprehensive market analysis reports, segmentation data, growth forecasts, competitive landscape insights, and actionable recommendations tailored to enhance strategic decision-making for stakeholders.

What are the market trends of cloud Integration Software?

Emerging trends in cloud integration software include a shift towards Integration Platform as a Service (iPaaS) solutions, increased emphasis on hybrid cloud models, and the growing significance of real-time data processing capabilities.