Cloud Network Security Market Report

Published Date: 31 January 2026 | Report Code: cloud-network-security

Cloud Network Security Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Cloud Network Security market, including comprehensive insights on market size, trends, regional dynamics, and key players over the forecast period from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

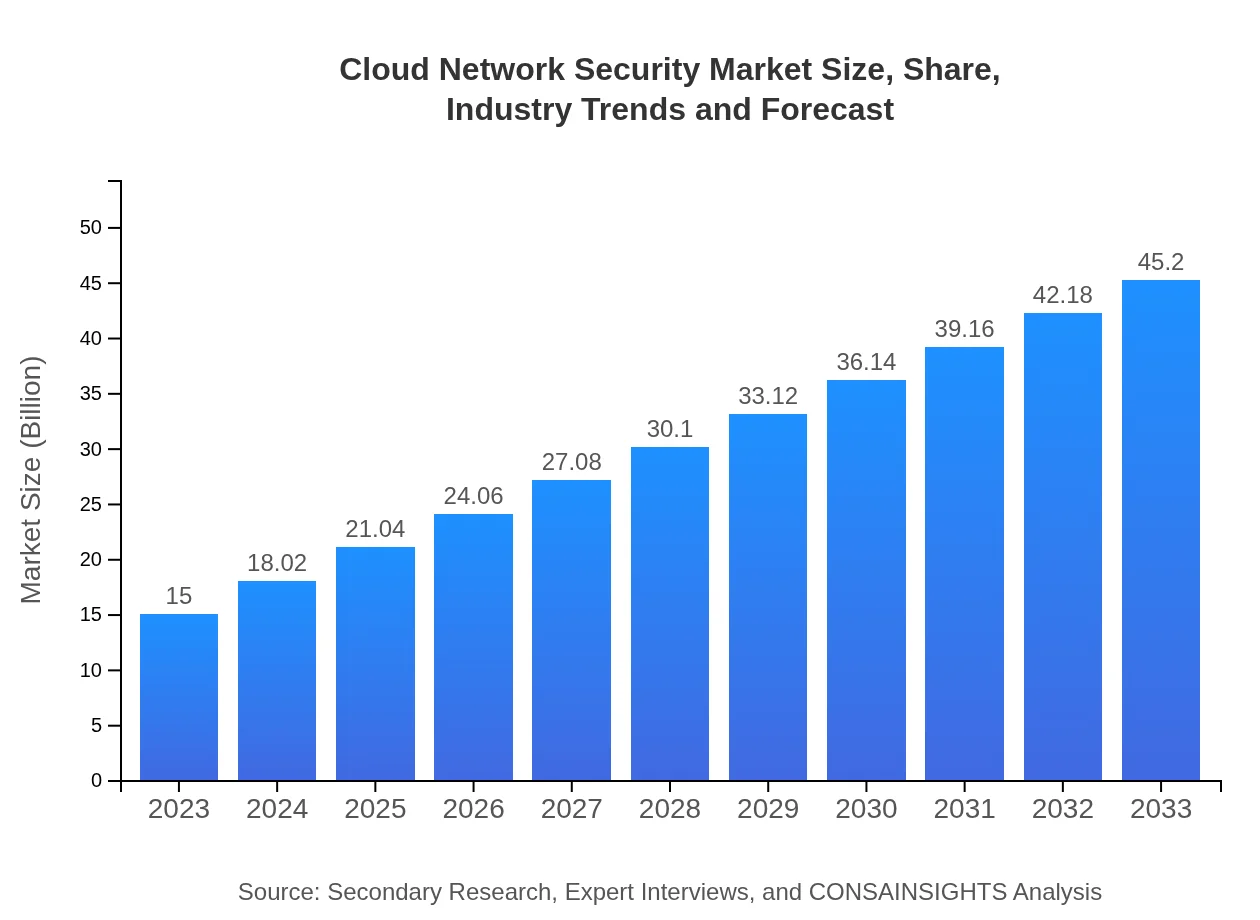

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 11.2% |

| 2033 Market Size | $45.20 Billion |

| Top Companies | Cisco Systems, Inc., Palo Alto Networks, Fortinet, Inc. |

| Last Modified Date | 31 January 2026 |

Cloud Network Security Market Overview

Customize Cloud Network Security Market Report market research report

- ✔ Get in-depth analysis of Cloud Network Security market size, growth, and forecasts.

- ✔ Understand Cloud Network Security's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cloud Network Security

What is the Market Size & CAGR of Cloud Network Security market in 2023?

Cloud Network Security Industry Analysis

Cloud Network Security Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cloud Network Security Market Analysis Report by Region

Europe Cloud Network Security Market Report:

Europe's Cloud Network Security market is projected to grow from $4.01 billion in 2023 to $12.09 billion by 2033. Stringent data protection regulations like GDPR mandate robust security measures, thus boosting market growth in this region.Asia Pacific Cloud Network Security Market Report:

Asia Pacific is witnessing robust growth in the Cloud Network Security market, with a projected market size of $8.67 billion by 2033, up from $2.88 billion in 2023. The rising digital transformation initiatives and increasing incidences of cyberattacks have compelled businesses to adopt advanced security solutions actively.North America Cloud Network Security Market Report:

North America continues to dominate the Cloud Network Security market, with a market size expected to reach $16.12 billion by 2033, significantly up from $5.35 billion in 2023. The region's advanced technological infrastructure and high rates of cloud adoption are fueling this trend.South America Cloud Network Security Market Report:

In South America, the Cloud Network Security market is expected to grow from $1.31 billion in 2023 to $3.94 billion by 2033. Growing awareness of cybersecurity among enterprises and the need to comply with international security standards is driving this growth.Middle East & Africa Cloud Network Security Market Report:

The Middle East and Africa region is also on a growth trajectory, with market size increasing from $1.45 billion in 2023 to $4.38 billion by 2033. Factors contributing to this growth include increasing investments in digital transformation and heightened cyber threat awareness among organizations.Tell us your focus area and get a customized research report.

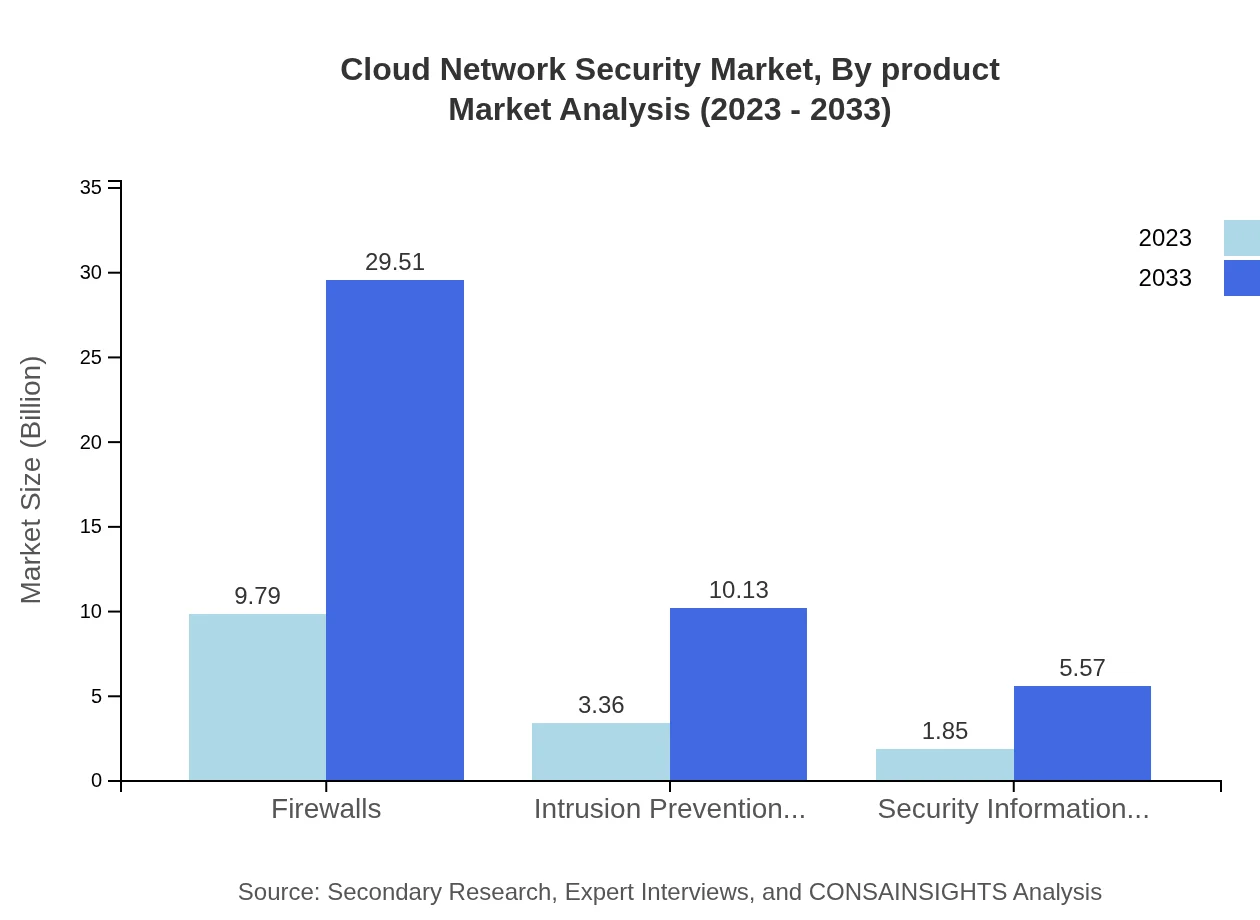

Cloud Network Security Market Analysis By Product

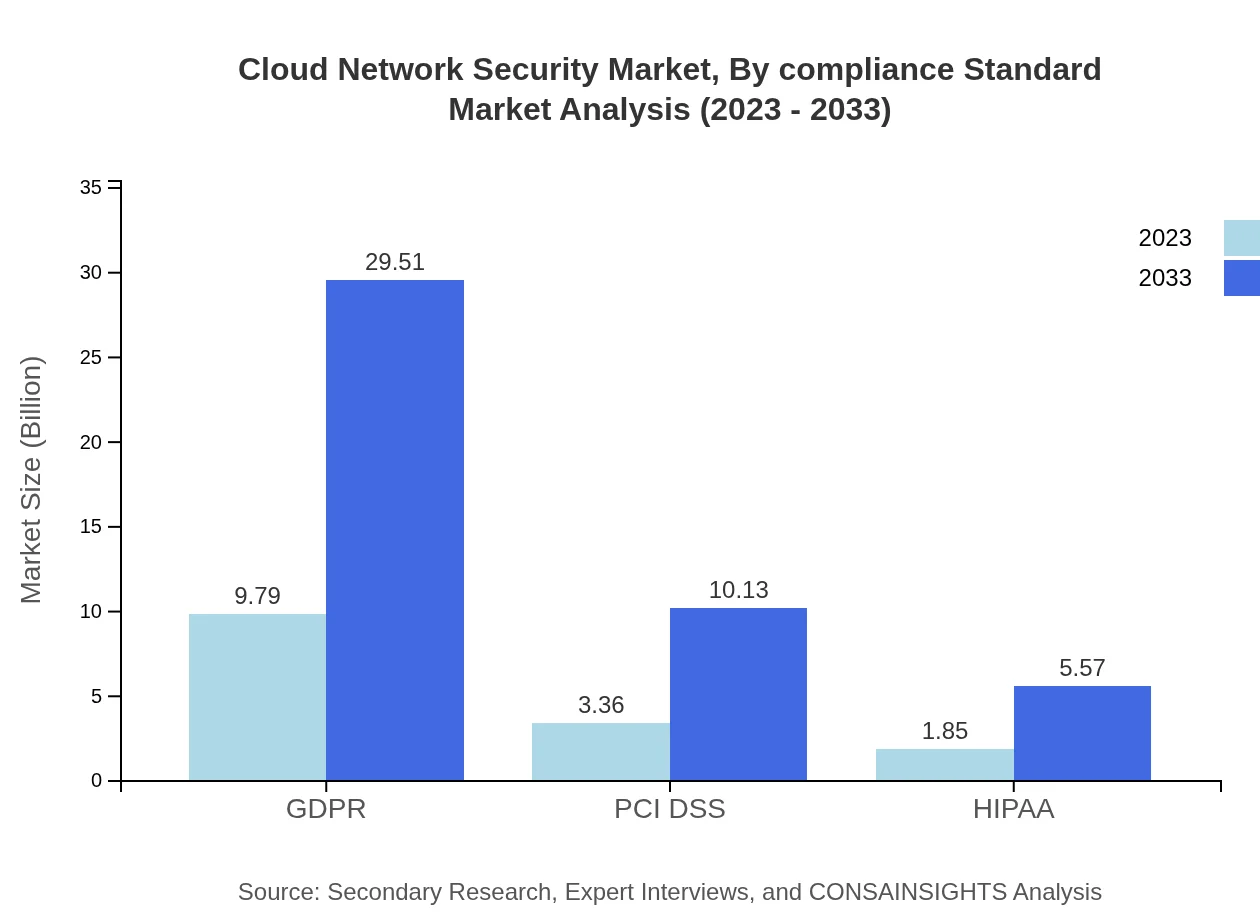

The segmentation by product includes Firewalls, Intrusion Prevention Systems (IPS), Security Information and Event Management (SIEM), and others. Firewalls, dominating the market share at 65.28% in 2023, are anticipated to maintain this position in the coming years with a market size surge from $9.79 billion in 2023 to $29.51 billion in 2033. IPS and SIEM solutions are also on a positive growth trajectory, with respective market sizes projected at $10.13 billion and $5.57 billion by 2033.

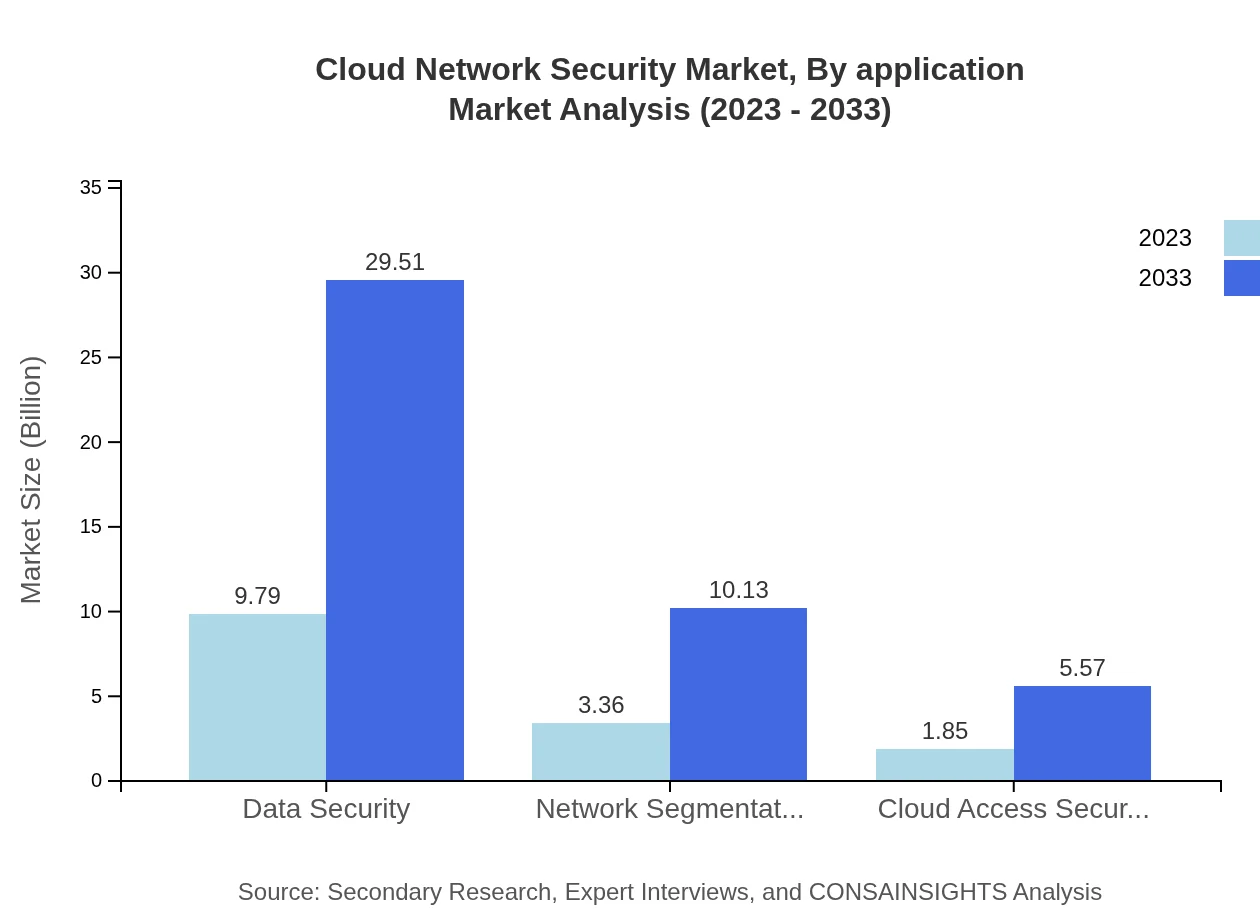

Cloud Network Security Market Analysis By Application

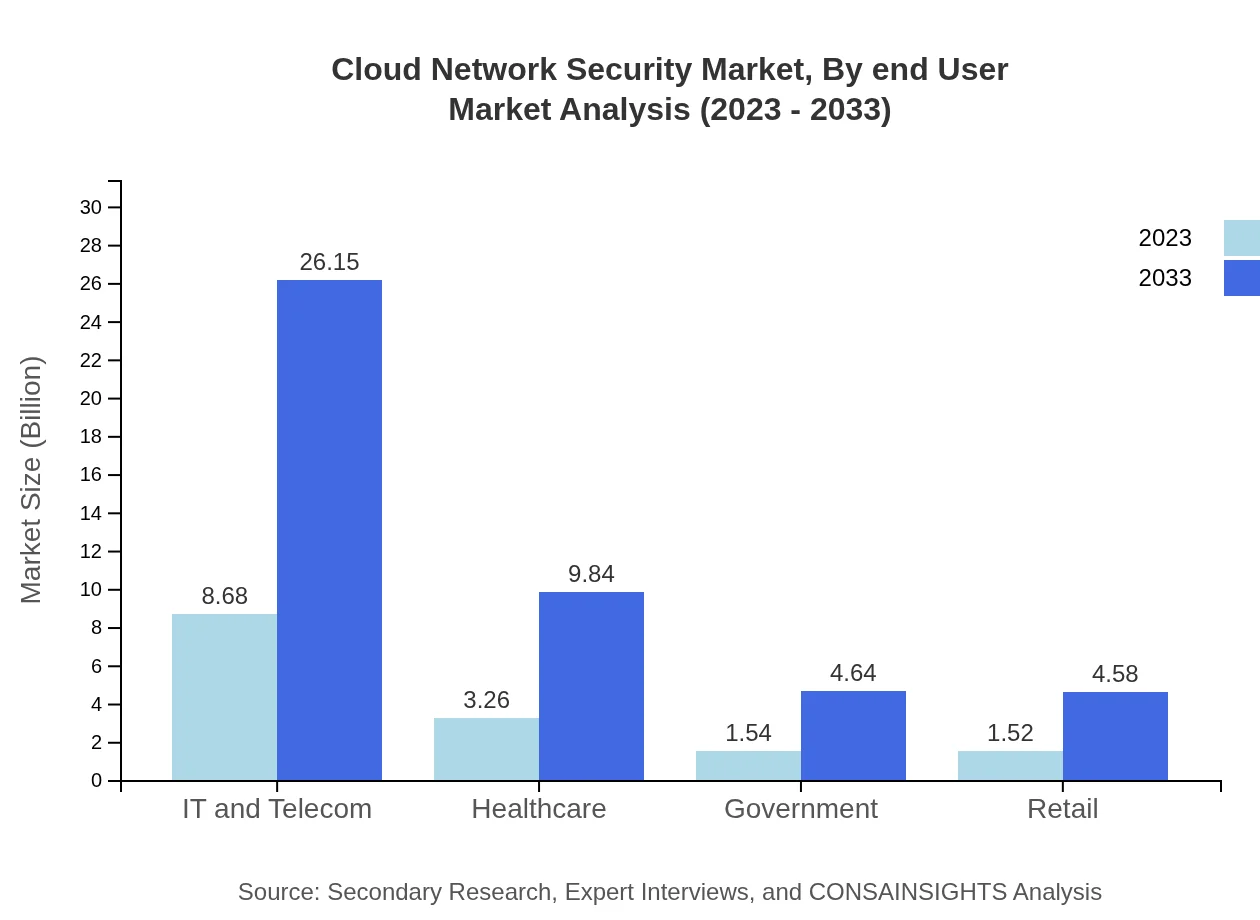

End-user applications ranging from IT and Telecom to Healthcare and Government play critical roles in shaping cloud security demands. For instance, the IT and Telecom sector, accounting for a 57.85% share in 2023, is forecasted to grow from $8.68 billion in 2023 to $26.15 billion by 2033, highlighting the significant reliance on cloud security solutions in these areas.

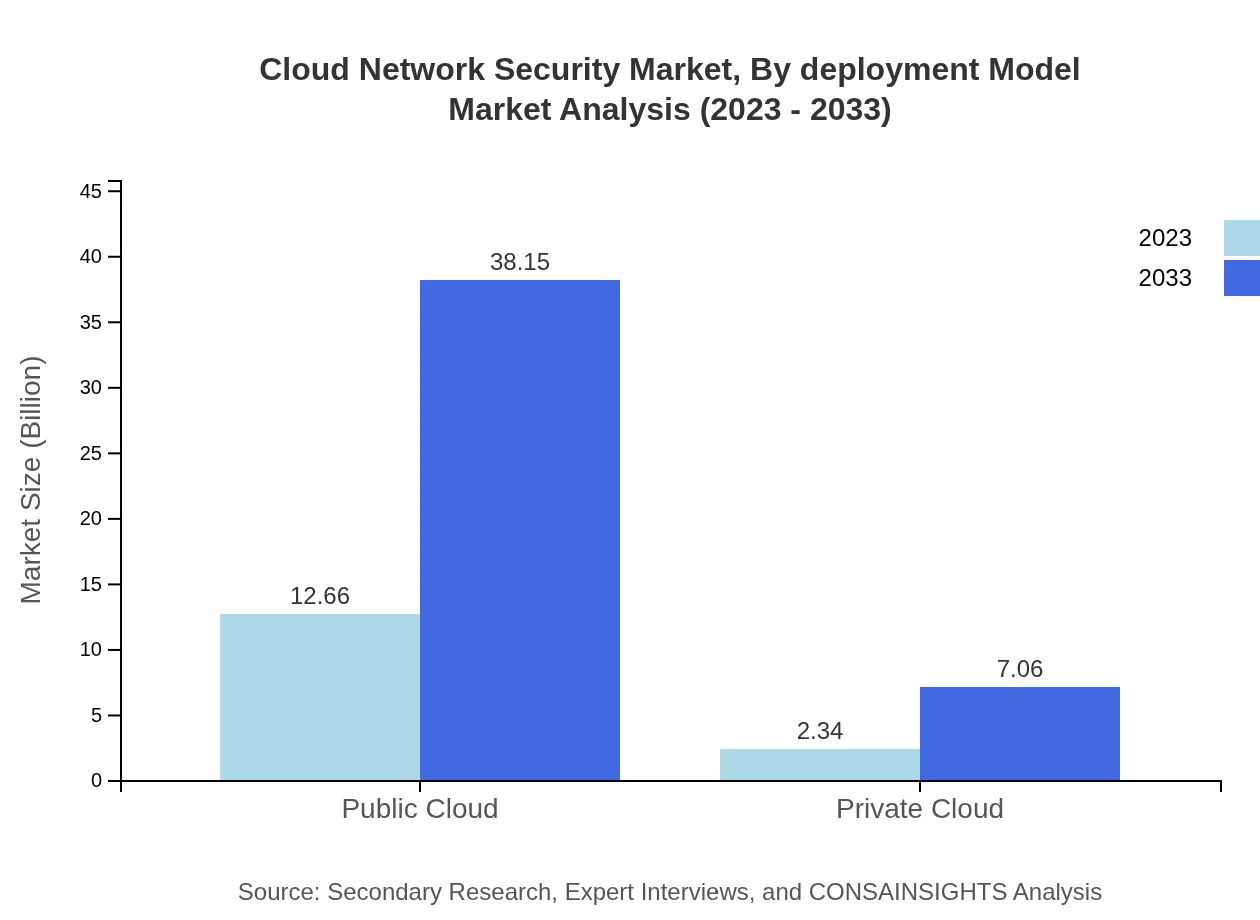

Cloud Network Security Market Analysis By Deployment Model

The deployment model segment is divided into Public Cloud and Private Cloud. The Public Cloud segment is anticipated to dominate, growing from $12.66 billion in 2023 to $38.15 billion by 2033, holding an 84.39% market share. In contrast, the Private Cloud segment is also expanding, reaching $7.06 billion in size by the forecasted year, driven by increasing security concerns and compliance standards.

Cloud Network Security Market Analysis By End User

With sectors like Government, Healthcare, and Retail contributing significantly to the demand for cloud network security, this segment is expected to see considerable growth. The Healthcare segment, for example, is projected to grow from $3.26 billion in 2023 to $9.84 billion by 2033, illustrating the critical need for data security within this sensitive industry.

Cloud Network Security Market Analysis By Compliance Standard

Compliance with standards such as GDPR, PCI DSS, and HIPAA plays an integral role in cloud security strategies across industries. The GDPR segment, which commands a 65.28% share in 2023, is expected to see considerable growth, moving from $9.79 billion in 2023 to $29.51 billion by 2033, reflecting the heightened focus on data privacy and protection regulations.

Cloud Network Security Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cloud Network Security Industry

Cisco Systems, Inc.:

Cisco is a leading provider of networking hardware and security solutions. Their portfolio includes advanced firewall systems and intrusion prevention technologies that enhance enterprise network defenses against cyber threats.Palo Alto Networks:

Palo Alto Networks specializes in cloud security solutions, including next-gen firewalls and cloud workload protection. Their innovative platform provides comprehensive visibility and control of cloud applications and services.Fortinet, Inc.:

Fortinet provides broad cybersecurity solutions, including firewalls, intrusion prevention, and endpoint security that cater to the growing needs of businesses in securing their cloud environments.We're grateful to work with incredible clients.

FAQs

What is the market size of cloud Network Security?

The global cloud network security market is currently valued at approximately $15 billion, with a projected Compound Annual Growth Rate (CAGR) of 11.2%. This indicates significant growth potential as businesses increasingly prioritize cybersecurity solutions across their cloud infrastructures.

What are the key market players or companies in the cloud Network Security industry?

Key players in the cloud network security industry include recognized technology firms such as Cisco, Palo Alto Networks, and Fortinet. These companies lead in innovation and market share, providing a range of cloud security services and products to meet growing demand.

What are the primary factors driving the growth in the cloud Network Security industry?

Factors driving growth in the cloud network security industry include the rising frequency of cyber threats, a shift toward remote work, and increased adoption of cloud services. Compliance regulations and the need for data protection further fuel investment in advanced security solutions.

Which region is the fastest Growing in the cloud Network Security?

The fastest-growing region in the cloud network security market is North America, expected to grow from $5.35 billion in 2023 to $16.12 billion by 2033. Europe and Asia-Pacific are also emerging as significant markets, contributing to global growth.

Does ConsaInsights provide customized market report data for the cloud Network Security industry?

Yes, ConsaInsights offers customized market report data tailored to the needs of clients in the cloud network security industry. This allows companies to gain insights specific to their market segment and regional focus, enhancing decision-making and strategy.

What deliverables can I expect from this cloud Network Security market research project?

Deliverables from ConsaInsights' cloud network security market research project typically include comprehensive market analysis, growth forecasts, competitive landscape assessments, and key insights into trends and challenges influencing the market through detailed reports.

What are the market trends of cloud Network Security?

Current trends in the cloud network security market include increased investments in advanced technologies such as AI and machine learning for threat detection, a growing focus on compliance and regulatory standards, and the shift towards zero-trust security models as organizations embrace cloud computing.