Cloud Point Of Sale Pos Market Report

Published Date: 31 January 2026 | Report Code: cloud-point-of-sale-pos

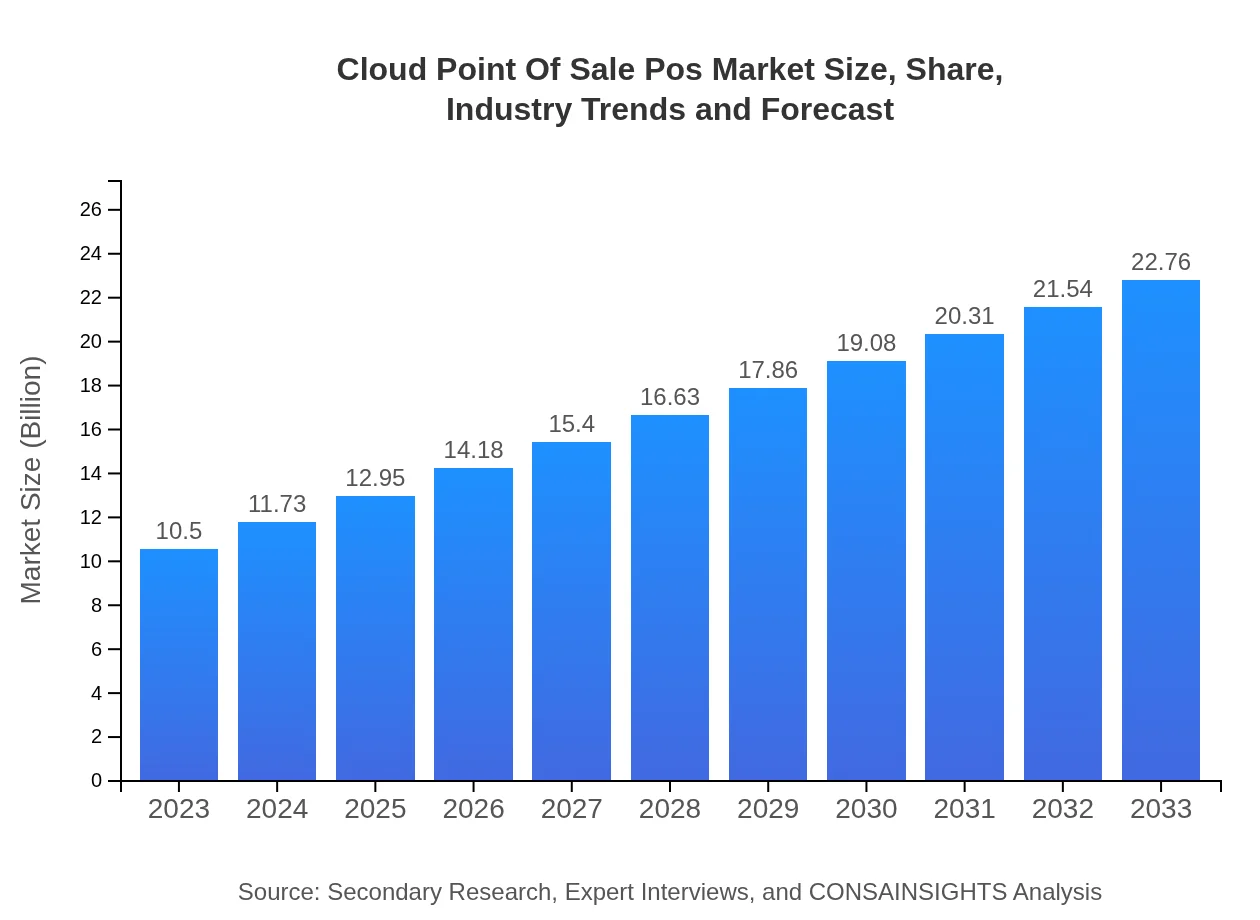

Cloud Point Of Sale Pos Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Cloud Point of Sale (POS) market from 2023 to 2033, highlighting market trends, segmentation, regional insights, and forecasts, along with a detailed industry analysis and profile of global market leaders.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $22.76 Billion |

| Top Companies | Square, Inc., Shopify POS, Clover Network, Inc., Lightspeed POS, Toast, Inc. |

| Last Modified Date | 31 January 2026 |

Cloud Point Of Sale Pos Market Overview

Customize Cloud Point Of Sale Pos Market Report market research report

- ✔ Get in-depth analysis of Cloud Point Of Sale Pos market size, growth, and forecasts.

- ✔ Understand Cloud Point Of Sale Pos's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cloud Point Of Sale Pos

What is the Market Size & CAGR of Cloud Point Of Sale Pos market in 2023?

Cloud Point Of Sale Pos Industry Analysis

Cloud Point Of Sale Pos Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cloud Point Of Sale Pos Market Analysis Report by Region

Europe Cloud Point Of Sale Pos Market Report:

The Europe Cloud POS market is set to escalate from $2.76 billion in 2023 to $5.99 billion by 2033, influenced by the strong retail sector and a notable shift towards digitization. Countries like the UK, Germany, and France are at the forefront of adopting cloud technologies.Asia Pacific Cloud Point Of Sale Pos Market Report:

The Asia Pacific Cloud POS market is expected to grow from $2.01 billion in 2023 to $4.36 billion by 2033. Factors such as the rapid digitization of the retail sector and increasing smartphone penetration drive this growth. Countries like China and India are leading in adopting cloud solutions as businesses aim for agile operations.North America Cloud Point Of Sale Pos Market Report:

North America, being a mature market, is expected to grow from $4.09 billion in 2023 to $8.87 billion by 2033. The demand for advanced Cloud POS solutions among SMEs in retail and hospitality is fostering this growth. Innovations and the presence of leading vendors in the US market contribute to a competitive landscape.South America Cloud Point Of Sale Pos Market Report:

The South American Cloud POS market is projected to increase from $0.74 billion in 2023 to $1.61 billion by 2033, driven by expanding retail sectors and a growing preference for mobile payment solutions. Brazil and Argentina are key markets displaying rapid cloud adoption.Middle East & Africa Cloud Point Of Sale Pos Market Report:

The Middle East and Africa (MEA) Cloud POS market is anticipated to rise from $0.89 billion in 2023 to $1.94 billion by 2033. Growth in e-commerce, alongside rising adoption of mobile payment technologies in the UAE and South Africa, is stimulating the market in this region.Tell us your focus area and get a customized research report.

Cloud Point Of Sale Pos Market Analysis Small Business

Global Cloud POS Market, By Product Type Market Analysis (2023 - 2033)

The market for Small Businesses is projected to grow from $6.89 billion in 2023 to $14.93 billion by 2033, making up about 65.61% of the overall Cloud POS market share in both years. The trend of adopting cost-effective and user-friendly solutions is driving this segment's growth, as small businesses seek competitive advantages through efficient transaction handling.

Cloud Point Of Sale Pos Market Analysis Large Enterprise

Global Cloud POS Market, By Application Market Analysis (2023 - 2033)

In the Large Enterprise segment, the market size is expected to expand from $2.25 billion in 2023 to $4.87 billion by 2033, holding a steady share of 21.4%. Large enterprises prefer customizable and scalable Cloud POS systems to handle high transaction volumes and complex operational needs.

Cloud Point Of Sale Pos Market Analysis Service Industry

Global Cloud POS Market, By Deployment Type Market Analysis (2023 - 2033)

The Service Industry segment anticipates an increase from $1.36 billion in 2023 to $2.96 billion by 2033. Representing a share of about 12.99%, this segment thrives as businesses leverage Cloud POS systems for enhancing customer service and streamlining operations.

Cloud Point Of Sale Pos Market Analysis Retail

Global Cloud POS Market, By End-User Sector Market Analysis (2023 - 2033)

The Retail sector leads the Cloud POS market with a size projected from $5.60 billion in 2023 to $12.15 billion by 2033, holding approximately 53.37% market share. The inclination towards contactless payments and operational efficiency drives significant growth in this sector.

Cloud Point Of Sale Pos Market Analysis Mobile Technology

Global Cloud POS Market, By Technology Market Analysis (2023 - 2033)

The Mobile Technology segment will experience substantial growth from $8.45 billion in 2023 to $18.32 billion by 2033, maintaining a remarkable share of 80.48%. The rise in smartphone usage and mobile payment solutions is creating lucrative opportunities in this rapidly evolving segment.

Cloud Point Of Sale Pos Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cloud Point Of Sale Pos Industry

Square, Inc.:

A leader in mobile payments and point of sale solutions, Square provides tailored solutions for businesses to process payments and manage inventory effectively.Shopify POS:

Shopify's POS solution allows retailers to integrate their online and offline sales seamlessly, equipped with real-time inventory management and flexible payment options.Clover Network, Inc.:

Clover offers customizable POS systems and integrated payment solutions, catering to various business sizes with a focus on customer experience enhancement.Lightspeed POS:

Lightspeed provides a cloud-based POS system for retail and restaurant businesses, emphasizing advanced analytics and easy integration with e-commerce platforms.Toast, Inc.:

A leading POS and management system designed specifically for the hospitality sector, offering comprehensive tools for order management, reporting, and customer engagement.We're grateful to work with incredible clients.

FAQs

What is the market size of cloud Point Of Sale Pos?

The global Cloud Point of Sale (POS) market is currently valued at $10.5 billion in 2023 and is projected to grow with a CAGR of 7.8%, indicating robust demand and expansion opportunities within the industry by 2033.

What are the key market players or companies in this cloud Point Of Sale Pos industry?

Key players in the Cloud POS industry include companies such as Square, Toast, Shopify, Lightspeed, and NCR, which dominate the market with innovative solutions, enhanced functionalities, and a strong customer service framework.

What are the primary factors driving the growth in the cloud Point Of Sale Pos industry?

Factors driving the growth of the Cloud POS market include the increasing demand for cloud-based solutions, the rise of mobile payment technologies, the necessity for remote order processing, and heightened consumer preference for convenient, fast transactions.

Which region is the fastest Growing in the cloud Point Of Sale Pos?

The fastest-growing region in the Cloud POS market is Europe, expected to grow from $2.76 billion in 2023 to $5.99 billion by 2033, followed closely by the Asia Pacific and North America regions.

Does ConsaInsights provide customized market report data for the cloud Point Of Sale Pos industry?

Yes, ConsaInsights offers customized market report data tailored to your needs, allowing clients to delve into specific trends, competitive analysis, and market forecasts within the Cloud POS industry.

What deliverables can I expect from this cloud Point Of Sale Pos market research project?

From the Cloud POS market research project, you can expect comprehensive reports, detailed segment analysis, regional market insights, competitive benchmarking, and strategic recommendations tailored to meet your business objectives.

What are the market trends of cloud Point Of Sale Pos?

Market trends in the Cloud POS industry include the increasing adoption of mobile and hybrid solutions, a shift towards integrated software and hardware systems, and growing emphasis on data security and customer experience enhancements.