Cloud Services Brokerage Market Report

Published Date: 31 January 2026 | Report Code: cloud-services-brokerage

Cloud Services Brokerage Market Size, Share, Industry Trends and Forecast to 2033

This report on Cloud Services Brokerage provides comprehensive insights into market trends, size, segmentation, and forecasts from 2023 to 2033. It highlights the industry's dynamics and key players, offering data-driven insights for stakeholders.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

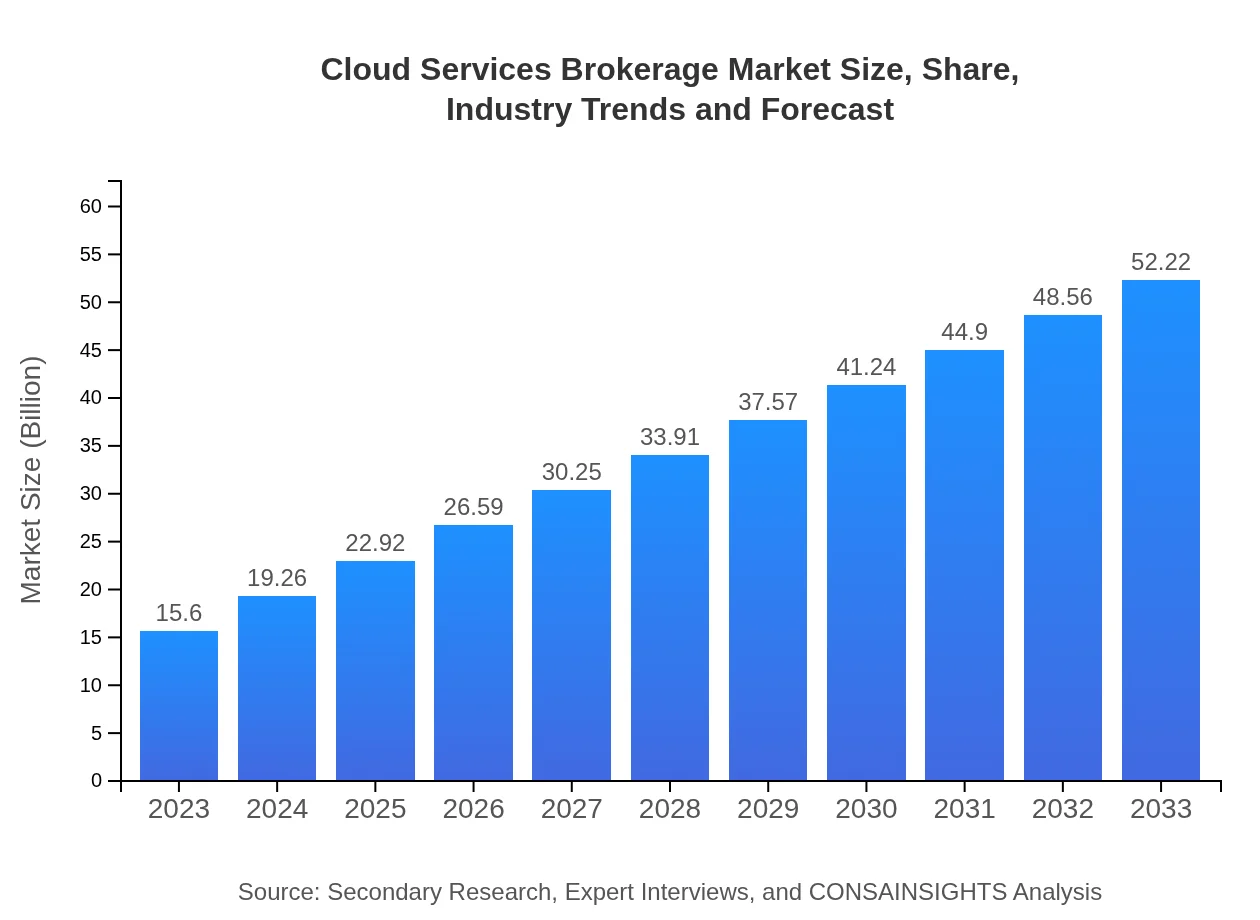

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 12.3% |

| 2033 Market Size | $52.22 Billion |

| Top Companies | IBM, Accenture, CloudBolt, Morpheus Data, RightScale (Flexera) |

| Last Modified Date | 31 January 2026 |

Cloud Services Brokerage Market Overview

Customize Cloud Services Brokerage Market Report market research report

- ✔ Get in-depth analysis of Cloud Services Brokerage market size, growth, and forecasts.

- ✔ Understand Cloud Services Brokerage's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cloud Services Brokerage

What is the Market Size & CAGR of Cloud Services Brokerage market in 2023?

Cloud Services Brokerage Industry Analysis

Cloud Services Brokerage Market Segmentation and Scope

Tell us your focus area and get a customized research report.

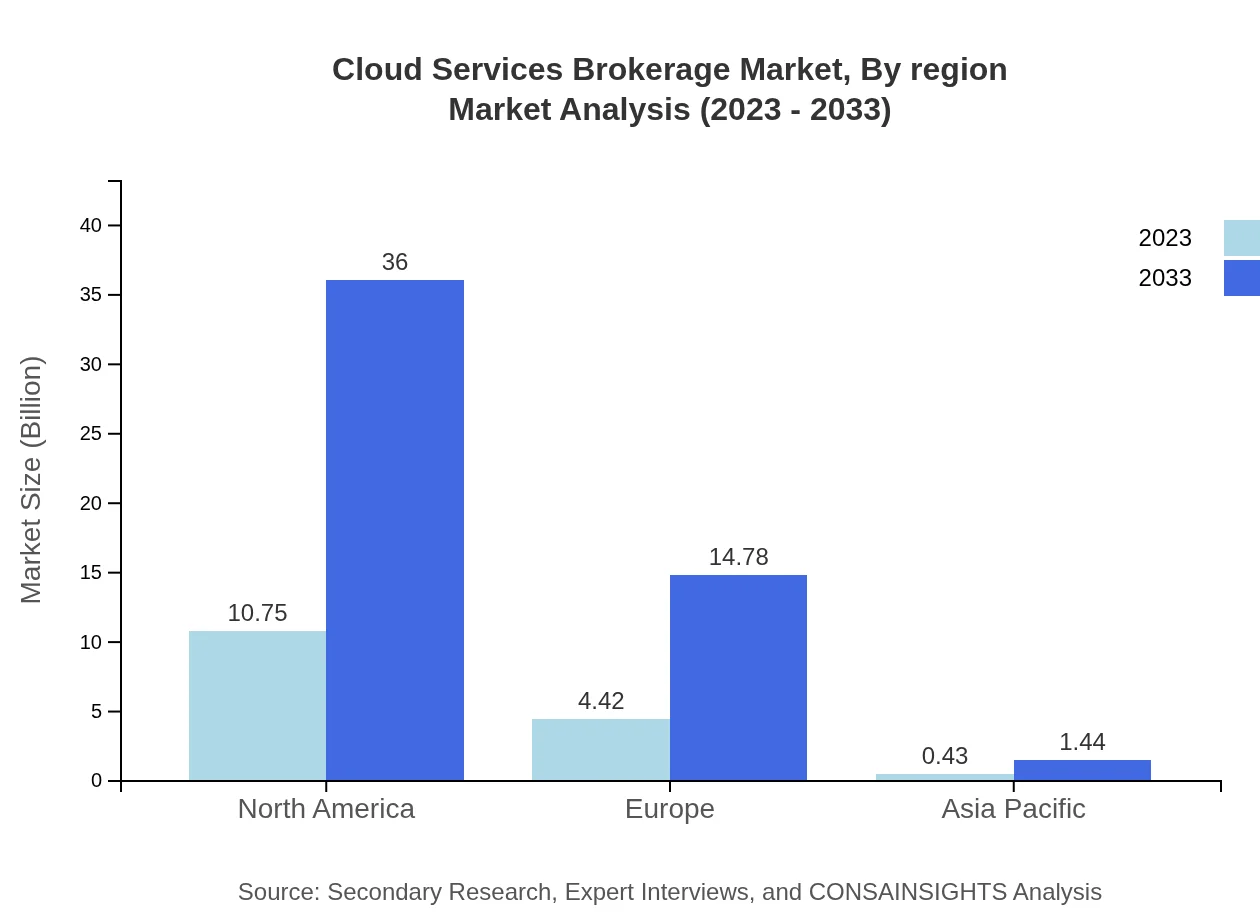

Cloud Services Brokerage Market Analysis Report by Region

Europe Cloud Services Brokerage Market Report:

In Europe, the market for Cloud Services Brokerage reached \$4.03 billion in 2023, with projections estimating \$13.48 billion by 2033. The European market is largely driven by the need for data sovereignty and compliance with regulations such as GDPR, prompting businesses to seek reliable cloud solutions. Additionally, growing investments in digital technology are expected to support this upward trend.Asia Pacific Cloud Services Brokerage Market Report:

As of 2023, the Cloud Services Brokerage market in Asia Pacific stands at \$3.30 billion, with a forecasted growth to \$11.03 billion by 2033. The rapid digitalization across countries like China and India and the increasing adoption of cloud solutions among enterprises fuel this growth. Additionally, government initiatives promoting digital transformation are enhancing the demand for cloud brokerage services in the region.North America Cloud Services Brokerage Market Report:

Dominating the global market, North America shows a market size of \$5.40 billion in 2023, projected to increase to \$18.06 billion by 2033. The region showcases a high level of cloud adoption among enterprises, backed by a mature technology infrastructure. Key investment in cloud computing and digital transformation initiatives among major corporations drives this robust growth.South America Cloud Services Brokerage Market Report:

The South American Cloud Services Brokerage market is valued at \$1.10 billion in 2023 and expected to grow to \$3.68 billion by 2033. Factors such as the increasing number of startups and the need for cost-effective solutions for cloud management are driving the market. However, regional challenges include slower internet connectivity and regulatory hurdles that could impact growth.Middle East & Africa Cloud Services Brokerage Market Report:

The Middle East and Africa regional market, currently at \$1.78 billion in 2023, is anticipated to grow to \$5.96 billion by 2033. This growth is attributed to the increasing cloud penetration in various sectors, supported by government initiatives aimed at empowering digital ecosystems in the region.Tell us your focus area and get a customized research report.

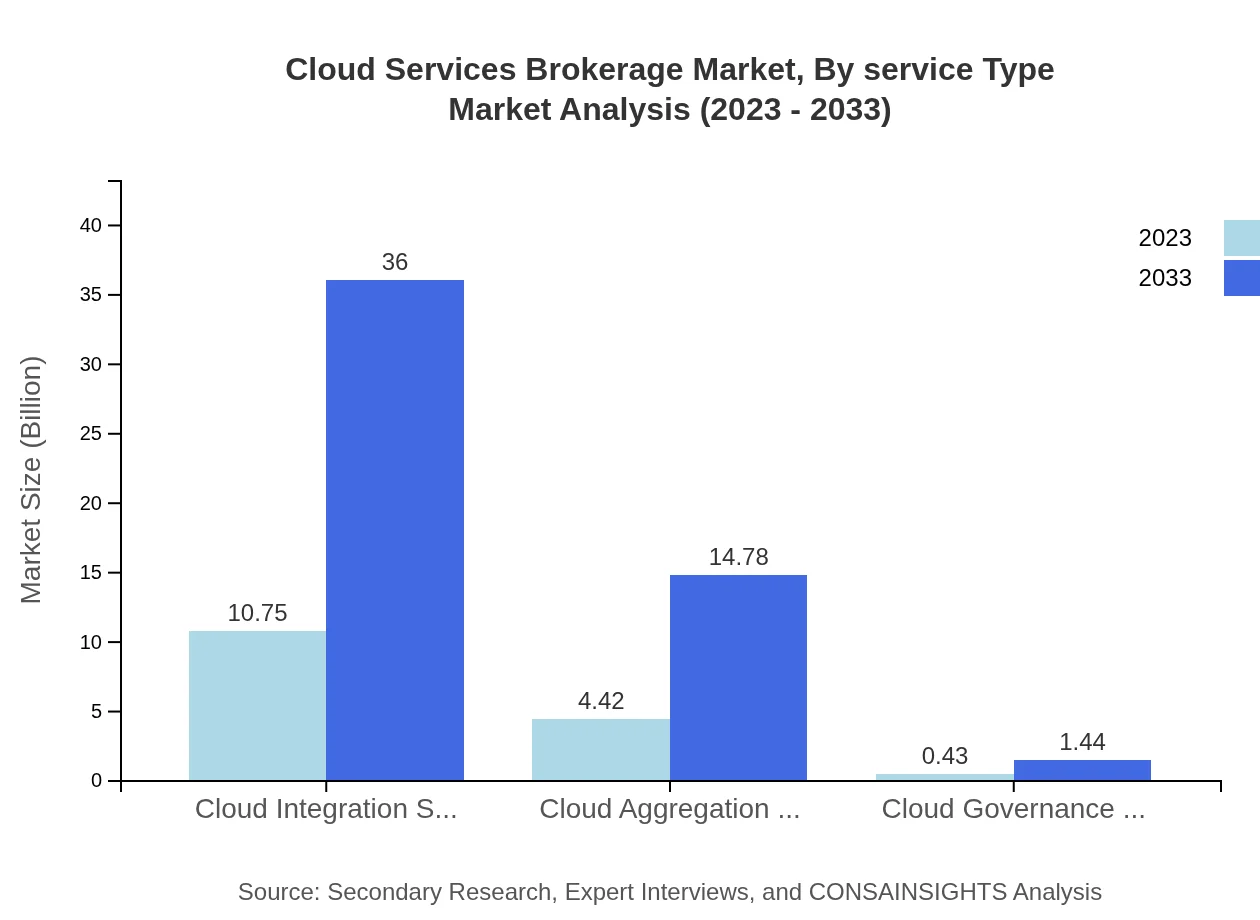

Cloud Services Brokerage Market Analysis By Service Type

The service type segmentation of the Cloud Services Brokerage market outlines the different offerings available. The leading segment is cloud integration services, estimated to be \$10.75 billion in 2023, growing to \$36.00 billion by 2033. Other essential service types include cloud aggregation and cloud governance services, with significant market shares of 28.31% and 2.76% respectively.

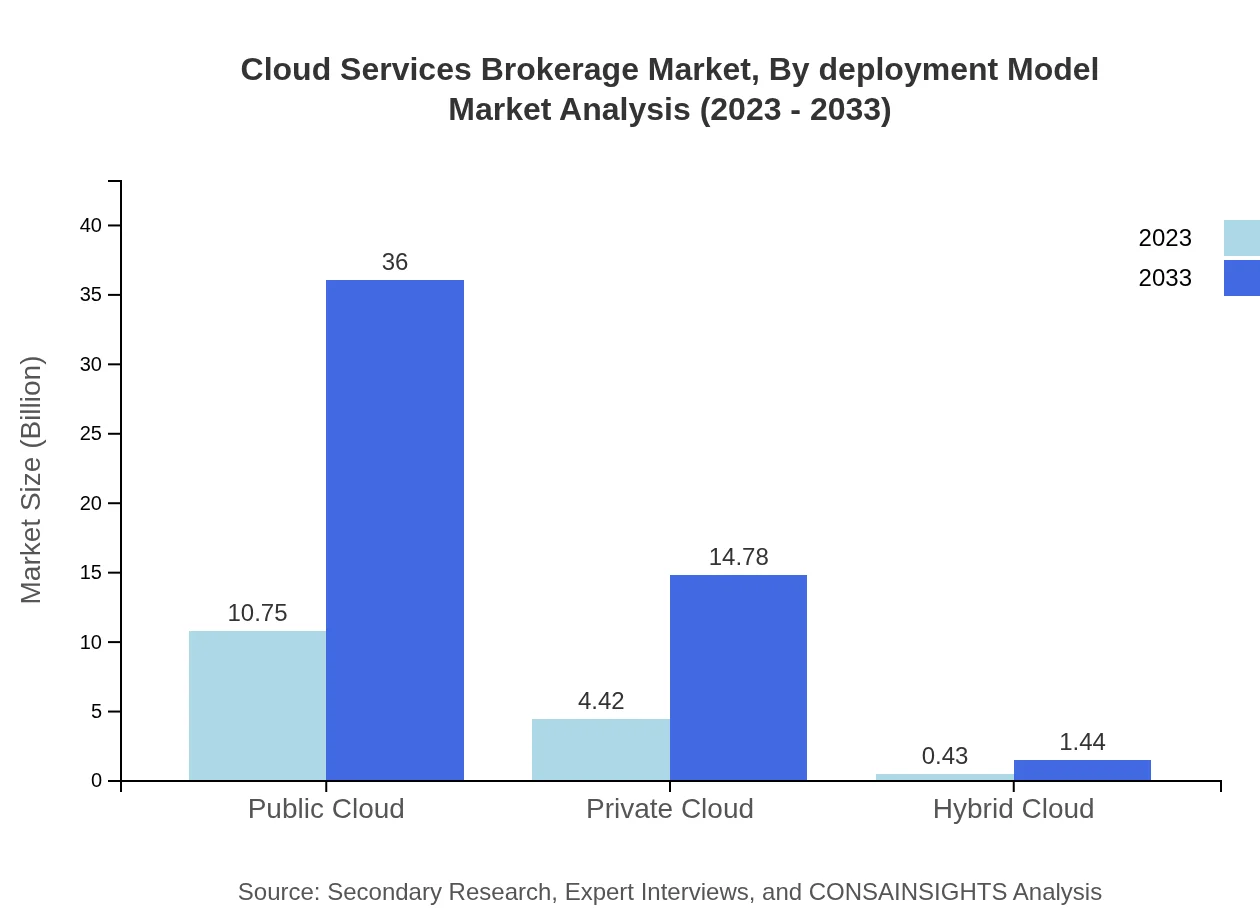

Cloud Services Brokerage Market Analysis By Deployment Model

Deployment models significantly impact the adoption of Cloud Services Brokerage services. Public cloud services are expected to dominate, with growth from \$10.75 billion in 2023 to \$36.00 billion in 2033, maintaining a 68.93% share. Private and hybrid cloud models represent smaller segments; however, they are essential for organizations seeking customized solutions.

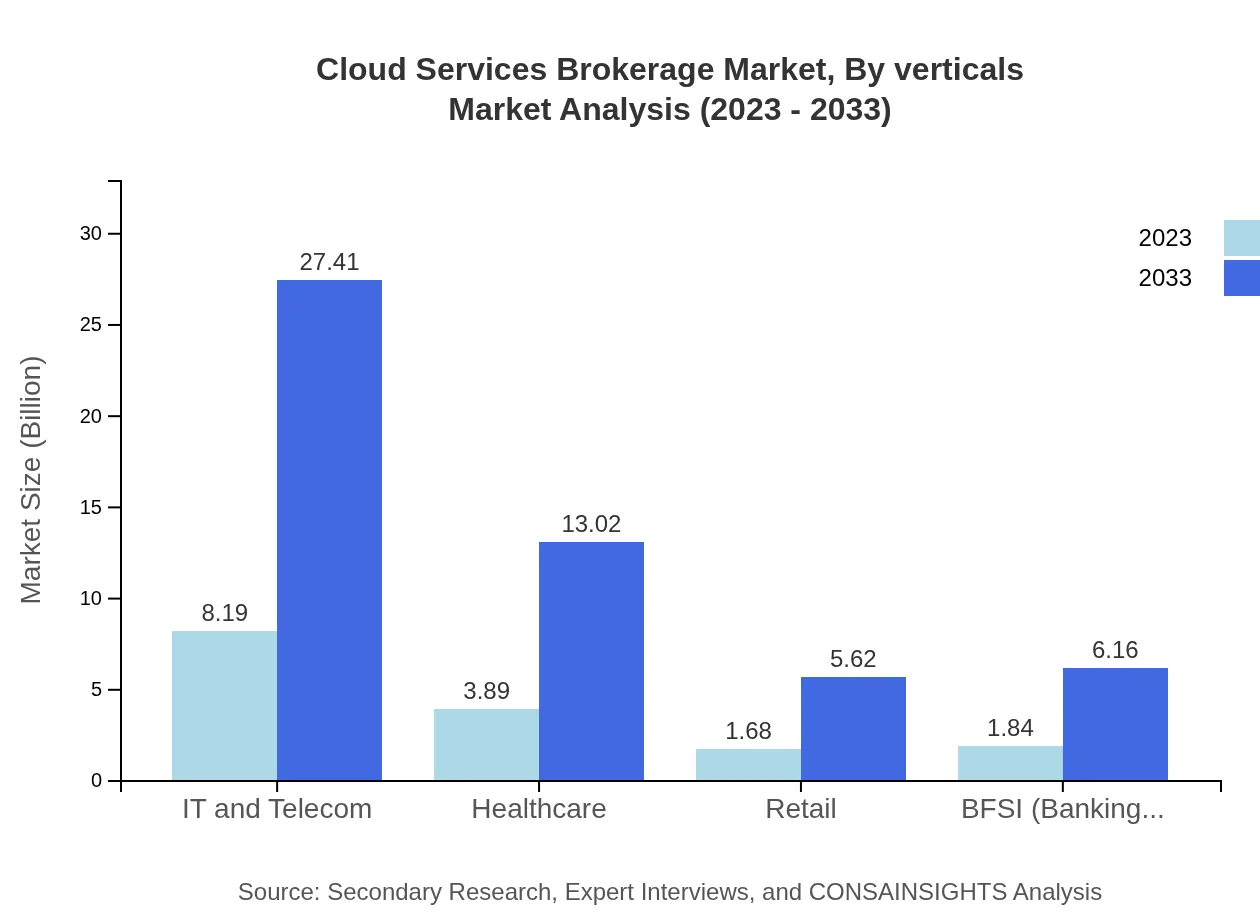

Cloud Services Brokerage Market Analysis By Verticals

Vertical segmentation highlights the diverse use cases of cloud services. The IT and Telecom sector leads with a market size of \$8.19 billion in 2023 and expected growth to \$27.41 billion by 2033, maintaining a share of 52.49%. Other sectors include healthcare, retail, and BFSI, each with unique requirements that cloud brokers fulfill.

Cloud Services Brokerage Market Analysis By Region

Regional analysis emphasizes market dynamics varying by geographic area. North America, as the market leader, highlights a substantial size and share. In contrast, emerging regions like Asia Pacific and South America show significant growth potential driven by increased digital transformation and cloud adoption.

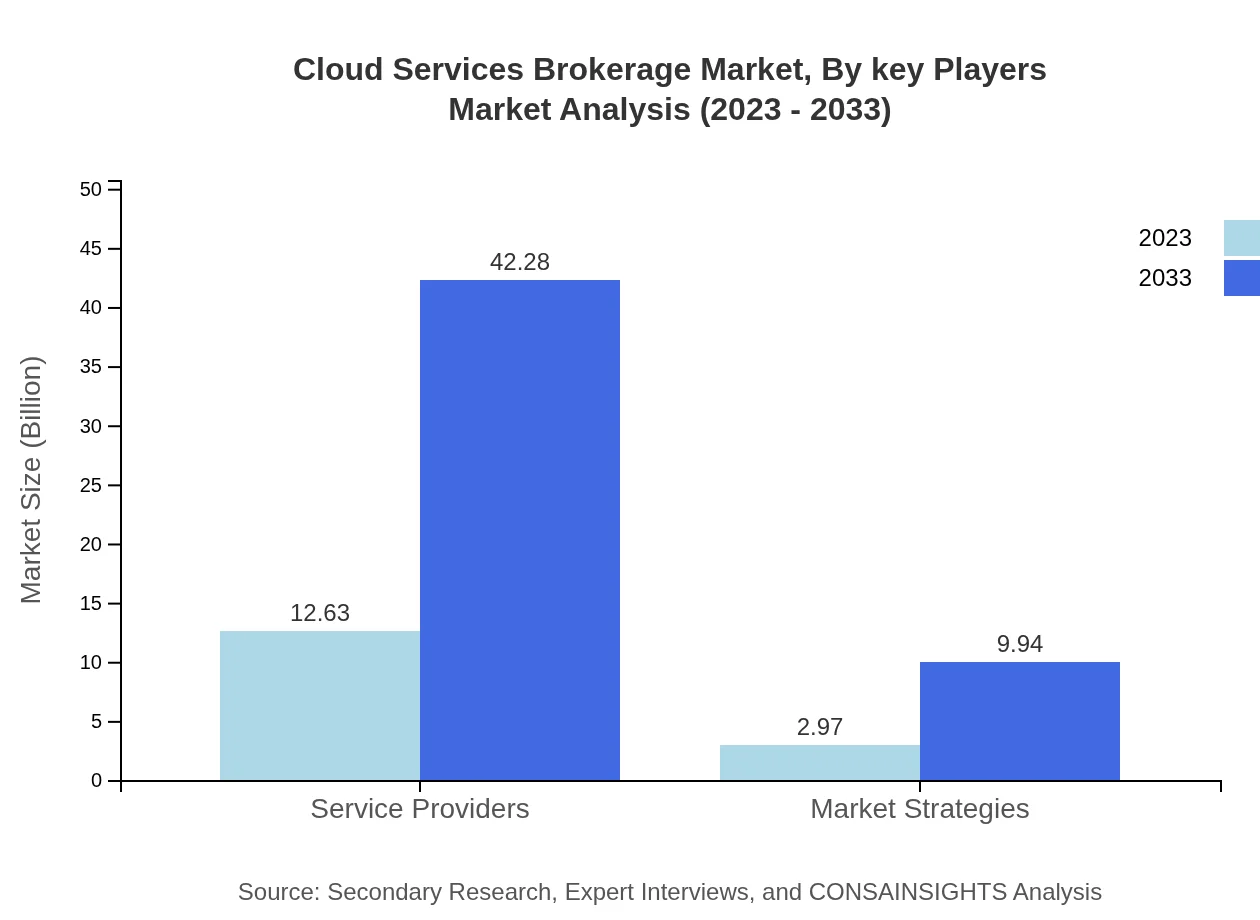

Cloud Services Brokerage Market Analysis By Key Players

Key players in the Cloud Services Brokerage market contribute significantly to its growth through innovation and strategic partnerships. Market leaders include firms like IBM, Accenture, and CloudBolt. Each offers a range of solutions that enhance cloud management and facilitate integrated services for enterprises.

Cloud Services Brokerage Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cloud Services Brokerage Industry

IBM:

IBM offers comprehensive cloud brokerage solutions that help organizations integrate and manage their multi-cloud environments, combining advanced technology with deep industry expertise.Accenture:

Accenture provides exceptional cloud services combining consulting and technology capabilities to optimize clients’ cloud strategies and implementations.CloudBolt:

CloudBolt specializes in cloud management solutions that ensure better visibility, further governance, and cloud cost management for enterprises adopting multi-cloud services.Morpheus Data:

Morpheus Data delivers cloud management solutions across hybrid environments, supporting enterprises in their journey toward digital transformation and effective cloud strategy implementation.RightScale (Flexera):

RightScale helps organizations manage their cloud environments effectively with analytics-rich platforms that optimize cloud usage and spending.We're grateful to work with incredible clients.

FAQs

What is the market size of cloud Services Brokerage?

The cloud services brokerage market is currently valued at approximately $15.6 billion in 2023, with a projected CAGR of 12.3%, indicating robust growth potential and increasing adoption of cloud solutions.

What are the key market players or companies in this cloud Services Brokerage industry?

Key players in the cloud services brokerage industry include major technology companies such as AWS, Microsoft, Google Cloud, IBM, and Salesforce, which dominate the market with innovative solutions and strategic partnerships.

What are the primary factors driving the growth in the cloud Services Brokerage industry?

Growth in the cloud services brokerage industry is driven by increasing digital transformation initiatives, demand for multi-cloud solutions, improved customer service, and the need for effective cloud management and integration.

Which region is the fastest Growing in the cloud Services Brokerage?

North America is the fastest-growing region in the cloud services brokerage market, with a projected size increase from $5.40 billion in 2023 to $18.06 billion by 2033, reflecting strong adoption rates and technological advancements.

Does ConsaInsights provide customized market report data for the cloud Services Brokerage industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the cloud services brokerage industry, enabling businesses to access exclusive insights and analysis relevant to their strategic goals.

What deliverables can I expect from this cloud Services Brokerage market research project?

From the cloud services brokerage market research project, you can expect detailed reports including market analysis, growth forecasts, competitive landscape, and segmentation insights tailored for stakeholders and decision-makers.

What are the market trends of cloud Services Brokerage?

Current market trends in cloud services brokerage include an increased focus on automation, enhanced security measures, growing preference for hybrid and multi-cloud environments, and the emergence of new service models.