Cloudbased Payroll Software Market Report

Published Date: 31 January 2026 | Report Code: cloudbased-payroll-software

Cloudbased Payroll Software Market Size, Share, Industry Trends and Forecast to 2033

This market report provides a comprehensive analysis of the Cloudbased Payroll Software industry from 2023 to 2033. It includes insights on market size, regional analysis, segmentation, leading companies, and future trends to guide stakeholders in decision-making.

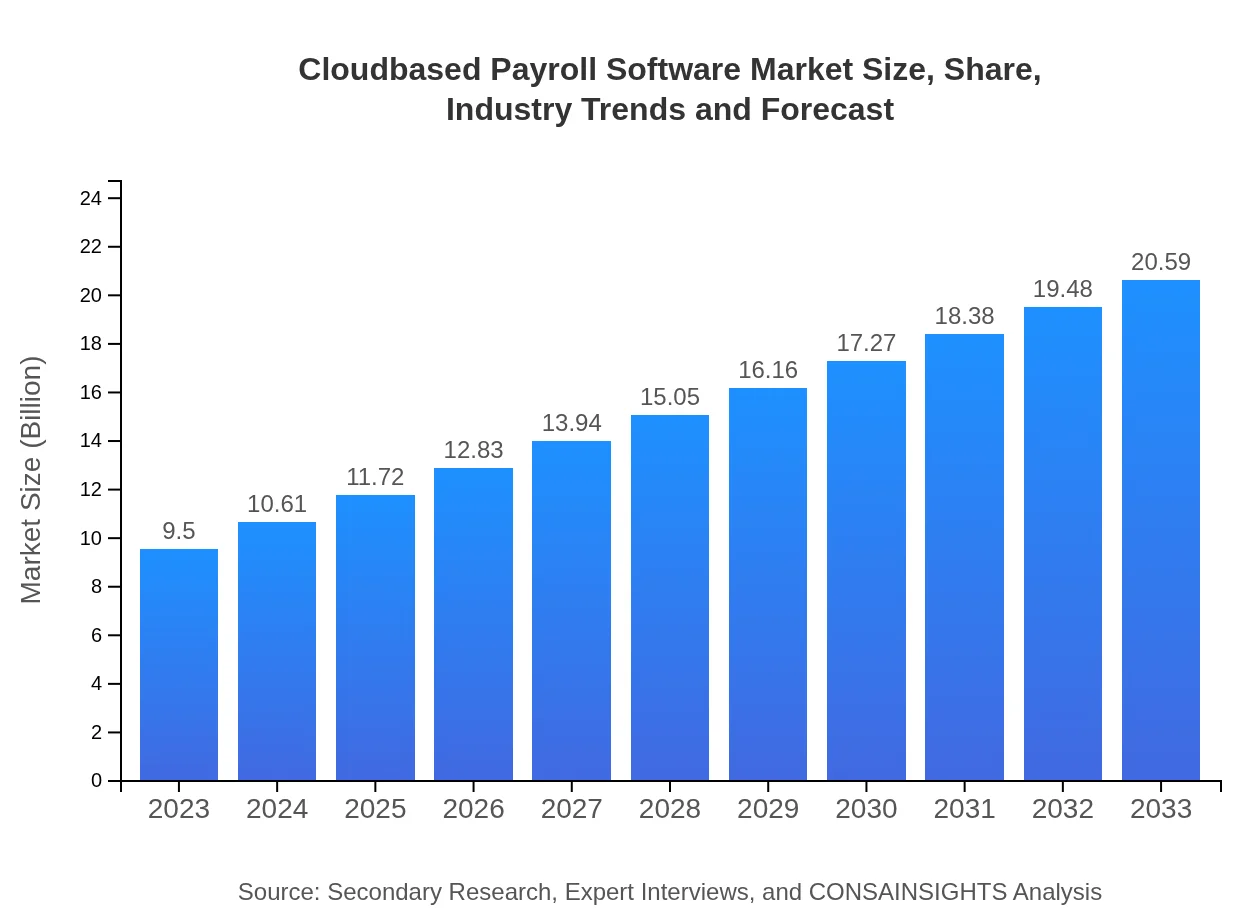

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $9.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $20.59 Billion |

| Top Companies | ADP, Paychex , Paycor, Gusto, Zenefits |

| Last Modified Date | 31 January 2026 |

Cloudbased Payroll Software Market Overview

Customize Cloudbased Payroll Software Market Report market research report

- ✔ Get in-depth analysis of Cloudbased Payroll Software market size, growth, and forecasts.

- ✔ Understand Cloudbased Payroll Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cloudbased Payroll Software

What is the Market Size & CAGR of Cloudbased Payroll Software market in 2023?

Cloudbased Payroll Software Industry Analysis

Cloudbased Payroll Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cloudbased Payroll Software Market Analysis Report by Region

Europe Cloudbased Payroll Software Market Report:

Europe's Cloudbased Payroll Software market is anticipated to expand from $2.84 billion in 2023 to $6.15 billion by 2033, with a CAGR of 8.25%. Strong regulations around data protection and a focus on employee experience enhance the need for sophisticated payroll solutions across European nations.Asia Pacific Cloudbased Payroll Software Market Report:

In the Asia Pacific region, the Cloudbased Payroll Software market is expected to grow from $1.94 billion in 2023 to $4.21 billion by 2033, with a CAGR of 8.08%. The increasing digitalization of businesses and the rise of SMEs in countries like India and China contribute significantly to this growth, along with a growing demand for automated payroll solutions.North America Cloudbased Payroll Software Market Report:

North America remains the largest market, valued at $3.29 billion in 2023 and expected to rise to $7.14 billion by 2033, maintaining a CAGR of 8.21%. The presence of leading players and early adoption of cloud technologies in the US and Canada are key drivers, along with rigorous regulatory frameworks.South America Cloudbased Payroll Software Market Report:

The South American market is smaller, with a valuation of $0.19 billion in 2023, projected to reach $0.42 billion by 2033, growing at a CAGR of 8.50%. Growing awareness of digital solutions and the need for regulatory compliance drive adoption in this region, although challenges such as economic instability may impact growth rates.Middle East & Africa Cloudbased Payroll Software Market Report:

In the Middle East and Africa, the market is expected to increase from $1.23 billion in 2023 to $2.68 billion by 2033, growing at a CAGR of 8.06%. Rapid digitization in emerging economies and a growing demand for workforce efficiency in established markets like UAE drive this growth.Tell us your focus area and get a customized research report.

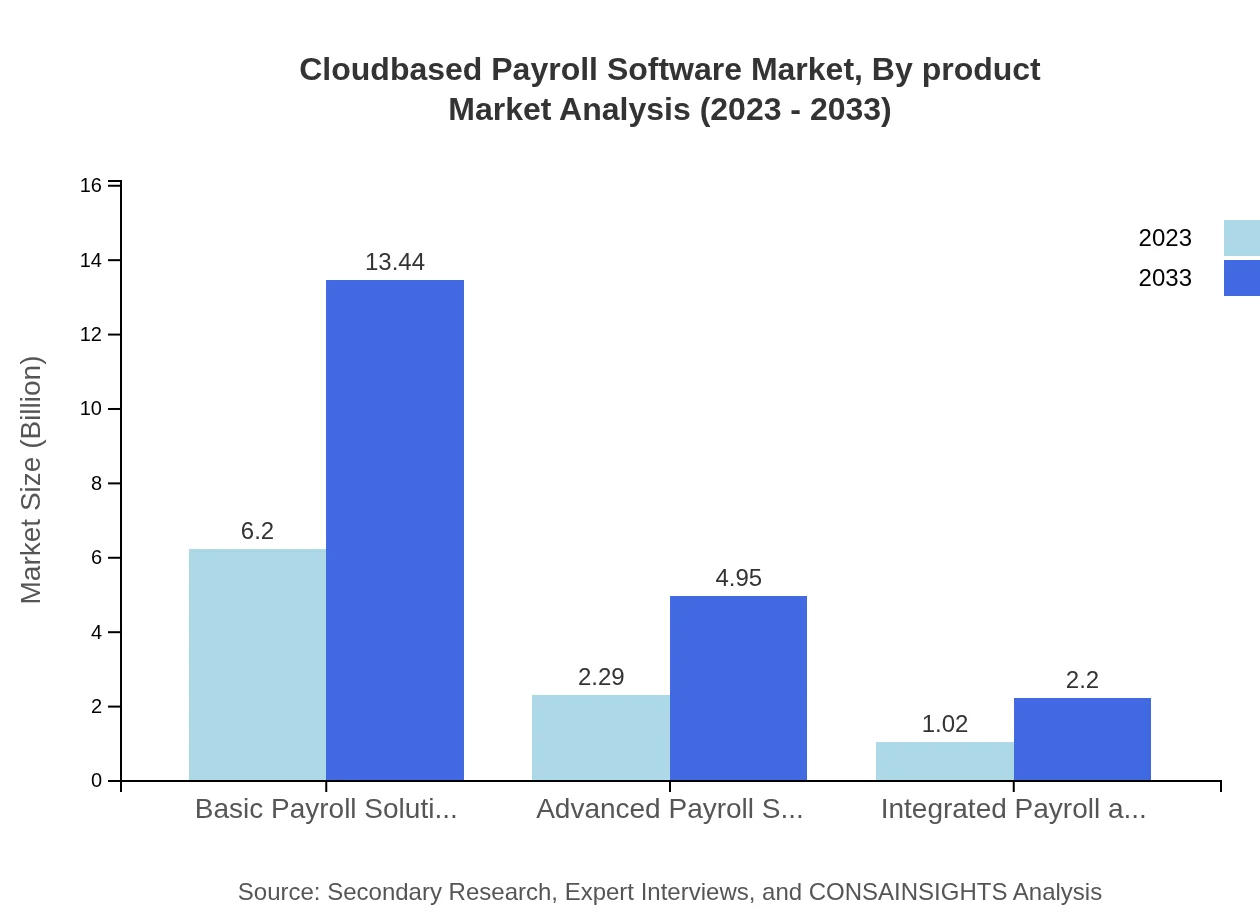

Cloudbased Payroll Software Market Analysis By Product

The Cloudbased Payroll Software market is categorized into three primary product types: Basic Payroll Solutions, Advanced Payroll Solutions, and Integrated Payroll and HR Solutions. Basic Payroll Solutions dominate the market with a size of $6.20 billion in 2023 and projected growth to $13.44 billion by 2033. Advanced Payroll Solutions show promise with a market size of $2.29 billion in 2023, scaling to $4.95 billion in 2033. Integrated Payroll and HR Solutions are also gaining traction, expected to grow from $1.02 billion to $2.20 billion over the same period.

Cloudbased Payroll Software Market Analysis By Application

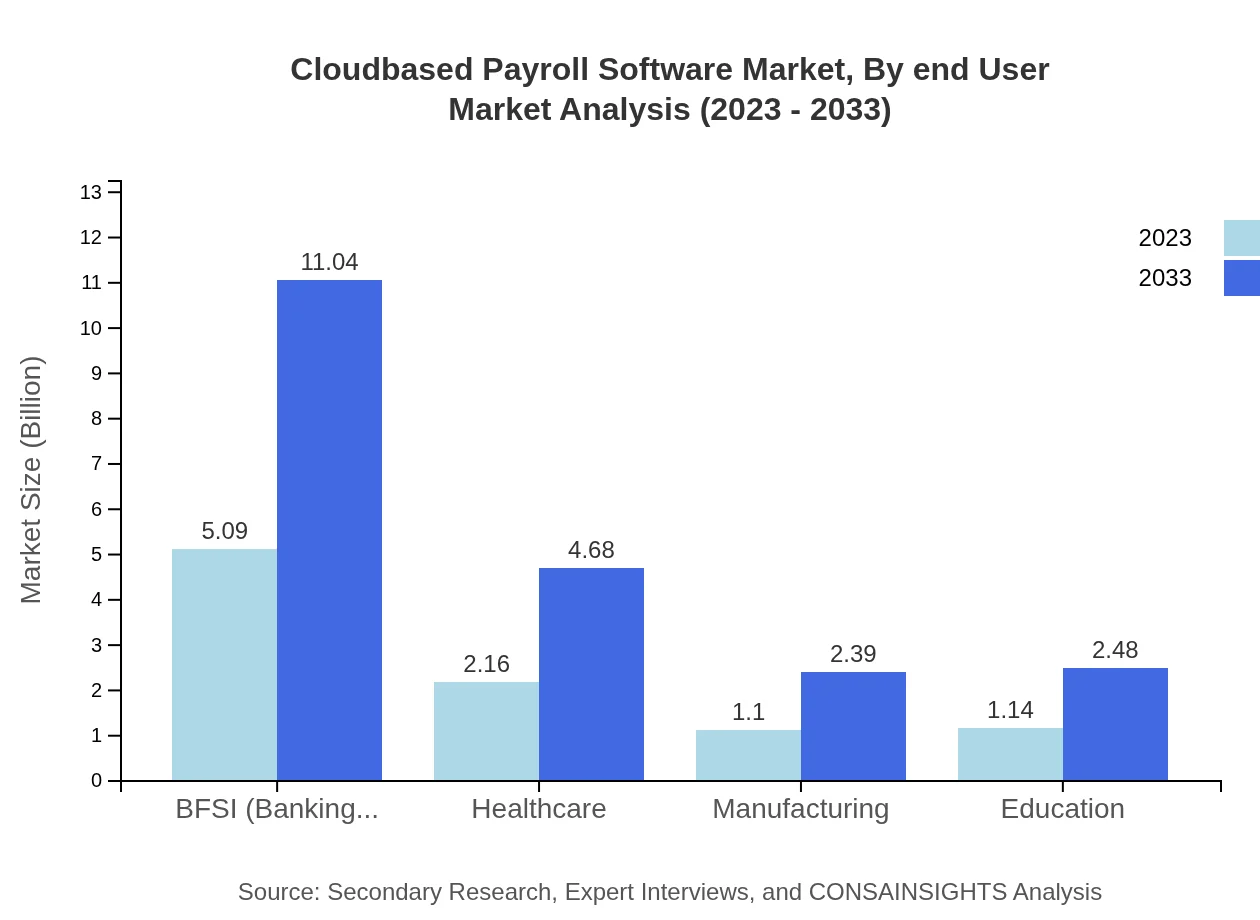

Different applications across industries utilize Cloudbased Payroll Software, such as Banking, Financial Services and Insurance (BFSI), Healthcare, Manufacturing, and Education. BFSI dominates with a size of $5.09 billion in 2023, rising to $11.04 billion by 2033. The Healthcare sector follows, valued at $2.16 billion in 2023, projected to reach $4.68 billion by 2033.

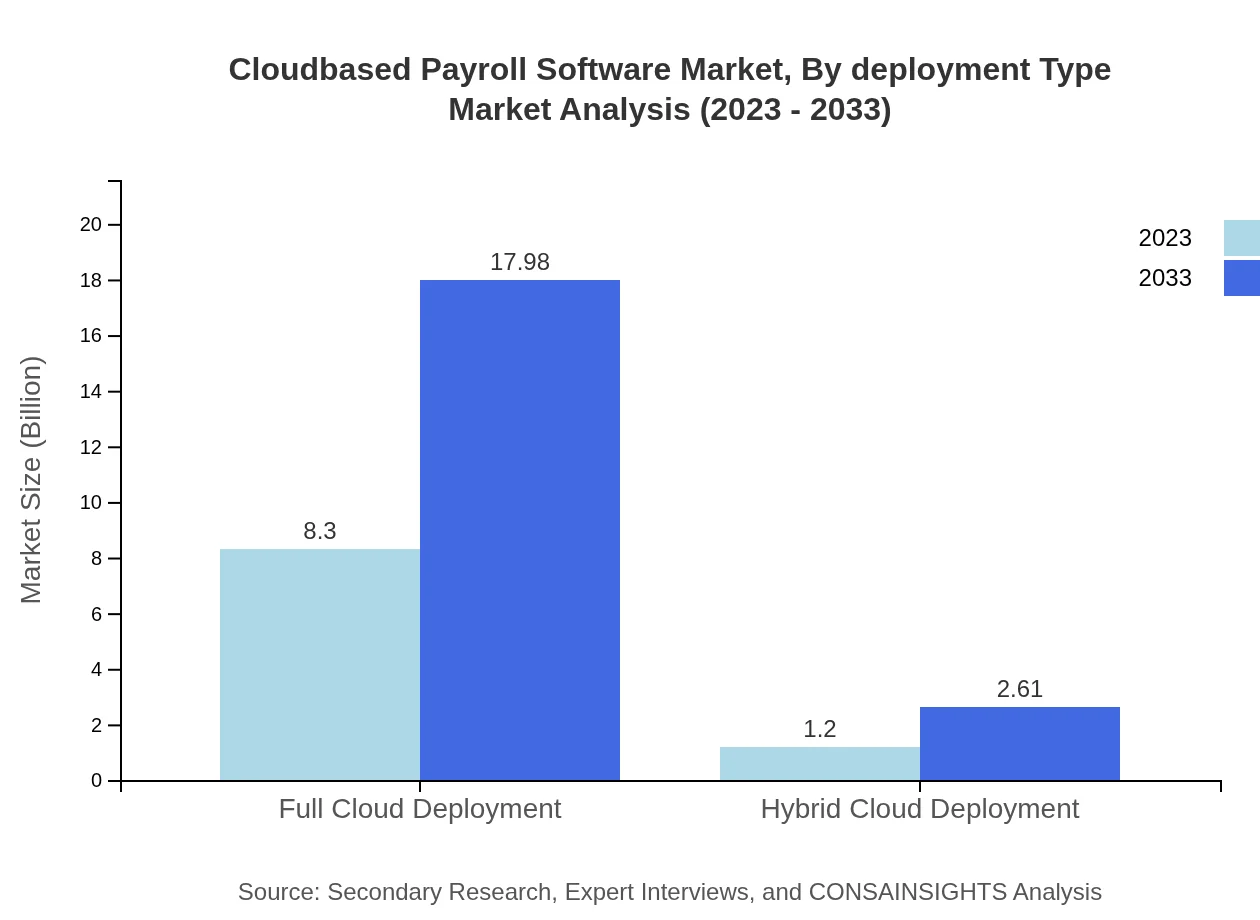

Cloudbased Payroll Software Market Analysis By Deployment Type

Deployment types for Cloudbased Payroll Software include Full Cloud Deployment and Hybrid Cloud Deployment. Full Cloud Deployment enjoys the largest share, valued at $8.30 billion in 2023, predicted to grow to $17.98 billion by 2033. Hybrid Cloud Deployment is also relevant, with a valuation of $1.20 billion expected to reach $2.61 billion in the same period.

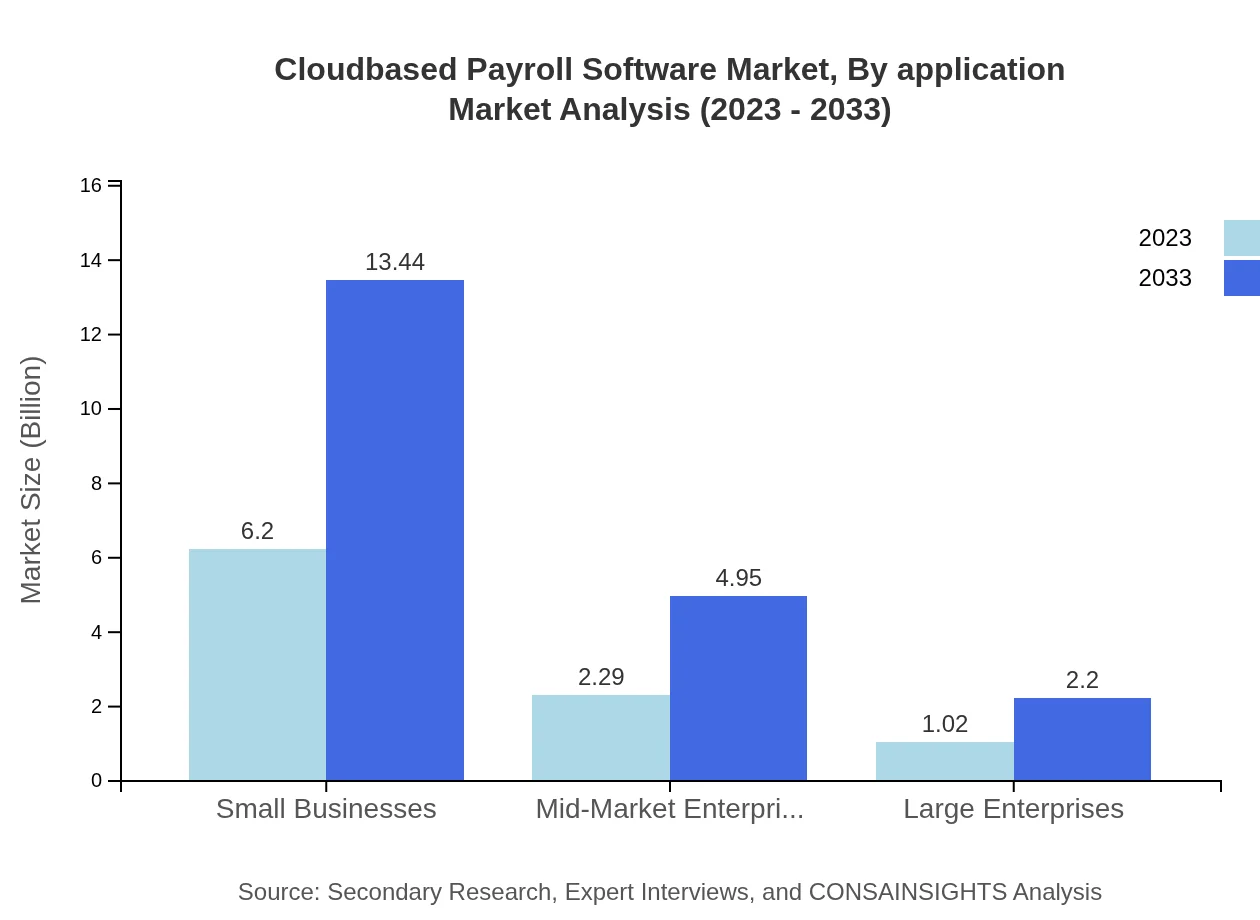

Cloudbased Payroll Software Market Analysis By End User

The end-user segments consist of Small Businesses, Mid-Market Enterprises, and Large Enterprises. Small Businesses hold a significant market share of $6.20 billion in 2023, anticipated to reach $13.44 billion by 2033. Mid-Market Enterprises are projected to grow from $2.29 billion to $4.95 billion, and Large Enterprises from $1.02 billion to $2.20 billion in the same period.

Cloudbased Payroll Software Market Analysis By Features

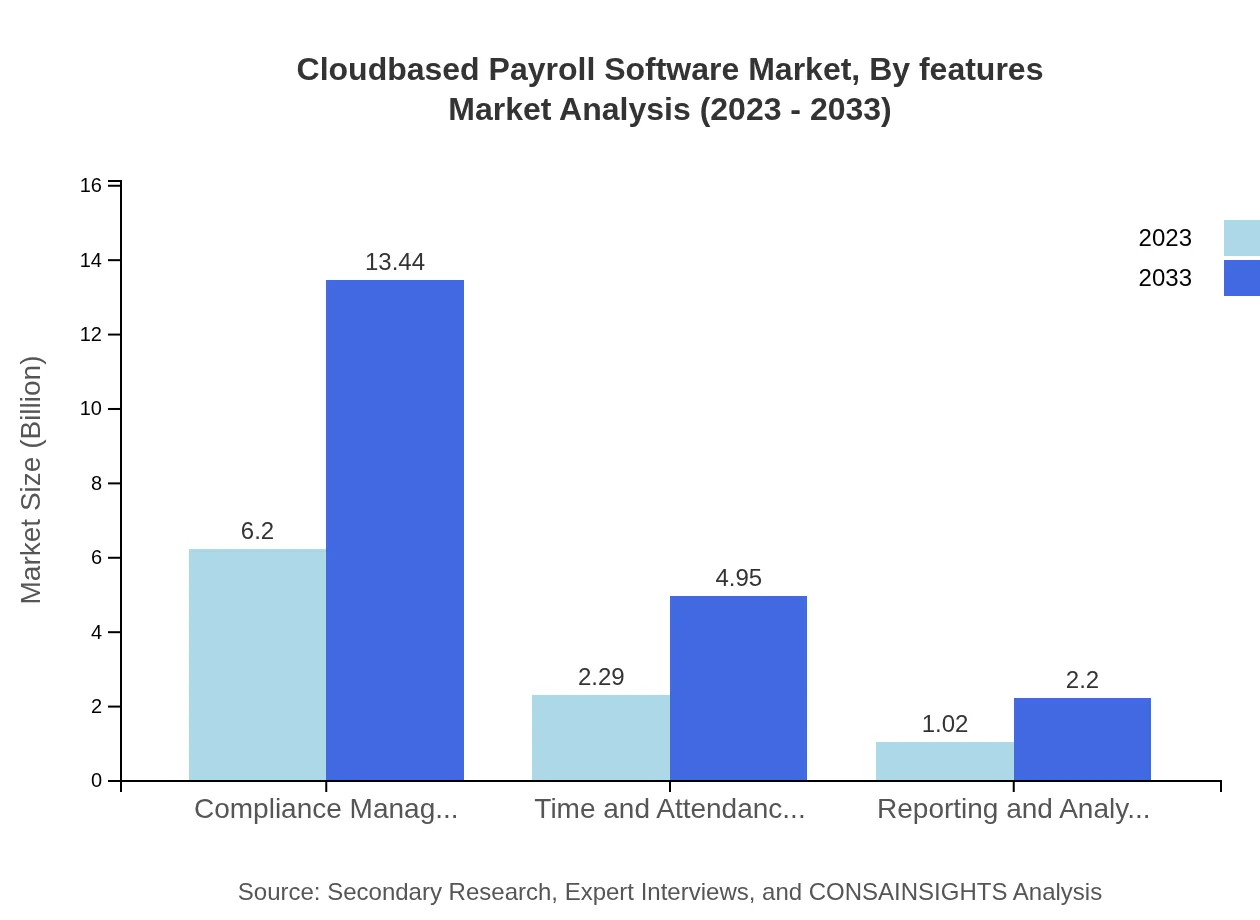

Key features in Cloudbased Payroll Software include Compliance Management, Time and Attendance Tracking, and Reporting and Analytics. Compliance Management leads this segment with a size of $6.20 billion in 2023, expected to grow to $13.44 billion. Time and Attendance Tracking is also significant, projected to increase from $2.29 billion to $4.95 billion by 2033.

Cloudbased Payroll Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cloudbased Payroll Software Industry

ADP:

ADP is a pioneer in payroll services, offering comprehensive cloud-based payroll solutions for businesses of all sizes, focusing on compliance, scalability, and efficiency.Paychex :

Paychex provides innovative payroll and HR solutions through its cloud platform, supporting small to medium-sized businesses with robust tools for payroll processing and employee management.Paycor:

Paycor offers cloud-based HR and payroll solutions, delivering services geared towards small and mid-sized businesses, emphasizing ease of use and integration.Gusto:

Gusto specializes in cloud-based payroll and HR software, focusing on modernizing payroll solutions for small businesses and enriching the employee experience.Zenefits:

Zenefits is an all-in-one digital HR platform that includes payroll processing, aimed at simplifying HR functions for small and mid-sized businesses.We're grateful to work with incredible clients.

FAQs

What is the market size of cloudbased Payroll Software?

The cloud-based payroll software market is projected to reach $9.5 billion by 2033, growing at a CAGR of 7.8% from 2023. This growth signifies a robust demand for efficient payroll solutions across various industries.

What are the key market players or companies in the cloudbased Payroll Software industry?

The key players in the cloud-based payroll software market include major industry leaders such as ADP, Paychex, Intuit, Gusto, and Paylocity, all playing vital roles in shaping industry standards and innovation.

What are the primary factors driving the growth in the cloudbased Payroll Software industry?

Growth in the cloud-based payroll software industry is driven by increasing demand for automation, growing remote workforce, legislative compliance needs, and advancements in technology such as AI and machine learning integration.

Which region is the fastest Growing in the cloudbased Payroll Software?

The fastest-growing region for cloud-based payroll software is North America, projected to grow from $3.29 billion in 2023 to $7.14 billion by 2033, driven by high adoption rates of digital payroll solutions in various sectors.

Does ConsaInsights provide customized market report data for the cloudbased Payroll Software industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the cloud-based payroll software industry, ensuring insightful analysis that aligns with unique business objectives.

What deliverables can I expect from this cloudbased Payroll Software market research project?

Expect comprehensive deliverables including detailed reports, market forecasts, competitive analysis, segmentation insights, and region-specific trends that can inform strategic decision-making and business planning.

What are the market trends of cloudbased Payroll Software?

Current trends in the cloud-based payroll software market include the rise of integrated HR solutions, increased focus on compliance management, and an emphasis on user-friendly platforms that enhance employee engagement and experience.