Cmos Image Sensors Market Report

Published Date: 31 January 2026 | Report Code: cmos-image-sensors

Cmos Image Sensors Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the CMOS Image Sensors market from 2023 to 2033. It includes insights into market size, segmentation, regional analysis, industry trends, and future forecasts, offering stakeholders vital data for strategic decision-making.

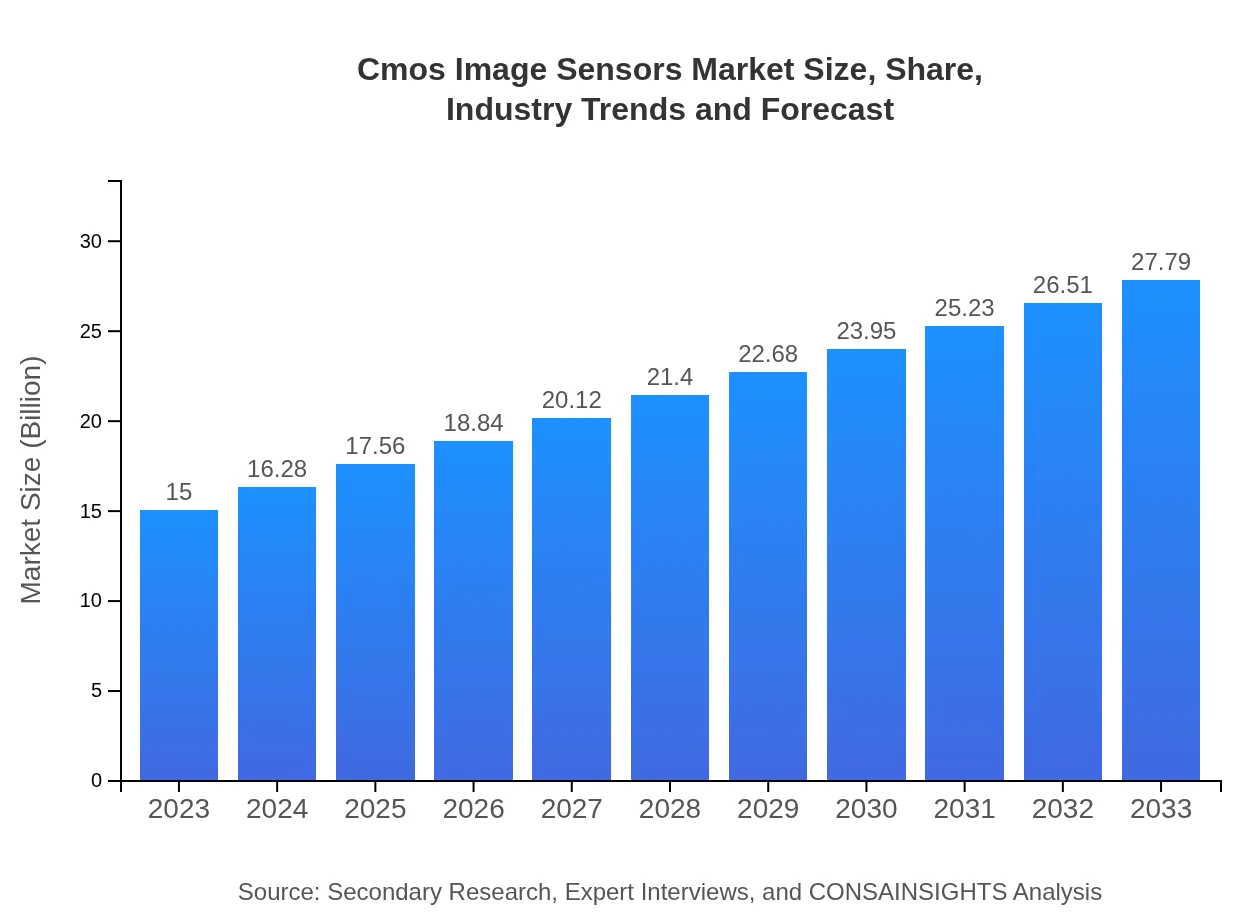

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $27.79 Billion |

| Top Companies | Sony, Samsung Electronics, OmniVision Technologies, Canon |

| Last Modified Date | 31 January 2026 |

Cmos Image Sensors Market Overview

Customize Cmos Image Sensors Market Report market research report

- ✔ Get in-depth analysis of Cmos Image Sensors market size, growth, and forecasts.

- ✔ Understand Cmos Image Sensors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cmos Image Sensors

What is the Market Size & CAGR of Cmos Image Sensors market in 2023?

Cmos Image Sensors Industry Analysis

Cmos Image Sensors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cmos Image Sensors Market Analysis Report by Region

Europe Cmos Image Sensors Market Report:

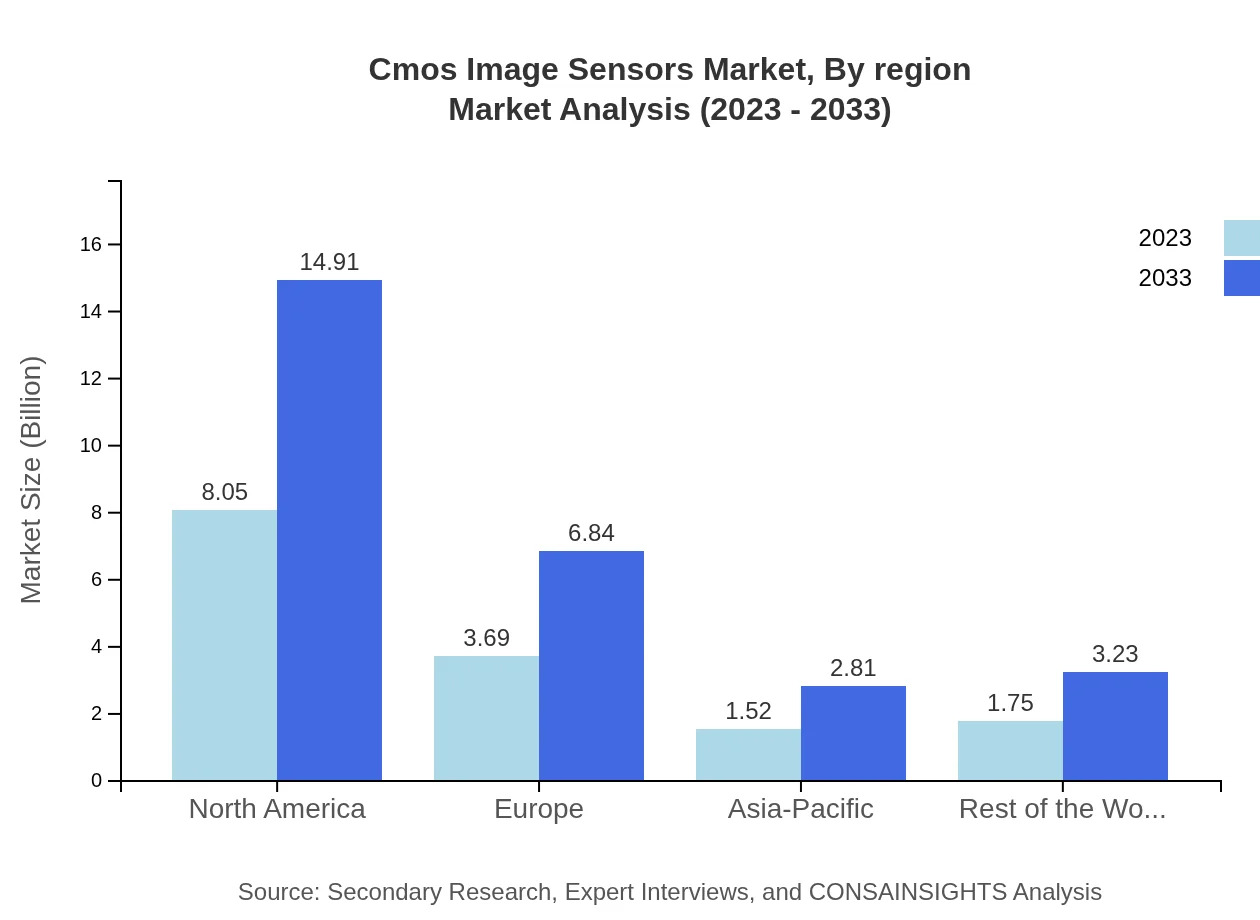

In Europe, the market for CMOS image sensors is projected to rise from $4.13 billion in 2023 to $7.65 billion in 2033. Factors contributing to this growth include the region's focus on R&D and innovation in imaging technologies.Asia Pacific Cmos Image Sensors Market Report:

The Asia-Pacific region exhibits robust growth potential in the CMOS image sensors market, with the market size anticipated to expand from $3.25 billion in 2023 to $6.03 billion in 2033. The region's dominance is attributed to the presence of key electronics manufacturers and a surge in smartphone production.North America Cmos Image Sensors Market Report:

North America is expected to hold a significant share of the market, growing from $5.26 billion in 2023 to $9.75 billion by 2033. The region's strong demand for advanced automotive applications and security systems will drive this growth.South America Cmos Image Sensors Market Report:

The South American market for CMOS image sensors is projected to grow from $1.34 billion in 2023 to $2.47 billion by 2033. The growth can be linked to the increasing adoption of digital imaging in sectors such as healthcare and security.Middle East & Africa Cmos Image Sensors Market Report:

The Middle East and Africa show moderate growth, with the market anticipated to grow from $1.02 billion in 2023 to $1.89 billion by 2033. Increasing investments in surveillance and security technologies will support market growth.Tell us your focus area and get a customized research report.

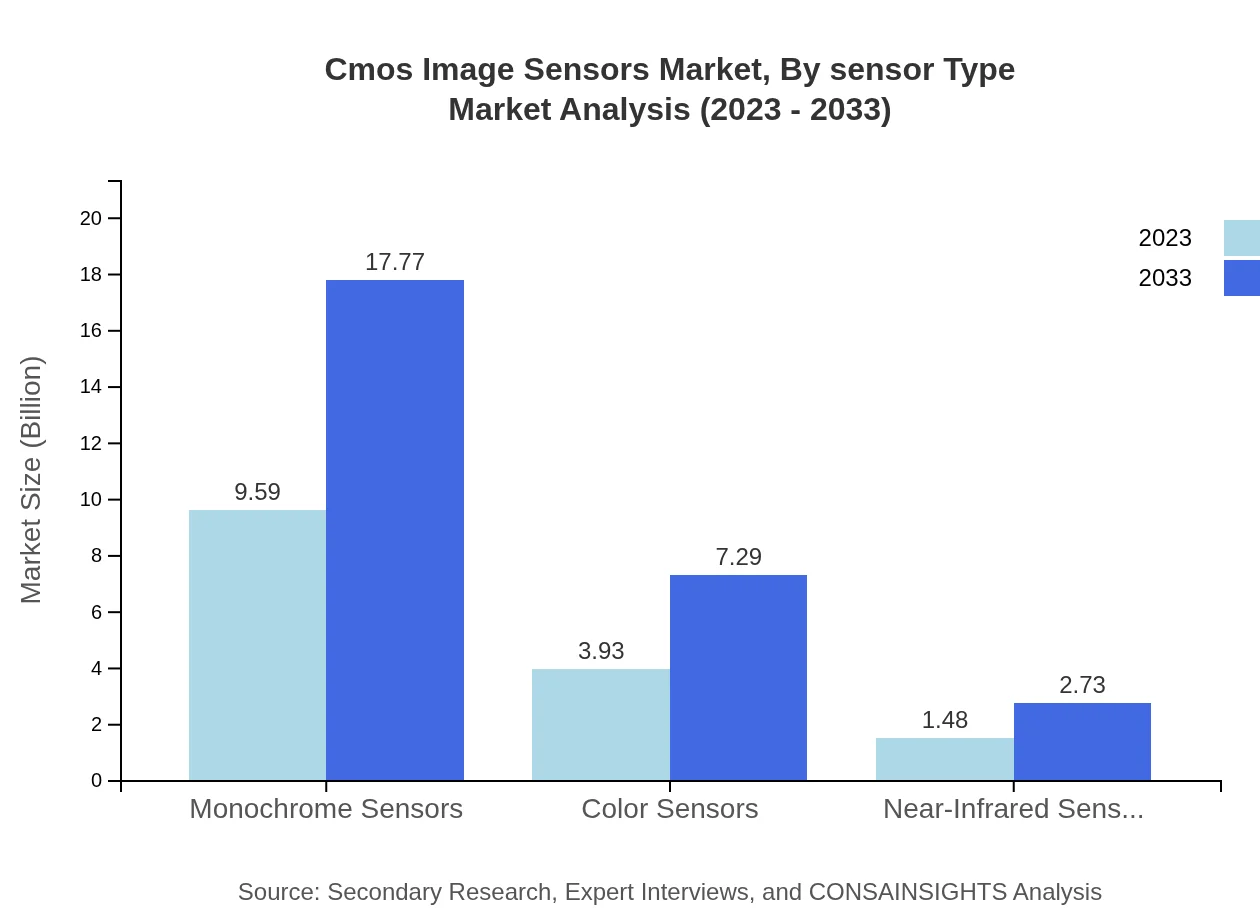

Cmos Image Sensors Market Analysis By Sensor Type

The analysis of the market by sensor type indicates that conventional CMOS sensors dominate with a market size of $9.59 billion in 2023, expected to reach $17.77 billion by 2033, holding a market share of 63.93%. Backside Illumination (BSI) sensors follow closely, with a growth from $3.93 billion to $7.29 billion, representing a market share of 26.23%. Stacked CMOS technology, though smaller, is projected to grow significantly as demand for advanced imaging solutions rises.

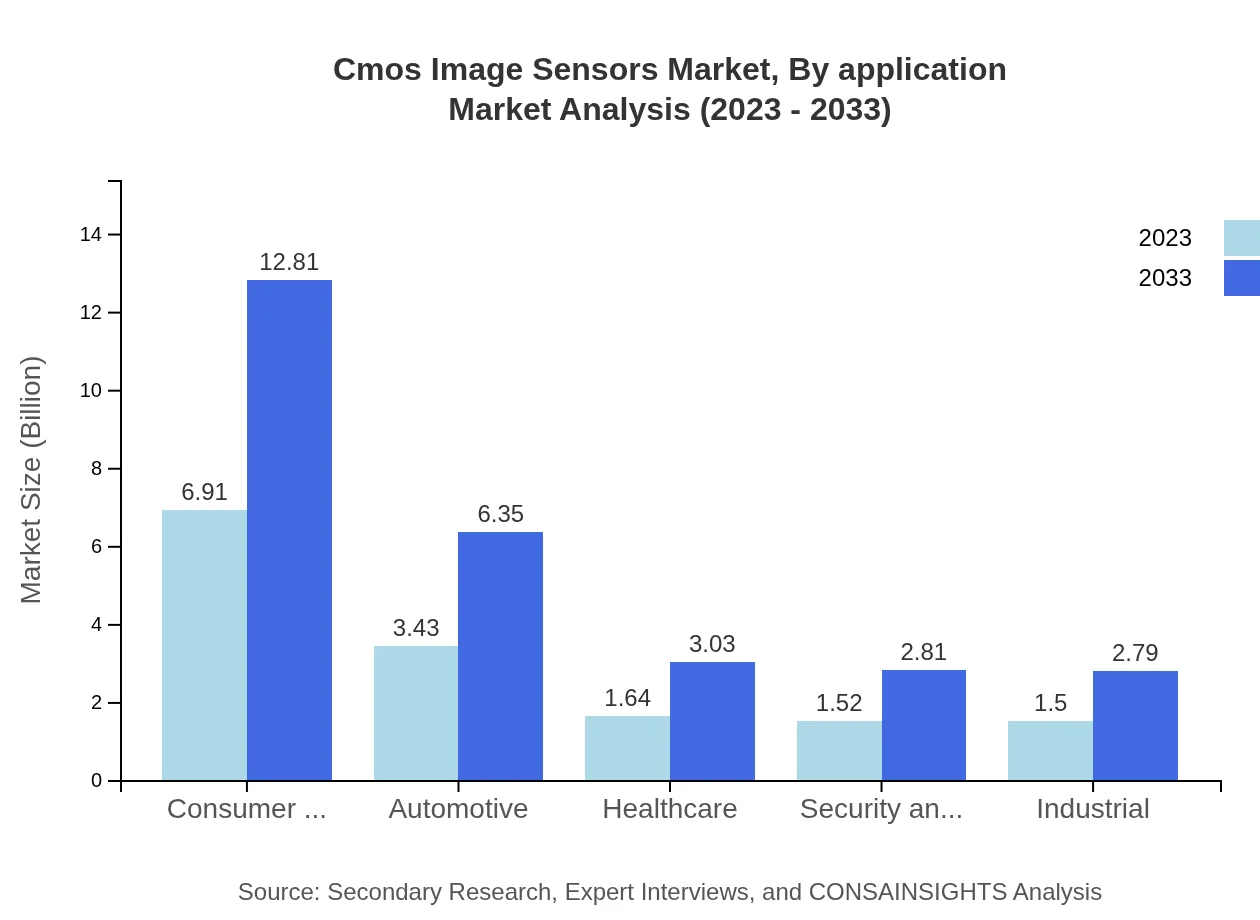

Cmos Image Sensors Market Analysis By Application

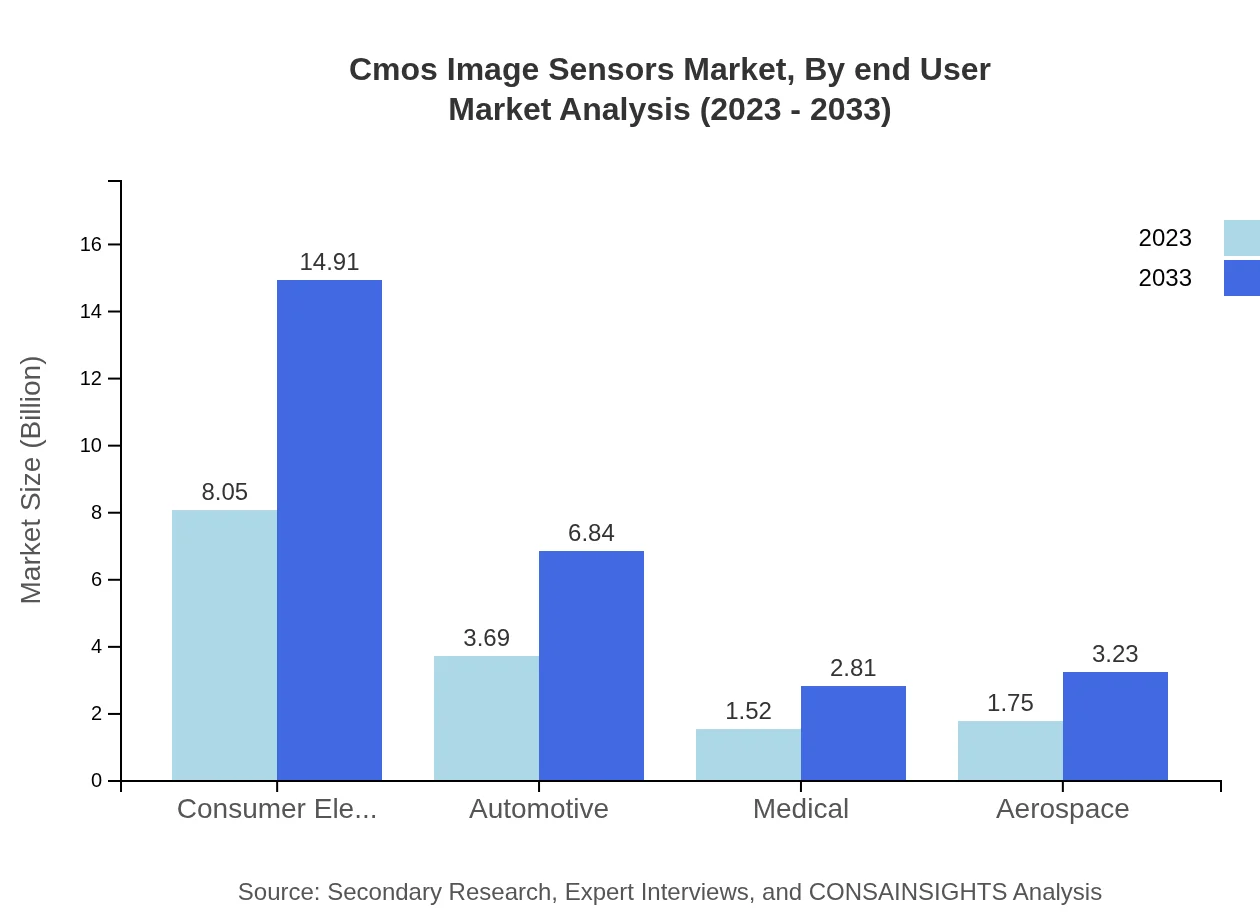

Consumer electronics lead the applications sector with a market size of $8.05 billion in 2023, expected to grow to $14.91 billion by 2033, maintaining a share of 53.64%. Automotive applications closely follow, projected to rise from $3.69 billion to $6.84 billion. Other segments like healthcare and industrial applications are also expanding, reflecting the versatile utility of CMOS image sensors.

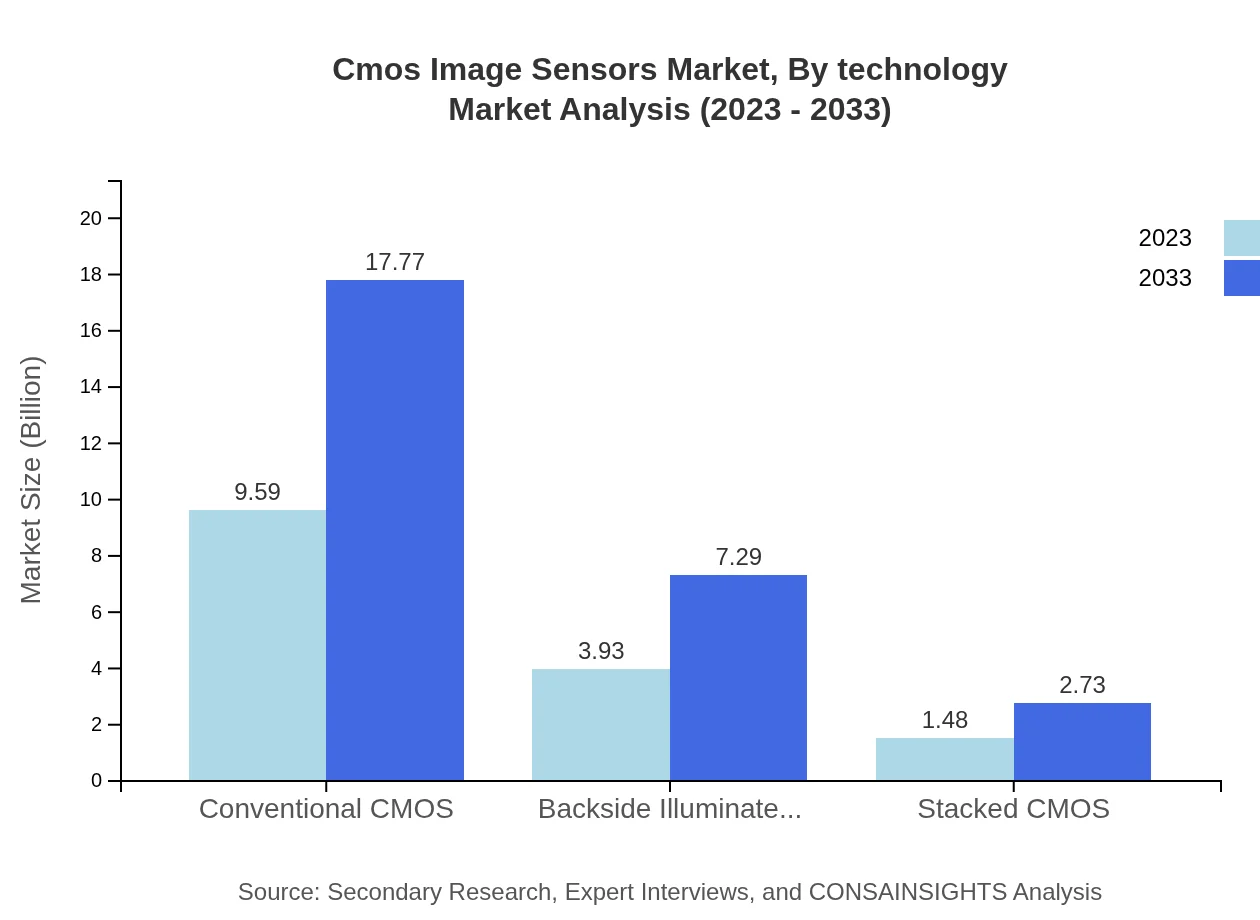

Cmos Image Sensors Market Analysis By Technology

Technologies impacting the market include standard CMOS, BSI, and stacked CMOS designs. Each technology plays a crucial role depending on use cases. BSI, for instance, offers better performance in low-light conditions, essential for modern smartphones and surveillance. The trend towards integrating AI capabilities also drives innovation in sensor technology, promising greater personalization and efficiency in image capture.

Cmos Image Sensors Market Analysis By End User

The end-user industry segmentation showcases a strong presence of consumer electronics, expected to maintain a share of over 53% by 2033. Automotive and medical sectors are notable contributors as well, with respective market sizes from $3.43 billion to $6.35 billion and $1.64 billion to $3.03 billion over the forecast period.

Cmos Image Sensors Market Analysis By Region

Regional analysis shows distinct trends, with North America leading the market in size, followed by Europe and Asia-Pacific. The consolidation of technology companies in North America, alongside Asia-Pacific's manufacturing prowess, further highlights the competitive landscape driven by innovation.

Cmos Image Sensors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cmos Image Sensors Industry

Sony:

Sony is a leading manufacturer of CMOS image sensors, recognized for its innovation and high-quality imaging technology, catering to both consumer electronics and professional cameras.Samsung Electronics:

Samsung is a key player in the CMOS sensor market, focusing on smart device integration and producing high-resolution sensors used extensively in mobile devices.OmniVision Technologies:

OmniVision specializes in advanced image sensor solutions, particularly in automotive and security applications, enhancing imaging capabilities worldwide.Canon:

Canon is known for its imaging and optical products and produces CMOS sensors used across its digital cameras and related equipment.We're grateful to work with incredible clients.

FAQs

What is the market size of cmos Image Sensors?

The global CMOS image sensor market is expected to reach approximately $15 billion by 2033, growing at a CAGR of 6.2% from its current valuation. This steady growth reflects increased demand across various sectors.

What are the key market players or companies in the cmos Image Sensors industry?

Leading companies in the CMOS image sensors market include Sony Corporation, Samsung Electronics, OmniVision Technologies, STMicroelectronics, and Canon Inc. Their continuous innovation and product development drive competition and market expansion.

What are the primary factors driving the growth in the cmos Image Sensors industry?

Key factors fueling growth include the rising demand for consumer electronics, advancements in automotive safety features, and emerging applications in medical imaging and industrial automation. Technological advancements further enhance product capabilities.

Which region is the fastest Growing in the cmos Image Sensors?

The Asia-Pacific region is witnessing rapid growth in the CMOS image sensors market, projected to grow from $3.25 billion in 2023 to $6.03 billion by 2033. This growth is attributed to increased electronics manufacturing.

Does ConsaInsights provide customized market report data for the cmos Image Sensors industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the CMOS image sensors industry. This can include detailed insights on market dynamics, competitive analysis, and forecasts.

What deliverables can I expect from this cmos Image Sensors market research project?

Deliverables include a comprehensive report featuring market size, growth forecasts, competitive landscape analysis, and segmentation data across various factors such as technology and application.

What are the market trends of cmos Image Sensors?

Market trends indicate a shift towards high-resolution sensors, BSI technology adoption, and integration into IoT devices. Additionally, increasing applications in autonomous vehicles and healthcare are notable growth drivers.