Cockpit Display Market Report

Published Date: 02 February 2026 | Report Code: cockpit-display

Cockpit Display Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Cockpit Display market, focusing on its growth forecasts from 2023 to 2033. It delves into market dynamics, segmentation, regional insights, and key technology trends impacting the industry.

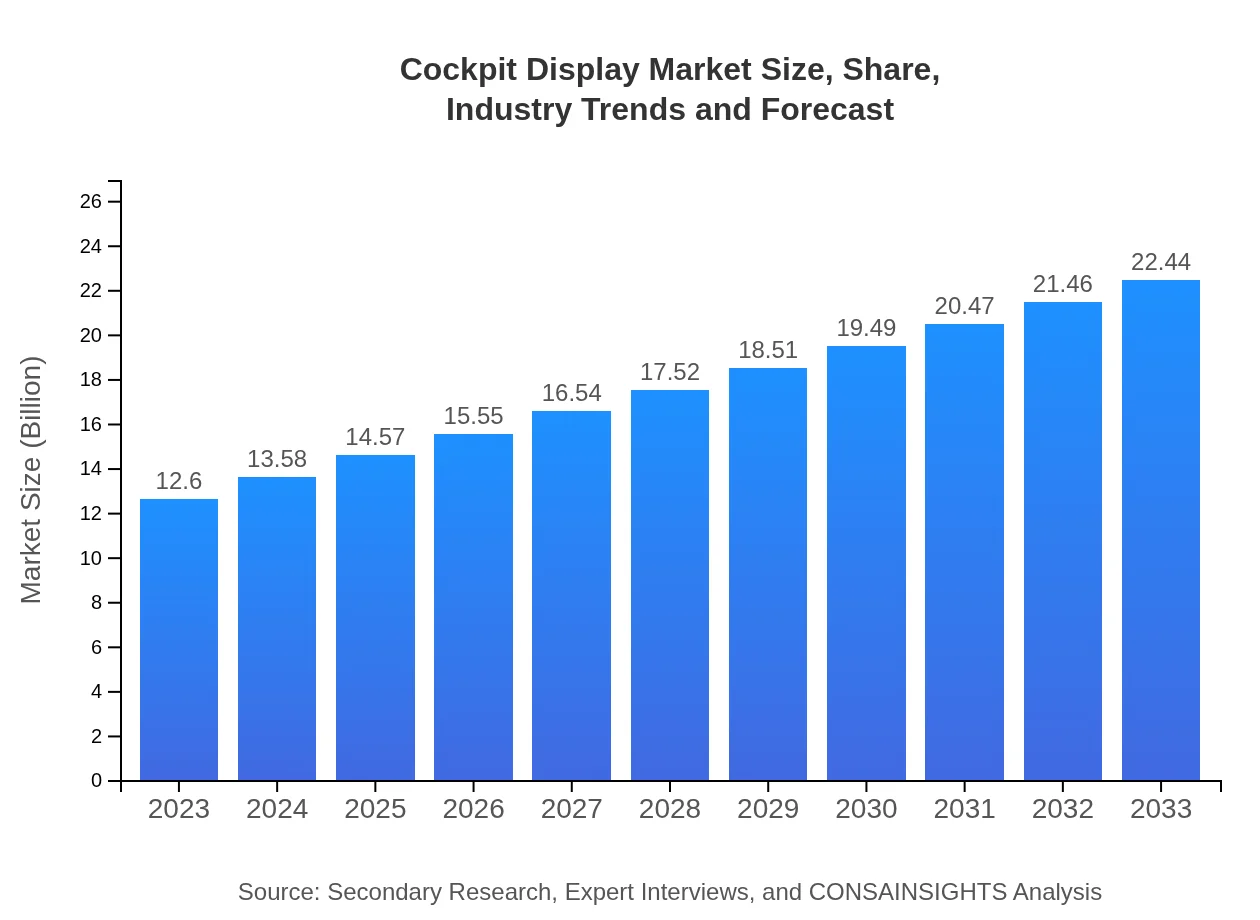

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.60 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $22.44 Billion |

| Top Companies | Honeywell International Inc., Rockwell Collins, Garmin Ltd., Thales Group, Northrop Grumman Corporation |

| Last Modified Date | 02 February 2026 |

Cockpit Display Market Overview

Customize Cockpit Display Market Report market research report

- ✔ Get in-depth analysis of Cockpit Display market size, growth, and forecasts.

- ✔ Understand Cockpit Display's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cockpit Display

What is the Market Size & CAGR of Cockpit Display market in 2023?

Cockpit Display Industry Analysis

Cockpit Display Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cockpit Display Market Analysis Report by Region

Europe Cockpit Display Market Report:

Europe’s market, valued at $3.95 billion in 2023, is anticipated to reach around $7.04 billion by 2033. The region's emphasis on safety and modernization in aviation technologies contributes to this growth.Asia Pacific Cockpit Display Market Report:

In the Asia Pacific region, the Cockpit Display market was valued at approximately $2.58 billion in 2023, projected to reach around $4.60 billion by 2033, reflecting significant growth due to increasing air travel demand and investments in modernizing aircraft fleet.North America Cockpit Display Market Report:

North America's Cockpit Display market is projected to grow from $4.14 billion in 2023 to an estimated $7.37 billion by 2033, bolstered by substantial investments from aircraft manufacturers and technological innovation.South America Cockpit Display Market Report:

The South American market for Cockpit Displays was valued at $1.22 billion in 2023 and is expected to grow to $2.18 billion by 2033. The growth is driven by the expansion of the airline industry and increasing military expenditure.Middle East & Africa Cockpit Display Market Report:

The Middle East and Africa market was valued at $0.71 billion in 2023 and is expected to grow to approximately $1.26 billion by 2033, driven by the growing aviation industry and investments in defense capabilities.Tell us your focus area and get a customized research report.

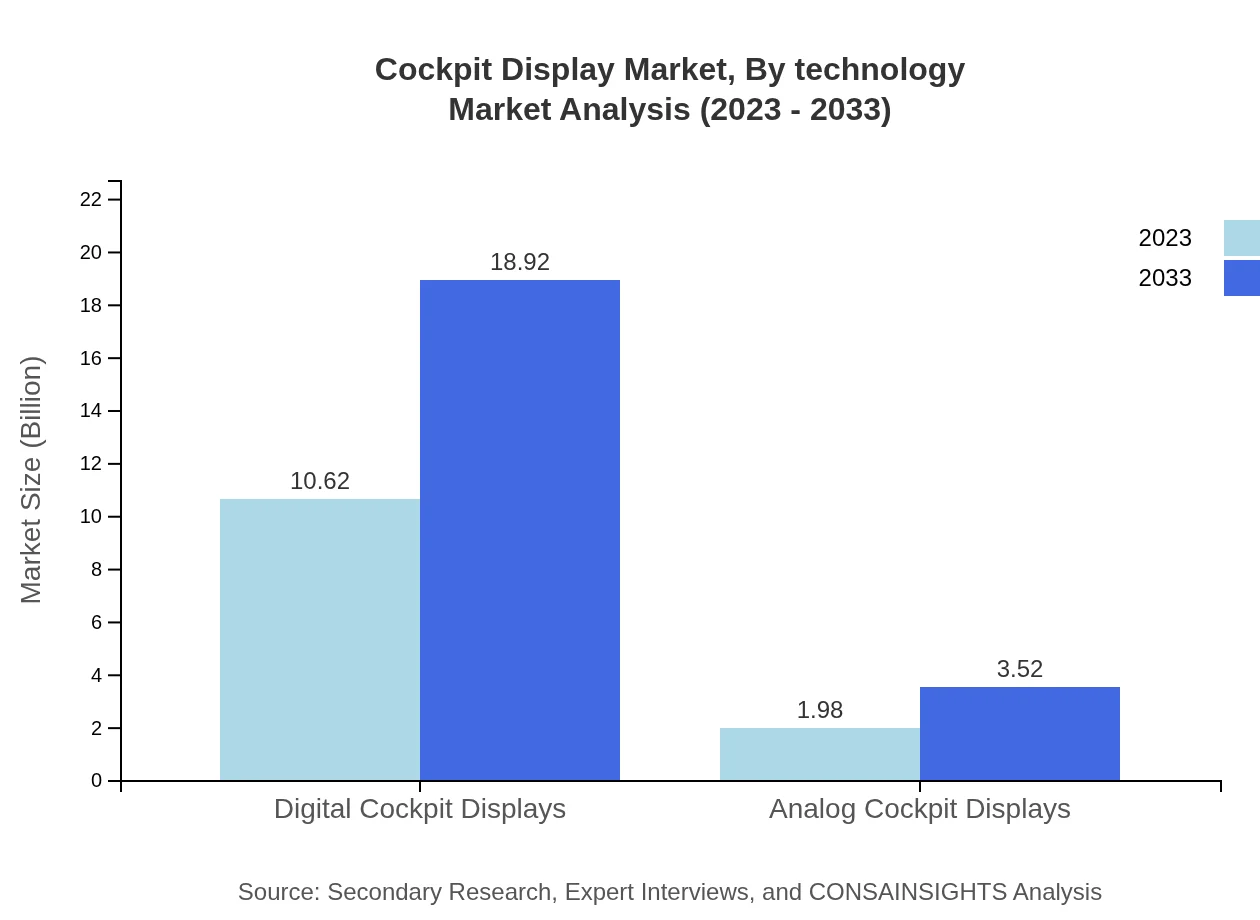

Cockpit Display Market Analysis By Display Type

The Cockpit Display Market is primarily segmented into Digital Cockpit Displays and Analog Cockpit Displays. In 2023, digital displays dominate with a market size of $10.62 billion, which is expected to grow to $18.92 billion by 2033. Analog displays, while less popular, still occupy a significant share, increasing from $1.98 billion in 2023 to $3.52 billion in 2033.

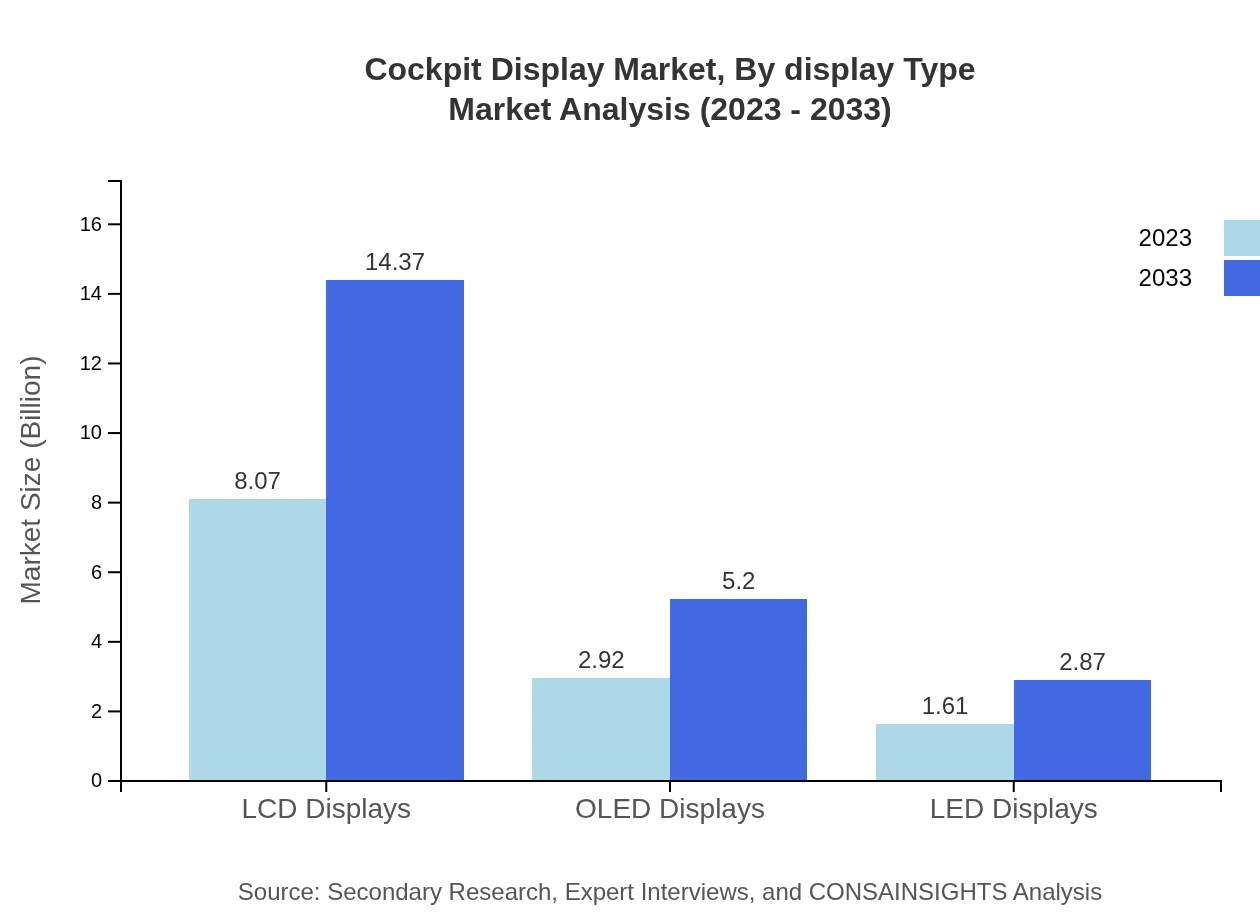

Cockpit Display Market Analysis By Technology

The Cockpit Display market is segmented by technology into LCD Displays, OLED Displays, and LED Displays. LCD technology leads with a market size of $8.07 billion in 2023, projected to rise to $14.37 billion by 2033. OLED and LED displays are also gaining traction, with OLEDs increasing from $2.92 billion to $5.20 billion in the same period.

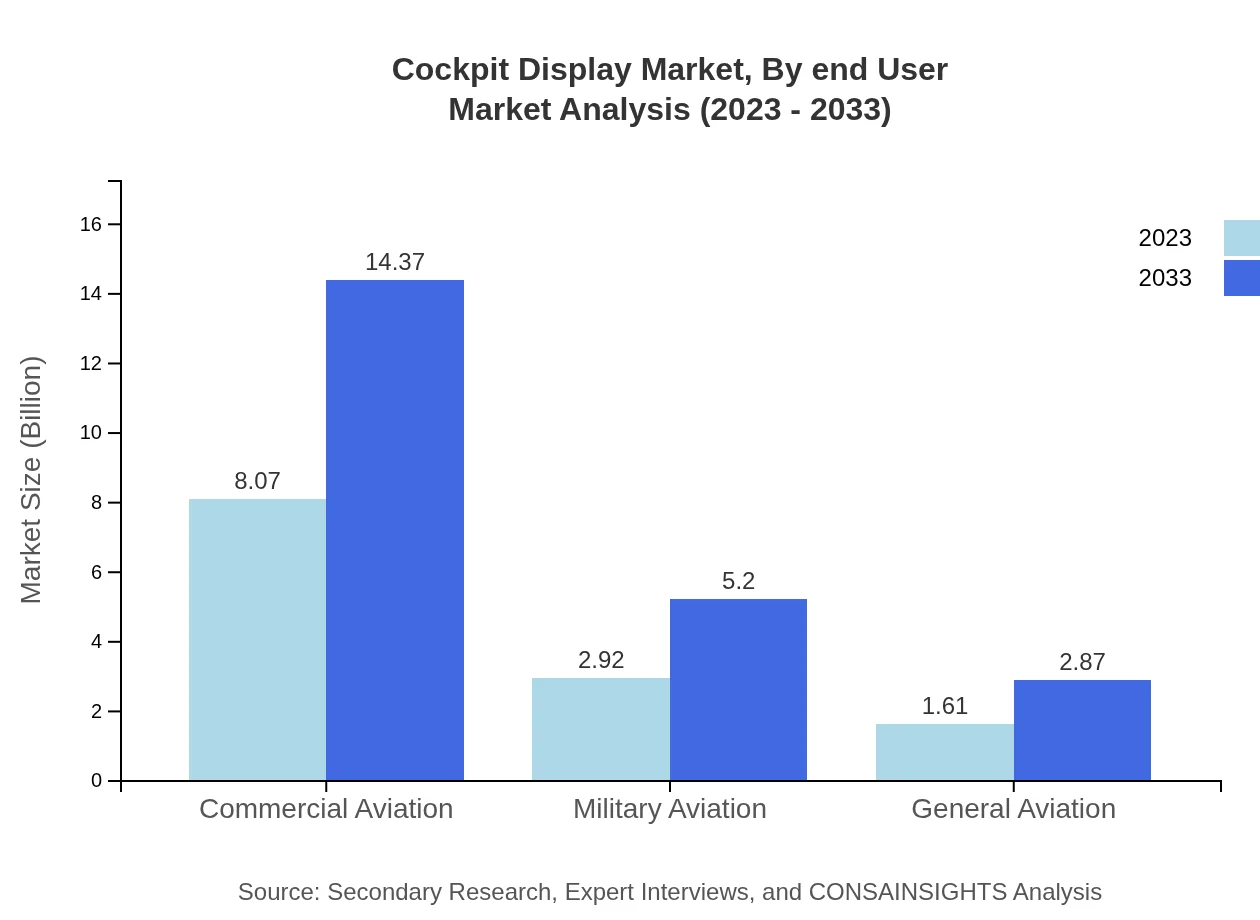

Cockpit Display Market Analysis By End User

By end-user segmentation, the Cockpit Display market comprises Commercial Aviation, Military Aviation, and General Aviation. Commercial Aviation commands a considerable share, projected at $8.07 billion in 2023, expanding to $14.37 billion by 2033. Military Aviation is also significant, expected to grow from $2.92 billion to $5.20 billion, while General Aviation is anticipated to increase from $1.61 billion to $2.87 billion during the same period.

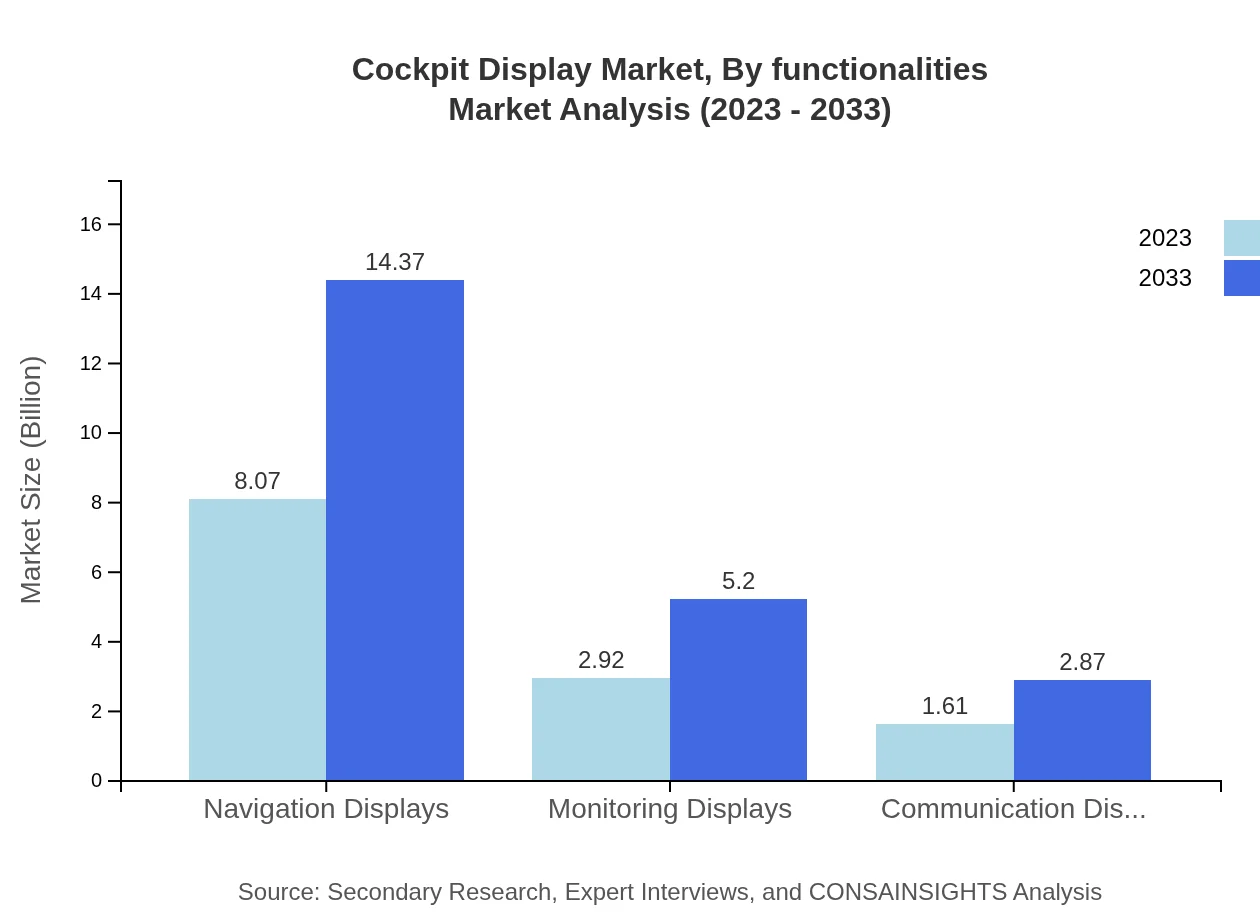

Cockpit Display Market Analysis By Functionalities

Segmented by functionalities into Navigation Displays, Monitoring Displays, and Communication Displays, the Cockpit Display market sees Navigation Displays leading with a size of $8.07 billion in 2023 and rising to $14.37 billion by 2033. Monitoring Displays follow, growing from $2.92 billion to $5.20 billion, while Communication Displays increase from $1.61 billion to $2.87 billion.

Cockpit Display Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cockpit Display Industry

Honeywell International Inc.:

A leading manufacturer of advanced cockpit display systems, Honeywell specializes in avionics and has pioneering products that enhance the operations of both commercial and military aircraft.Rockwell Collins:

Now part of Collins Aerospace, Rockwell Collins is known for its innovative avionics solutions and robust cockpit display systems that assist pilots with precise navigation and monitoring.Garmin Ltd.:

Garmin is widely recognized for its cutting-edge technology in aviation navigation, including reliable cockpit display systems that enhance situational awareness.Thales Group:

Thales provides advanced cockpit display systems, contributing significantly to military and commercial aviation with innovative technologies.Northrop Grumman Corporation:

Specializing in defense and advanced cockpit systems, Northrop Grumman develops state-of-the-art display technologies for military aircraft.We're grateful to work with incredible clients.

FAQs

What is the market size of cockpit display?

The cockpit display market is valued at approximately $12.6 billion in 2023, with a forecasted compound annual growth rate (CAGR) of 5.8% from 2023 to 2033, indicating significant growth potential in the upcoming decade.

What are the key market players or companies in the cockpit display industry?

Key players in the cockpit display market include Honeywell International, Rockwell Collins, Thales Group, and Textron Aviation, which lead in technology development and innovation for advanced cockpit solutions.

What are the primary factors driving the growth in the cockpit display industry?

Growth in the cockpit display industry is primarily driven by the increasing demand for advanced avionics systems, enhancements in pilot situational awareness, and the shift towards digital cockpit solutions in aviation.

Which region is the fastest Growing in the cockpit display market?

The fastest-growing region in the cockpit display market is Europe, projected to grow from $3.95 billion in 2023 to $7.04 billion by 2033, illustrating strong investments in aviation infrastructure and demand for advanced systems.

Does ConsaInsights provide customized market report data for the cockpit display industry?

Yes, ConsaInsights offers customized market report data for the cockpit display industry, allowing clients to tailor their research needs and obtain insights specific to their business objectives.

What deliverables can I expect from this cockpit display market research project?

Deliverables from the cockpit display market research project will include comprehensive data reports, market trend analysis, segment-specific insights, and growth forecasts tailored to support strategic decision-making.

What are the market trends of cockpit display?

Current market trends in the cockpit display sector include a shift towards digital displays, increased adoption of LCD and OLED technology, and a focus on integrating navigation and communication functionalities for enhanced pilot efficiency.