Cocoa And Chocolate Market Report

Published Date: 31 January 2026 | Report Code: cocoa-and-chocolate

Cocoa And Chocolate Market Size, Share, Industry Trends and Forecast to 2033

This report provides a thorough analysis of the Cocoa And Chocolate market, offering insights into market size, trends, and forecasts from 2023 to 2033. The data encompasses various segments, regional performances, and key industry players, providing a comprehensive perspective on this dynamic market.

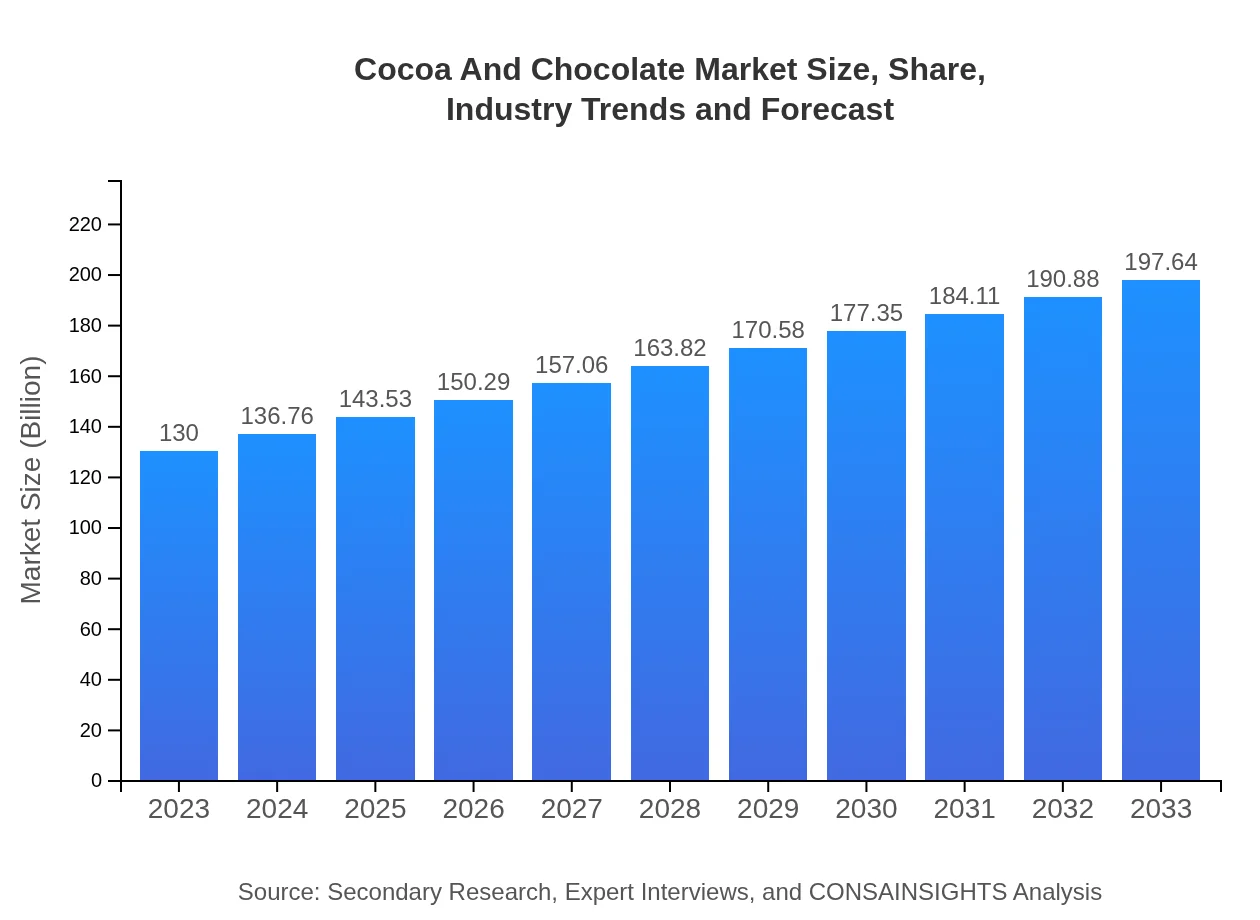

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $130.00 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $197.64 Billion |

| Top Companies | Barry Callebaut, Mars, Inc., Cargill , Nestlé |

| Last Modified Date | 31 January 2026 |

Cocoa And Chocolate Market Overview

Customize Cocoa And Chocolate Market Report market research report

- ✔ Get in-depth analysis of Cocoa And Chocolate market size, growth, and forecasts.

- ✔ Understand Cocoa And Chocolate's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cocoa And Chocolate

What is the Market Size & CAGR of Cocoa And Chocolate market in 2023?

Cocoa And Chocolate Industry Analysis

Cocoa And Chocolate Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cocoa And Chocolate Market Analysis Report by Region

Europe Cocoa And Chocolate Market Report:

Europe is a significant market, valued at $39.04 billion in 2023, with expectations to rise to $59.35 billion by 2033. The region is known for its premium chocolate brands and is a hub for innovation in flavors and sustainable cocoa sourcing. Consumer trends favoring dark and artisanal chocolates are contributing to this growth.Asia Pacific Cocoa And Chocolate Market Report:

In 2023, the Cocoa and Chocolate market in Asia Pacific is valued at $27.34 billion and is projected to grow to $41.56 billion by 2033. The region's growth is fueled by rising disposable incomes, urbanization, and increasing demand for luxury chocolates. Companies are focusing on adapting their offerings to local tastes, leading to innovative product launches that cater to diverse consumer preferences.North America Cocoa And Chocolate Market Report:

North America holds a prominent position with a market size of $41.65 billion in 2023, projected to escalate to $63.32 billion by 2033. The region benefits from high demand for chocolate products, driven by strong consumer culture around confectionery and gifting. Additionally, growing trends towards organic and premium chocolates are expected to fuel market growth.South America Cocoa And Chocolate Market Report:

The South American market recorded a size of $4.09 billion in 2023, expecting to reach $6.23 billion by 2033. The growth is driven by increased cocoa production in countries like Brazil and Ecuador. There's a growing trend towards local consumption and exports, positioning the region as a key contributor in the global cocoa supply chain.Middle East & Africa Cocoa And Chocolate Market Report:

The market in the Middle East and Africa is valued at $17.88 billion in 2023, anticipated to grow to $27.18 billion by 2033. The increase in chocolate consumption, along with a rising middle class and improved retail infrastructure, are significant factors influencing market expansion in this region.Tell us your focus area and get a customized research report.

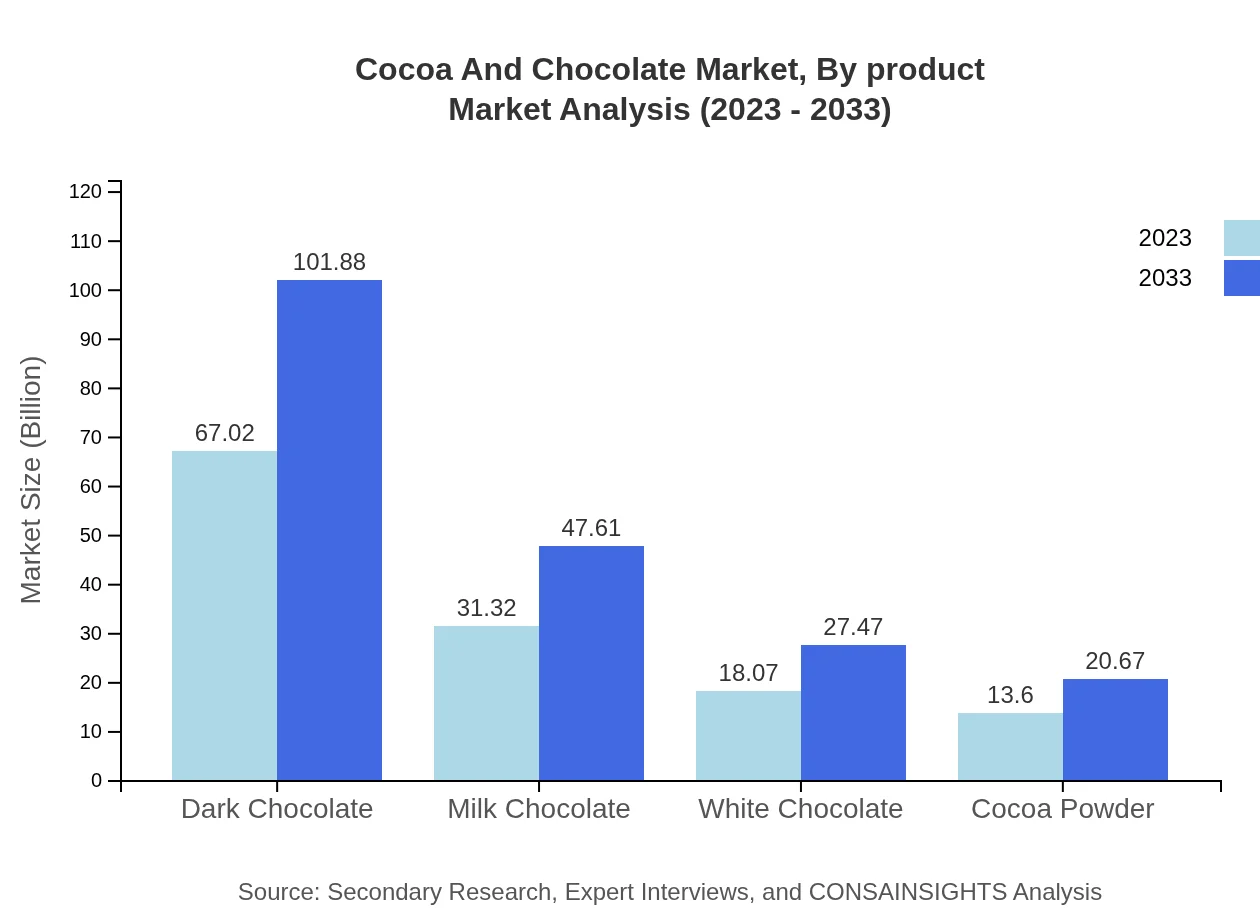

Cocoa And Chocolate Market Analysis By Product

The Cocoa and Chocolate market is heavily influenced by product segmentation. The solid chocolate segment dominates the market, with a size of $87.70 billion in 2023, projected to grow to $133.33 billion by 2033, reflecting a market share of 67.46%. Liquid products are also significant, with an expected growth from $26.25 billion to $39.90 billion over the same period. Cocoa powder also shows promising growth, reflecting diverse uses in various industries.

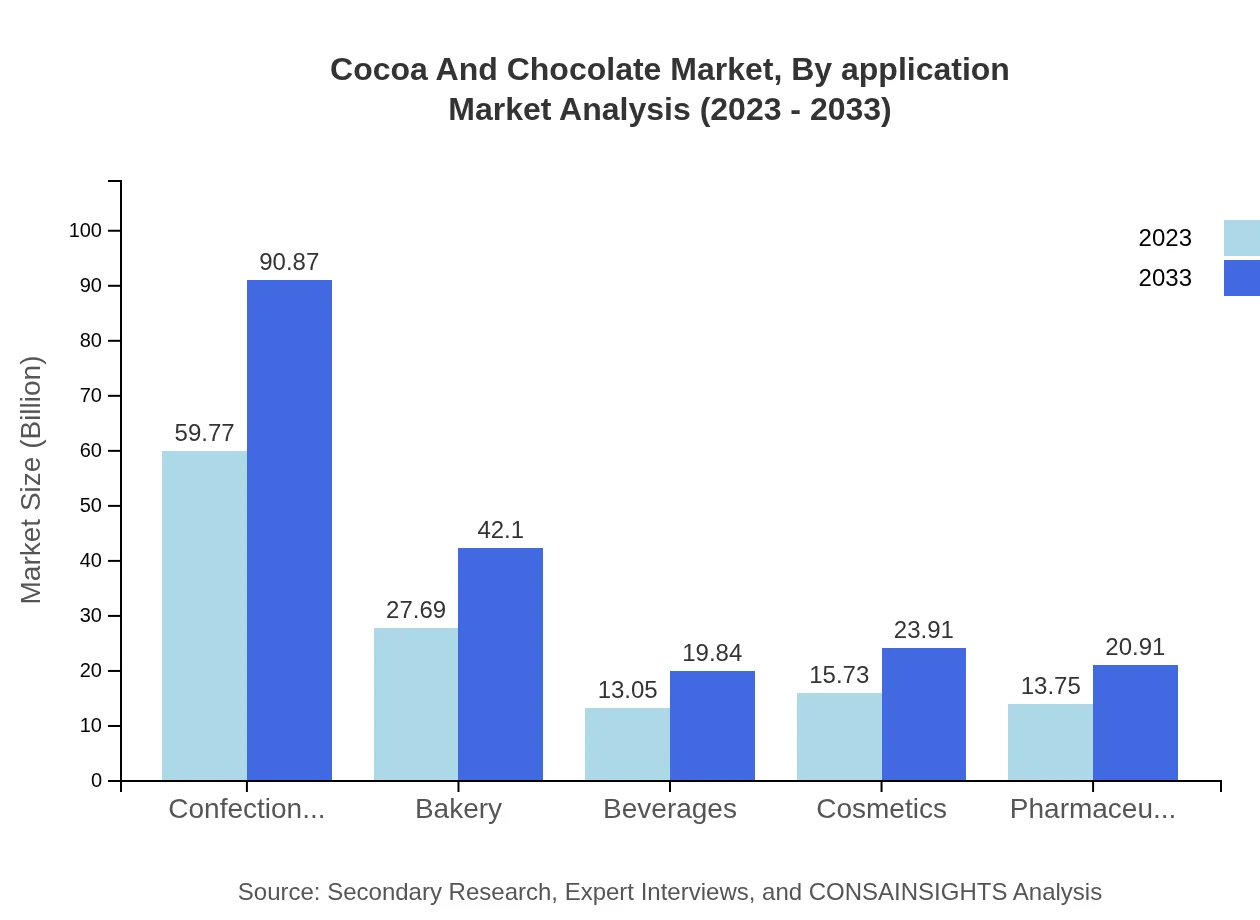

Cocoa And Chocolate Market Analysis By Application

The application segments highlight the versatility of cocoa and chocolate products. The confectionery segment leads with a market size expected to grow from $59.77 billion in 2023 to $90.87 billion by 2033, representing a market share of 45.98%. Bakery applications are also significant, with anticipated growth from $27.69 billion to $42.10 billion, driven by rising demand for chocolate-infused baked goods.

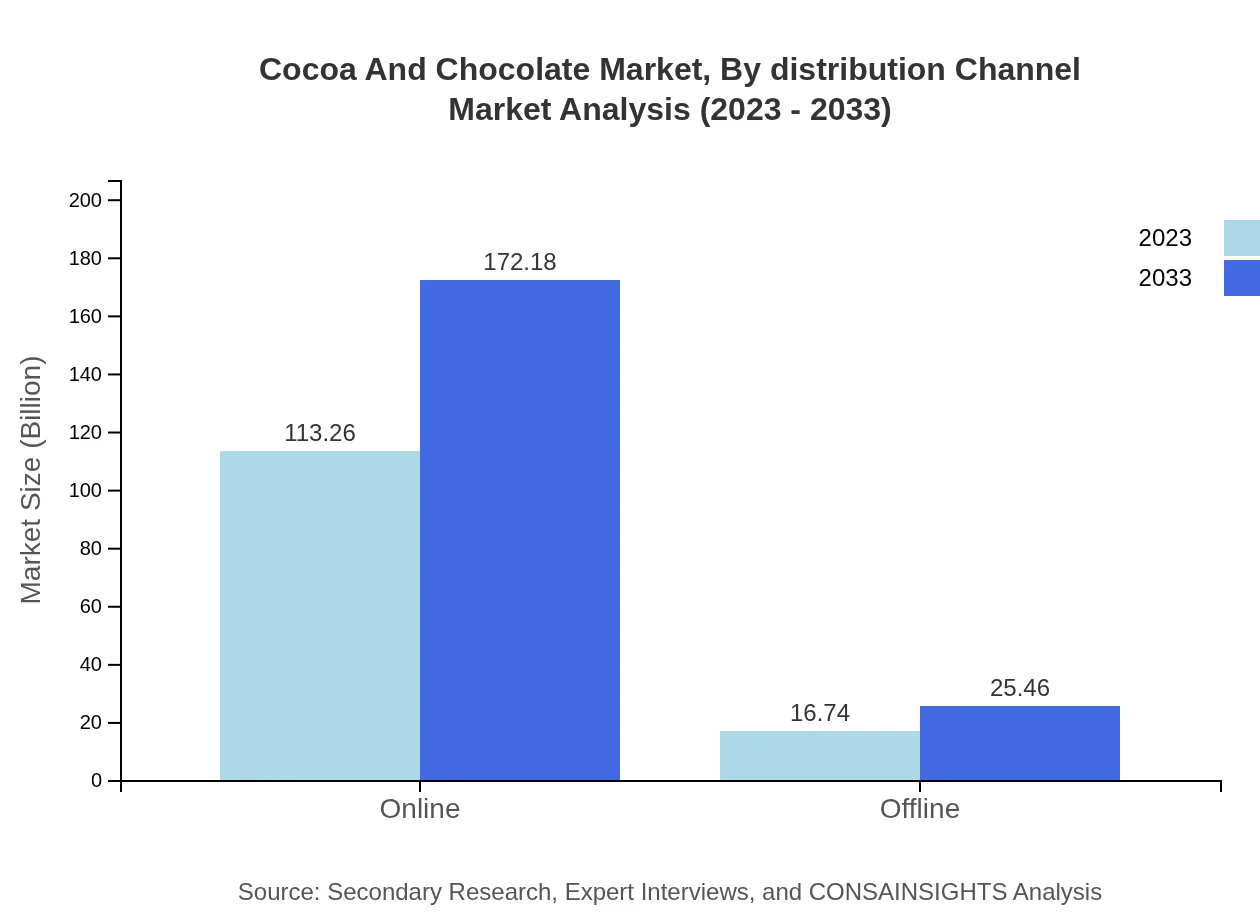

Cocoa And Chocolate Market Analysis By Distribution Channel

Distribution channels play a critical role in market access. Online sales dominate the channel mix, with a size projected to grow from $113.26 billion to $172.18 billion by 2033, accounting for a share of 87.12%. Offline channels, while smaller in comparison, are also growing as consumers seek traditional shopping experiences.

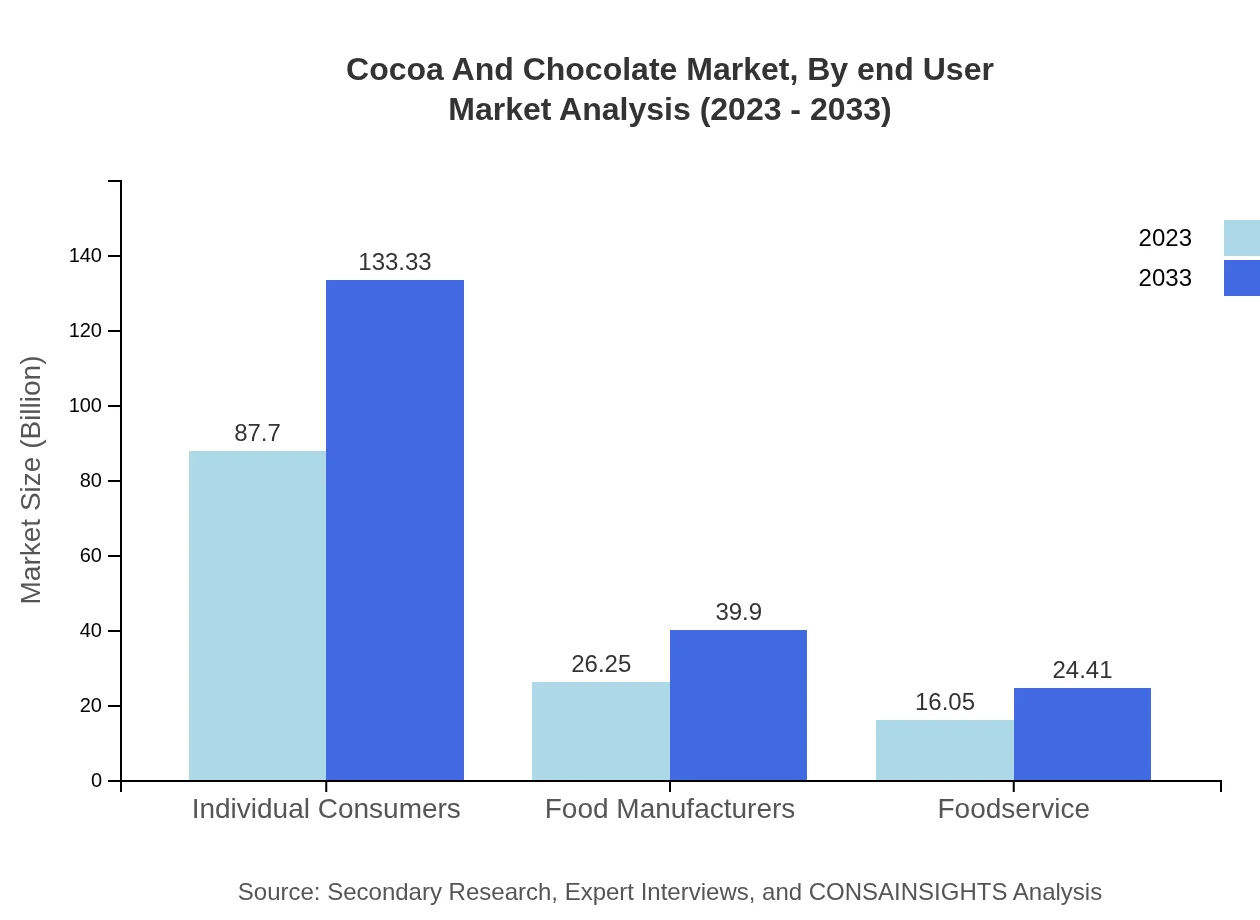

Cocoa And Chocolate Market Analysis By End User

The market is segmented by end-user demographics, with individual consumers representing the largest segment at an expected size increase from $87.70 billion to $133.33 billion over the forecast period. Food manufacturers and foodservice operators also show growth potential, driven by increasing demand for chocolate ingredients and confectionery products.

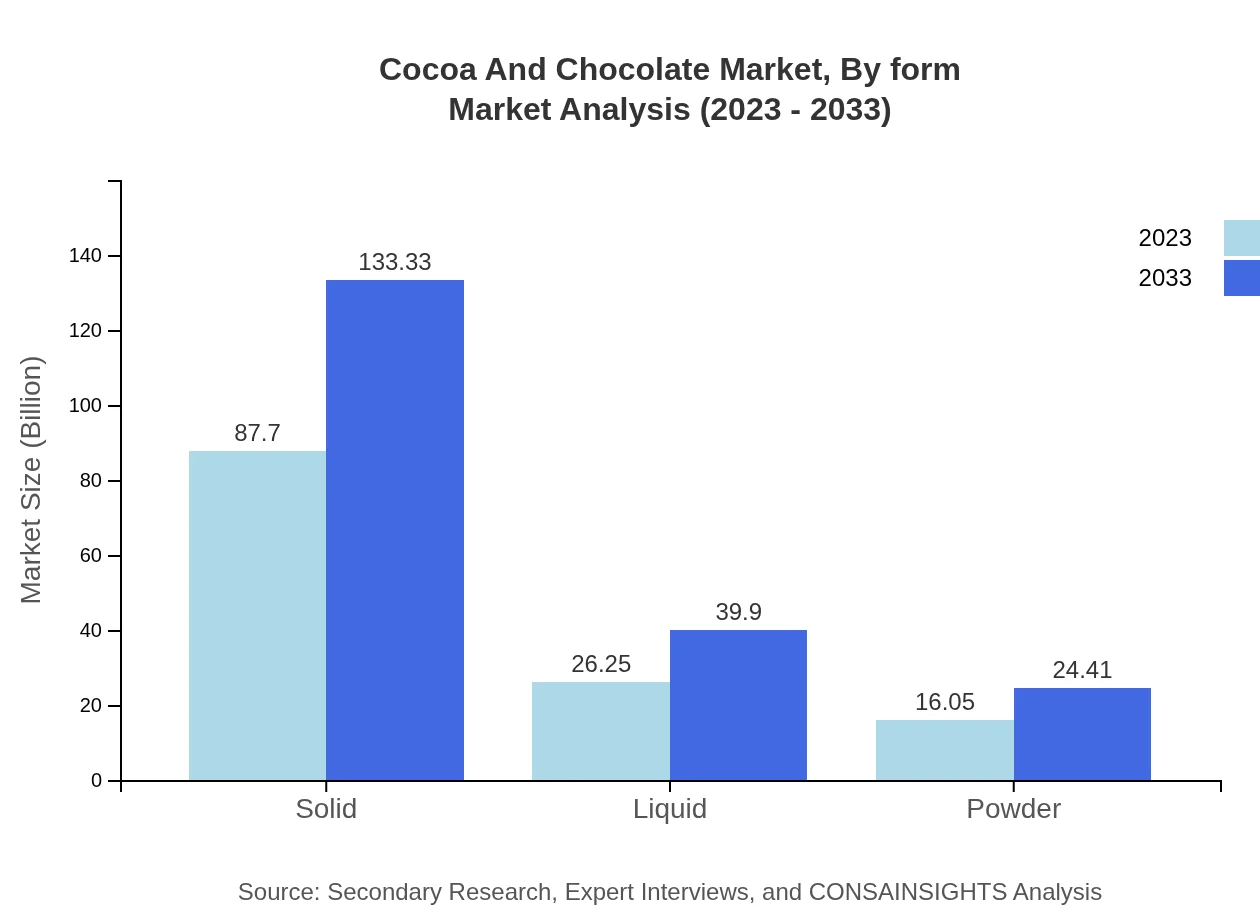

Cocoa And Chocolate Market Analysis By Form

Product forms significantly influence consumer preference and usage. The solid form segment is the largest, growing from $87.70 billion in 2023 to $133.33 billion by 2033. Liquid forms, used in beverages and syrups, also exhibit strong growth, alongside powdered forms used in baking and cooking.

Cocoa And Chocolate Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cocoa And Chocolate Industry

Barry Callebaut:

Barry Callebaut is a leading global supplier of high-quality chocolate and cocoa products. With a strong focus on sustainability, it sources cocoa directly from farmers and is a key player in developing new chocolate products and technologies.Mars, Inc.:

Mars, Inc. is one of the world's largest chocolate manufacturers, renowned for its iconic brands. The company emphasizes product innovation and is committed to responsible sourcing practices to enhance cocoa farming sustainability.Cargill :

Cargill is a major player in the cocoa industry, providing a wide range of ingredients for chocolate manufacturers. The company focuses on sustainability and digital solutions to streamline cocoa supply chains.Nestlé:

As a global food giant, Nestlé offers a diverse range of chocolate products. The company aims for quality and sustainability in sourcing ingredients, placing strong emphasis on innovative product development.We're grateful to work with incredible clients.

FAQs

What is the market size of cocoa And Chocolate?

The cocoa and chocolate market is projected to reach approximately $130 billion in 2023, with a compound annual growth rate (CAGR) of 4.2% expected, continuing into the next decade.

What are the key market players or companies in the cocoa And Chocolate industry?

Key players in the cocoa and chocolate market include major companies like Mars, Inc., Mondelez International, Nestlé S.A., and Barry Callebaut. These companies play a crucial role in shaping market dynamics through innovation and product diversification.

What are the primary factors driving the growth in the cocoa And Chocolate industry?

Factors such as rising disposable incomes, increasing demand for premium chocolate products, and the growing popularity of cocoa-based beverages contribute significantly to the growth of the cocoa and chocolate industry.

Which region is the fastest Growing in the cocoa And Chocolate market?

Among regions, Asia Pacific is noted for its rapid growth in the cocoa and chocolate sector, with market sizes expected to rise from $27.34 billion in 2023 to $41.56 billion by 2033.

Does ConsaInsights provide customized market report data for the cocoa And Chocolate industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs, along with detailed insights into trends, forecasts, and competitive landscapes within the cocoa and chocolate industry.

What deliverables can I expect from this cocoa And Chocolate market research project?

Expect comprehensive deliverables such as detailed market analysis, competitive landscape summaries, regional insights, and forecasts, all designed to provide actionable intelligence in the cocoa and chocolate industry.

What are the market trends of cocoa And Chocolate?

Current trends in the cocoa and chocolate market involve a shift towards healthier options, organic products, and dark chocolate categories, reflecting an increase in consumer health consciousness and demand for premium offerings.