Coffee Value Chain Analysis Market Report

Published Date: 02 February 2026 | Report Code: coffee-value-chain-analysis

Coffee Value Chain Analysis Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Coffee Value Chain from sourcing to consumption. It offers insights into market dynamics, trends, and forecasts for the period 2023 to 2033, focusing on size, segmentation, and regional analysis.

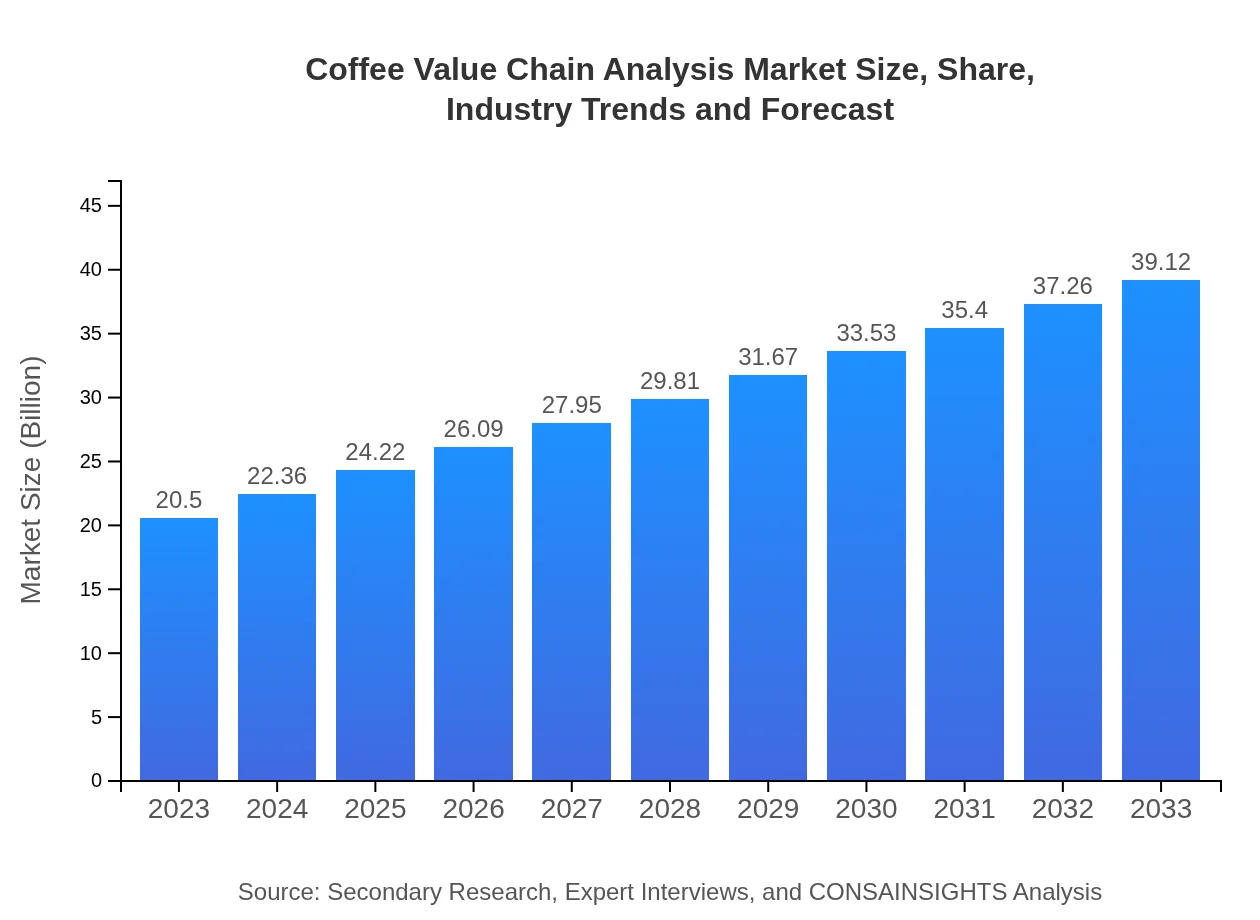

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.50 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $39.12 Billion |

| Top Companies | Nestlé S.A., Starbucks Corporation, J.M. Smucker Company, Kraft Heinz Company |

| Last Modified Date | 02 February 2026 |

Coffee Value Chain Analysis Market Overview

Customize Coffee Value Chain Analysis Market Report market research report

- ✔ Get in-depth analysis of Coffee Value Chain Analysis market size, growth, and forecasts.

- ✔ Understand Coffee Value Chain Analysis's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Coffee Value Chain Analysis

What is the Market Size & CAGR of Coffee Value Chain Analysis market in 2023?

Coffee Value Chain Analysis Industry Analysis

Coffee Value Chain Analysis Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Coffee Value Chain Analysis Market Analysis Report by Region

Europe Coffee Value Chain Analysis Market Report:

Europe remains a key player in the Coffee Value Chain, with a market value increasing from $6.99 billion in 2023 to $13.33 billion in 2033. The region's strong preference for quality coffee and ethical sourcing contributes to its growth.Asia Pacific Coffee Value Chain Analysis Market Report:

In the Asia Pacific region, the Coffee Value Chain market is expected to grow from $3.75 billion in 2023 to $7.16 billion by 2033. Significant growth is driven by rising coffee consumption in emerging markets and increasing investments in local coffee production.North America Coffee Value Chain Analysis Market Report:

North America's market is projected to see growth from $6.73 billion in 2023 to approximately $12.85 billion by 2033. The trend towards specialty and premium coffee has driven heightened demand, particularly in the United States.South America Coffee Value Chain Analysis Market Report:

South America, being a major coffee producer, presents a market size growth from $1.92 billion in 2023 to $3.66 billion by 2033. Countries like Brazil and Colombia dominate the market, focusing on sustainability and specialty coffee production.Middle East & Africa Coffee Value Chain Analysis Market Report:

The Middle East and Africa market is anticipated to grow from $1.11 billion in 2023 to $2.12 billion by 2033. Increasing urbanization and changing consumer habits promote coffee culture in urban centers.Tell us your focus area and get a customized research report.

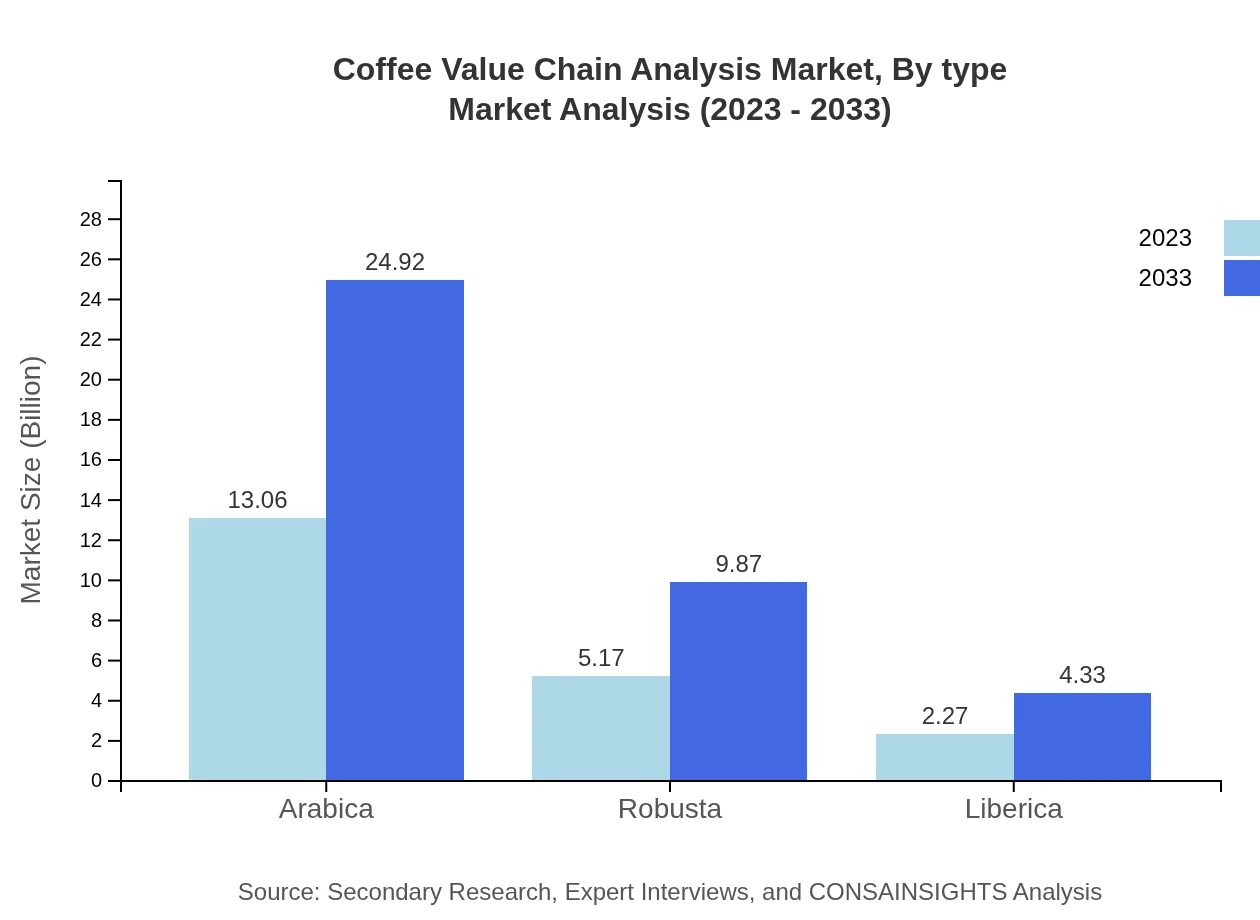

Coffee Value Chain Analysis Market Analysis By Type

The Coffee Value Chain is significantly influenced by the types of coffee produced. Arabica coffee, known for its distinct flavor, accounts for a market size of $13.06 billion in 2023, projected to reach $24.92 billion by 2033. Meanwhile, Robusta coffee, often used for instant coffee, has a market size expected to grow from $5.17 billion to $9.87 billion over the same period. The share for Arabica remains consistent at 63.69%, while Robusta holds 25.24%.

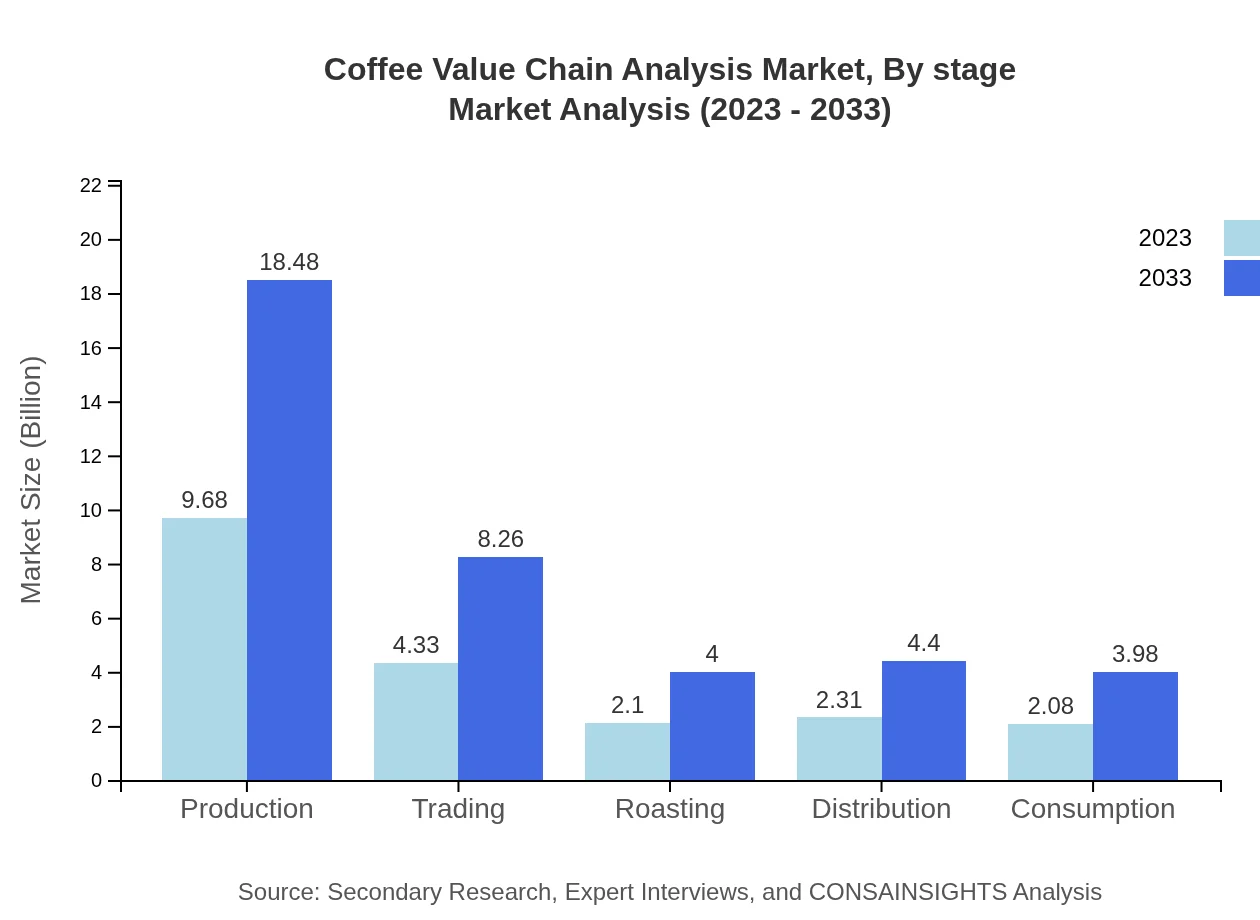

Coffee Value Chain Analysis Market Analysis By Stage

The stages of the Coffee Value Chain are crucial in determining market dynamics. The production stage commands a market size of $9.68 billion in 2023, projected to double to $18.48 billion by 2033. Each stage, from trading to roasting and consumption, represents vital revenue opportunities, with trading and roasting also showing robust growth.

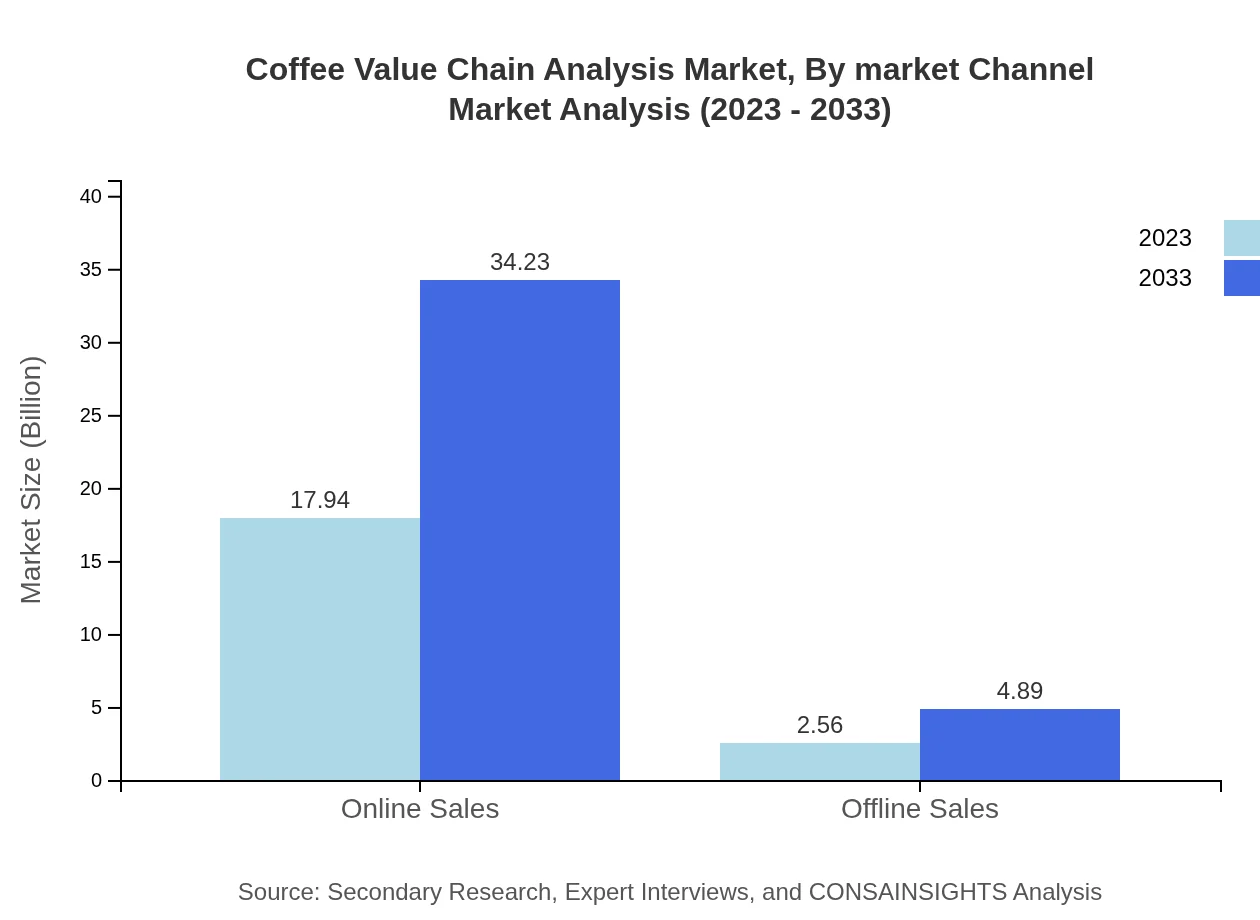

Coffee Value Chain Analysis Market Analysis By Market Channel

Market channels play a significant role in coffee distribution. Online sales lead the channel analysis with a size of $17.94 billion in 2023, forecasted to reach $34.23 billion by 2033. This increase indicates shifting consumer behavior toward eCommerce. Offline sales will grow, but at a slower rate, from $2.56 billion to $4.89 billion.

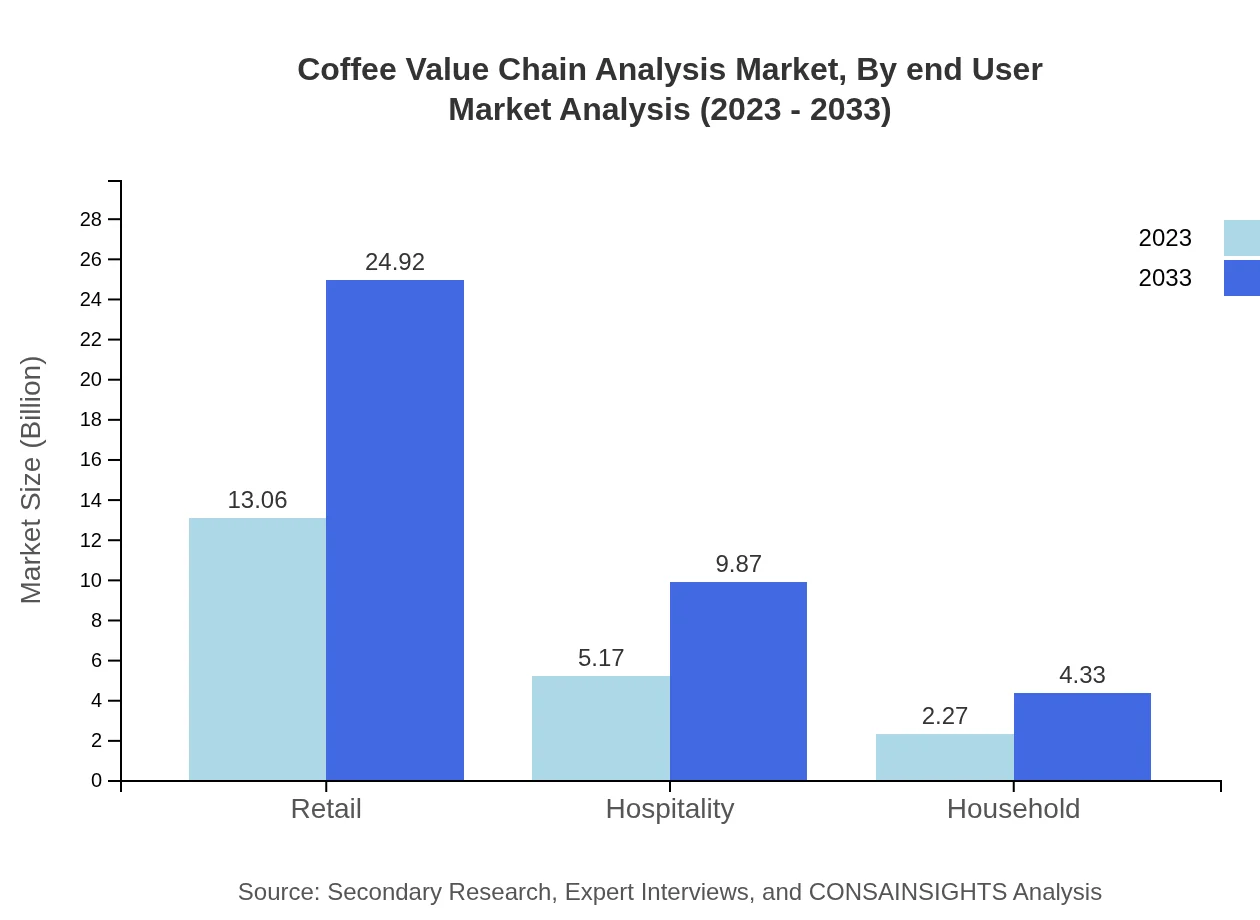

Coffee Value Chain Analysis Market Analysis By End User

In terms of end-users, the retail sector dominates with a size of $13.06 billion in 2023, expected to climb to $24.92 billion by 2033. The hospitality sector is also significant, with values moving from $5.17 billion to $9.87 billion. As coffee culture expands, end-user preferences will continue to shape market dynamics.

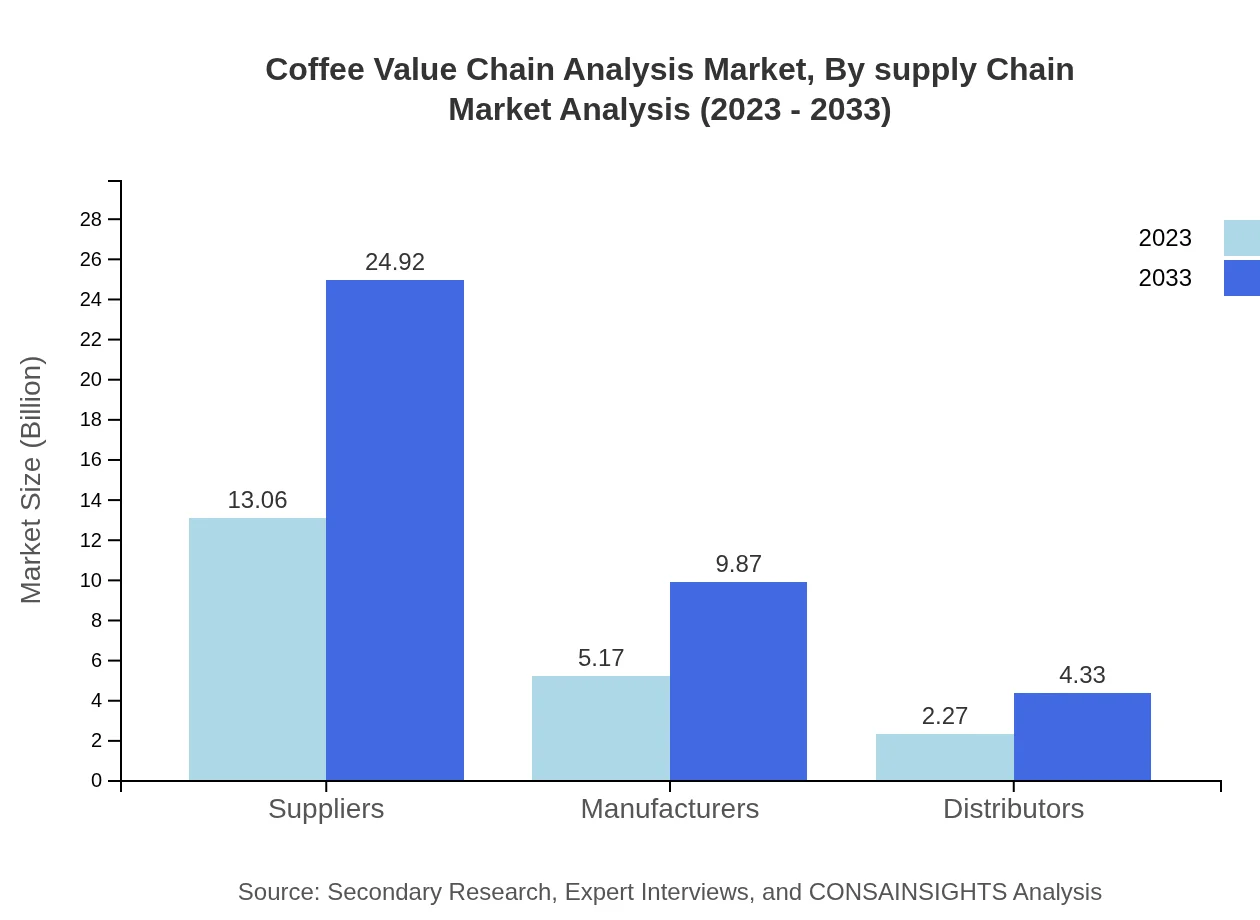

Coffee Value Chain Analysis Market Analysis By Supply Chain

Within the Coffee Value Chain, suppliers remain essential to ensure quality and consistency. The suppliers' market size is currently at $13.06 billion, expected to grow to $24.92 billion by 2033. This sector includes small farmers to large exporters, each playing a crucial role in meeting global demand.

Coffee Value Chain Analysis Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Coffee Value Chain Analysis Industry

Nestlé S.A.:

A leading multinational food and beverage company, Nestlé is one of the largest players in the coffee market, offering a wide range of coffee products, including Nescafé and Nespresso.Starbucks Corporation:

Starbucks is a prominent coffeehouse chain that plays a significant role in the retail segment of the coffee market, known for its premium coffee beverages and ethical sourcing.J.M. Smucker Company:

Smucker is a key player in the coffee category, particularly in ground coffee and instant products, distributing beloved brands like Folgers and Dunkin'.Kraft Heinz Company:

Kraft Heinz is known for its coffee brands, including Maxwell House, contributing significantly to the global coffee market and household consumption.We're grateful to work with incredible clients.

FAQs

What is the market size of coffee Value Chain Analysis?

The global coffee value chain analysis market size is projected to grow from $20.5 billion in 2023 to a significant value by 2033, with a compound annual growth rate (CAGR) of 6.5% during this period.

What are the key market players or companies in this coffee Value Chain Analysis industry?

Key players in the coffee value chain analysis industry include major coffee producers, regional trading companies, processing firms, and retailers. Their collaborations and innovative strategies drive market dynamics and ensure competitiveness throughout the supply chain.

What are the primary factors driving the growth in the coffee Value Chain Analysis industry?

Growth in the coffee value chain analysis industry is driven by increasing global coffee consumption, advancements in agricultural technologies, sustainability initiatives, and rising consumer demand for quality coffee products, alongside expanding e-commerce platforms.

Which region is the fastest Growing in the coffee Value Chain Analysis?

The Asia Pacific region is emerging as the fastest-growing market in the coffee value chain analysis, projected to expand from $3.75 billion in 2023 to $7.16 billion in 2033, signifying a strong CAGR driven by rising coffee consumption.

Does ConsaInsights provide customized market report data for the coffee Value Chain Analysis industry?

Yes, ConsaInsights offers customized market report data tailored to the coffee value chain analysis industry, allowing clients to gain insights specific to their operational needs, competitive landscape, and market trends.

What deliverables can I expect from this coffee Value Chain Analysis market research project?

Deliverables from the coffee value chain analysis market research project typically include comprehensive market analysis reports, segment-wise breakdowns, competitive landscape assessments, regional insights, and actionable recommendations for strategic decision-making.

What are the market trends of coffee Value Chain Analysis?

Market trends in the coffee value chain analysis show a growing emphasis on sustainability, increased interest in specialty coffees, technological innovations in production and distribution, as well as significant shifts towards online sales channels.