Coherent Radar Market Report

Published Date: 03 February 2026 | Report Code: coherent-radar

Coherent Radar Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Coherent Radar market, covering insights into market trends, forecasts from 2023 to 2033, regional dynamics, segmentation, and key players in the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

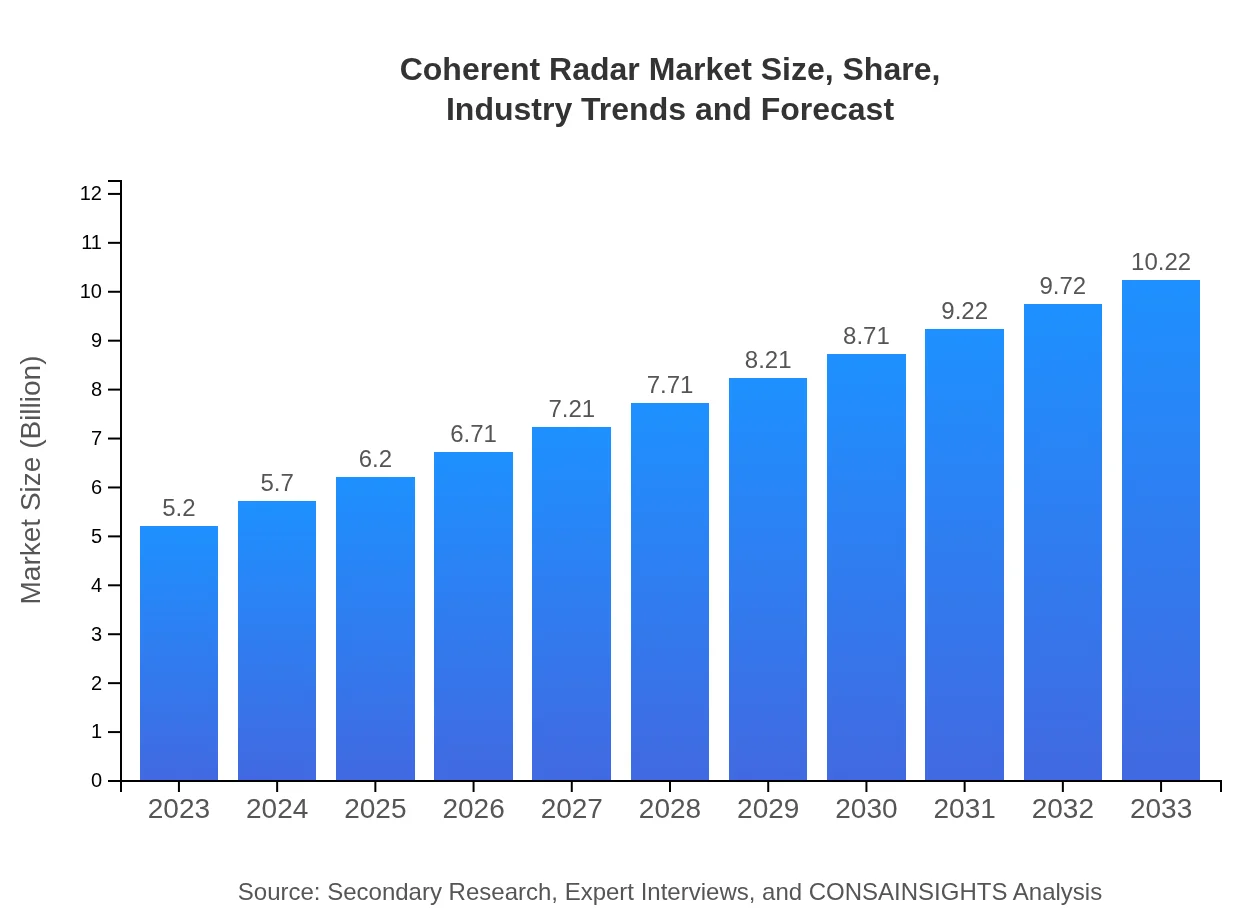

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.22 Billion |

| Top Companies | Lockheed Martin, Raytheon Technologies, Thales Group, Northrop Grumman |

| Last Modified Date | 03 February 2026 |

Coherent Radar Market Overview

Customize Coherent Radar Market Report market research report

- ✔ Get in-depth analysis of Coherent Radar market size, growth, and forecasts.

- ✔ Understand Coherent Radar's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Coherent Radar

What is the Market Size & CAGR of Coherent Radar Market in 2023?

Coherent Radar Industry Analysis

Coherent Radar Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Coherent Radar Market Analysis Report by Region

Europe Coherent Radar Market Report:

Europe is witnessing significant advancements in coherent radar technology, expected to reach a market size of $2.91 billion by 2033. The region's stringent regulations and focus on automation in industries contribute to the growing demand for sophisticated radar systems.Asia Pacific Coherent Radar Market Report:

The Asia Pacific region is experiencing rapid growth, with the market size expected to reach $1.93 billion by 2033. This growth is driven by increased investments in defense and aerospace sectors, coupled with advancements in automotive technologies, resulting in heightened demand for coherent radar systems.North America Coherent Radar Market Report:

North America remains the largest market for Coherent Radar, with a projected size of $3.85 billion by 2033. The region's focus on military applications and technological innovations drives substantial investments in radar systems.South America Coherent Radar Market Report:

In South America, the market is projected to grow modestly, reaching $0.30 billion by 2033. Factors such as government initiatives to improve infrastructure and defense capabilities are expected to contribute to this growth.Middle East & Africa Coherent Radar Market Report:

The Middle East and Africa market is forecasted to grow to $1.23 billion by 2033, driven by regional security concerns and investments in surveillance technologies, particularly in defense contexts.Tell us your focus area and get a customized research report.

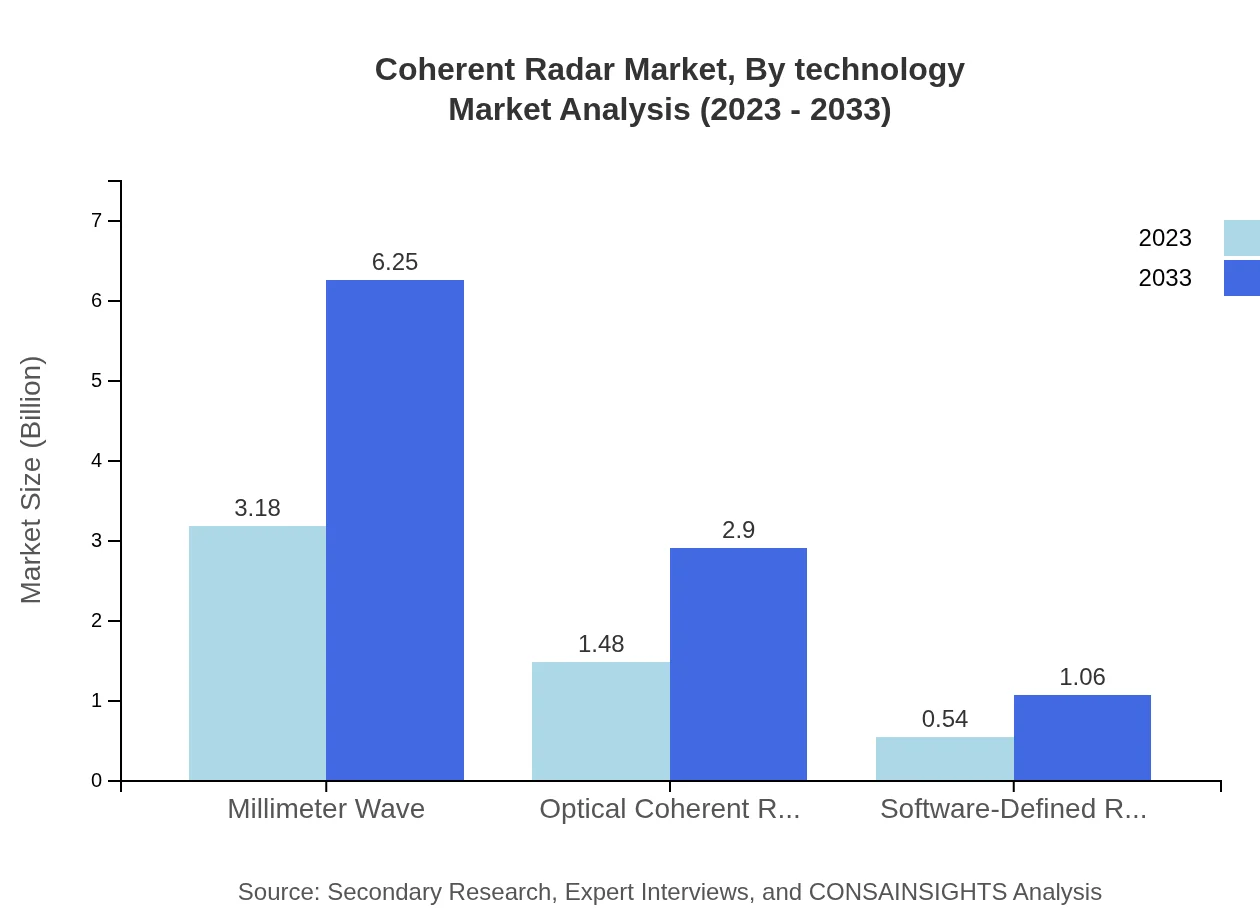

Coherent Radar Market Analysis By Technology

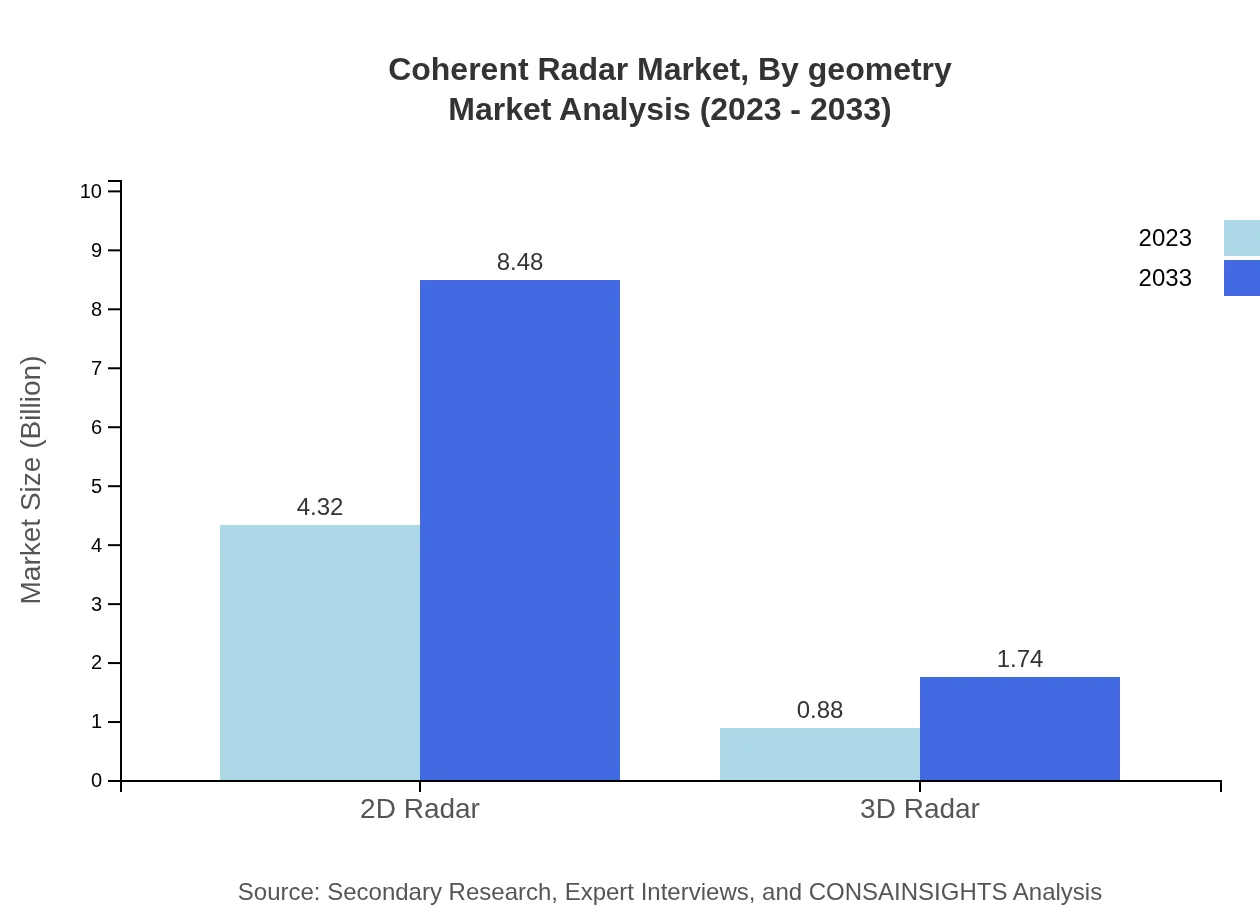

Coherent Radar technology is primarily divided into segments such as 2D radar and 3D radar systems. In 2023, 2D radar systems dominate the market with a share of 83.01% and a market value of $4.32 billion, while 3D systems capture 16.99% with $0.88 billion. By 2033, both segments are anticipated to grow substantially, reflecting advancements in radar technology.

Coherent Radar Market Analysis By Application

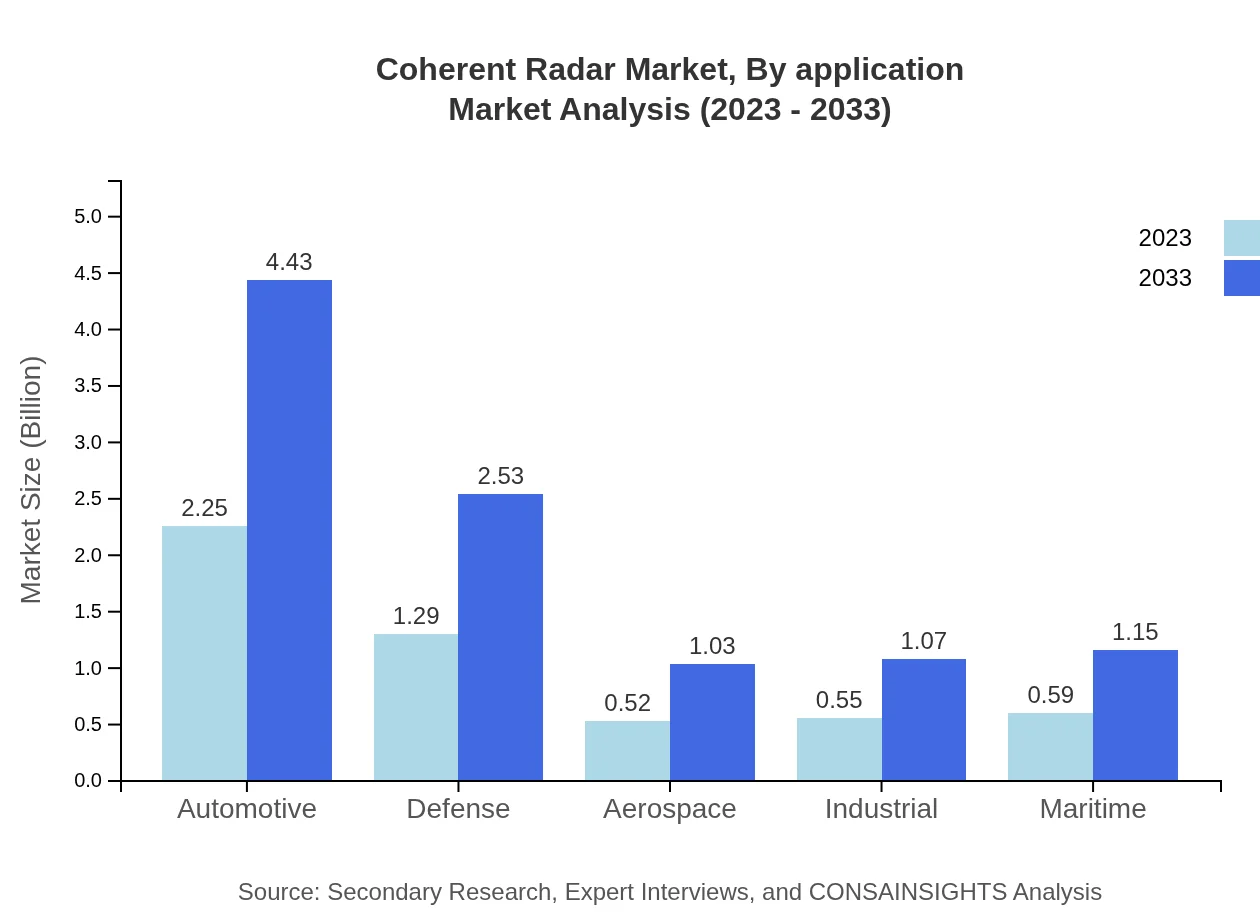

In the application category, governmental use leads with a market size of $2.85 billion in 2023, retaining a 54.9% share. The automotive sector holds critical importance too, estimated at $2.25 billion. By 2033, government and automotive applications will continue to dominate the space, focusing on security and operational efficiency.

Coherent Radar Market Analysis By Component

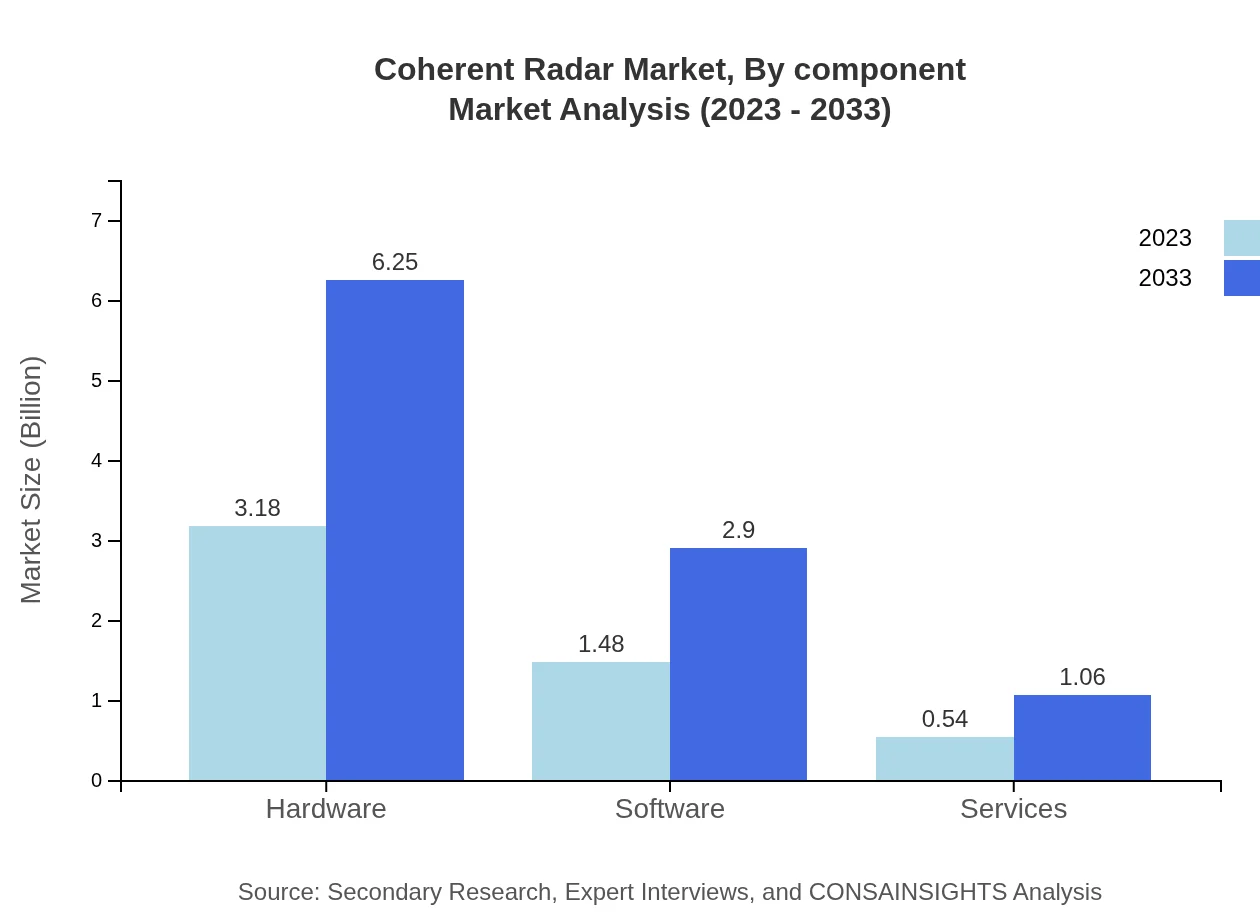

The component analysis indicates hardware holds a significant position in the market, accounting for 61.18% of the market share with $3.18 billion in 2023. Software components, while smaller in share at 28.41%, show strong growth potential, as do service components, highlighting the importance of integrated solutions.

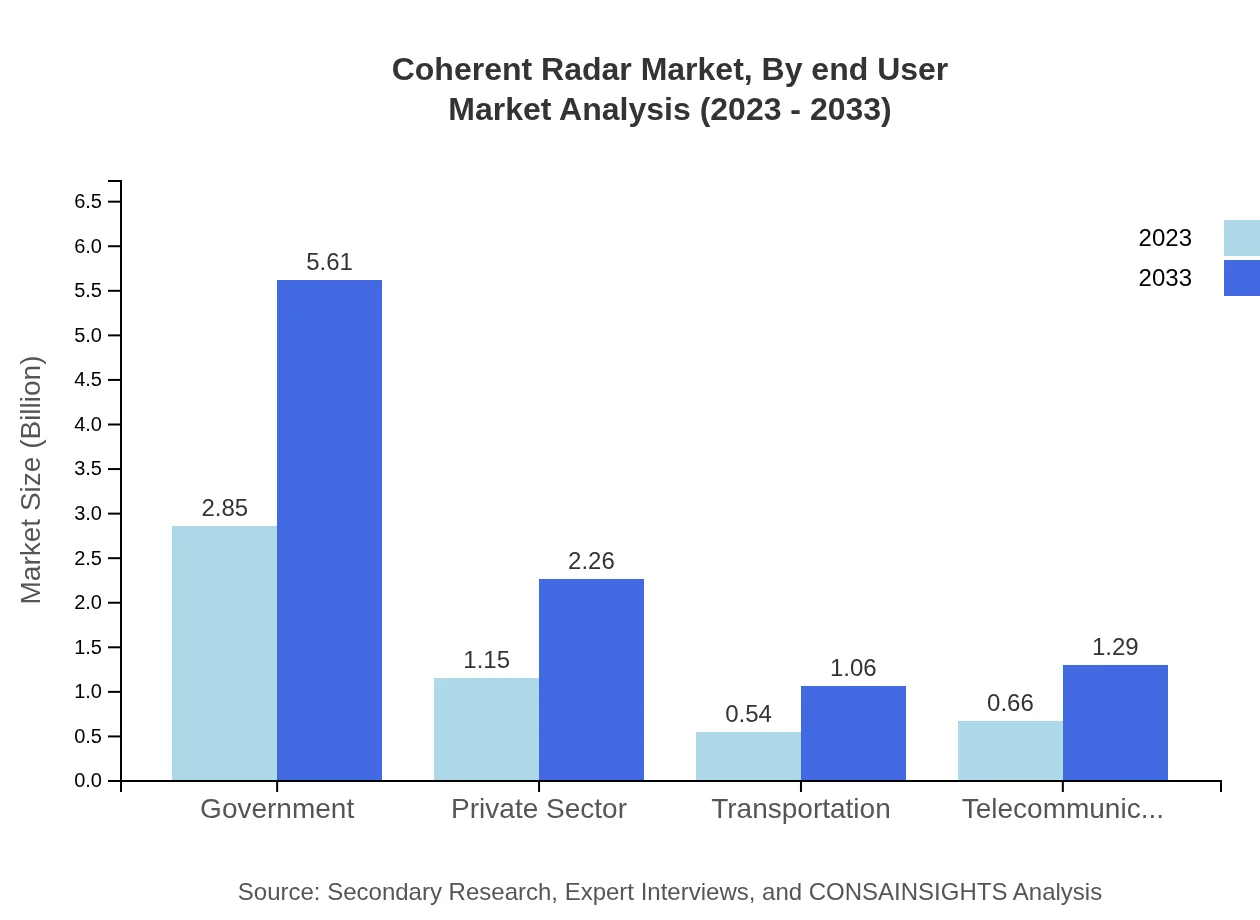

Coherent Radar Market Analysis By End User

End-user industries like defense and automotive are pivotal. For instance, the automotive sector correlates with a market size of $2.25 billion and holds around 43.36% market share as of 2023. As safety regulations and technological advancements surge, end-user industries will trend towards larger investments in coherent radar systems.

Coherent Radar Market Analysis By Geometry

The geometry segment focuses on applications that require varied radar shapes. As coherent radar systems develop with AI-integrated algorithms, growth opportunities arise for geometrically optimized radar designs tailored for specific use cases across different industries.

Coherent Radar Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Coherent Radar Industry

Lockheed Martin:

Lockheed Martin is a leading global aerospace and defense company heavily invested in radar technology, providing advanced coherent radar solutions for military applications.Raytheon Technologies:

Raytheon Technologies specializes in defense and aerospace systems, delivering cutting-edge radar technologies that enhance surveillance and detection capabilities.Thales Group:

Thales Group offers advanced technology solutions and services in various sectors, including transportation and defense, focusing on national security through innovative radar technologies.Northrop Grumman:

Northrop Grumman is a leader in aerospace and defense technology, recognized for its innovations in radar systems, particularly in situational awareness and threat detection.We're grateful to work with incredible clients.

FAQs

What is the market size of coherent Radar?

The coherent radar market is poised to reach a size of $5.2 billion by 2033, with a compound annual growth rate (CAGR) of 6.8% between 2023 and 2033. This indicates a strong upward trend in market adoption and investment.

What are the key market players or companies in the coherent Radar industry?

Key players in the coherent radar market include industry leaders specializing in radar technology, electronics manufacturers, and innovative companies in sensors and imaging. Their role is crucial in pushing advancements and meeting rising demand across various sectors.

What are the primary factors driving the growth in the coherent radar industry?

Growth in the coherent radar industry is driven by increased demand for precision in automotive applications, advancements in telecommunications, and the rising need for defense and security solutions. These factors underscore the technological evolution and safety regulations enhancing market prospects.

Which region is the fastest Growing in the coherent radar market?

Among the different regions, North America is the fastest-growing in the coherent radar market, projected to grow from $1.96 billion in 2023 to $3.85 billion by 2033, fueled by technological innovations and a strong industrial base.

Does ConsaInsights provide customized market report data for the coherent radar industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the coherent radar industry. This service ensures businesses receive insightful analyses and precise data relevant to their operations and market strategies.

What deliverables can I expect from this coherent radar market research project?

Deliverables from the coherent radar market research project include detailed market analysis, segmentation insights, growth projections, competitor mapping, and strategic recommendations, enabling informed decision-making and planning for stakeholders.

What are the market trends of coherent radar?

Current trends in the coherent radar market include an increased focus on miniaturization, the integration of radar with artificial intelligence, and advancements in software-defined radar systems. These trends reflect the industry's shift towards enhancing operational efficiency and capability.