Cold Chain Market Report

Published Date: 22 January 2026 | Report Code: cold-chain

Cold Chain Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the global Cold Chain market, covering its size, growth projections, key drivers, technology trends, and competitive landscape from 2023 to 2033.

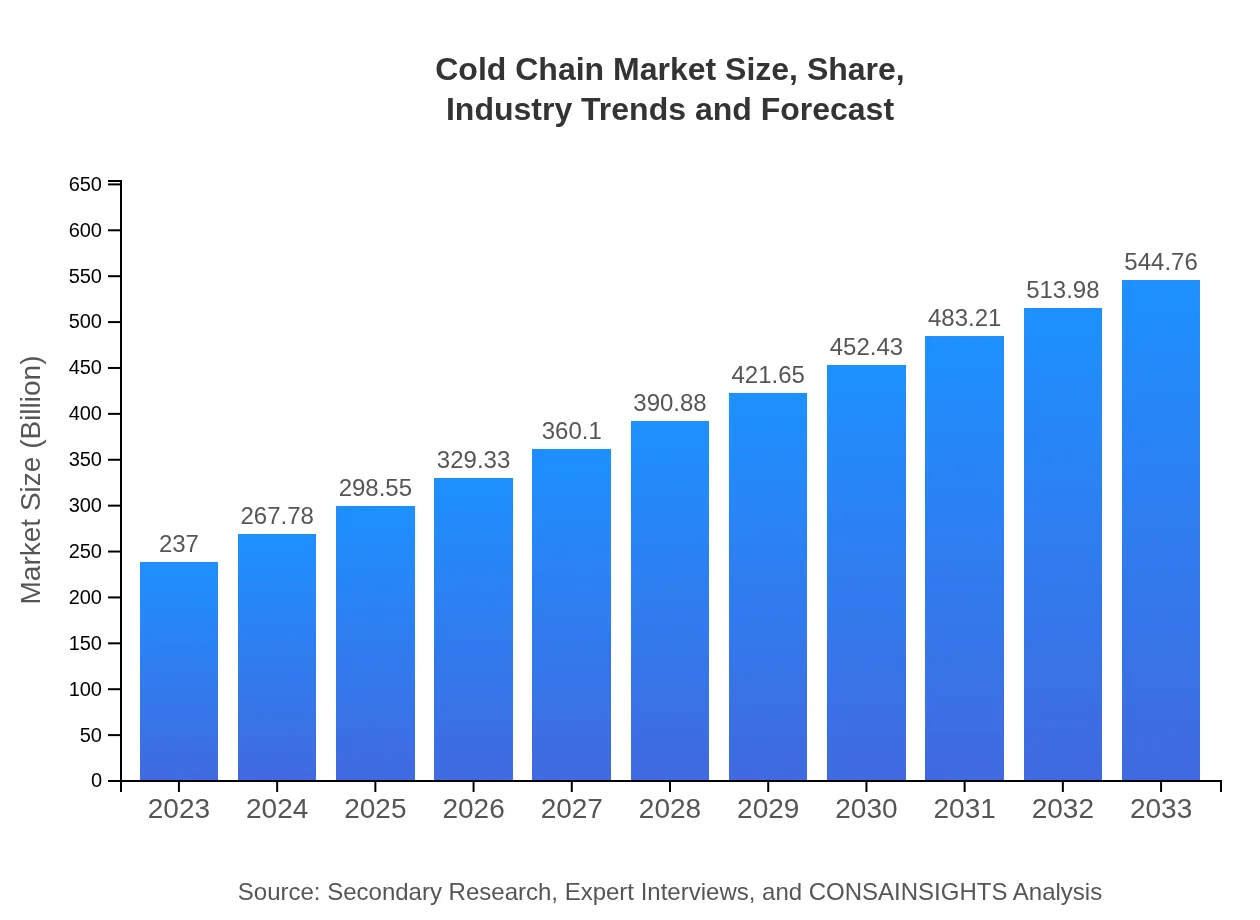

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $237.00 Billion |

| CAGR (2023-2033) | 8.4% |

| 2033 Market Size | $544.76 Billion |

| Top Companies | United Parcel Service (UPS), XPO Logistics, Lineage Logistics, DB Schenker, Nippon Express |

| Last Modified Date | 22 January 2026 |

Cold Chain Market Overview

Customize Cold Chain Market Report market research report

- ✔ Get in-depth analysis of Cold Chain market size, growth, and forecasts.

- ✔ Understand Cold Chain's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cold Chain

What is the Market Size & CAGR of Cold Chain market in 2023?

Cold Chain Industry Analysis

Cold Chain Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cold Chain Market Analysis Report by Region

Europe Cold Chain Market Report:

The European Cold Chain market is anticipated to increase from 75.18 billion in 2023 to 172.80 billion in 2033. Enhanced regulations surrounding food safety combined with the growing trend towards organic and frozen foods drive this growth. Companies are increasingly investing in sustainable practices to meet regulatory demands and consumer preferences.Asia Pacific Cold Chain Market Report:

In the Asia Pacific region, the Cold Chain market is expected to grow from 37.85 billion in 2023 to 87.00 billion in 2033. Factors such as urbanization, population growth, and increasing consumer awareness regarding food safety drive the demand for Cold Chain solutions. Enhanced logistics networks and government initiatives in countries like China and India further bolster growth.North America Cold Chain Market Report:

North America has one of the most advanced Cold Chain systems globally, with the market size expected to escalate from 90.18 billion in 2023 to 207.28 billion in 2033. The region benefits from stringent food safety regulations and a significant pharmaceutical sector contributing to robust growth in Cold Chain logistics.South America Cold Chain Market Report:

The South American Cold Chain market is projected to expand from 23.49 billion in 2023 to 53.99 billion in 2033. Rising disposable incomes and changing dietary habits are pushing demand for fresh produce and frozen foods, necessitating the development of sustainable Cold Chain infrastructure.Middle East & Africa Cold Chain Market Report:

In the Middle East and Africa, the Cold Chain market is set to grow from 10.31 billion in 2023 to 23.70 billion in 2033. Factors such as increasing population, urbanization, and improvements in logistics networks contribute to the demand for reliable Cold Chain solutions in these regions.Tell us your focus area and get a customized research report.

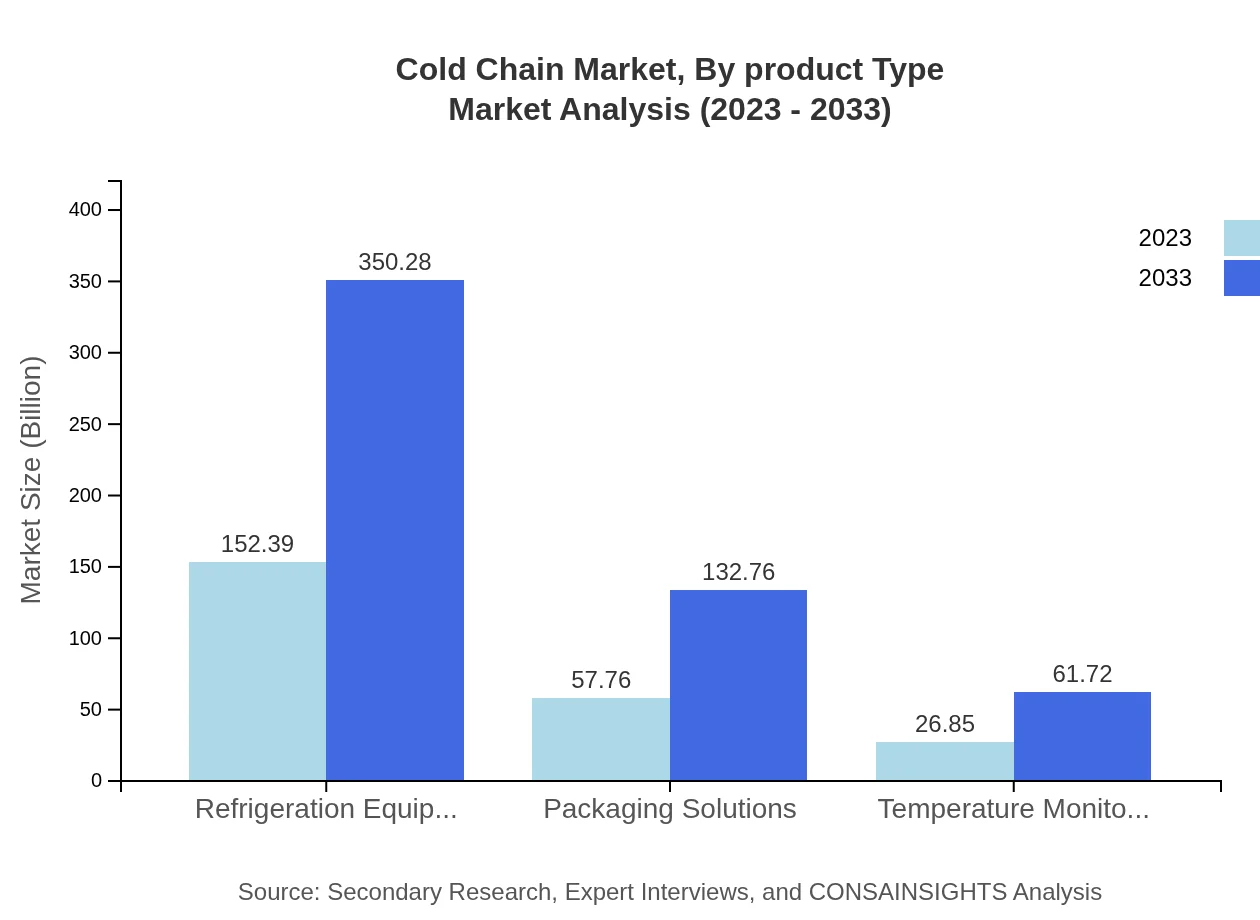

Cold Chain Market Analysis By Product Type

The Cold Chain market by product type includes Refrigeration Equipment, Temperature Monitoring Solutions, and Packaging Solutions. Refrigeration equipment leads the market with a size of 152.39 billion in 2023, growing to 350.28 billion by 2033, representing 64.3% market share. Temperature monitoring solutions are projected to grow from 26.85 billion to 61.72 billion, comprising a significant portion of compliance-focused applications.

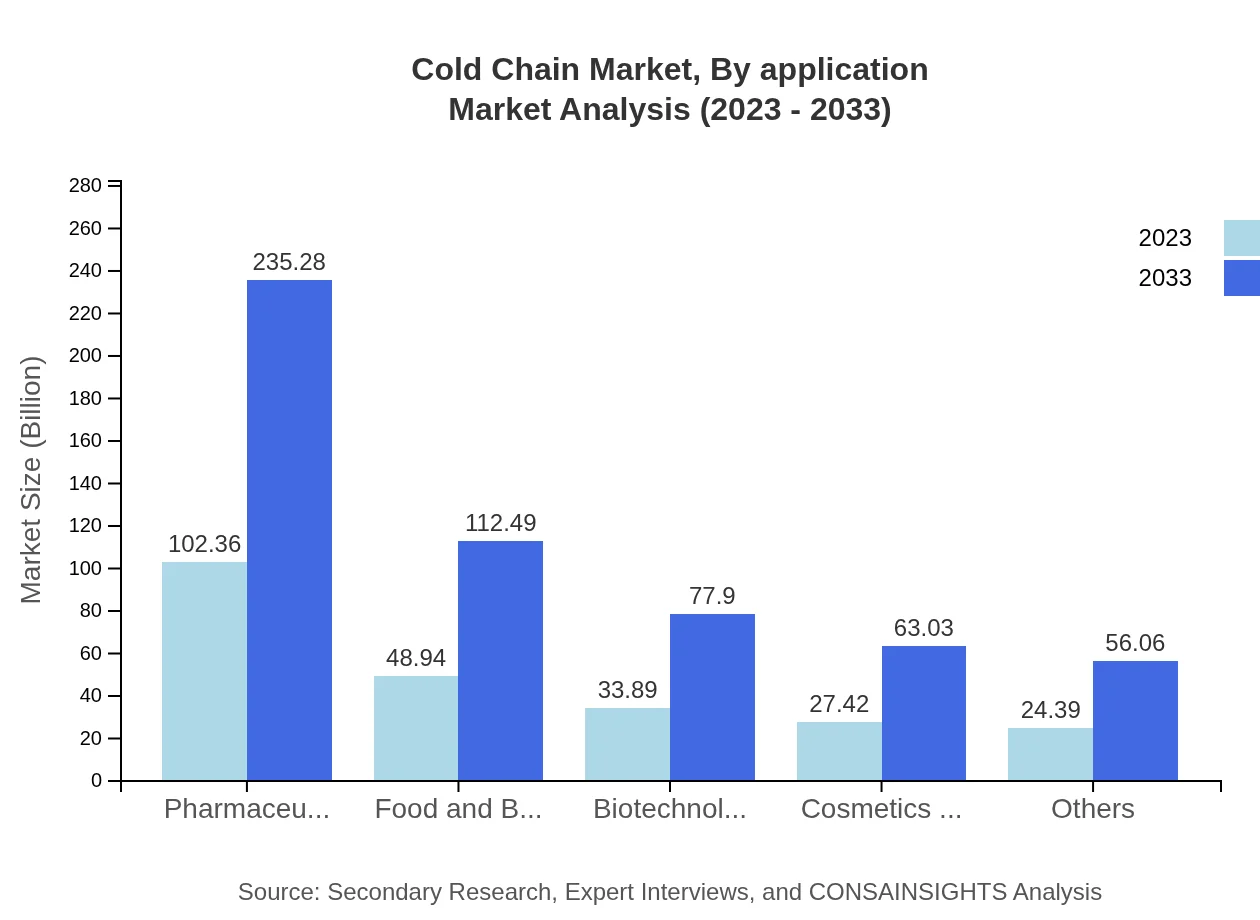

Cold Chain Market Analysis By Application

The key applications of the Cold Chain include Pharmaceuticals, Food and Beverages, Biotechnology, and Cosmetics. Pharmaceuticals dominate the market, projected to grow from 102.36 billion to 235.28 billion by 2033, holding a significant share of 43.19%. Food and Beverages also exhibit substantial growth potential, expected to rise from 48.94 billion to 112.49 billion amidst increasing consumer demand for safety and quality.

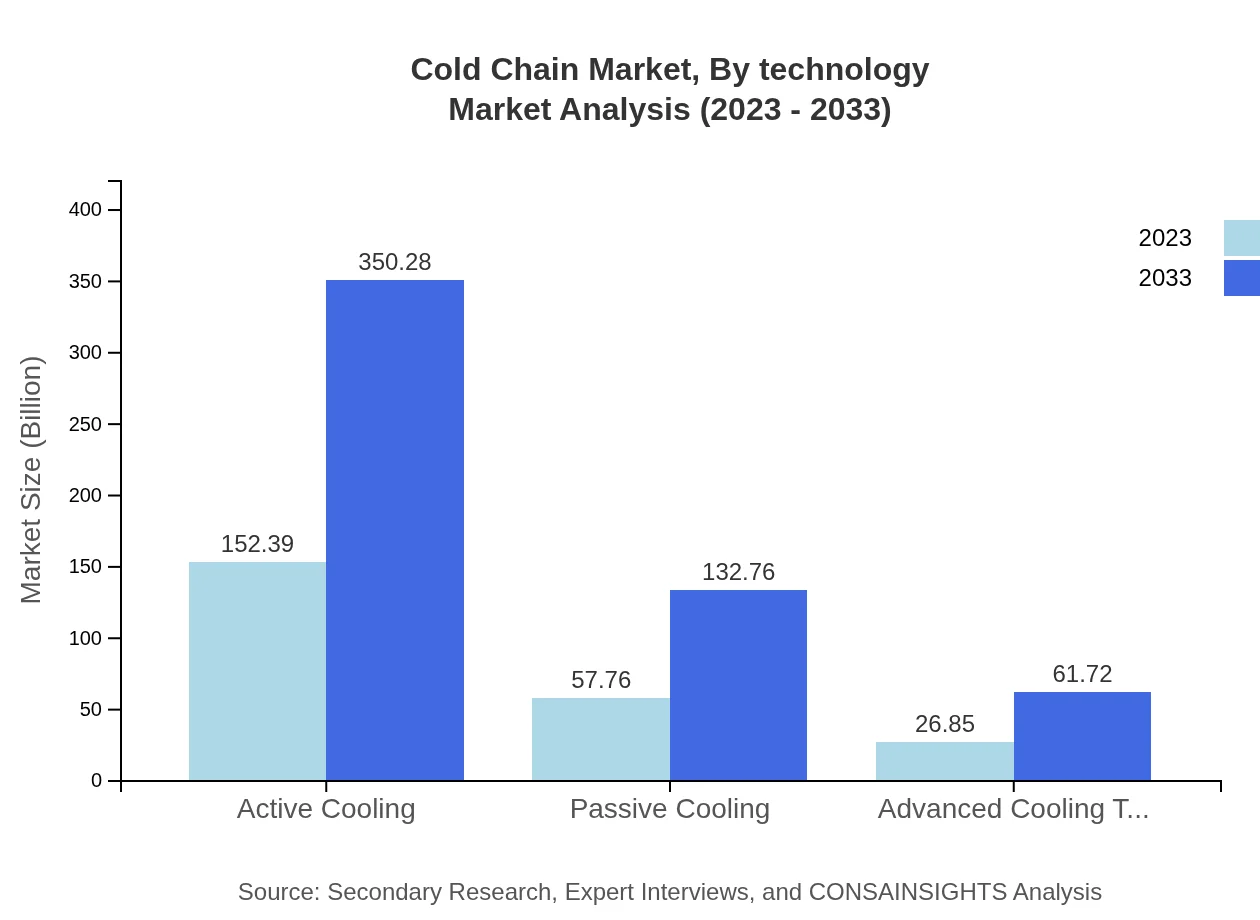

Cold Chain Market Analysis By Technology

The Cold Chain Market by technology is categorized into Active Cooling, Passive Cooling, and Advanced Cooling Technology. Active cooling represents the largest segment, with a market size of 152.39 billion in 2023 improving to 350.28 billion by 2033, accounting for a share of 64.3%. Meanwhile, advanced cooling technology is gaining traction due to a shift towards energy-efficient solutions, projected to grow from 26.85 billion to 61.72 billion by 2033.

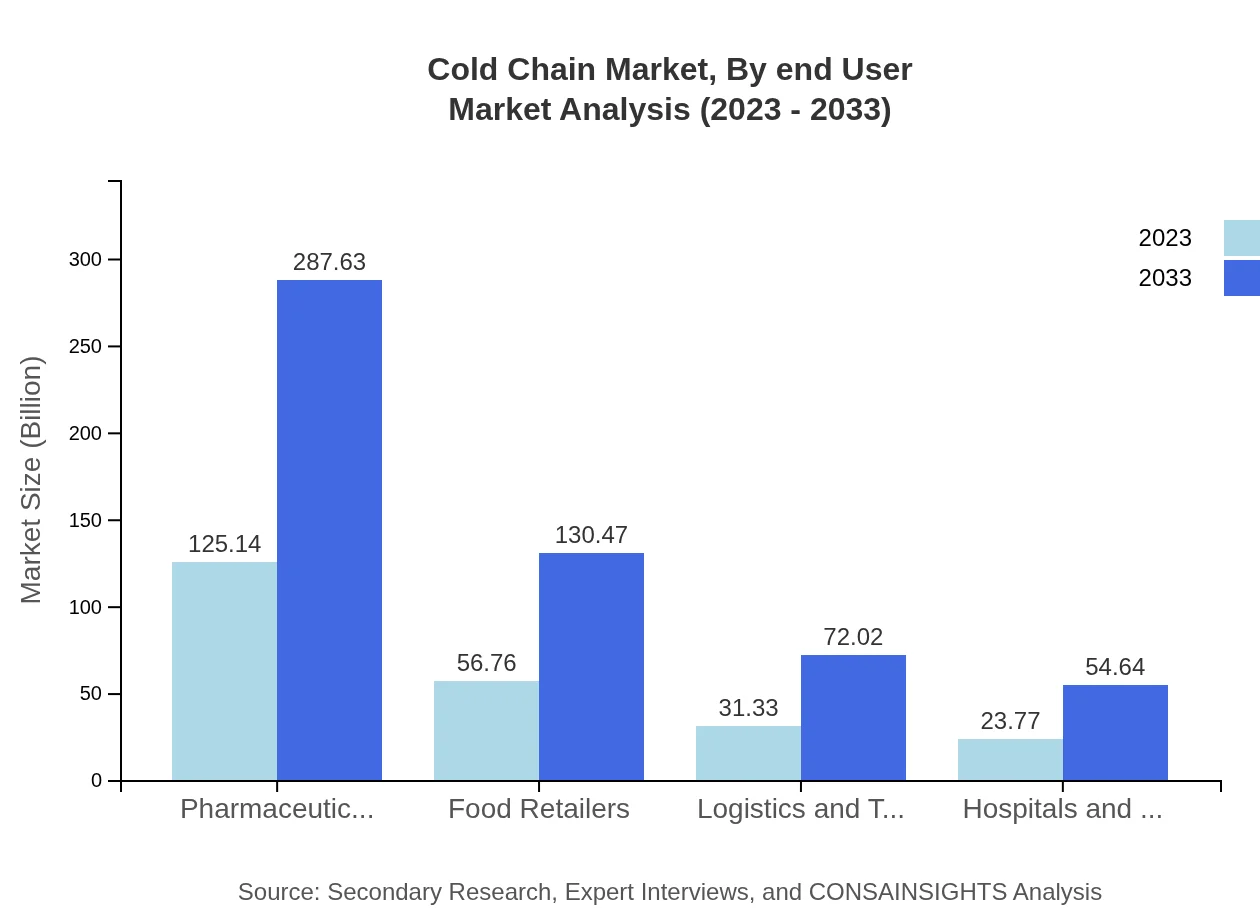

Cold Chain Market Analysis By End User

The Cold Chain market can be segmented by end-user industries including Pharmaceutical Companies, Food Retailers, Logistics and Transportation companies, and Hospitals & Healthcare. The pharmaceutical sector is crucial, with market sizes expected to rise from 125.14 billion to 287.63 billion due to stringent requirements for drug transport.

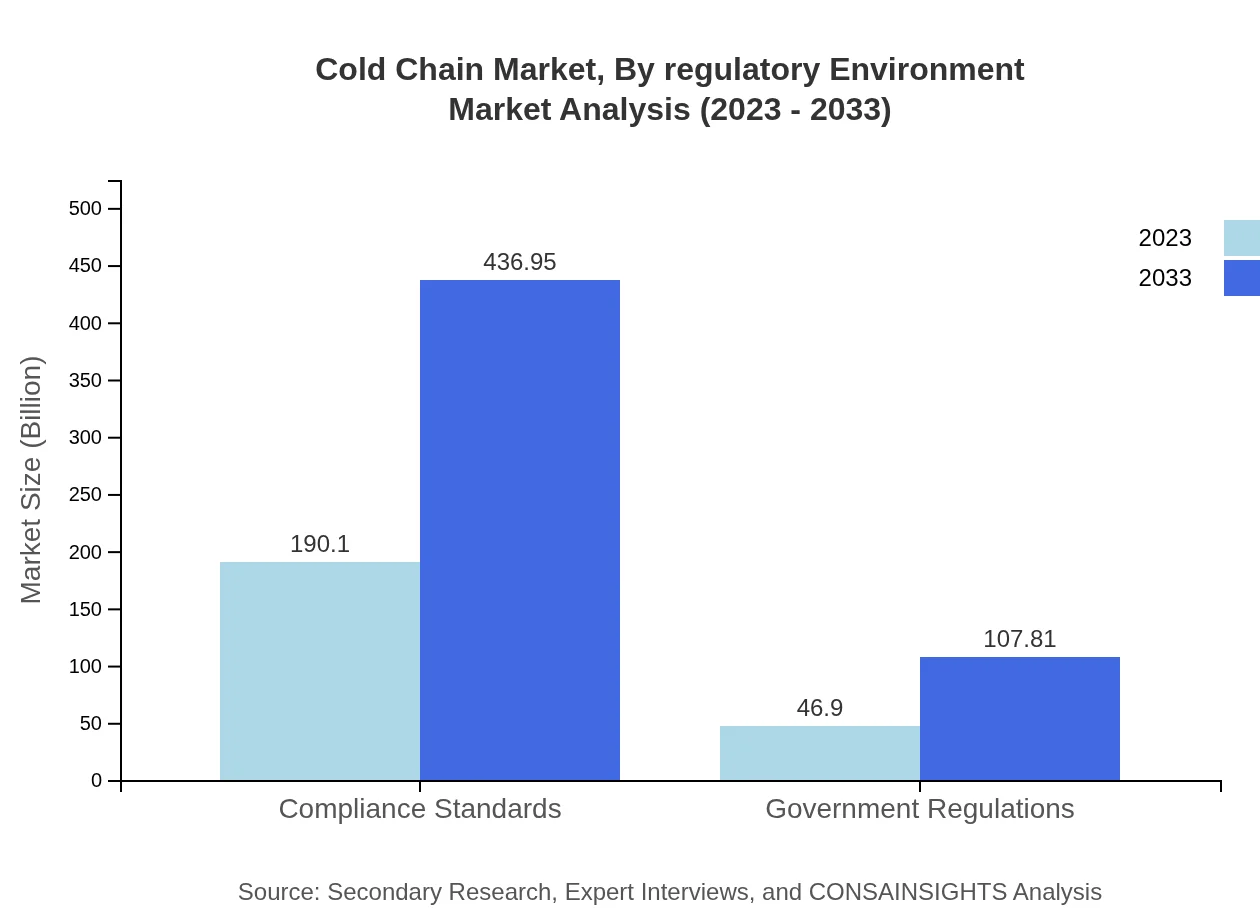

Cold Chain Market Analysis By Regulatory Environment

Regulatory frameworks play a significant role in the Cold Chain. Compliance standards are projected to grow from 190.10 billion to 436.95 billion, emphasizing the need for companies to adhere to regulations to ensure product integrity. Government regulations also shape market dynamics, poised to expand from 46.90 billion to 107.81 billion, reflecting increasing oversight on food and pharmaceutical safety.

Cold Chain Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cold Chain Industry

United Parcel Service (UPS):

UPS provides supply chain solutions with a dedicated focus on temperature-sensitive logistics, ensuring compliance with global health regulations.XPO Logistics:

A leading provider of logistics solutions, XPO offers comprehensive Cold Chain services leveraging advanced technologies for real-time tracking.Lineage Logistics:

Specializes in temperature-controlled logistics services and is recognized for its extensive cold storage facilities and innovative warehousing solutions.DB Schenker:

Offering integrated logistics solutions, DB Schenker provides specialized Cold Chain services particularly for the pharmaceutical sectors.Nippon Express:

A global logistics provider with a significant focus on Cold Chain solutions, Nippon Express caters to diverse industries including food and pharmaceuticals.We're grateful to work with incredible clients.

FAQs

What is the market size of cold Chain?

The cold-chain market is currently valued at $237 billion, with a projected CAGR of 8.4% from 2023 to 2033, indicating significant growth in this critical industry.

What are the key market players or companies in the cold Chain industry?

Key players include major logistics firms, refrigeration equipment manufacturers, and companies specializing in temperature monitoring solutions. Prominent firms often lead in innovation and compliance standards, shaping market dynamics.

What are the primary factors driving the growth in the cold Chain industry?

Factors include increased demand for pharmaceuticals and perishable goods, technological advancements in refrigeration, regulatory requirements, and a growing focus on food safety and quality assurance.

Which region is the fastest Growing in the cold Chain?

North America is the fastest-growing region, with a market projected to grow from $90.18 billion in 2023 to $207.28 billion by 2033, driven by technological innovations and high consumer demand.

Does ConsaInsights provide customized market report data for the cold Chain industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs and industry segments, providing in-depth analysis for stakeholders seeking detailed insights.

What deliverables can I expect from this cold Chain market research project?

Deliverables include comprehensive market reports, segmentation analysis, competitive landscape assessments, trend identification, and forecasts that support strategic decision-making.

What are the market trends of cold Chain?

Current trends include the adoption of advanced cooling technologies, increasing investments in logistics infrastructure, and heightened focus on sustainable practices and compliance with regulatory standards.