Collision Sensors Market Report

Published Date: 31 January 2026 | Report Code: collision-sensors

Collision Sensors Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Collision Sensors market, focusing on trends, industry dynamics, and regional insights from 2023 to 2033. It includes detailed forecasts, market size analysis, and identifies key players in the industry.

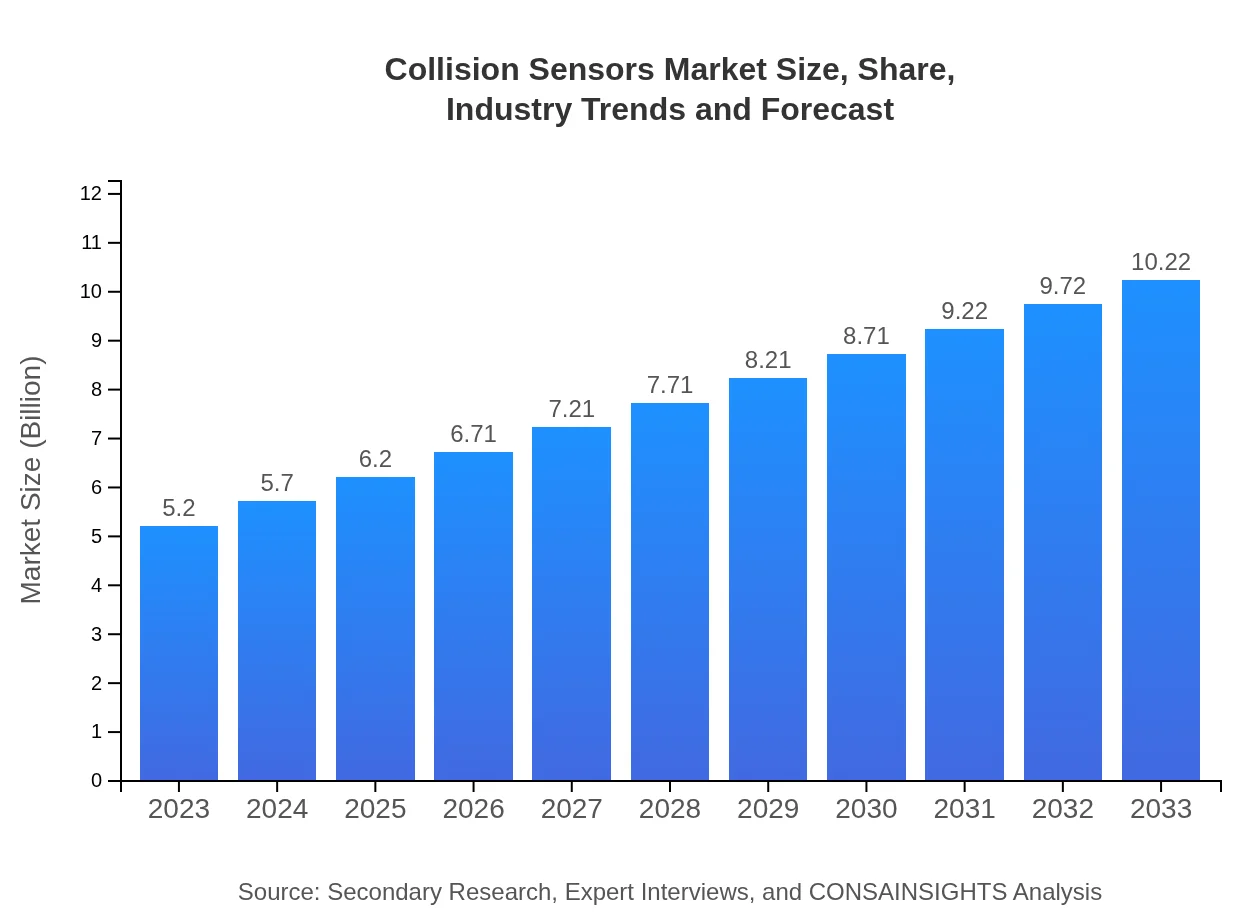

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.22 Billion |

| Top Companies | Bosch, Continental AG, Denso Corporation |

| Last Modified Date | 31 January 2026 |

Collision Sensors Market Overview

Customize Collision Sensors Market Report market research report

- ✔ Get in-depth analysis of Collision Sensors market size, growth, and forecasts.

- ✔ Understand Collision Sensors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Collision Sensors

What is the Market Size & CAGR of Collision Sensors market in 2023?

Collision Sensors Industry Analysis

Collision Sensors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Collision Sensors Market Analysis Report by Region

Europe Collision Sensors Market Report:

In Europe, the Collision Sensors market is projected to grow from $1.55 billion in 2023 to $3.05 billion by 2033. The region is focusing on stringent safety regulations, along with the growing trend of electric and autonomous vehicles, driving the adoption of advanced sensor technologies.Asia Pacific Collision Sensors Market Report:

In the Asia Pacific region, the Collision Sensors market is expected to grow from $1.07 billion in 2023 to $2.10 billion by 2033. This growth is largely attributed to increasing vehicle production and a rising focus on automobile safety standards in countries like China and India.North America Collision Sensors Market Report:

North America will witness significant growth, with the market rising from $1.72 billion in 2023 to approximately $3.39 billion by 2033. The emphasis on advanced driver-assistance systems (ADAS) in vehicles and stringent regulatory measures to enhance safety will fuel this demand.South America Collision Sensors Market Report:

The South American Collision Sensors market is anticipated to expand from $0.32 billion in 2023 to $0.63 billion by 2033. Factors such as increasing automotive sales and growing infrastructure investments will drive this growth in the region.Middle East & Africa Collision Sensors Market Report:

The Middle East and Africa market is expected to increase from $0.54 billion in 2023 to $1.05 billion by 2033. Rising automotive sales and increasing awareness about safety measures will support market growth in this region.Tell us your focus area and get a customized research report.

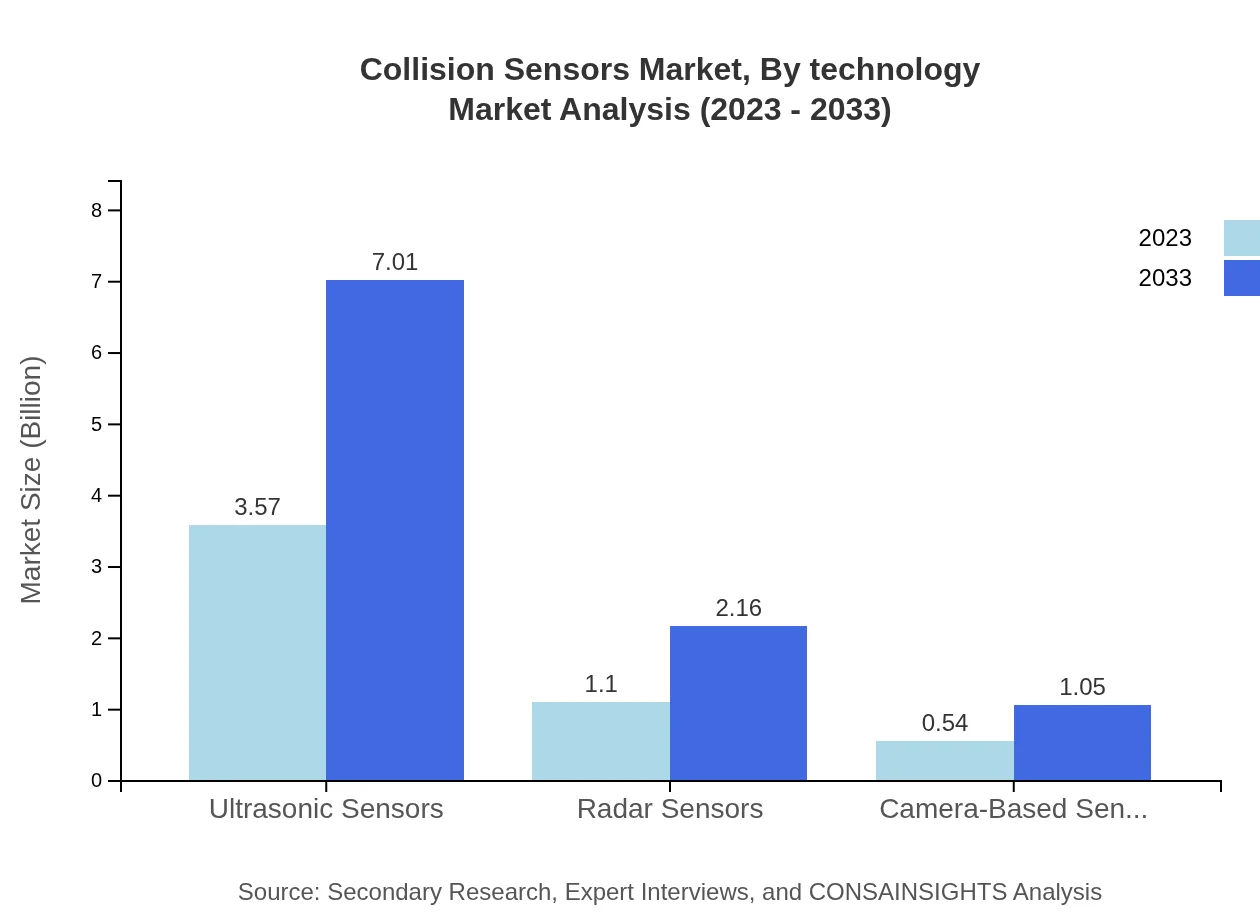

Collision Sensors Market Analysis By Technology

The Collision Sensors market is primarily divided into three technology types: Ultrasonic Sensors, Radar Sensors, and Camera-Based Sensors. Ultrasonic sensors dominate the market, with a size of $3.57 billion in 2023, projected to grow to $7.01 billion by 2033, holding a market share of approximately 68.56%. Radar sensors also show significant growth, expected to increase from $1.10 billion to $2.16 billion during the same period, maintaining a 21.13% market share. Camera-based sensors are emerging as a vital technology, expected to grow from $0.54 billion to $1.05 billion by 2033, with 10.31% of the market share.

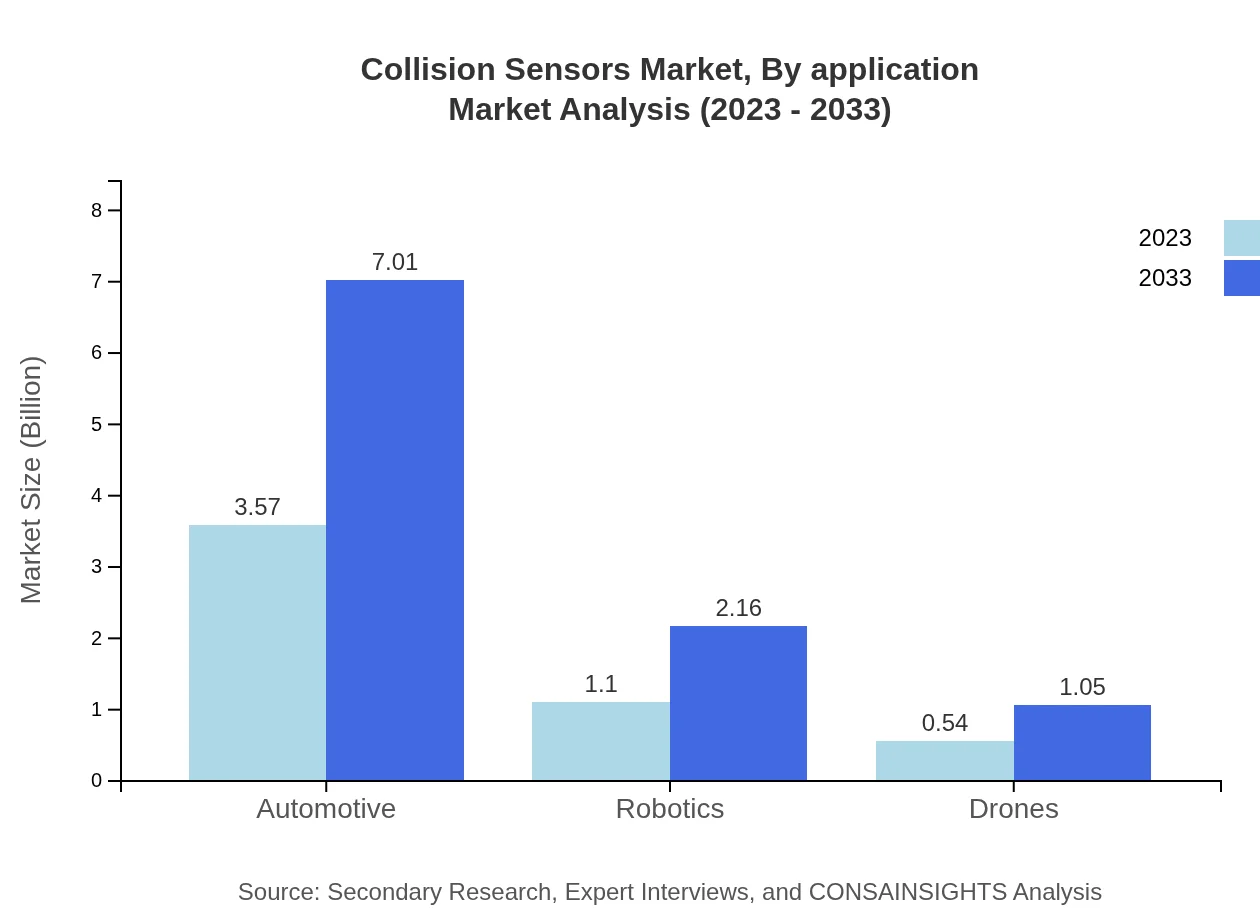

Collision Sensors Market Analysis By Application

The Collision Sensors market can be segmented by application into Automotive, Transportation, and Robotics. The automotive sector leads the market with a size of $3.57 billion in 2023, expected to reach $7.01 billion by 2033, maintaining a 68.56% market share. The transportation sector, which includes logistics and public transit, is also significant, growing from $1.10 billion to $2.16 billion by 2033, holding a 21.13% share. Robotics, including drones and industrial applications, is a growing segment anticipated to increase from $0.54 billion to $1.05 billion by 2033, reinforcing its importance in automation.

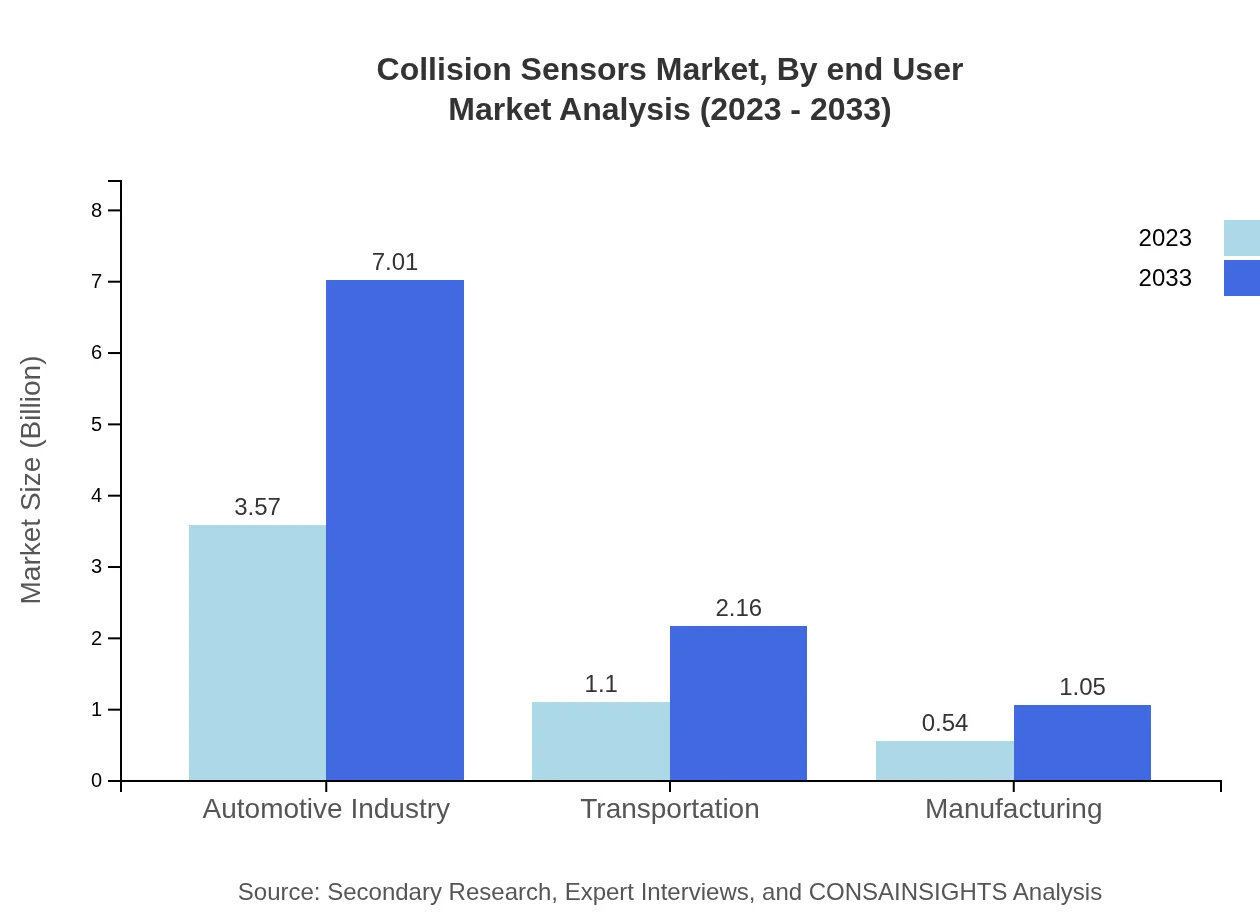

Collision Sensors Market Analysis By End User

The end-user segmentation includes Automotive, Robotics, and Drones. The Automotive sector represents the largest share of the market, as key stakeholders are increasingly investing in safety solutions. In 2023, the Automotive market segment stands at $3.57 billion, projected to reach $7.01 billion by 2033. Robotics applications are also gaining momentum, increasing from $1.10 billion to $2.16 billion within the same timeframe. Drones are making significant contributions as well, expanding from $0.54 billion in 2023 to $1.05 billion by 2033.

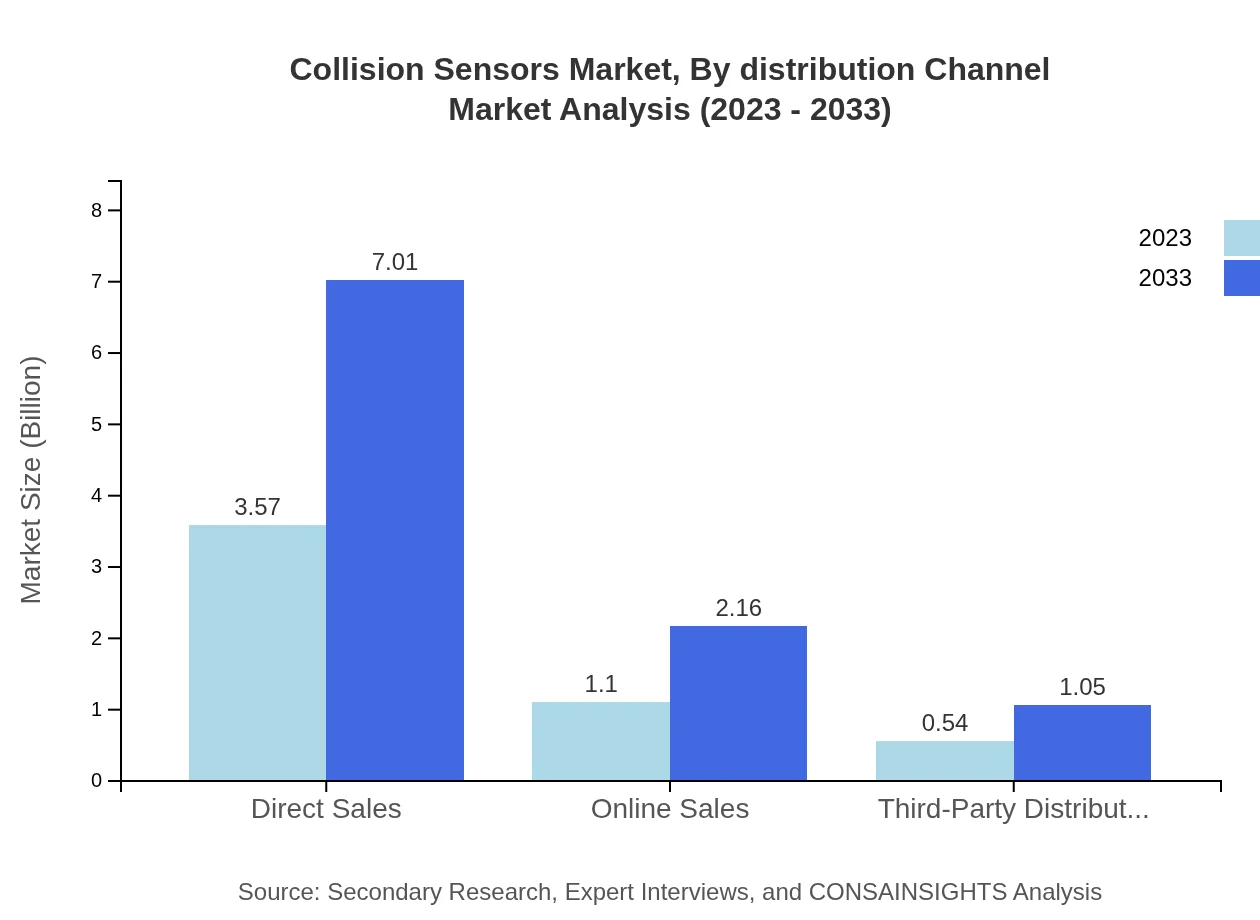

Collision Sensors Market Analysis By Distribution Channel

The market is segmented based on distribution channels into Direct Sales, Online Sales, and Third-Party Distributors. Direct sales dominate with a projected size of $3.57 billion in 2023, increasing to $7.01 billion by 2033, accounting for 68.56% of the market. Online sales are also significant, expanding from $1.10 billion to $2.16 billion by 2033 with a 21.13% share. Third-party distributors are projected to increase from $0.54 billion to $1.05 billion during the same period, underscoring the importance of various sales approaches in the Collision Sensors market.

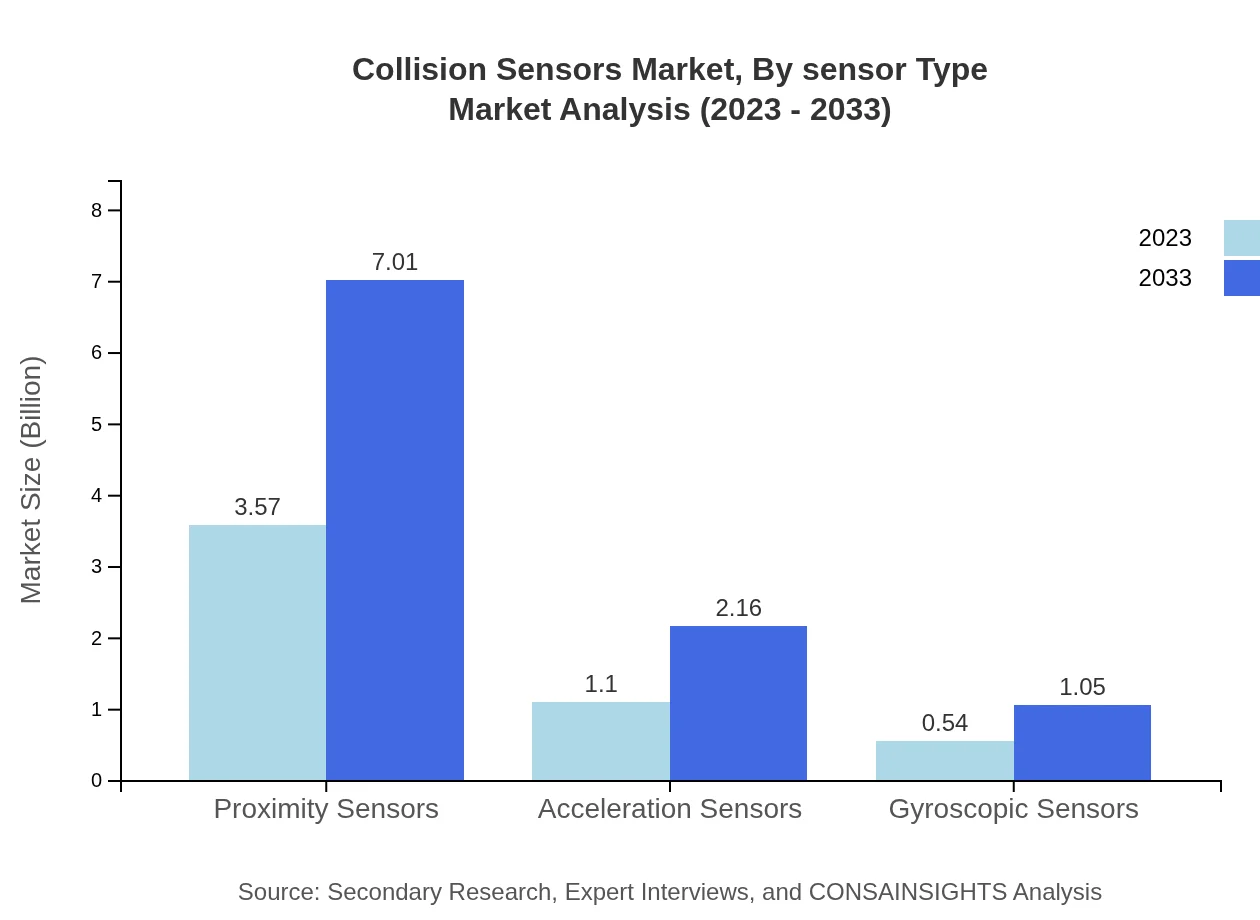

Collision Sensors Market Analysis By Sensor Type

Collision Sensors can be categorized by sensor type into Ultrasonic, Radar, and Camera-based sensors. Ultrasonic sensors are the most widely used, dominating the market at $3.57 billion and expected to rise to $7.01 billion by 2033, holding a steady market share of 68.56%. Radar sensors follow, growing from $1.10 billion to $2.16 billion by 2033, representing a 21.13% share. Camera-based sensors, while currently smaller, are anticipated to grow from $0.54 billion to $1.05 billion, making up 10.31% of the market share.

Collision Sensors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Collision Sensors Industry

Bosch:

Bosch is a leader in automotive technology, known for its commitment to safety innovations, including advanced collision sensors that enhance vehicle safety and automation.Continental AG:

Continental AG specializes in creating innovative sensor solutions, driving advancements in collision detection that support autonomous vehicles and smart transport systems.Denso Corporation:

Denso is a global supplier of advanced automotive technology, providing high-quality collision sensors to improve safety and promote the future of transportation.We're grateful to work with incredible clients.

FAQs

What is the market size of collision Sensors?

The collision sensors market is projected to reach approximately $5.2 billion by 2033, growing from around $3 billion in 2023, at a CAGR of 6.8%, driven by increasing demand for safety innovations in vehicles.

What are the key market players or companies in the collision sensors industry?

Key players in the collision sensors market include companies like Bosch, Continental AG, and Denso Corporation. These companies are recognized for their innovation in automotive safety and sensor technology.

What are the primary factors driving the growth in the collision sensors industry?

Primary factors include the rising demand for advanced driver assistance systems (ADAS), increased awareness of vehicle safety standards, and an upward trend in vehicle production and sales globally.

Which region is the fastest Growing in the collision sensors?

The fastest-growing region for collision sensors is North America, with the market expected to grow from $1.72 billion in 2023 to $3.39 billion by 2033. Europe and Asia Pacific also show significant growth.

Does ConsaInsights provide customized market report data for the collision sensors industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, enabling clients to gain insights on diverse aspects of the collision sensors industry, including trends and forecasts.

What deliverables can I expect from this collision sensors market research project?

Deliverables include comprehensive reports, market analyses, projections, segmentation data, and insights tailored to client requirements, ensuring informed decision-making in the collision sensors market.

What are the market trends of collision sensors?

Trends in the collision sensors market include escalating adoption of ADAS technologies, integration of IoT in automotive sensors, and a shift towards environmentally friendly manufacturing practices.