Combat Helmet Market Report

Published Date: 03 February 2026 | Report Code: combat-helmet

Combat Helmet Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Combat Helmet market, including market size, growth forecasts (2023-2033), industry analysis, regional breakdowns, and competitive landscape. It aims to equip stakeholders with vital information for making strategic decisions in this evolving market.

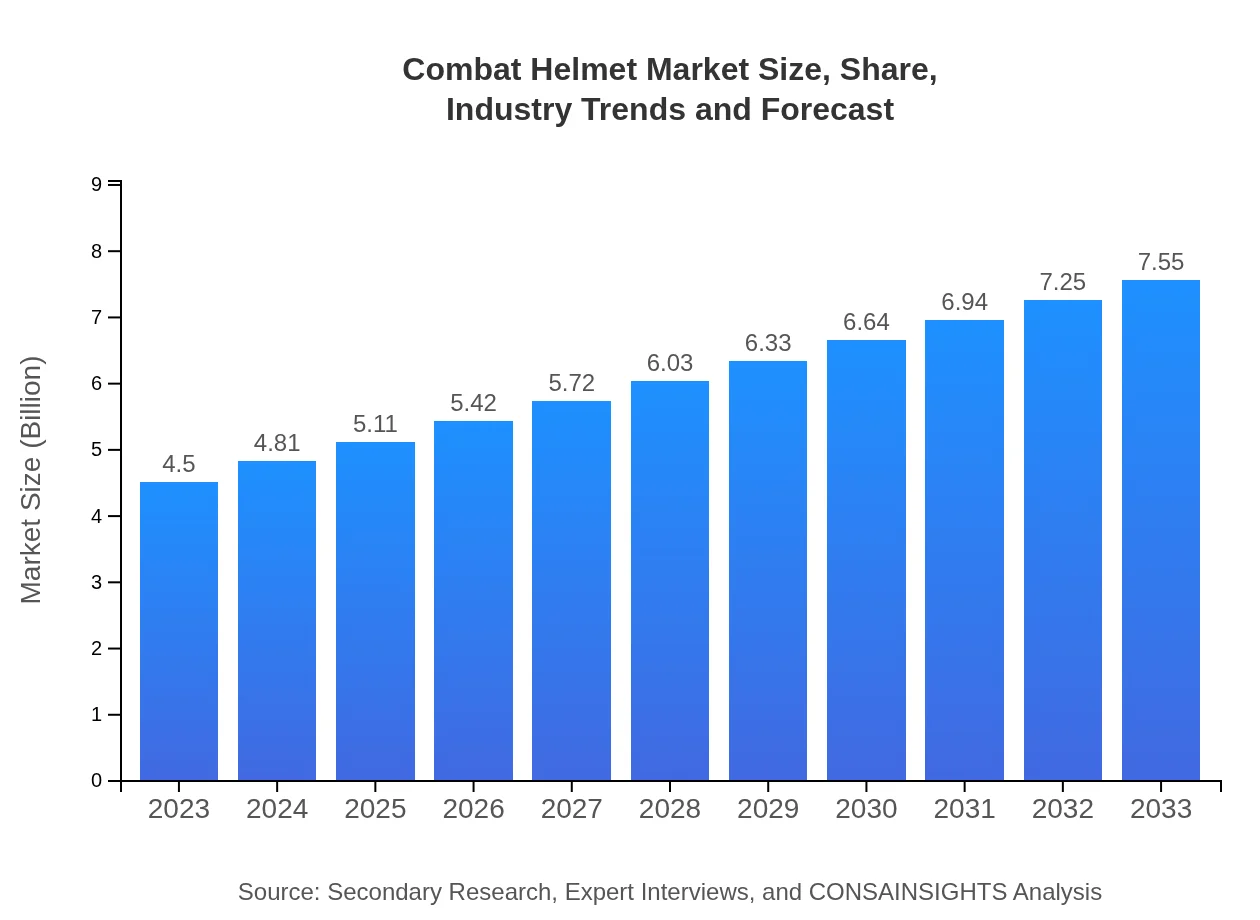

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $7.55 Billion |

| Top Companies | Honeywell International Inc., Gentex Corporation, MSA Safety Incorporated, Revision Military |

| Last Modified Date | 03 February 2026 |

Combat Helmet Market Overview

Customize Combat Helmet Market Report market research report

- ✔ Get in-depth analysis of Combat Helmet market size, growth, and forecasts.

- ✔ Understand Combat Helmet's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Combat Helmet

What is the Market Size & CAGR of Combat Helmet market in 2023 and 2033?

Combat Helmet Industry Analysis

Combat Helmet Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Combat Helmet Market Analysis Report by Region

Europe Combat Helmet Market Report:

Europe’s market is anticipated to grow from $1.44 billion in 2023 to $2.41 billion by 2033. Ongoing threats of terrorism and military conflicts within and outside the region necessitate government spending on advanced personal protective equipment, including combat helmets.Asia Pacific Combat Helmet Market Report:

In the Asia Pacific region, the market was valued at approximately $0.85 billion in 2023, expected to grow to $1.43 billion by 2033. Increasing military expenditures and advancements in national security are key drivers, leading to a growing demand for modern combat helmets among armed forces and law enforcement.North America Combat Helmet Market Report:

North America holds one of the largest markets, valued at $1.56 billion in 2023 and projected to reach $2.62 billion by 2033. The United States military's substantial investments in soldier modernization programs foster continuous demand for innovative helmet technologies and materials.South America Combat Helmet Market Report:

The South American market, valued at $0.41 billion in 2023, is set to increase to $0.68 billion by 2033. The rising focus on internal security and law enforcement upgrades in several countries are encouraging growth in helmet demand, particularly in police forces.Middle East & Africa Combat Helmet Market Report:

The Middle East and Africa were valued at $0.25 billion in 2023, with expectations to grow to $0.41 billion by 2033. The ongoing conflicts in several countries and a heightened focus on security technologies surge demand for combat helmets in military and police sectors.Tell us your focus area and get a customized research report.

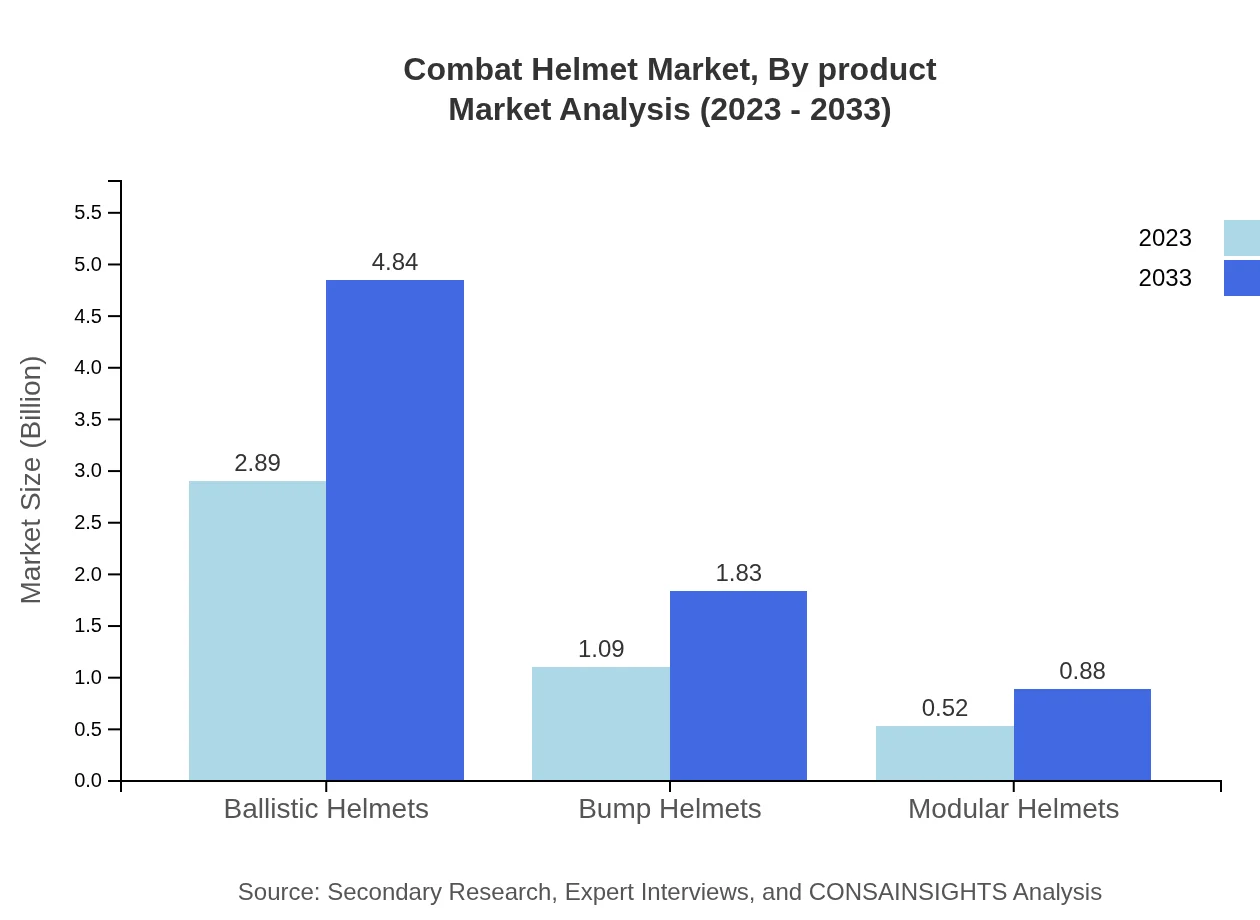

Combat Helmet Market Analysis By Product

The Combat Helmet market is predominantly categorized into various product types. Ballistic helmets are projected to dominate the segment with a value increase from $2.89 billion in 2023 to $4.84 billion by 2033, capturing a substantial 64.12% market share. Bump helmets, while important for recreational and law enforcement sectors, represent a smaller share, growing from $1.09 billion to $1.83 billion. Modular helmets are also set to expand, but their total market remains under development.

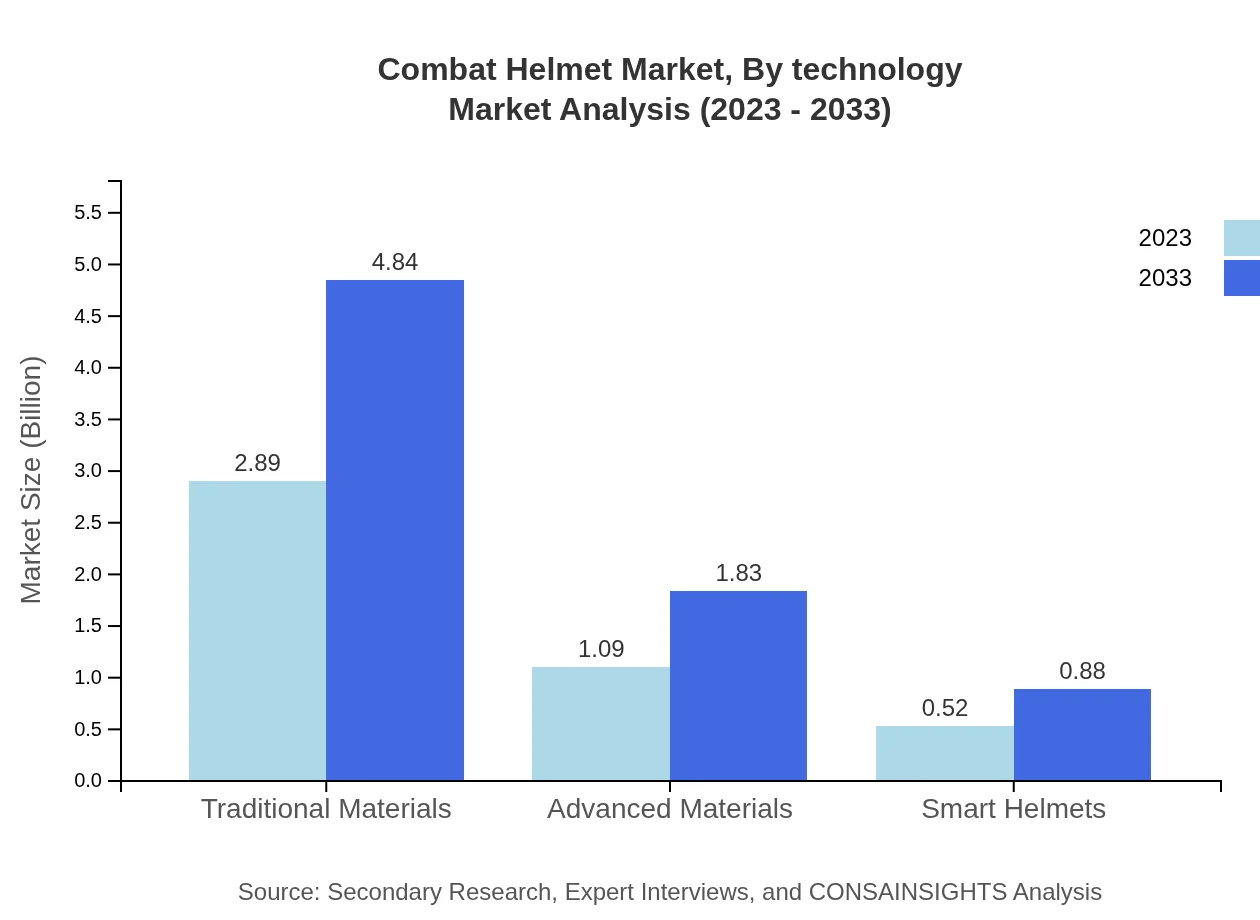

Combat Helmet Market Analysis By Technology

The market is divided into traditional materials and advanced materials, with traditional materials (including Kevlar and fiberglass) leading the market from $2.89 billion in 2023 to $4.84 billion by 2033, with a share of 64.12%. Advanced materials (such as carbon fiber and composite materials) are anticipated to grow from $1.09 billion to $1.83 billion, fueled by demand for lighter, stronger, and more durable helmets. Smart helmets also hold potential for growth, integrating augmented reality features to enhance user capability.

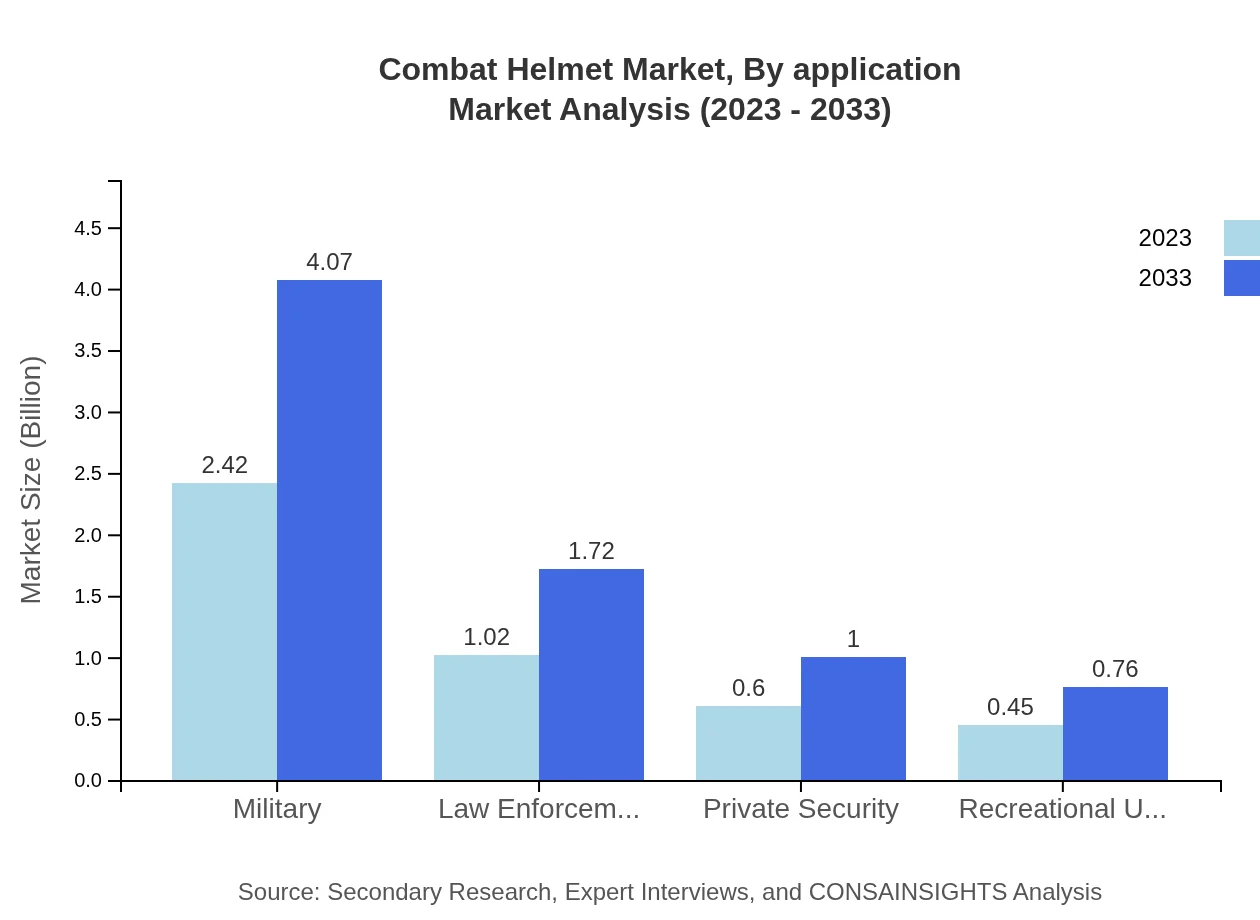

Combat Helmet Market Analysis By Application

The primary application of combat helmets lies in military use, accounting for $2.42 billion in 2023, forecasted to grow to $4.07 billion by 2033 with a notable share of 53.88%. The law enforcement sector is also significant with a market value expanding from $1.02 billion to $1.72 billion, illustrating the increasing focus on officer safety. Growth in the recreational sector, while lesser, is noteworthy as it responds to consumer interest in personal safety equipment.

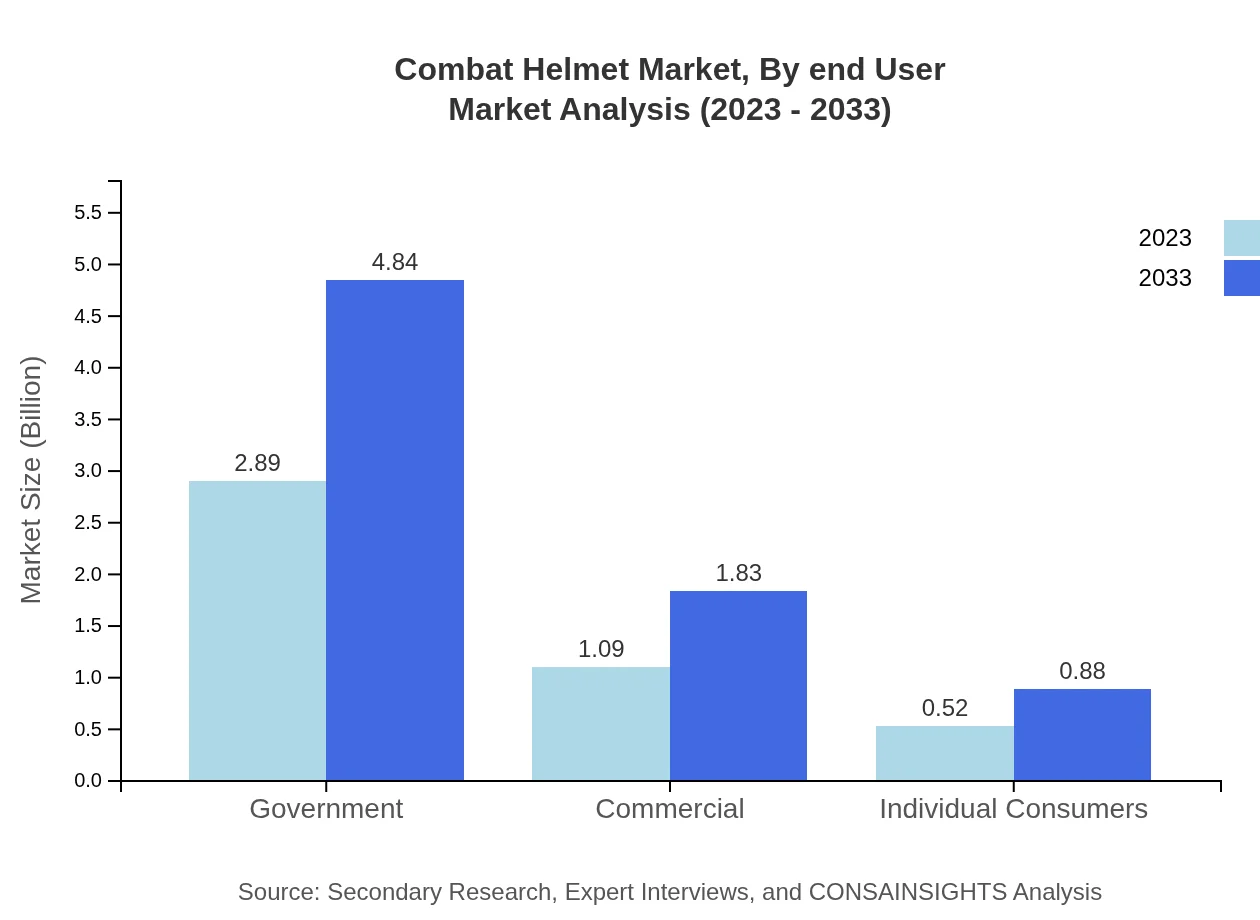

Combat Helmet Market Analysis By End User

The major end-users of combat helmets include military agencies, law enforcement, and private security forces. The military sector occupies a dominant space, reflecting a market size of $2.42 billion in 2023, expected to reach $4.07 billion by 2033. Law enforcement and private security reflect considerable growth paths as well; law enforcement is projected to grow from $1.02 billion to $1.72 billion.

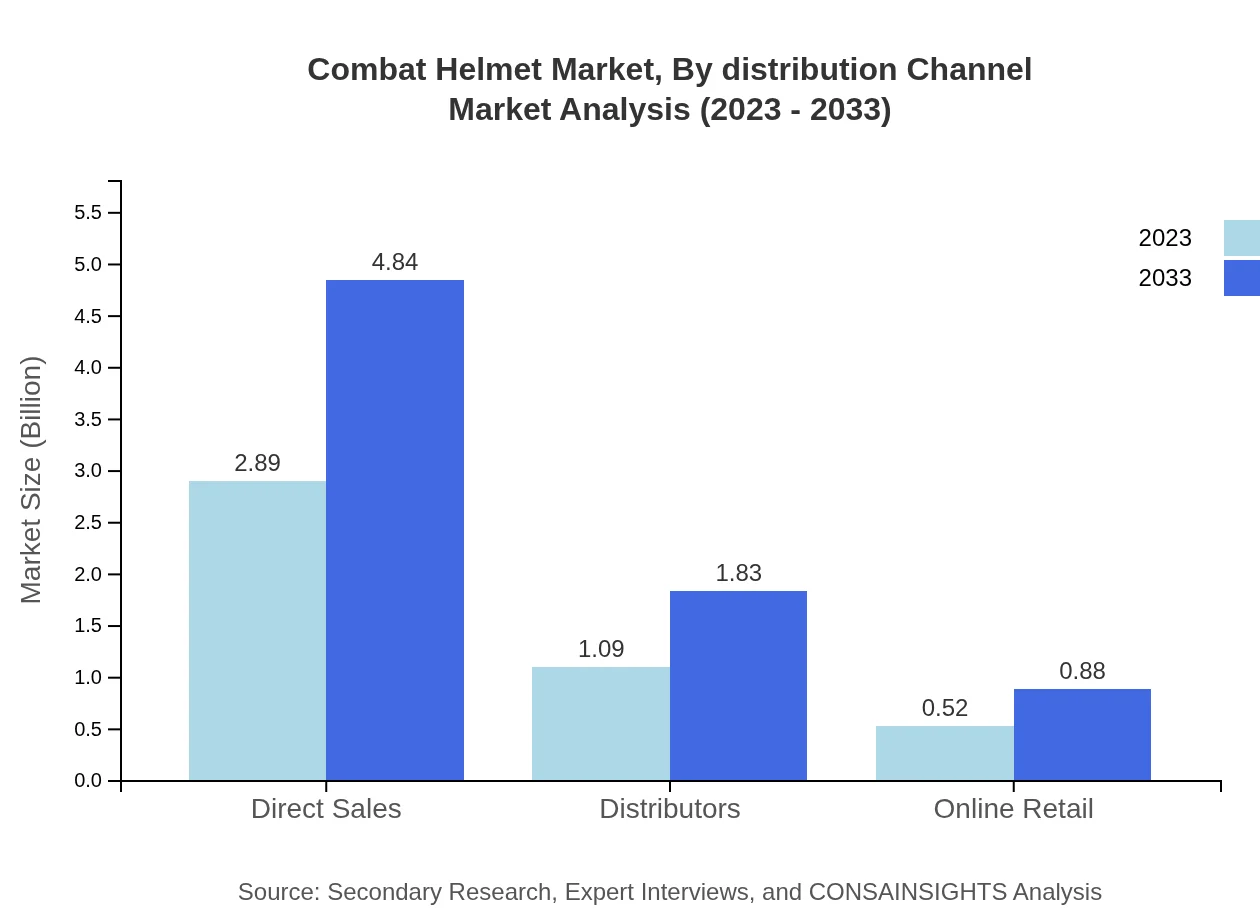

Combat Helmet Market Analysis By Distribution Channel

Distribution channels play a critical role in the Combat Helmet market. Direct sales maintain a substantial market share, from $2.89 billion to $4.84 billion by 2033. Distributors and online retail, while smaller, also show growth trends due to the increasing consumer preference for online shopping and the evolving landscape of sales channels.

Combat Helmet Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Combat Helmet Industry

Honeywell International Inc.:

A leader in personal protective equipment, Honeywell provides innovative helmet solutions with advanced materials offering unmatched safety in combat situations.Gentex Corporation:

Gentex is renowned for producing cutting-edge helmets and protective gear designed for military, law enforcement, and industrial sectors, focusing on integrating communication technologies into headgear.MSA Safety Incorporated:

A key player in the protective equipment market, MSA Safety develops helmets that meet rigorous safety standards for military and emergency responders.Revision Military:

Revision is dedicated to developing high-quality ballistic helmets and protective eyewear, with a strong emphasis on soldier safety and performance in extreme conditions.We're grateful to work with incredible clients.

FAQs

What is the market size of combat Helmet?

The combat helmet market is projected to grow from approximately $4.5 billion in 2023 to a significant size by 2033, with a compound annual growth rate (CAGR) of 5.2%, indicating robust demand.

What are the key market players or companies in this combat Helmet industry?

Key players in the combat helmet market include companies that specialize in ballistic protection products, military supplies, and safety gear. These manufacturers often engage in research and development to enhance helmet technology and performance.

What are the primary factors driving the growth in the combat Helmet industry?

Growth factors in the combat helmet industry include increasing military expenditure, rising demand for personal safety equipment, advancements in helmet technology, and heightened awareness regarding safety standards and regulations in defense.

Which region is the fastest Growing in the combat Helmet?

North America is currently the fastest-growing region in the combat helmet market, with market size projected to increase from $1.56 billion in 2023 to $2.62 billion by 2033, driven by military modernization and safety initiatives.

Does ConsaInsights provide customized market report data for the combat Helmet industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the combat helmet industry, enabling stakeholders to obtain insights that align closely with their business objectives.

What deliverables can I expect from this combat Helmet market research project?

Deliverables from the combat helmet market research project typically include comprehensive reports featuring market analysis, growth forecasts, competitive landscape evaluations, and recommendations for strategic decision-making.

What are the market trends of combat Helmet?

Current trends in the combat helmet market include a shift towards smart helmets with advanced features, increasing use of lightweight materials, and a rising demand for customizable designs to enhance user comfort and effectiveness.