Combination Anti Diabetes Drugs Market Report

Published Date: 31 January 2026 | Report Code: combination-anti-diabetes-drugs

Combination Anti Diabetes Drugs Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Combination Anti Diabetes Drugs market, covering market trends, size, segmented analysis, and forecasts from 2023 to 2033. Key insights include regional analysis, industry leaders, and technological advancements influencing market growth.

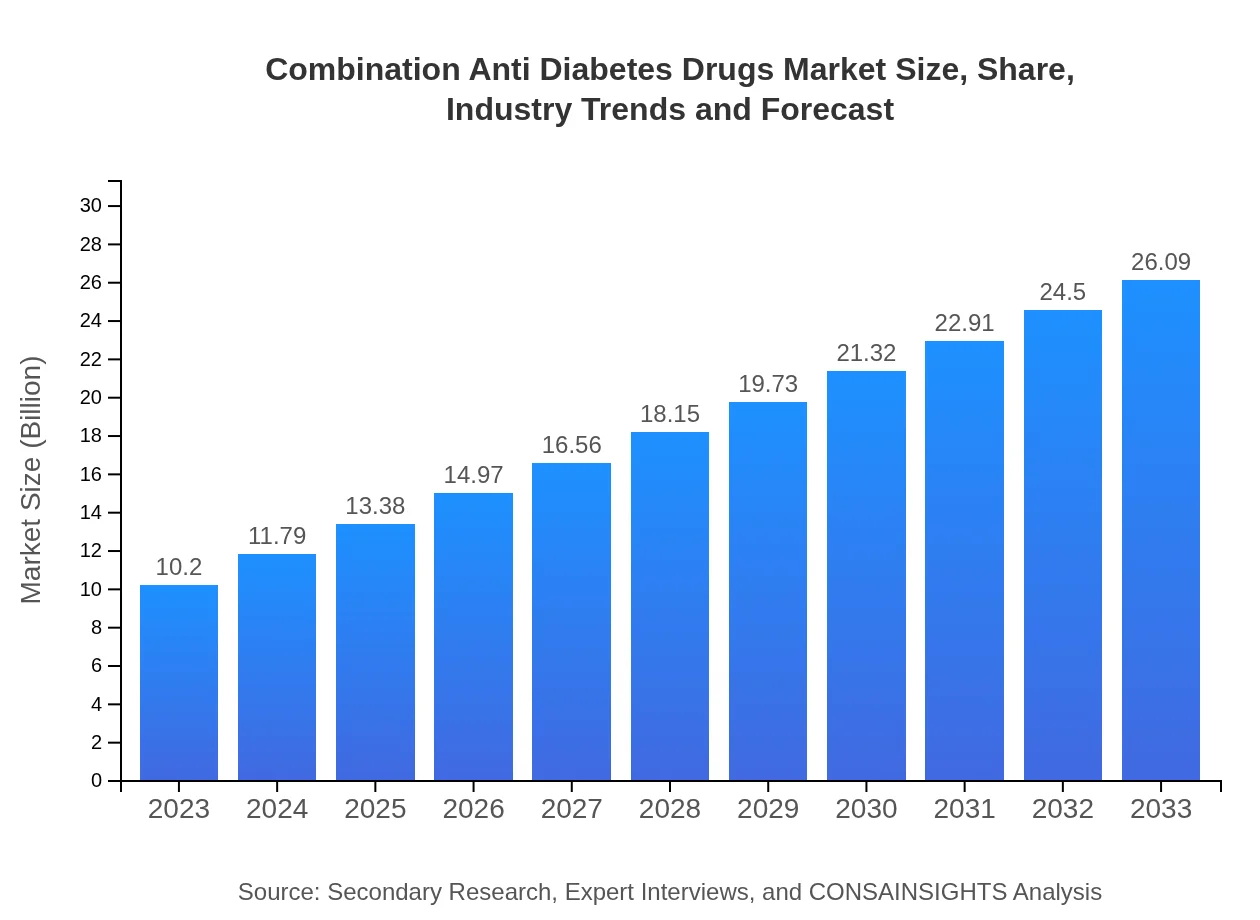

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.20 Billion |

| CAGR (2023-2033) | 9.5% |

| 2033 Market Size | $26.09 Billion |

| Top Companies | Boehringer Ingelheim, Novo Nordisk, Sanofi, Eli Lilly, Merck & Co. |

| Last Modified Date | 31 January 2026 |

Combination Anti Diabetes Drugs Market Overview

Customize Combination Anti Diabetes Drugs Market Report market research report

- ✔ Get in-depth analysis of Combination Anti Diabetes Drugs market size, growth, and forecasts.

- ✔ Understand Combination Anti Diabetes Drugs's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Combination Anti Diabetes Drugs

What is the Market Size & CAGR of Combination Anti Diabetes Drugs market in 2023?

Combination Anti Diabetes Drugs Industry Analysis

Combination Anti Diabetes Drugs Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Combination Anti Diabetes Drugs Market Analysis Report by Region

Europe Combination Anti Diabetes Drugs Market Report:

Europe's market is set to expand considerably, with projections indicating growth from $3.25 billion in 2023 to $8.31 billion by 2033. The region benefits from progressive healthcare policies and a strong focus on diabetes care innovation.Asia Pacific Combination Anti Diabetes Drugs Market Report:

The Asia Pacific region is projected to see substantial growth, with the market reaching approximately $4.33 billion by 2033, up from $1.69 billion in 2023. This growth is driven by increasing urbanization, dietary shifts, and higher obesity rates, necessitating better diabetes management solutions.North America Combination Anti Diabetes Drugs Market Report:

North America currently leads the global market, with revenues expected to rise from $3.79 billion in 2023 to $9.70 billion by 2033. High healthcare expenditure, better access to innovative drugs, and the presence of key market players contribute to this growth.South America Combination Anti Diabetes Drugs Market Report:

In South America, the market is expected to grow from $0.18 billion in 2023 to $0.47 billion by 2033. Factors such as a rising population and increased awareness about diabetes are stimulating demand for effective therapeutic options.Middle East & Africa Combination Anti Diabetes Drugs Market Report:

The Middle East and Africa are poised for growth, with the market increasing from $1.28 billion in 2023 to $3.27 billion in 2033. Improved healthcare infrastructure and rising incidence rates of diabetes influence this elevation in market value.Tell us your focus area and get a customized research report.

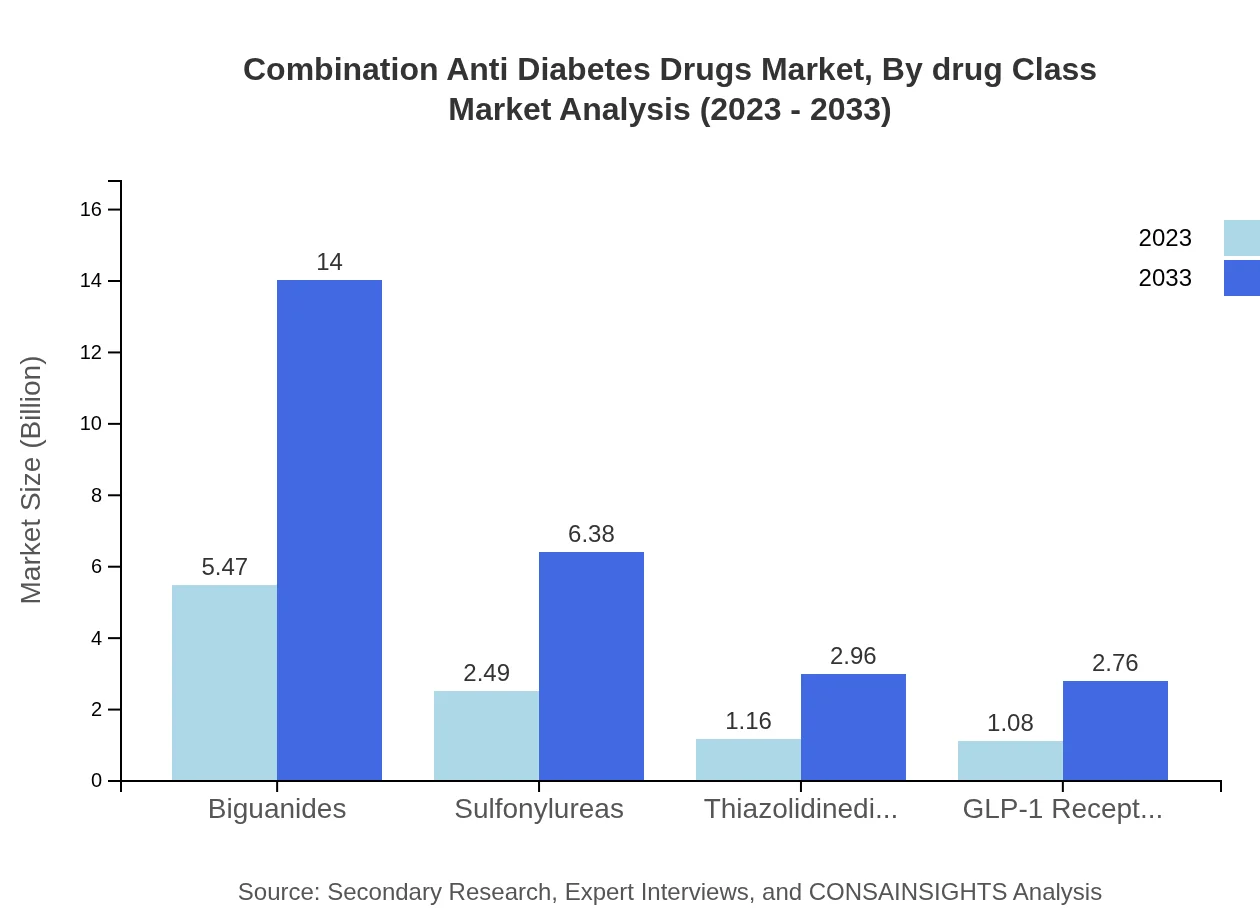

Combination Anti Diabetes Drugs Market Analysis By Drug Class

Biguanides dominate the market, anticipated to grow from $5.47 billion in 2023 to $14.00 billion by 2033, maintaining a share of 53.65%. Sulfonylureas follow, with growth from $2.49 billion to $6.38 billion, holding 24.44%. Thiazolidinediones and GLP-1 Receptor Agonists showcase growth potential, with respective market sizes of $1.16 billion to $2.96 billion and $1.08 billion to $2.76 billion, indicating the ongoing shift towards more effective treatment modalities.

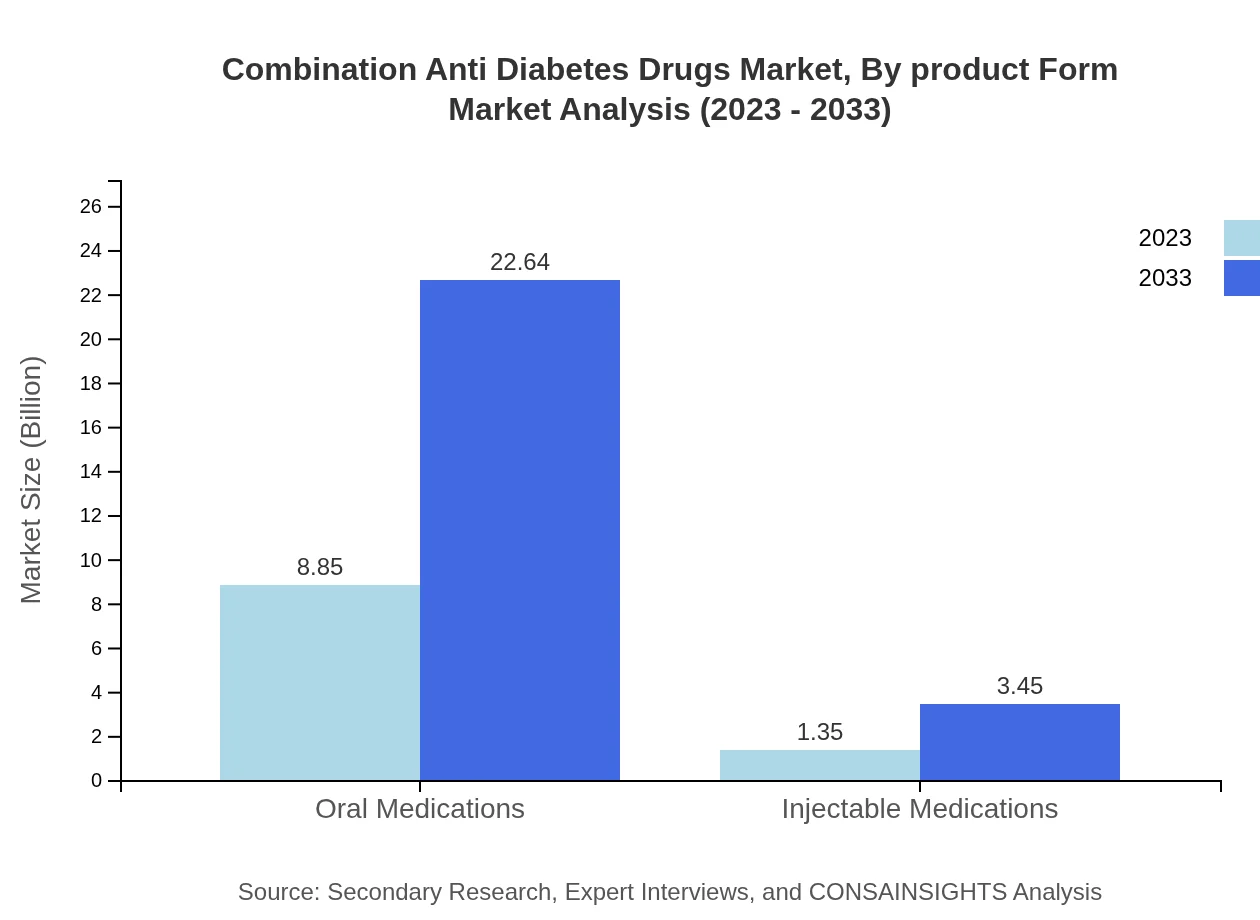

Combination Anti Diabetes Drugs Market Analysis By Product Form

The oral medications segment accounts for the largest share and is expected to grow from $8.85 billion in 2023 to $22.64 billion by 2033, representing 86.76%. Injectable medications, while a smaller segment, are projected to increase from $1.35 billion to $3.45 billion, capturing attention due to their efficacy in insulin management.

Combination Anti Diabetes Drugs Market Analysis By Therapy Type

Monotherapy dominates the market segment, expected to grow from $8.85 billion in 2023 to $22.64 billion by 2033, representing 86.76%. Conversely, combination therapy shows promising growth from $1.35 billion to $3.45 billion, demonstrating a shift in treatment paradigms towards integrated approaches to diabetes management.

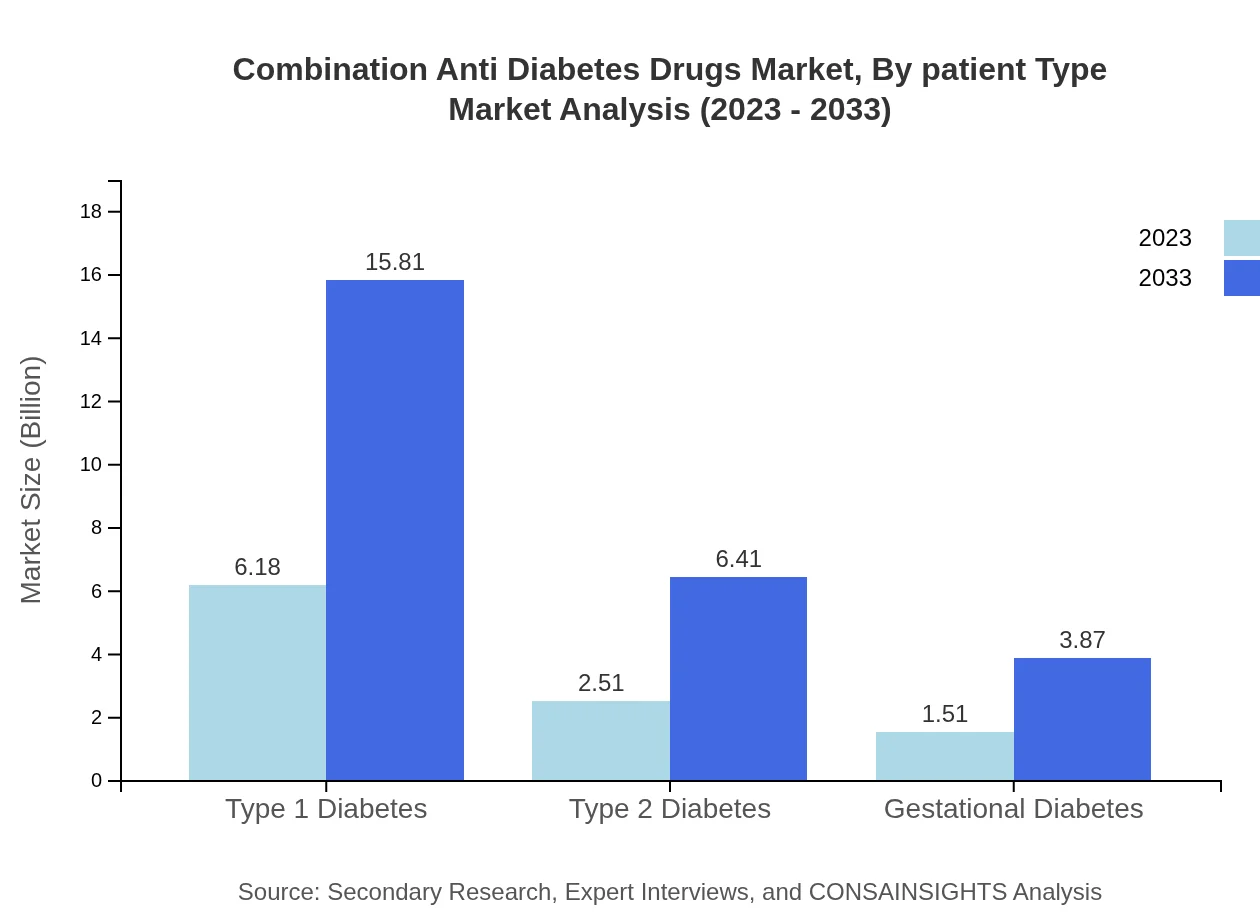

Combination Anti Diabetes Drugs Market Analysis By Patient Type

The market for Type 1 Diabetes is projected to expand significantly, with sizes growing from $6.18 billion in 2023 to $15.81 billion by 2033, covering 60.6% of the market share. Type 2 diabetes follows, growing from $2.51 billion to $6.41 billion, while gestational diabetes therapy is set to increase from $1.51 billion to $3.87 billion, marking its importance in comprehensive diabetes care.

Combination Anti Diabetes Drugs Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Combination Anti Diabetes Drugs Industry

Boehringer Ingelheim:

A key player known for developing the GLP-1 receptor agonist class of drugs, Boehringer Ingelheim has significantly contributed to innovative therapies for diabetes, enhancing patient management.Novo Nordisk:

As a leader in diabetes treatment, Novo Nordisk offers a wide portfolio of combination therapies, focusing on personalized medicine to optimize diabetes management.Sanofi:

Sanofi is recognized for its dual-acting diabetes treatments that provide effective glycemic control, while enhancing patient adherence through optimized drug delivery systems.Eli Lilly:

Eli Lilly has played a pivotal role in advancing diabetes treatment, particularly through its innovative insulin products and combination therapies targeting Type 2 diabetes.Merck & Co.:

Merck & Co. focuses on comprehensive diabetes management, integrating cutting-edge research to develop effective combination treatments for managing diabetes.We're grateful to work with incredible clients.

FAQs

What is the market size of combination Anti Diabetes Drugs?

The combination anti-diabetes drugs market is projected to reach $10.2 billion by 2033, with a compound annual growth rate (CAGR) of 9.5%. This growth reflects increasing diabetes prevalence and advancements in drug formulations.

What are the key market players or companies in this combination Anti Diabetes Drugs industry?

Key players in the combination anti-diabetes drugs market include major pharmaceutical companies actively focusing on innovative treatments. Leading firms are strengthening their portfolios through mergers, collaborations, and new product developments to enhance their market presence.

What are the primary factors driving the growth in the combination Anti Diabetes Drugs industry?

Factors driving growth in the combination anti-diabetes drugs market include rising diabetes cases, increased awareness of diabetes management, advancements in drug delivery systems, and a surge in research and development activities focused on diabetes solutions.

Which region is the fastest Growing in the combination Anti Diabetes Drugs?

The fastest-growing region in the combination anti-diabetes drugs market is North America, with market expectations of $9.70 billion by 2033, up from $3.79 billion in 2023, driven by high diabetes prevalence and advanced healthcare infrastructure.

Does ConsaInsights provide customized market report data for the combination Anti Diabetes Drugs industry?

Yes, ConsaInsights offers tailored market reports for the combination anti-diabetes drugs industry, allowing clients to receive specific data and insights aligned with their business needs, industry segments, or particular geographical regions.

What deliverables can I expect from this combination Anti Diabetes Drugs market research project?

From this market research project, clients can expect deliverables including comprehensive market analysis, segment breakdowns, competitive landscape assessment, growth forecasts, and actionable insights to guide strategic decision-making.

What are the market trends of combination Anti Diabetes Drugs?

Current market trends in combination anti-diabetes drugs include a shift towards personalized medicine, increased adoption of combination therapies, and a focus on oral medications, which dominate the market with an 86.76% share as of 2023.