Commercial Aircraft Aerostructures Market Report

Published Date: 03 February 2026 | Report Code: commercial-aircraft-aerostructures

Commercial Aircraft Aerostructures Market Size, Share, Industry Trends and Forecast to 2033

This report offers an insightful analysis of the Commercial Aircraft Aerostructures market from 2023 to 2033, highlighting market dynamics, size, and trends impacting growth, alongside exclusive insights on components, technologies, and regional developments.

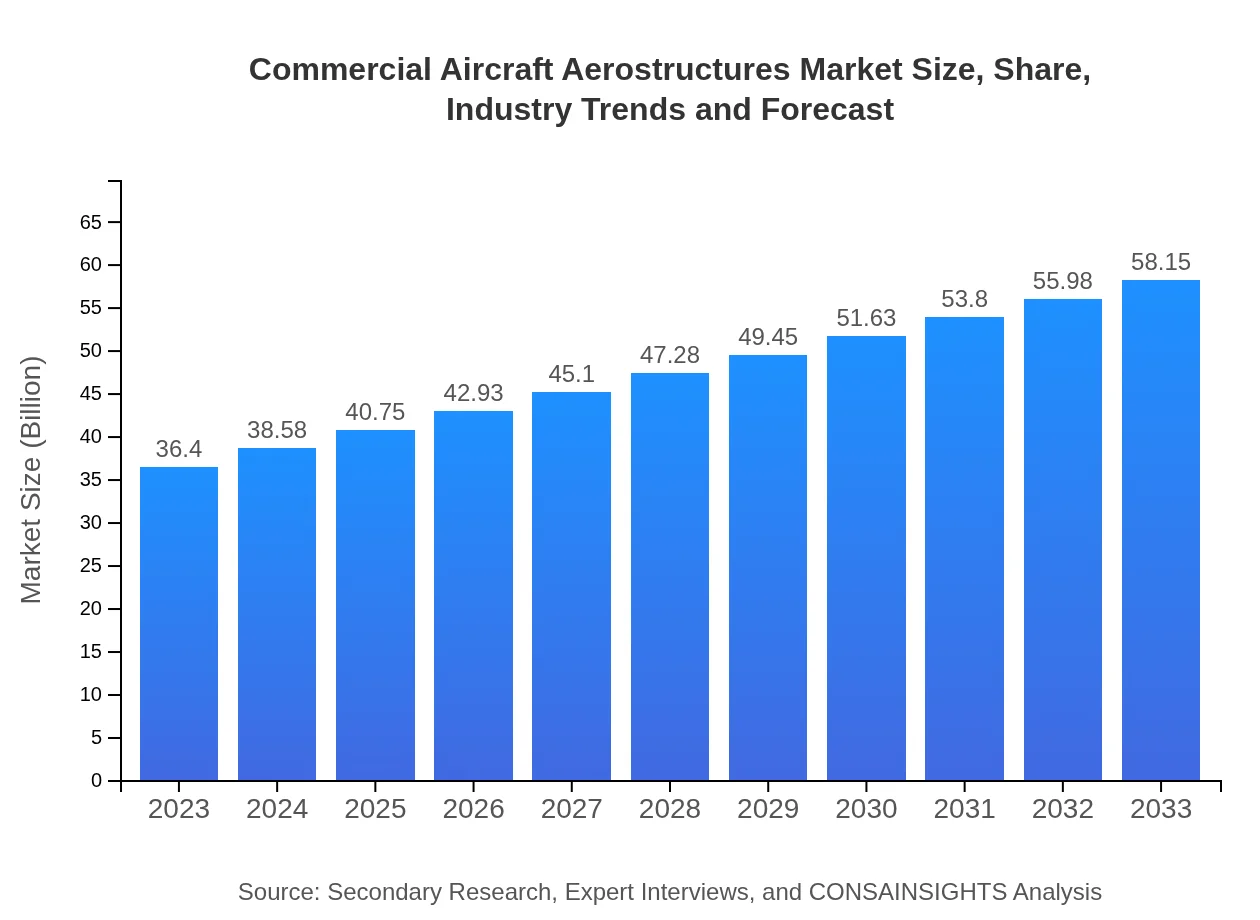

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $36.40 Billion |

| CAGR (2023-2033) | 4.7% |

| 2033 Market Size | $58.15 Billion |

| Top Companies | Boeing , Airbus, Lockheed Martin, Northrop Grumman, GKN Aerospace |

| Last Modified Date | 03 February 2026 |

Commercial Aircraft Aerostructures Market Overview

Customize Commercial Aircraft Aerostructures Market Report market research report

- ✔ Get in-depth analysis of Commercial Aircraft Aerostructures market size, growth, and forecasts.

- ✔ Understand Commercial Aircraft Aerostructures's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Commercial Aircraft Aerostructures

What is the Market Size & CAGR of Commercial Aircraft Aerostructures market in 2023?

Commercial Aircraft Aerostructures Industry Analysis

Commercial Aircraft Aerostructures Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Commercial Aircraft Aerostructures Market Analysis Report by Region

Europe Commercial Aircraft Aerostructures Market Report:

The European market is expected to expand from $9.44 billion in 2023 to $15.08 billion by 2033. The increase is driven by robust aerospace engineering capabilities, a focus on sustainability, and comprehensive regulatory frameworks promoting aircraft safety and efficiency.Asia Pacific Commercial Aircraft Aerostructures Market Report:

The Asia Pacific region is experiencing significant growth in the Commercial Aircraft Aerostructures market, expected to rise from $6.93 billion in 2023 to $11.07 billion by 2033. Supported by expanding air travel, increasing aircraft orders, and investments in local manufacturing capabilities, this region is poised to become a key player in the global market.North America Commercial Aircraft Aerostructures Market Report:

North America remains the largest market for Commercial Aircraft Aerostructures, estimated to grow from $13.02 billion in 2023 to $20.80 billion by 2033. The region is home to major aircraft manufacturers and a strong demand for next-generation aircraft that utilize advanced aerostructures.South America Commercial Aircraft Aerostructures Market Report:

In South America, the market is projected to grow from $2.84 billion in 2023 to $4.54 billion in 2033. Growth is attributed to a recovering aviation sector, increased emphasis on regional aircraft, and government initiatives promoting aviation infrastructures.Middle East & Africa Commercial Aircraft Aerostructures Market Report:

The Middle East and Africa market is forecasted to grow from $4.17 billion in 2023 to $6.66 billion by 2033. Growth is fueled by increasing air travel demand, investment in new airline fleets, and strategic partnerships in aviation development across the region.Tell us your focus area and get a customized research report.

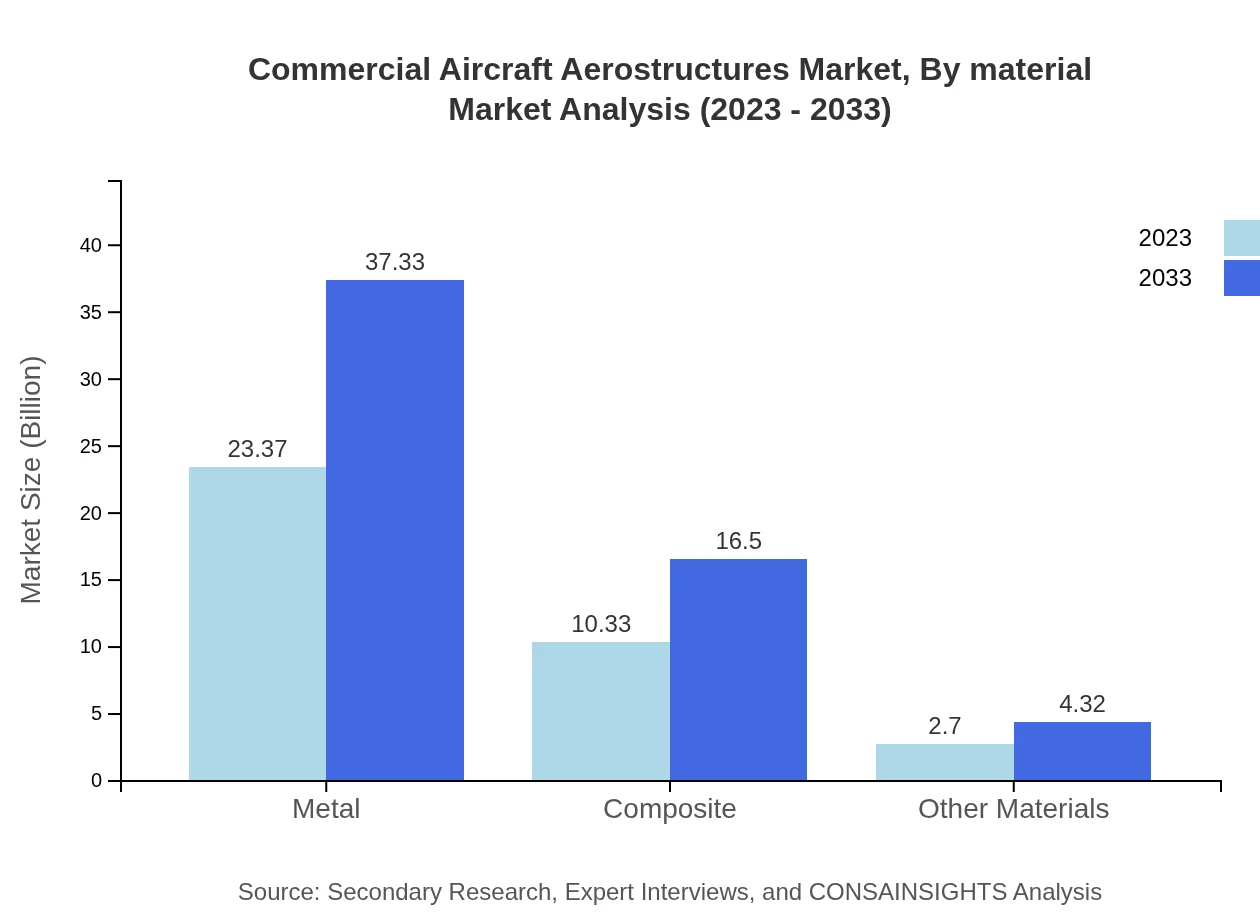

Commercial Aircraft Aerostructures Market Analysis By Material

In terms of materials, metals dominate the market, expected to maintain a consistency in market share of 64.19% from 2023 to 2033. Composites are also gaining traction due to their lightweight properties, projected to grow from $10.33 billion in 2023 to $16.50 billion in 2033, maintaining a share of 28.38%. Other materials such as plastics and alloys are emerging but currently constitute a smaller percentage of the market.

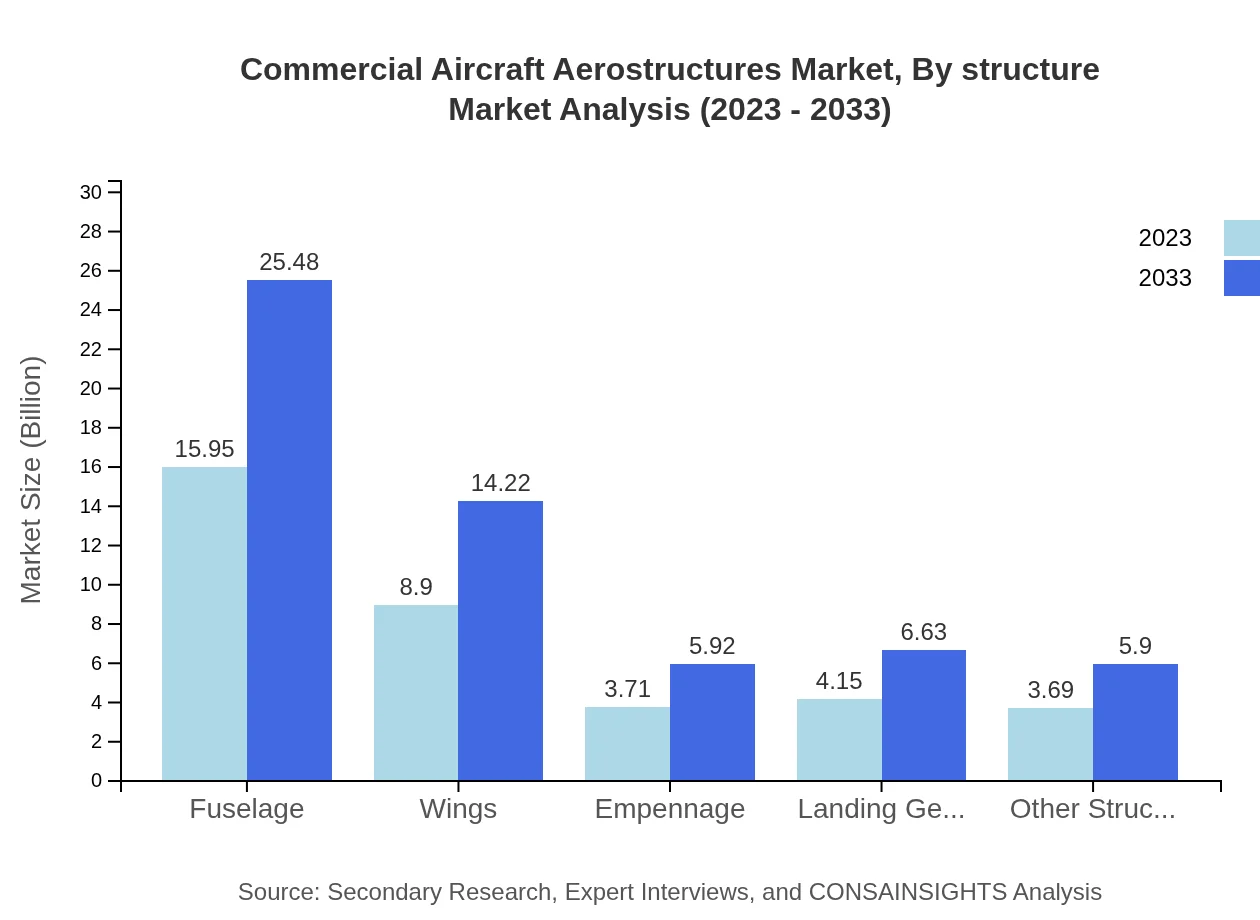

Commercial Aircraft Aerostructures Market Analysis By Structure

The most prominent segment, fuselage structures, represents 43.81% of the overall market share in 2023, expected to grow robustly to $25.48 billion by 2033. Other significant structure types include wings at 24.46% share, forecasted to increase due to rising aircraft production rates.

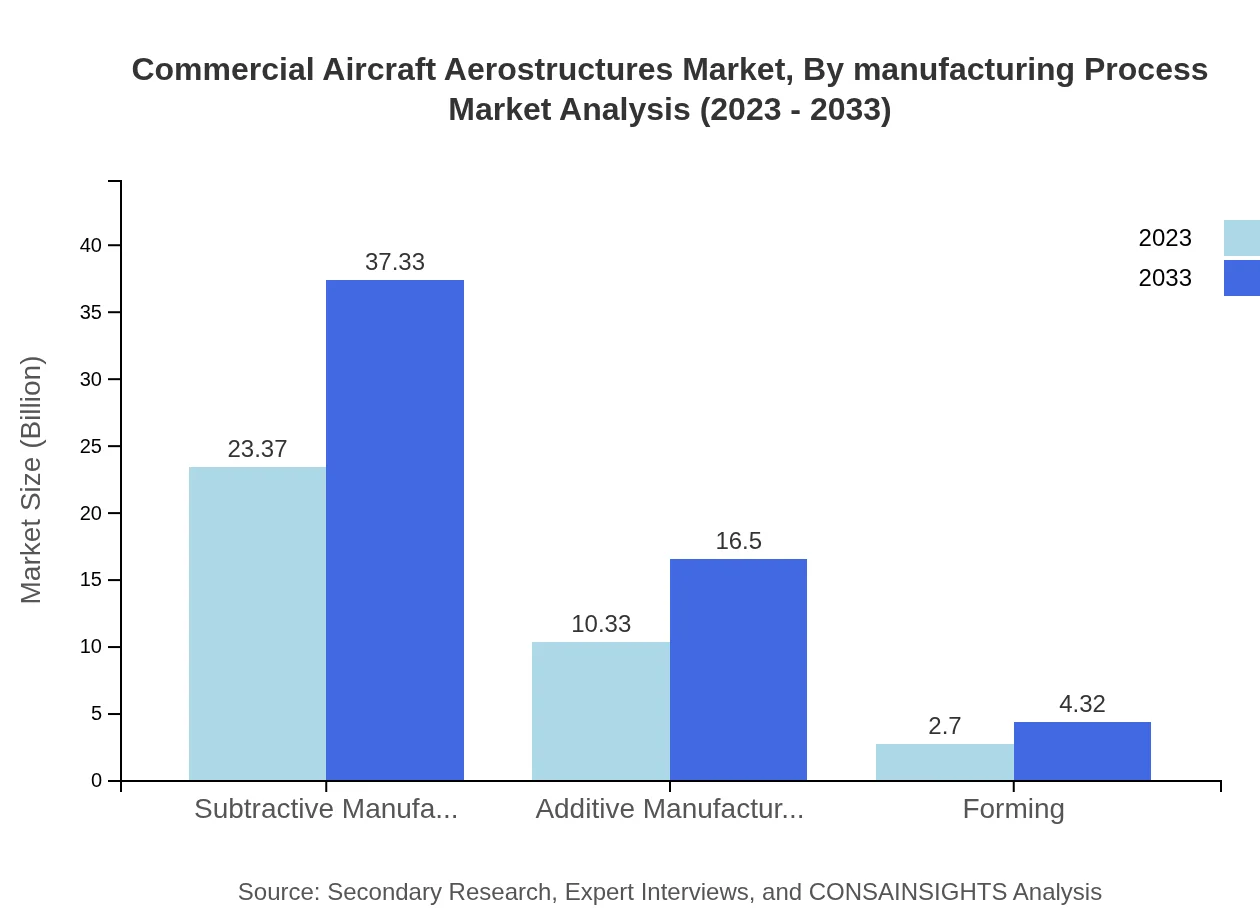

Commercial Aircraft Aerostructures Market Analysis By Manufacturing Process

Subtractive manufacturing processes are prevalent, representing the bulk of the market share at 64.19%. Additive manufacturing is expected to see substantial growth, rising from $10.33 billion in 2023 to $16.50 billion by 2033, providing new capabilities and efficiencies in aerostructure production.

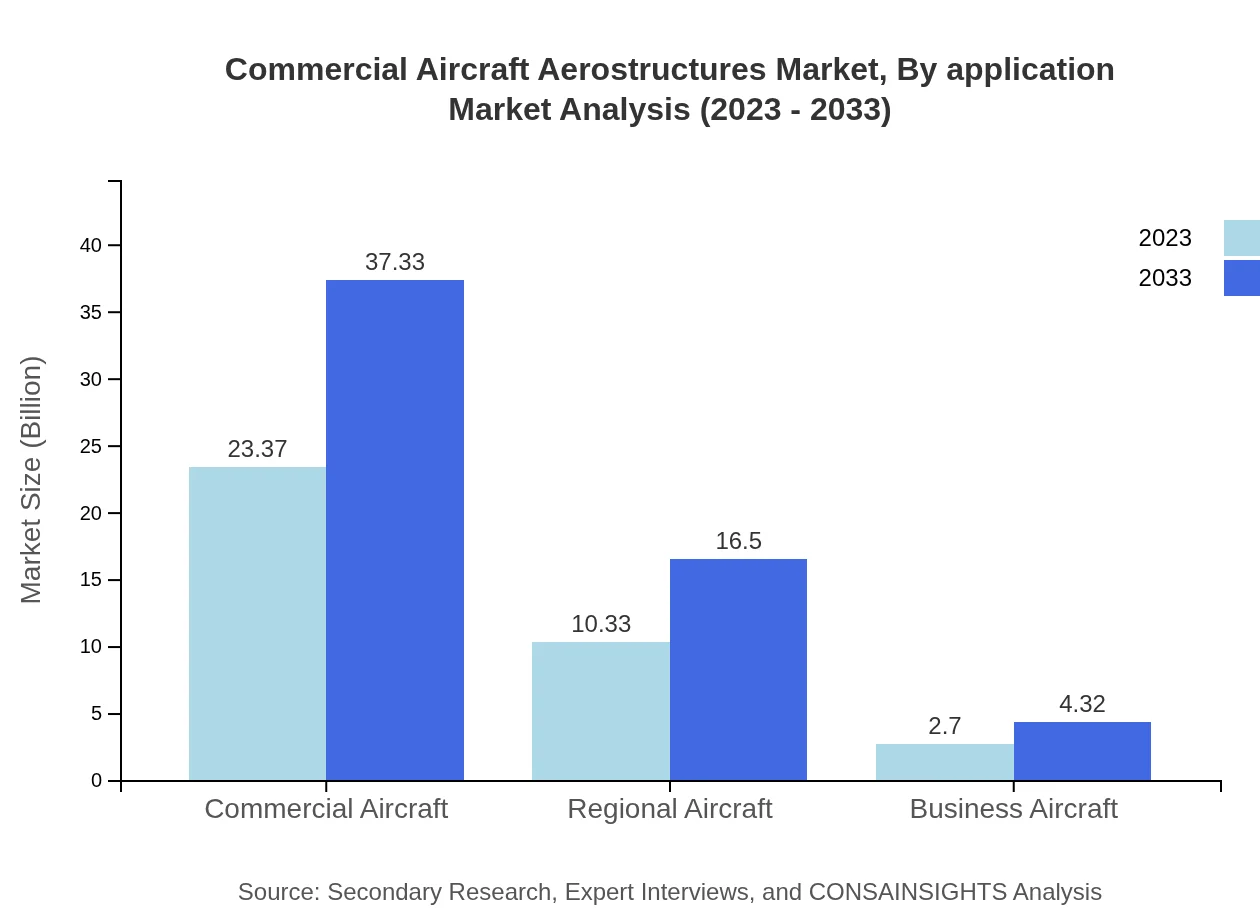

Commercial Aircraft Aerostructures Market Analysis By Application

The airline segment is the largest within application types, commanding a significant share of 64.19% of the market. Other applications including aircraft manufacturing and MRO services collectively illustrate the diversification of demand across the market.

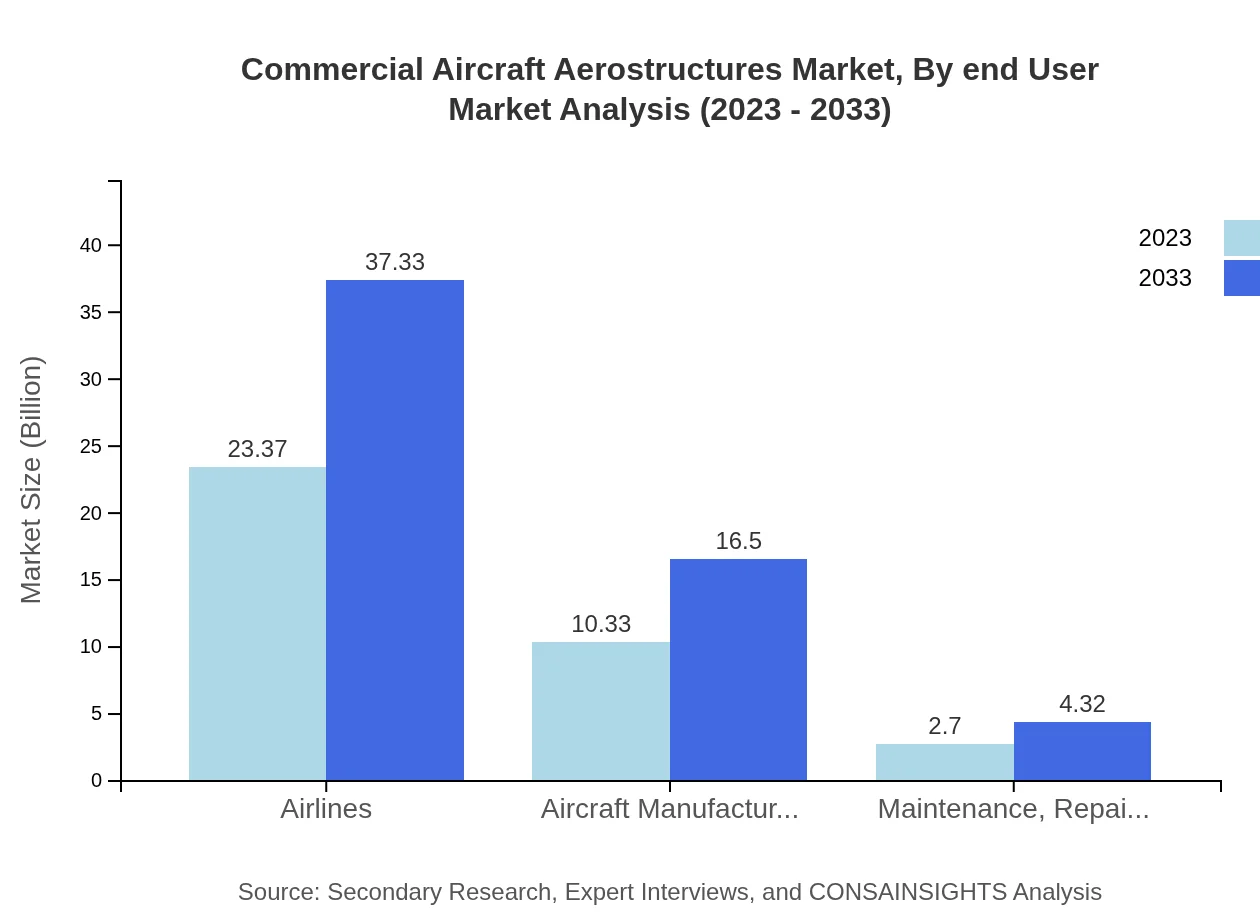

Commercial Aircraft Aerostructures Market Analysis By End User

Commercial aircraft manufacturers account for a considerable portion of the end-user market, projected to grow steadily with increasing aircraft demands. The MRO sector is also expanding, representing an essential component for the lifecycle management of aircraft aerostructures.

Commercial Aircraft Aerostructures Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Commercial Aircraft Aerostructures Industry

Boeing :

Boeing is a leading aerospace manufacturer known for its advanced commercial aircraft and aerostructures, heavily investing in R&D for innovative materials and technologies.Airbus:

Airbus is a major player in the commercial aircraft sector, providing cutting-edge aerostructures and pursuing initiatives to enhance manufacturing efficiency and sustainability.Lockheed Martin:

Lockheed Martin operates in the aerostructures market with a strong emphasis on defense and commercial applications, focusing on advanced manufacturing processes and technologies.Northrop Grumman:

Northrop Grumman is a significant aerospace and defense technology leader, delivering innovative aerostructure solutions and capabilities to their clientele.GKN Aerospace:

GKN Aerospace specializes in fully integrated aerostructures, providing lightweight and high-performance components crucial for modern aircraft.We're grateful to work with incredible clients.

FAQs

What is the market size of commercial Aircraft Aerostructures?

The commercial aircraft aerostructures market is valued at approximately $36.4 billion in 2023, with a projected CAGR of 4.7% from 2023 to 2033.

What are the key market players or companies in this commercial Aircraft Aerostructures industry?

Key players in the commercial aircraft aerostructures market include major companies such as Boeing, Airbus, Lockheed Martin, Northrop Grumman, and Bombardier, which play significant roles in manufacturing and supplying aerostructures.

What are the primary factors driving the growth in the commercial Aircraft Aerostructures industry?

Growth in this industry is primarily driven by increased air travel demand, advancements in manufacturing technologies, the need for lightweight materials to enhance fuel efficiency, and rising investments in R&D by major aerospace players.

Which region is the fastest Growing in the commercial Aircraft Aerostructures?

The Asia Pacific region is the fastest-growing market, projected to rise from $6.93 billion in 2023 to $11.07 billion by 2033, driven by expanding airlines and increasing aircraft production capacity.

Does ConsaInsights provide customized market report data for the commercial Aircraft Aerostructures industry?

Yes, ConsaInsights provides customized market reports tailored to specific client needs in the commercial aircraft aerostructures industry, offering in-depth insights and data analyses.

What deliverables can I expect from this commercial Aircraft Aerostructures market research project?

Deliverables include comprehensive market reports with segmented data analysis, growth forecasts, competitive landscape overview, regional market insights, and actionable recommendations for stakeholders.

What are the market trends of commercial Aircraft Aerostructures?

Current trends include a shift towards composite materials for weight reduction, an increase in automation and additive manufacturing technologies, and a growing emphasis on sustainability and eco-friendly practices in aircraft design.