Commercial Aircraft Aftermarket Parts Market Report

Published Date: 03 February 2026 | Report Code: commercial-aircraft-aftermarket-parts

Commercial Aircraft Aftermarket Parts Market Size, Share, Industry Trends and Forecast to 2033

This market report analyzes the Commercial Aircraft Aftermarket Parts industry from 2023 to 2033. It offers insights into market size, trends, segmentation, and competitive landscape, providing a comprehensive understanding of future growth opportunities and challenges within the market.

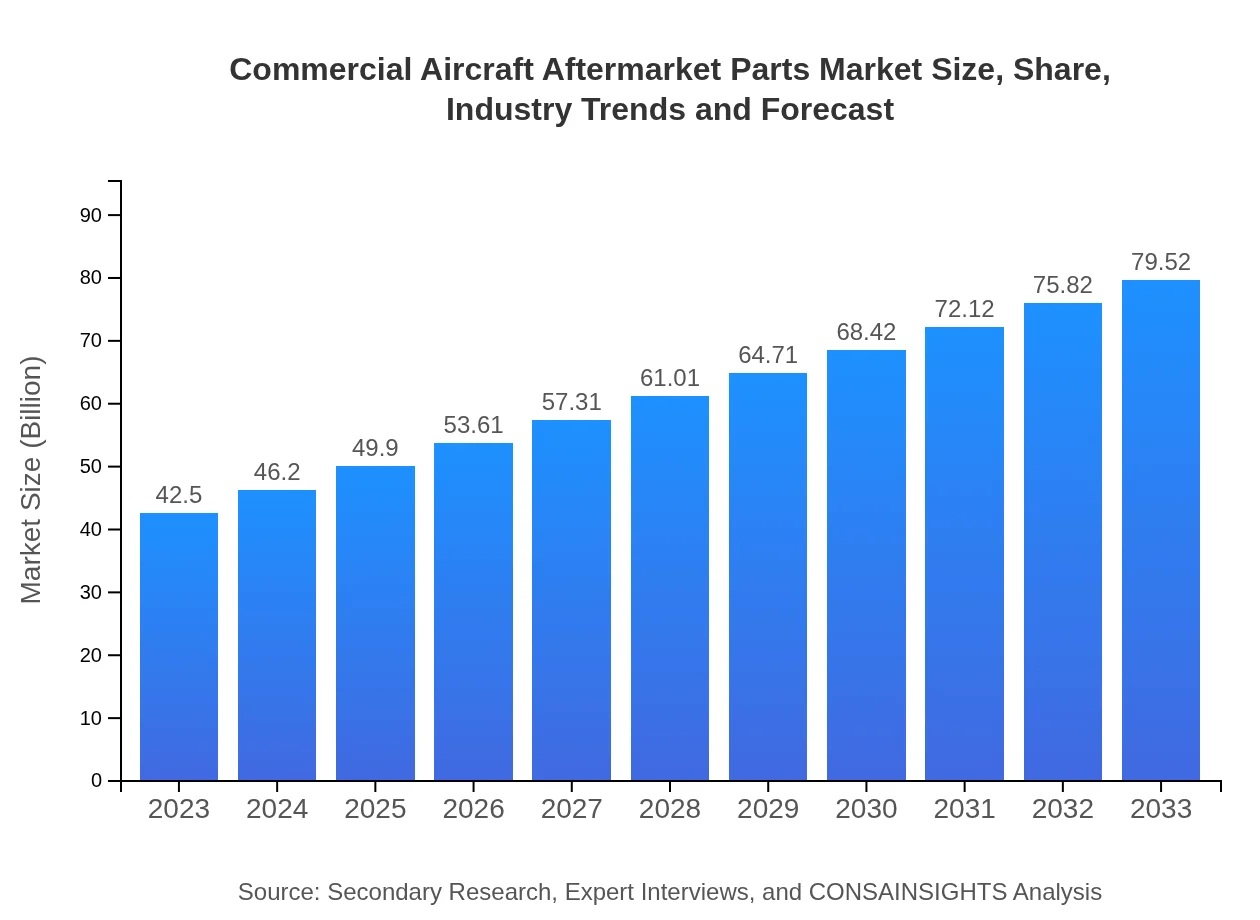

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $42.50 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $79.52 Billion |

| Top Companies | General Electric, Honeywell Aerospace, Boeing , Airbus, Collins Aerospace |

| Last Modified Date | 03 February 2026 |

Commercial Aircraft Aftermarket Parts Market Overview

Customize Commercial Aircraft Aftermarket Parts Market Report market research report

- ✔ Get in-depth analysis of Commercial Aircraft Aftermarket Parts market size, growth, and forecasts.

- ✔ Understand Commercial Aircraft Aftermarket Parts's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Commercial Aircraft Aftermarket Parts

What is the Market Size & CAGR of Commercial Aircraft Aftermarket Parts market in 2023 and 2033?

Commercial Aircraft Aftermarket Parts Industry Analysis

Commercial Aircraft Aftermarket Parts Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Commercial Aircraft Aftermarket Parts Market Analysis Report by Region

Europe Commercial Aircraft Aftermarket Parts Market Report:

Europe's market is poised for significant growth, expected to escalate from $10.37 billion in 2023 to $19.41 billion by 2033. Strong regulatory frameworks and an emphasis on safety and efficiency in the region are driving the procurement of quality aftermarket parts.Asia Pacific Commercial Aircraft Aftermarket Parts Market Report:

The Asia-Pacific region is witnessing robust growth in the Commercial Aircraft Aftermarket Parts market, driven by rising air travel demand and expanding airline networks. The market is expected to grow from $9.17 billion in 2023 to $17.15 billion by 2033. Countries like China and India are investing heavily in aviation infrastructure, propelling the demand for aftermarket services.North America Commercial Aircraft Aftermarket Parts Market Report:

North America represents the largest market for Commercial Aircraft Aftermarket Parts, with a size anticipated to increase from $15.87 billion in 2023 to $29.69 billion by 2033. Established aerospace manufacturers and a large base of commercial airlines fuel the demand for maintenance and spare parts.South America Commercial Aircraft Aftermarket Parts Market Report:

In South America, the market for Commercial Aircraft Aftermarket Parts is projected to grow from $3.71 billion in 2023 to $6.93 billion by 2033. The region is gradually enhancing its aviation sector, with growing interest from international airlines, thereby increasing the need for reliable aftermarket support.Middle East & Africa Commercial Aircraft Aftermarket Parts Market Report:

The Middle East and Africa market is anticipated to expand from $3.39 billion in 2023 to $6.34 billion by 2033. Growth in this region is fueled by the rise of low-cost carriers and increasing investments in airport infrastructure, leading to a higher demand for aftermarket products and services.Tell us your focus area and get a customized research report.

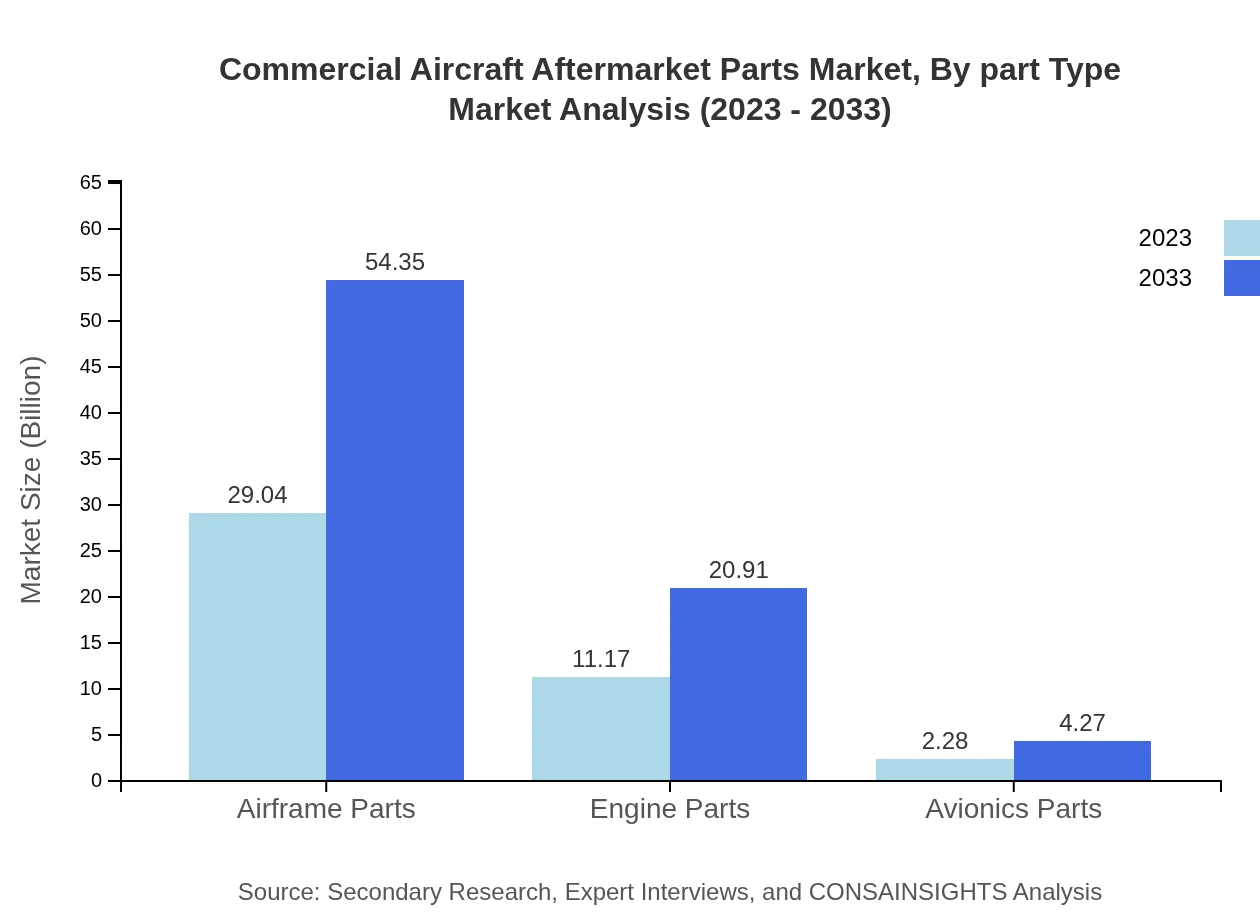

Commercial Aircraft Aftermarket Parts Market Analysis By Part Type

Airframe parts dominate the market, accounting for approximately $29.04 billion in 2023 and projected to reach $54.35 billion by 2033. Engine parts follow, with a market size of $11.17 billion in 2023, expected to grow to $20.91 billion by 2033. Avionics parts hold a smaller share, projected to increase from $2.28 billion to $4.27 billion by 2033.

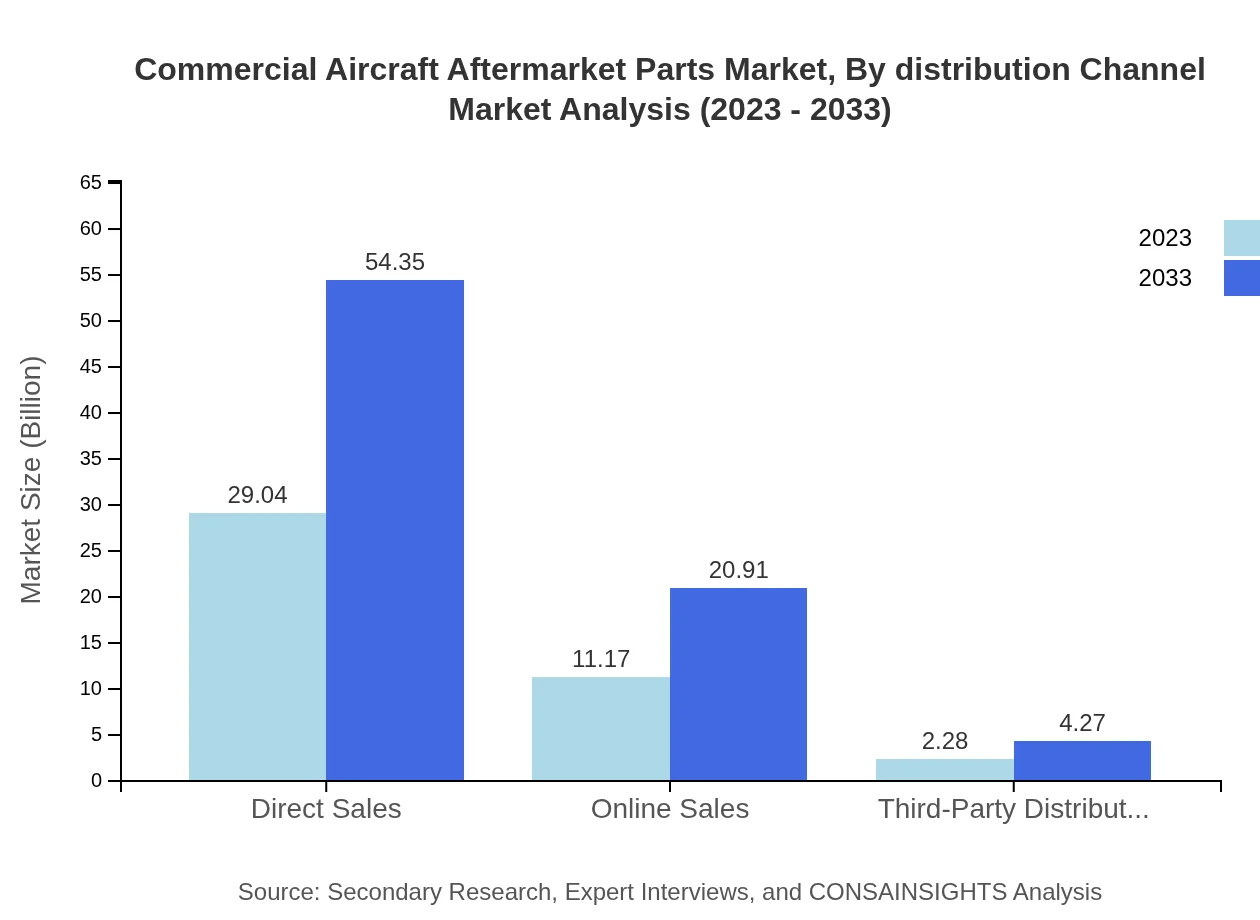

Commercial Aircraft Aftermarket Parts Market Analysis By Distribution Channel

Direct sales are the leading distribution channel with a market size of $29.04 billion in 2023 and expected to remain constant till 2033. Online sales are anticipated to grow significantly, from $11.17 billion in 2023 to $20.91 billion by 2033, as digital platforms gain traction.

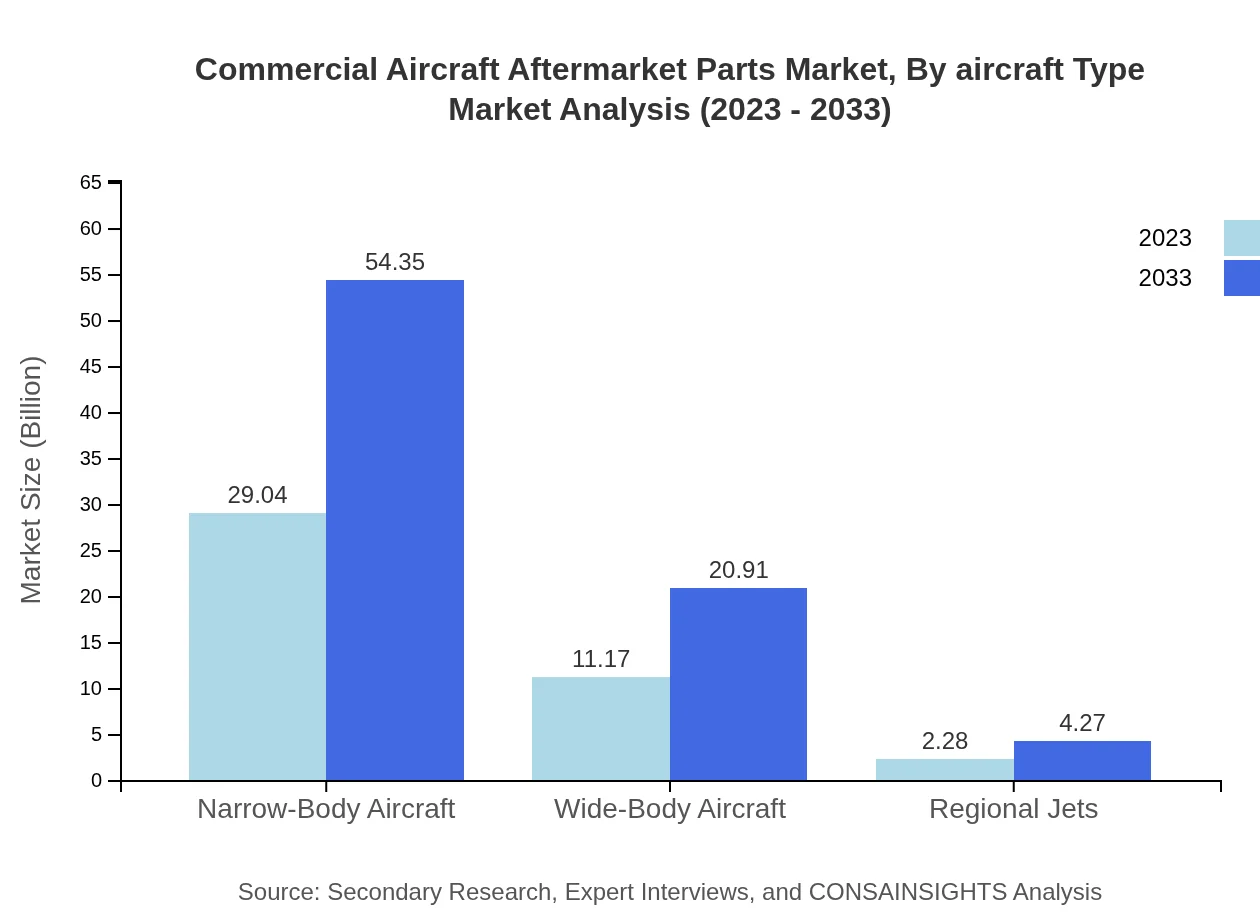

Commercial Aircraft Aftermarket Parts Market Analysis By Aircraft Type

The narrow-body aircraft segment represents the highest share, with market sizes projected at $29.04 billion in 2023, growing to $54.35 billion by 2033. Wide-body aircraft parts also show considerable growth, from $11.17 billion to $20.91 billion over the forecast period.

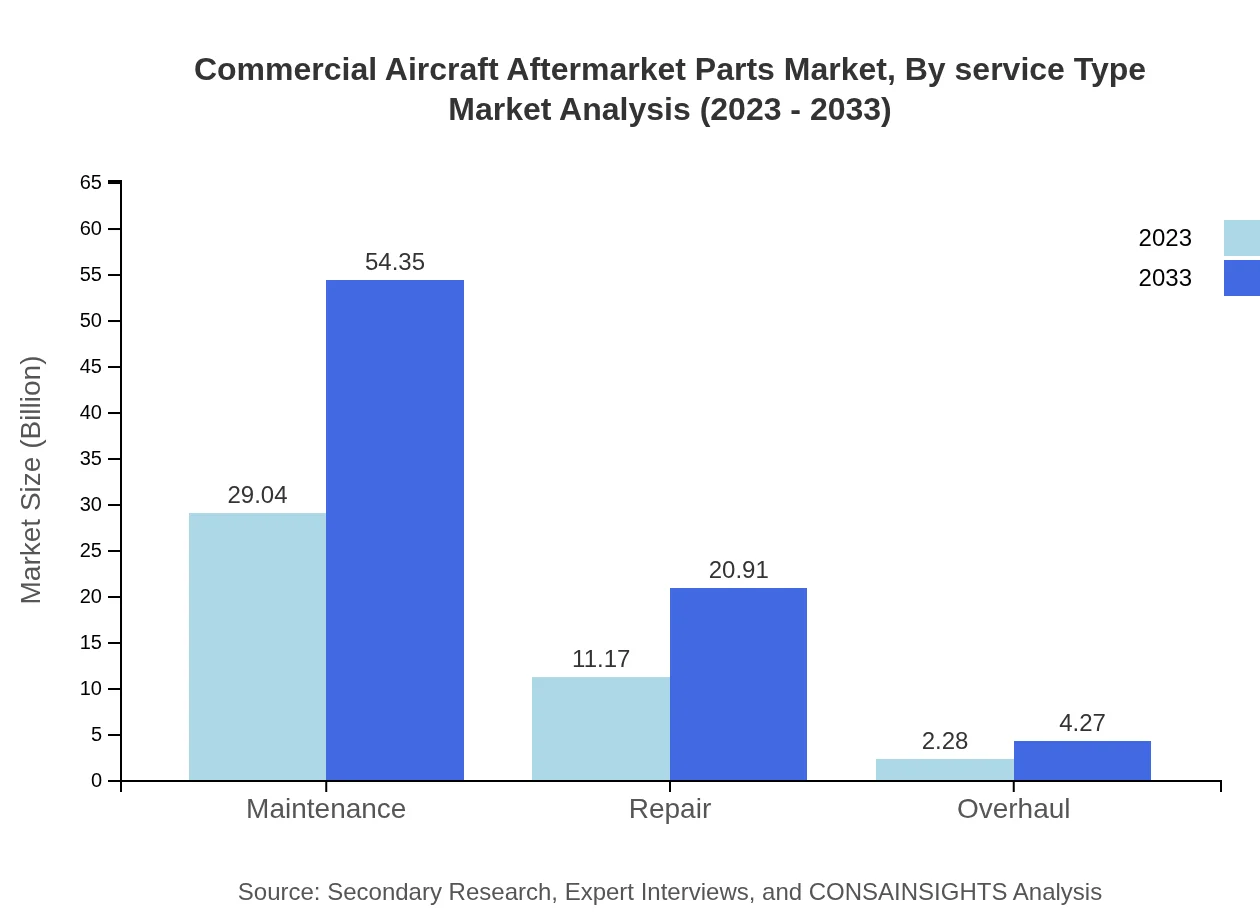

Commercial Aircraft Aftermarket Parts Market Analysis By Service Type

Maintenance services dominate the market, with a size of $29.04 billion in 2023 and projected to rise to $54.35 billion by 2033. Repair services and overhauls also remain relevant, showing growth from $11.17 billion and $2.28 billion respectively in 2023.

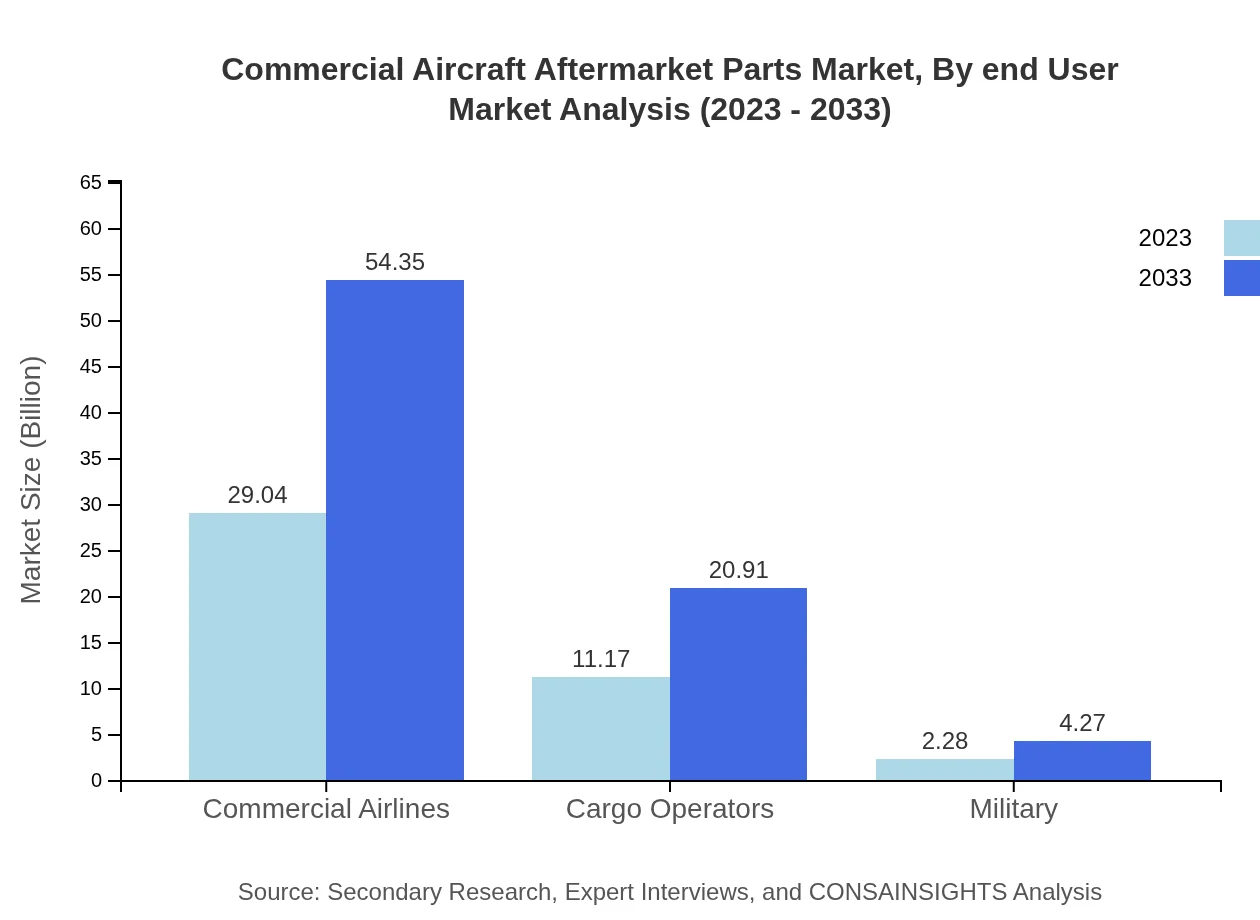

Commercial Aircraft Aftermarket Parts Market Analysis By End User

The commercial airlines sector represents the largest end-user, with a size of $29.04 billion in 2023 expected to reach $54.35 billion by 2033. Cargo operators follow, projected to grow from $11.17 billion to $20.91 billion during the same period.

Commercial Aircraft Aftermarket Parts Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Commercial Aircraft Aftermarket Parts Industry

General Electric:

A leader in engine manufacturing, GE Aviation provides innovative aftermarket solutions and is a primary player in supporting airlines worldwide.Honeywell Aerospace:

Honeywell offers advanced avionics and emergency response systems, focusing on enhancing safety and maintenance efficiency for commercial aviation.Boeing :

Boeing is not only a leading manufacturer but also a significant aftermarket service provider, specializing in maintenance and parts supply for its fleet.Airbus:

Airbus provides comprehensive aftermarket services tied closely with its aircraft models, ensuring efficient operations for airlines globally.Collins Aerospace:

A key player in aerospace manufacturing, offering world-class aftermarket services and parts tailored for efficiency and high performance.We're grateful to work with incredible clients.

FAQs

What is the market size of commercial aircraft aftermarket parts?

The commercial aircraft aftermarket parts market is estimated to reach approximately $42.5 billion by 2033, growing at a CAGR of 6.3% from its current valuation in 2023.

What are the key market players or companies in the commercial aircraft aftermarket parts industry?

Key players include major aircraft manufacturers, suppliers of aftermarket parts, and MRO service providers, predominantly focusing on innovation, supply chain efficiencies, and strategic collaborations.

What are the primary factors driving the growth in the commercial aircraft aftermarket parts industry?

Growth drivers include increased aircraft fleet size, rising global air travel demand, advancements in technology, and ongoing maintenance needs, creating a robust aftermarket parts requirement.

Which region is the fastest Growing in the commercial aircraft aftermarket parts market?

Asia Pacific is the fastest-growing region, expected to expand from $9.17 billion in 2023 to $17.15 billion by 2033, driven by rising air traffic and fleet expansion.

Does ConsaInsights provide customized market report data for the commercial aircraft aftermarket parts industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs, ensuring relevant insights that cater to unique market dimensions.

What deliverables can I expect from this commercial aircraft aftermarket parts market research project?

Deliverables typically include comprehensive market analysis, trend evaluations, competitive landscape assessments, and future growth projections over specified periods.

What are the market trends of commercial aircraft aftermarket parts?

Key trends include digital transformation in MRO, sustainability initiatives, adoption of predictive maintenance technologies, and increased focus on regional aircraft markets.