Commercial Aircraft Air Management Systems Market Report

Published Date: 03 February 2026 | Report Code: commercial-aircraft-air-management-systems

Commercial Aircraft Air Management Systems Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Commercial Aircraft Air Management Systems market, providing insights into key trends, market size, segmentation, industry dynamics, and regional performance from 2023 to 2033.

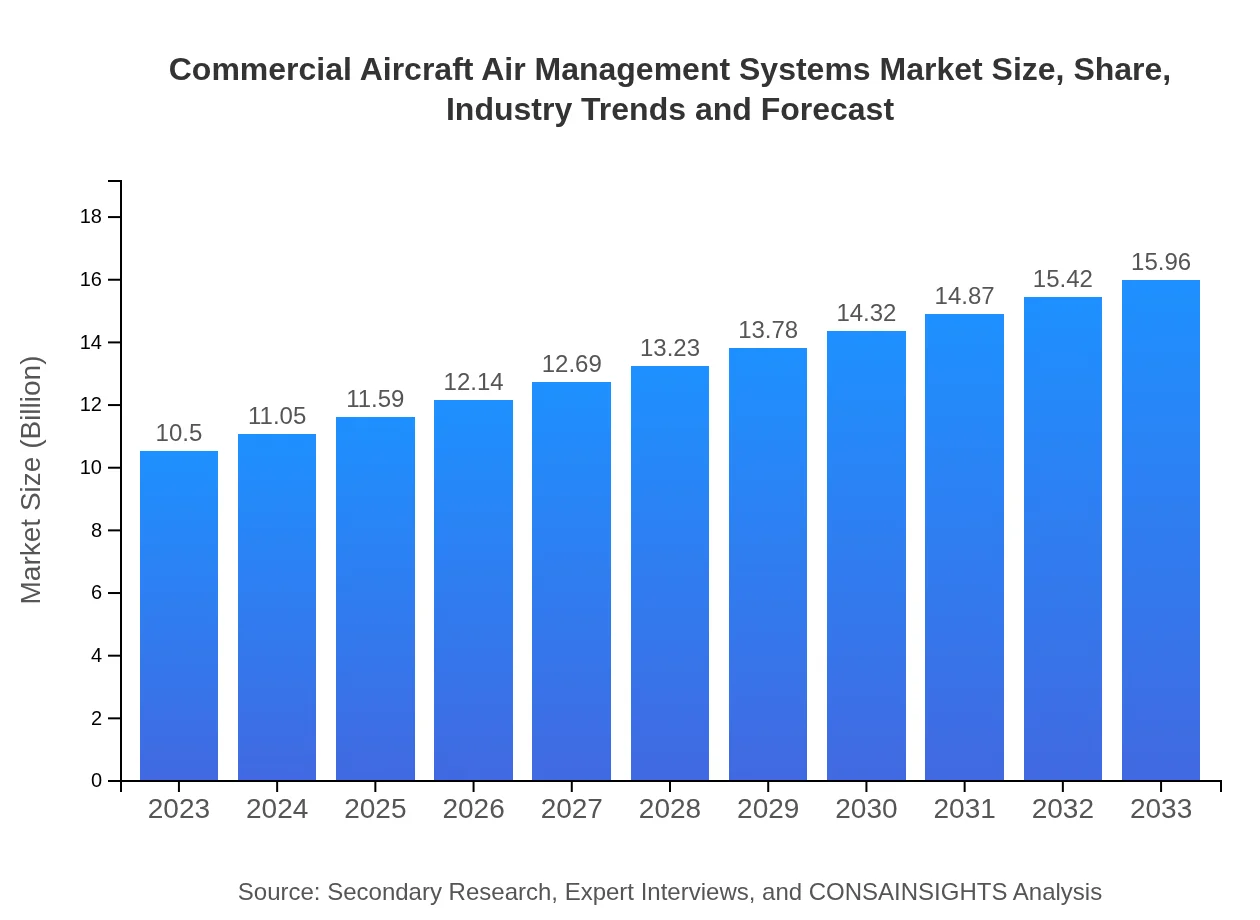

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $15.96 Billion |

| Top Companies | Honeywell International Inc., Boeing , Airbus, United Technologies Corporation, Parker Hannifin Corporation |

| Last Modified Date | 03 February 2026 |

Commercial Aircraft Air Management Systems Market Overview

Customize Commercial Aircraft Air Management Systems Market Report market research report

- ✔ Get in-depth analysis of Commercial Aircraft Air Management Systems market size, growth, and forecasts.

- ✔ Understand Commercial Aircraft Air Management Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Commercial Aircraft Air Management Systems

What is the Market Size & CAGR of Commercial Aircraft Air Management Systems market in 2023?

Commercial Aircraft Air Management Systems Industry Analysis

Commercial Aircraft Air Management Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Commercial Aircraft Air Management Systems Market Analysis Report by Region

Europe Commercial Aircraft Air Management Systems Market Report:

The European market for Commercial Aircraft Air Management Systems is estimated at $3.24 billion in 2023, growing to $4.93 billion by 2033. The European aviation market is characterized by operational efficiency and sustainability initiatives. Airlines in this region are investing in new technologies to upgrade older fleets, aiming for environmental compliance and improved performance, thereby driving market growth.Asia Pacific Commercial Aircraft Air Management Systems Market Report:

The Asia Pacific region accounts for a rapidly growing segment of the Commercial Aircraft Air Management Systems market, with a projected market size of $1.92 billion in 2023, increasing to $2.91 billion by 2033. This growth is driven by rising middle-class incomes and increasing air travel demands, particularly in emerging markets like China and India. The investments in domestic aviation sectors and collaborations with leading aircraft manufacturers further support this market's expansion.North America Commercial Aircraft Air Management Systems Market Report:

North America holds a significant share of the Commercial Aircraft Air Management Systems market, with a valuation of $3.85 billion in 2023, projected to reach $5.86 billion by 2033. The region is home to established aircraft manufacturers and suppliers, fostering innovation. With a strong regulatory framework, airlines are compelled to adopt advanced air management systems to ensure compliance and enhance the passenger experience.South America Commercial Aircraft Air Management Systems Market Report:

In South America, the market size for Commercial Aircraft Air Management Systems is expected to grow from $0.90 billion in 2023 to $1.37 billion by 2033. The growth in this region is primarily attributed to the increase in low-cost carriers and a gradual recovery in air travel post-pandemic. Airlines are focusing on enhancing passenger comfort through upgraded aircraft systems, driving market demand.Middle East & Africa Commercial Aircraft Air Management Systems Market Report:

The Middle East and Africa region's Commercial Aircraft Air Management Systems market is expected to expand from $0.59 billion in 2023 to $0.90 billion by 2033. Strategic investments in aviation infrastructure and growing international tourism are key factors driving the demand for advanced air management systems in this region. Additionally, the influx of new airlines enhances competition, prompting upgrades and innovations within existing fleets.Tell us your focus area and get a customized research report.

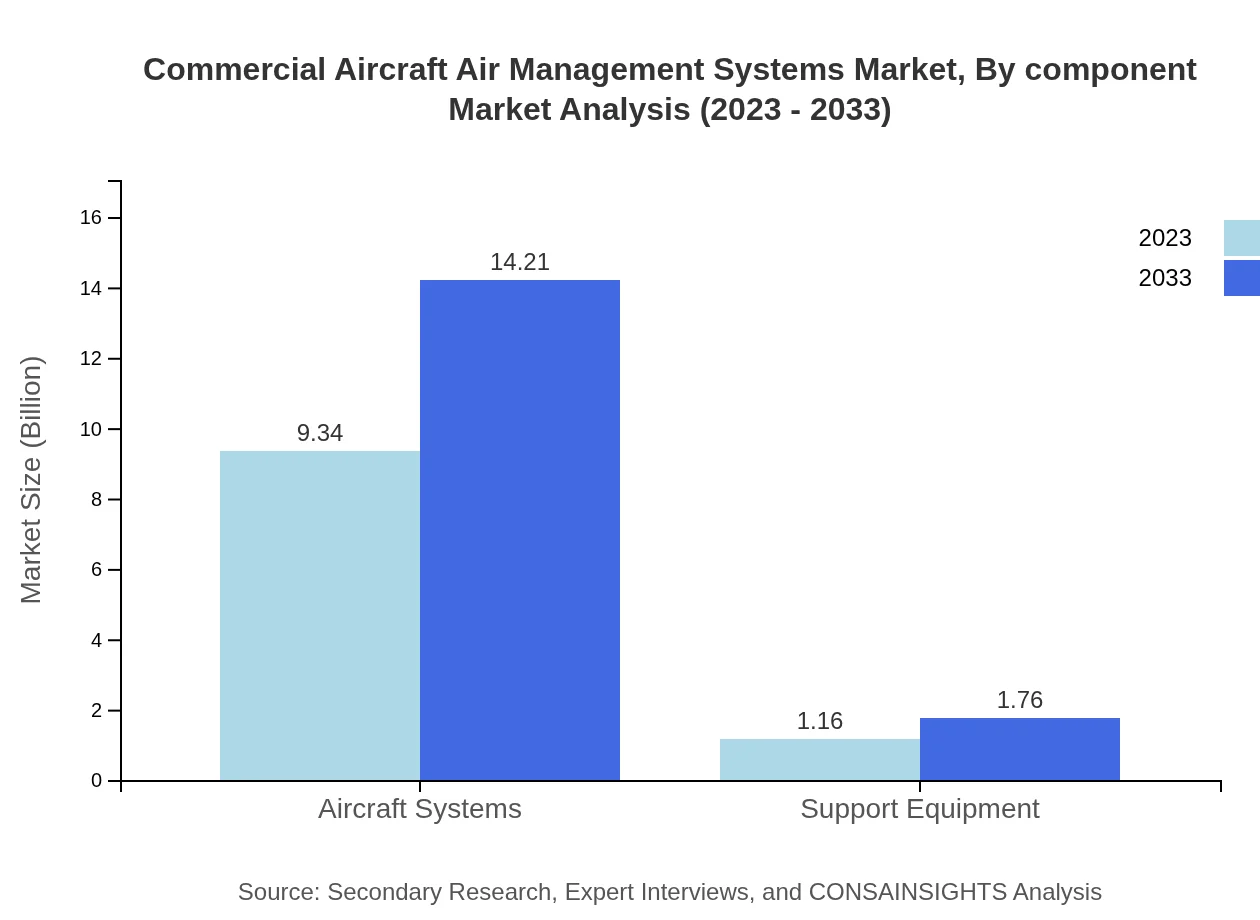

Commercial Aircraft Air Management Systems Market Analysis By Component

In 2023, the component segment for the Commercial Aircraft Air Management Systems market is dominated by mechanical systems at $6.63 billion, expected to reach $10.08 billion by 2033 representing a 5.51% CAGR. The electrical systems segment will grow from $2.76 billion to $4.20 billion, while hybrid systems will see an increase from $1.11 billion to $1.68 billion. These components are critical for managing the various air management functions in modern aircraft.

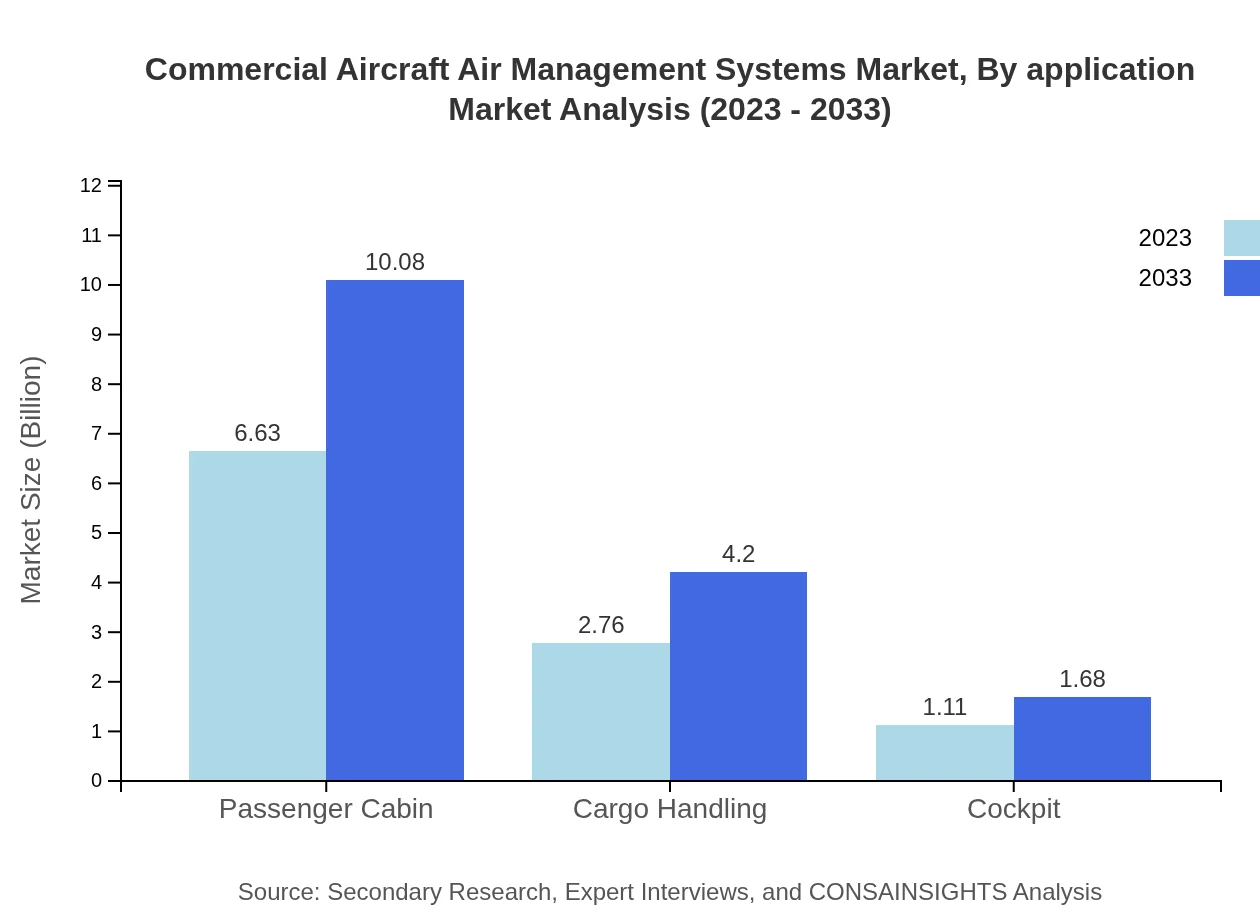

Commercial Aircraft Air Management Systems Market Analysis By Application

The passenger cabin application segment is significant, accounting for $6.63 billion in 2023, growing to $10.08 billion by 2033. Cargo handling applications also have a noteworthy market presence, rising from $2.76 billion to $4.20 billion. The cockpit application is smaller, yet grows from $1.11 billion to $1.68 billion. This segmentation highlights the importance of passenger comfort and safety in driving upgrades and innovations in air management systems.

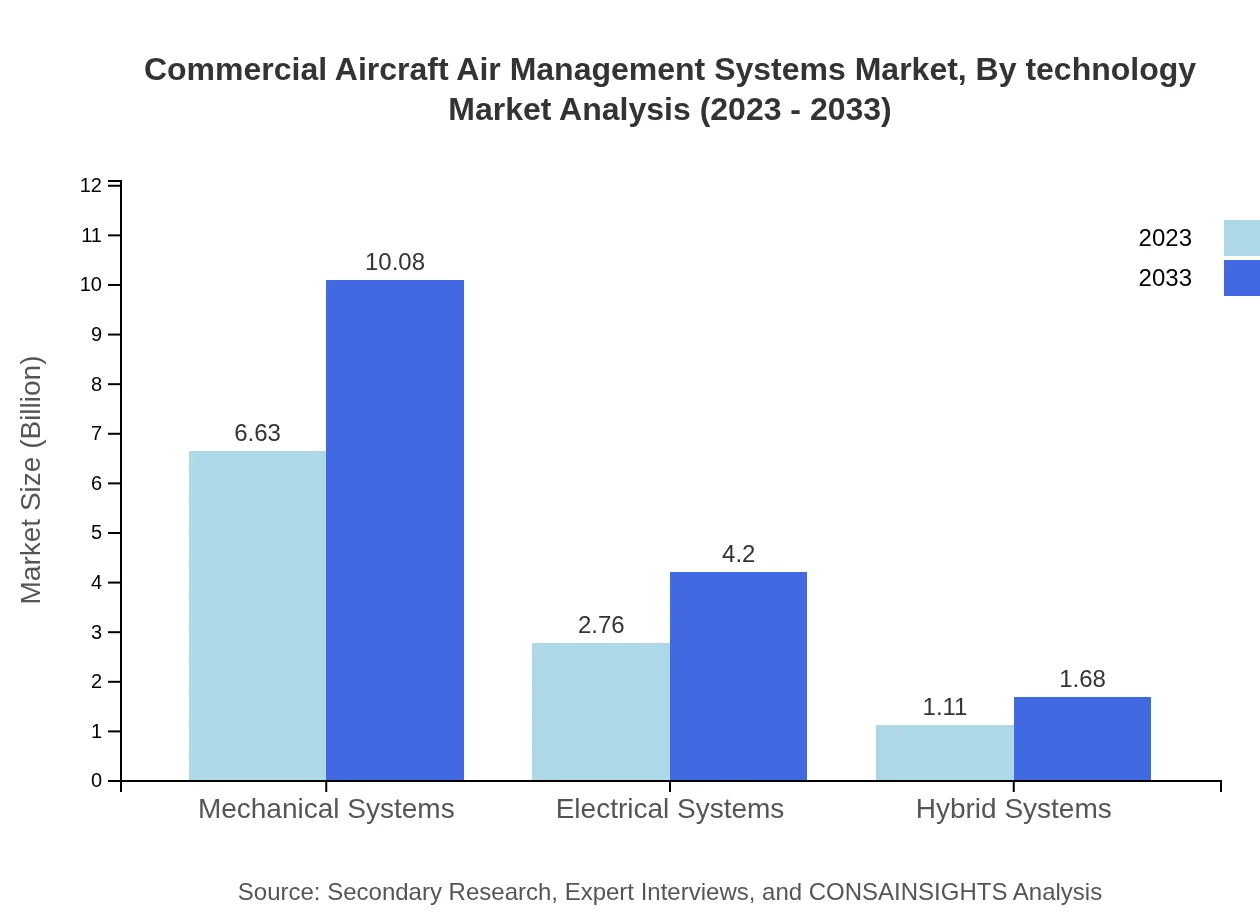

Commercial Aircraft Air Management Systems Market Analysis By Technology

The technology segment of the Commercial Aircraft Air Management Systems market is evolving with significant advancements in thermal management systems and air quality control technologies. Mechanical systems dominate with 88.99% share in 2023 and the projected growth indicates an increasing effort towards integrating sustainable technologies that enhance operational efficiency and reduce environmental impact.

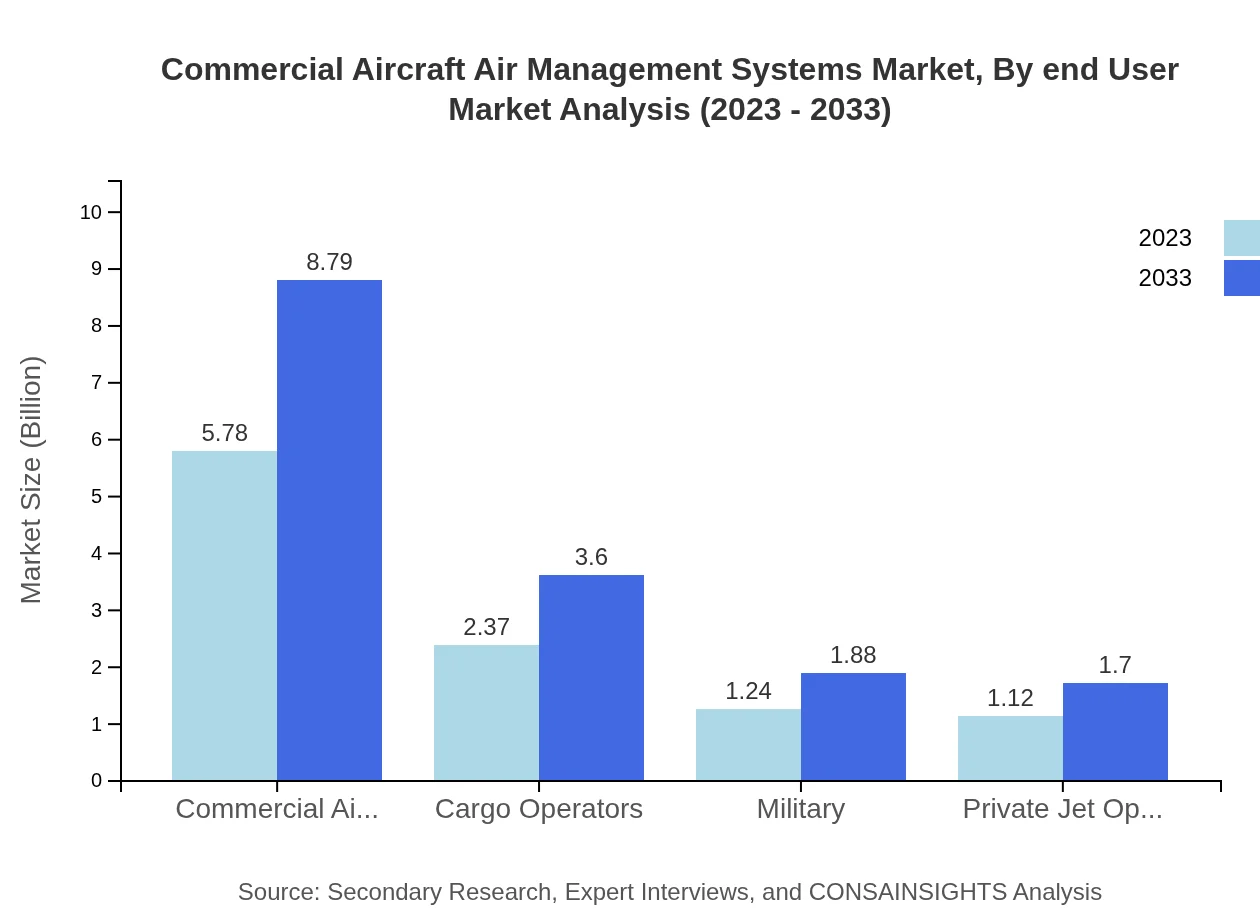

Commercial Aircraft Air Management Systems Market Analysis By End User

Commercial airlines form the largest share of the end-user market at approximately $5.78 billion in 2023, expected to grow to $8.79 billion in 2033, maintaining a steady 5.67% share of the market. Cargo operators follow with a projection from $2.37 billion to $3.60 billion, while military operators account for smaller segments but have been steadily evolving thanks to advancements in technologies tailored for defense purposes.

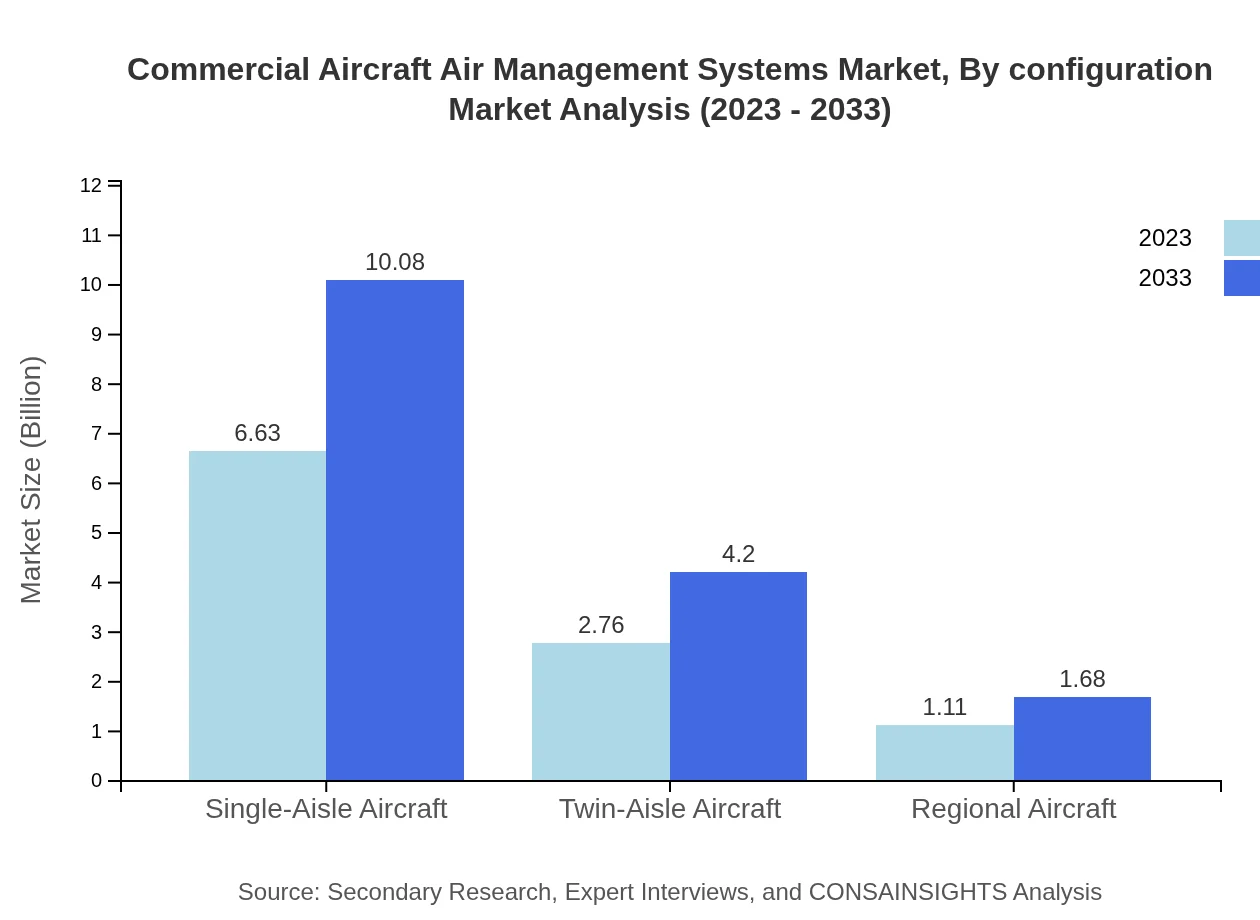

Commercial Aircraft Air Management Systems Market Analysis By Configuration

The market is also analyzed by configuration, with single-aisle aircraft holding the majority share at 63.12%, projected to reach $10.08 billion by 2033 from $6.63 billion in 2023. Twin-aisle and regional aircraft configurations project growth as well, but are smaller in market presence, reflecting the ongoing trend towards more efficient single-aisle aircraft models which are used predominantly for short-haul routes.

Commercial Aircraft Air Management Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Commercial Aircraft Air Management Systems Industry

Honeywell International Inc.:

A leading manufacturer of aerospace systems, Honeywell provides advanced air management systems to improve passenger comfort and safety within commercial aircraft.Boeing :

As one of the world’s largest aerospace companies, Boeing integrates cutting-edge air management systems within its commercial airplanes to enhance operational efficiency.Airbus:

Airbus is a significant player in the aerospace industry, delivering innovative air management solutions that prioritize performance and sustainability.United Technologies Corporation:

UTC specializes in high-performance aerospace systems, including air management technologies tailored for commercial aircraft applications.Parker Hannifin Corporation:

Known for its motion and control technologies, Parker Hannifin offers specialized air management solutions aimed at aircraft performance optimization.We're grateful to work with incredible clients.

FAQs

What is the market size of Commercial Aircraft Air Management Systems?

The global Commercial Aircraft Air Management Systems market is valued at approximately $10.5 billion in 2023, with a projected CAGR of 4.2%, indicating steady growth and increased demand through 2033.

What are the key market players or companies in this Commercial Aircraft Air Management Systems industry?

Key players in the Commercial Aircraft Air Management Systems market include Honeywell International, Inc., UTC Aerospace Systems, and Safran S.A., all of which play significant roles in advancing air management technologies.

What are the primary factors driving the growth in the Commercial Aircraft Air Management Systems industry?

The growth drivers for this industry include increasing air travel demand, technological advancements in aircraft systems, regulatory requirements for improved safety, and rising fuel efficiency standards.

Which region is the fastest Growing in the Commercial Aircraft Air Management Systems?

North America is the fastest-growing region in the Commercial Aircraft Air Management Systems market, expected to grow from $3.85 billion in 2023 to $5.86 billion by 2033, highlighting its significant market potential.

Does ConsaInsights provide customized market report data for the Commercial Aircraft Air Management Systems industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs, ensuring comprehensive insights into the Commercial Aircraft Air Management Systems market tailored for strategic decision-making.

What deliverables can I expect from this Commercial Aircraft Air Management Systems market research project?

Clients can expect detailed reports including market size analysis, growth forecasts, competitive landscape, segmented data, and actionable insights tailored for strategic planning within the Commercial Aircraft Air Management Systems market.

What are the market trends of Commercial Aircraft Air Management Systems?

Current trends include the shift toward integrated and automated air management systems, increased focus on sustainability, and innovations in materials and components to enhance system efficiency and reduce emissions.