Commercial Aircraft Avionics Market Report

Published Date: 03 February 2026 | Report Code: commercial-aircraft-avionics

Commercial Aircraft Avionics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Commercial Aircraft Avionics market, examining key trends, market size, projections for 2023-2033, and the competitive landscape. It aims to deliver valuable insights into technological advancements, regional growth, and significant market segments that impact the avionics sector.

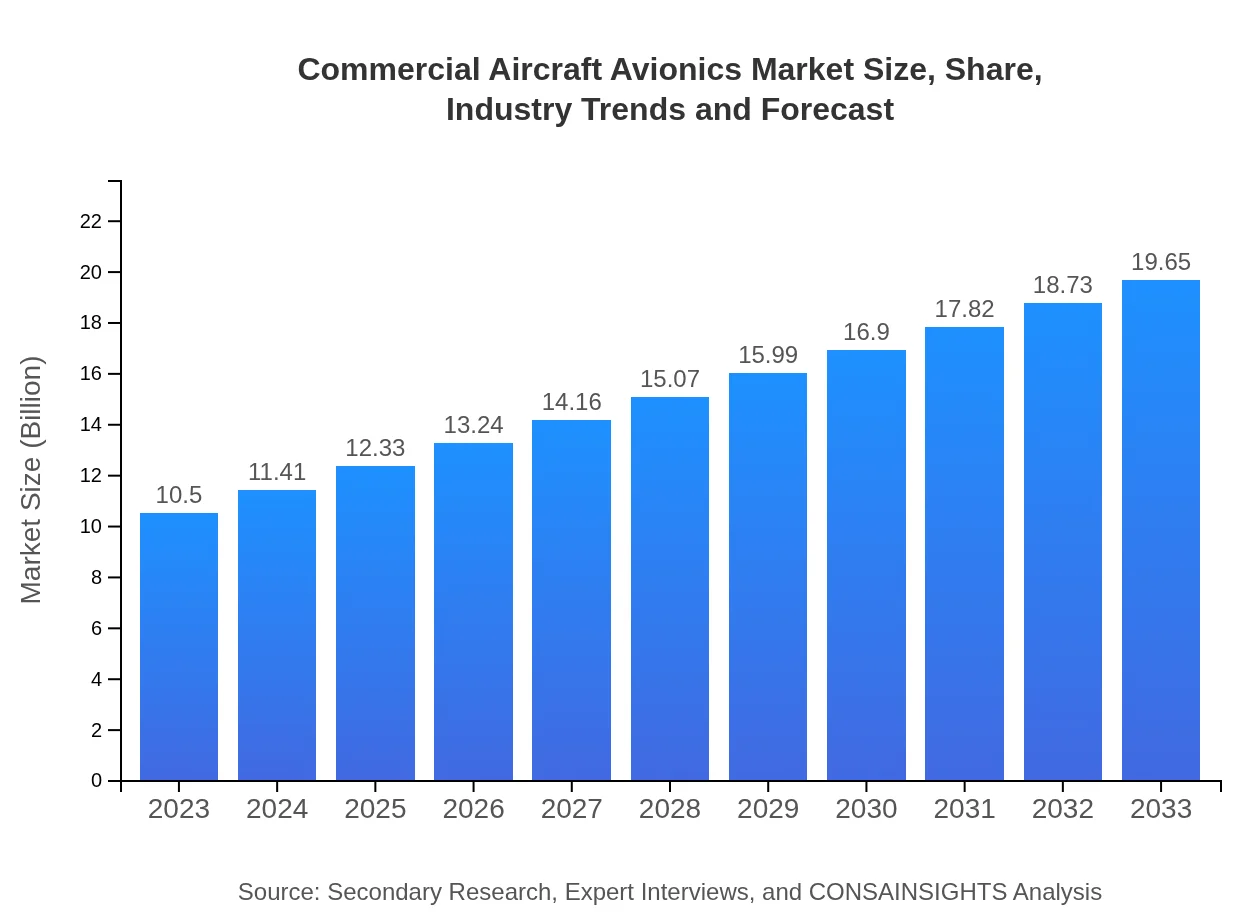

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $19.65 Billion |

| Top Companies | Honeywell International Inc., Garmin Ltd., Rockwell Collins (Collins Aerospace), Thales Group, Northrop Grumman |

| Last Modified Date | 03 February 2026 |

Commercial Aircraft Avionics Market Overview

Customize Commercial Aircraft Avionics Market Report market research report

- ✔ Get in-depth analysis of Commercial Aircraft Avionics market size, growth, and forecasts.

- ✔ Understand Commercial Aircraft Avionics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Commercial Aircraft Avionics

What is the Market Size & CAGR of Commercial Aircraft Avionics market in 2023 and 2033?

Commercial Aircraft Avionics Industry Analysis

Commercial Aircraft Avionics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Commercial Aircraft Avionics Market Analysis Report by Region

Europe Commercial Aircraft Avionics Market Report:

The European market for Commercial Aircraft Avionics is expected to grow significantly from $2.89 billion in 2023 to $5.40 billion by 2033. Strong regulatory frameworks and commitment to aviation safety have spurred investment in modern avionics systems. Additionally, European Union initiatives aimed at reducing carbon emissions in aviation further propel the market for eco-friendly avionics solutions.Asia Pacific Commercial Aircraft Avionics Market Report:

In the Asia Pacific region, the Commercial Aircraft Avionics market is projected to grow from $1.98 billion in 2023 to $3.71 billion by 2033. Factors such as the increasing number of airlines, the expansion of airport infrastructure, and rising disposable incomes among consumers are driving demand for avionics systems. Additionally, countries such as China and India are prioritizing investments in advanced avionics technology to support their burgeoning aviation sectors.North America Commercial Aircraft Avionics Market Report:

North America is a significant market for Commercial Aircraft Avionics, valued at $4.06 billion in 2023 and projected to reach $7.61 billion by 2033. The presence of major aircraft manufacturers and avionics suppliers, along with strict regulatory compliance, drives innovation and adoption of advanced systems in this region. The strong airline industry, coupled with ongoing modernization efforts of older fleets, contributes to robust market growth.South America Commercial Aircraft Avionics Market Report:

South America is expected to witness modest growth, with the market size moving from $0.70 billion in 2023 to approximately $1.31 billion by 2033. Economic recovery in the region post-pandemic and the growth of budget airlines will fuel the demand for modern avionics systems, particularly in Brazil and Argentina, where air travel is gaining traction.Middle East & Africa Commercial Aircraft Avionics Market Report:

The Middle East and African market is projected to grow from $0.86 billion in 2023 to $1.61 billion by 2033. Rapid expansion of airports and an increase in air travel due to tourism and business activities in the Gulf region are key factors driving market growth. Countries like the UAE and Saudi Arabia are significant contributors as they enhance their aviation capabilities.Tell us your focus area and get a customized research report.

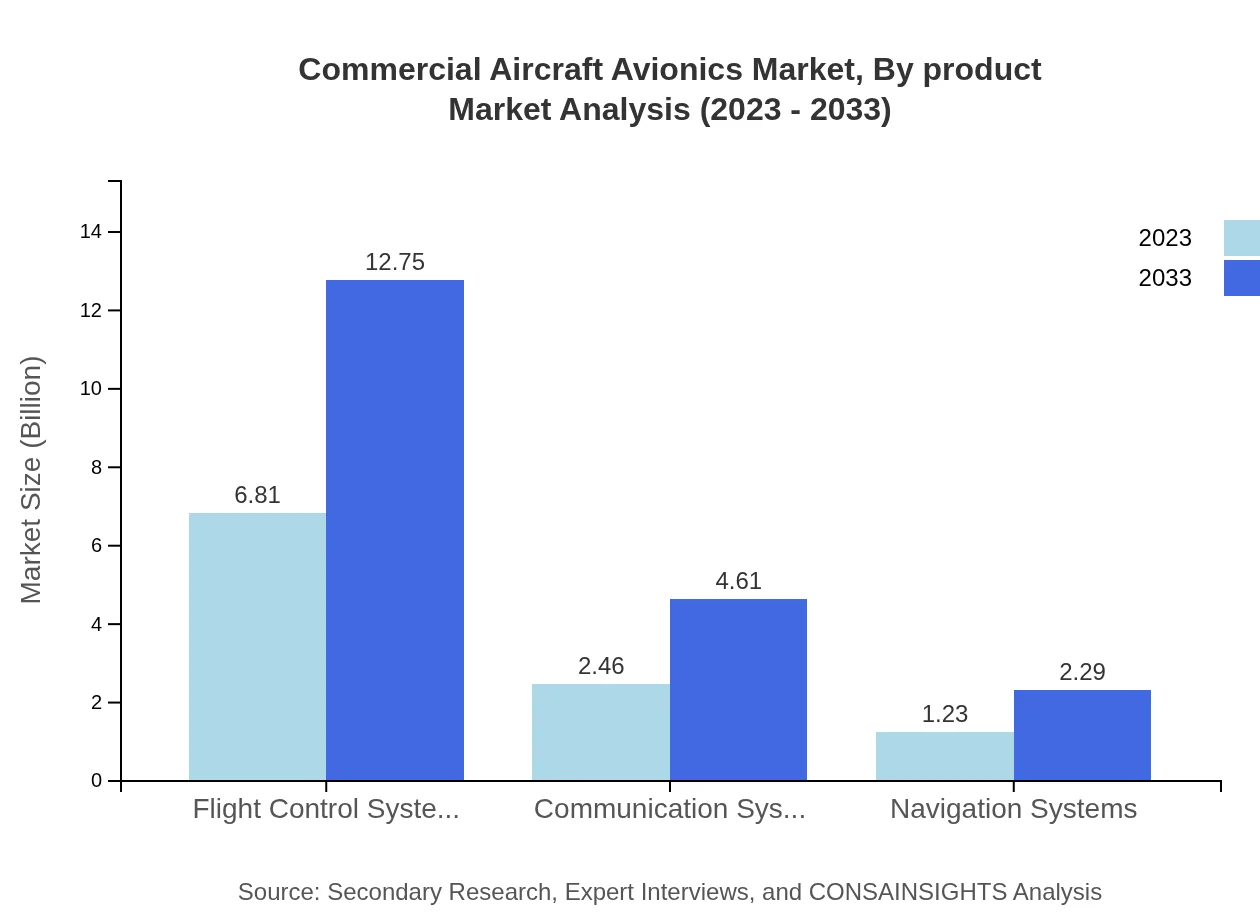

Commercial Aircraft Avionics Market Analysis By Product

The segment analysis shows that Flight Control Systems dominate the market, growing from $6.81 billion in 2023 to $12.75 billion by 2033, maintaining a consistent market share of 64.88%. Communication and navigation systems are also vital contributors, with communication systems showing growth from $2.46 billion to $4.61 billion and navigation systems from $1.23 billion to $2.29 billion during the same period.

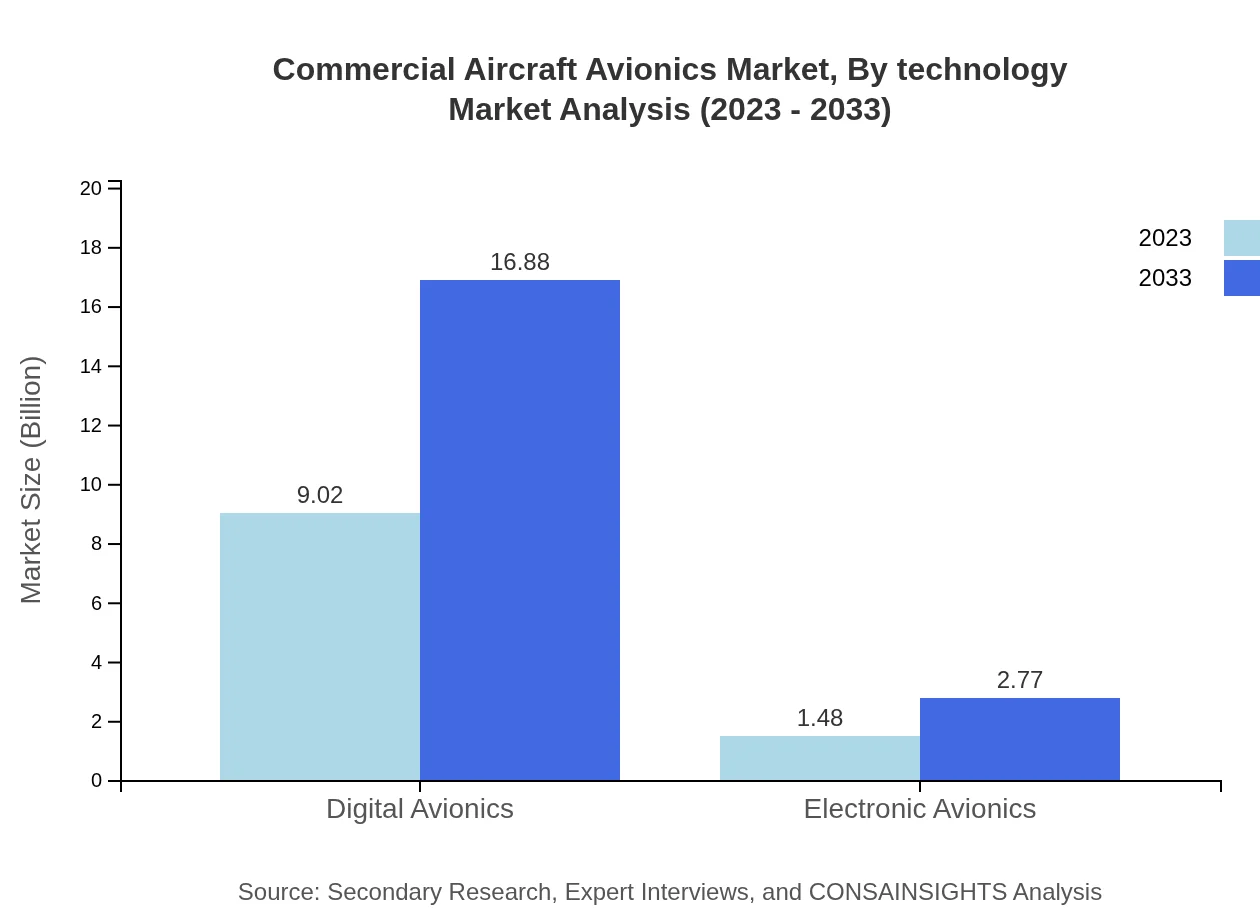

Commercial Aircraft Avionics Market Analysis By Technology

The advent of digital avionics is transforming the market landscape, with digital avionics size expected to increase from $9.02 billion in 2023 to $16.88 billion by 2033, capturing a remarkable 85.91% market share. Meanwhile, electronic avionics will also grow, albeit at a slower pace, from $1.48 billion to $2.77 billion, holding a 14.09% market share.

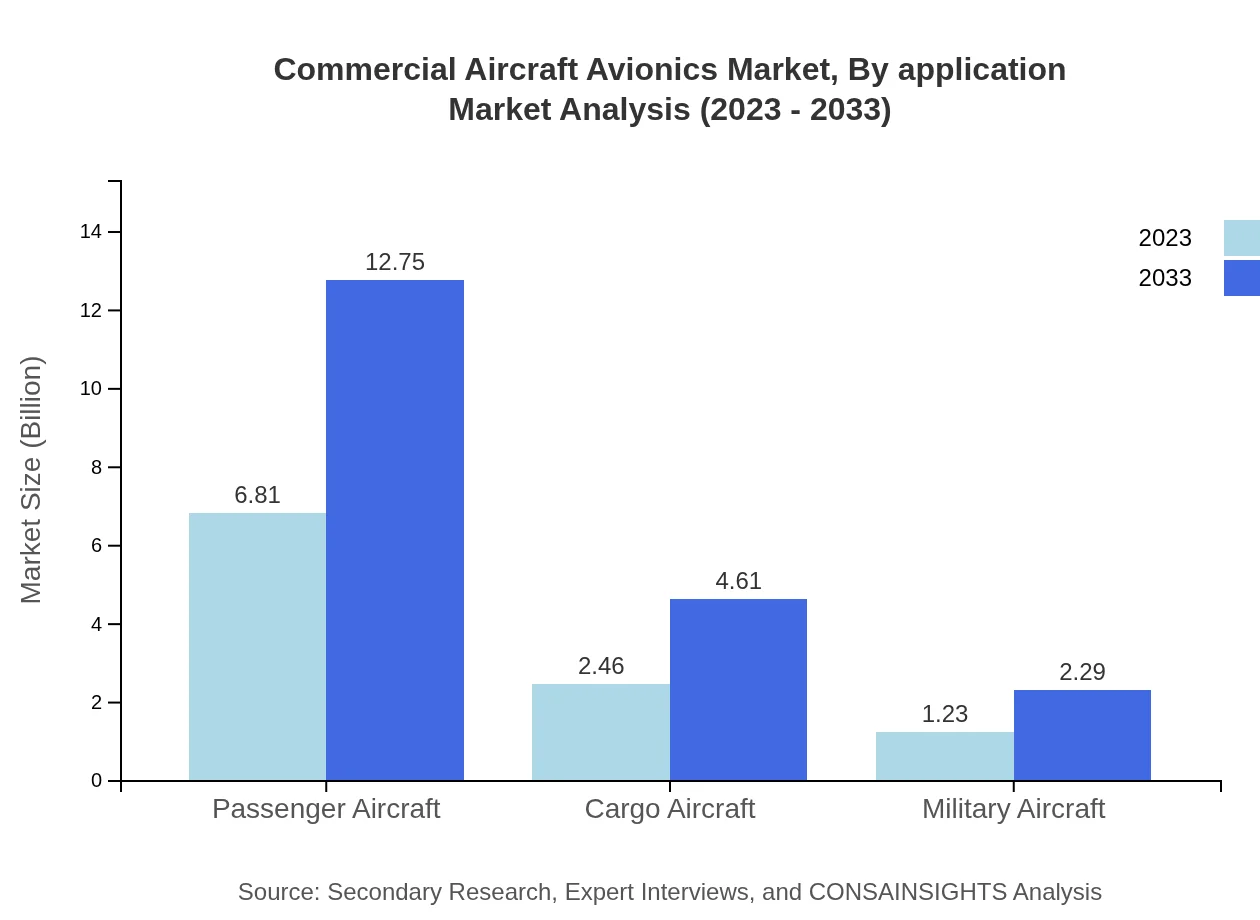

Commercial Aircraft Avionics Market Analysis By Application

Passenger aircraft represent the largest share of the market, estimated at $6.81 billion in 2023 and projected to reach $12.75 billion by 2033. Cargo aircraft and military aircraft segments, while smaller, continue to grow steadily, reflecting a demand for updated avionics systems within these operational frameworks.

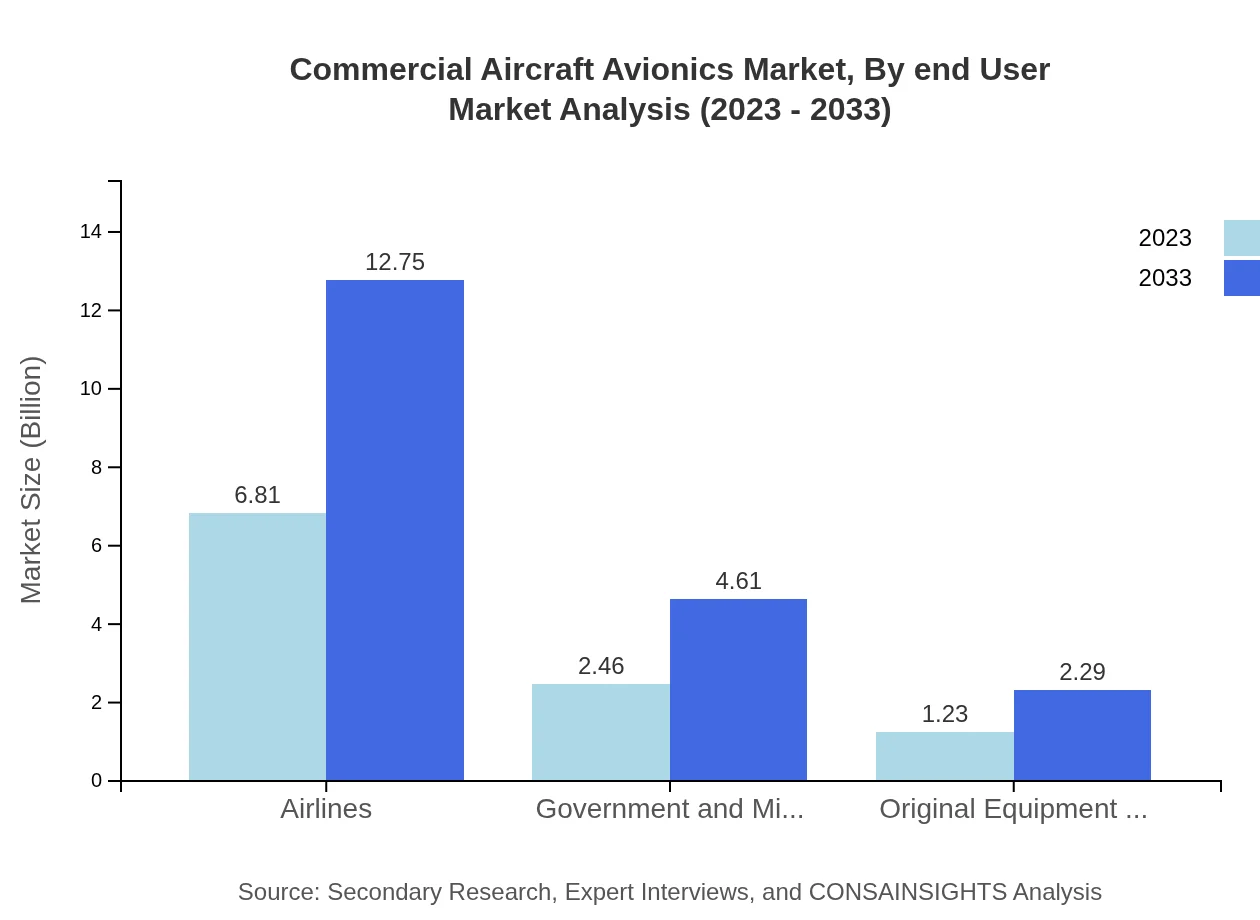

Commercial Aircraft Avionics Market Analysis By End User

The primary end-user segment includes airlines, which dominate the market, expanding from $6.81 billion in 2023 to $12.75 billion by 2033, with a consistent market share. Government and military applications also hold a significant share, driving demand as many military operations modernize their avionics capabilities. OEMs make up the smallest segment, growing from $1.23 billion to $2.29 billion in the same timeframe.

Commercial Aircraft Avionics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Commercial Aircraft Avionics Industry

Honeywell International Inc.:

Honeywell is a leading manufacturer of a wide range of avionics systems and solutions, known for its innovative flight control systems and performance-driven technology.Garmin Ltd.:

Garmin specializes in GPS technology and avionic systems for a range of aircraft, providing cutting-edge navigation and communication solutions for the aviation sector.Rockwell Collins (Collins Aerospace):

Rockwell Collins is a major player in the avionics market, known for its comprehensive suite of communication systems and flight deck technologies.Thales Group:

Thales is noted for its advanced avionics and global systems integration solutions, emphasizing safety, connectivity, and information management in flight operations.Northrop Grumman:

With a strong focus on defense and military applications, Northrop Grumman develops sophisticated avionics systems that enhance surveillance, navigation, and combat capabilities.We're grateful to work with incredible clients.

FAQs

What is the market size of commercial Aircraft Avionics?

The global Commercial Aircraft Avionics market is currently valued at approximately $10.5 billion and is projected to grow at a CAGR of 6.3% from 2023 to 2033, indicating significant advancement in aircraft technology and increasing demand.

What are the key market players or companies in this commercial Aircraft Avionics industry?

Key players in the commercial aircraft avionics industry include major firms such as Honeywell Aerospace, Rockwell Collins (now UTC Aerospace Systems), Thales Group, and Garmin. These companies are known for their innovation and contribution to advanced avionics solutions.

What are the primary factors driving the growth in the commercial Aircraft Avionics industry?

Growth in the commercial aircraft avionics industry is driven by factors such as the increasing need for modernization of aging aircraft, advancements in avionics technologies, and growing demand for passenger safety and comfort during flights.

Which region is the fastest Growing in the commercial Aircraft Avionics?

The fastest-growing region in the commercial aircraft avionics market is North America, with projected market growth from $4.06 billion in 2023 to $7.61 billion by 2033, followed closely by Europe and Asia-Pacific.

Does ConsaInsights provide customized market report data for the commercial Aircraft Avionics industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the commercial aircraft avionics industry. Clients can request detailed reports that focus on particular segments or regions for more precise insights.

What deliverables can I expect from this commercial Aircraft Avionics market research project?

Expected deliverables from the commercial aircraft avionics market research project include comprehensive market analysis reports, segmentation data, competitive landscape insights, and forecasts on market trends and growth potential.

What are the market trends of commercial Aircraft Avionics?

Market trends in commercial aircraft avionics include a shift towards digital avionics systems, increased investment in automation, and a focus on improving cybersecurity in avionic systems, reflecting the industry's evolution towards smarter solutions.