Commercial Aircraft Cabin Interior Market Report

Published Date: 03 February 2026 | Report Code: commercial-aircraft-cabin-interior

Commercial Aircraft Cabin Interior Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Commercial Aircraft Cabin Interior market, covering market size, growth forecasts through 2033, industry trends, and regional insights. Key market players and their contributions are also highlighted, alongside critical analysis of market segments and technological advancements.

| Metric | Value |

|---|---|

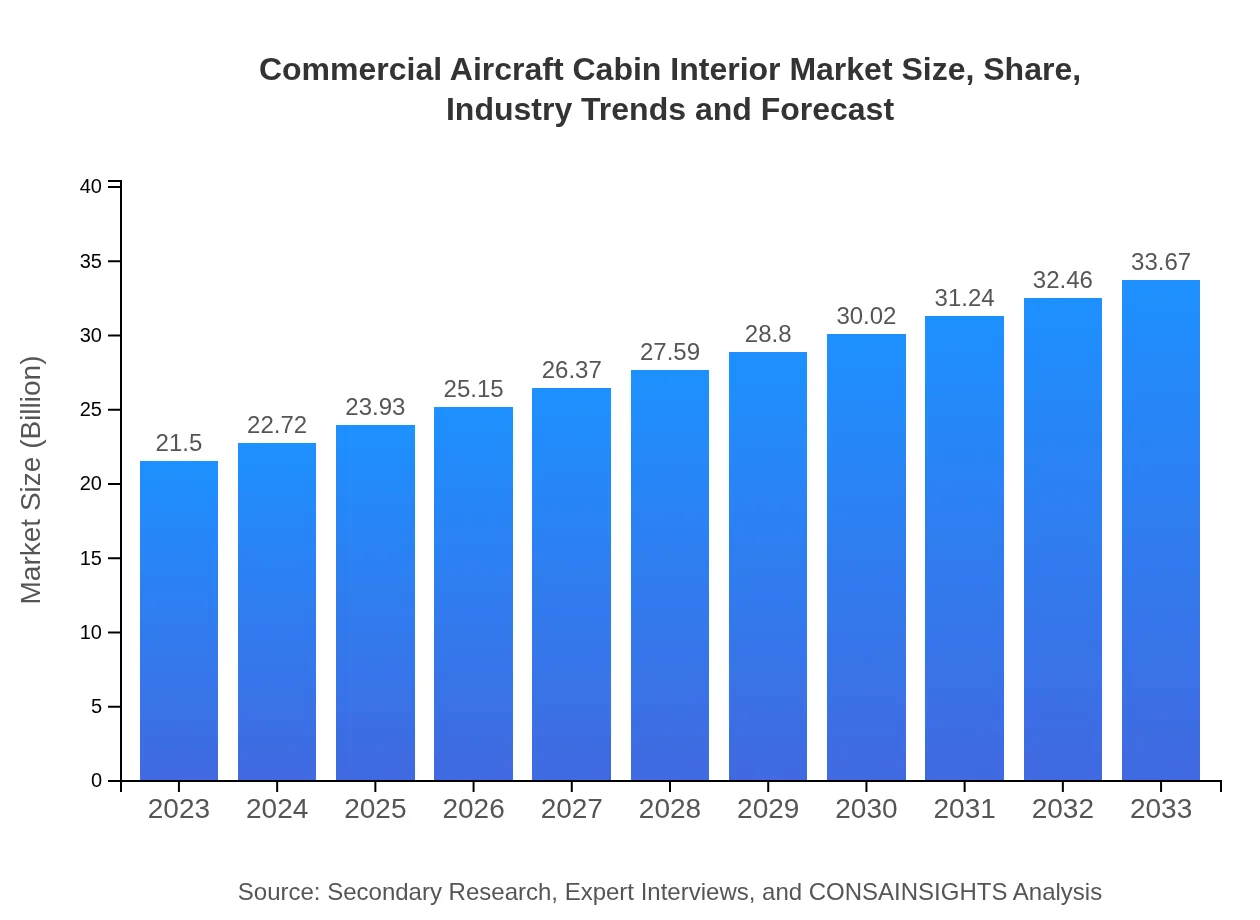

| Study Period | 2023 - 2033 |

| 2023 Market Size | $21.50 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $33.67 Billion |

| Top Companies | Boeing , Airbus, Raytheon Technologies, Zodiac Aerospace, Diehl Aviation |

| Last Modified Date | 03 February 2026 |

Commercial Aircraft Cabin Interior Market Overview

Customize Commercial Aircraft Cabin Interior Market Report market research report

- ✔ Get in-depth analysis of Commercial Aircraft Cabin Interior market size, growth, and forecasts.

- ✔ Understand Commercial Aircraft Cabin Interior's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Commercial Aircraft Cabin Interior

What is the Market Size & CAGR of Commercial Aircraft Cabin Interior market in 2023?

Commercial Aircraft Cabin Interior Industry Analysis

Commercial Aircraft Cabin Interior Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Commercial Aircraft Cabin Interior Market Analysis Report by Region

Europe Commercial Aircraft Cabin Interior Market Report:

The European market size for Commercial Aircraft Cabin Interiors stood at USD 7.30 billion in 2023 and is projected to reach USD 11.44 billion by 2033. Numerous leading airlines in this region are investing heavily in sustainability practices and modern cabin enhancements, thereby sustaining growth.Asia Pacific Commercial Aircraft Cabin Interior Market Report:

In the Asia Pacific region, the market size was USD 3.89 billion in 2023 and is expected to reach USD 6.10 billion by 2033. The growth is driven by increasing air travel and demand for new aircraft as economies in countries like China and India expand. Strong investments in aviation infrastructure and a purchasing shift towards modern cabin designs exacerbate this growth trend.North America Commercial Aircraft Cabin Interior Market Report:

North America has a well-established market, valued at USD 7.25 billion in 2023, and forecasted to be USD 11.35 billion by 2033. The region's strong emphasis on technological adoption, coupled with large aircraft procurements and consumer preferences for premium experiences, ensures robust growth in this segment.South America Commercial Aircraft Cabin Interior Market Report:

The South American market for Commercial Aircraft Cabin Interiors was valued at USD 1.44 billion in 2023 and is projected to grow to USD 2.26 billion by 2033. This growth can be attributed to the expansion of regional airlines and an increase in tourism, alongside a growing emphasis on fleet modernization.Middle East & Africa Commercial Aircraft Cabin Interior Market Report:

In the Middle East and Africa, the market value was USD 1.61 billion in 2023 and is expected to reach USD 2.53 billion by 2033, driven by the region's expanding aviation market and increasing preferences for luxury travel experiences, especially from aviation hubs like the UAE.Tell us your focus area and get a customized research report.

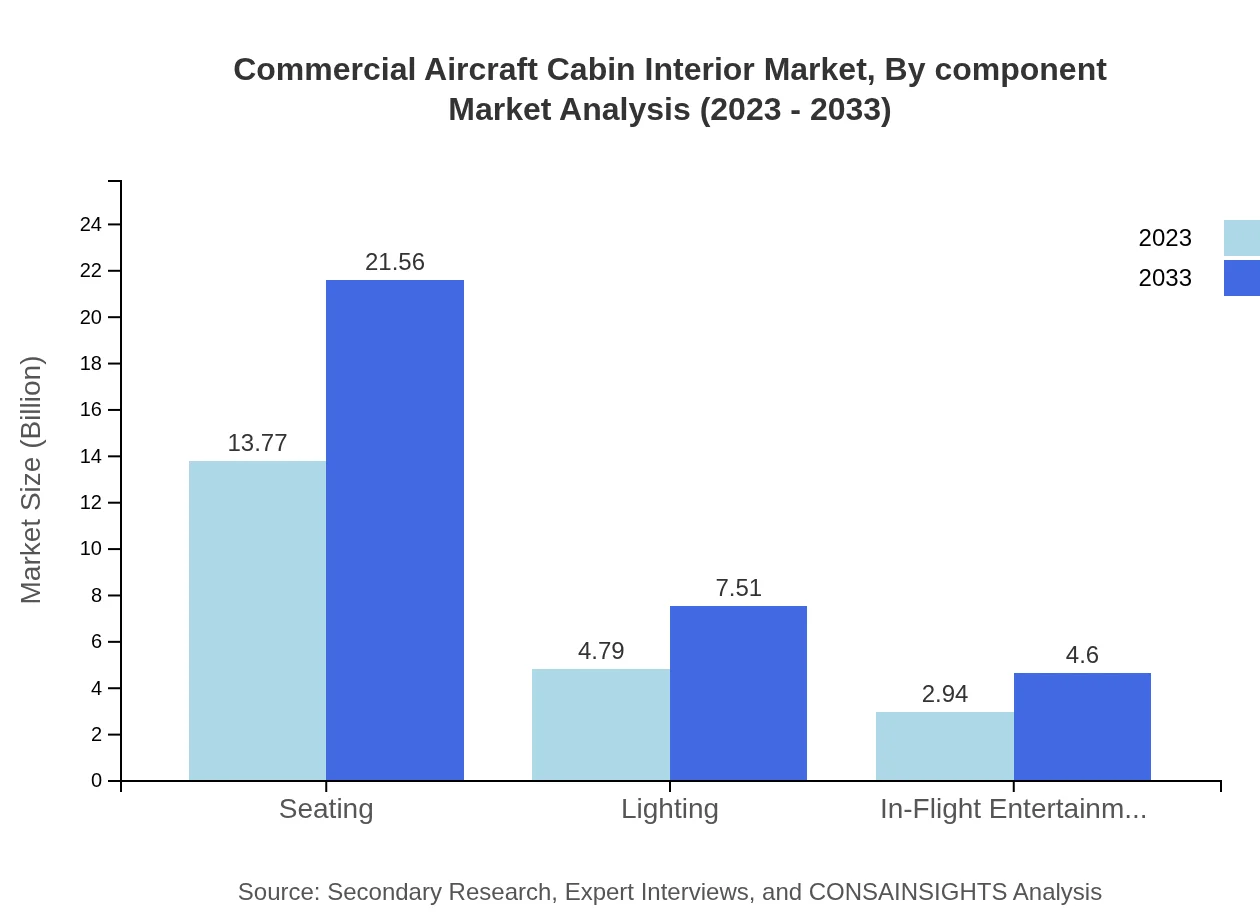

Commercial Aircraft Cabin Interior Market Analysis By Component

Seating remains the largest component of the market, experiencing a market size of USD 13.77 billion in 2023 and expected to grow to USD 21.56 billion by 2033. Lighting and in-flight entertainment systems are also growing segments, with a focus on passenger comfort and engagement.

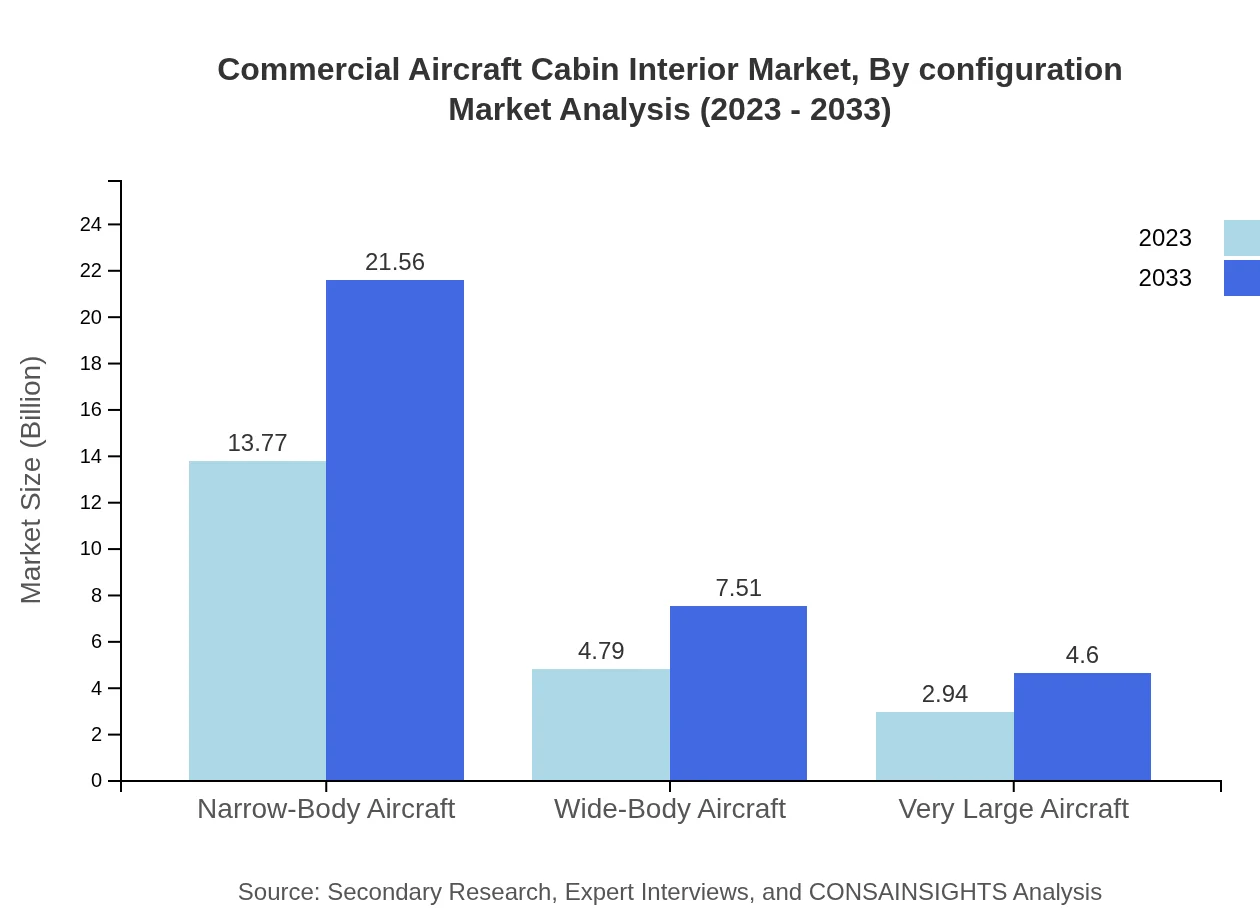

Commercial Aircraft Cabin Interior Market Analysis By Configuration

The analysis based on configuration shows that narrow-body aircraft dominate the market, accounting for a significant share in both 2023 and 2033 due to their high connection of regional routes. Wide-body and very large aircraft configurations are also experiencing growth as airlines increase long-haul services.

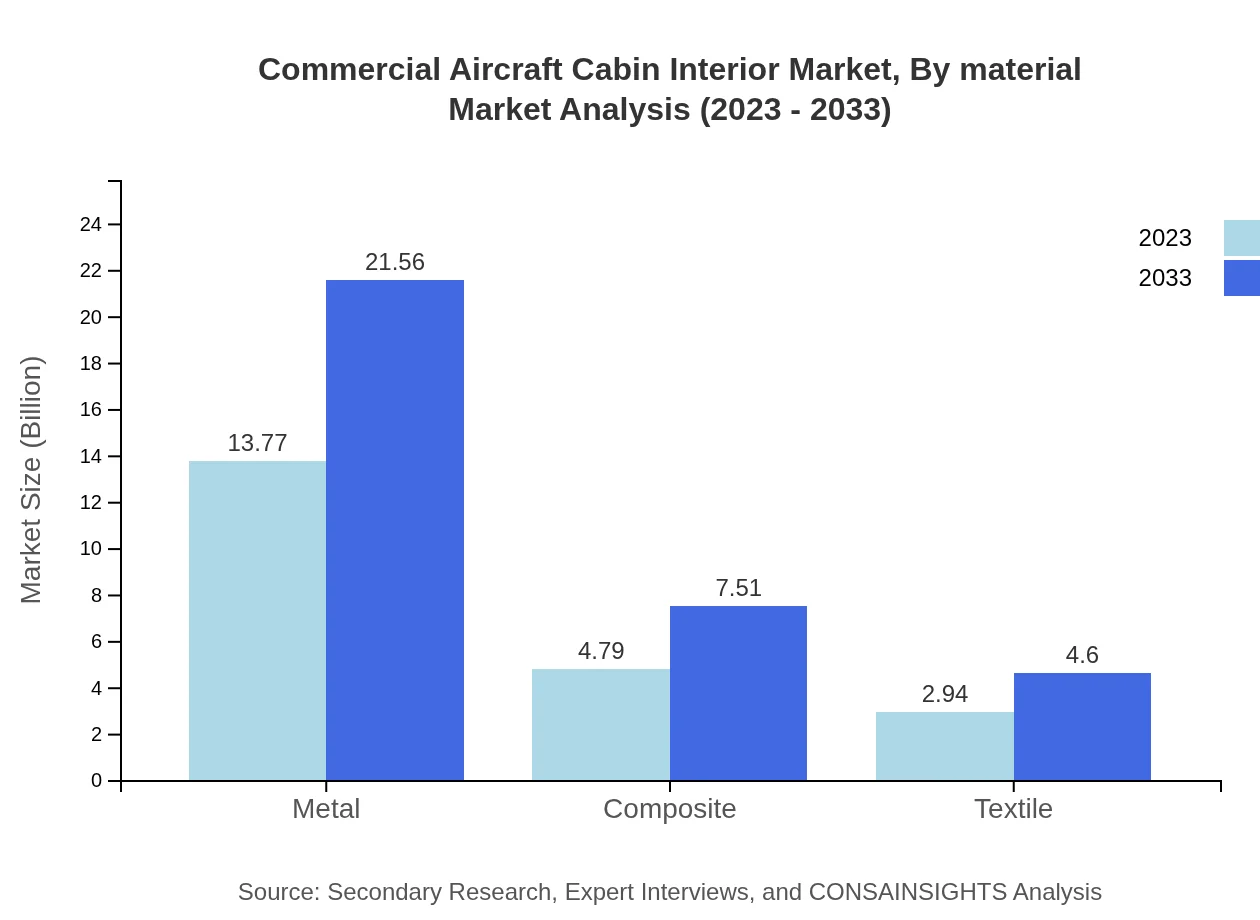

Commercial Aircraft Cabin Interior Market Analysis By Material

The material segment reveals that metal remains the dominant choice, valued at USD 13.77 billion in 2023, with composites steadily gaining traction due to their lightweight properties and the push for fuel efficiency in aircraft design.

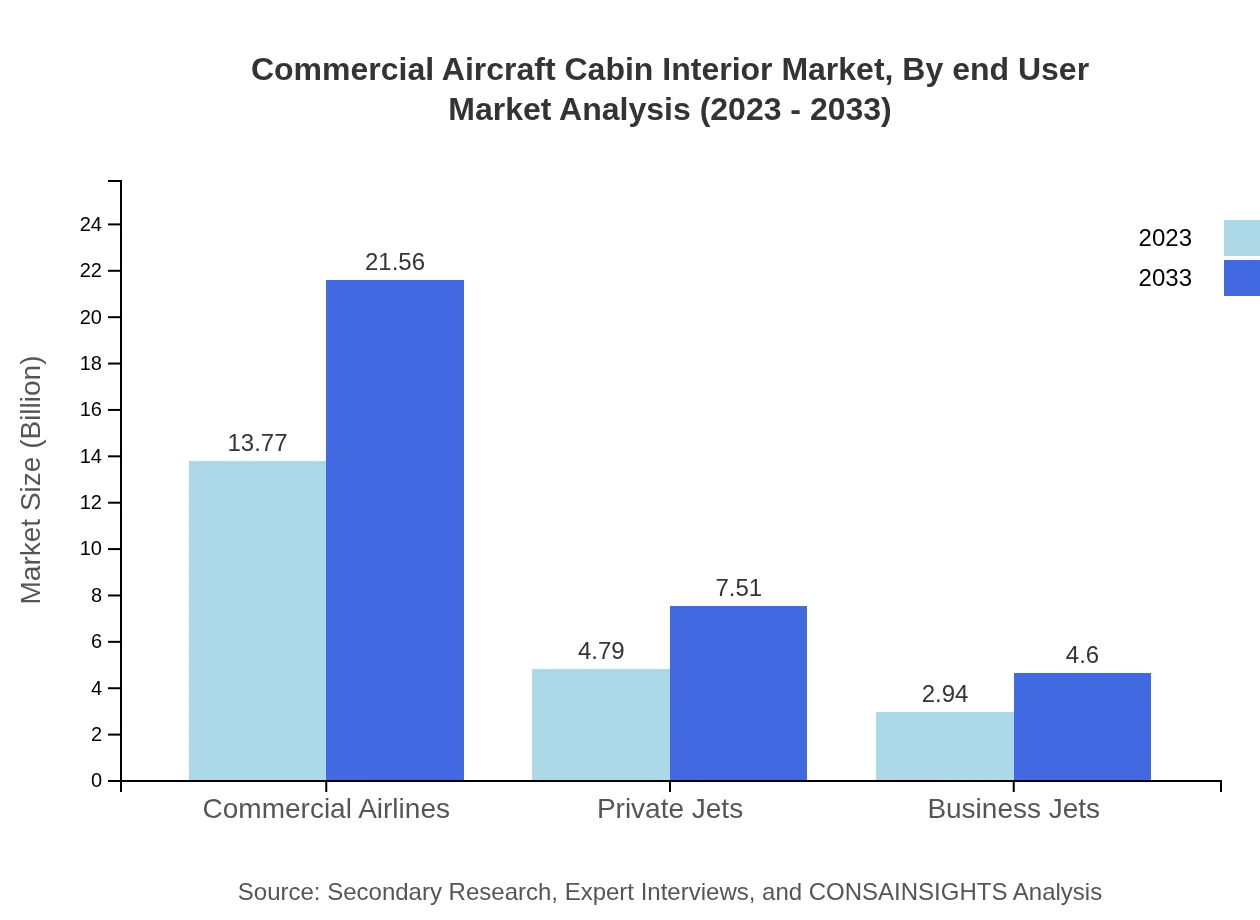

Commercial Aircraft Cabin Interior Market Analysis By End User

The commercial airlines segment leads this market, making up the largest portion of expenditures on cabin interiors. Private and business jets follow, holding substantial shares owing to the luxurious furnishings and customization options afforded to these aircraft types.

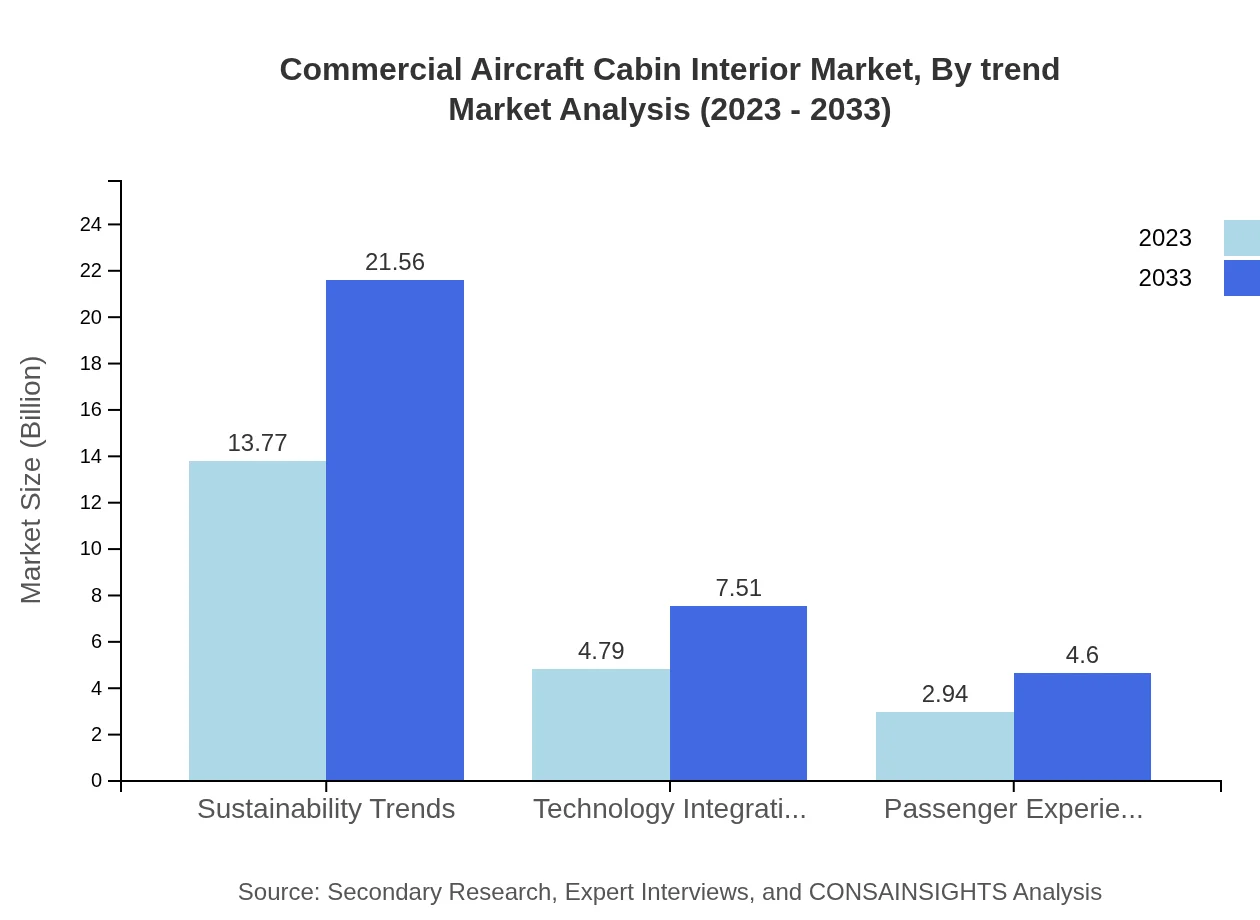

Commercial Aircraft Cabin Interior Market Analysis By Trend

Trends indicate a growing investment in sustainability, with a marked shift in industry focus toward integrating environmentally friendly materials and technologies. This trend not only reflects a commitment to reduce carbon footprints but also meets increasing consumer demand for sustainable travel options.

Commercial Aircraft Cabin Interior Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Commercial Aircraft Cabin Interior Industry

Boeing :

Boeing is a leading player in aviation and aerospace, providing innovative cabin designs and solutions that cater to airlines' needs for passenger comfort and operational efficiency.Airbus:

Airbus is known for its advanced aircraft design and manufacturing, offering bespoke cabin interiors that enhance the travel experience for passengers while optimizing airline performance.Raytheon Technologies:

Raytheon Technologies is pivotal in creating state-of-the-art in-flight entertainment and cabin systems, contributing significantly to modernizing aircraft interiors.Zodiac Aerospace:

Zodiac Aerospace specializes in cabin interiors, providing a range of innovative solutions aimed at increasing passenger satisfaction and safety in commercial aviation.Diehl Aviation:

Diehl Aviation focuses on cutting-edge cabin solutions, emphasizing sustainability through lightweight materials and integration of smart technologies into aircraft interiors.We're grateful to work with incredible clients.

FAQs

What is the market size of commercial Aircraft Cabin Interior?

The global commercial aircraft cabin interior market is estimated to be valued at $21.5 billion in 2023, with a projected CAGR of 4.5% over the next ten years, indicating a robust growth trajectory in response to rising passenger demands.

What are the key market players or companies in this commercial Aircraft Cabin Interior industry?

Key players in the commercial aircraft cabin interior industry include Boeing, Airbus, Zodiac Aerospace, Collins Aerospace, and Safran. These companies are at the forefront of innovation and design, driving advancements in passenger comfort and technology integration.

What are the primary factors driving the growth in the commercial Aircraft Cabin Interior industry?

Growth drivers in the commercial aircraft cabin interior market include increasing air travel demand, a strong focus on passenger experience enhancements, technological advancements in design and materials, and the push towards sustainable aviation solutions.

Which region is the fastest Growing in the commercial Aircraft Cabin Interior?

Among the regions, Europe is the fastest-growing market for commercial aircraft cabin interiors, expected to grow from $7.30 billion in 2023 to $11.44 billion by 2033, followed closely by the Asia Pacific, which anticipates growth from $3.89 billion to $6.10 billion.

Does ConsaInsights provide customized market report data for the commercial Aircraft Cabin Interior industry?

Yes, ConsaInsights offers customized market report data tailored to specific inquiries within the commercial aircraft cabin interior industry, providing in-depth insights based on unique business needs and market dynamics.

What deliverables can I expect from this commercial Aircraft Cabin Interior market research project?

Deliverables from the commercial aircraft cabin interior market research project typically include comprehensive reports, market analysis, competitive landscape assessments, trend analysis, and recommendations for strategic development.

What are the market trends of commercial Aircraft Cabin Interior?

Current trends in the commercial aircraft cabin interior market include increased investment in sustainability, integration of advanced technologies for passenger comfort, and a focus on enhancing the overall passenger experience through innovative interior design solutions.