Commercial Aircraft Carbon Brake Market Report

Published Date: 03 February 2026 | Report Code: commercial-aircraft-carbon-brake

Commercial Aircraft Carbon Brake Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the commercial aircraft carbon brake market, offering insights on market size, growth trends, regional distribution, and technology advancements for the forecast period 2023-2033.

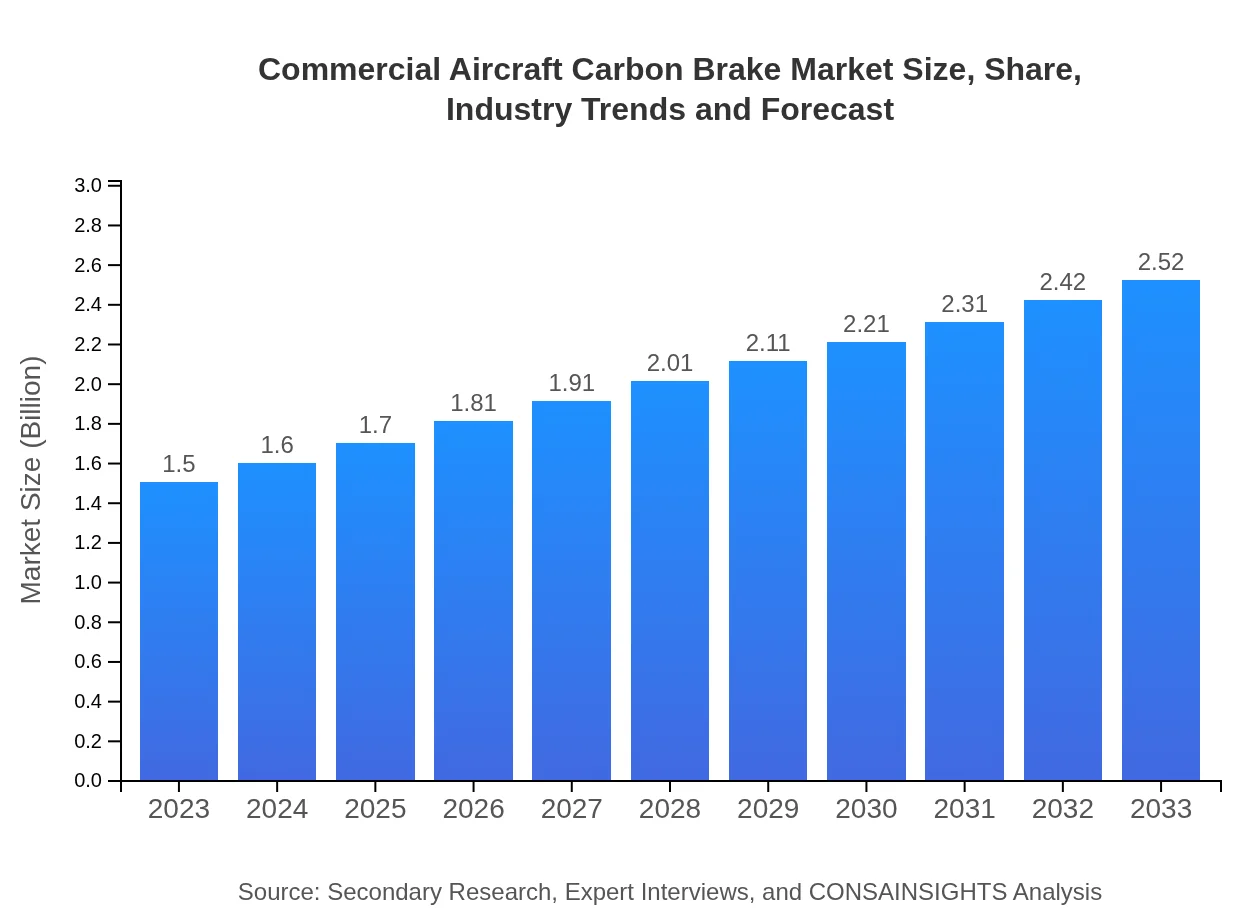

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $2.52 Billion |

| Top Companies | Honeywell Aerospace, Safran Landing Systems, UTC Aerospace Systems, Boeing |

| Last Modified Date | 03 February 2026 |

Commercial Aircraft Carbon Brake Market Overview

Customize Commercial Aircraft Carbon Brake Market Report market research report

- ✔ Get in-depth analysis of Commercial Aircraft Carbon Brake market size, growth, and forecasts.

- ✔ Understand Commercial Aircraft Carbon Brake's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Commercial Aircraft Carbon Brake

What is the Market Size & CAGR of Commercial Aircraft Carbon Brake market in 2023?

Commercial Aircraft Carbon Brake Industry Analysis

Commercial Aircraft Carbon Brake Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Commercial Aircraft Carbon Brake Market Analysis Report by Region

Europe Commercial Aircraft Carbon Brake Market Report:

The European market is characterized by its emphasis on innovation and eco-friendly solutions, with a market size of 0.48 billion USD in 2023 predicted to grow to 0.81 billion USD by 2033. Several key manufacturers are based in this region, and ongoing partnerships among airlines and technology firms further support market expansion.Asia Pacific Commercial Aircraft Carbon Brake Market Report:

The Asia Pacific region is expected to witness robust growth due to increasing air traffic and rising commercial aircraft orders. In 2023, the market size stands at 0.28 billion USD, projected to reach 0.47 billion USD by 2033, representing significant opportunities for carbon brake manufacturers.North America Commercial Aircraft Carbon Brake Market Report:

North America remains a dominant player in the commercial aircraft carbon brake market with a projected market size of 0.52 billion USD in 2023, growing to 0.88 billion USD by 2033. The region's advanced aerospace industry and stringent aviation regulations drive demand for high-performance braking technologies.South America Commercial Aircraft Carbon Brake Market Report:

In South America, the market for commercial aircraft carbon brakes is relatively smaller, with a size of 0.10 billion USD in 2023 and an expected increase to 0.17 billion USD by 2033. The region is focusing on enhancing aviation safety standards and expanding its fleet of commercial aircraft.Middle East & Africa Commercial Aircraft Carbon Brake Market Report:

The Middle East and Africa region shows potential for growth in the commercial aircraft carbon brake market, with a market size of 0.12 billion USD in 2023, expected to rise to 0.20 billion USD by 2033. The region's investments in airport infrastructure and new aircraft acquisitions are key growth drivers.Tell us your focus area and get a customized research report.

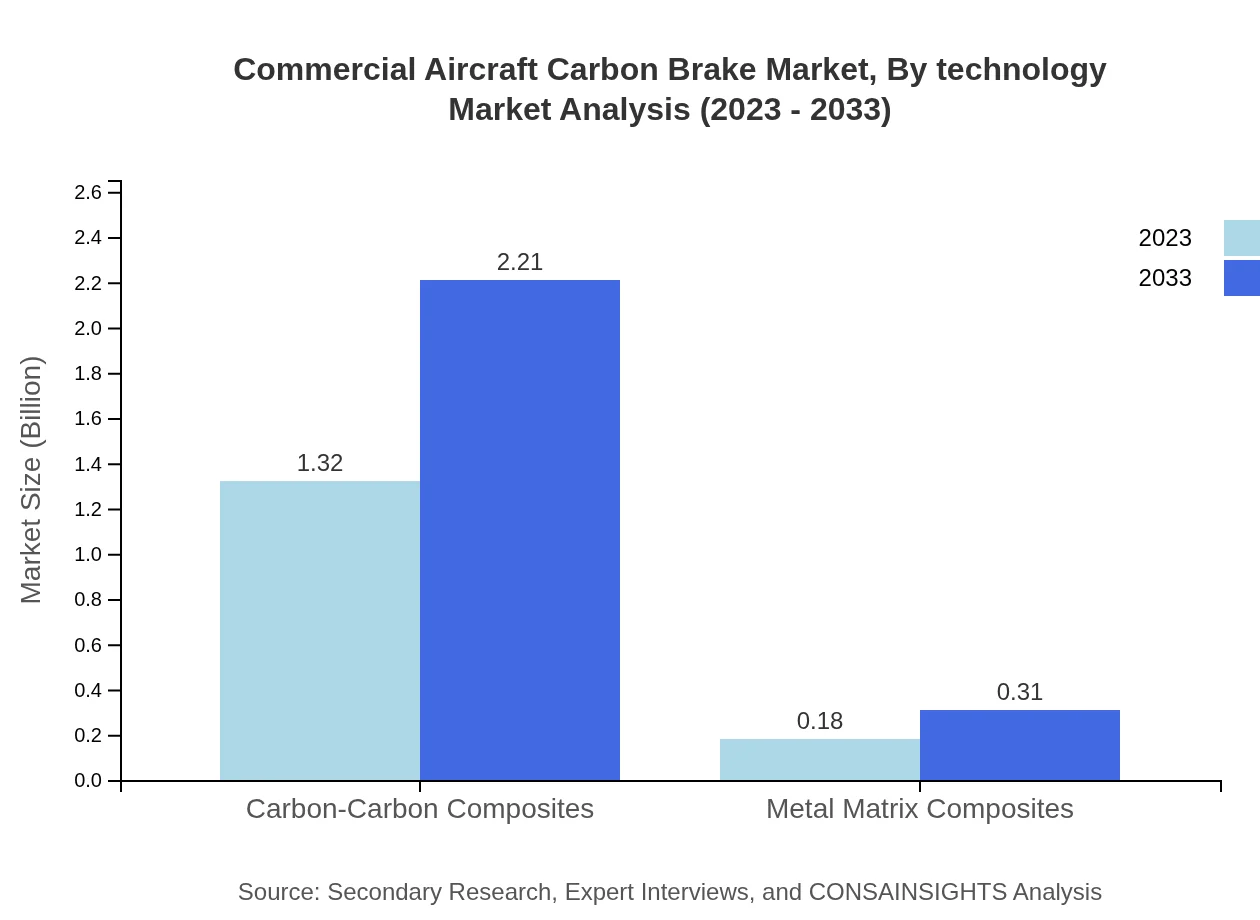

Commercial Aircraft Carbon Brake Market Analysis By Technology

The technology segment of the commercial aircraft carbon brake market comprises mainly carbon-carbon composites, which dominate the market with a share of 87.84% in 2023. This segment sees a size of 1.32 billion USD in 2023, growing to 2.21 billion USD by 2033. The alternative technology, metal matrix composites, holds a smaller share of 12.16%, with expectations of growth as innovations continue to emerge.

Commercial Aircraft Carbon Brake Market Analysis By Aircraft Type

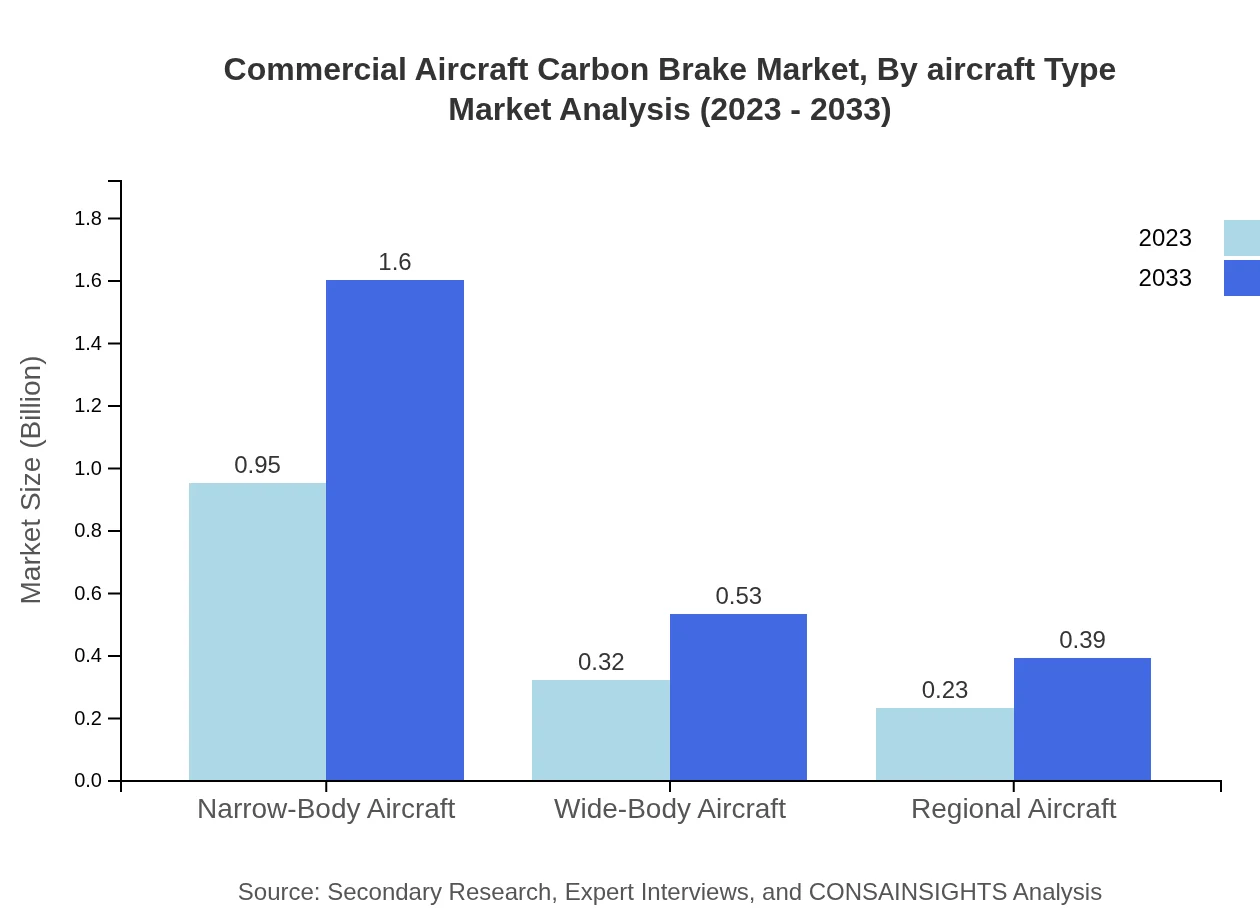

In terms of aircraft types, narrow-body aircraft represent the largest segment with a size of 0.95 billion USD in 2023, growing to 1.60 billion USD by 2033. Wide-body aircraft and regional aircraft hold respective market sizes of 0.32 billion USD and 0.23 billion USD in 2023, projected to see proportional growth as air travel demand expands globally.

Commercial Aircraft Carbon Brake Market Analysis By Application

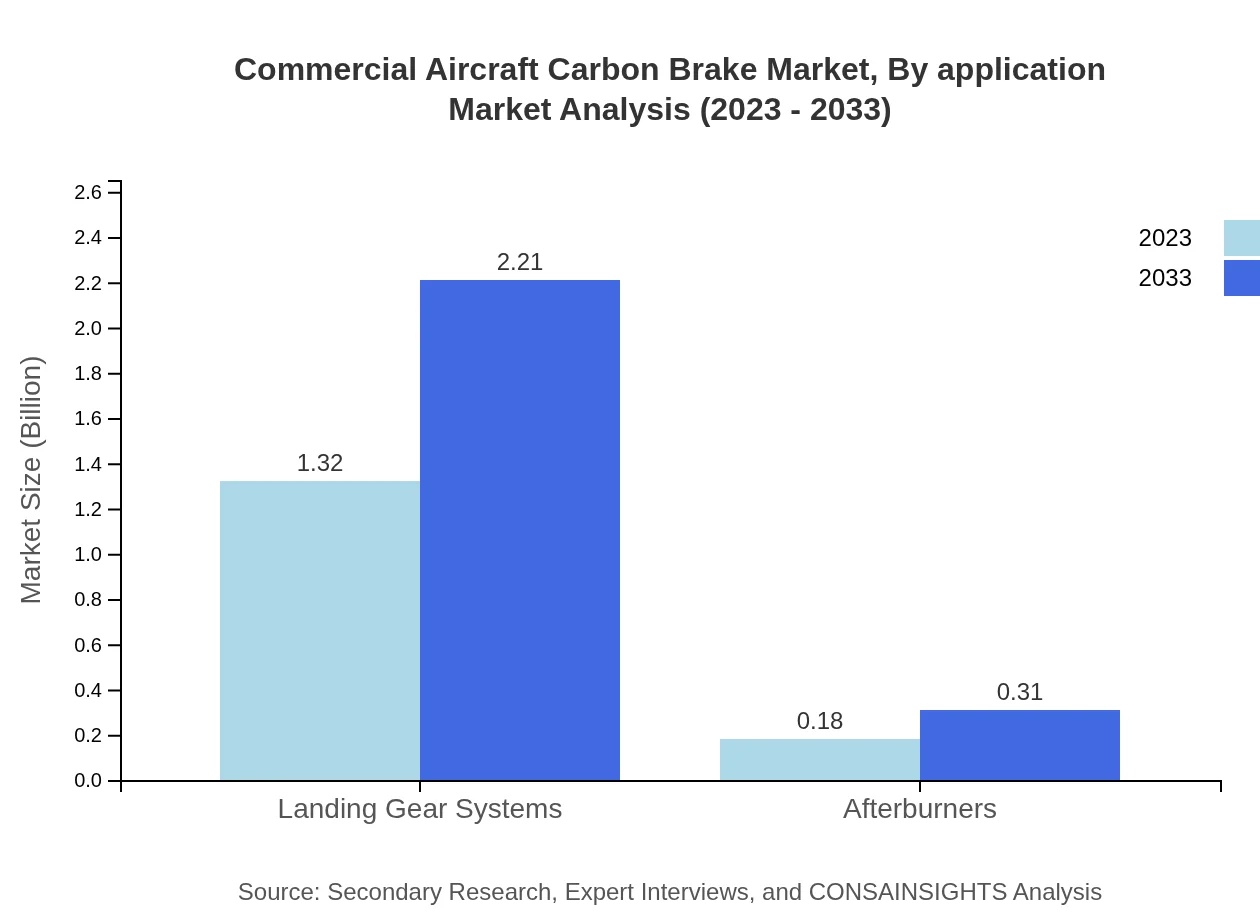

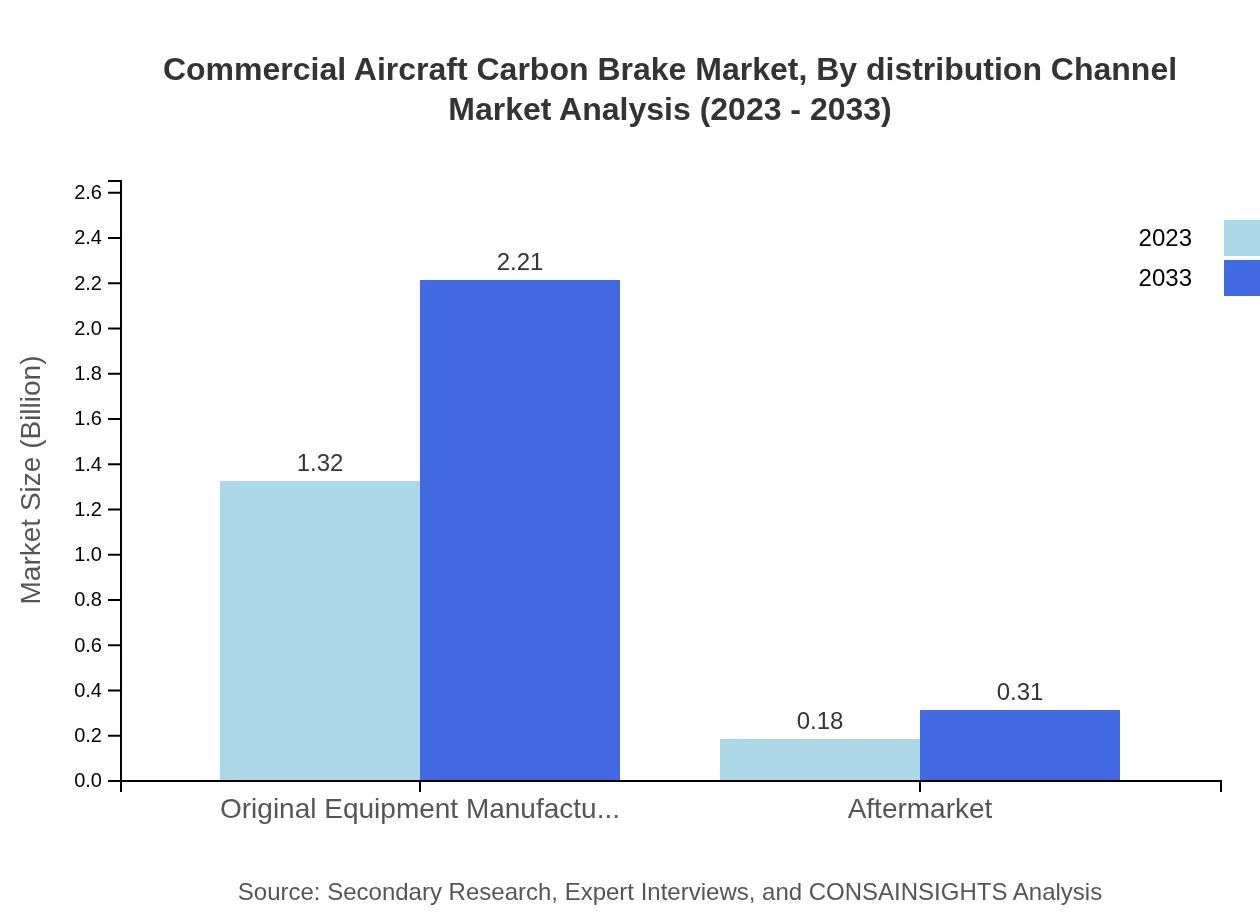

The application segment is divided between original equipment manufacturers (OEMs) and aftermarket solutions, with OEMs commanding an 87.84% market share and a size of 1.32 billion USD in 2023. The aftermarket segment, representing 12.16% market share, is progressing as airlines seek cost-effective solutions for maintenance and replacement.

Commercial Aircraft Carbon Brake Market Analysis By Distribution Channel

Distribution channels for the commercial aircraft carbon brake market include direct sales through manufacturers and third-party distributors. Direct sales are prominent, accounting for most market share as they allow for streamlined communication and expert advice directly from industry players.

Commercial Aircraft Carbon Brake Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Commercial Aircraft Carbon Brake Industry

Honeywell Aerospace:

A leading provider of aerospace products and services, Honeywell Aerospace is known for its innovative carbon brake technologies and solutions, focusing on performance and sustainability.Safran Landing Systems:

Specializing in aircraft landing systems, Safran is a recognized leader in carbon brake technology, offering advanced braking solutions integrated into modern commercial aircraft.UTC Aerospace Systems:

Part of Raytheon Technologies, UTC Aerospace Systems provides a wide range of aerospace components, including high-performance carbon brake systems recognized for their reliability.Boeing :

Boeing, a major aircraft manufacturer, also invests in development of advanced braking technologies, enhancing performance and safety in its commercial aircraft models.We're grateful to work with incredible clients.

FAQs

What is the market size of commercial Aircraft Carbon Brake?

The commercial aircraft carbon brake market is anticipated to reach a size of approximately $1.5 billion by 2033, growing at a compound annual growth rate (CAGR) of 5.2% from its current valuation.

What are the key market players or companies in this commercial Aircraft Carbon Brake industry?

Key players in the commercial aircraft carbon brake industry include prominent companies that are engaged in manufacturing and supplying high-quality brake systems. These players are known for their innovative technologies and strong market presence.

What are the primary factors driving the growth in the commercial aircraft carbon brake industry?

Growth in the commercial aircraft carbon brake industry is driven by increasing air travel demand, advancements in materials technology, and the need for improved braking efficiency, which leads to better safety and performance.

Which region is the fastest Growing in the commercial aircraft carbon brake?

The North America region is projected to experience significant growth in the commercial aircraft carbon brake market, expanding from $0.52 billion in 2023 to approximately $0.88 billion by 2033, indicating a strong demand.

Does ConsaInsights provide customized market report data for the commercial aircraft carbon brake industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients within the commercial aircraft carbon brake industry, enabling targeted insights and strategic planning.

What deliverables can I expect from this commercial Aircraft Carbon Brake market research project?

Expect comprehensive reports, analytical insights, market forecasts, and segment analyses, along with tailored recommendations based on the latest market trends and data specific to the commercial aircraft carbon brake sector.

What are the market trends of commercial Aircraft Carbon Brake?

Current market trends in the commercial aircraft carbon brake segment include increasing adoption of carbon-carbon composites, a shift towards eco-friendly materials, and innovations aimed at enhancing brake performance and safety.