Commercial Aircraft Collision Avoidance System Market Report

Published Date: 03 February 2026 | Report Code: commercial-aircraft-collision-avoidance-system

Commercial Aircraft Collision Avoidance System Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Commercial Aircraft Collision Avoidance System market, including market size, trends, regional insights, technology advancements, and forecasts extending from 2023 to 2033.

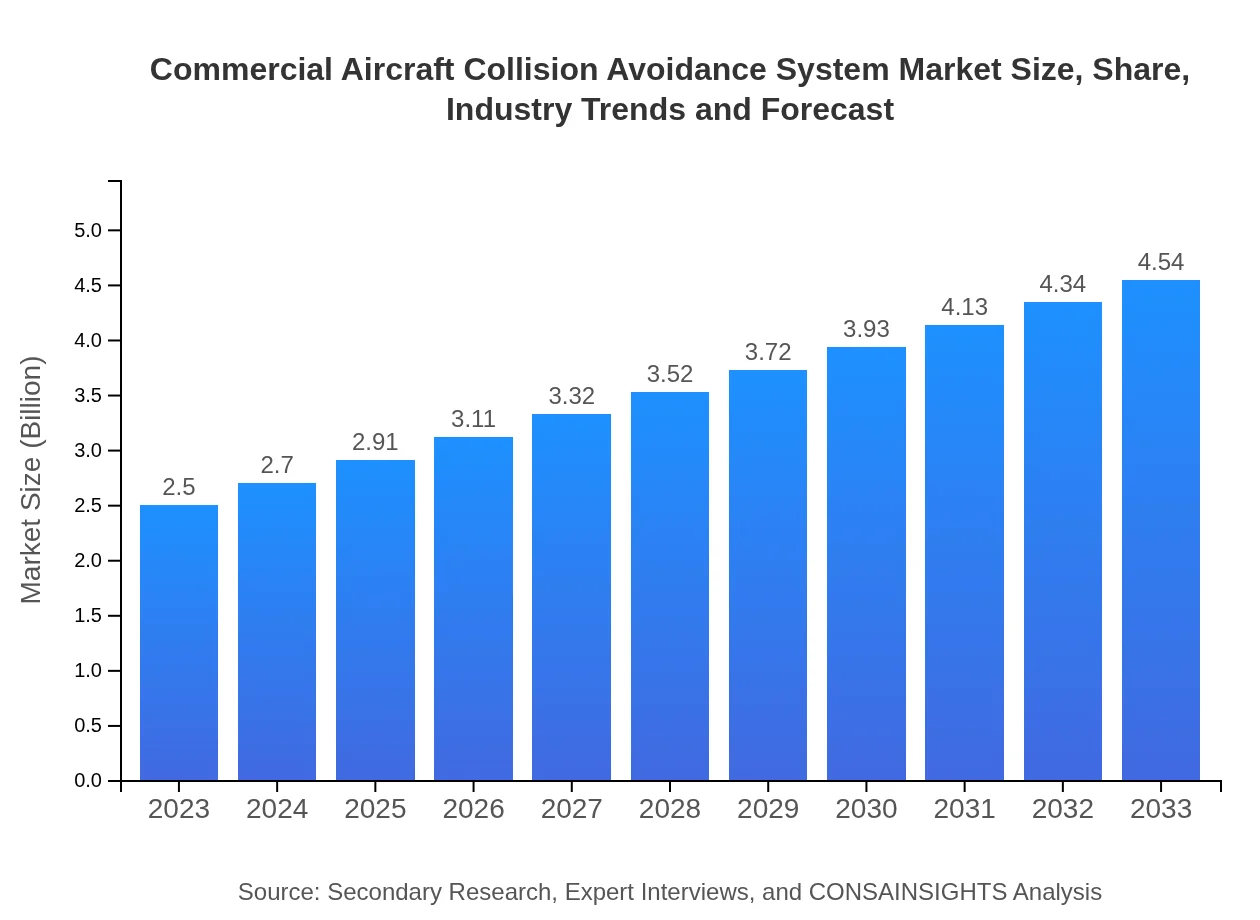

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $4.54 Billion |

| Top Companies | Honeywell Aerospace, Thales Group, Raytheon Technologies, Garmin Ltd., Rockwell Collins |

| Last Modified Date | 03 February 2026 |

Commercial Aircraft Collision Avoidance System Market Overview

Customize Commercial Aircraft Collision Avoidance System Market Report market research report

- ✔ Get in-depth analysis of Commercial Aircraft Collision Avoidance System market size, growth, and forecasts.

- ✔ Understand Commercial Aircraft Collision Avoidance System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Commercial Aircraft Collision Avoidance System

What is the Market Size & CAGR of Commercial Aircraft Collision Avoidance System market in 2033?

Commercial Aircraft Collision Avoidance System Industry Analysis

Commercial Aircraft Collision Avoidance System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Commercial Aircraft Collision Avoidance System Market Analysis Report by Region

Europe Commercial Aircraft Collision Avoidance System Market Report:

Europe's market for Commercial Aircraft Collision Avoidance Systems is projected to grow from $0.78 billion in 2023 to $1.43 billion by 2033. With a focus on enhancing aviation safety and compliance with rigorous EU safety regulations, the region is experiencing a significant technological shift towards modernized collision avoidance systems.Asia Pacific Commercial Aircraft Collision Avoidance System Market Report:

The Asia Pacific region is projected to experience robust growth in the Commercial Aircraft Collision Avoidance System market, reaching $0.83 billion by 2033, up from $0.45 billion in 2023. This growth is supported by rising air travel demand, increasing investment in airport infrastructure, and regulatory support for advanced safety technologies, particularly in countries like China and India.North America Commercial Aircraft Collision Avoidance System Market Report:

North America is anticipated to maintain its leadership in the Commercial Aircraft Collision Avoidance System market, with a substantial increase from $0.95 billion in 2023 to around $1.72 billion in 2033. This growth will be propelled by the presence of key industry players, significant investments in research and development, and stringent safety regulations governing air travel operations.South America Commercial Aircraft Collision Avoidance System Market Report:

In South America, the market for Commercial Aircraft Collision Avoidance Systems is expected to grow from $0.08 billion in 2023 to $0.15 billion by 2033. The growth is primarily driven by expanding aviation networks and the need for improved safety measures in emerging markets, enhancing the overall competitiveness of airlines in the region.Middle East & Africa Commercial Aircraft Collision Avoidance System Market Report:

The Middle East and Africa are expected to see growth from $0.23 billion in 2023 to $0.42 billion by 2033 in the Commercial Aircraft Collision Avoidance System market. Factors contributing to this growth include ongoing development in the aviation sector, the rise of budget airlines, and increased investment in airport infrastructure and safety technologies.Tell us your focus area and get a customized research report.

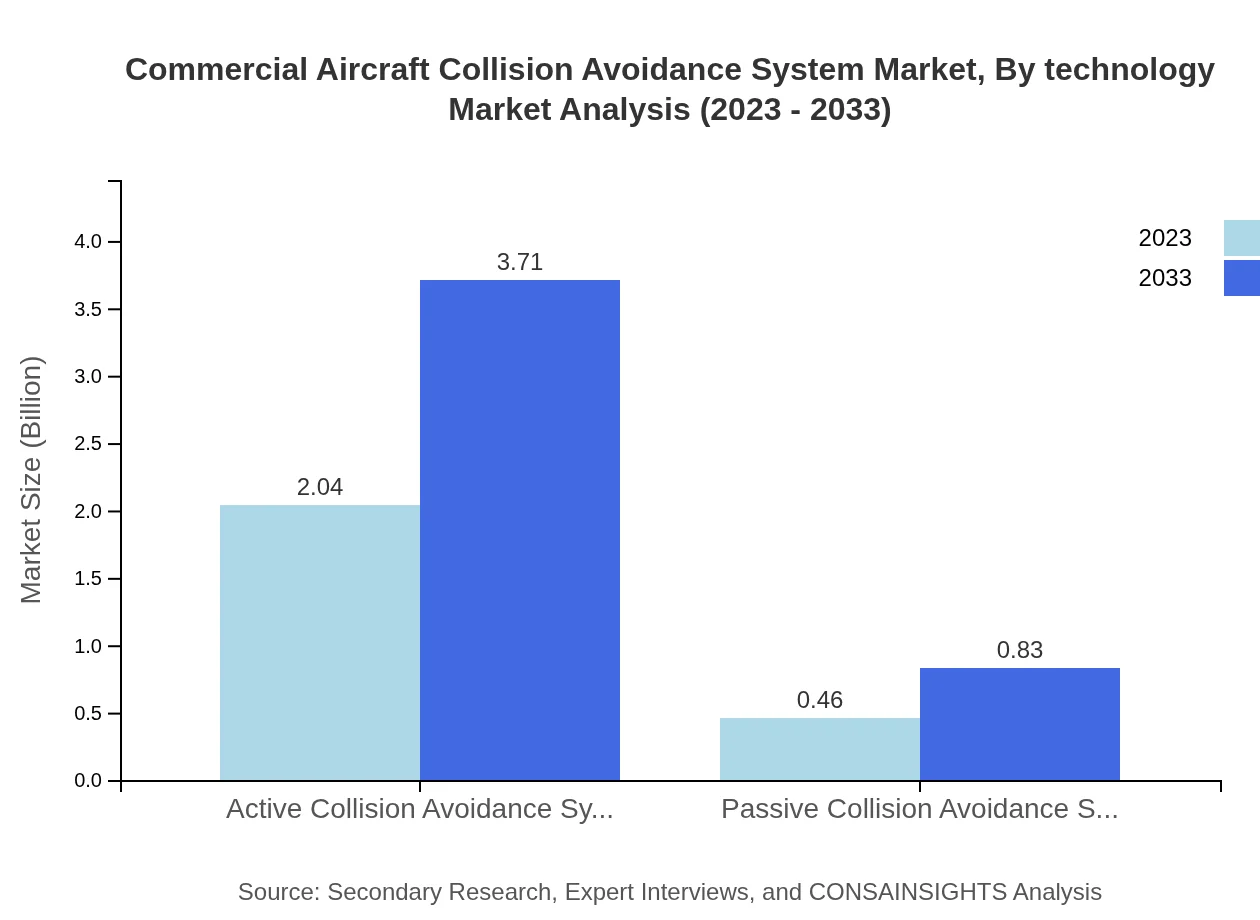

Commercial Aircraft Collision Avoidance System Market Analysis By Technology

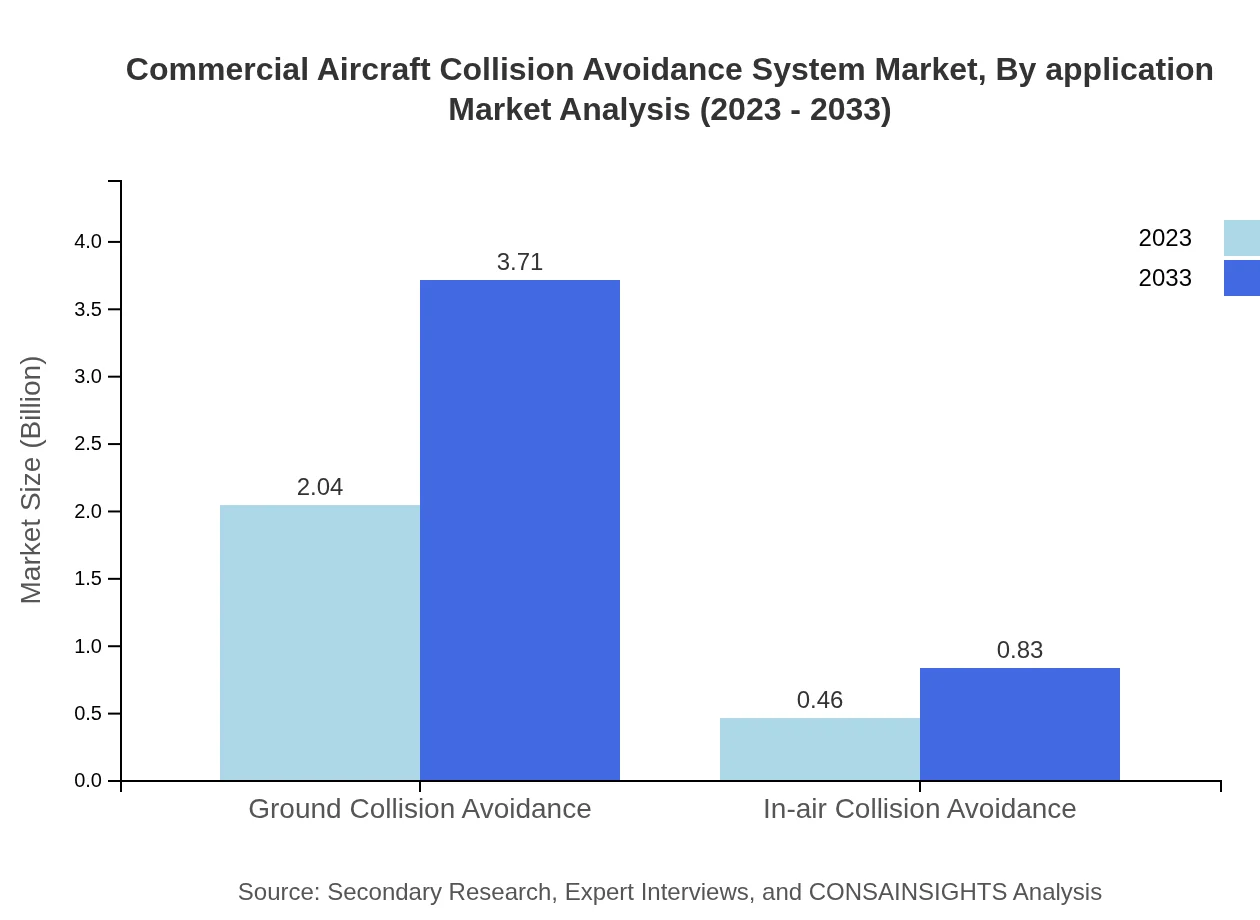

The market is dominated by Active Collision Avoidance Systems, which are projected to grow from $2.04 billion in 2023 to $3.71 billion in 2033, capturing an estimated 81.73% market share. Passive systems, although smaller, are expected to expand from $0.46 billion to $0.83 billion, representing 18.27% of the market share. These trends indicate a clear preference for proactive safety measures in aviation.

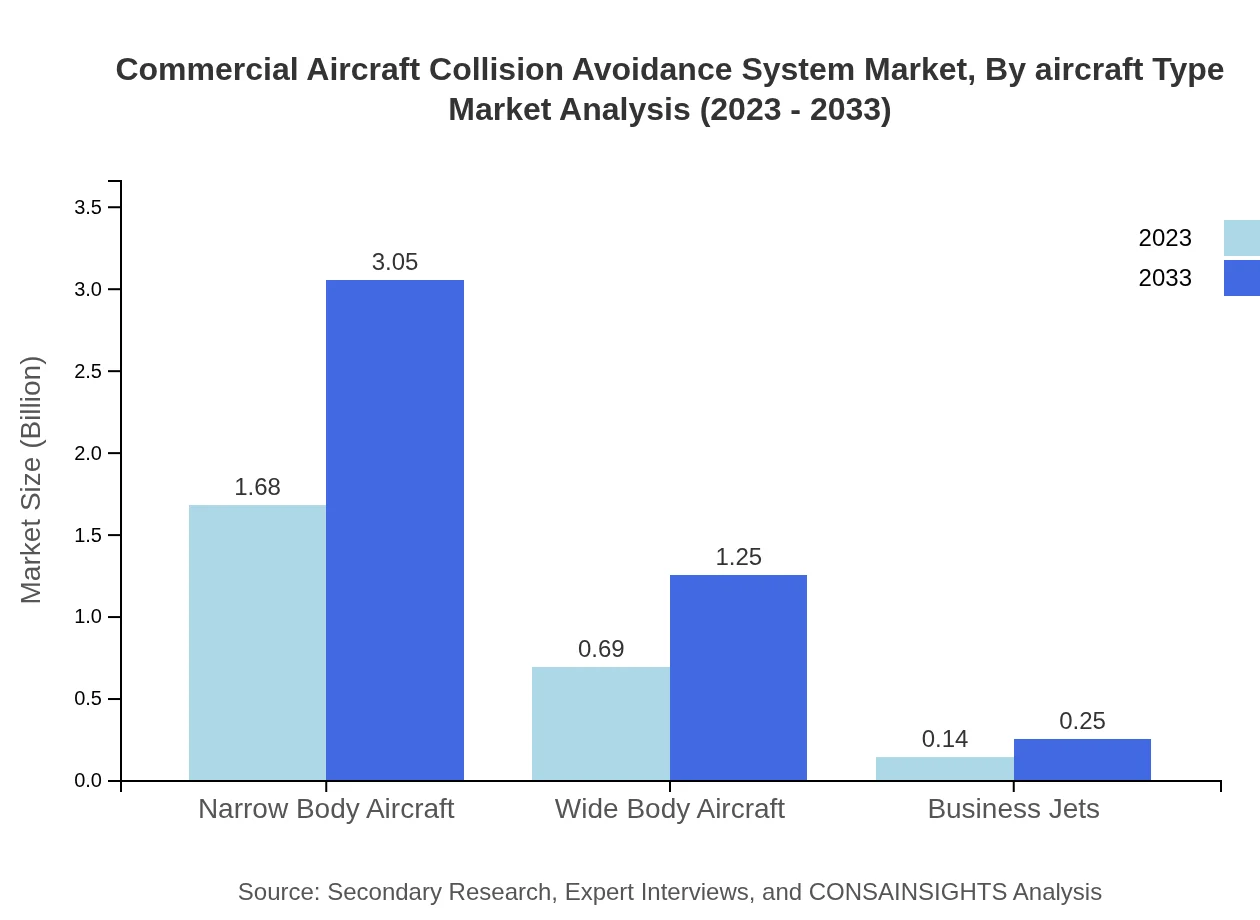

Commercial Aircraft Collision Avoidance System Market Analysis By Aircraft Type

The segmentation by aircraft type shows Narrow Body Aircraft leading the market with current figures of $1.68 billion in 2023 and expected to reach $3.05 billion by 2033, holding a 67.07% market share. Wide Body Aircraft follow with a market progression from $0.69 billion to $1.25 billion and a share of 27.45%. Business Jets also contribute significantly but remain a smaller segment at $0.14 billion, growing to $0.25 billion by 2033, reflecting a share of 5.48%.

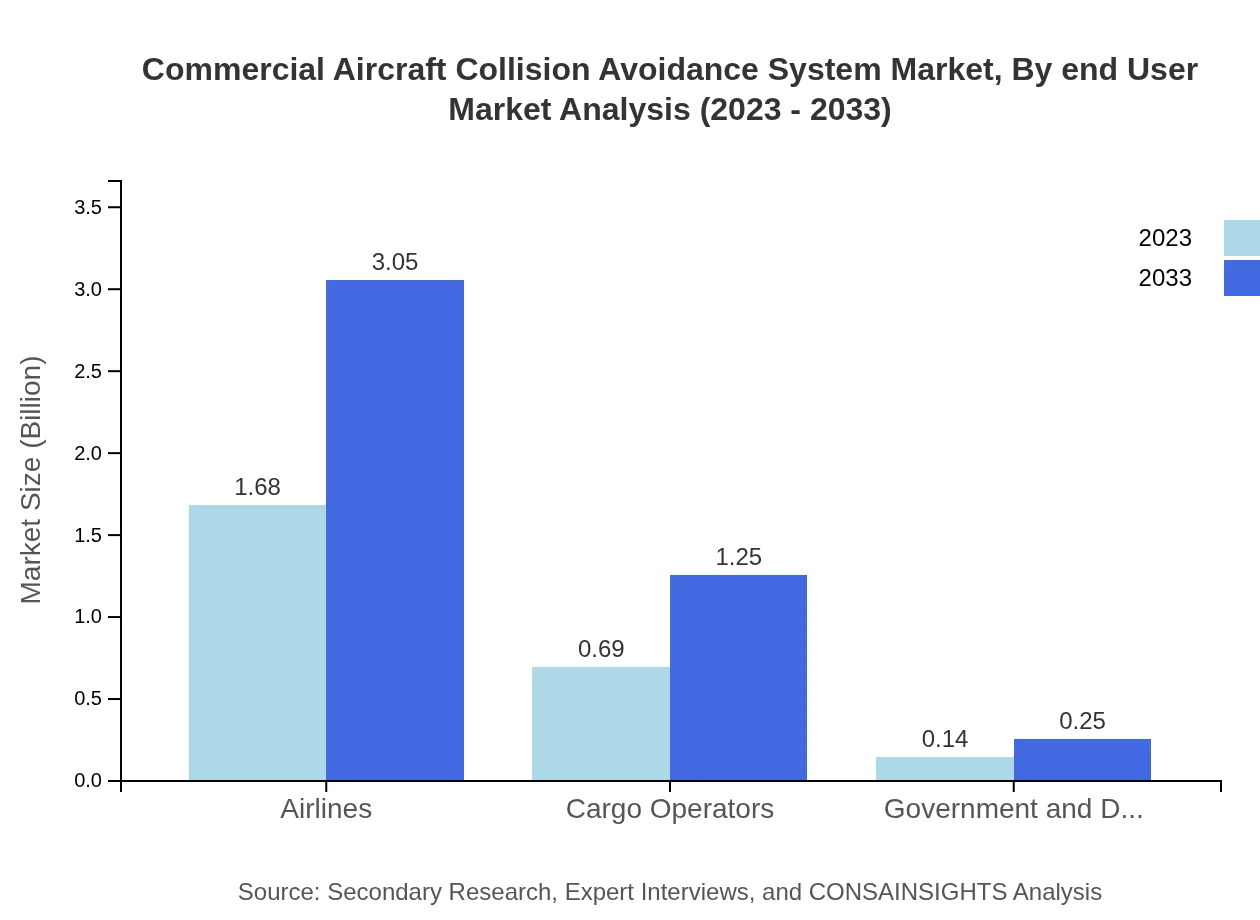

Commercial Aircraft Collision Avoidance System Market Analysis By End User

Airlines constitute the largest segment in the market, with a size of $1.68 billion in 2023, expected to rise to $3.05 billion by 2033. Cargo Operators follow with $0.69 billion growing to $1.25 billion, while the Government and Defense sector contributes $0.14 billion, aimed to increase to $0.25 billion over the same period.

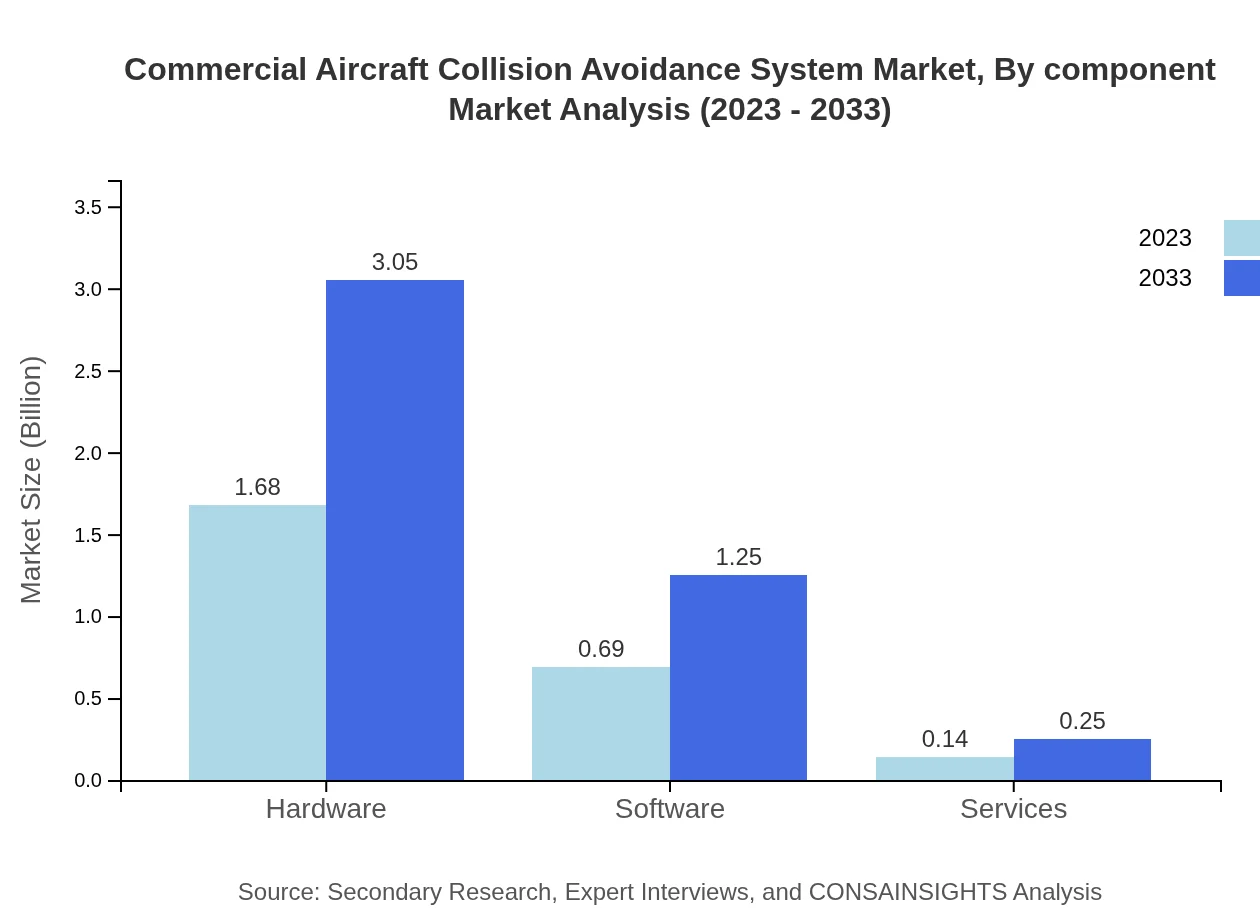

Commercial Aircraft Collision Avoidance System Market Analysis By Component

In terms of component analysis, Hardware remains the leading category, expected to grow from $1.68 billion in 2023 to $3.05 billion by 2033, holding steady at 67.07% market share. Software, meanwhile, is rising from $0.69 billion to $1.25 billion, indicating a growing reliance on software-driven solutions, while Services expand slightly from $0.14 billion to $0.25 billion.

Commercial Aircraft Collision Avoidance System Market Analysis By Application

The market application shows Ground Collision Avoidance Systems taking precedence, with a size of $2.04 billion expected to reach $3.71 billion by 2033. In-air Collision Avoidance systems are also notable, moving from $0.46 billion to $0.83 billion, which emphasizes the industry’s focus on comprehensive safety across different operational phases.

Commercial Aircraft Collision Avoidance System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Commercial Aircraft Collision Avoidance System Industry

Honeywell Aerospace:

Honeywell Aerospace is a major player in the aviation industry, providing advanced collision avoidance systems and avionics that enhance flight safety and operational efficiency.Thales Group:

Thales Group specializes in aerospace and defense, offering comprehensive solutions in collision avoidance systems and integrating them with air traffic management technologies.Raytheon Technologies:

Raytheon offers innovative technologies and systems that improve pilot situational awareness and mitigate collision risks in civilian and military aviation.Garmin Ltd.:

Garmin designs superior navigation and avionics systems, enhancing safety with advanced collision avoidance features embedded in commercial aircraft.Rockwell Collins:

Rockwell Collins specializes in communication and electronic systems, providing cutting-edge collision avoidance solutions to improve aviation safety.We're grateful to work with incredible clients.

FAQs

What is the market size of commercial Aircraft Collision Avoidance System?

The commercial aircraft collision avoidance system market is valued at approximately $2.5 billion in 2023. It is projected to grow at a CAGR of 6%, indicating significant expansion and increasing demand over the forecast period.

What are the key market players or companies in this commercial aircraft collision avoidance system industry?

Key players in the commercial aircraft collision avoidance system industry include Boeing, Honeywell International, Collins Aerospace, and Airbus. These companies lead the market with innovative technologies and comprehensive systems ensuring aviation safety.

What are the primary factors driving the growth in the commercial aircraft collision avoidance system industry?

Growth in the commercial aircraft collision avoidance system market is driven by advances in aviation technology, increasing air traffic, regulatory requirements for safety enhancements, and a heightened focus on accident prevention in the aviation sector.

Which region is the fastest Growing in the commercial aircraft collision avoidance system?

The fastest-growing region in the commercial aircraft collision avoidance system market is Europe, projected to grow from $0.78 billion in 2023 to $1.43 billion by 2033. Asia-Pacific follows closely, with a rise from $0.45 billion to $0.83 billion during the same period.

Does ConsaInsights provide customized market report data for the commercial aircraft collision avoidance system industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the commercial aircraft collision avoidance system industry, providing in-depth analysis and insights into various market segments and trends.

What deliverables can I expect from this commercial aircraft collision avoidance system market research project?

From the commercial aircraft collision avoidance system market research project, clients can expect detailed reports including market size data, growth forecasts, competitive landscape analysis, and insights into key market trends and regional analyses.

What are the market trends of commercial aircraft collision avoidance system?

Current market trends in the commercial aircraft collision avoidance system industry include a shift towards advanced active collision avoidance solutions, increased investment in R&D for safer aircraft technologies, and a growing emphasis on software integration for enhanced operational safety.