Commercial Aircraft Engines Market Report

Published Date: 03 February 2026 | Report Code: commercial-aircraft-engines

Commercial Aircraft Engines Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Commercial Aircraft Engines market, covering key insights, market trends, and comprehensive forecasts from 2023 to 2033. It highlights segment performance, regional analysis, and the impact of technological advancements in the industry.

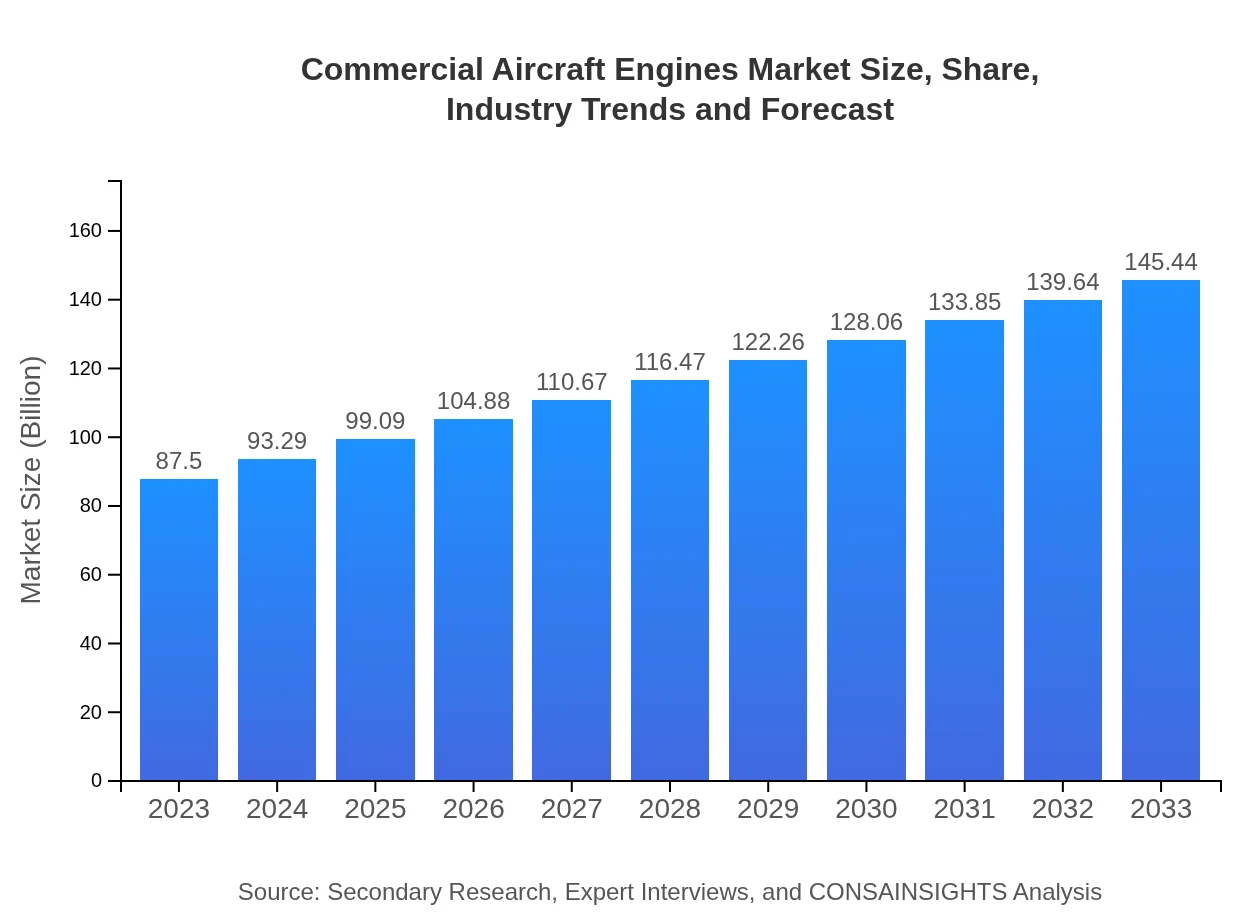

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $87.50 Billion |

| CAGR (2023-2033) | 5.1% |

| 2033 Market Size | $145.44 Billion |

| Top Companies | Pratt & Whitney, General Electric, Rolls-Royce |

| Last Modified Date | 03 February 2026 |

Commercial Aircraft Engines Market Overview

Customize Commercial Aircraft Engines Market Report market research report

- ✔ Get in-depth analysis of Commercial Aircraft Engines market size, growth, and forecasts.

- ✔ Understand Commercial Aircraft Engines's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Commercial Aircraft Engines

What is the Market Size & CAGR of Commercial Aircraft Engines market in 2023?

Commercial Aircraft Engines Industry Analysis

Commercial Aircraft Engines Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Commercial Aircraft Engines Market Analysis Report by Region

Europe Commercial Aircraft Engines Market Report:

The European market is forecasted to grow from USD 23.80 billion in 2023 to USD 39.56 billion by 2033. Regulatory frameworks aimed at reducing aircraft emissions are prompting airlines to invest in more efficient engines.Asia Pacific Commercial Aircraft Engines Market Report:

In the Asia Pacific region, the market is anticipated to grow from USD 18.53 billion in 2023 to USD 30.80 billion by 2033. This growth is driven by an increase in air travel demand, particularly in countries like China and India, which are boosting their airline operations and fleet sizes to accommodate rising passenger numbers.North America Commercial Aircraft Engines Market Report:

North America leads the market, projected to grow from USD 31.07 billion in 2023 to USD 51.64 billion by 2033. The strong presence of major aircraft manufacturers and engine suppliers, coupled with high air passenger traffic, drives continuous demand for advanced engines.South America Commercial Aircraft Engines Market Report:

The South American market for Commercial Aircraft Engines is expected to expand from USD 4.95 billion in 2023 to USD 8.23 billion by 2033. Economic recovery and increased tourism are key factors stimulating this growth, enabling airlines to enhance their fleet performance and efficiency.Middle East & Africa Commercial Aircraft Engines Market Report:

In the Middle East and Africa, the market is expected to increase from USD 9.14 billion in 2023 to USD 15.20 billion by 2033. The region's strategic location as a global aviation hub is catalyzing growth in both passenger and cargo aircraft operations.Tell us your focus area and get a customized research report.

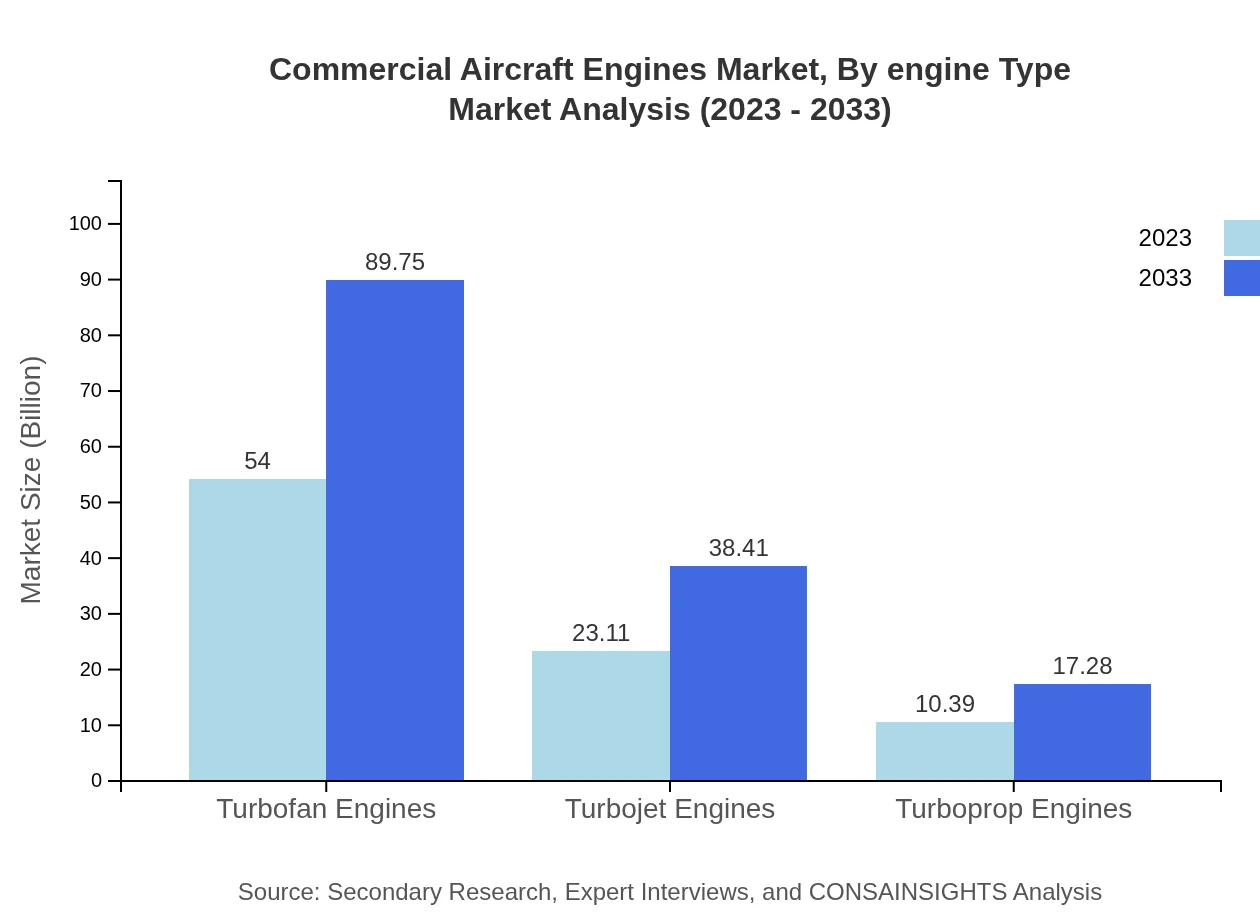

Commercial Aircraft Engines Market Analysis By Engine Type

The market by engine type highlights the performance of turbofan engines as a leading choice among commercial airlines, anticipated to grow from USD 54.00 billion in 2023 to USD 89.75 billion by 2033. Turbojet engines, although less prevalent, are also growing, with a forecast increase from USD 23.11 billion to USD 38.41 billion, driven by military and specialized applications. Turboprop engines, which are primarily used for regional and short-haul flights, are expected to grow from USD 10.39 billion to USD 17.28 billion.

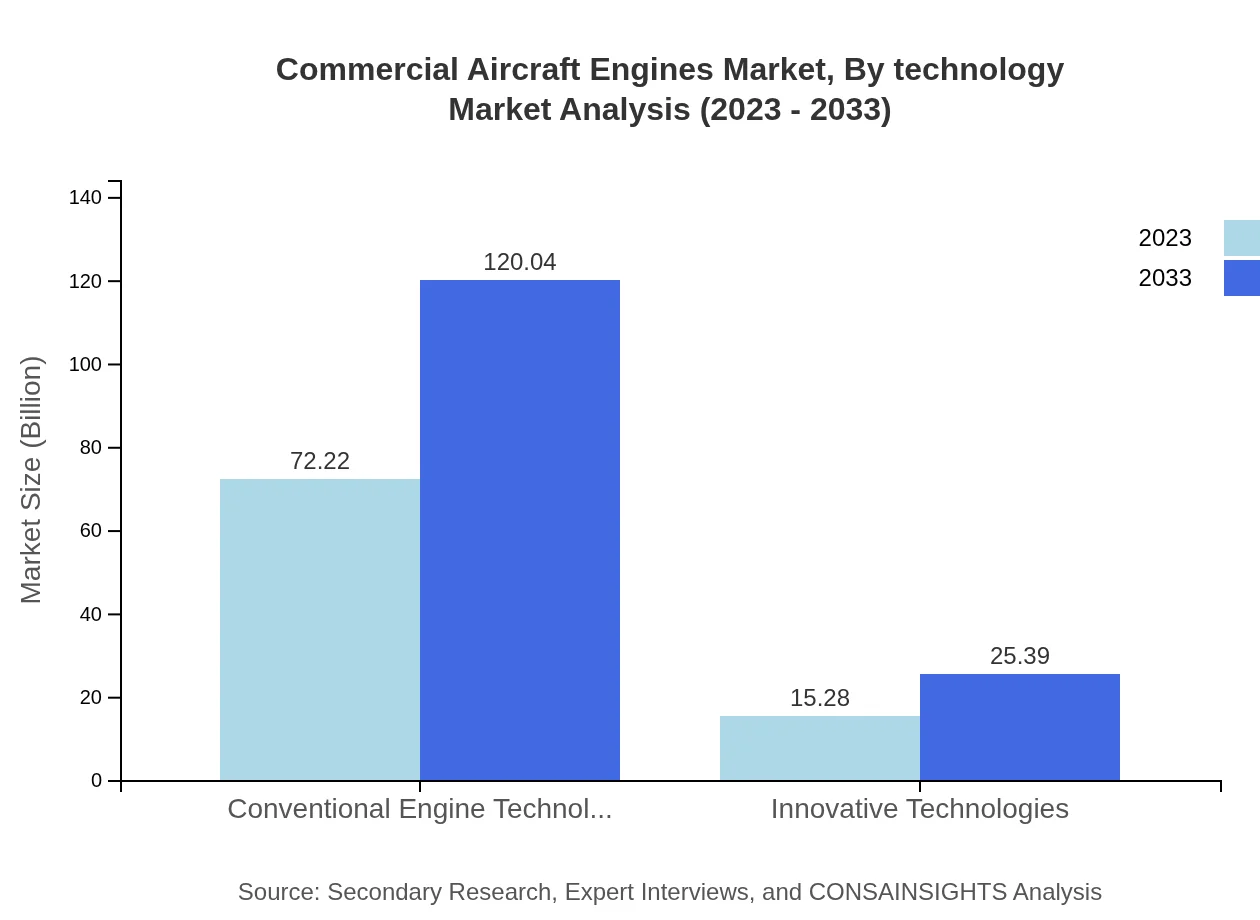

Commercial Aircraft Engines Market Analysis By Technology

In terms of technology, the segment focusing on conventional engine technology will dominate the market, expected to grow from USD 72.22 billion in 2023 to USD 120.04 billion by 2033. However, innovative technologies are gaining traction as well, with their market size expected to rise from USD 15.28 billion in 2023 to USD 25.39 billion, as manufacturers explore more sustainable solutions.

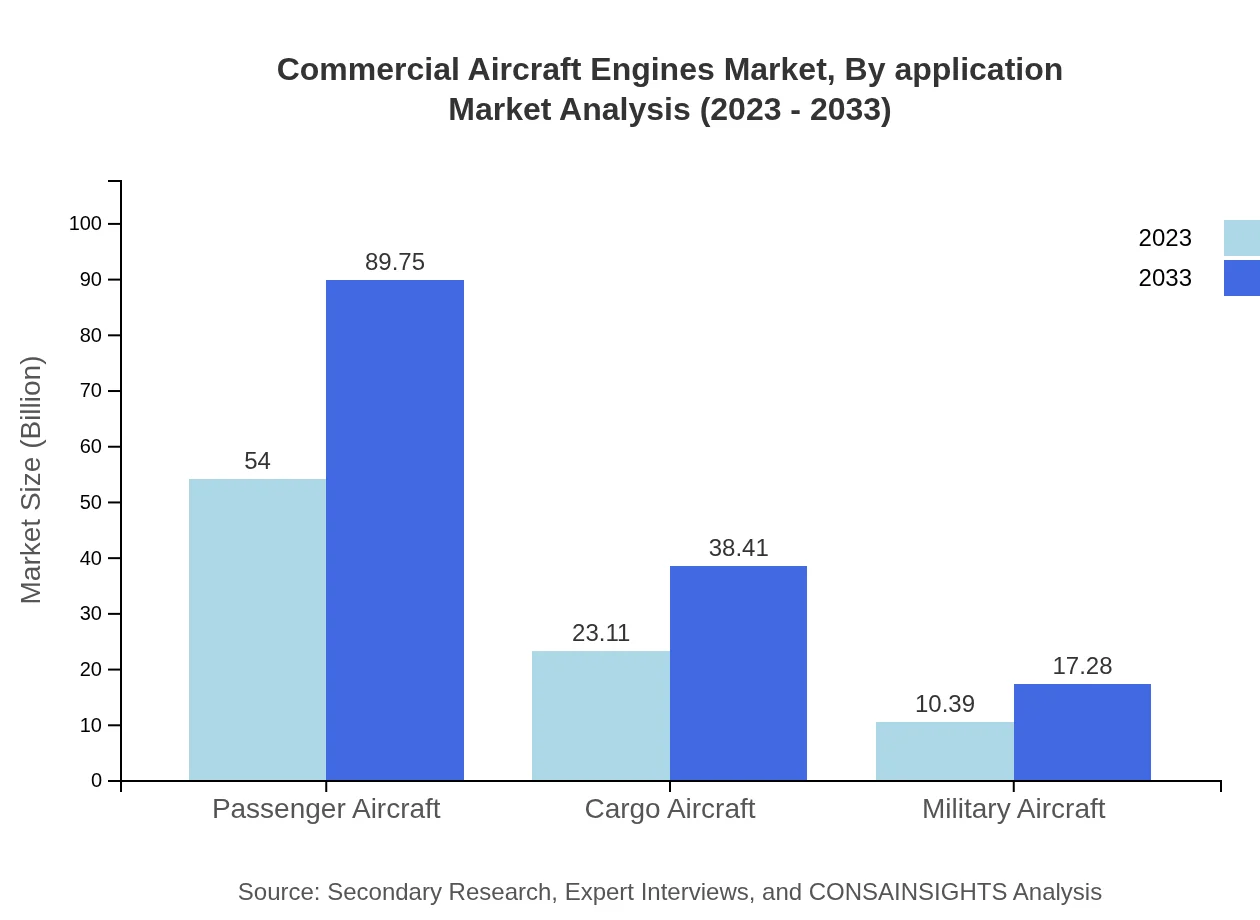

Commercial Aircraft Engines Market Analysis By Application

Under the application domain, the passenger aircraft segment leads the market, projected to grow from USD 54.00 billion in 2023 to USD 89.75 billion by 2033, reflecting growing demand for air travel. The cargo aircraft segment will also experience growth, expected to rise from USD 23.11 billion to USD 38.41 billion, while military aircraft demand is projected to increase from USD 10.39 billion to USD 17.28 billion.

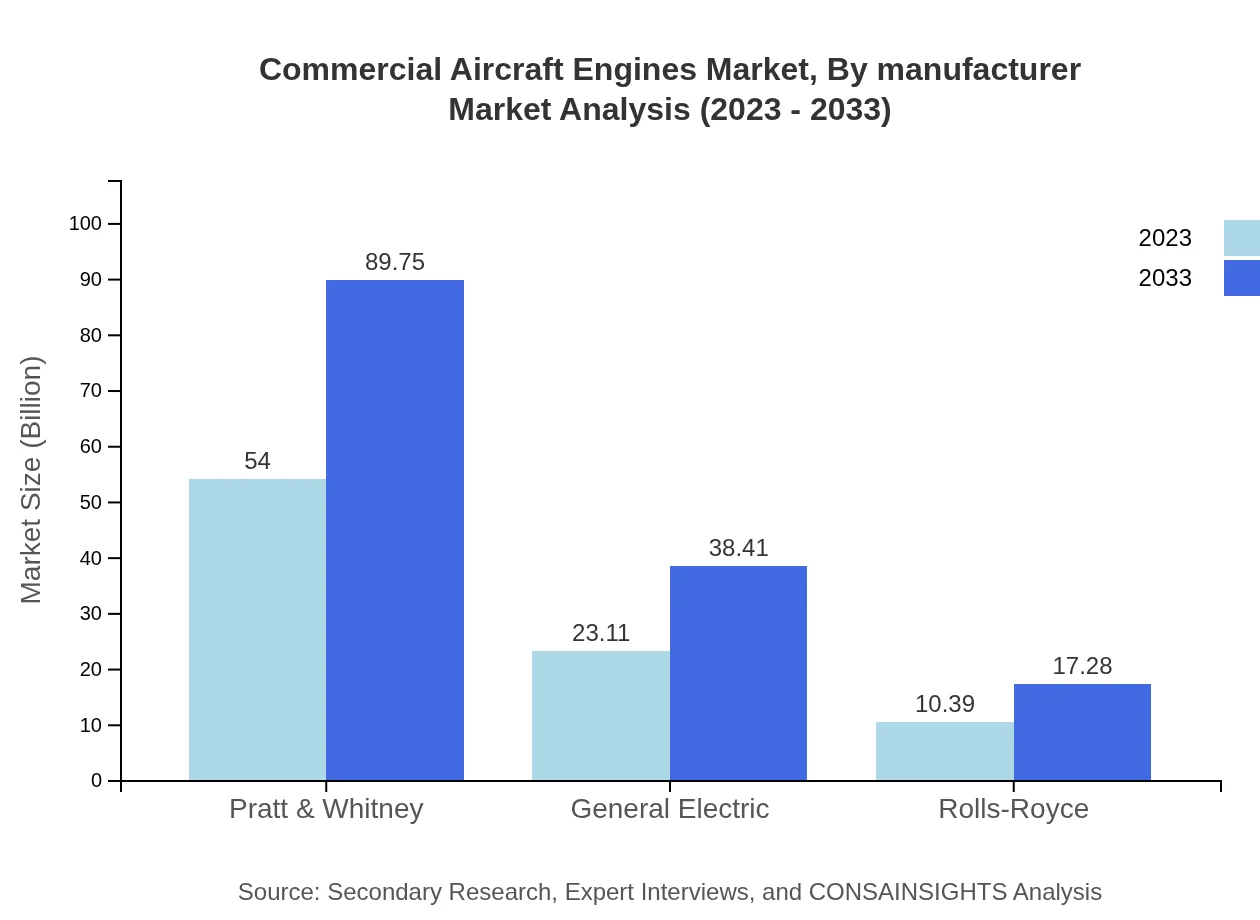

Commercial Aircraft Engines Market Analysis By Manufacturer

Market analysis by manufacturer underscores the dominance of key players like Pratt & Whitney, General Electric, and Rolls-Royce. For instance, Pratt & Whitney will have a notable market size increase from USD 54.00 billion to USD 89.75 billion, while General Electric and Rolls-Royce continue to solidify their market shares focusing on innovation and efficiency.

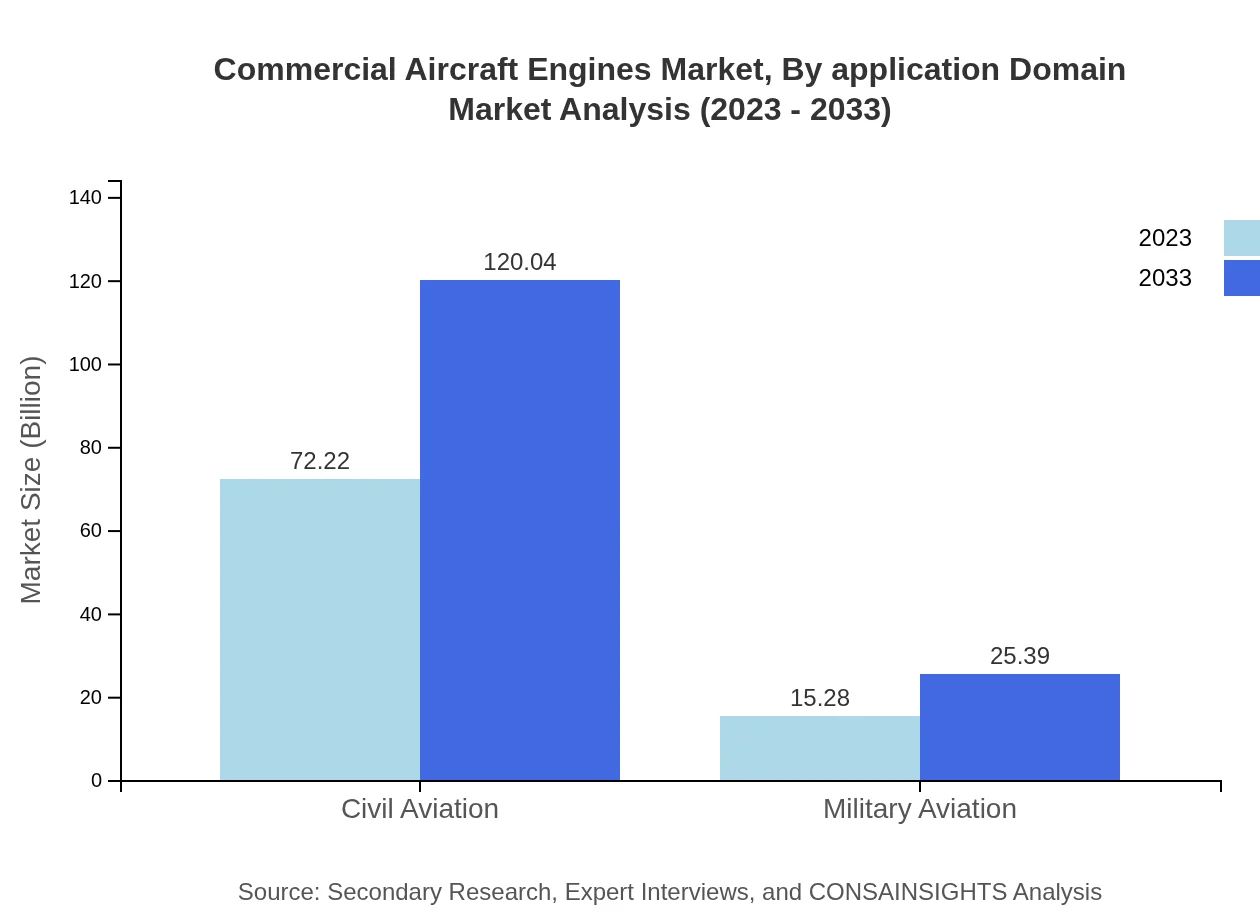

Commercial Aircraft Engines Market Analysis By Application Domain

The analysis of application domains indicates that civil aviation will maintain its leading share, growing from USD 72.22 billion in 2023 to USD 120.04 billion by 2033, while military aviation is expected to grow from USD 15.28 billion to USD 25.39 billion as governments expand their defense capabilities.

Commercial Aircraft Engines Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Commercial Aircraft Engines Industry

Pratt & Whitney:

A leader in aircraft engines, Pratt & Whitney is known for its innovative turbofan engines and commitment to sustainability.General Electric:

General Electric is a major player in the aerospace sector, focusing on developing efficient engines and technological solutions.Rolls-Royce:

Specializing in high-performance aircraft engines, Rolls-Royce is dedicated to advancing technology and improving engine efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of commercial aircraft engines?

The global commercial aircraft engines market is projected to reach $87.5 billion by 2033, growing at a CAGR of 5.1%. With increasing air travel demand, this sector is expected to be a significant contributor to aviation technologies.

What are the key market players or companies in this commercial aircraft engines industry?

Key players in the commercial aircraft engines market include Pratt & Whitney, General Electric, and Rolls-Royce, which dominate through innovative technologies and extensive product offerings within the aviation industry.

What are the primary factors driving the growth in the commercial aircraft engines industry?

Growth factors include rising passenger air traffic, advancements in fuel-efficient engine technologies, regulatory mandates for emissions reductions, and increasing military and cargo aviation needs.

Which region is the fastest Growing in the commercial aircraft engines market?

The fastest-growing region is North America, expected to expand from a market size of $31.07 billion in 2023 to $51.64 billion by 2033, driven by major aviation companies and technological advancements.

Does ConsaInsights provide customized market report data for the commercial aircraft engines industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs, covering various aspects of the commercial aircraft engines industry.

What deliverables can I expect from this commercial aircraft engines market research project?

Deliverables include an in-depth analysis report, market size and forecasts, segment profiles, competitive landscape, and insights into major trends and regional performance.

What are the market trends of commercial aircraft engines?

Current trends include a shift toward innovative technologies, increased investments in sustainable aviation, development of hybrid engines, and a focus on enhancing operational efficiencies in airline operations.