Commercial Aircraft In Seat Power System Market Report

Published Date: 03 February 2026 | Report Code: commercial-aircraft-in-seat-power-system

Commercial Aircraft In Seat Power System Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Commercial Aircraft In-Seat Power System market from 2023 to 2033, covering market size, growth trends, segmentation, and key players to deliver valuable insights for stakeholders.

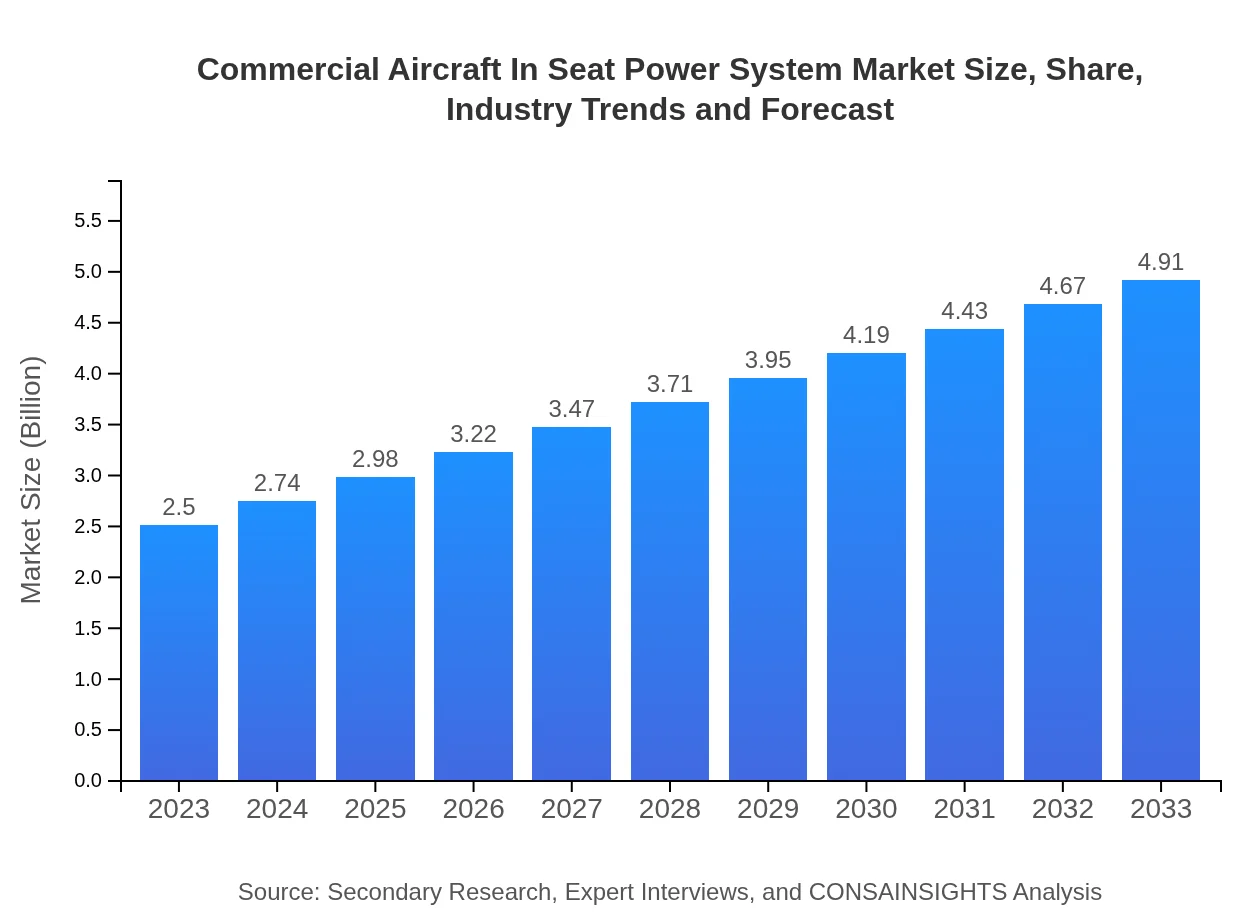

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Boeing , Airbus, Honeywell , Safran, Rockwell Collins |

| Last Modified Date | 03 February 2026 |

Commercial Aircraft In Seat Power System Market Overview

Customize Commercial Aircraft In Seat Power System Market Report market research report

- ✔ Get in-depth analysis of Commercial Aircraft In Seat Power System market size, growth, and forecasts.

- ✔ Understand Commercial Aircraft In Seat Power System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Commercial Aircraft In Seat Power System

What is the Market Size & CAGR of Commercial Aircraft In Seat Power System market in 2023 and 2033?

Commercial Aircraft In Seat Power System Industry Analysis

Commercial Aircraft In Seat Power System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Commercial Aircraft In Seat Power System Market Analysis Report by Region

Europe Commercial Aircraft In Seat Power System Market Report:

In Europe, the market is emerging from a valuation of $0.75 billion in 2023 to an anticipated $1.48 billion by 2033, driven by stringent regulations for passenger comfort and safety, as well as the growing trend of eco-sustainability.Asia Pacific Commercial Aircraft In Seat Power System Market Report:

The Asia Pacific region holds a significant share of the Commercial Aircraft In-Seat Power System market, valued at $0.45 billion in 2023, projected to grow to $0.89 billion by 2033. The surge in air travel demand, increasing middle-class population, and rapid fleet expansions by airlines contribute to this growth trajectory.North America Commercial Aircraft In Seat Power System Market Report:

North America is expected to maintain a lead in the Commercial Aircraft In-Seat Power System market, projected to grow from $0.95 billion in 2023 to $1.86 billion by 2033. The region benefits from technological innovation, established airlines, and consistent upgrades of aircraft to include advanced in-seat power solutions.South America Commercial Aircraft In Seat Power System Market Report:

In South America, the market for Commercial Aircraft In-Seat Power Systems is relatively smaller, with a market size of $0.03 billion in 2023, expected to reach $0.07 billion by 2033. The limited growth is attributed to economic fluctuations and a slow recovery in air travel post-pandemic.Middle East & Africa Commercial Aircraft In Seat Power System Market Report:

The Middle East and Africa region is also witnessing growth, with the market projected to grow from $0.32 billion in 2023 to $0.62 billion by 2033. The expansion of regional carriers and increased investment in airport infrastructure are key growth contributors.Tell us your focus area and get a customized research report.

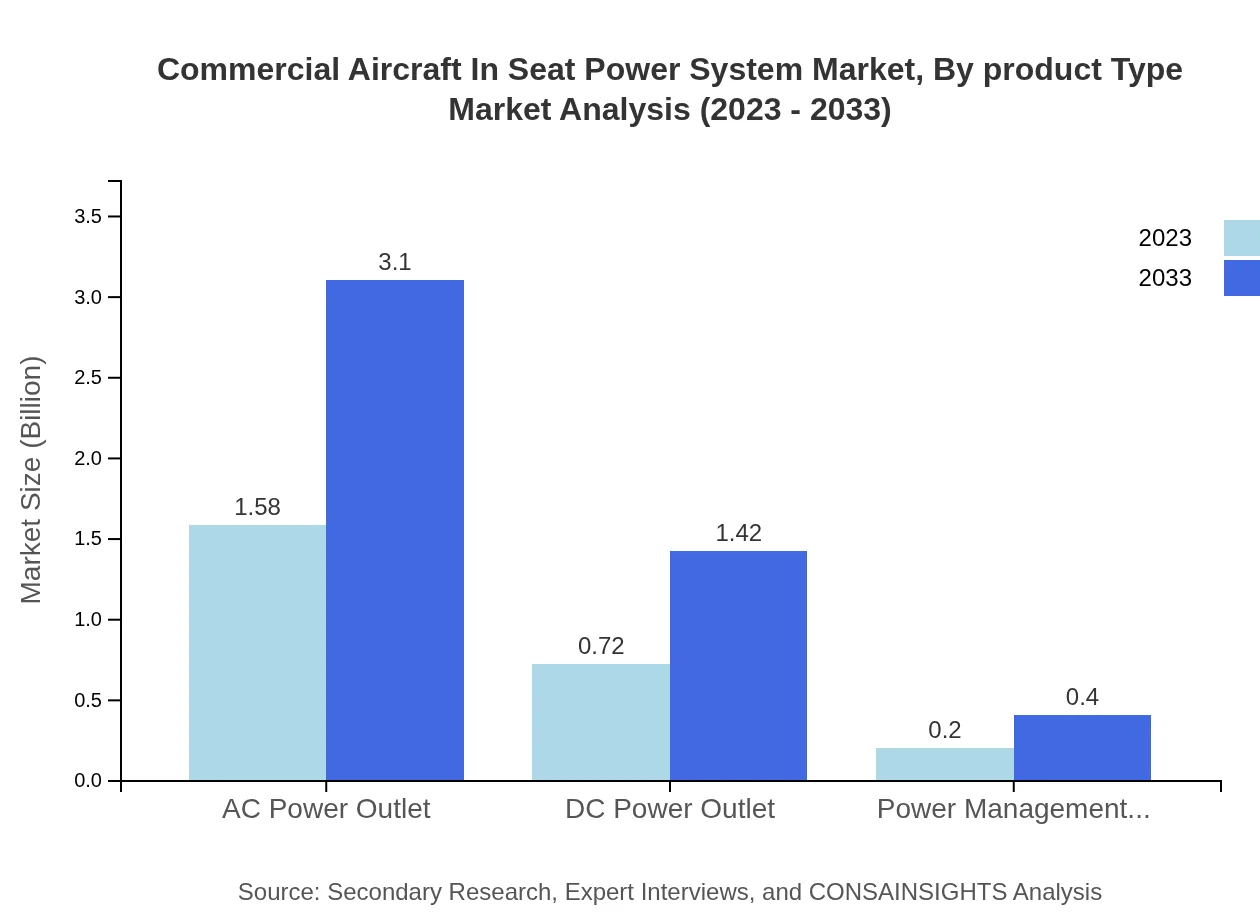

Commercial Aircraft In Seat Power System Market Analysis By Product Type

The Commercial Aircraft In-Seat Power System Market is significantly influenced by product types, notably AC Power Outlets which dominate this segment with a share of 63.14% in 2023 and expected to hold consistent growth through 2033. Meanwhile, DC Power Outlets and Power Management Units account for 28.8% and 8.06% shares respectively. The sales of Legacy Systems will remain formidable as they cater to most airlines, while next-generation systems are expected to capture incremental trends in passenger preferences for versatility.

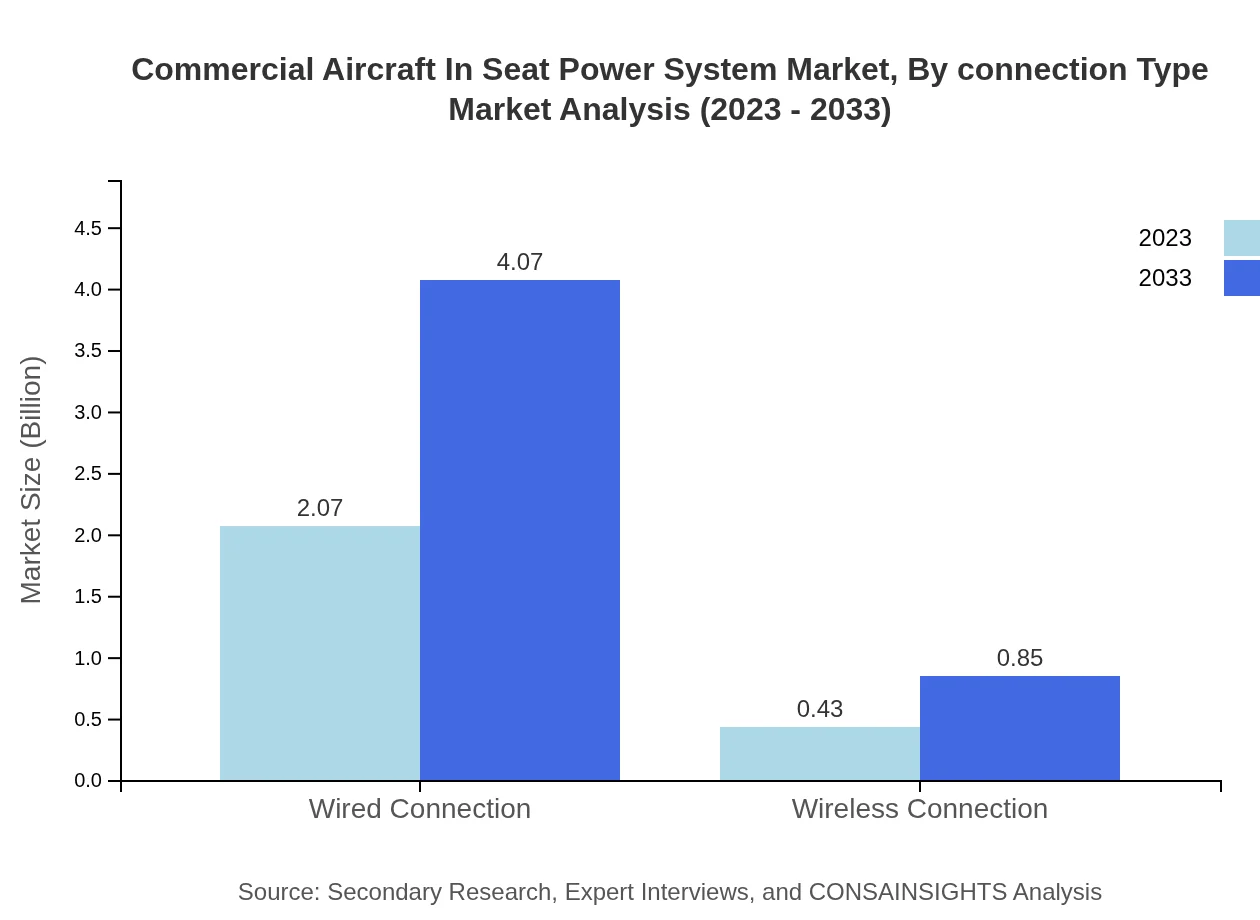

Commercial Aircraft In Seat Power System Market Analysis By Connection Type

Wired Connections dominate with an 82.76% share in 2023, as airlines prefer the reliability of hard-wired systems. Conversely, Wireless Connections, emerging at 17.24%, are experiencing increased adoption as passenger demand for cable-free convenience grows, expected to double by 2033.

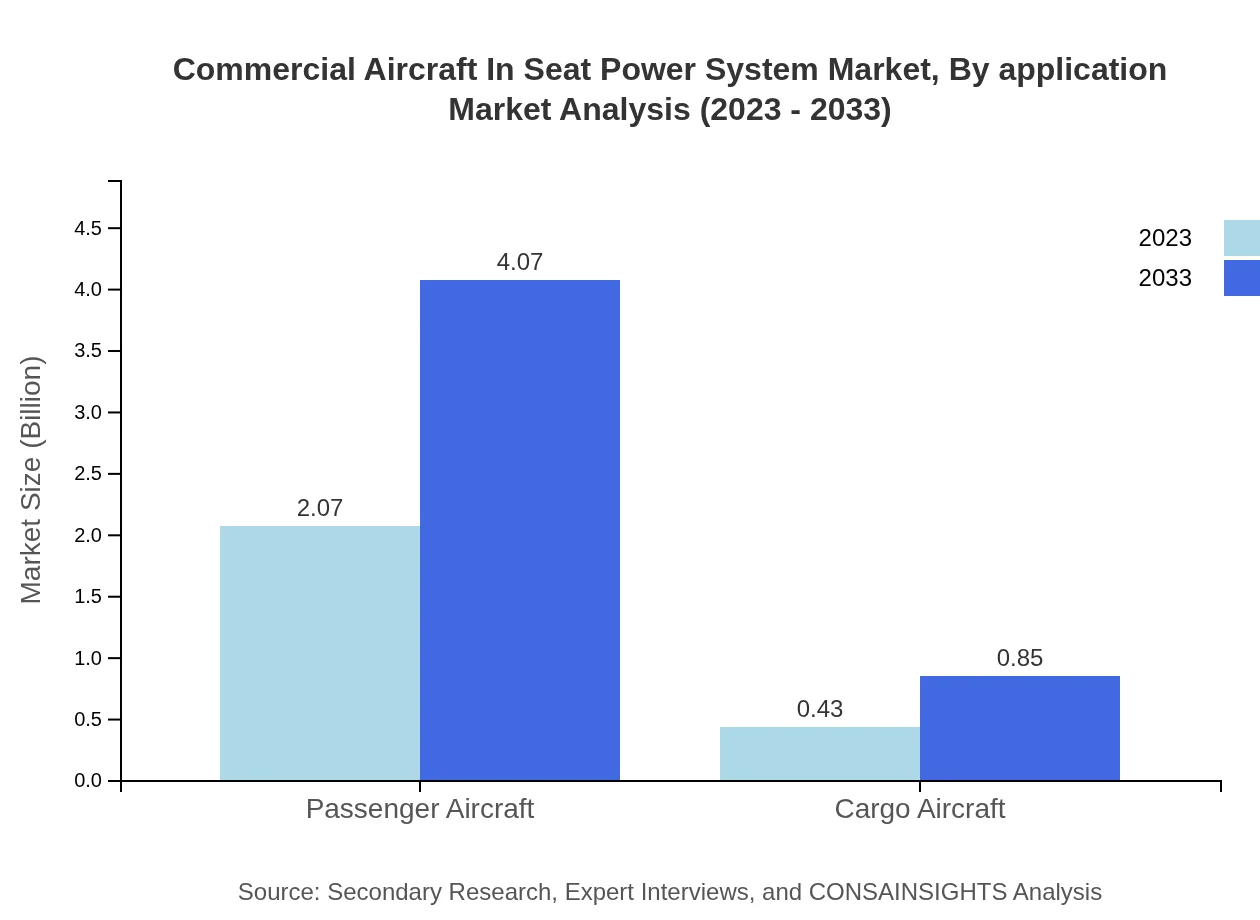

Commercial Aircraft In Seat Power System Market Analysis By Application

In the application segment, the Passenger Aircraft category holds a sizable stake at 82.76% in 2023, catering largely to commercial airlines. Cargo Aircraft utilize 17.24% of power systems, indicating a focused demand for system efficiency and performance enhancements in freight transport.

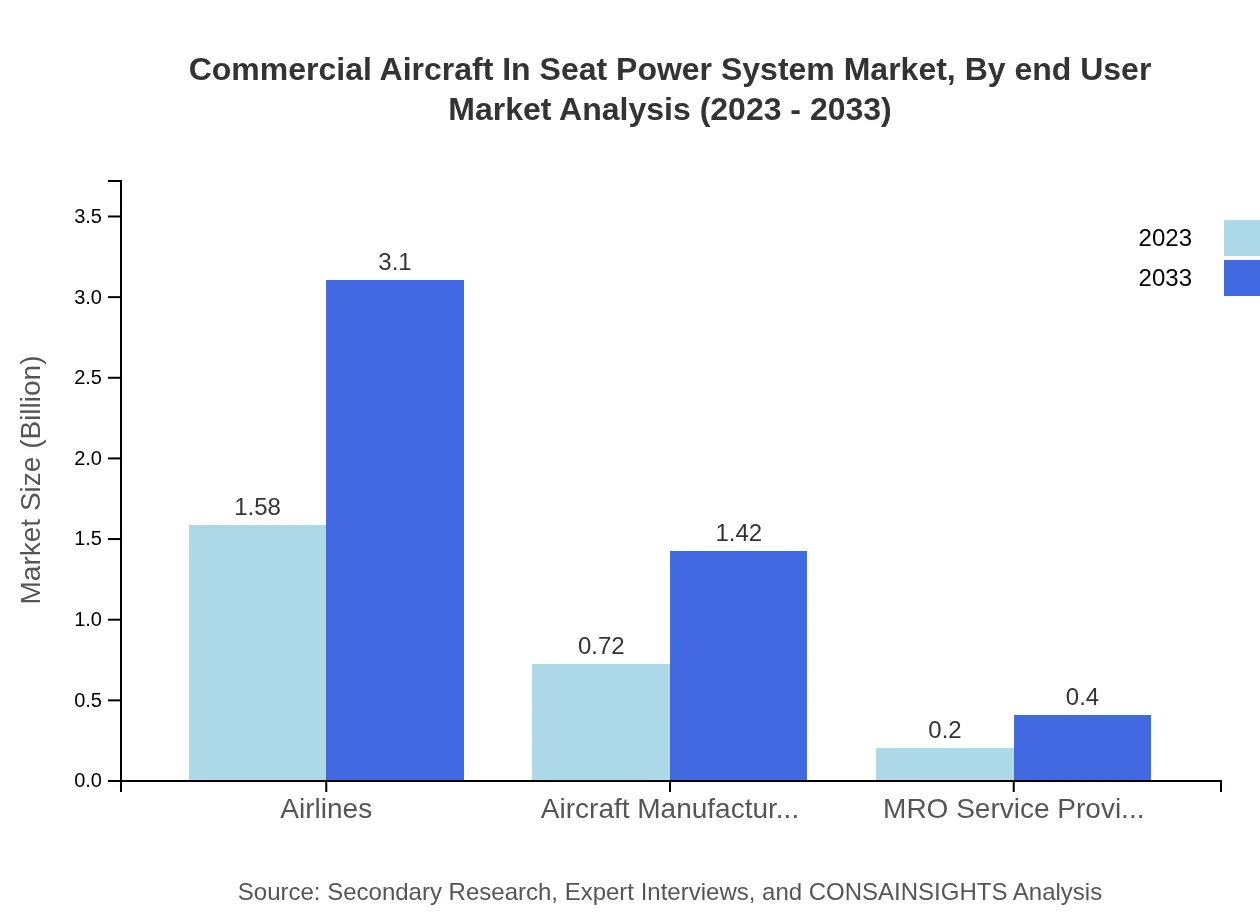

Commercial Aircraft In Seat Power System Market Analysis By End User

Airlines are the primary end-users, accounting for 63.14% of the market share in 2023 with estimated growth projected through 2033. Aircraft Manufacturers and MRO Service Providers both exhibit steady growth rates, as they innovate their offerings in line with evolving passenger expectations and maintenance needs.

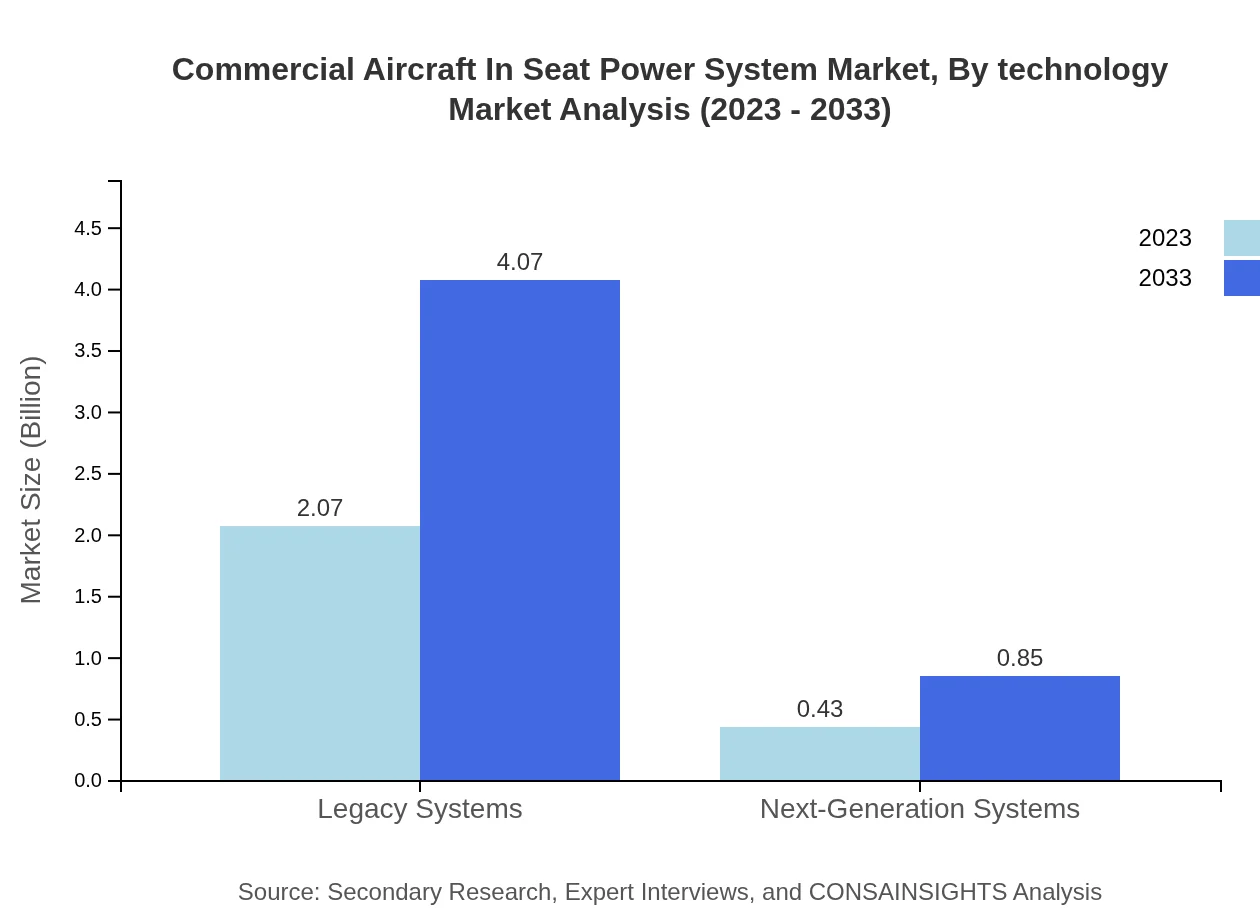

Commercial Aircraft In Seat Power System Market Analysis By Technology

Legacy Systems continue to dominate the technology landscape with an 82.76% market share in 2023, yet Next-Generation Systems are progressively being integrated due to their advantages in energy consumption and user-friendliness, forecasted to capture an increasing share as airlines upgrade their fleets over the decade.

Commercial Aircraft In Seat Power System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Commercial Aircraft In Seat Power System Industry

Boeing :

A leading aerospace manufacturer known for its innovation in aircraft design and power systems integration, contributing significantly to the in-seat power system domain.Airbus:

An essential player in commercial aircraft manufacturing with a strong emphasis on passenger comfort and advanced power management systems.Honeywell :

Provides well-engineered power management solutions that cater to the needs of modern commercial aircraft, enhancing both operational efficiency and passenger satisfaction.Safran:

Focuses on interconnected systems in aviation that revolutionize passenger experiences, including the development of innovative in-seat power technologies.Rockwell Collins:

Specializes in aviation electronics and connectivity solutions, significantly contributing to the advanced in-seat power systems relied upon by many airlines.We're grateful to work with incredible clients.

FAQs

What is the market size of commercial Aircraft In Seat Power System?

The market size for the commercial aircraft in-seat power system is projected to reach approximately $2.5 billion in 2023, with a CAGR of 6.8% expected until 2033, indicating robust growth in demand for in-flight power solutions.

What are the key market players or companies in this commercial Aircraft In Seat Power System industry?

Key players in the commercial aircraft in-seat power system market include major manufacturers and service providers involved in the design and production of power systems, ensuring competitiveness through innovation and technology advancements.

What are the primary factors driving the growth in the commercial Aircraft In Seat Power System industry?

Growth is primarily driven by increasing passenger demand for onboard connectivity and power solutions, advancements in technology leading to more efficient systems, and the expansion of air travel in emerging markets.

Which region is the fastest Growing in the commercial Aircraft In Seat Power System?

The Asia Pacific region shows remarkable growth potential, with the market expanding from $0.45 billion in 2023 to $0.89 billion by 2033, reflecting a strong increase in airline capacity and passenger traffic.

Does ConsaInsights provide customized market report data for the commercial Aircraft In Seat Power System industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients, providing insights into market trends, competitive landscape, and regional performance of the commercial aircraft in-seat power system.

What deliverables can I expect from this commercial Aircraft In Seat Power System market research project?

Expect comprehensive deliverables including an in-depth market analysis, trend identification, regional segmentation data, competitive landscape, and strategic recommendations to support decision-making.

What are the market trends of commercial Aircraft In Seat Power System?

Current trends include increased use of wireless power solutions, integration of next-generation systems into passenger aircraft, and a shift towards sustainable energy sources in power management for commercial air travel.