Commercial Aircraft Landing Gear Market Report

Published Date: 03 February 2026 | Report Code: commercial-aircraft-landing-gear

Commercial Aircraft Landing Gear Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Commercial Aircraft Landing Gear market, spanning the forecast period from 2023 to 2033. It covers market size, trends, regional insights, technological advancements, and competitive landscapes to offer valuable insights for stakeholders and industry participants.

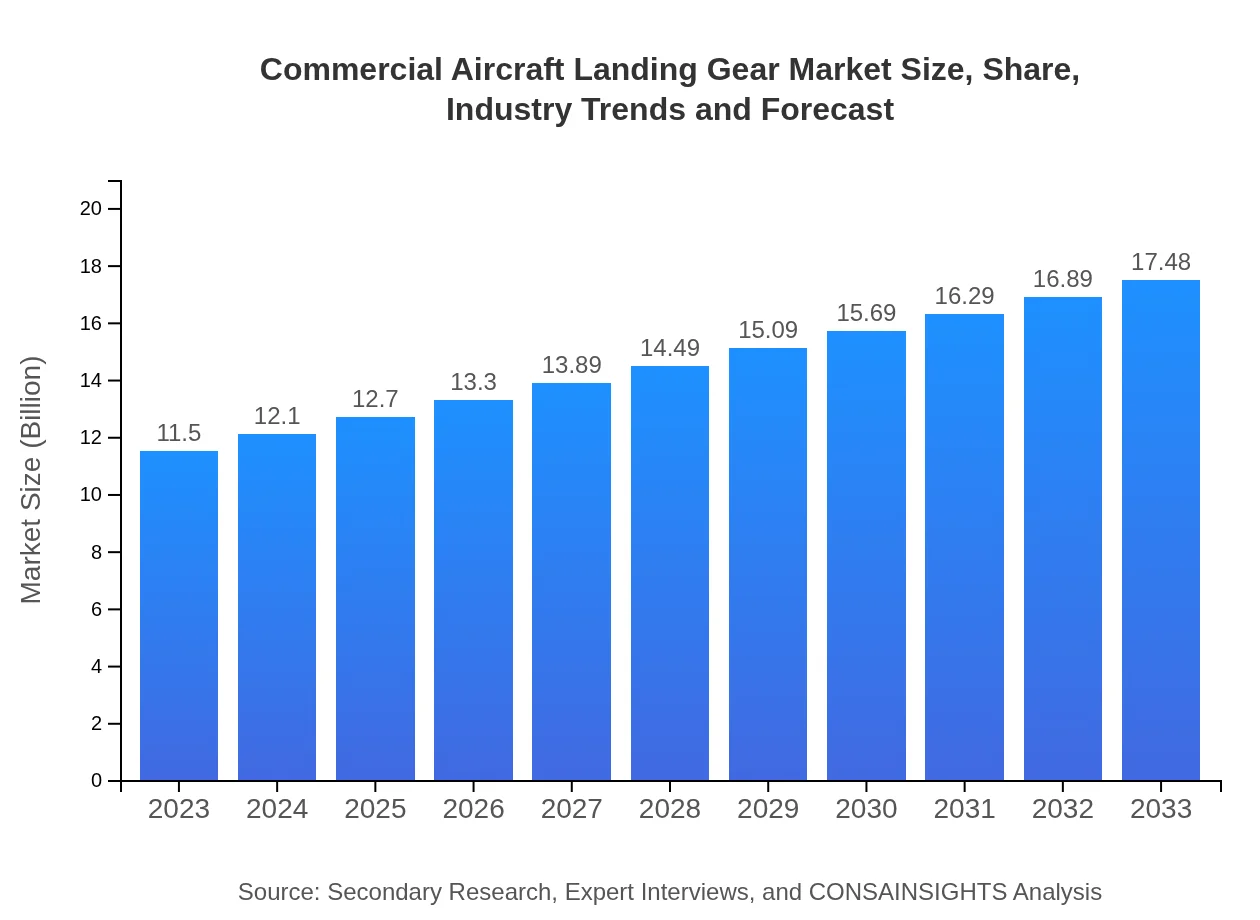

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $11.50 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $17.48 Billion |

| Top Companies | Honeywell International Inc., UTC Aerospace Systems, Safran Landing Systems, Woodward, Inc. |

| Last Modified Date | 03 February 2026 |

Commercial Aircraft Landing Gear Market Overview

Customize Commercial Aircraft Landing Gear Market Report market research report

- ✔ Get in-depth analysis of Commercial Aircraft Landing Gear market size, growth, and forecasts.

- ✔ Understand Commercial Aircraft Landing Gear's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Commercial Aircraft Landing Gear

What is the Market Size & CAGR of Commercial Aircraft Landing Gear market in 2023?

Commercial Aircraft Landing Gear Industry Analysis

Commercial Aircraft Landing Gear Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Commercial Aircraft Landing Gear Market Analysis Report by Region

Europe Commercial Aircraft Landing Gear Market Report:

In Europe, the market is forecast to grow from USD 3.30 billion in 2023 to USD 5.02 billion in 2033. The region's strict aviation regulations and emphasis on safety are driving advancements in landing gear technology.Asia Pacific Commercial Aircraft Landing Gear Market Report:

In the Asia Pacific region, the Commercial Aircraft Landing Gear market is anticipated to grow from USD 2.45 billion in 2023 to USD 3.72 billion in 2033. Countries like China and India are witnessing substantial increases in air travel demand, leading to higher aircraft manufacturing and delivery rates, which will consequently drive landing gear demand.North America Commercial Aircraft Landing Gear Market Report:

North America, with a market size of USD 3.71 billion in 2023, is expected to reach USD 5.65 billion by 2033. The presence of major aircraft manufacturers and airlines, coupled with continuous technological innovation in landing gear systems, underscores the region's leading market position.South America Commercial Aircraft Landing Gear Market Report:

The South American market is projected to expand from USD 1.14 billion in 2023 to USD 1.73 billion in 2033. Factors contributing to this growth include increasing air traffic and investment in new aircraft to support regional connectivity.Middle East & Africa Commercial Aircraft Landing Gear Market Report:

The Middle East and Africa market is anticipated to develop from USD 0.89 billion in 2023 to USD 1.36 billion in 2033, facilitated by increasing airline operations and investments in airport infrastructures, enhancing aircraft capacity and landing gear needs.Tell us your focus area and get a customized research report.

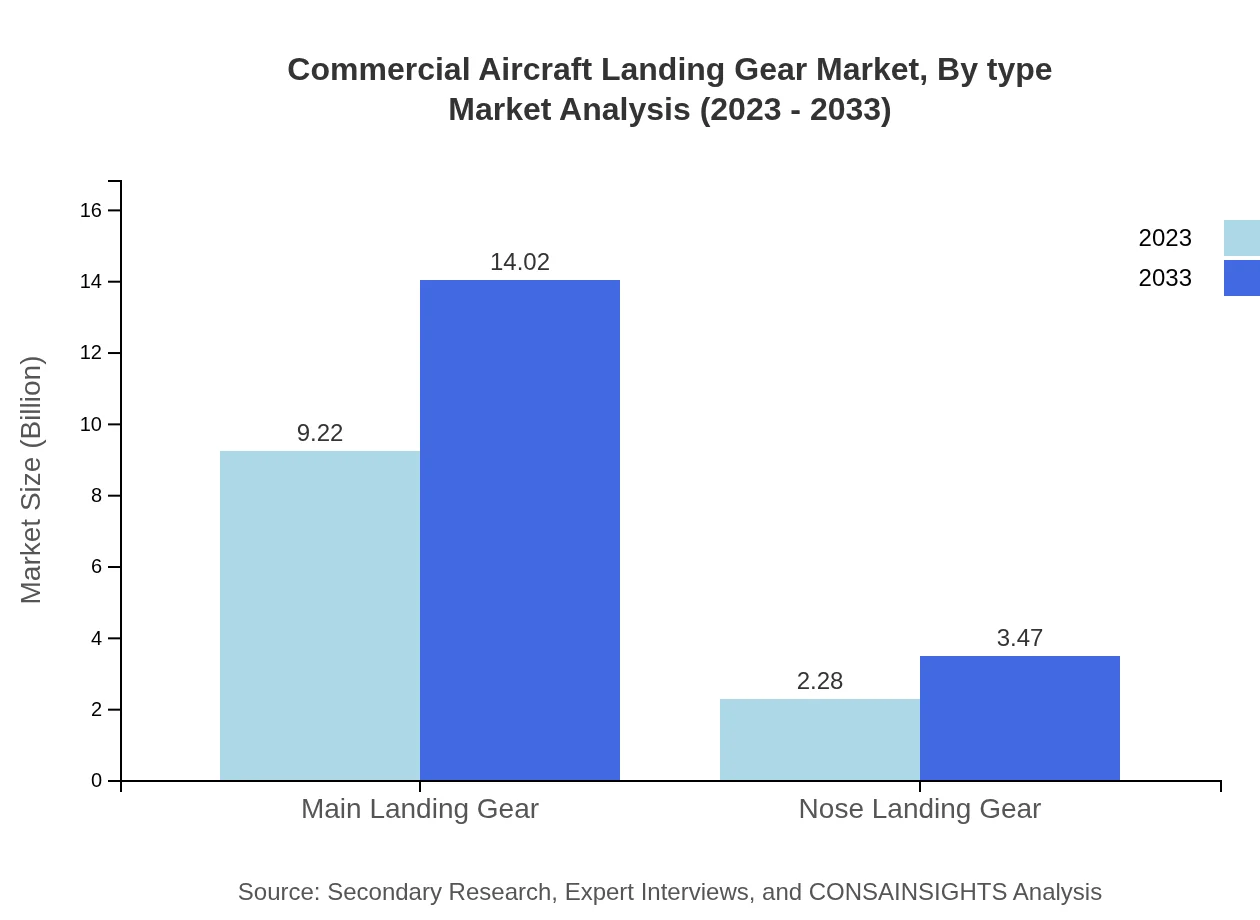

Commercial Aircraft Landing Gear Market Analysis By Type

The Commercial Aircraft Landing Gear market is majorly divided into types: Main Landing Gear and Nose Landing Gear. The Main Landing Gear holds a significant market share of 80.18% in 2023, valuing at USD 9.22 billion, and is projected to increase to USD 14.02 billion by 2033. In contrast, Nose Landing Gear represents 19.82% of the market, valued at USD 2.28 billion in 2023 and expected to grow to USD 3.47 billion by 2033.

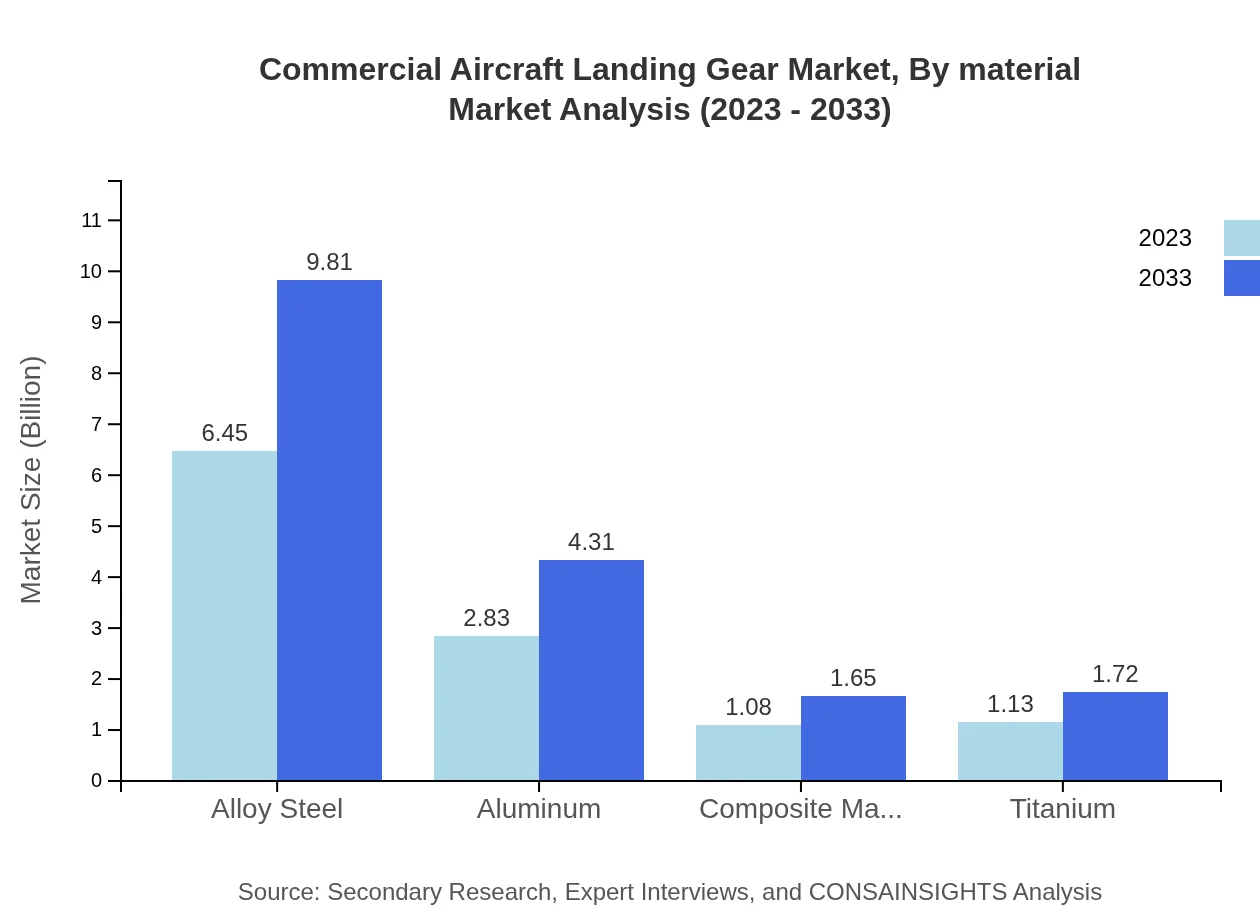

Commercial Aircraft Landing Gear Market Analysis By Material

The materials used in landing gear production include Alloy Steel, Aluminum, Composite Materials, and Titanium. Alloy Steel dominates the segment with a market share of 56.12%, valued at USD 6.45 billion in 2023, projected to reach USD 9.81 billion by 2033. Aluminum accounts for 24.64% with a value of USD 2.83 billion in 2023, anticipated to grow to USD 4.31 billion by 2033.

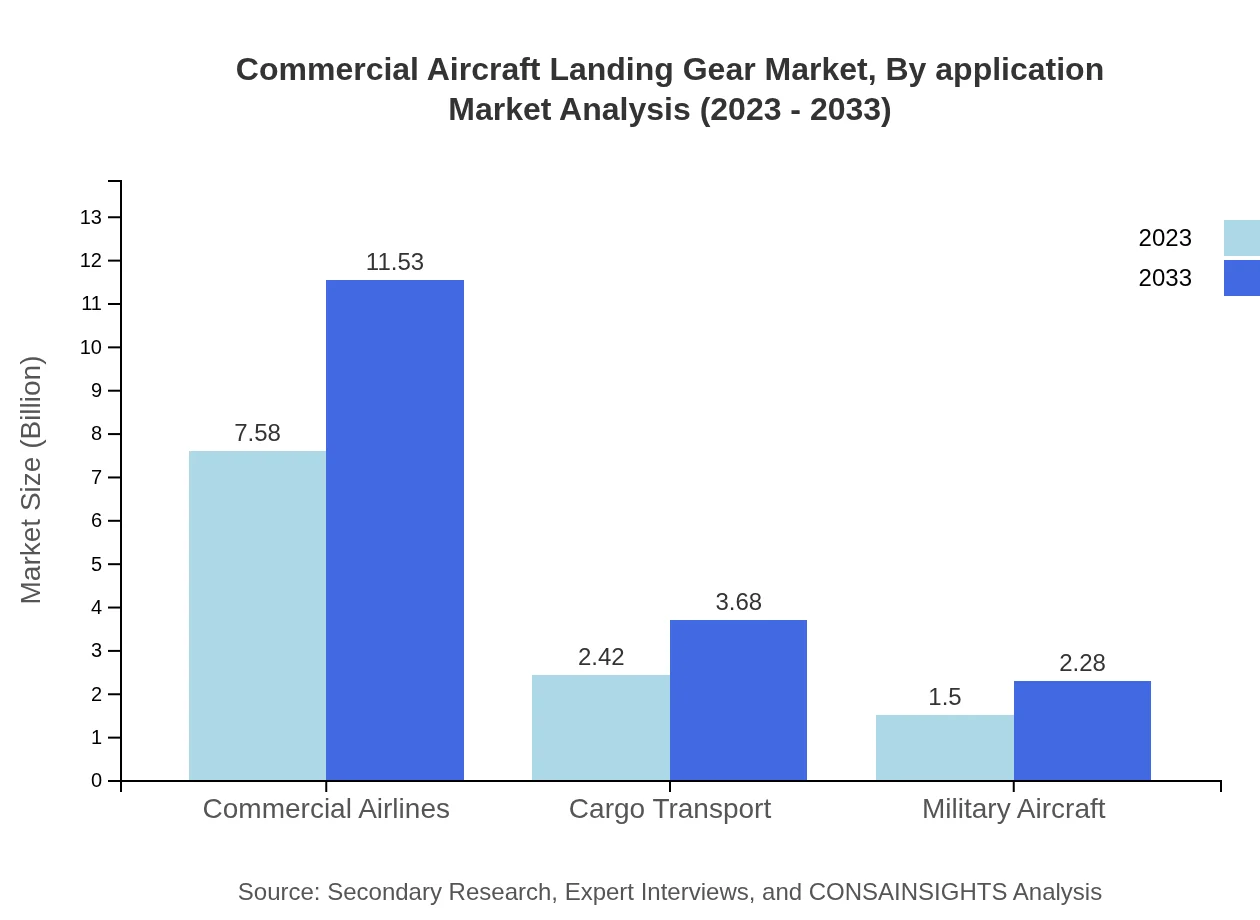

Commercial Aircraft Landing Gear Market Analysis By Application

Commercial Airlines account for the largest share of the application segment at 65.93%, valued at USD 7.58 billion in 2023 and expected to grow to USD 11.53 billion by 2033. Cargo Transport and Military Aircraft are also important applications, representing 21.05% and 13.02% of the market, respectively.

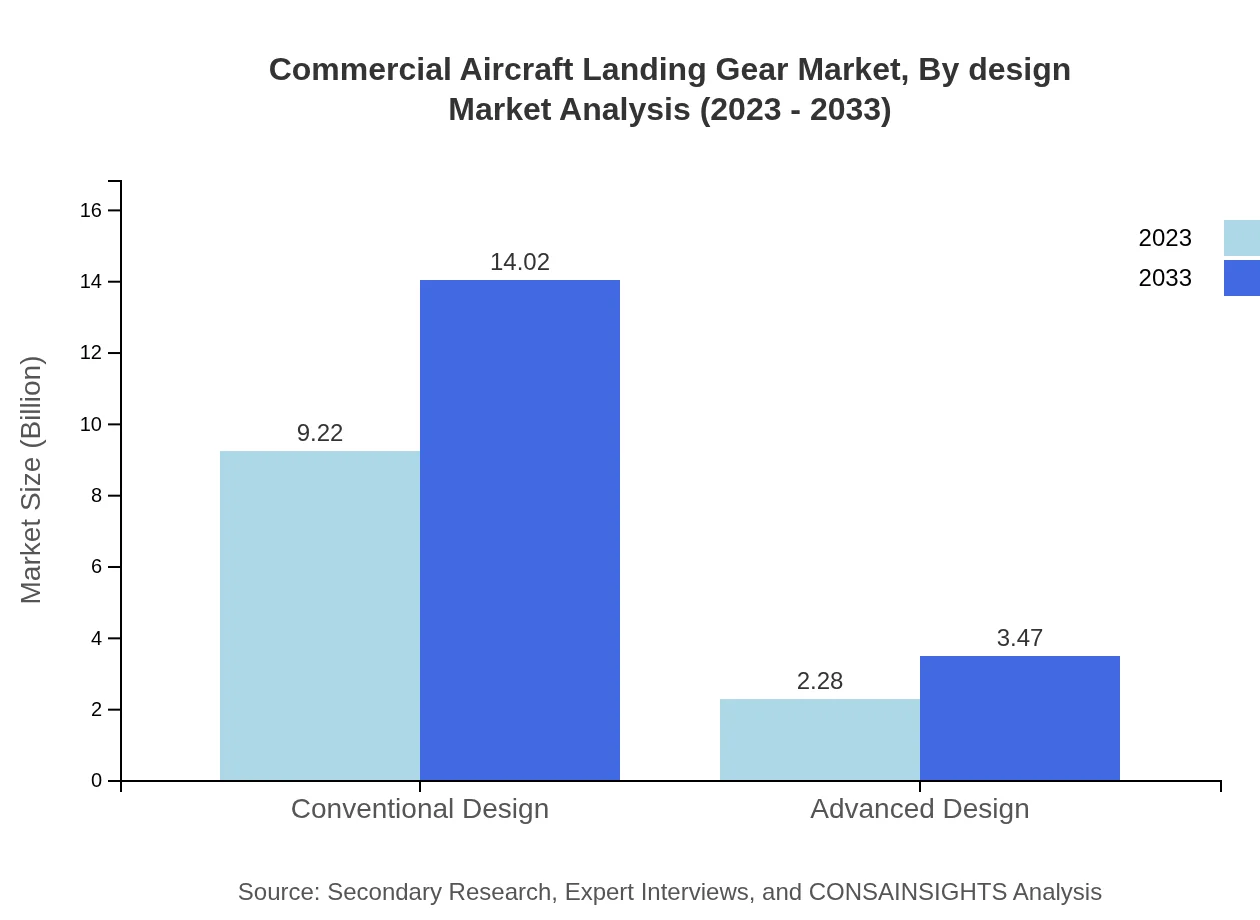

Commercial Aircraft Landing Gear Market Analysis By Design

Landing gear designs fall into two main categories: Conventional Design and Advanced Design. Conventional Design holds a market share of 80.18% valued at USD 9.22 billion in 2023 and projected to reach USD 14.02 billion by 2033. Advanced Design accounts for 19.82% with a market value of USD 2.28 billion in 2023, expected to grow to USD 3.47 billion by 2033.

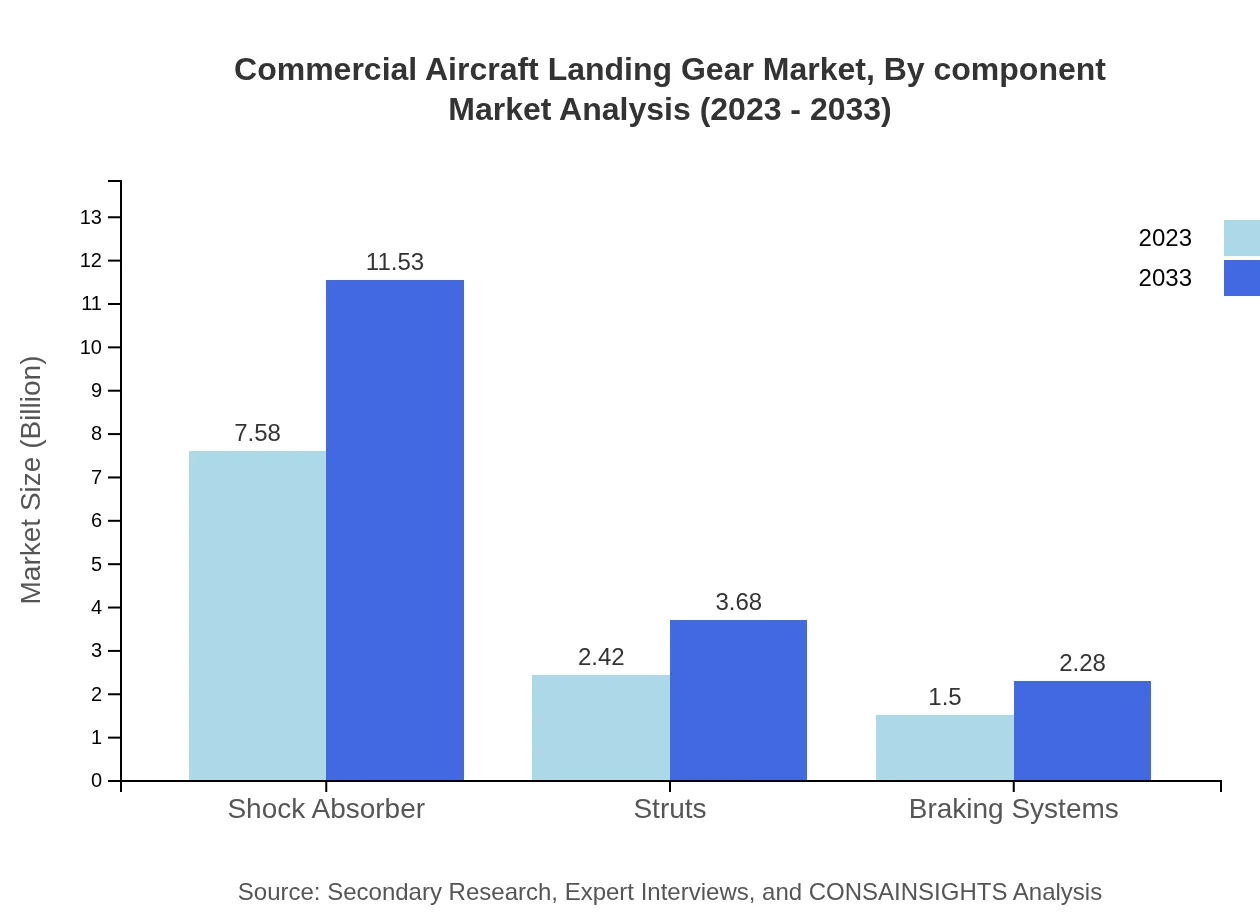

Commercial Aircraft Landing Gear Market Analysis By Component

Major components of landing gear systems include Shock Absorbers, Struts, and Braking Systems. Shock Absorbers lead this segment with a share of 65.93%, boasting a value of USD 7.58 billion in 2023 and anticipated growth to USD 11.53 billion by 2033. Struts represent 21.05% with a value of USD 2.42 billion in 2023, expected to rise to USD 3.68 billion by 2033.

Commercial Aircraft Landing Gear Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Commercial Aircraft Landing Gear Industry

Honeywell International Inc.:

Honeywell is a leading manufacturer of aircraft landing systems, known for its innovation in integrated avionics and advanced landing gear solutions that enhance aircraft safety and performance.UTC Aerospace Systems:

UTC Aerospace Systems provides critical landing gear systems with a reputation for reliability and high-quality engineering, focusing on advanced technologies to meet modern aviation demand.Safran Landing Systems:

As one of the world leaders in landing gear technology, Safran Landing Systems specializes in advanced materials and innovative designs aimed at optimizing aircraft performance.Woodward, Inc.:

Woodward, Inc. offers high-performance landing gear systems and components, emphasizing precision engineering and advanced technologies in the aerospace sector.We're grateful to work with incredible clients.

FAQs

What is the market size of commercial Aircraft Landing Gear?

The commercial aircraft landing gear market size is currently valued at $11.5 billion, with a projected CAGR of 4.2% from 2023 to 2033, reflecting a steady growth trajectory in this essential aerospace component sector.

What are the key market players or companies in this commercial Aircraft Landing Gear industry?

The key market players in the commercial aircraft landing gear industry include major aerospace manufacturers and suppliers such as Collins Aerospace, Safran, and Leonardo, each contributing significantly through technology innovation and market influence.

What are the primary factors driving the growth in the commercial Aircraft Landing Gear industry?

Growth in the commercial aircraft landing gear market is driven by increasing air travel demand, advancements in landing gear technology, and a focus on safety and operational efficiency, which enhance the overall customer experience.

Which region is the fastest Growing in the commercial Aircraft Landing Gear?

The fastest-growing region in the commercial aircraft landing gear market is North America, with market growth expected to rise from $3.71 billion in 2023 to $5.65 billion by 2033, highlighting robust aerospace activity and innovation.

Does ConsaInsights provide customized market report data for the commercial Aircraft Landing Gear industry?

Yes, ConsaInsights specializes in providing customized market report data tailored to specific needs and parameters in the commercial aircraft landing gear industry, ensuring relevant insights for strategic decision-making.

What deliverables can I expect from this commercial Aircraft Landing Gear market research project?

Deliverables from the commercial aircraft landing gear market research project typically include detailed market assessments, segmented analysis, competitive landscape overview, and actionable insights to guide strategic planning.

What are the market trends of commercial Aircraft Landing Gear?

Current trends in the commercial aircraft landing gear market include increased adoption of lightweight materials, advancements in automation, and a shift towards sustainable manufacturing practices to minimize environmental impact.