Commercial Aircraft Maintenance Repair And Overhaul Mro Market Report

Published Date: 03 February 2026 | Report Code: commercial-aircraft-maintenance-repair-and-overhaul-mro

Commercial Aircraft Maintenance Repair And Overhaul Mro Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Commercial Aircraft Maintenance Repair and Overhaul (MRO) market. It includes insights into market trends, size, regional dynamics, and forecasts from 2023 to 2033.

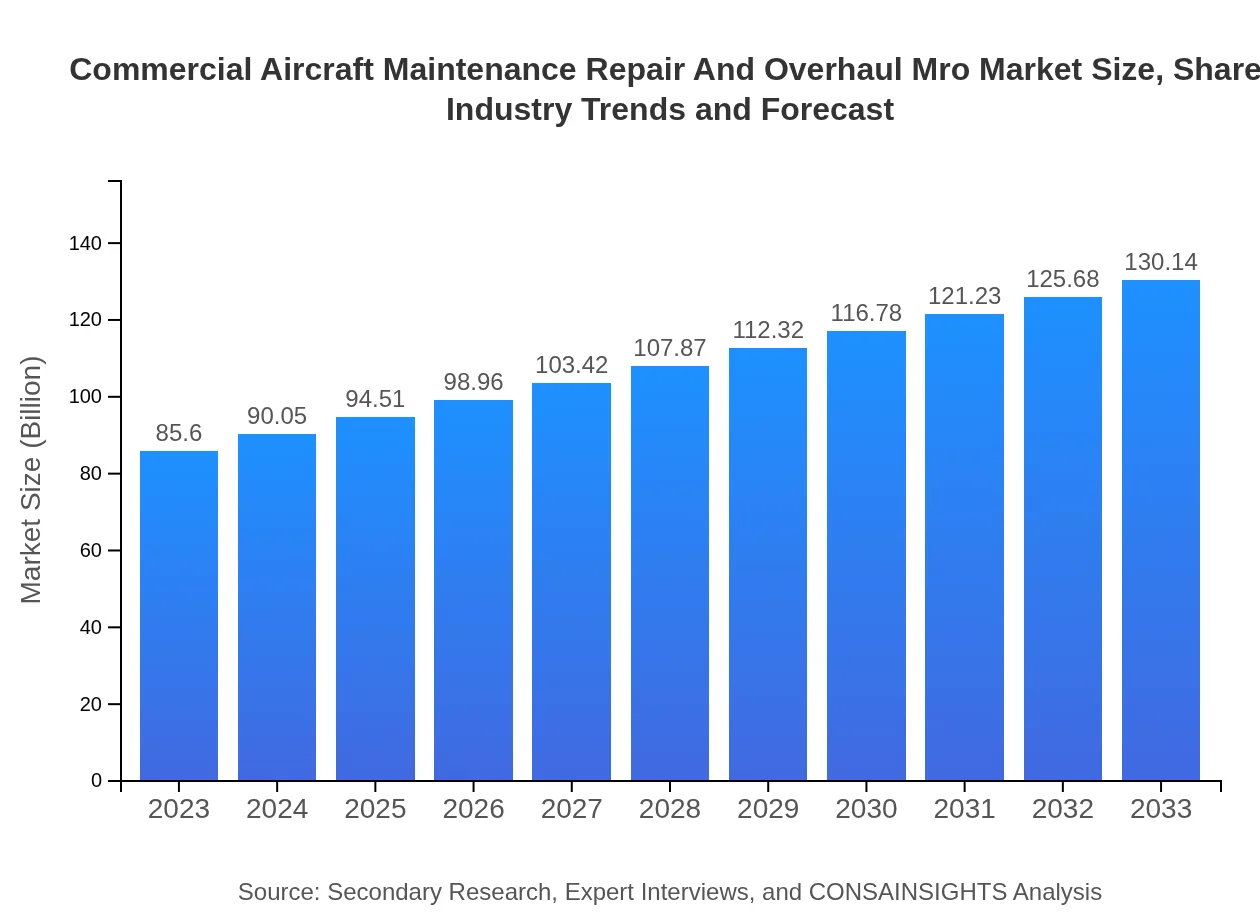

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $85.60 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $130.14 Billion |

| Top Companies | General Electric, Airbus, Boeing , Rolls-Royce, Honeywell International Inc. |

| Last Modified Date | 03 February 2026 |

Commercial Aircraft Maintenance Repair And Overhaul Mro Market Overview

Customize Commercial Aircraft Maintenance Repair And Overhaul Mro Market Report market research report

- ✔ Get in-depth analysis of Commercial Aircraft Maintenance Repair And Overhaul Mro market size, growth, and forecasts.

- ✔ Understand Commercial Aircraft Maintenance Repair And Overhaul Mro's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Commercial Aircraft Maintenance Repair And Overhaul Mro

What is the Market Size & CAGR of Commercial Aircraft Maintenance Repair And Overhaul Mro market in 2023?

Commercial Aircraft Maintenance Repair And Overhaul Mro Industry Analysis

Commercial Aircraft Maintenance Repair And Overhaul Mro Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Commercial Aircraft Maintenance Repair And Overhaul Mro Market Analysis Report by Region

Europe Commercial Aircraft Maintenance Repair And Overhaul Mro Market Report:

The European MRO market is expected to grow from $28.18 billion in 2023 to $42.84 billion by 2033. The region is known for its advanced technology in MRO services and a strong regulatory framework, promoting safety and reliability in commercial aviation.Asia Pacific Commercial Aircraft Maintenance Repair And Overhaul Mro Market Report:

In the Asia Pacific region, the MRO market is projected to grow from $14.59 billion in 2023 to $22.18 billion by 2033. This growth is influenced by the rapidly expanding airline industry and the increasing number of commercial aircraft in operation, particularly in emerging markets like China and India.North America Commercial Aircraft Maintenance Repair And Overhaul Mro Market Report:

North America remains the largest MRO market, with a value of $31.18 billion in 2023 projected to reach $47.41 billion by 2033. Factors include a mature aviation sector, technological advancements, and stringent safety regulations demanding regular maintenance and overhaul services.South America Commercial Aircraft Maintenance Repair And Overhaul Mro Market Report:

The South American MRO market is forecasted to increase from $3.34 billion in 2023 to approximately $5.08 billion by 2033. The growth is driven by rising air travel and the need for improved fleet management solutions as airlines modernize their operations.Middle East & Africa Commercial Aircraft Maintenance Repair And Overhaul Mro Market Report:

In the Middle East and Africa, the MRO market is set to grow from $8.31 billion in 2023 to $12.64 billion by 2033, spurred by increasing air travel in the region and efforts to establish local maintenance hubs.Tell us your focus area and get a customized research report.

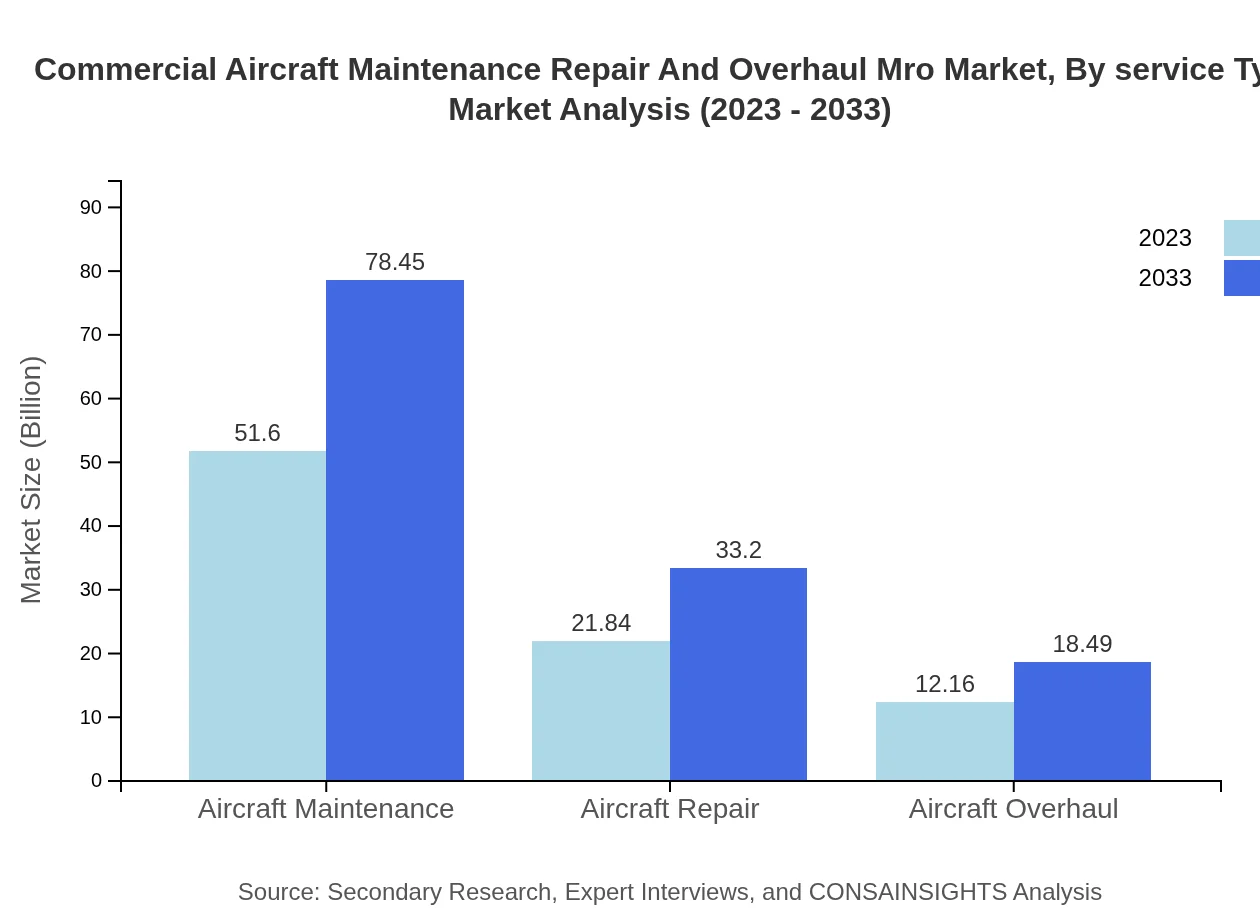

Commercial Aircraft Maintenance Repair And Overhaul Mro Market Analysis By Service Type

The MRO market is segmented into maintenance, repair, and overhaul services. Maintenance services dominate the market due to their essential nature in ensuring aircraft safety. In 2023, maintenance accounted for $51.60 billion, expected to grow to $78.45 billion by 2033. Repair and overhaul services were valued at $21.84 billion and $12.16 billion in 2023, with forecasts indicating increases to $33.20 billion and $18.49 billion, respectively by 2033.

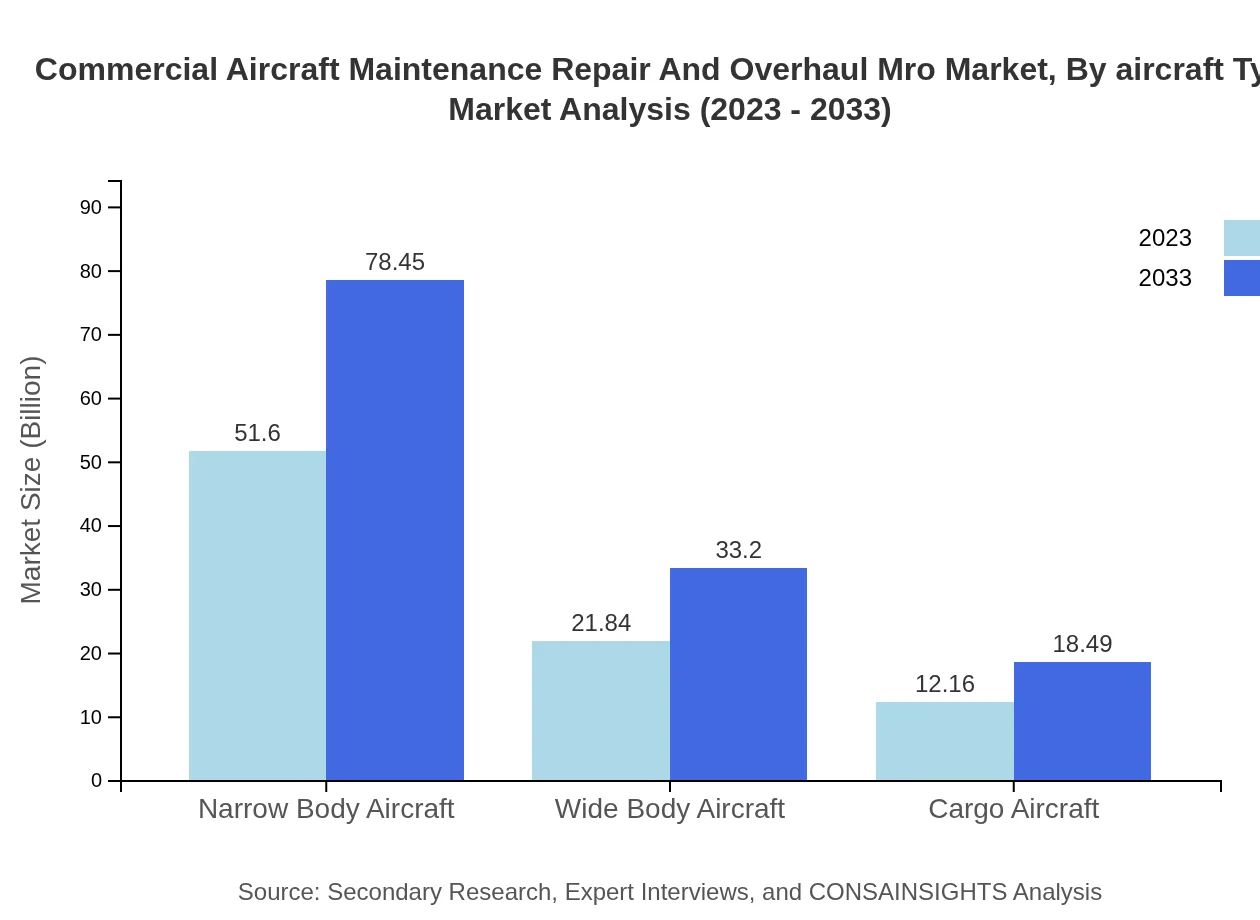

Commercial Aircraft Maintenance Repair And Overhaul Mro Market Analysis By Aircraft Type

The market is categorized based on aircraft type, including narrow-body, wide-body, and cargo aircraft. Narrow-body aircraft dominate the MRO market, accounting for $51.60 billion in 2023 with projections to reach $78.45 billion by 2033. Wide-body aircraft and cargo aircraft had market sizes of $21.84 billion and $12.16 billion in 2023, with expectations of $33.20 billion and $18.49 billion by 2033, respectively.

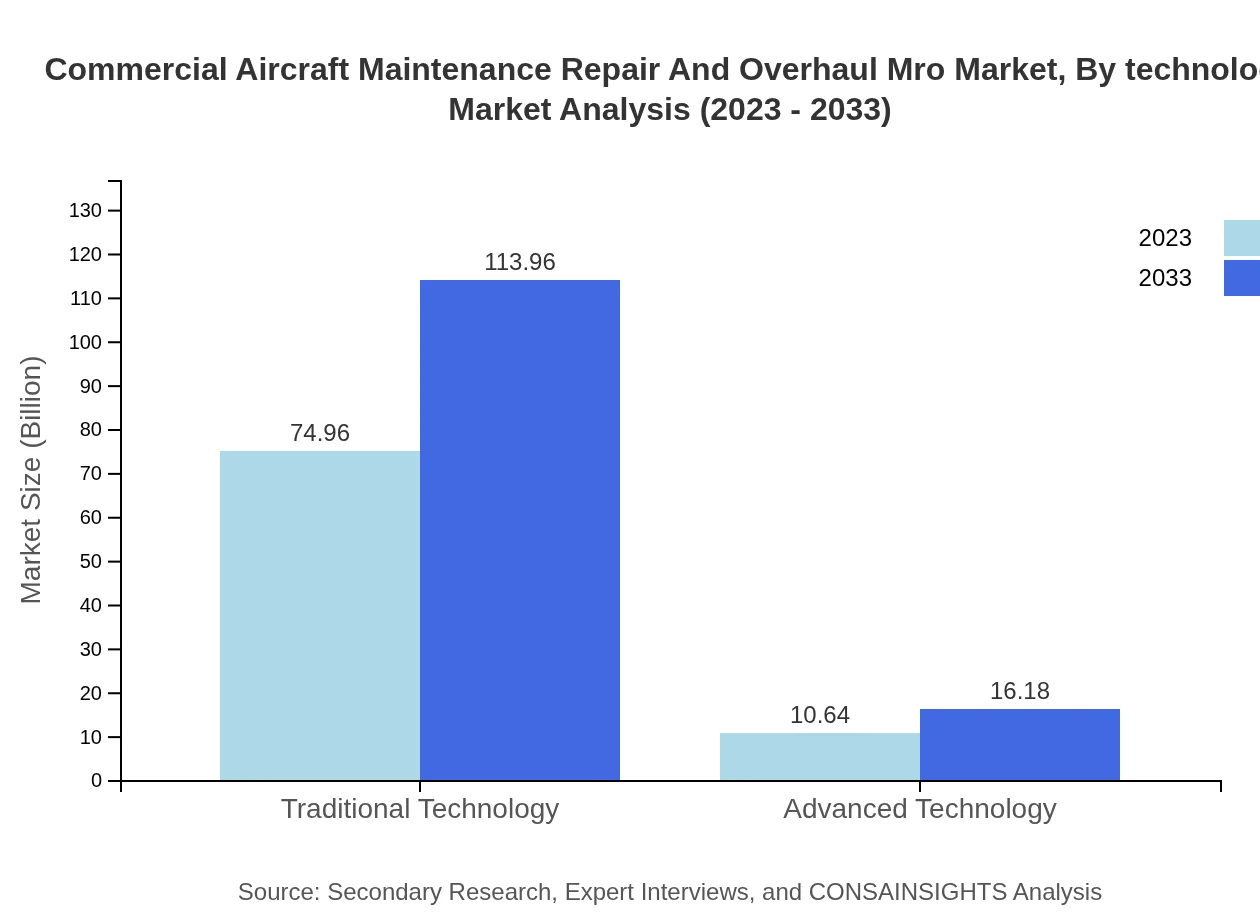

Commercial Aircraft Maintenance Repair And Overhaul Mro Market Analysis By Technology

The MRO market is segmented into traditional and advanced technology. Traditional technology continues to hold a significant share, valued at $74.96 billion in 2023 and growing to $113.96 billion by 2033. Advanced technology services are showing growth from $10.64 billion in 2023 to $16.18 billion by 2033, driven by operational efficiency and enhanced maintenance capabilities.

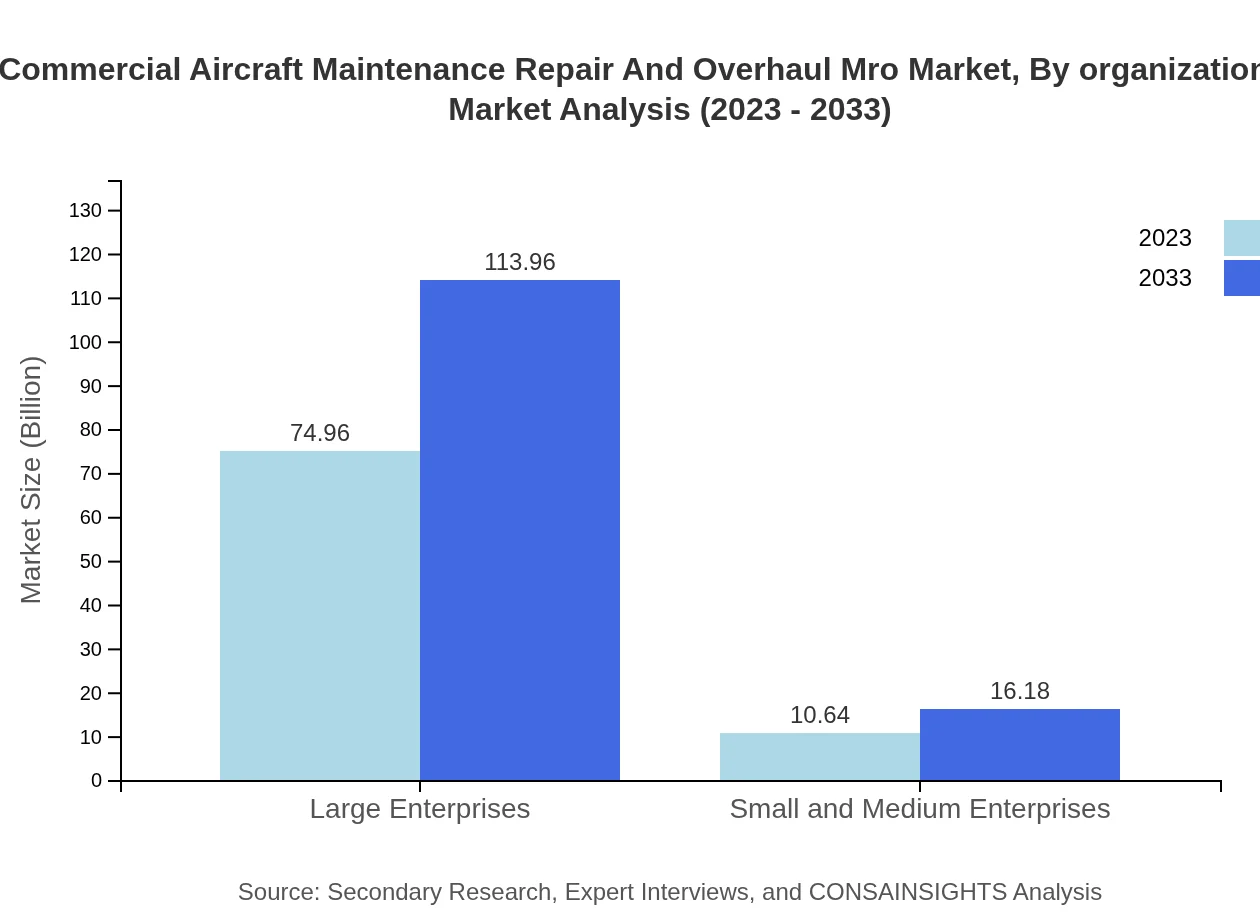

Commercial Aircraft Maintenance Repair And Overhaul Mro Market Analysis By Organization Size

The MRO market is categorized by organization size into large enterprises and small to medium enterprises. Large enterprises dominate the landscape with a market size of $74.96 billion in 2023, set to rise to $113.96 billion by 2033. Small and medium enterprises are also growing, with a market size of $10.64 billion in 2023 projected to increase to $16.18 billion by 2033.

Commercial Aircraft Maintenance Repair And Overhaul Mro Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Commercial Aircraft Maintenance Repair And Overhaul Mro Industry

General Electric:

A leading player in the aviation sector, GE offers comprehensive MRO services and innovative technological solutions to enhance aircraft efficiency and safety.Airbus:

Known for its extensive expertise in aircraft manufacturing, Airbus also provides MRO services focused on optimizing performance and maintaining fleet airworthiness.Boeing :

Boeing plays a critical role in the MRO market, providing comprehensive maintenance, repair, and overhaul services tailored to enhance operational efficiency for its customers.Rolls-Royce:

Specialized in power systems, Rolls-Royce offers MRO services for aviation engines, emphasizing reliability and advanced technology integration.Honeywell International Inc.:

A technology leader, Honeywell provides innovative MRO solutions, emphasizing software and analytics to improve MRO processes.We're grateful to work with incredible clients.

FAQs

What is the market size of commercial aircraft maintenance, repair, and overhaul (MRO)?

The global market size for commercial aircraft maintenance, repair, and overhaul (MRO) is projected at approximately $85.6 billion in 2023, with an expected CAGR of 4.2% through 2033, driven by increasing aircraft utilization and aging fleet maintenance needs.

What are the key market players or companies in the commercial aircraft maintenance, repair, and overhaul (MRO) industry?

Key players in the commercial aircraft MRO industry include firms like Boeing, Airbus, General Electric, and Lockheed Martin. These companies dominate the market by providing cutting-edge maintenance solutions and technologies essential for operational efficiency and safety in aviation.

What are the primary factors driving the growth in the commercial aircraft maintenance, repair, and overhaul (MRO) industry?

Market growth is primarily driven by the increasing global air travel demand, advancements in maintenance technologies, the expansion of fleet sizes, and the aging aircraft population, which necessitates regular and more sophisticated maintenance, repair, and overhaul services.

Which region is the fastest Growing in the commercial aircraft maintenance, repair, and overhaul (MRO)?

Asia Pacific is the fastest-growing region in the commercial aircraft MRO market, expanding from $14.59 billion in 2023 to $22.18 billion by 2033, fueled by rising air traffic and significant investments in aviation infrastructure and services.

Does ConsaInsights provide customized market report data for the commercial aircraft maintenance, repair, and overhaul (MRO) industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the commercial aircraft MRO industry, facilitating targeted insights that drive strategic decision-making.

What deliverables can I expect from this commercial aircraft maintenance, repair, and overhaul (MRO) market research project?

Clients can expect comprehensive reports including market size analysis, segment insights, competitive landscape assessments, regional analysis, and projections, enabling informed strategic planning and investment decisions within the commercial aircraft MRO sector.

What are the market trends of commercial aircraft maintenance, repair, and overhaul (MRO)?

Key trends in the commercial aircraft MRO market include a shift toward advanced technologies in maintenance practices, increased outsourcing of MRO services, and a focus on sustainable practices that reduce environmental impact while improving operational efficiencies.