Commercial Aircraft Market Report

Published Date: 03 February 2026 | Report Code: commercial-aircraft

Commercial Aircraft Market Size, Share, Industry Trends and Forecast to 2033

This market report provides an in-depth analysis of the Commercial Aircraft sector, assessing market trends, sizes, forecasts, and competitive dynamics from 2023 to 2033. It includes insights into regional markets, industry analysis, and key players impacting the worldwide commercial aviation landscape.

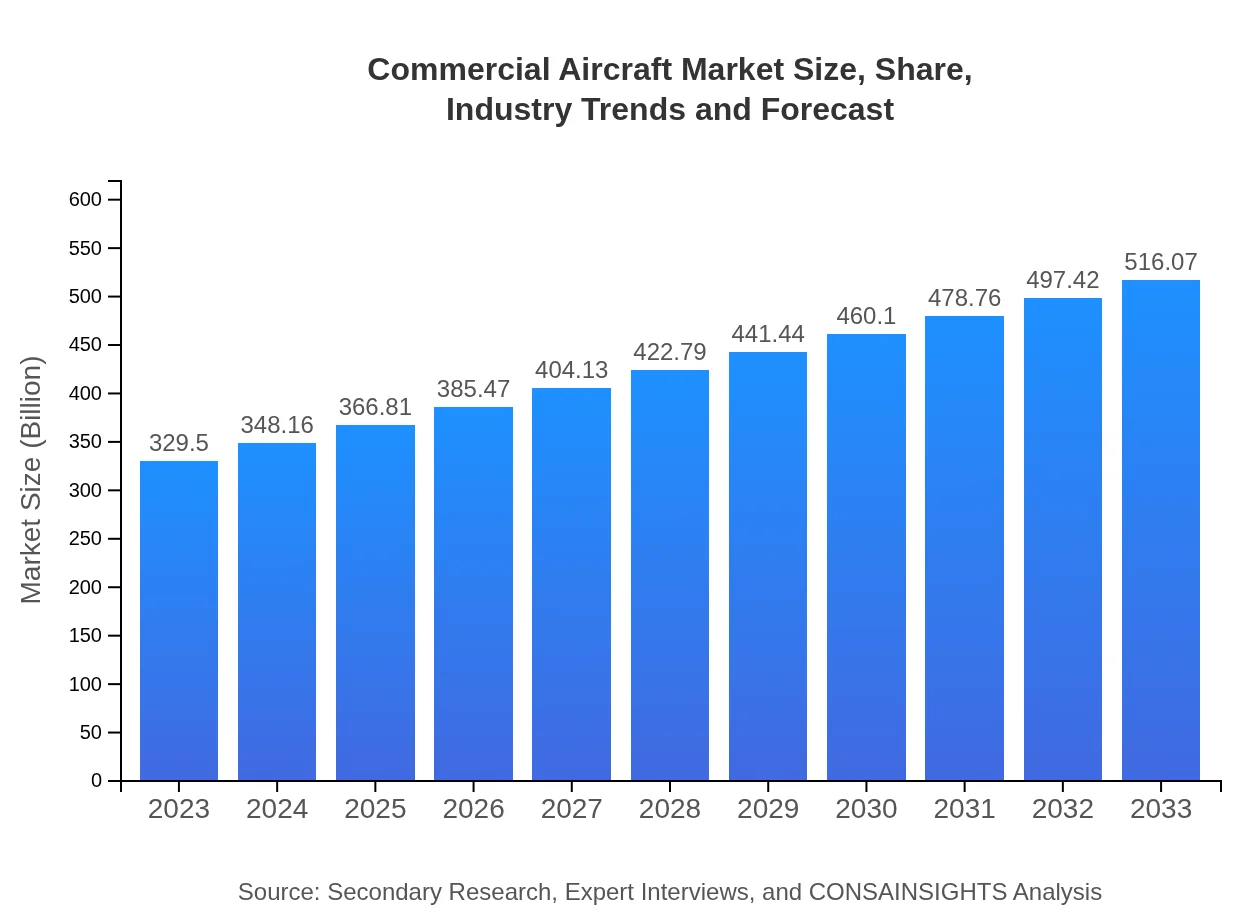

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $329.50 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $516.07 Billion |

| Top Companies | Boeing , Airbus, Embraer, Bombardier, Lockheed Martin |

| Last Modified Date | 03 February 2026 |

Commercial Aircraft Market Overview

Customize Commercial Aircraft Market Report market research report

- ✔ Get in-depth analysis of Commercial Aircraft market size, growth, and forecasts.

- ✔ Understand Commercial Aircraft's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Commercial Aircraft

What is the Market Size & CAGR of the Commercial Aircraft market in 2023?

Commercial Aircraft Industry Analysis

Commercial Aircraft Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Commercial Aircraft Market Analysis Report by Region

Europe Commercial Aircraft Market Report:

The European market is projected to rise from $80.30 billion in 2023 to $125.77 billion by 2033. The region emphasizes sustainability and compliance with strict regulatory standards, resulting in significant investments in greener aircraft technology.Asia Pacific Commercial Aircraft Market Report:

In 2023, the Asia Pacific Commercial Aircraft market is valued at $62.74 billion and is expected to grow to $98.26 billion by 2033. The growth is catalyzed by increasing airline travel, expanding low-cost carriers, and significant investments in airport infrastructure.North America Commercial Aircraft Market Report:

North America remains the largest market for Commercial Aircraft, valued at $120.66 billion in 2023, with expectations of reaching $188.99 billion by 2033. The region leads in fleet modernization efforts and the development of advanced aircraft technologies.South America Commercial Aircraft Market Report:

South America holds a market value of $26.85 billion in 2023, projected to increase to $42.06 billion by 2033. The growth is supported by rising middle-class populations and the need for improved regional connectivity.Middle East & Africa Commercial Aircraft Market Report:

In the MEA region, the market stands at $38.95 billion in 2023, forecasted to grow to $61.00 billion by 2033, driven by air travel demand in growing economies and increased investments in aviation infrastructure.Tell us your focus area and get a customized research report.

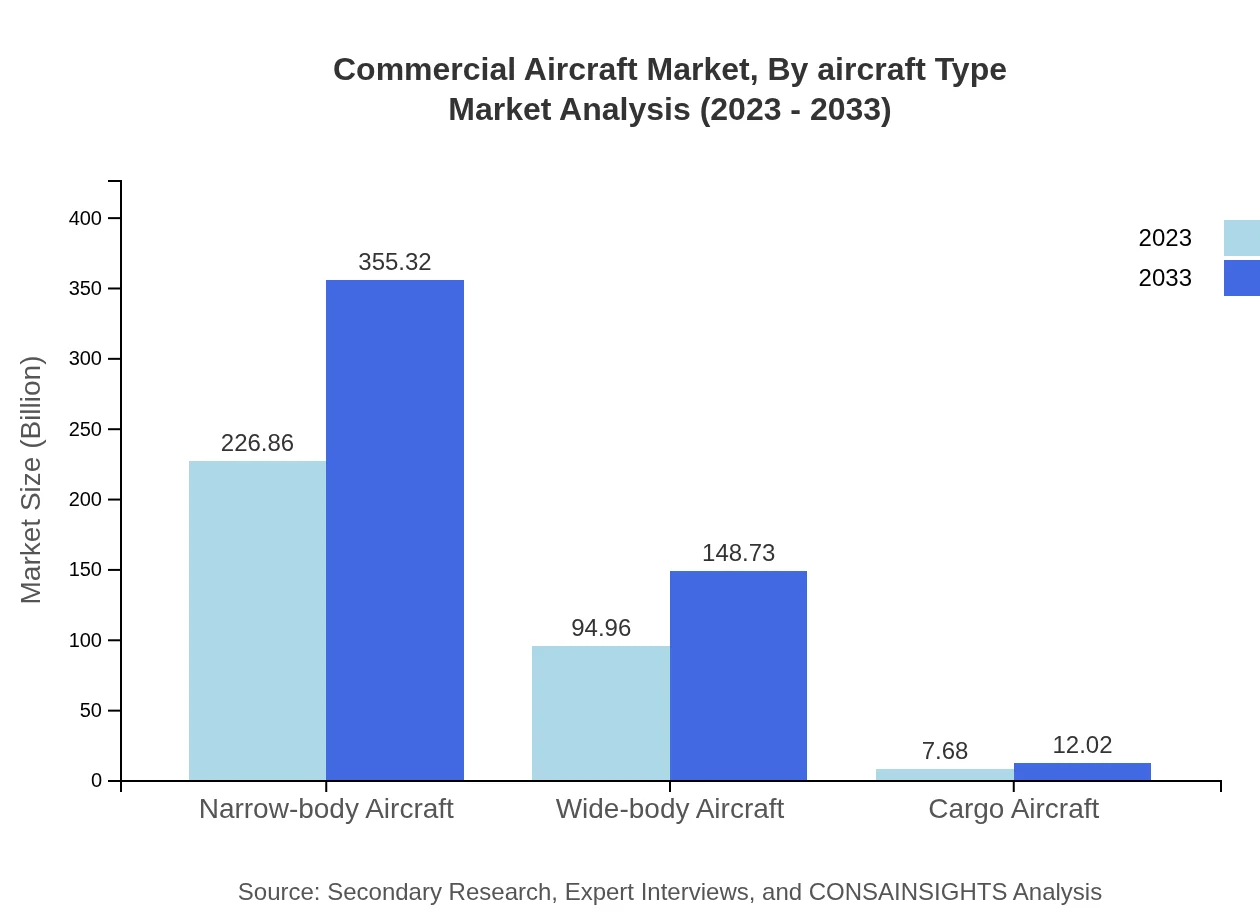

Commercial Aircraft Market Analysis By Aircraft Type

The aircraft type segmentation includes narrow-body, wide-body, and cargo aircraft, where narrow-body aircraft dominate with a market size of $226.86 billion in 2023, expanding to $355.32 billion by 2033. Wide-body aircraft follow, with a size of $94.96 billion in 2023, anticipated to reach $148.73 billion. Cargo aircraft comprise a smaller segment, with a forecast market growth from $7.68 billion to $12.02 billion over the same period.

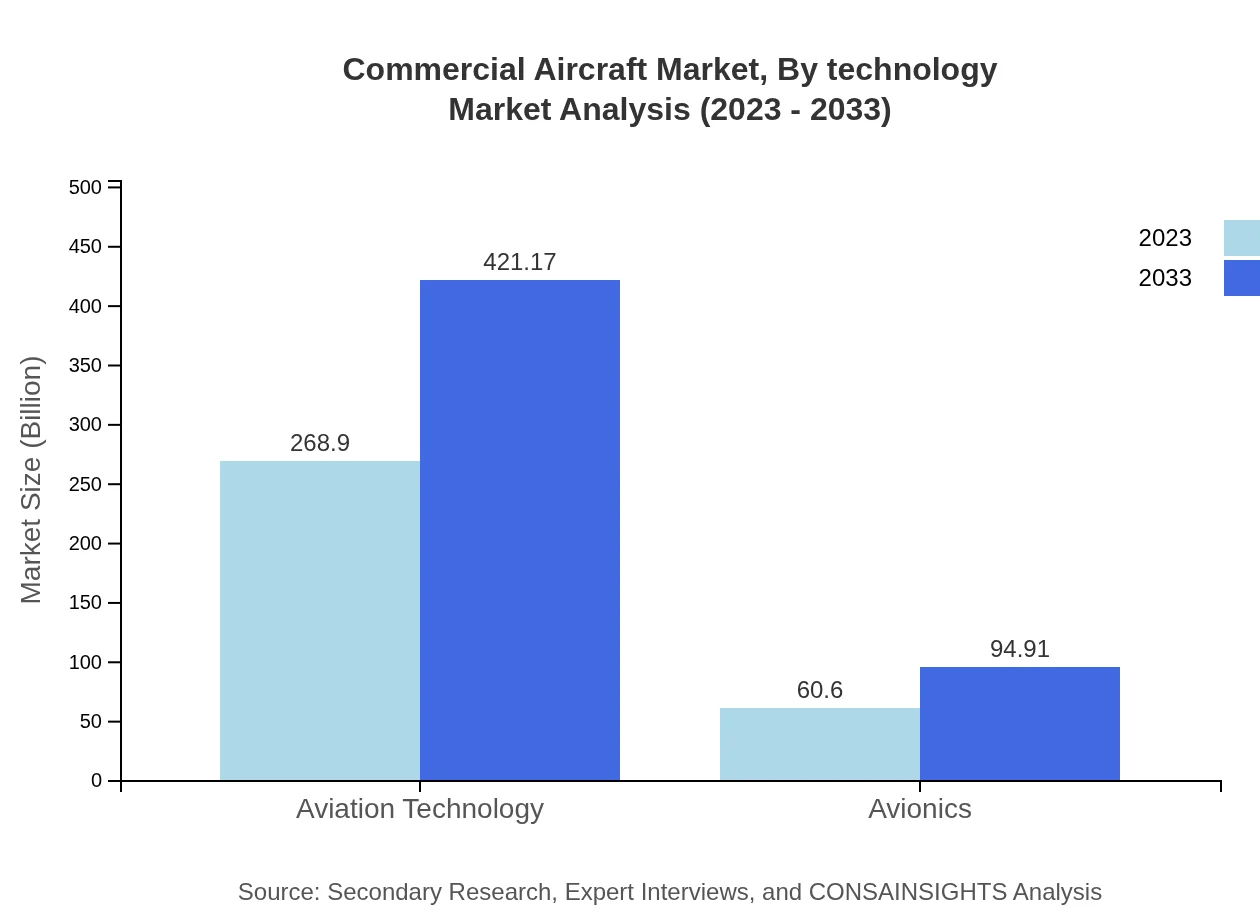

Commercial Aircraft Market Analysis By Technology

Innovations in aviation technology drive significant market growth. The Aviation Technology segment is expected to grow from $268.90 billion in 2023 to $421.17 billion by 2033. Key advancements include improved fuel efficiency technologies and avionics systems, which enhance operational safety and passenger comfort.

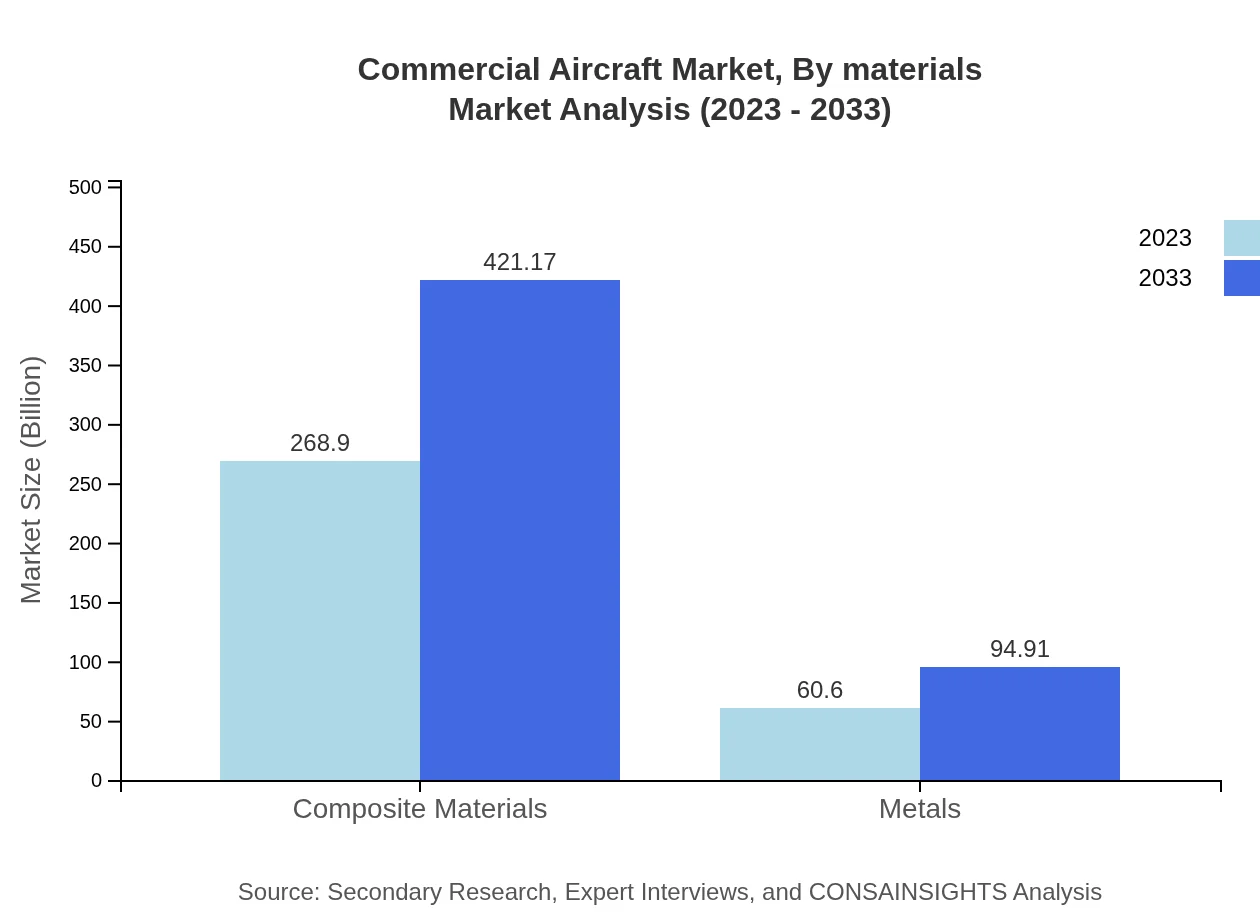

Commercial Aircraft Market Analysis By Materials

In terms of materials, the demand for composite materials in aircraft manufacturing is anticipated to grow significantly, with a projection rising from $268.90 billion in 2023 to $421.17 billion by 2033, reflective of their essential role in reducing weight and improving fuel efficiency.

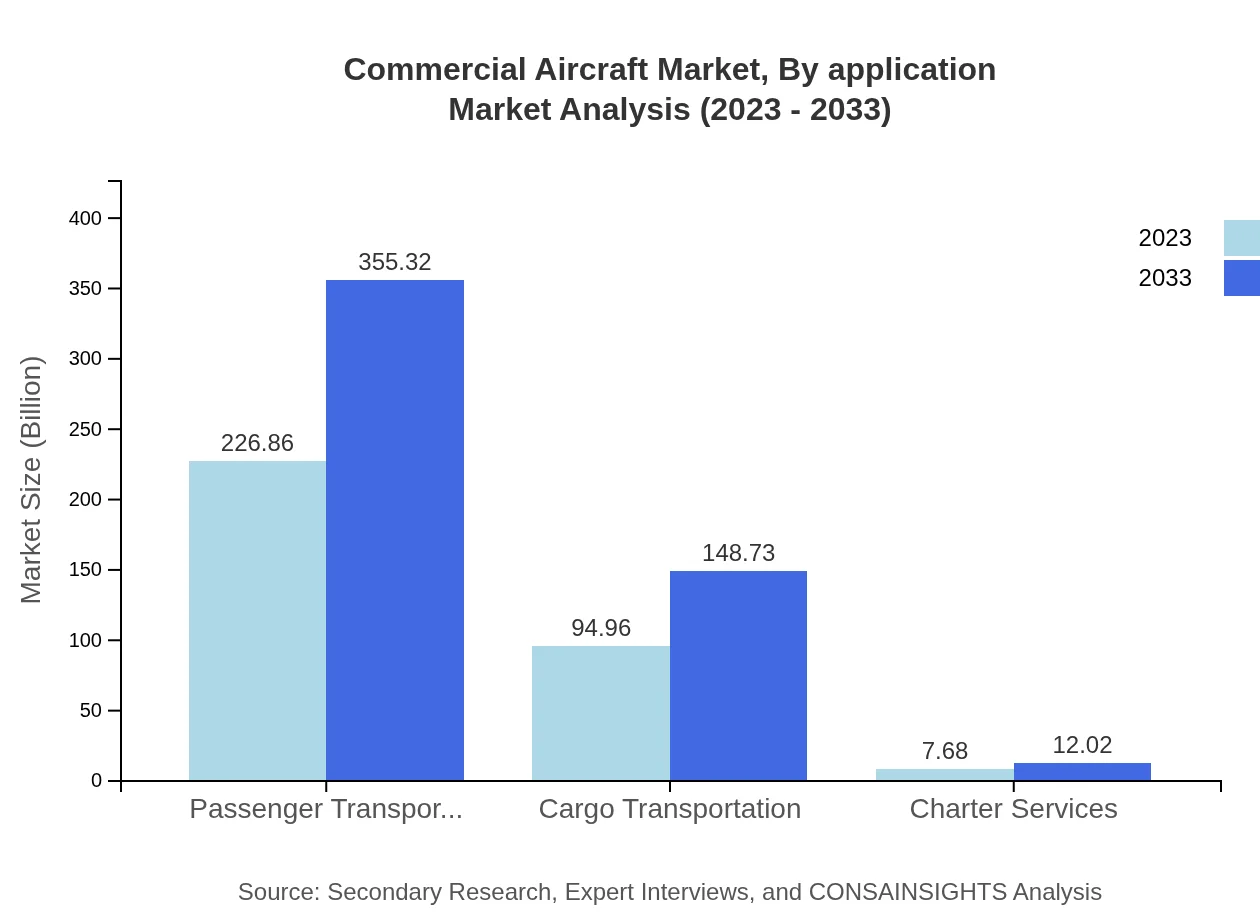

Commercial Aircraft Market Analysis By Application

The commercial aircraft market is primarily segmented into passenger transportation, accounting for $226.86 billion in 2023, and cargo transportation at $94.96 billion. This reflects strong growth in passenger travel post-pandemic and rising demand for air freight services.

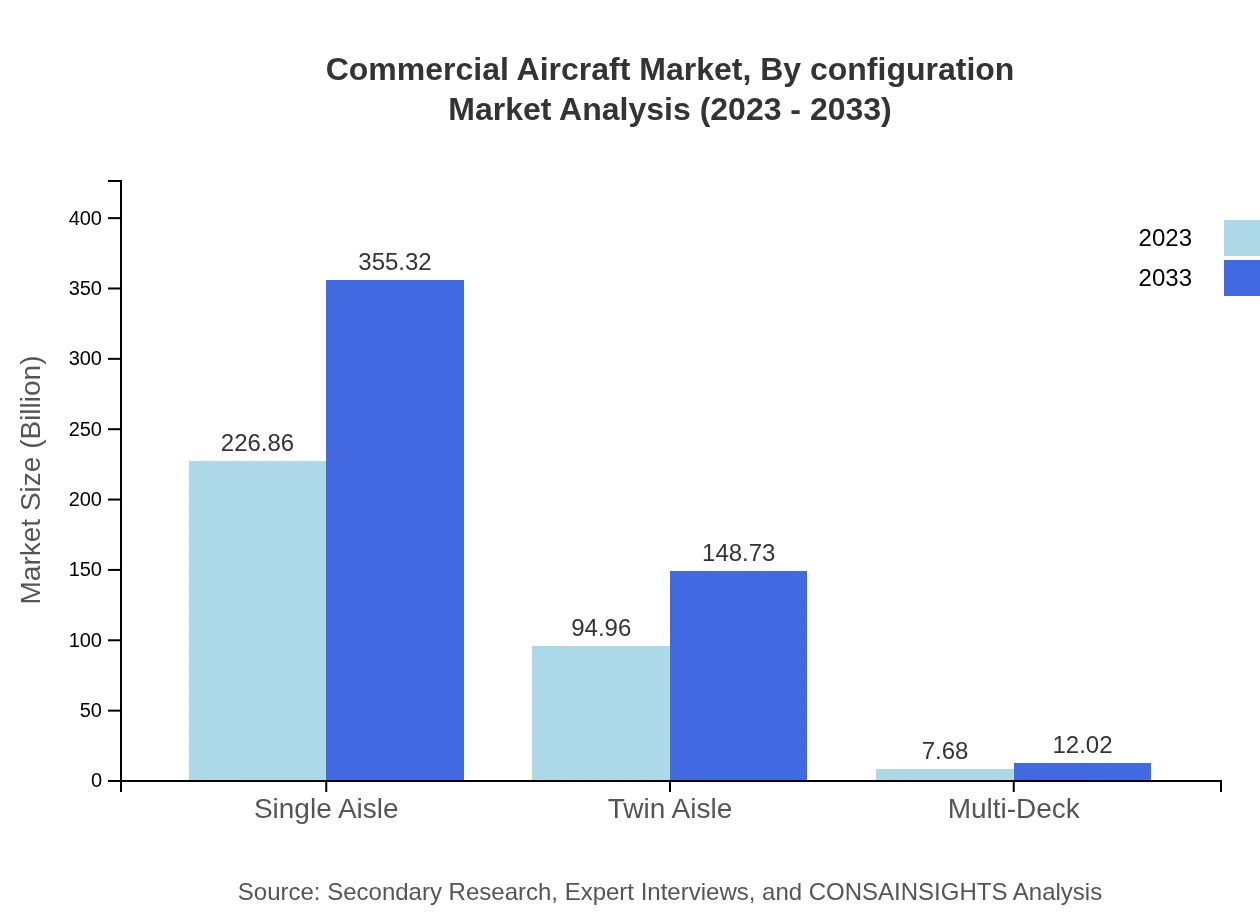

Commercial Aircraft Market Analysis By Configuration

The configuration segmentation includes single aisle and twin aisle aircraft, with single aisle aircraft projected to maintain a dominant market share, growing from $226.86 billion to $355.32 billion by 2033, while twin aisle aircraft will grow from $94.96 billion to $148.73 billion during the same period.

Commercial Aircraft Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in the Commercial Aircraft Industry

Boeing :

Boeing is a leading manufacturer of commercial jetliners and defense aircraft, renowned for innovations in aviation technology and safety.Airbus:

Airbus is a global leader in aerospace manufacturing, recognized for its fuel-efficient aircraft and comprehensive service solutions across the aviation market.Embraer:

Embraer is known for producing regional and executive aircraft, emphasizing innovative designs and market adaptability.Bombardier:

Bombardier specializes in business jets and commercial aircraft, focusing on quality and customer service.Lockheed Martin:

Lockheed Martin, while primarily known for defense, also contributes to the commercial aircraft sector through advanced technology development.We're grateful to work with incredible clients.

FAQs

What is the market size of commercial aircraft?

The commercial aircraft market is currently valued at approximately $329.5 billion, with a projected CAGR of 4.5% from 2023 to 2033.

What are the key market players or companies in this commercial aircraft industry?

Key players in the commercial aircraft industry include Boeing, Airbus, Embraer, Bombardier, and Lockheed Martin, among others.

What are the primary factors driving the growth in the commercial aircraft industry?

Major factors include increasing air travel demand, advancements in aviation technology, and rising investments in fleet modernization.

Which region is the fastest Growing in the commercial aircraft market?

North America is the fastest-growing region, expected to grow from $120.66 billion in 2023 to $188.99 billion in 2033.

Does ConsaInsights provide customized market report data for the commercial aircraft industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the commercial aircraft industry.

What deliverables can I expect from this commercial aircraft market research project?

Deliverables include a comprehensive market analysis report, insights into regional markets, competitive landscape, and segmentation data.

What are the market trends of commercial aircraft?

Trends include a shift towards eco-friendly technologies, increasing demand for narrow-body and wide-body aircraft, and enhanced passenger safety features.