Commercial Aircraft Materials Market Report

Published Date: 03 February 2026 | Report Code: commercial-aircraft-materials

Commercial Aircraft Materials Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Commercial Aircraft Materials market, encompassing market trends, size estimates, regional insights, and forecasts from 2023 to 2033. It serves as a comprehensive guide for stakeholders seeking unparalleled insights into materials used in the aviation sector.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

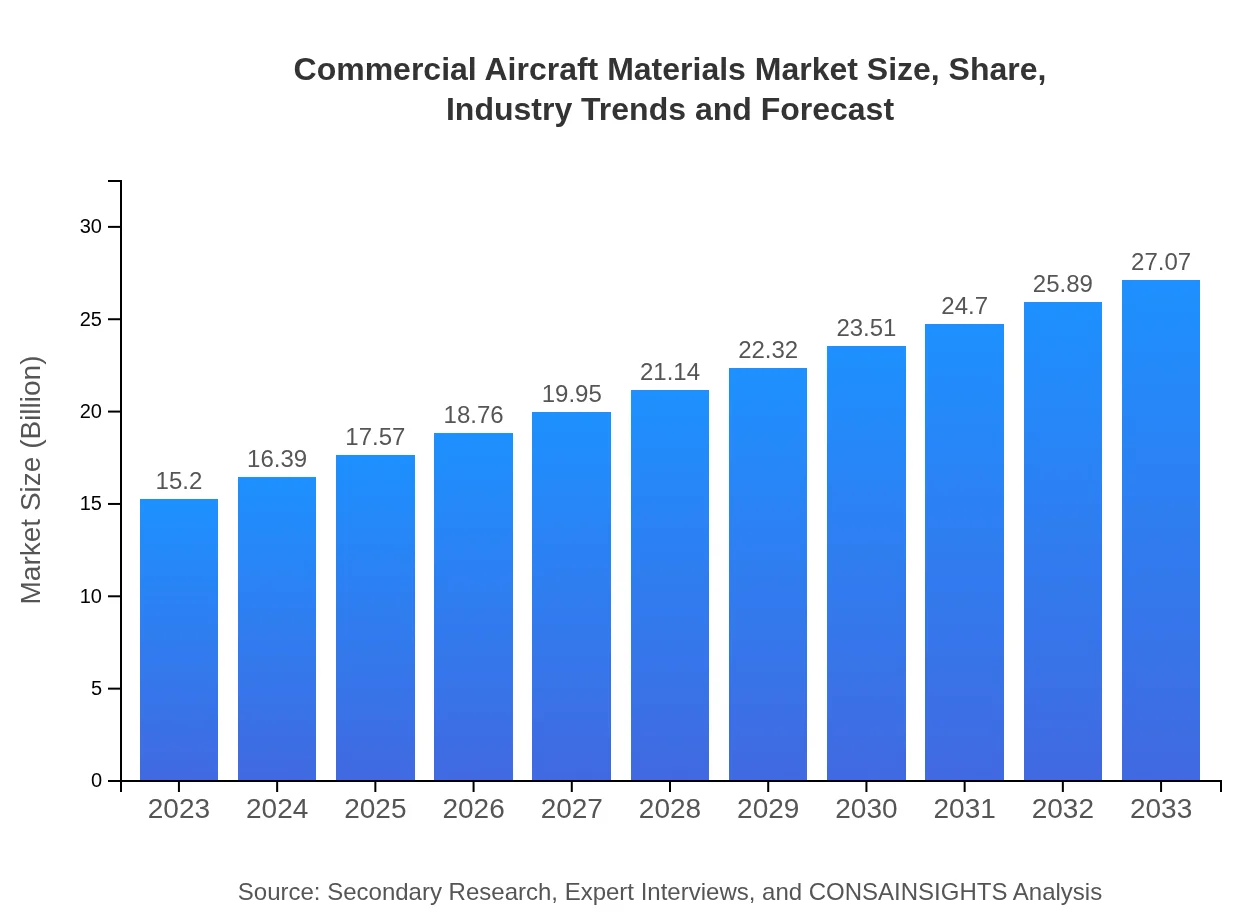

| 2023 Market Size | $15.20 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $27.07 Billion |

| Top Companies | Boeing , Airbus, Hexcel Corporation, DuPont |

| Last Modified Date | 03 February 2026 |

Commercial Aircraft Materials Market Overview

Customize Commercial Aircraft Materials Market Report market research report

- ✔ Get in-depth analysis of Commercial Aircraft Materials market size, growth, and forecasts.

- ✔ Understand Commercial Aircraft Materials's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Commercial Aircraft Materials

What is the Market Size & CAGR of Commercial Aircraft Materials market in 2023?

Commercial Aircraft Materials Industry Analysis

Commercial Aircraft Materials Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Commercial Aircraft Materials Market Analysis Report by Region

Europe Commercial Aircraft Materials Market Report:

Europe's market size is projected to grow from $4.85 billion in 2023 to $8.63 billion by 2033. The focus on reducing emissions coupled with advancements in sustainable aviation practices are pivotal in shaping the growth landscape, promoting the use of advanced materials.Asia Pacific Commercial Aircraft Materials Market Report:

The Asia Pacific region is poised for significant growth in the Commercial Aircraft Materials market, projected to reach $4.66 billion by 2033 from $2.61 billion in 2023. The increase in passenger traffic and government initiatives for aviation development are key drivers in this region, alongside rising investments in aircraft manufacturing facilities.North America Commercial Aircraft Materials Market Report:

The North American market is the largest for Commercial Aircraft Materials, expected to rise from $5.49 billion in 2023 to $9.79 billion by 2033. Home to major aircraft manufacturers, this region benefits from technological innovation and a strong aerospace supply chain, sustaining its market leadership.South America Commercial Aircraft Materials Market Report:

In South America, the market for Commercial Aircraft Materials is anticipated to grow from $0.93 billion in 2023 to $1.65 billion by 2033. Economic growth and increased air travel are fuelling this expansion, although challenges like regulatory constraints may impact growth rates.Middle East & Africa Commercial Aircraft Materials Market Report:

The Middle East and Africa are projected to see growth from $1.32 billion in 2023 to $2.34 billion by 2033, driven by a rise in tourism and investments in international airports. However, challenges such as geopolitical instability could present barriers to growth in this region.Tell us your focus area and get a customized research report.

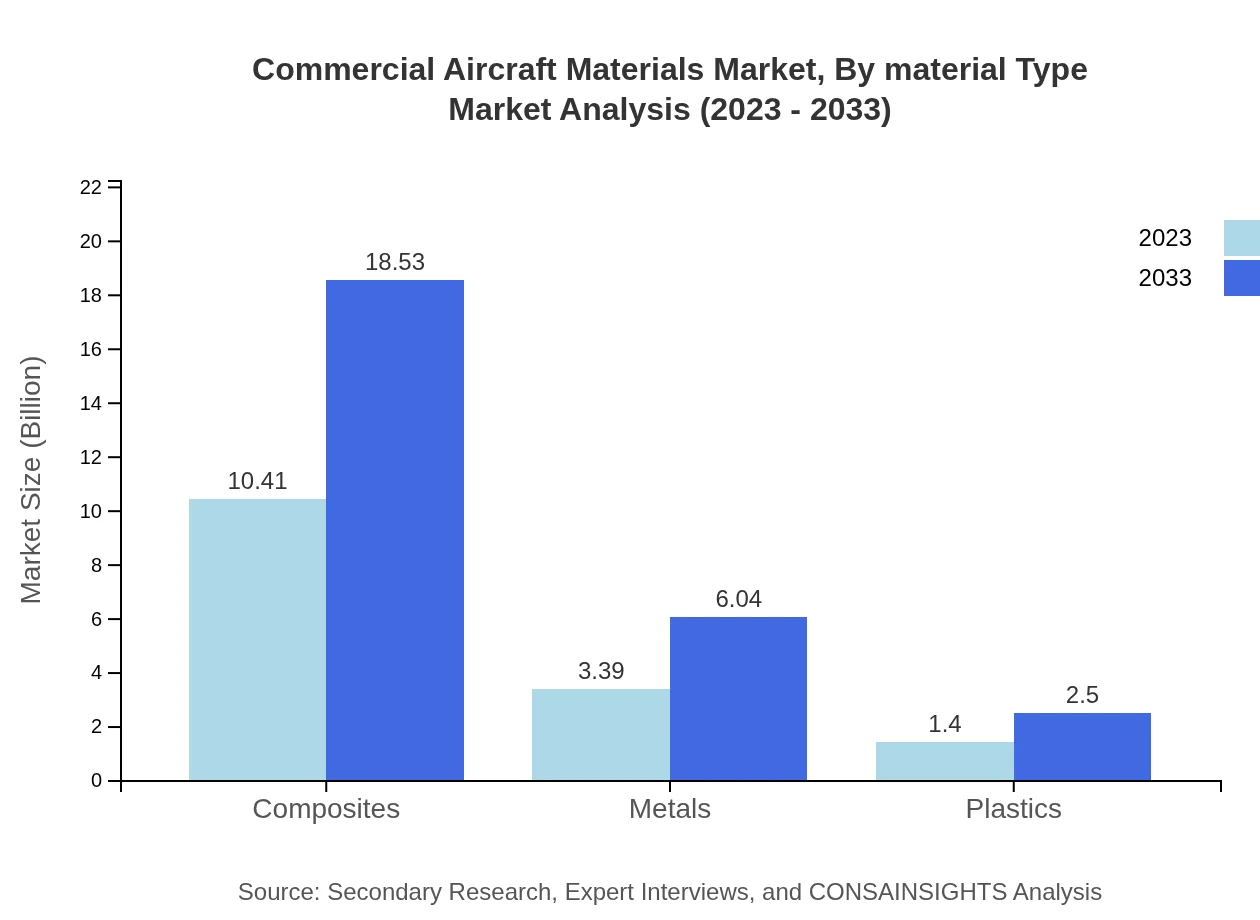

Commercial Aircraft Materials Market Analysis By Material Type

In 2023, the composites segment leads the market with a size of $10.41 billion, projected to grow to $18.53 billion by 2033, maintaining a market share of 68.46%. Metals follow with a market size of $3.39 billion in 2023, expected to reach $6.04 billion by 2033, claiming a share of 22.31%. Plastics also contribute significantly, with a size of $1.40 billion growing to $2.50 billion, representing a 9.23% share.

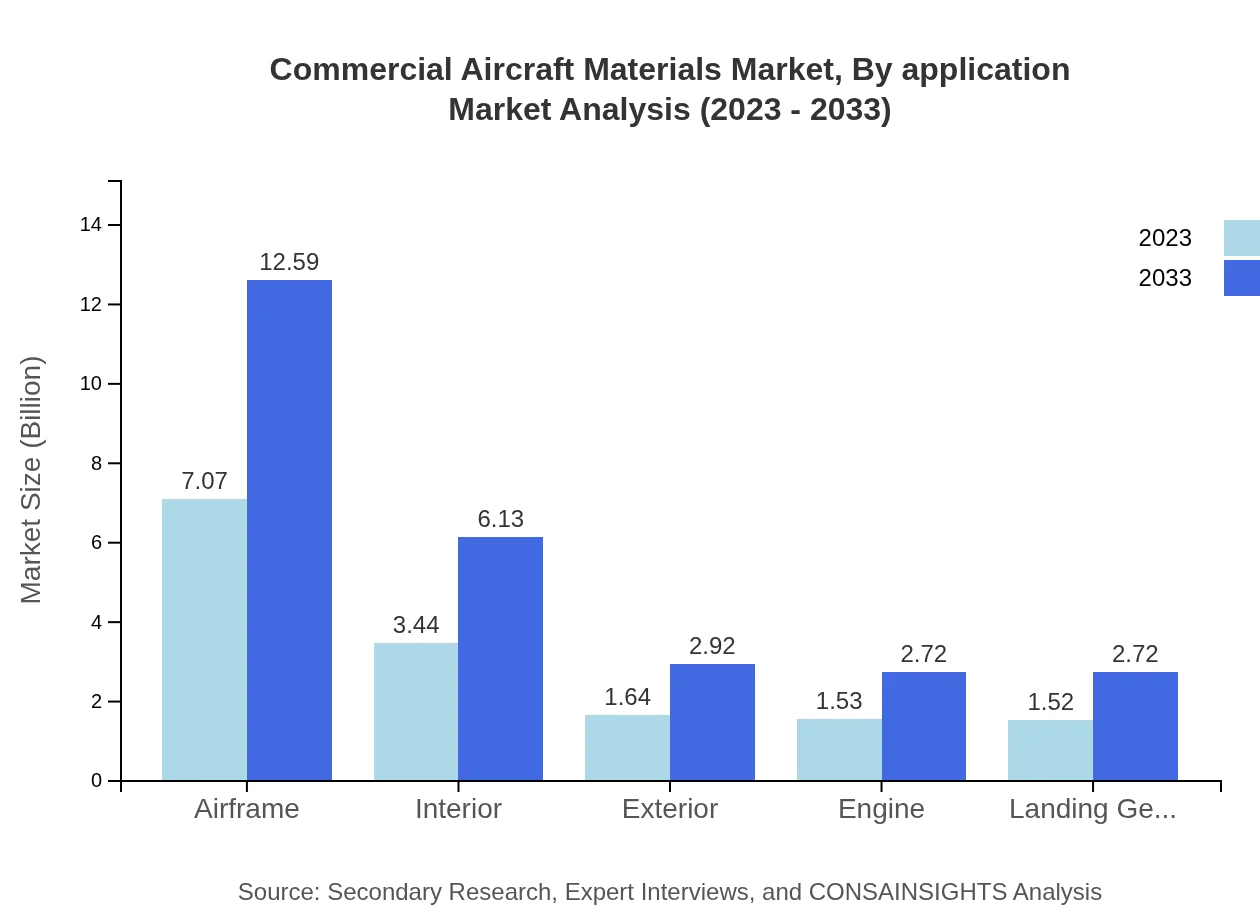

Commercial Aircraft Materials Market Analysis By Application

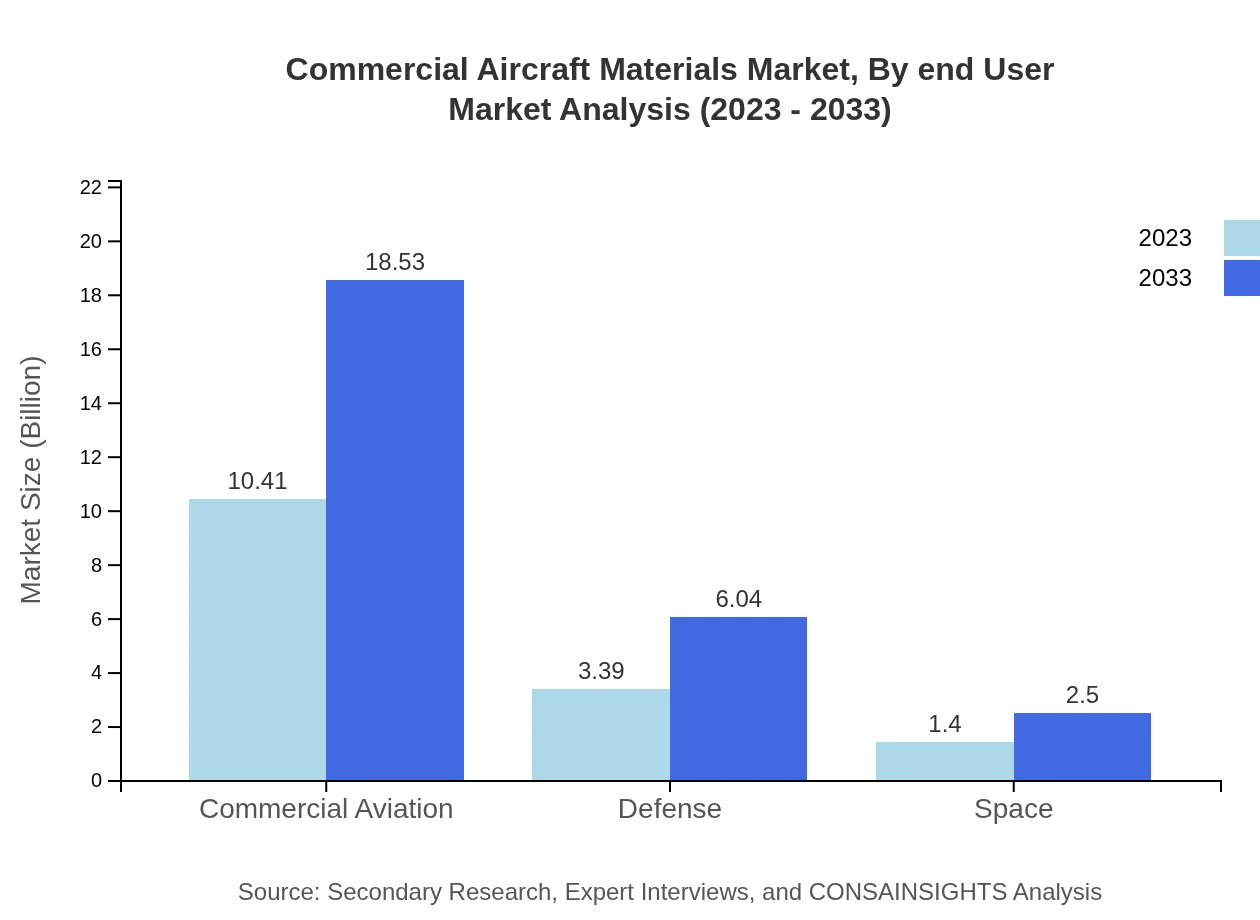

The commercial aviation sector dominates the application segment with a market value of $10.41 billion in 2023, projected to reach $18.53 billion by 2033, holding a steady share of 68.46%. Defense applications also remain significant, projected to increase from $3.39 billion to $6.04 billion, while the space sector is anticipated to grow from $1.40 billion to $2.50 billion.

Commercial Aircraft Materials Market Analysis By Manufacturing Process

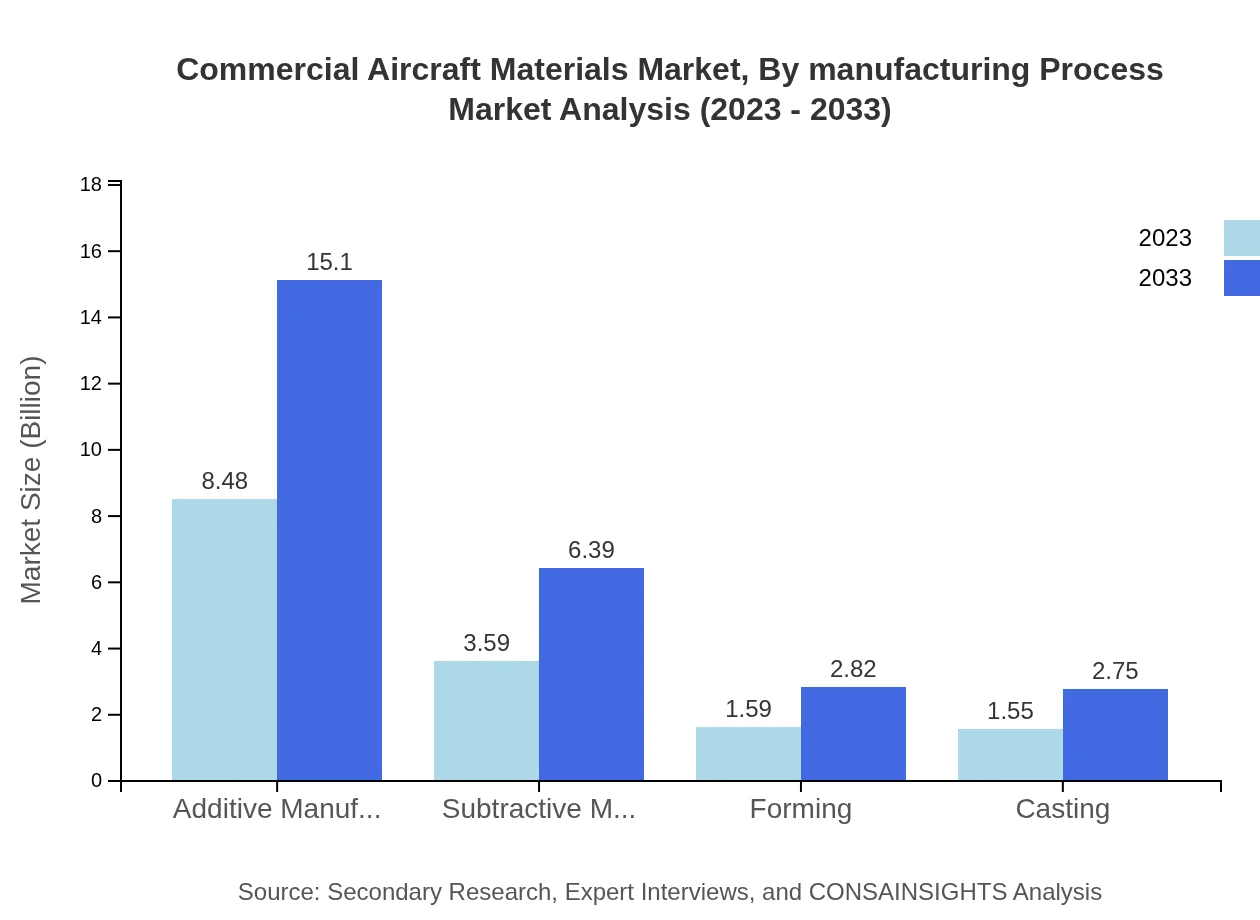

The additive manufacturing segment holds a substantial share, valued at $8.48 billion in 2023 and expected to escalate to $15.10 billion by 2033, representing a share of 55.79%. Conversely, subtractive manufacturing is expanding its presence with a forecast from $3.59 billion to $6.39 billion, showcasing a share of 23.61%.

Commercial Aircraft Materials Market Analysis By End User

The commercial aviation end-user segment captures the bulk of market revenue, with a size of $10.41 billion in 2023 projected to grow to $18.53 billion by 2033. Defense and space users also exhibit growth trends, contributing a combined market size of $4.79 billion in 2023, with robust projections for the future.

Commercial Aircraft Materials Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Commercial Aircraft Materials Industry

Boeing :

A leader in aerospace manufacturing, Boeing is actively engaged in the development of innovative materials that enhance aircraft performance and sustainability, particularly in the commercial aviation segment.Airbus:

Another major aircraft manufacturer, Airbus is at the forefront of using advanced composites and technologies to optimize aircraft design and reduce weight.Hexcel Corporation:

Hexcel specializes in advanced composites and is known for its innovative solutions that help improve the efficiency and performance of aircraft.DuPont:

DuPont is involved in the development of high-performance materials and solutions for the aviation sector, including composites and specialty chemicals that enhance aircraft durability.We're grateful to work with incredible clients.

FAQs

What is the market size of commercial aircraft materials?

The global commercial aircraft materials market is valued at approximately $15.2 billion in 2023, with a projected compound annual growth rate (CAGR) of 5.8%. By 2033, the market is expected to continue expanding significantly.

What are the key market players or companies in the commercial aircraft materials industry?

Key players in the commercial aircraft materials market include Boeing, Airbus, Hexcel Corporation, Huntsman Corporation, and DuPont. These firms play a crucial role in innovation, supplying materials, and shaping the industry's future.

What are the primary factors driving growth in the commercial aircraft materials industry?

Factors driving growth include increasing demand for fuel-efficient aircraft, advancements in material technology, and rising air travel. Additionally, the shift toward lightweight materials to improve performance and sustainability underlies market expansion.

Which region is the fastest Growing in the commercial aircraft materials market?

Asia Pacific is the fastest-growing region in the commercial aircraft materials market, expected to reach a market size of $4.66 billion by 2033, up from $2.61 billion in 2023, reflecting significant growth in aerospace manufacturing and air travel.

Does ConsaInsights provide customized market report data for the commercial aircraft materials industry?

Yes, ConsaInsights offers customized market report data for the commercial aircraft materials industry, allowing clients to access specific insights tailored to their needs, including market size, growth forecasts, and competitive analysis.

What deliverables can I expect from this commercial aircraft materials market research project?

Clients can expect detailed reports encompassing market data, growth forecasts, segment analysis, and competitive landscape evaluations. Additionally, insights about emerging trends and regional performance will be included to provide comprehensive understanding.

What are the market trends of commercial aircraft materials?

Current trends include the increasing use of composites, advancements in additive manufacturing technologies, and a focus on sustainability. Innovations in material science are driving efficiencies and creating lightweight solutions for next-generation aircraft.