Commercial Aircraft Seating Market Report

Published Date: 03 February 2026 | Report Code: commercial-aircraft-seating

Commercial Aircraft Seating Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Commercial Aircraft Seating market from 2023 to 2033, offering insights on market trends, sizing, segmentation, regional analysis, and key players. It aims to equip stakeholders with critical data to make informed decisions.

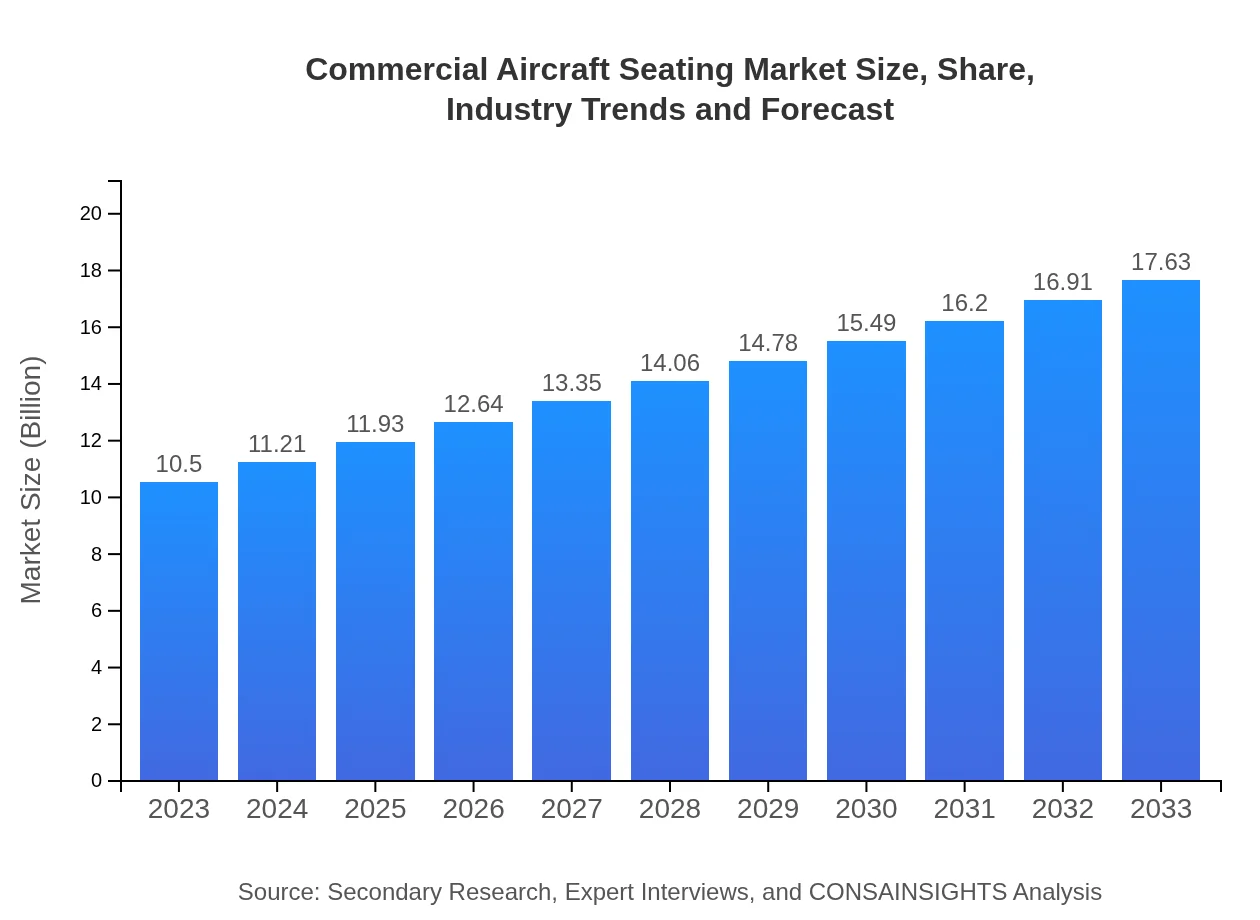

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $17.63 Billion |

| Top Companies | Recaro Aircraft Seating, Collins Aerospace, Zodiac Aerospace, Sofema Aviation Services, BE Aerospace |

| Last Modified Date | 03 February 2026 |

Commercial Aircraft Seating Market Overview

Customize Commercial Aircraft Seating Market Report market research report

- ✔ Get in-depth analysis of Commercial Aircraft Seating market size, growth, and forecasts.

- ✔ Understand Commercial Aircraft Seating's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Commercial Aircraft Seating

What is the Market Size & CAGR of Commercial Aircraft Seating market in 2023?

Commercial Aircraft Seating Industry Analysis

Commercial Aircraft Seating Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Commercial Aircraft Seating Market Analysis Report by Region

Europe Commercial Aircraft Seating Market Report:

The European market for Commercial Aircraft Seating is anticipated to grow substantially, with a market value of $2.74 billion in 2023 expected to rise to $4.60 billion by 2033. Major factors contributing to this growth include increasing air travel and a heightened focus on developing innovative seating solutions by key players in the region.Asia Pacific Commercial Aircraft Seating Market Report:

The Asia Pacific region is witnessing robust growth in the Commercial Aircraft Seating market, driven by increasing air travel demand and the expansion of the airline industry. The market size in 2023 is pegged at $2.19 billion, expected to reach approximately $3.68 billion by 2033, fueled by growth in low-cost carriers and significant investments in new aircraft acquisitions.North America Commercial Aircraft Seating Market Report:

North America is a leading market for Commercial Aircraft Seating, valued at about $3.95 billion in 2023 and expected to rise to $6.63 billion by 2033. The region benefits from strong airline operators and a high demand for premium seating products. Furthermore, ongoing fleet upgrades are key drivers for market expansion.South America Commercial Aircraft Seating Market Report:

In South America, the Commercial Aircraft Seating market is gradually emerging, with a market size of $0.74 billion in 2023 projected to grow to $1.24 billion by 2033. Factors such as improving economic conditions and increased domestic and international travel are propelling this growth.Middle East & Africa Commercial Aircraft Seating Market Report:

The Middle East and Africa region is emerging as a significant hub for the Commercial Aircraft Seating market. With a market size of $0.88 billion in 2023 set to increase to $1.48 billion by 2033, driving factors include increasing investments in airline infrastructure and expanding tourism industries.Tell us your focus area and get a customized research report.

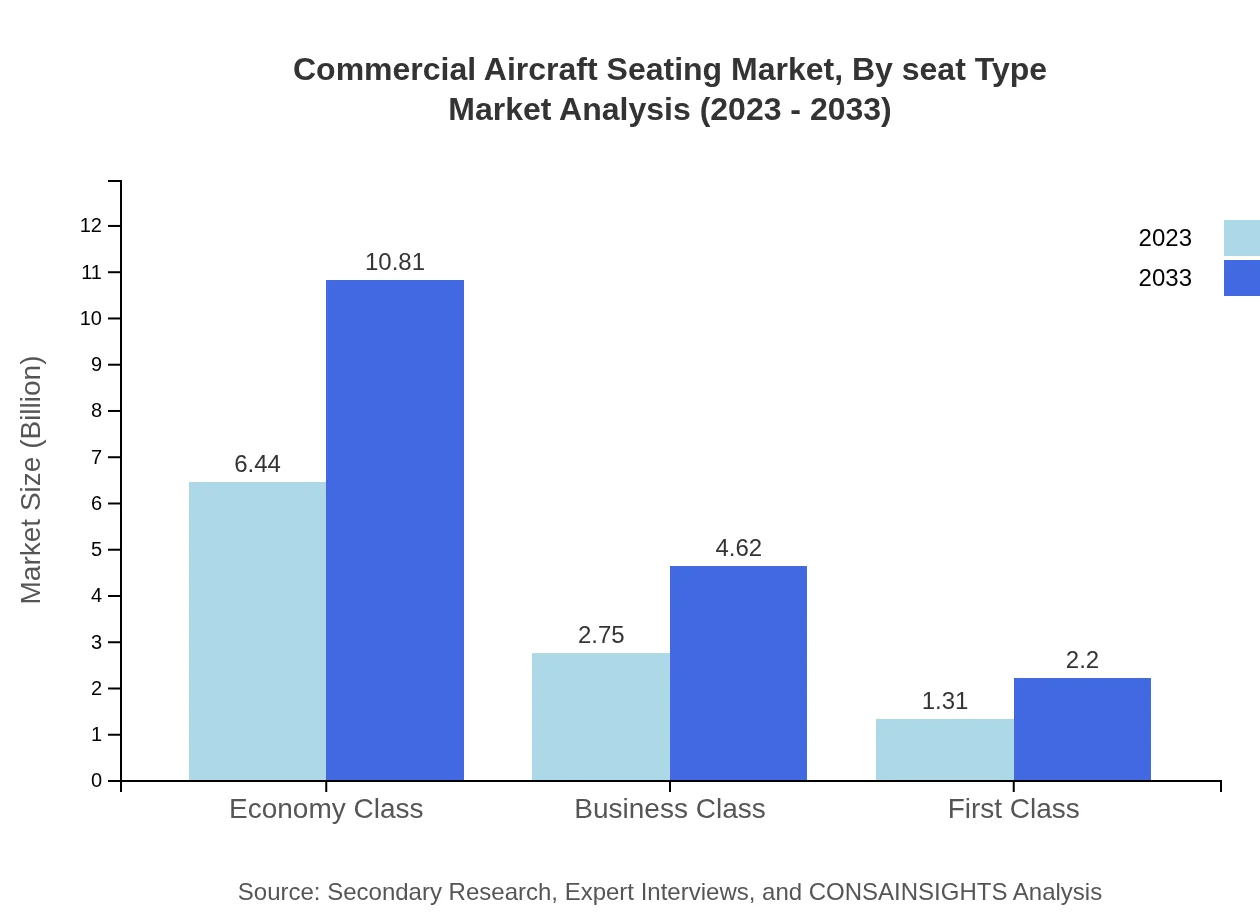

Commercial Aircraft Seating Market Analysis By Seat Type

The market for Commercial Aircraft Seating by seat type is categorized into Economy Class, Business Class, and First Class. As of 2023, Economy Class dominates with a size of $6.44 billion and maintains the largest share in 2033 with projected growth to $10.81 billion. Business Class and First Class follow with respective sizes of $2.75 billion and $1.31 billion in 2023, expected to increase to $4.62 billion and $2.20 billion by 2033.

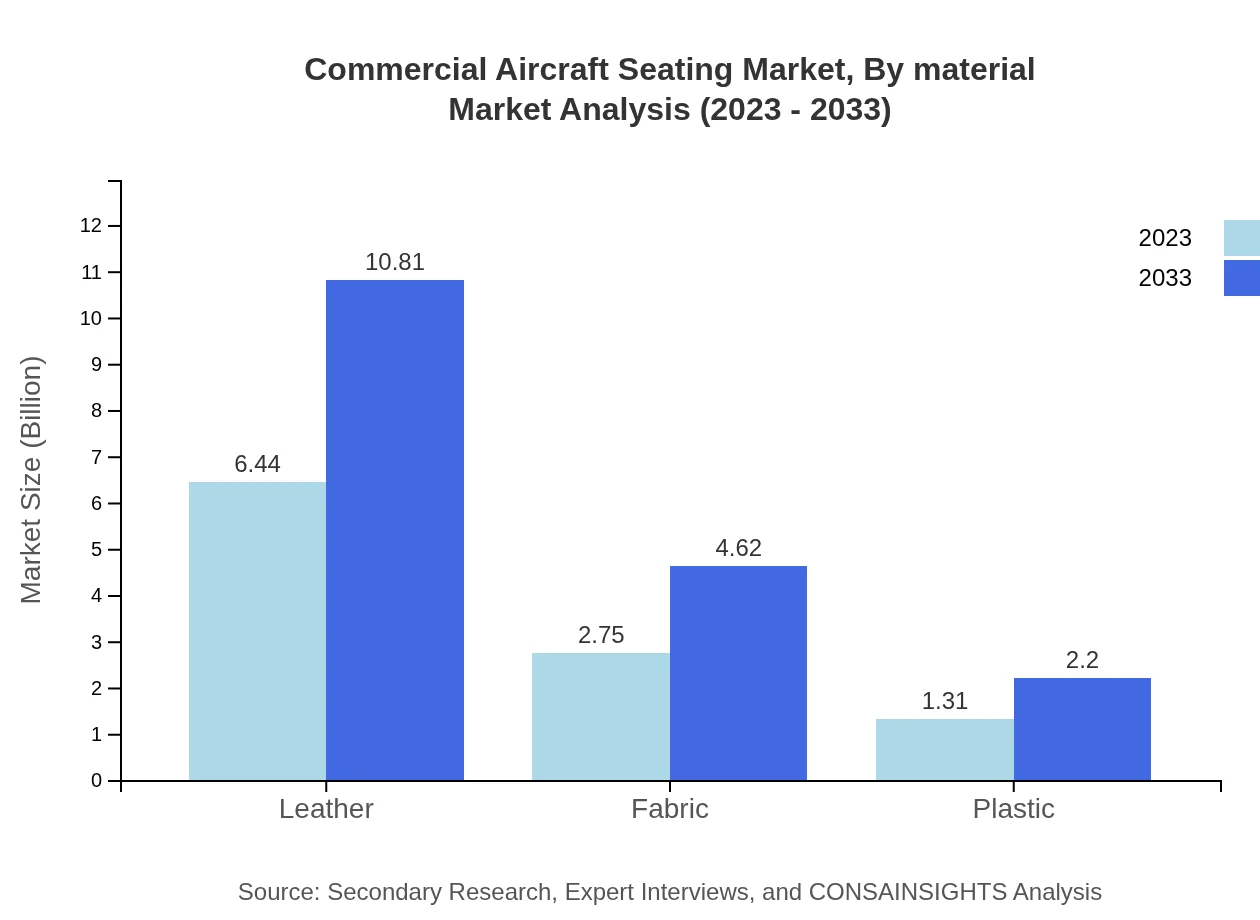

Commercial Aircraft Seating Market Analysis By Material

In terms of material, Leather, Fabric, and Plastic are key segments. Leather holds the largest market share, valued at $6.44 billion in 2023 and expected to grow to $10.81 billion by 2033. Fabric and Plastic also perform well, with projected market values of $2.75 billion and $1.31 billion in 2023 rising to $4.62 billion and $2.20 billion respectively by 2033.

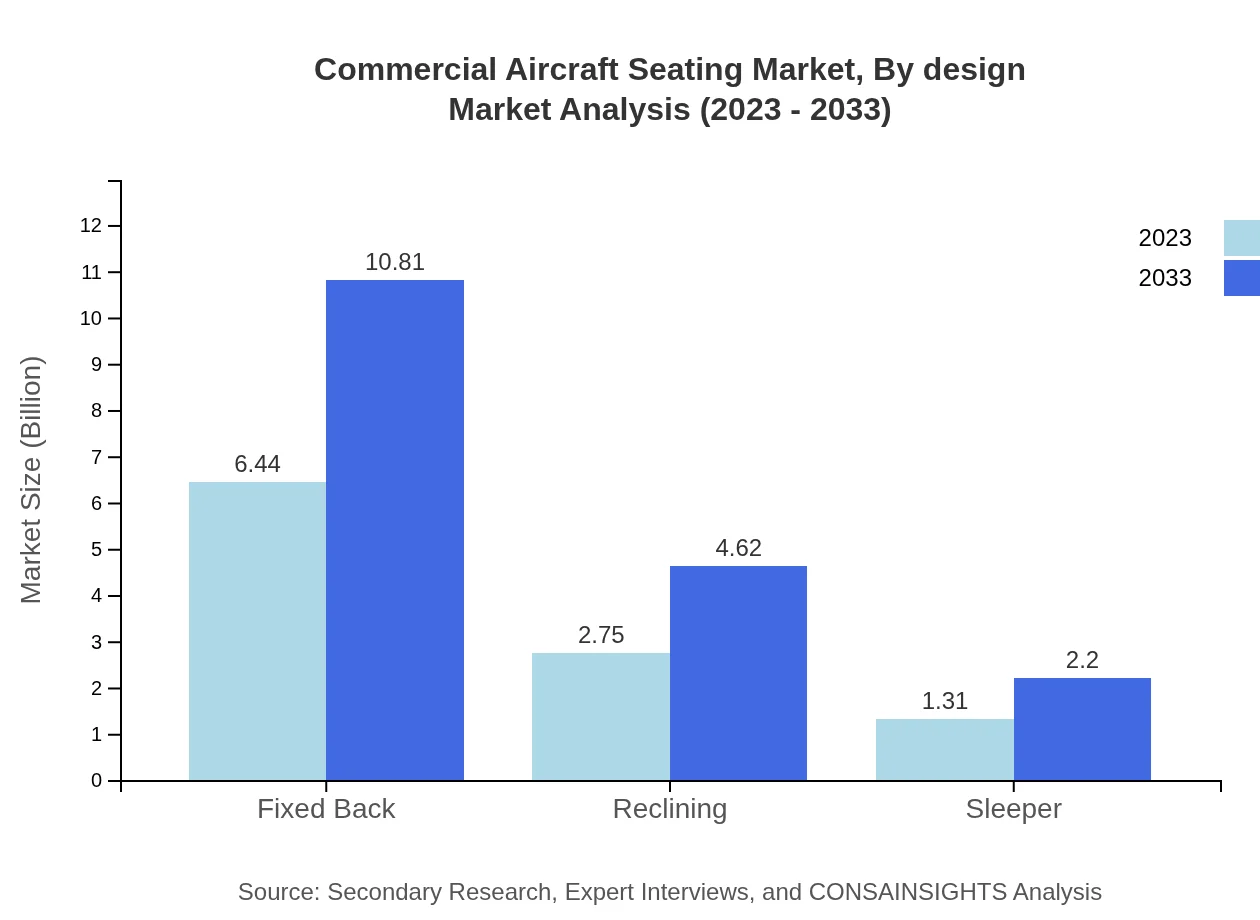

Commercial Aircraft Seating Market Analysis By Design

The analysis by design indicates demand for Fixed Back, Reclining, and Sleeper seats. Fixed Back seats will retain the highest market share throughout the forecast period, starting from $6.44 billion in 2023 and growing to $10.81 billion by 2033. Reclining seats start at $2.75 billion in 2023 and rise to $4.62 billion by 2033, while Sleeper seat market will see progress from $1.31 billion to $2.20 billion.

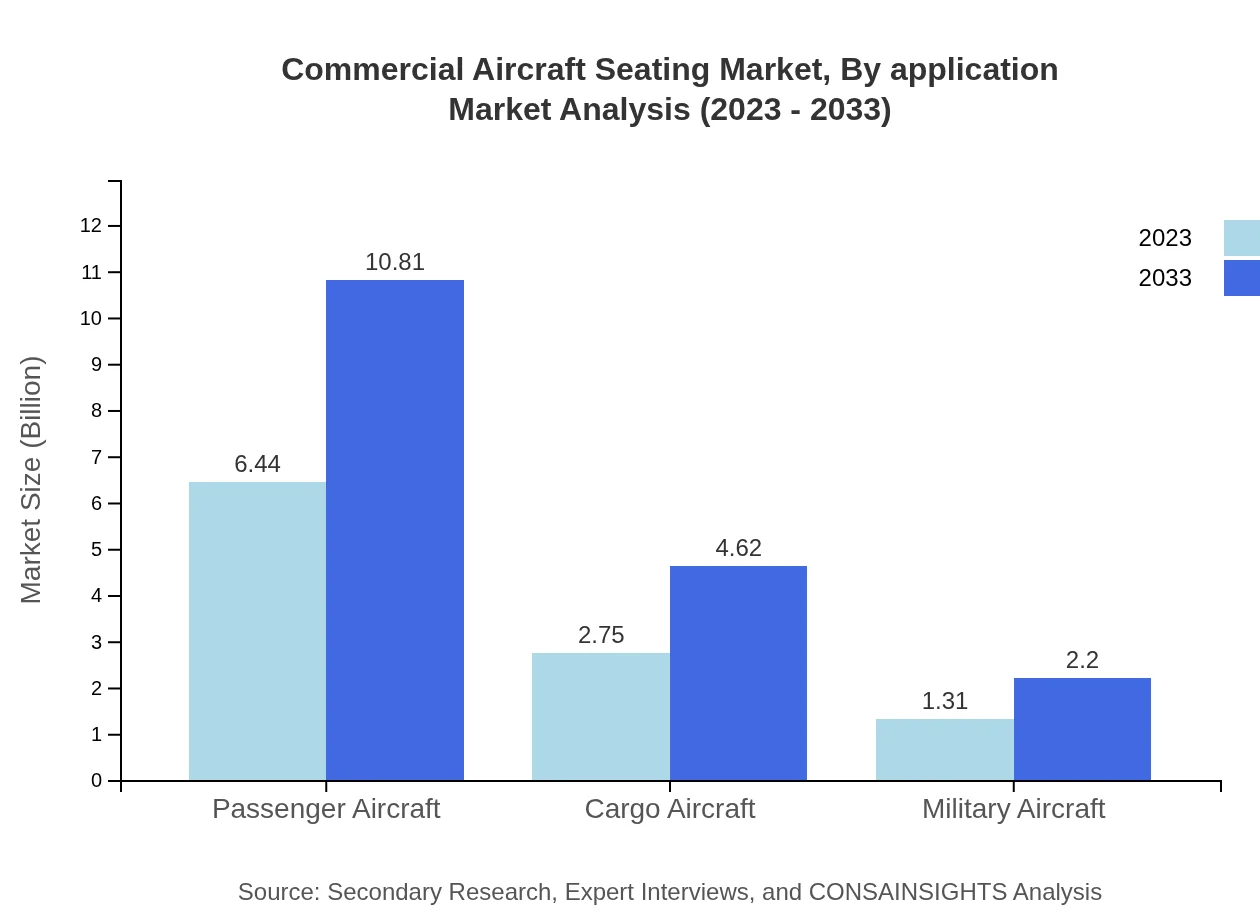

Commercial Aircraft Seating Market Analysis By Application

The market by application includes Passenger Aircraft, Cargo Aircraft, and Military Aircraft. Passenger Aircraft dominates with $6.44 billion in 2023, expected to grow to $10.81 billion. Cargo and Military Aircraft seating holds smaller segments, respectively increasing from $2.75 billion and $1.31 billion in 2023 to $4.62 billion and $2.20 billion by 2033.

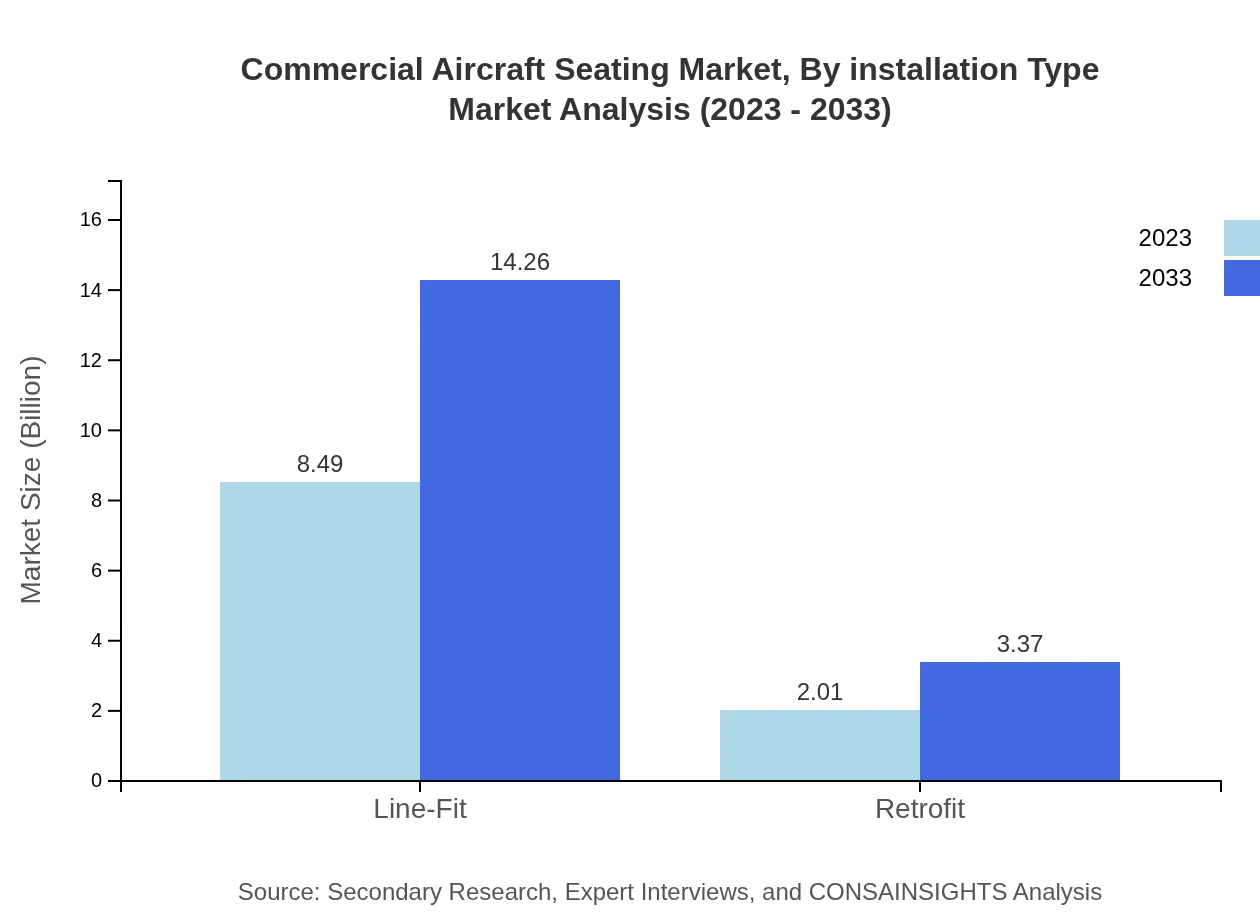

Commercial Aircraft Seating Market Analysis By Installation Type

Commercial Aircraft Seating is segmented by installation type into Line-Fit and Retrofit segments. Line-Fit is projected to dominate, growing from $8.49 billion in 2023 to $14.26 billion by 2033, due to high demand for new aircraft seating. Retrofit demand is also increasing, from $2.01 billion to $3.37 billion, indicating ongoing interest in upgrading existing aircraft.

Commercial Aircraft Seating Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Commercial Aircraft Seating Industry

Recaro Aircraft Seating:

Recaro is a leading manufacturer known for its high-quality seating solutions, focusing on innovation and enhanced passenger comfort.Collins Aerospace:

A major player in aerospace manufacturing, Collins Aerospace provides advanced seating solutions integrated with smart technology for passenger safety and comfort.Zodiac Aerospace:

Zodiac Aerospace specializes in the design and manufacture of aircraft seats including pioneering designs aimed at luxury first-class travel.Sofema Aviation Services:

Sofema is recognized for its extensive training programs and consultancy services that help improve aircraft seating standards.BE Aerospace:

BE Aerospace is a prominent supplier of aircraft seating and provides solutions designed for airlines aiming to enhance their service offerings.We're grateful to work with incredible clients.

FAQs

What is the market size of commercial Aircraft Seating?

The commercial aircraft seating market is projected to grow to $10.5 billion by 2033, with a CAGR of 5.2%. This growth is underpinned by ongoing demand for air travel and advancements in seating technology.

What are the key market players or companies in this commercial Aircraft Seating industry?

Key players in the commercial aircraft seating industry include major manufacturers like Boeing, Airbus, Zodiac Aerospace, Collins Aerospace, and Recaro Aircraft Seating. These companies dominate due to their innovative designs and product offerings.

What are the primary factors driving the growth in the commercial Aircraft Seating industry?

Growth in the commercial aircraft seating industry is driven by rising passenger demand for air travel, increasing aircraft deliveries, advancements in seating comfort and safety features, and innovations in lightweight materials that improve fuel efficiency.

Which region is the fastest Growing in the commercial Aircraft Seating?

The fastest-growing region in the commercial aircraft seating market is projected to be North America, with a market size of $6.63 billion by 2033, followed closely by Europe at $4.60 billion in the same year, highlighting robust demand in these regions.

Does ConsaInsights provide customized market report data for the commercial Aircraft Seating industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications in the commercial aircraft seating industry, allowing for detailed insights based on specific regional or segment analysis.

What deliverables can I expect from this commercial Aircraft Seating market research project?

Deliverables from the commercial aircraft seating market research project include comprehensive market analysis, segmented data by type and region, industry forecasts, competitive landscape insights, and strategic recommendations for market entry.

What are the market trends of commercial Aircraft Seating?

Current market trends in commercial aircraft seating include a shift towards more sustainable materials, increased demand for premium seating options, innovations in ergonomics for improved passenger comfort, and the integration of smart technology into seating features.