Commercial Aircraft Upholstery Market Report

Published Date: 03 February 2026 | Report Code: commercial-aircraft-upholstery

Commercial Aircraft Upholstery Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Commercial Aircraft Upholstery market, covering market size, growth trends, regional insights, and competitive landscape from 2023 to 2033. Expect detailed data on segmentation by material, product types, and applications while highlighting future forecasts.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

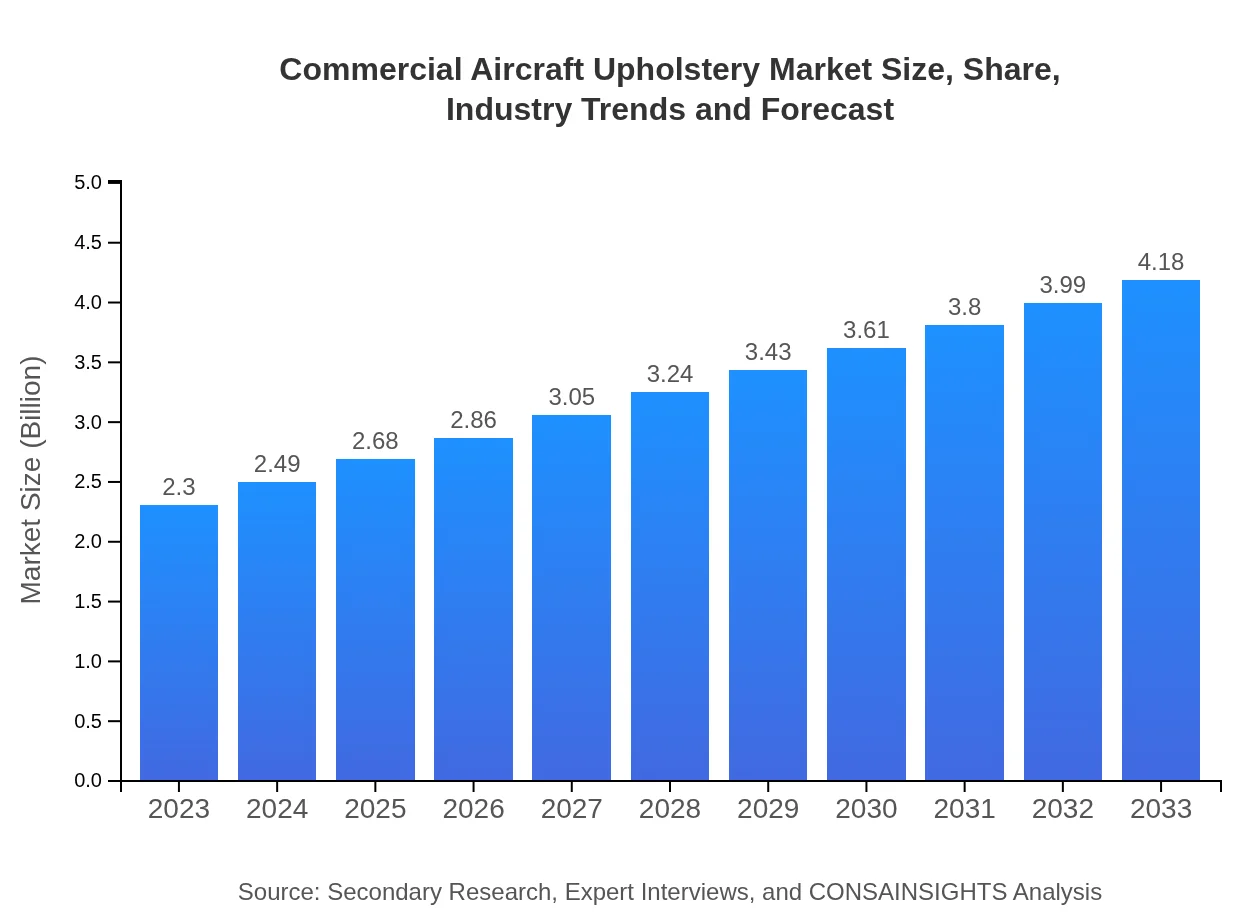

| 2023 Market Size | $2.30 Billion |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $4.18 Billion |

| Top Companies | B/E Aerospace, Zodiac Aerospace, F/List, AeroMexico Interiors |

| Last Modified Date | 03 February 2026 |

Commercial Aircraft Upholstery Market Overview

Customize Commercial Aircraft Upholstery Market Report market research report

- ✔ Get in-depth analysis of Commercial Aircraft Upholstery market size, growth, and forecasts.

- ✔ Understand Commercial Aircraft Upholstery's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Commercial Aircraft Upholstery

What is the Market Size & CAGR of the Commercial Aircraft Upholstery market in 2023?

Commercial Aircraft Upholstery Industry Analysis

Commercial Aircraft Upholstery Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Commercial Aircraft Upholstery Market Analysis Report by Region

Europe Commercial Aircraft Upholstery Market Report:

The European market is expected to grow from $0.60 billion in 2023 to $1.09 billion by 2033. European airlines are focusing on innovative designs and comfort, while adhering to strict regulatory standards for safety, prompting investments in advanced upholstery technologies.Asia Pacific Commercial Aircraft Upholstery Market Report:

In the Asia Pacific region, the Commercial Aircraft Upholstery market is estimated to grow from $0.49 billion in 2023 to $0.89 billion by 2033. The region is witnessing rapid growth in air travel, fueled by rising disposable incomes and urbanization. Furthermore, major airlines are investing in modernizing their fleets which drives demand for high-quality upholstery.North America Commercial Aircraft Upholstery Market Report:

North America holds a significant share of the market, with values rising from $0.77 billion in 2023 to $1.41 billion in 2033. The region is characterized by a demand for luxury and comfort within passenger travel, driving airlines to invest substantially in high-quality upholstery solutions and sustainable materials.South America Commercial Aircraft Upholstery Market Report:

The South American Commercial Aircraft Upholstery market is projected to increase from $0.22 billion in 2023 to $0.40 billion in 2033. Although growth rates are slower compared to other regions, there is a gradual increase in air travel demand that prompts airlines to enhance their passenger services through better upholstery and interior designs.Middle East & Africa Commercial Aircraft Upholstery Market Report:

The market in the Middle East and Africa is forecasted to grow from $0.22 billion in 2023 to $0.39 billion in 2033, fueled by increased air travel in the region and significant developments in airport infrastructure, leading to enhanced airline services.Tell us your focus area and get a customized research report.

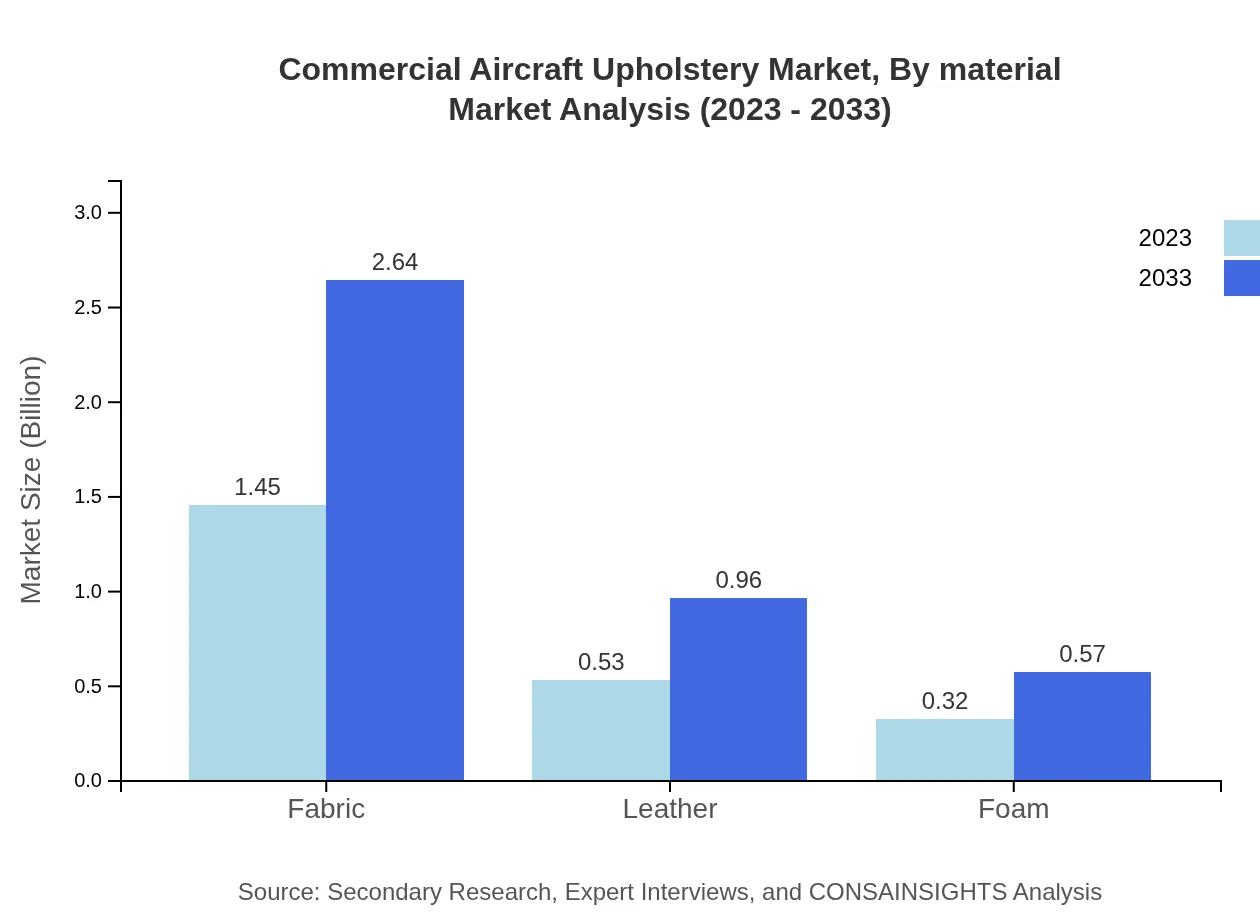

Commercial Aircraft Upholstery Market Analysis By Material

The analysis by material indicates that fabric holds the largest market share at 63.25% in 2023, valued at $1.45 billion and expected to reach $2.64 billion by 2033. Leather follows with a 23.05% share valued at $0.53 billion, and foam accounts for 13.7% with a value of $0.32 billion. The growing preference for lightweight and sustainable materials is anticipated to drive a further shift towards innovative fabric offerings.

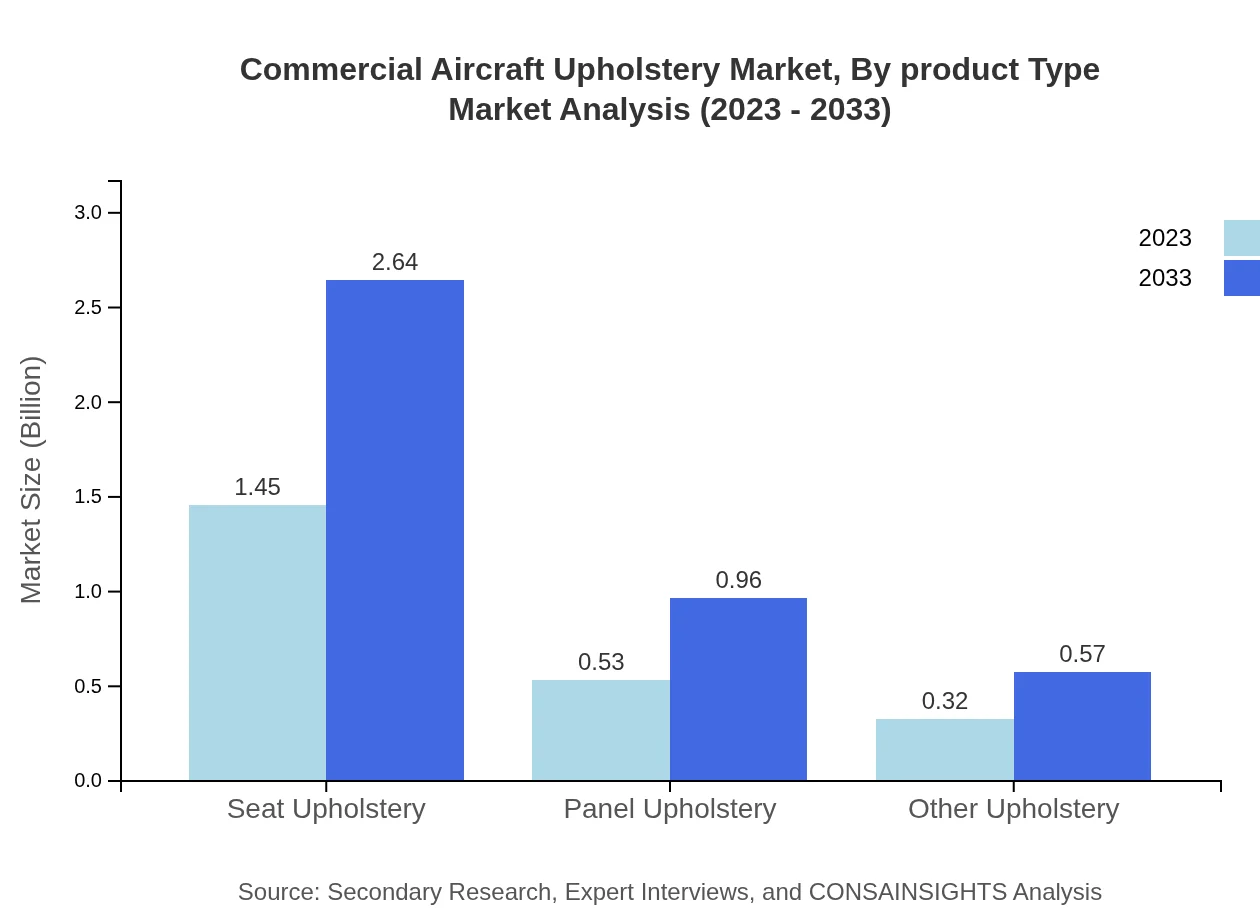

Commercial Aircraft Upholstery Market Analysis By Product Type

When looking at product types, seat upholstery accounts for 63.25% of the market share in 2023, worth $1.45 billion. This segment is projected to grow to $2.64 billion by 2033, driven by rising passenger numbers and the desire for enhanced comfort and premium experiences in commercial aircraft. Panel upholstery follows with a share of 23.05%, while other upholstery types occupy 13.7%.

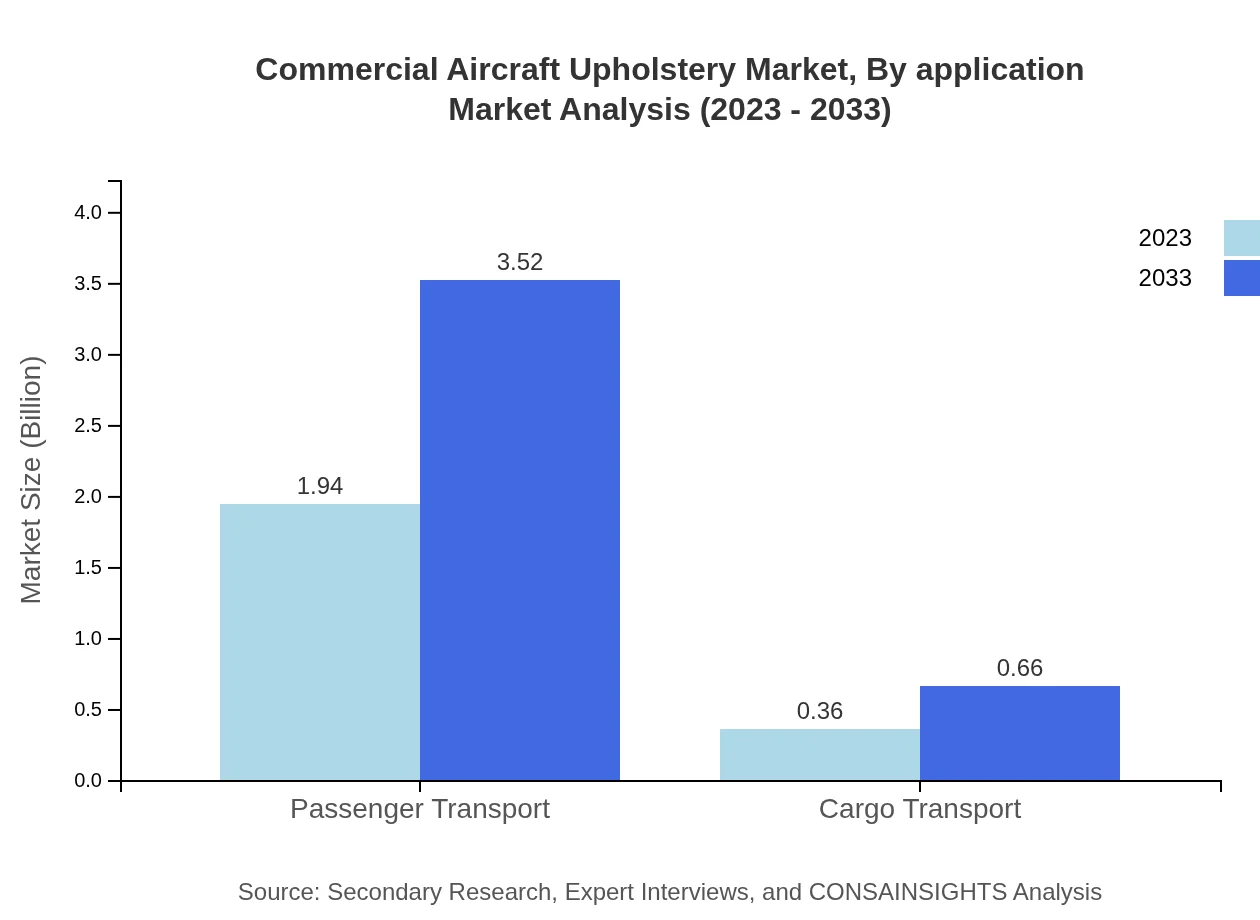

Commercial Aircraft Upholstery Market Analysis By Application

Passenger transport represents a dominant share in the upholstery market at 84.15% in 2023, anticipated to grow from $1.94 billion to $3.52 billion by 2033. Conversely, the cargo transport segment makes up 15.85% with expected growth from $0.36 billion to $0.66 billion, driven by increased demand for air cargo services globally.

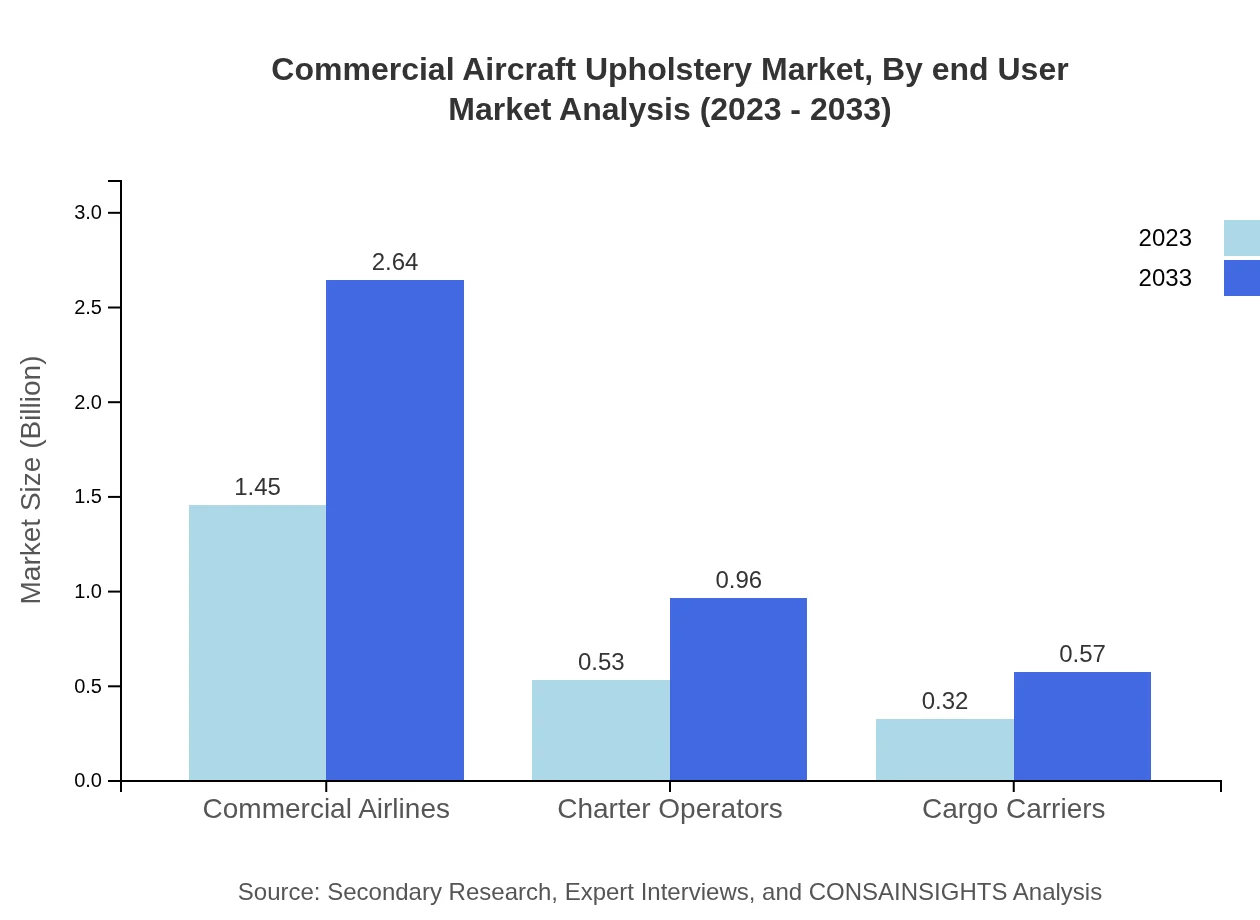

Commercial Aircraft Upholstery Market Analysis By End User

The primary end-users include commercial airlines and charter operators, with commercial airlines dominating with a 63.25% share in 2023, valued at $1.45 billion. Charter operators represent 23.05% valued at $0.53 billion. Cargo carriers, while smaller, hold equal significance for specialized upholstery to maintain cargo integrity and efficiency.

Commercial Aircraft Upholstery Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Commercial Aircraft Upholstery Industry

B/E Aerospace:

A leading supplier of aircraft cabin interior products, known for innovative design and engineering solutions, enhancing passenger experience in commercial aircraft.Zodiac Aerospace:

Specializing in aircraft interiors, Zodiac Aerospace provides a wide range of upholstery products renowned for quality and durability in the aviation market.F/List:

An expert in premium class cabin interiors and upholstery, F/List focuses on providing luxurious interior solutions for commercial and private aviation.AeroMexico Interiors:

Offers a comprehensive selection of upholstery and interior components specifically designed for improving aesthetics and safety in the aviation industry.We're grateful to work with incredible clients.

FAQs

What is the market size of commercial Aircraft Upholstery?

The commercial aircraft upholstery market is valued at approximately $2.3 billion in 2023, with a projected Compound Annual Growth Rate (CAGR) of 6% until 2033, indicating robust growth opportunities for industry stakeholders.

What are the key market players or companies in this commercial Aircraft Upholstery industry?

Key players in the commercial aircraft upholstery market include major aerospace manufacturers, upholstery suppliers, and material providers. These companies are investing in innovative technologies and material development to enhance passenger comfort and safety in aircraft interiors.

What are the primary factors driving the growth in the commercial Aircraft Upholstery industry?

The growth is primarily driven by increasing passenger air travel, advancements in upholstery materials for comfort and safety, and airlines' focus on enhancing passenger experience, contributing to the demand for high-quality aircraft upholstery.

Which region is the fastest Growing in the commercial Aircraft Upholstery?

The Asia-Pacific region is poised to be the fastest-growing market for commercial aircraft upholstery, projected to grow from $0.49 billion in 2023 to $0.89 billion by 2033, driven by rising air travel and fleet expansions.

Does ConsaInsights provide customized market report data for the commercial Aircraft Upholstery industry?

Yes, ConsaInsights offers customized market reports for the commercial aircraft upholstery sector. Clients can request tailored insights and data analyses to better meet their specific market research needs.

What deliverables can I expect from this commercial Aircraft Upholstery market research project?

Deliverables typically include comprehensive market analysis reports, segment breakdowns, competitive landscape overviews, regional insights, and future growth forecasts, providing a holistic view of the commercial aircraft upholstery market.

What are the market trends of commercial Aircraft Upholstery?

Current trends include a shift towards eco-friendly materials, emphasis on passenger comfort upgrades, growing customization in upholstery designs, and technological innovations in fabric and durability, shaping the future of the commercial aircraft upholstery market.