Commercial Aircraft Video Surveillance Systems Market Report

Published Date: 03 February 2026 | Report Code: commercial-aircraft-video-surveillance-systems

Commercial Aircraft Video Surveillance Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Commercial Aircraft Video Surveillance Systems market, highlighting market size, technological advancements, regional insights, and future trends. Covering the forecast period from 2023 to 2033, it aims to equip stakeholders with actionable insights for strategic decision-making.

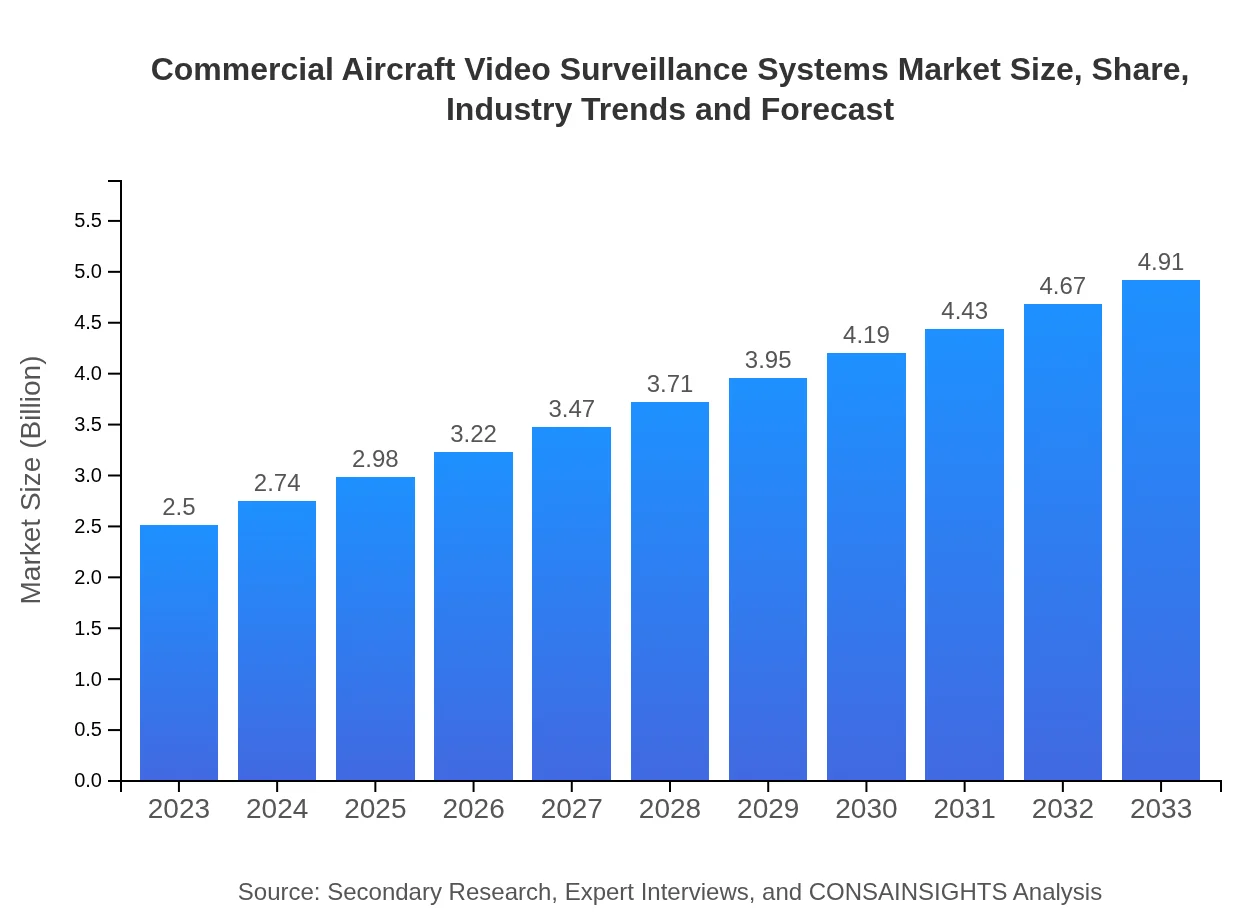

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Honeywell International Inc., FLIR Systems, Inc., L3Harris Technologies, Raytheon Technologies |

| Last Modified Date | 03 February 2026 |

Commercial Aircraft Video Surveillance Systems Market Overview

Customize Commercial Aircraft Video Surveillance Systems Market Report market research report

- ✔ Get in-depth analysis of Commercial Aircraft Video Surveillance Systems market size, growth, and forecasts.

- ✔ Understand Commercial Aircraft Video Surveillance Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Commercial Aircraft Video Surveillance Systems

What is the Market Size & CAGR of Commercial Aircraft Video Surveillance Systems market in 2033?

Commercial Aircraft Video Surveillance Systems Industry Analysis

Commercial Aircraft Video Surveillance Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Commercial Aircraft Video Surveillance Systems Market Analysis Report by Region

Europe Commercial Aircraft Video Surveillance Systems Market Report:

Europe's market is projected to rise from $0.66 billion in 2023 to $1.30 billion by 2033, reflecting a steady demand for improved safety measures amidst high regulatory standards. The integration of state-of-the-art surveillance technologies is prevalent among European airlines.Asia Pacific Commercial Aircraft Video Surveillance Systems Market Report:

In the Asia-Pacific region, the CAVSS market is expected to grow from $0.49 billion in 2023 to $0.96 billion by 2033. The growth is driven by increasing airline capacities and government investments in aviation security. Countries like China and India are leading the charge in adopting technological solutions to enhance aircraft surveillance.North America Commercial Aircraft Video Surveillance Systems Market Report:

North America remains the largest market for CAVSS, expected to grow from $0.91 billion in 2023 to $1.80 billion in 2033. The presence of major players and continuous technological innovations are key drivers in this region, coupled with robust regulatory frameworks.South America Commercial Aircraft Video Surveillance Systems Market Report:

The South American market is projected to increase from $0.18 billion in 2023 to $0.34 billion by 2033. This growth is attributed to rising passenger traffic and an emphasis on security protocols, as governments enhance regulatory measures to meet international standards.Middle East & Africa Commercial Aircraft Video Surveillance Systems Market Report:

The Middle East and Africa market is expected to reach $0.52 billion, growing from $0.26 billion in 2023. The region is witnessing significant growth in air travel and is investing heavily in advanced surveillance systems to mitigate risks associated with increased passenger traffic.Tell us your focus area and get a customized research report.

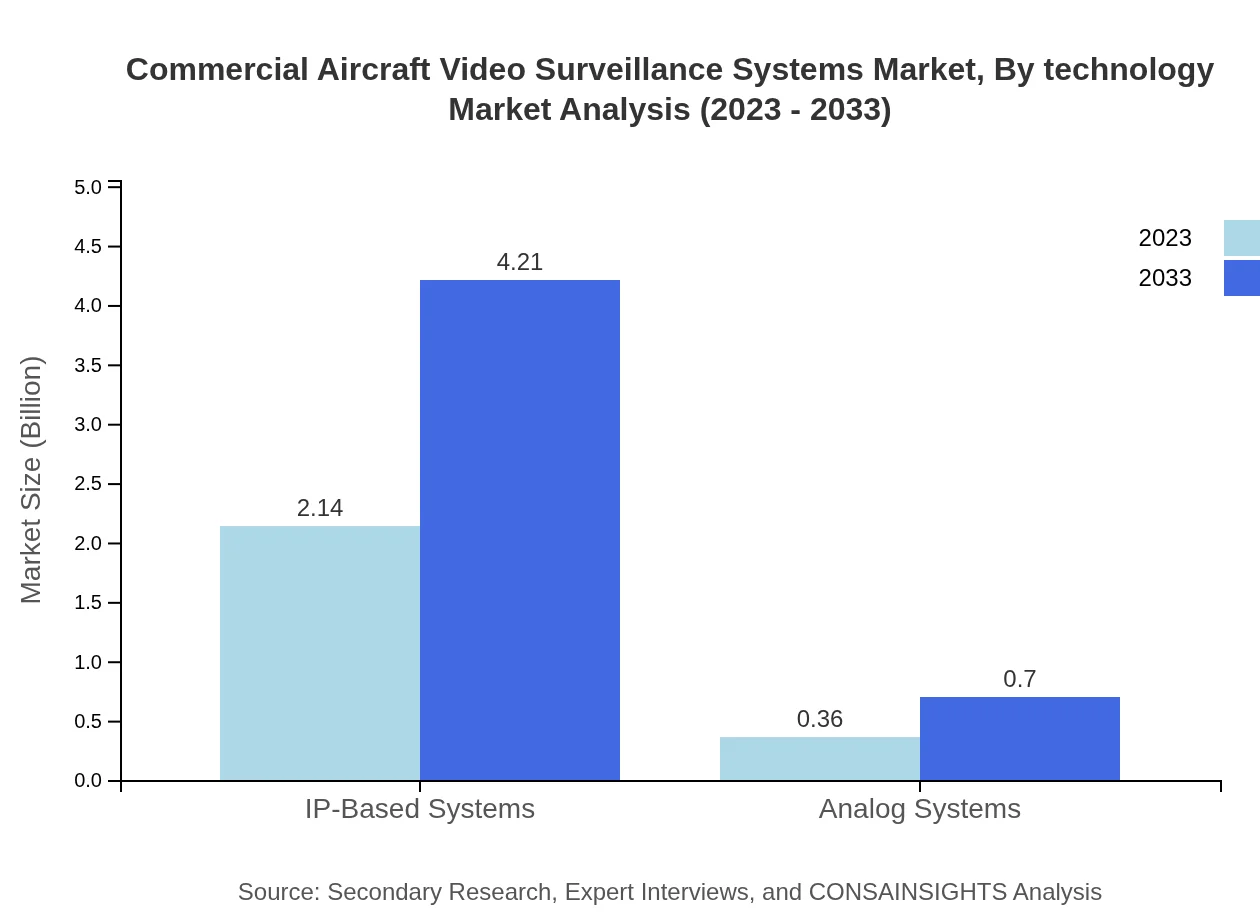

Commercial Aircraft Video Surveillance Systems Market Analysis By Product Type

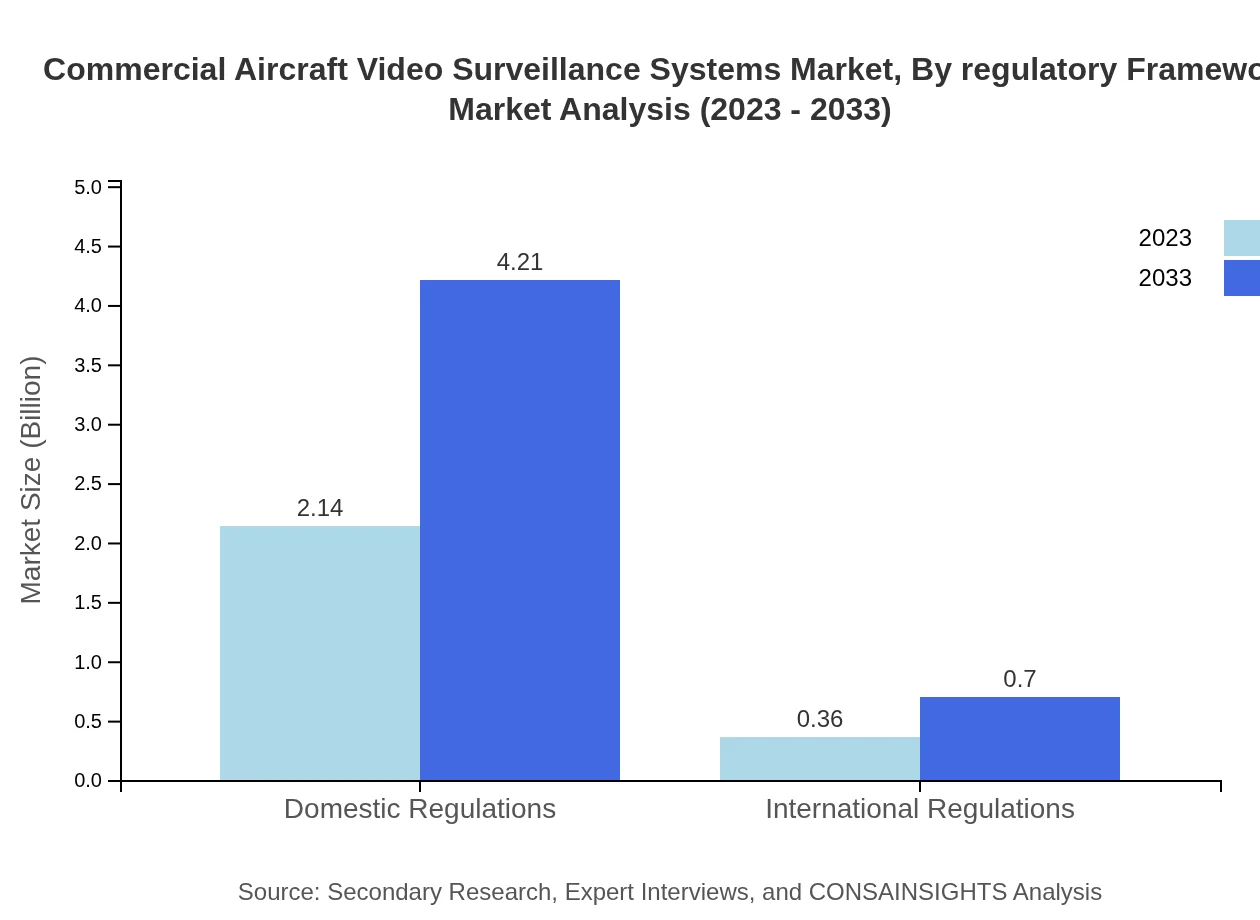

The product types in the CAVSS market include IP-based systems and Analog systems. As of 2023, IP-based systems dominate the market at $2.14 billion (85.66% share), with growth expected to reach $4.21 billion by 2033. Analog systems, though less popular, show growth from $0.36 billion to $0.70 billion in the same period, holding a 14.34% market share.

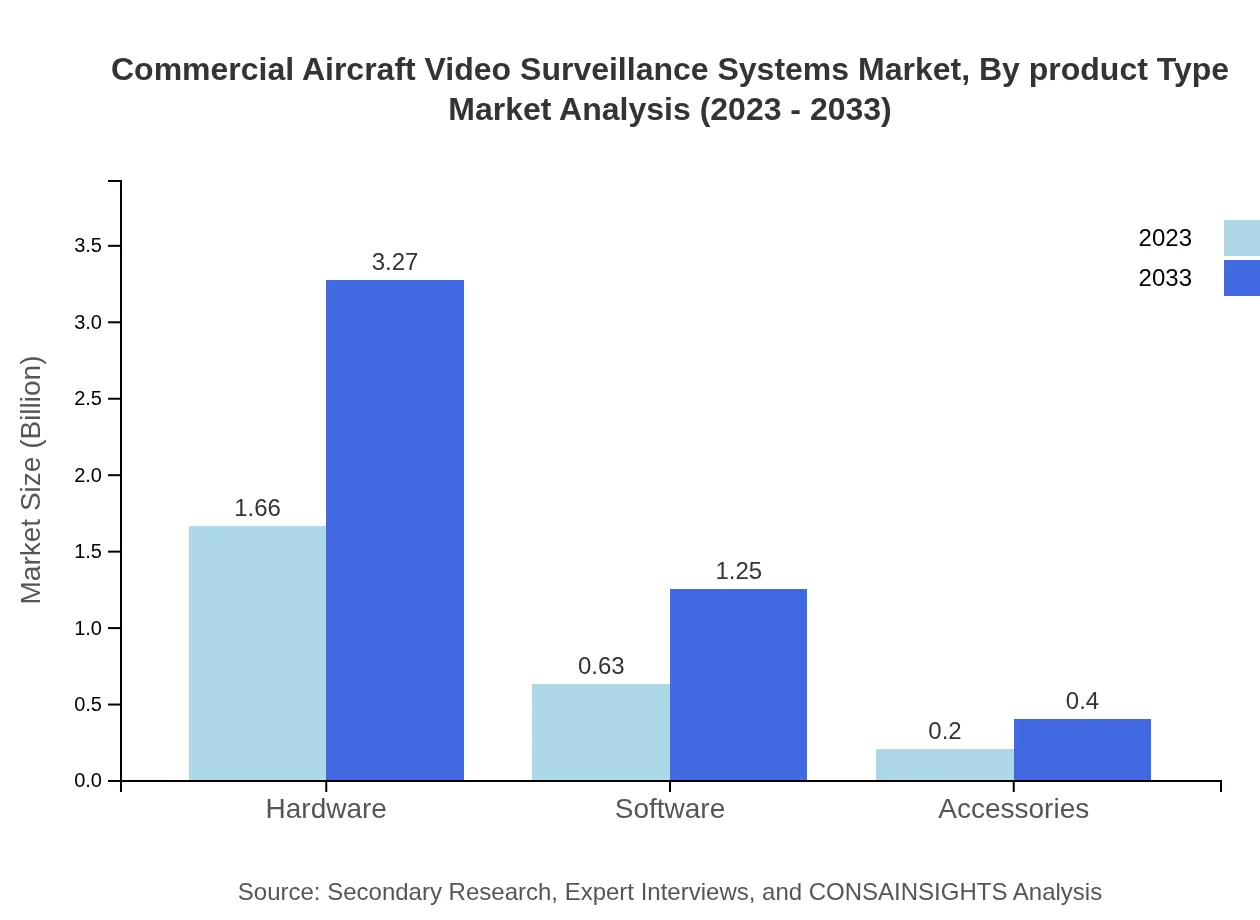

Commercial Aircraft Video Surveillance Systems Market Analysis By Technology

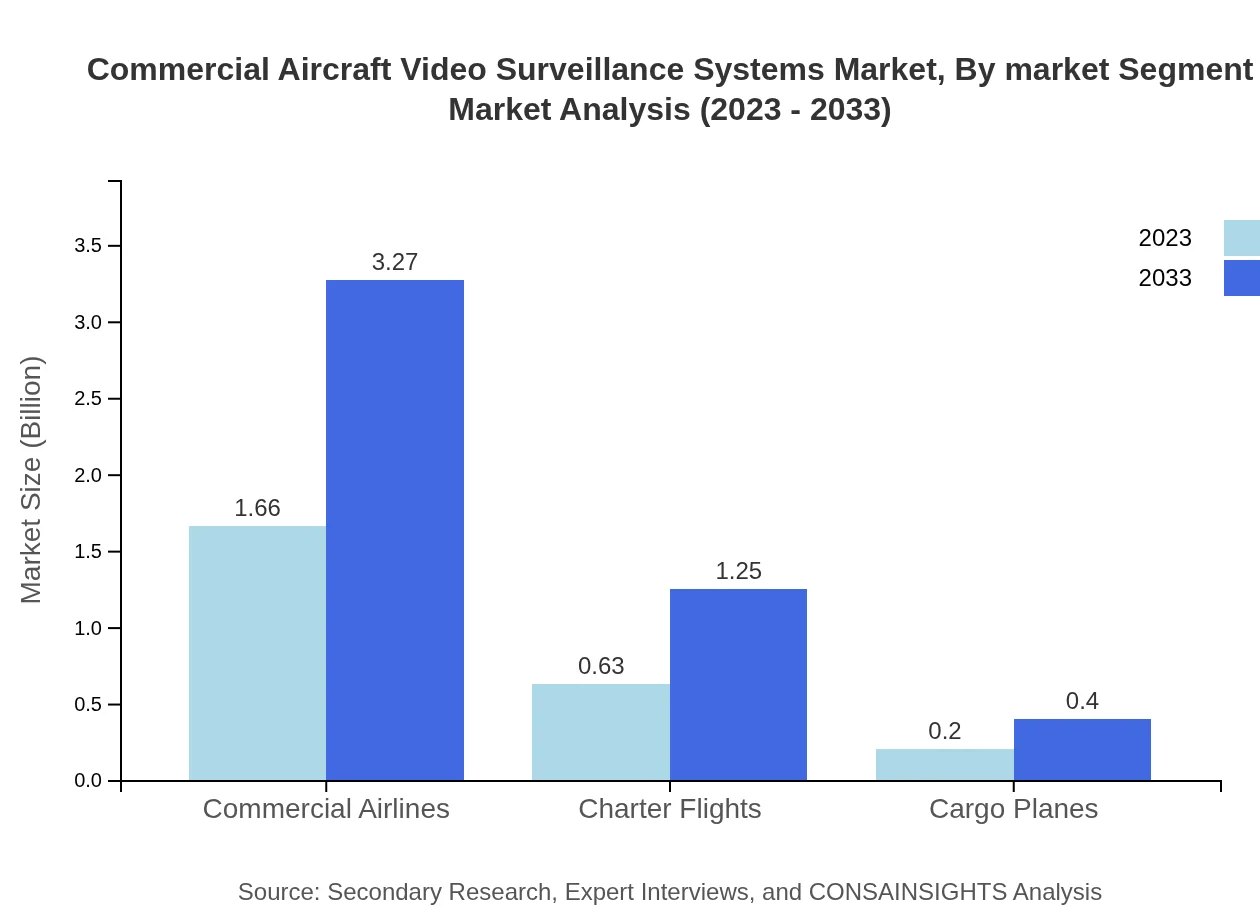

The market is further segmented by technology into hardware, software, and accessories. Hardware accounts for $1.66 billion (66.53% share) in 2023, growing to $3.27 billion. Software follows, with a current value of $0.63 billion and projected growth to $1.25 billion. Accessories, although a smaller segment at $0.20 billion, is expected to grow to $0.40 billion by 2033.

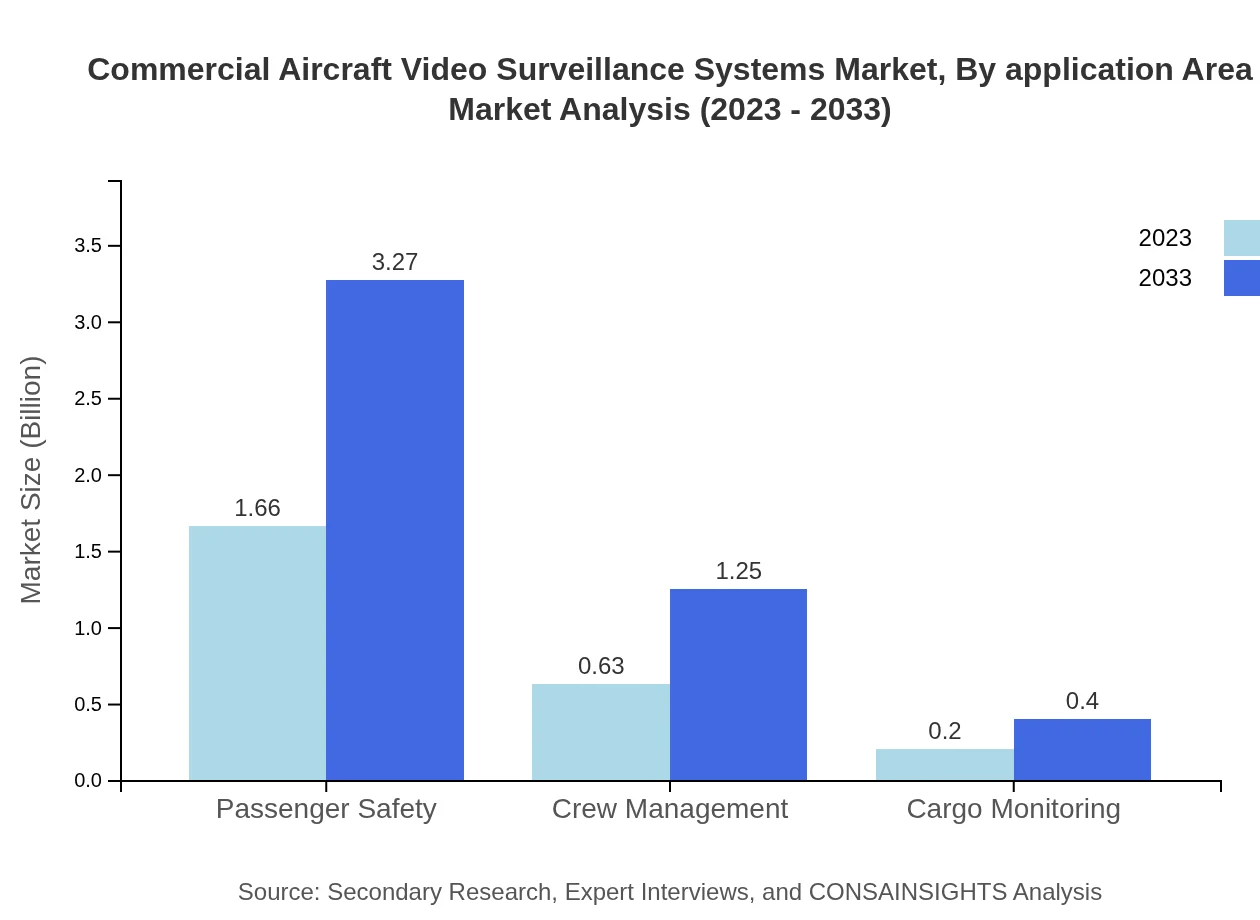

Commercial Aircraft Video Surveillance Systems Market Analysis By Application Area

The primary application areas include Passenger Safety, Crew Management, and Cargo Monitoring. Passenger Safety leads the market with $1.66 billion (66.53% share) in 2023, expected to increase to $3.27 billion. Crew Management stands at $0.63 billion with similar growth projections.

Commercial Aircraft Video Surveillance Systems Market Analysis By Market Segment

Key market segments include Commercial Airlines, Charter Flights, and Cargo Planes. Commercial Airlines dominate with $1.66 billion (66.53%), growing to $3.27 billion. Charter Flights and Cargo Planes contribute $0.63 billion and $0.20 billion, respectively, each projected to grow steadily.

Commercial Aircraft Video Surveillance Systems Market Analysis By Regulatory Framework

The regulatory framework segmentation includes Domestic and International Regulations. Domestic regulations are valued at $2.14 billion (85.66% share) and are expected to grow to $4.21 billion. International Regulations, though smaller at $0.36 billion, show growth to $0.70 billion by 2033.

Commercial Aircraft Video Surveillance Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Commercial Aircraft Video Surveillance Systems Industry

Honeywell International Inc.:

A leading provider of aviation safety solutions, Honeywell specializes in advanced surveillance technology for commercial aircraft, focusing on enhancing security and operational efficiency.FLIR Systems, Inc.:

FLIR is renowned for its thermal imaging systems and comprehensive surveillance solutions that enhance situational awareness and safety in aviation.L3Harris Technologies:

L3Harris delivers mission-critical communication technology and surveillance systems that improve situational awareness in commercial aviation.Raytheon Technologies:

Raytheon is a global leader in aerospace and defense technologies, providing innovative surveillance solutions for enhancing aircraft security.We're grateful to work with incredible clients.

FAQs

What is the market size of commercial Aircraft Video Surveillance Systems?

The commercial aircraft video surveillance systems market is valued at approximately $2.5 billion in 2023, with a projected CAGR of 6.8% from 2023 to 2033, indicating significant growth in this industry over the next decade.

What are the key market players or companies in this commercial Aircraft Video Surveillance Systems industry?

Key players in this market include industry leaders like Honeywell, Bosch Security Systems, and FLIR Systems, which contribute significantly to innovation and the adoption of video surveillance technologies within the aircraft sector.

What are the primary factors driving the growth in the commercial Aircraft Video Surveillance Systems industry?

Growth in this industry is driven by increasing passenger safety regulations, rising demand for aircraft security measures, technological advancements in video analytics, and the need for streamlined operations in commercial aviation.

Which region is the fastest Growing in the commercial Aircraft Video Surveillance Systems?

The Asia Pacific region is the fastest-growing area in the commercial aircraft video surveillance systems market, expected to grow from $0.49 billion in 2023 to $0.96 billion by 2033, driven by rising air travel and regulatory demands.

Does ConsaInsights provide customized market report data for the commercial Aircraft Video Surveillance Systems industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs, providing insights and detailed analysis specific to the commercial aircraft video surveillance systems market.

What deliverables can I expect from this commercial Aircraft Video Surveillance Systems market research project?

Deliverables typically include market analysis reports, growth forecasts, competitive landscape evaluation, and segmented data on regions and application types tailored to your research requirements.

What are the market trends of commercial Aircraft Video Surveillance Systems?

Current market trends include the adoption of IP-based surveillance systems, integration of AI for enhanced monitoring, increasing focus on cyber security for aircraft systems, and the growing customization of video surveillance solutions to meet specific airline needs.