Commercial Airport Radar Systems Market Report

Published Date: 03 February 2026 | Report Code: commercial-airport-radar-systems

Commercial Airport Radar Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Commercial Airport Radar Systems market, covering current trends, market size, forecasts from 2023 to 2033, and insights into key segments and players within the industry.

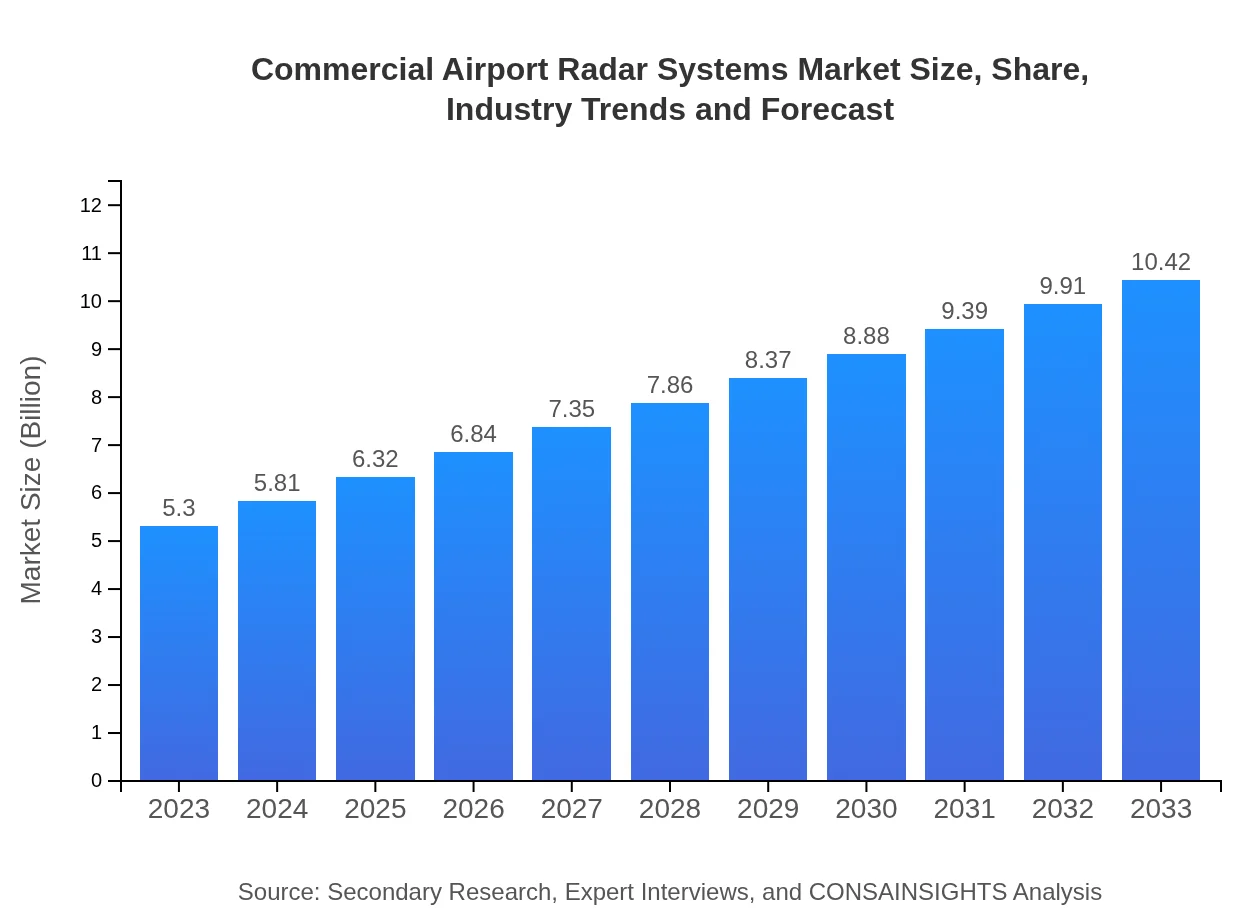

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.30 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.42 Billion |

| Top Companies | Raytheon Technologies, Thales Group, Harris Corporation, Indra Sistemas |

| Last Modified Date | 03 February 2026 |

Commercial Airport Radar Systems Market Overview

Customize Commercial Airport Radar Systems Market Report market research report

- ✔ Get in-depth analysis of Commercial Airport Radar Systems market size, growth, and forecasts.

- ✔ Understand Commercial Airport Radar Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Commercial Airport Radar Systems

What is the Market Size & CAGR of Commercial Airport Radar Systems market in 2023?

Commercial Airport Radar Systems Industry Analysis

Commercial Airport Radar Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Commercial Airport Radar Systems Market Analysis Report by Region

Europe Commercial Airport Radar Systems Market Report:

The European market is set to expand from 1.39 billion USD in 2023 to approximately 2.74 billion USD by 2033. The European Union’s regulations to enhance air traffic management systems will continue to drive this growth.Asia Pacific Commercial Airport Radar Systems Market Report:

In the Asia Pacific, the market is projected to grow from 1.07 billion USD in 2023 to about 2.10 billion USD by 2033, driven by increasing investments in aviation infrastructure and expanding air traffic.North America Commercial Airport Radar Systems Market Report:

North America leads in this segment with a market size of 1.77 billion USD in 2023, expected to reach 3.48 billion USD by 2033, bolstered by robust investments in technology and increasing air travel demand.South America Commercial Airport Radar Systems Market Report:

The South American market is anticipated to rise from 0.50 billion USD in 2023 to 0.99 billion USD by 2033, through enhancements in airport operations and a push towards adopting advanced radar systems for security and traffic management.Middle East & Africa Commercial Airport Radar Systems Market Report:

The Middle East and Africa market is projected to grow from 0.56 billion USD in 2023 to 1.11 billion USD by 2033, aided by developments in the aviation sector and increasing safety and security requirements.Tell us your focus area and get a customized research report.

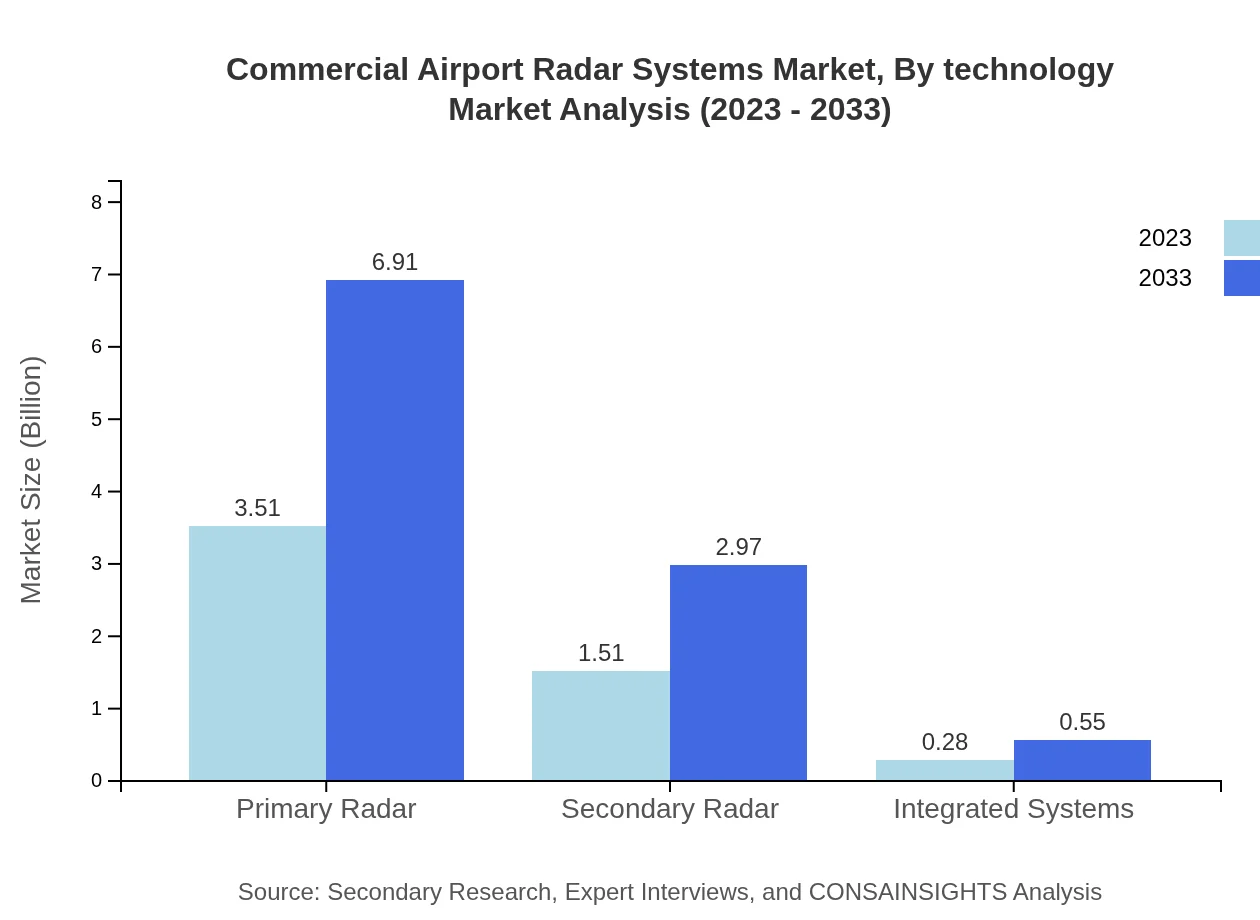

Commercial Airport Radar Systems Market Analysis By Technology

The technology segment is dominated by Primary Radar systems, comprising a significant market share of 66.29% in 2023 and projected to maintain that share through 2033. Secondary Radar systems represent a growing segment, expected to account for 28.47% of the market, with Integrated Systems contributing 5.24%.

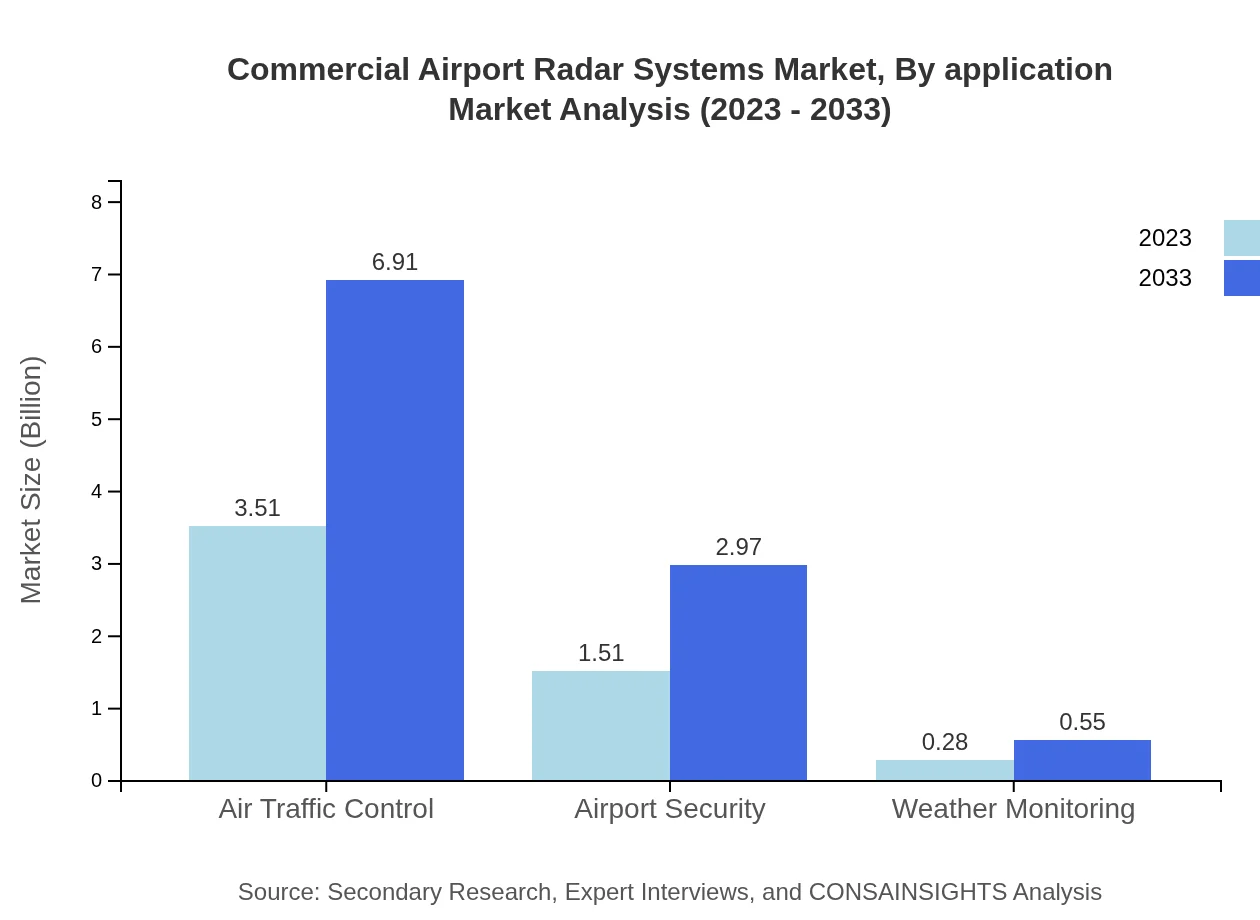

Commercial Airport Radar Systems Market Analysis By Application

In terms of application, Air Traffic Control constitutes a major segment with a commanding market share of 66.29%. This is closely followed by Airport Security at 28.47%, highlighting the critical importance of maintaining safety standards in airport operations, while Weather Monitoring provides essential data with a smaller market share of 5.24%.

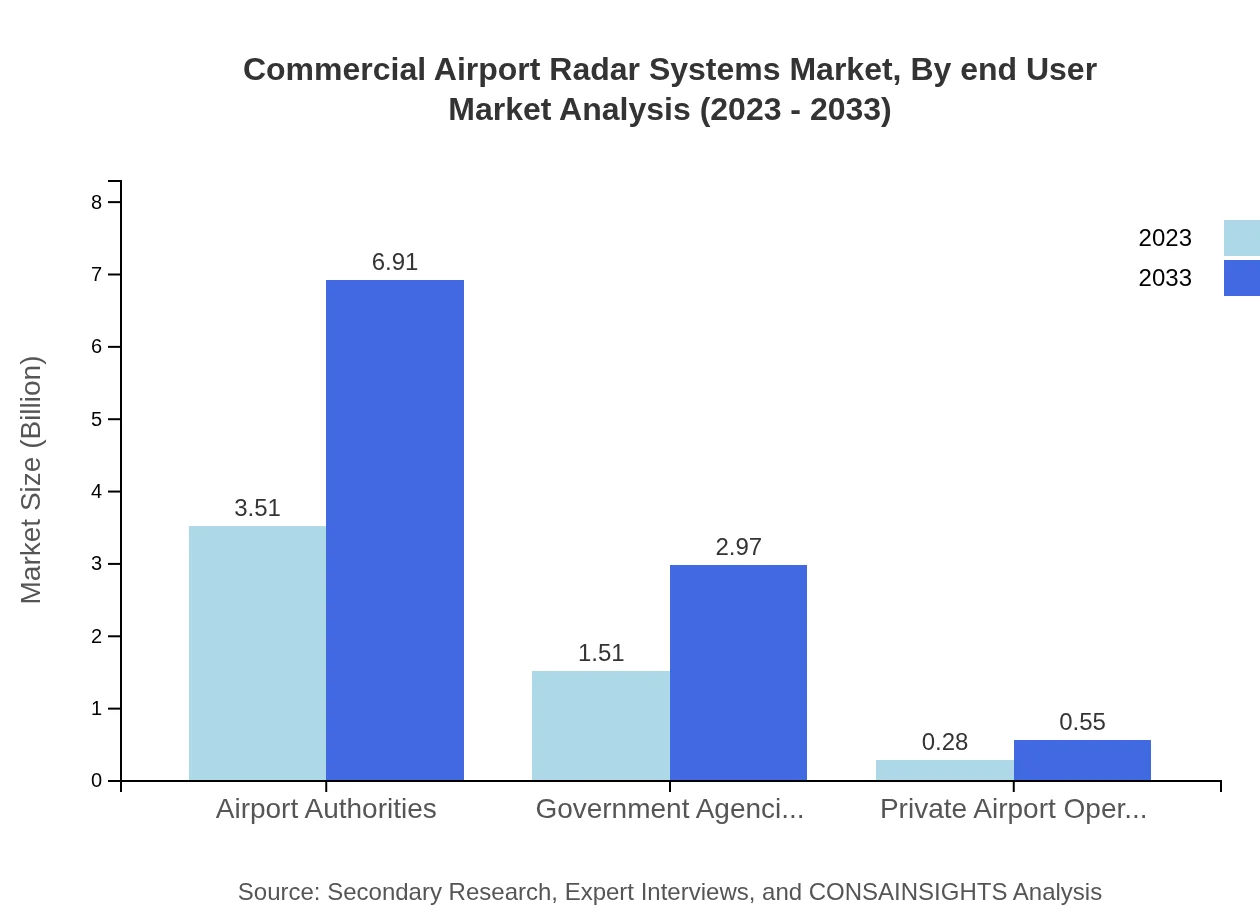

Commercial Airport Radar Systems Market Analysis By End User

Airport Authorities lead the market with a significant size of 3.51 billion USD in 2023, projected to reach 6.91 billion USD by 2033. Government Agencies also play a substantial role with a market size of 1.51 billion USD in 2023, expected to grow to 2.97 billion USD, while Private Airport Operators contribute a smaller yet important market share.

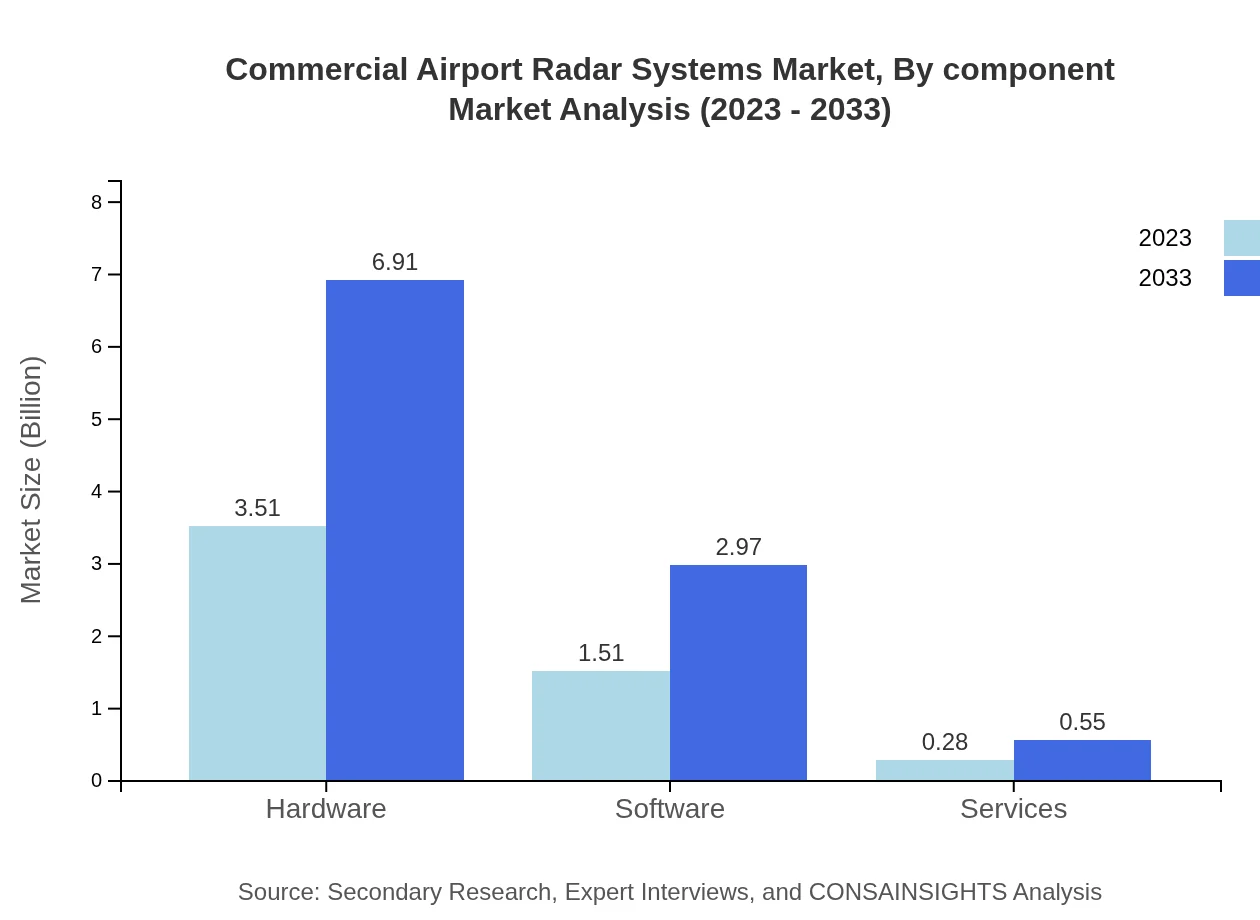

Commercial Airport Radar Systems Market Analysis By Component

The hardware segment dominates the market, reflecting the demand for physical infrastructure required for radar systems. The hardware market size is anticipated to grow from 3.51 billion USD in 2023 to 6.91 billion USD by 2033. Software solutions, while smaller, are catching up with an expected growth from 1.51 billion USD to 2.97 billion USD due to the rising necessity for sophisticated data processing.

Commercial Airport Radar Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Commercial Airport Radar Systems Industry

Raytheon Technologies:

Leading provider of advanced radar technology and air traffic management systems, Raytheon is pivotal in shaping the Commercial Airport Radar Systems industry.Thales Group:

Thales specializes in high-tech solutions, offering innovative radar systems that enhance operational safety and efficiency in the aviation sector.Harris Corporation:

A major player in communication and electronic systems, Harris delivers integrated radar solutions that support effective air traffic control and situational awareness.Indra Sistemas:

Indra is renowned for providing cutting-edge technology and systems in air traffic management and is integral in evolving the radar systems landscape.We're grateful to work with incredible clients.

FAQs

What is the market size of commercial airport radar systems?

The commercial airport radar systems market is estimated at $5.3 billion in 2023, with a projected CAGR of 6.8% through 2033, indicating robust growth as demand for advanced radar solutions increases globally.

What are the key market players or companies in this commercial airport radar systems industry?

Key players in the commercial airport radar systems market include well-established entities with extensive portfolios. These companies are innovating to enhance radar technologies and expand their market presence in various regions worldwide.

What are the primary factors driving the growth in the commercial airport radar systems industry?

Key growth factors include increasing air traffic, advancements in radar technology, strict safety regulations, and a push for modernized air traffic management systems, all contributing to the enhanced demand for radar solutions.

Which region is the fastest Growing in the commercial airport radar systems?

The North American region is the fastest-growing market, with the market size expected to increase from $1.77 billion in 2023 to $3.48 billion by 2033, influenced by technological advancements and investment in airport infrastructure.

Does ConsainInsights provide customized market report data for the commercial airport radar systems industry?

Yes, ConsainInsights offers customized market reports tailored to specific client needs, allowing businesses to gain insights into niche segments, regional analysis, and competitor strategies within the commercial airport radar systems industry.

What deliverables can I expect from this commercial airport radar systems market research project?

Clients can expect comprehensive deliverables, including detailed market analysis, segmented data, emerging trends, competitive landscape overviews, and forecasts tailored to specific client requirements on commercial airport radar systems.

What are the market trends of commercial airport radar systems?

Current market trends include the integration of AI in radar systems, rising investments in smart airport technologies, and increased focus on automation and cybersecurity in aviation radar operations, shaping the future of the industry.