Commercial Amino Acids Market Report

Published Date: 31 January 2026 | Report Code: commercial-amino-acids

Commercial Amino Acids Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Commercial Amino Acids market, providing insights into its size, growth patterns, regional performance, and industry analysis from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

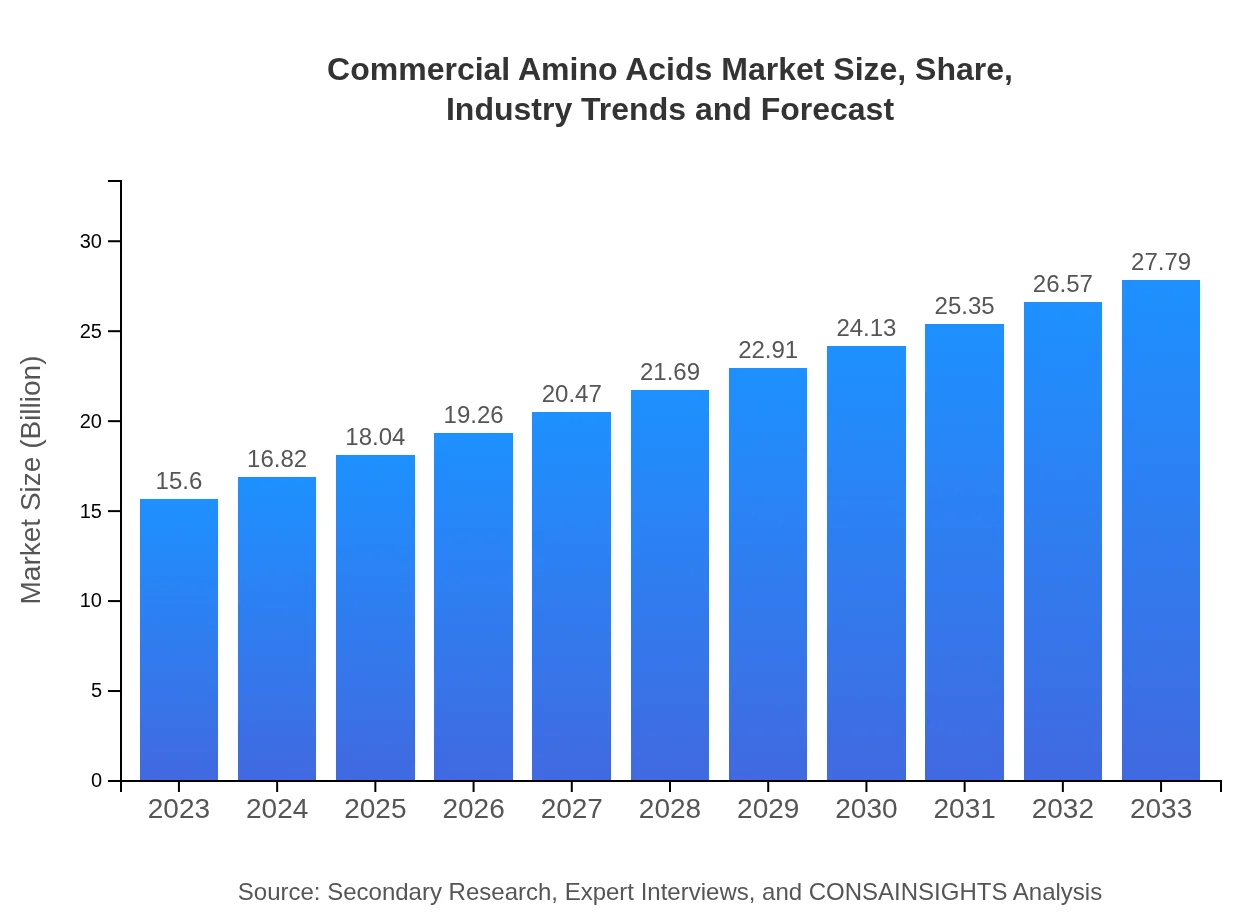

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $27.79 Billion |

| Top Companies | Ajinomoto Co., Inc., Evonik Industries AG, Cargill, Inc., ADM (Archer Daniels Midland Company), Kyowa Hakko Bio Co., Ltd. |

| Last Modified Date | 31 January 2026 |

Commercial Amino Acids Market Overview

Customize Commercial Amino Acids Market Report market research report

- ✔ Get in-depth analysis of Commercial Amino Acids market size, growth, and forecasts.

- ✔ Understand Commercial Amino Acids's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Commercial Amino Acids

What is the Market Size & CAGR of Commercial Amino Acids market in 2023?

Commercial Amino Acids Industry Analysis

Commercial Amino Acids Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Commercial Amino Acids Market Analysis Report by Region

Europe Commercial Amino Acids Market Report:

Europe is witnessing accelerated growth within the commercial amino acids market, valued at $4.65 billion in 2023 and expected to reach $8.27 billion by 2033. Innovations in food production and heightened focus on health have bolstered the market, with key countries including Germany, France, and the UK leading consumption.Asia Pacific Commercial Amino Acids Market Report:

The Asia Pacific region accounted for a market value of approximately $3.02 billion in 2023, projected to grow to $5.38 billion by 2033. The growth is driven by rising health awareness and an expanding food and beverage sector. Countries such as China and India are leading the growth due to their large populations and increasing consumption of protein-based food products.North America Commercial Amino Acids Market Report:

North America is a significant player, with a market size of around $5.56 billion in 2023, anticipated to rise to $9.89 billion by 2033. The region's growth is driven by an increase in health and wellness trends, alongside the booming nutritional supplements market, fostering robust demand for amino acids.South America Commercial Amino Acids Market Report:

In South America, the market size was approximately $0.92 billion in 2023, with expectations of reaching $1.63 billion by 2033. The expansion of the agricultural sector along with growth in dietary supplements contributes to this region's market dynamics, signifying potential opportunities for growth.Middle East & Africa Commercial Amino Acids Market Report:

The Middle East and Africa region displays a market size of approximately $1.46 billion in 2023, projected to increase to $2.61 billion by 2033. Growth in healthcare spending and rising adoption of dietary supplements are key drivers, alongside opportunities in agricultural applications.Tell us your focus area and get a customized research report.

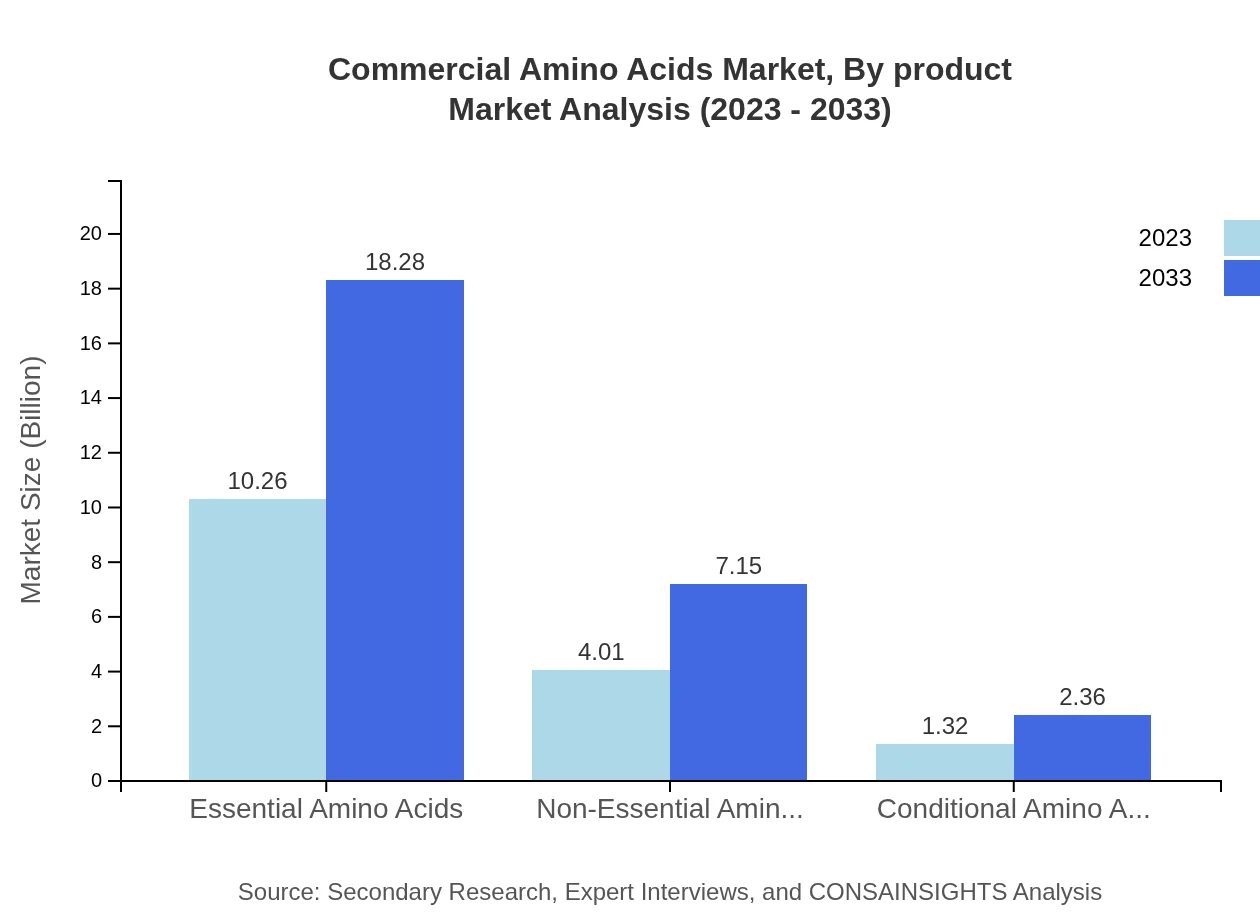

Commercial Amino Acids Market Analysis By Product

By product, the market is dominated by synthetic amino acids, which are expected to grow from $12.93 billion in 2023 to $23.03 billion in 2033, claiming 82.89% of the market share. In contrast, essential amino acids, valued at $10.26 billion in 2023, are projected to grow to $18.28 billion, capturing a significant market portion. Non-essential amino acids and conditional amino acids likewise show favorable growth trajectories.

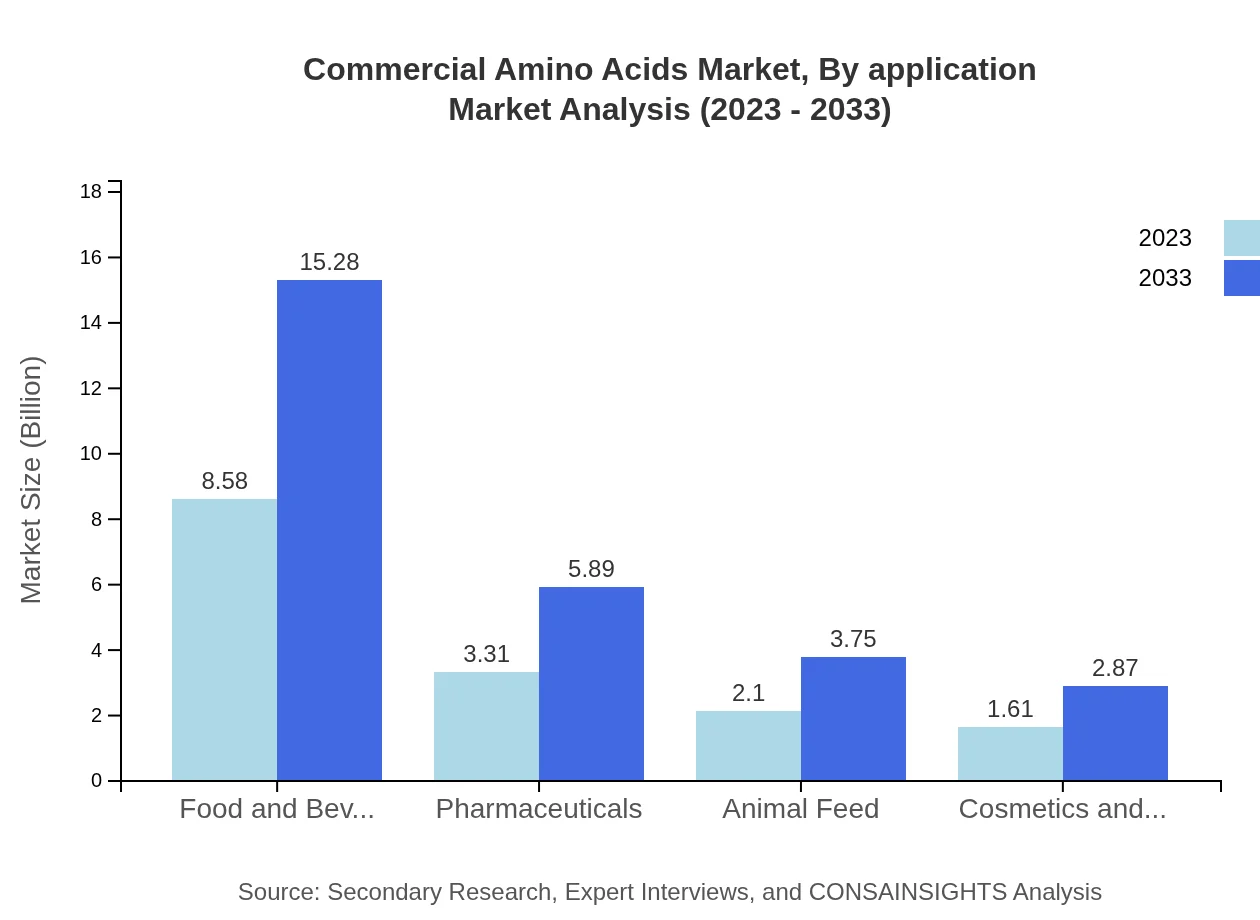

Commercial Amino Acids Market Analysis By Application

In application segmentation, the food and beverage sector dominates, with an expected market size of $8.58 billion in 2023, likely to reach $15.28 billion by 2033. Pharmaceuticals and cosmetics also play significant roles, valued at $3.31 billion and $1.61 billion, respectively, in 2023, with steady growth anticipated as health trends escalate.

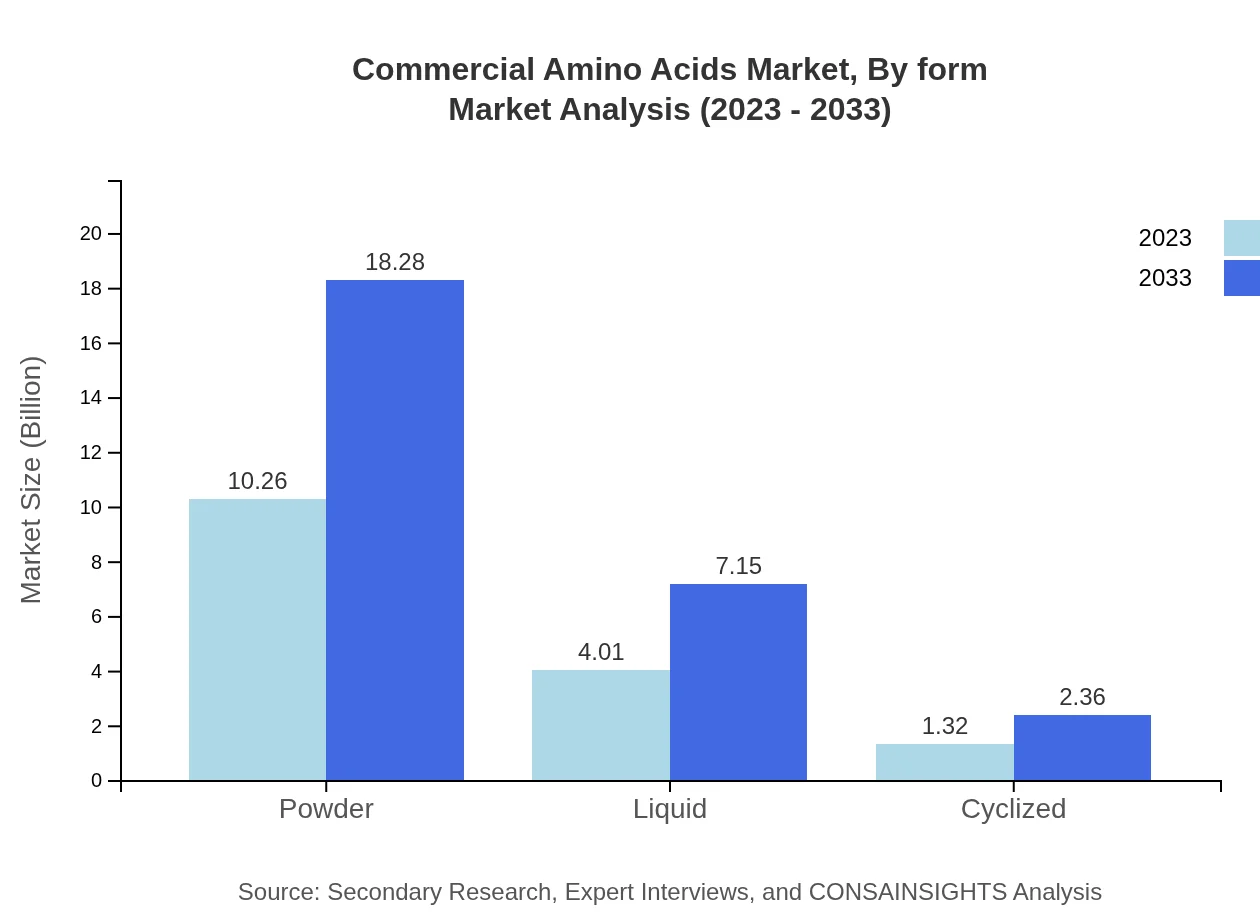

Commercial Amino Acids Market Analysis By Form

Amino acids are available in various forms, with powder formulations holding about 65.79% of the market share. In 2023, the powdered form is valued at $10.26 billion and is expected to reach $18.28 billion by 2033. Liquid formulations, while smaller in market size, also show healthy growth, moving from $4.01 billion in 2023 to $7.15 billion in 2033.

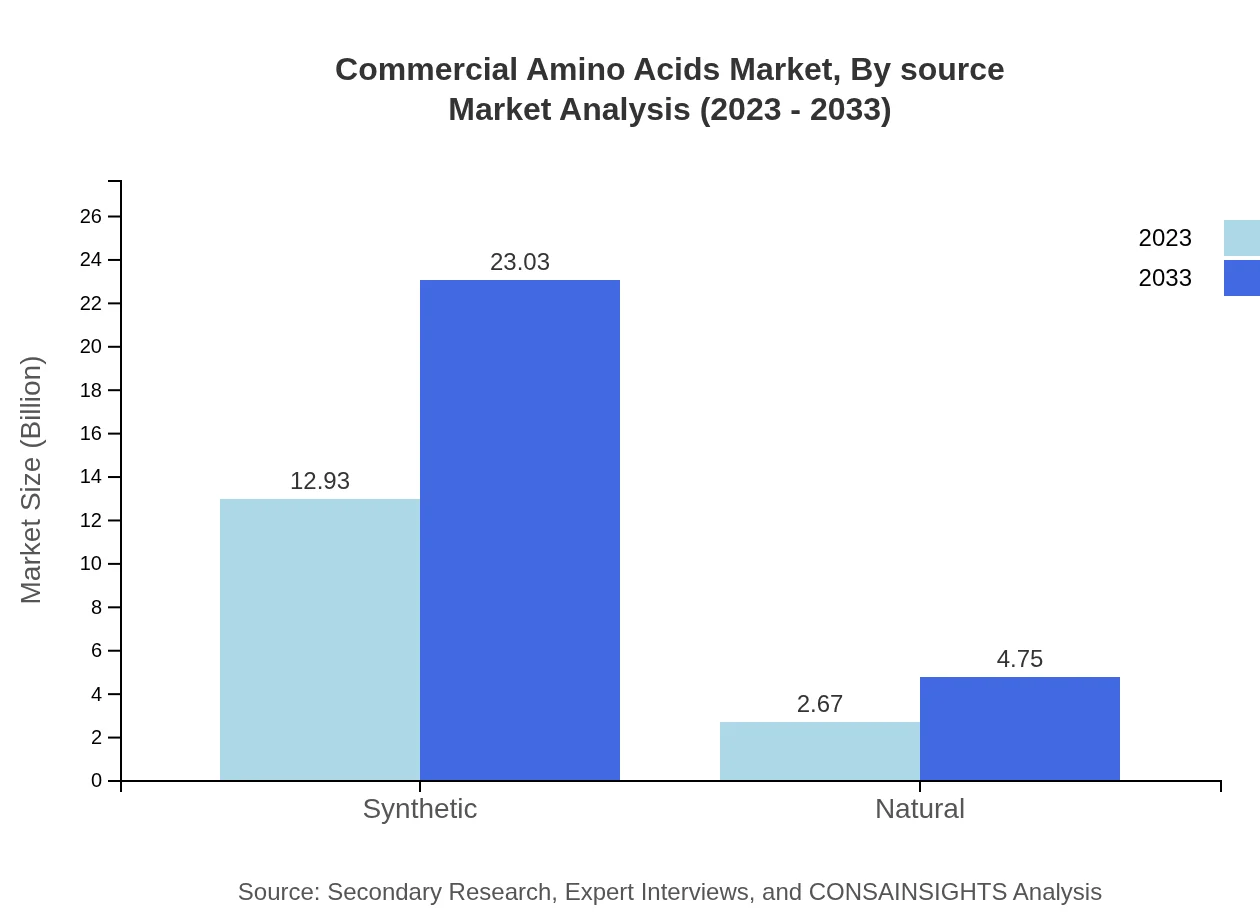

Commercial Amino Acids Market Analysis By Source

The source of amino acids can be categorized into synthetic and natural, with synthetic sources taking the lion's share. In 2023, synthetic amino acids are valued at $12.93 billion while natural sources are at $2.67 billion. By 2033, synthetic sources are estimated to reach $23.03 billion, reinforcing their dominance.

Commercial Amino Acids Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Commercial Amino Acids Industry

Ajinomoto Co., Inc.:

Ajinomoto is a global leader in amino acid production, known for innovative applications in food and pharmaceuticals.Evonik Industries AG:

Evonik specializes in specialty chemicals, including amino acids, focusing on sustainable and advanced production methods.Cargill, Inc.:

Cargill is a multinational corporation, significant in the agro-industrial sector, producing a range of amino acids primarily for food applications.ADM (Archer Daniels Midland Company):

ADM is an American global food processing and commodities trading corporation producing amino acids for various industries.Kyowa Hakko Bio Co., Ltd.:

Kyowa Hakko Bio is well-known for its high-quality amino acids, especially for nutraceutical and pharmaceutical applications.We're grateful to work with incredible clients.

FAQs

What is the market size of commercial amino acids?

The commercial amino acids market is projected to value approximately $15.6 billion in 2023, with a compound annual growth rate (CAGR) of 5.8%, reaching an estimated market size of around $27.0 billion by 2033.

What are the key market players or companies in this commercial amino acids industry?

Key players in the commercial amino acids market include companies like Ajinomoto Co., Inc., CJ CheilJedang Corporation, Evonik Industries, and Archer Daniels Midland Company, who lead the market through innovation and extensive product offerings.

What are the primary factors driving the growth in the commercial amino acids industry?

Growth in the commercial amino acids industry is primarily driven by rising demand in food and beverage applications, increasing nutritional awareness, and the growing use of amino acids in pharmaceuticals and animal feed, alongside expanding applications in cosmetics.

Which region is the fastest Growing in the commercial amino acids market?

The Asia Pacific region is the fastest-growing market for commercial amino acids, projected to increase from $3.02 billion in 2023 to $5.38 billion by 2033, reflecting strong demand in sectors like food and beverages.

Does ConsaInsights provide customized market report data for the commercial amino acids industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the commercial amino acids industry, allowing businesses to gain unique insights and competitive advantages.

What deliverables can I expect from this commercial amino acids market research project?

From this market research project, clients can expect comprehensive deliverables such as detailed market analysis, regional insights, competitive landscape examinations, and segmented breakdowns of various sub-markets.

What are the market trends of commercial amino acids?

Current market trends in commercial amino acids include a shift toward natural and plant-based amino acids, an increase in product applications across diverse industries, and an emphasis on sustainability and health-driven formulations.