Commercial Auto Insurance Market Report

Published Date: 31 January 2026 | Report Code: commercial-auto-insurance

Commercial Auto Insurance Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Commercial Auto Insurance market, covering market size, growth forecasts from 2023 to 2033, regional insights, technological advancements, and key industry segments.

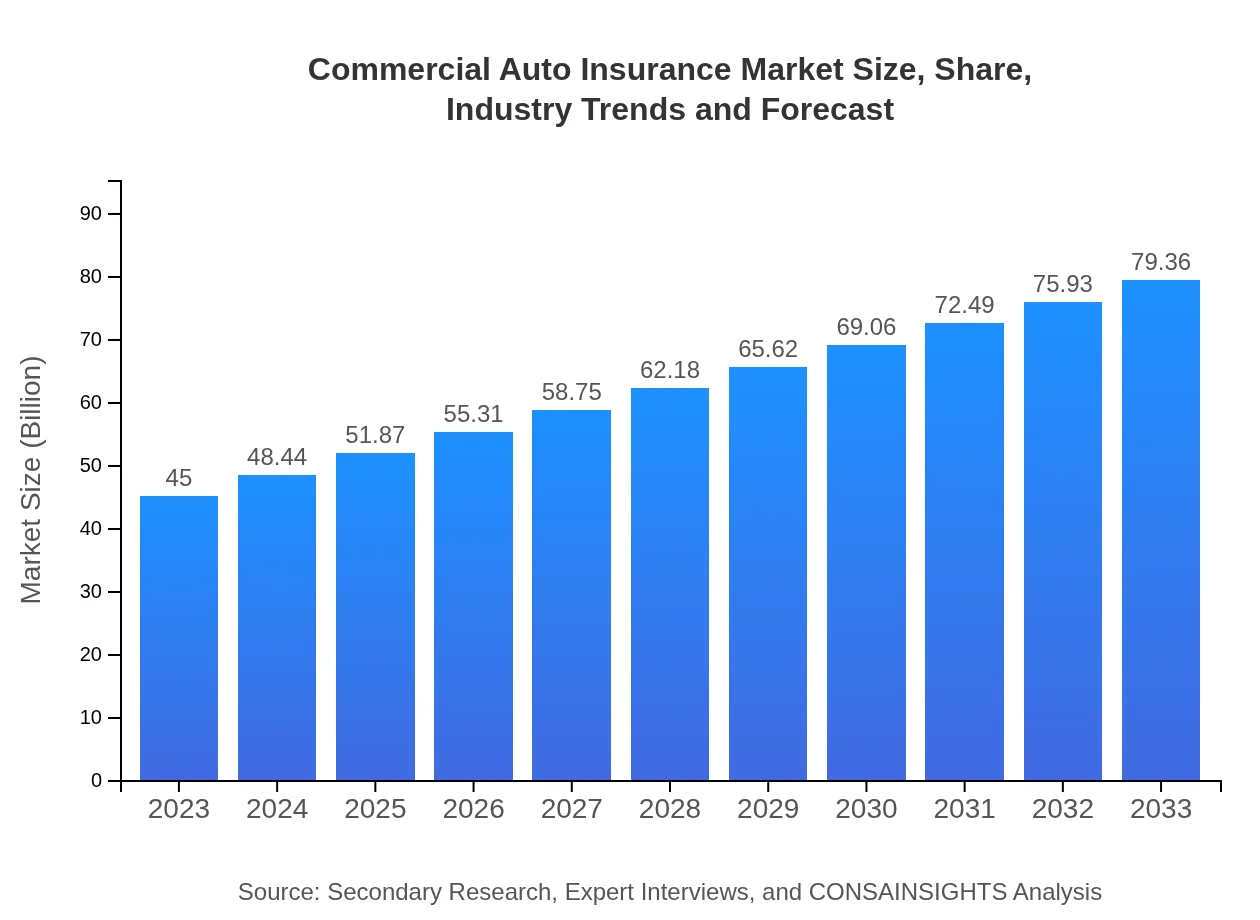

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $45.00 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $79.36 Billion |

| Top Companies | Progressive Corporation, State Farm, Allstate, Nationwide Mutual Insurance |

| Last Modified Date | 31 January 2026 |

Commercial Auto Insurance Market Overview

Customize Commercial Auto Insurance Market Report market research report

- ✔ Get in-depth analysis of Commercial Auto Insurance market size, growth, and forecasts.

- ✔ Understand Commercial Auto Insurance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Commercial Auto Insurance

What is the Market Size & CAGR of Commercial Auto Insurance market in 2023?

Commercial Auto Insurance Industry Analysis

Commercial Auto Insurance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Commercial Auto Insurance Market Analysis Report by Region

Europe Commercial Auto Insurance Market Report:

The European market is anticipated to grow from $11.45 billion in 2023 to $20.20 billion in 2033. The growth is supported by strong regulations around vehicle safety and environmental impact, encouraging businesses to uptake comprehensive insurance solutions. Insurers are also focusing on sustainable practices in response to growing environmental awareness among consumers.Asia Pacific Commercial Auto Insurance Market Report:

In the Asia Pacific region, the market size is projected to grow from $9.42 billion in 2023 to $16.61 billion in 2033. Growth in this region is stimulated by rapid urbanization, increased commercial activities, and governmental initiatives to enhance infrastructure. Insurers are adapting to local market needs, including enhancing their offerings for small businesses.North America Commercial Auto Insurance Market Report:

North America leads the Commercial Auto Insurance market, projected to grow from $16.56 billion in 2023 to $29.21 billion by 2033. The United States remains the largest market, driven by a high number of commercial vehicles and stringent regulatory requirements. Insurers are increasingly leveraging technology to innovate their services while improving customer experience.South America Commercial Auto Insurance Market Report:

The South American Commercial Auto Insurance market is expected to expand from $1.49 billion in 2023 to $2.63 billion in 2033, influenced by the economic growth in major countries like Brazil and Argentina. However, challenges such as political instability and regulatory changes continue to affect market dynamics.Middle East & Africa Commercial Auto Insurance Market Report:

The Middle East and Africa market is expected to witness growth from $6.08 billion in 2023 to $10.71 billion in 2033, driven by a growing emphasis on business operations and vehicle usage in the logistics sector. However, insurers face challenges such as economic volatility and varying regulatory frameworks across countries.Tell us your focus area and get a customized research report.

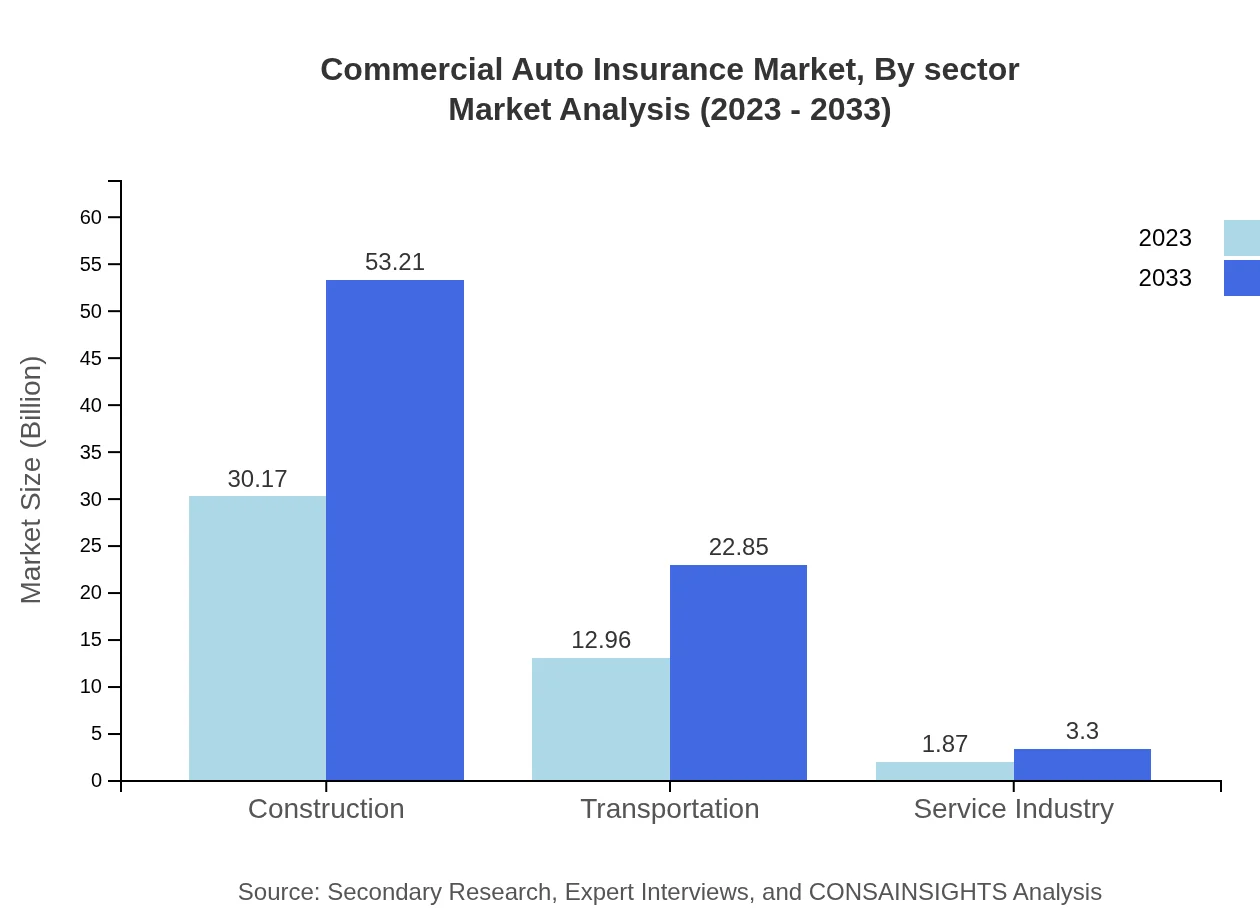

Commercial Auto Insurance Market Analysis By Sector

The major sectors contributing to the Commercial Auto Insurance market include construction, transportation, and service industries. The construction sector, leading with a market size of $30.17 billion in 2023, is expected to grow significantly, driven by ongoing construction projects across the globe. The transportation sector, witnessing a size of $12.96 billion, indicates steady growth due to the rise in logistics and passenger transport services.

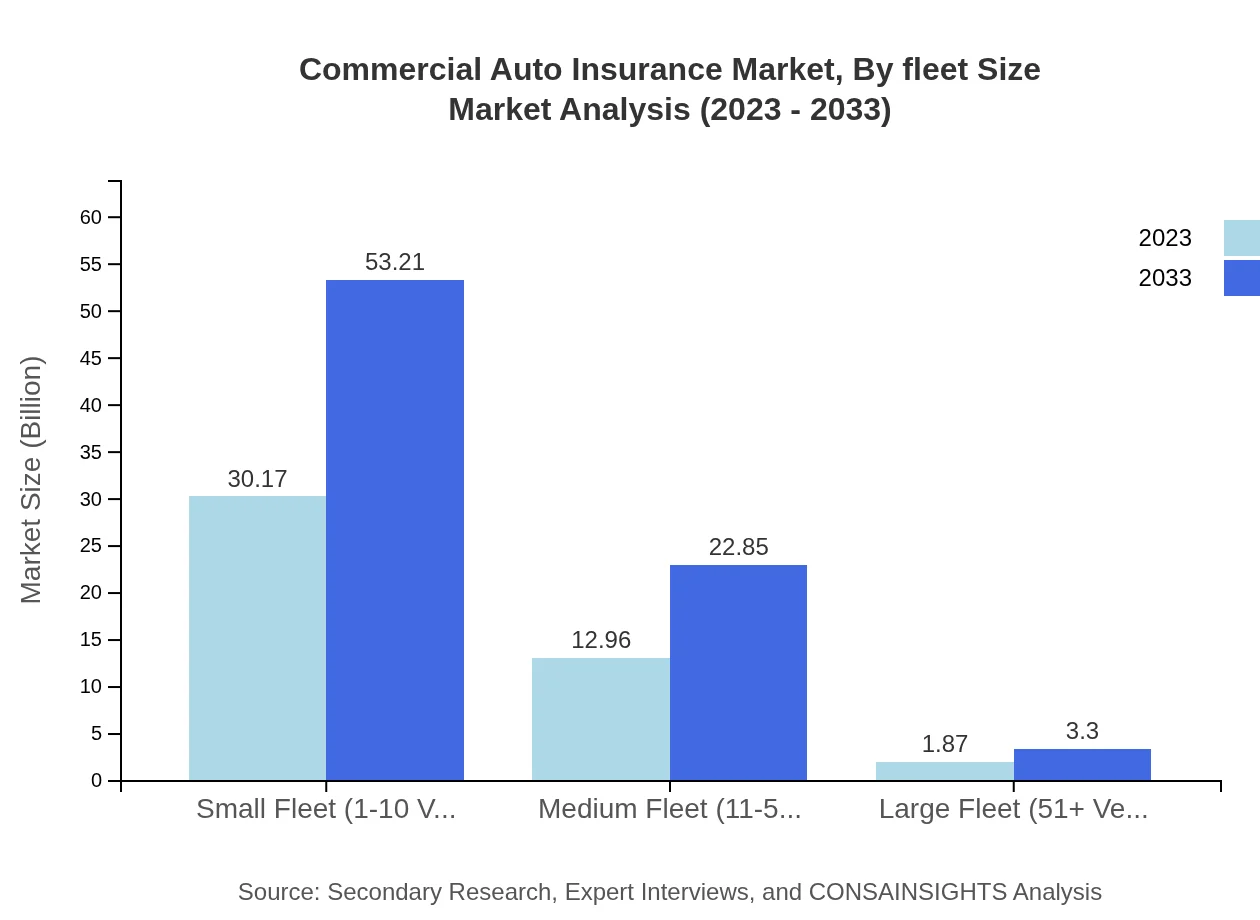

Commercial Auto Insurance Market Analysis By Fleet Size

Insurance needs vary significantly across fleet size. Small fleets (1-10 vehicles) dominate the market, accounting for a size of $30.17 billion in 2023 with consistent growth anticipated. Medium fleets (11-50 vehicles) have a steadily growing market of $12.96 billion, while large fleets (51+ vehicles) hold a market size of $1.87 billion, reflecting diverse insurance requirements based on operational scopes.

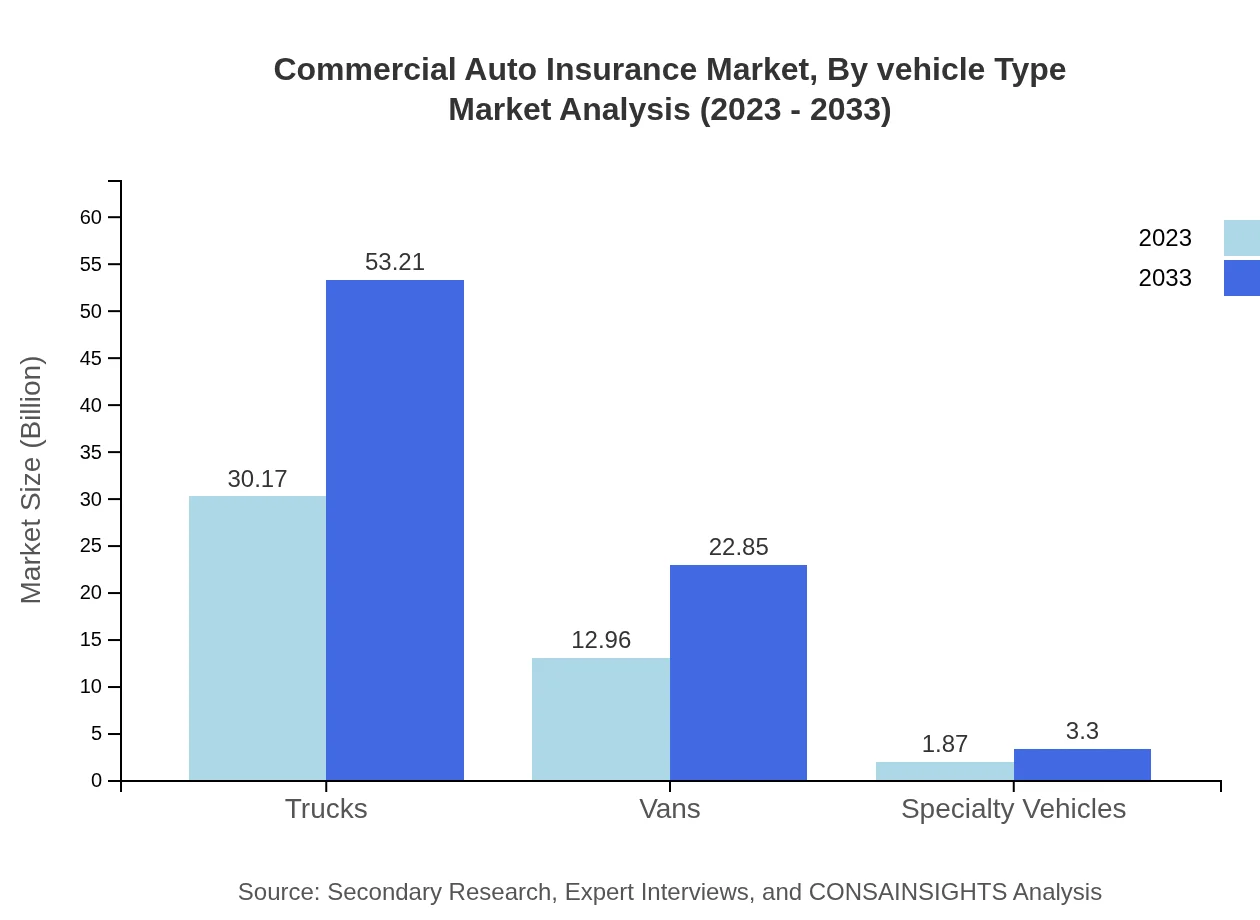

Commercial Auto Insurance Market Analysis By Vehicle Type

Transportation methods influence the demand for various vehicle types in commercial auto insurance. Trucks lead the market with a size of $30.17 billion due to the high demand for freight transportation services. Vans and specialty vehicles are also significant, highlighting the varied insurance requirements across vehicle types used in commercial activities.

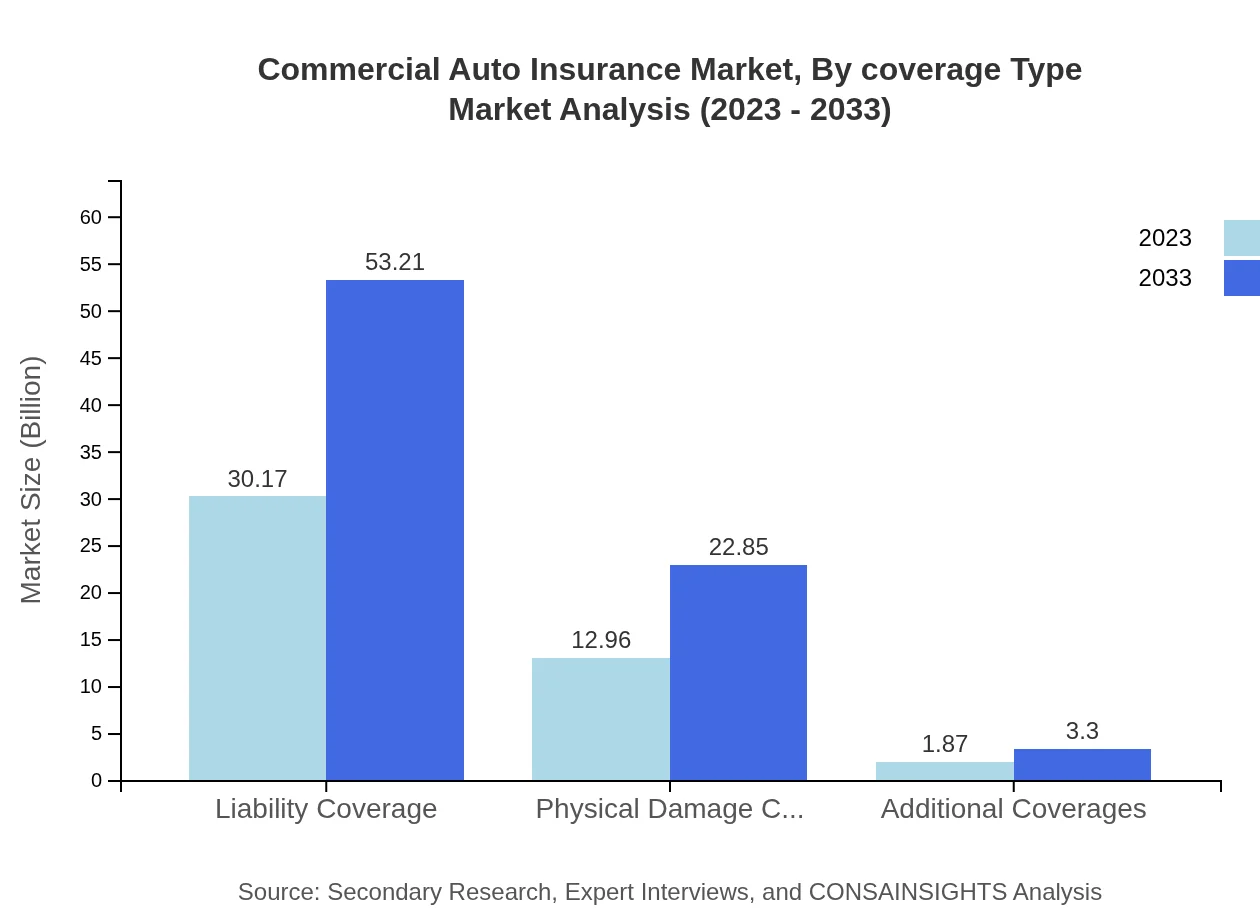

Commercial Auto Insurance Market Analysis By Coverage Type

Coverage types are essential in determining the risk management strategies of businesses. Liability coverage, representing a significant market portion at $30.17 billion, is crucial for protecting businesses against potential claims. Physical damage coverage, standing at $12.96 billion, showcases the importance of securing assets, while additional coverages, albeit smaller at $1.87 billion, meet specific coverage needs of businesses.

Commercial Auto Insurance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Commercial Auto Insurance Industry

Progressive Corporation:

Progressive is a leading provider of commercial auto insurance, offering innovative solutions and competitive pricing. Known for its user-friendly online services and extensive coverage options, it caters to a diverse client base.State Farm:

State Farm is one of the largest insurance companies in the United States, providing a range of commercial auto insurance products. Its strong brand reputation and vast network of agents allow for personalized service for businesses.Allstate:

Allstate offers comprehensive commercial auto insurance with customizable options. The company's focus on customer relations and technological advancements helps it stay competitive in the market.Nationwide Mutual Insurance:

Nationwide provides tailored commercial auto insurance solutions, specifically catering to the needs of business owners. Its extensive experience and commercial expertise make it a reliable choice in the industry.We're grateful to work with incredible clients.

FAQs

What is the market size of commercial Auto Insurance?

The global commercial auto insurance market is valued at approximately $45 billion, with a projected CAGR of 5.7% from 2023 to 2033, reflecting robust industry growth and demand.

What are the key market players or companies in the commercial Auto Insurance industry?

Key players include major insurance companies like Progressive, Allstate, Geico, and State Farm, among others, leading the market with comprehensive coverage options and innovative solutions.

What are the primary factors driving the growth in the commercial Auto Insurance industry?

Growth is driven by increased vehicle usage, regulatory changes, rising e-commerce, and heightened risk awareness among businesses, necessitating stronger coverage to protect assets.

Which region is the fastest Growing in the commercial Auto Insurance?

North America is currently the fastest-growing region, projected to expand from a market size of $16.56 billion in 2023 to $29.21 billion by 2033, fueled by high commercial activity.

Does ConsaInsights provide customized market report data for the commercial Auto Insurance industry?

Yes, ConsaInsights offers customized market report data to cater to specific client needs in the commercial auto insurance industry, providing tailored insights and analysis.

What deliverables can I expect from this commercial Auto Insurance market research project?

Deliverables typically include comprehensive reports, market forecasts, SWOT analysis, competitor landscape, and insights on trends and consumer preferences in the commercial auto insurance sector.

What are the market trends of commercial Auto Insurance?

Current trends include the integration of telematics for risk assessment, increased digitalization, customizable policies, and a focus on sustainability in fleet management within the commercial auto insurance market.