Commercial Avionics Systems Market Report

Published Date: 03 February 2026 | Report Code: commercial-avionics-systems

Commercial Avionics Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides detailed insights into the Commercial Avionics Systems market from 2023 to 2033, analyzing market trends, size, segmentation, regional dynamics, and forecasts while highlighting key industry players and technologies shaping the future.

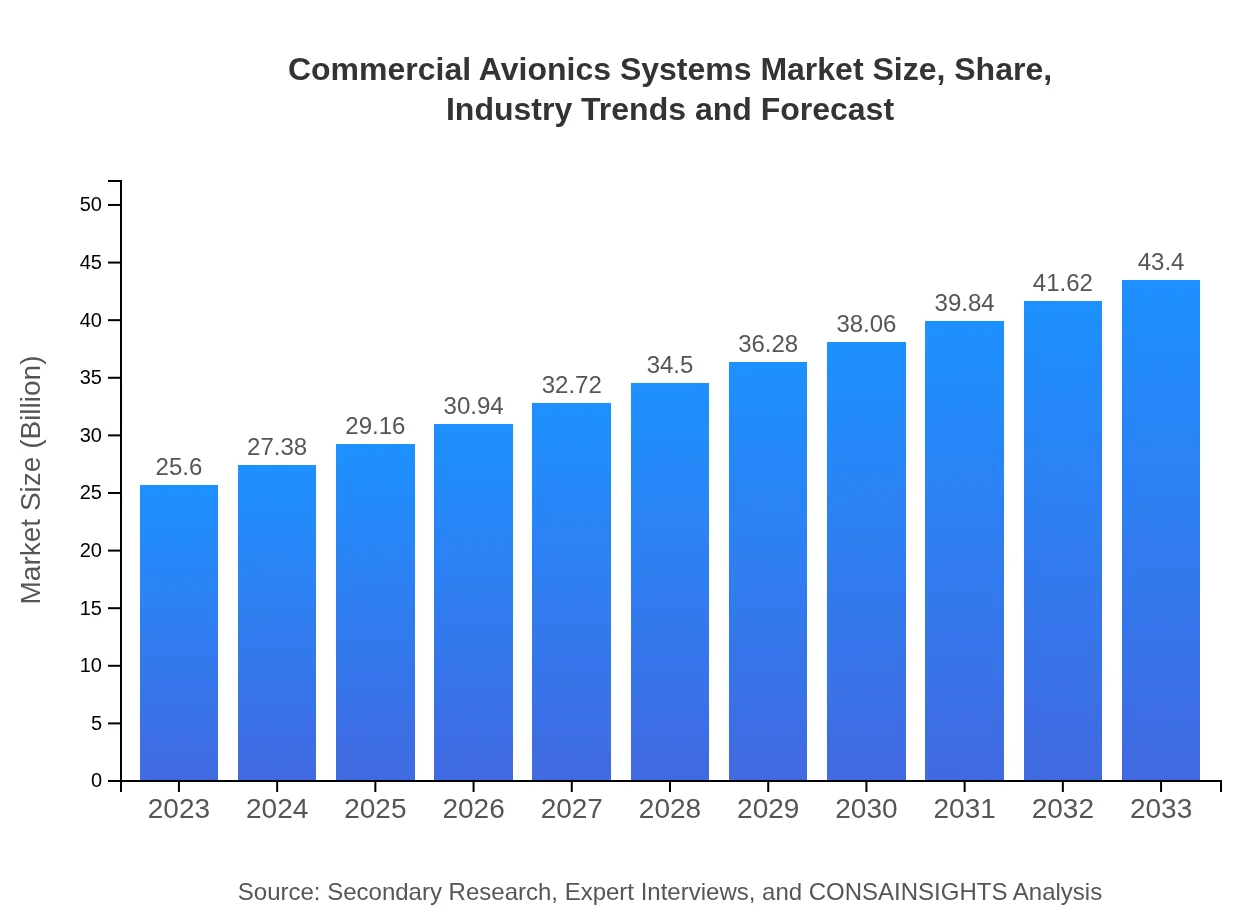

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.60 Billion |

| CAGR (2023-2033) | 5.3% |

| 2033 Market Size | $43.40 Billion |

| Top Companies | Honeywell International Inc., Rockwell Collins (now a part of Raytheon Technologies), Garmin Ltd., Thales Group, General Avionics |

| Last Modified Date | 03 February 2026 |

Commercial Avionics Systems Market Overview

Customize Commercial Avionics Systems Market Report market research report

- ✔ Get in-depth analysis of Commercial Avionics Systems market size, growth, and forecasts.

- ✔ Understand Commercial Avionics Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Commercial Avionics Systems

What is the Market Size & CAGR of Commercial Avionics Systems market in 2023?

Commercial Avionics Systems Industry Analysis

Commercial Avionics Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Commercial Avionics Systems Market Analysis Report by Region

Europe Commercial Avionics Systems Market Report:

The European market is anticipated to grow from $8.12 billion in 2023 to $13.77 billion by 2033. Factors contributing to this growth include stringent regulatory frameworks, a focus on sustainable aviation technologies, and the presence of key players in the avionics sector.Asia Pacific Commercial Avionics Systems Market Report:

The Asia Pacific market is expected to grow significantly, from $4.62 billion in 2023 to $7.83 billion by 2033, driven by increasing air passenger traffic and large-scale infrastructure developments in aviation. Countries like China and India are leading the charge, boosting demand for advanced avionics systems in both commercial and private aviation sectors.North America Commercial Avionics Systems Market Report:

North America remains the largest market for Commercial Avionics Systems, projected to expand from $9.07 billion in 2023 to $15.38 billion in 2033, fueled by the presence of major aircraft manufacturers, a robust aviation infrastructure, and continuous innovations in UAV technologies.South America Commercial Avionics Systems Market Report:

In South America, the market shows modest growth from $2.45 billion in 2023 to $4.15 billion in 2033. Countries such as Brazil and Argentina are focusing on rebuilding their aviation sectors, which is likely to catalyze investments in avionics technology.Middle East & Africa Commercial Avionics Systems Market Report:

The Middle East and Africa market is expected to see growth from $1.34 billion in 2023 to $2.27 billion by 2033, buoyed by expanding airline operations and public-sector investments in aviation technology, especially in the UAE and South Africa.Tell us your focus area and get a customized research report.

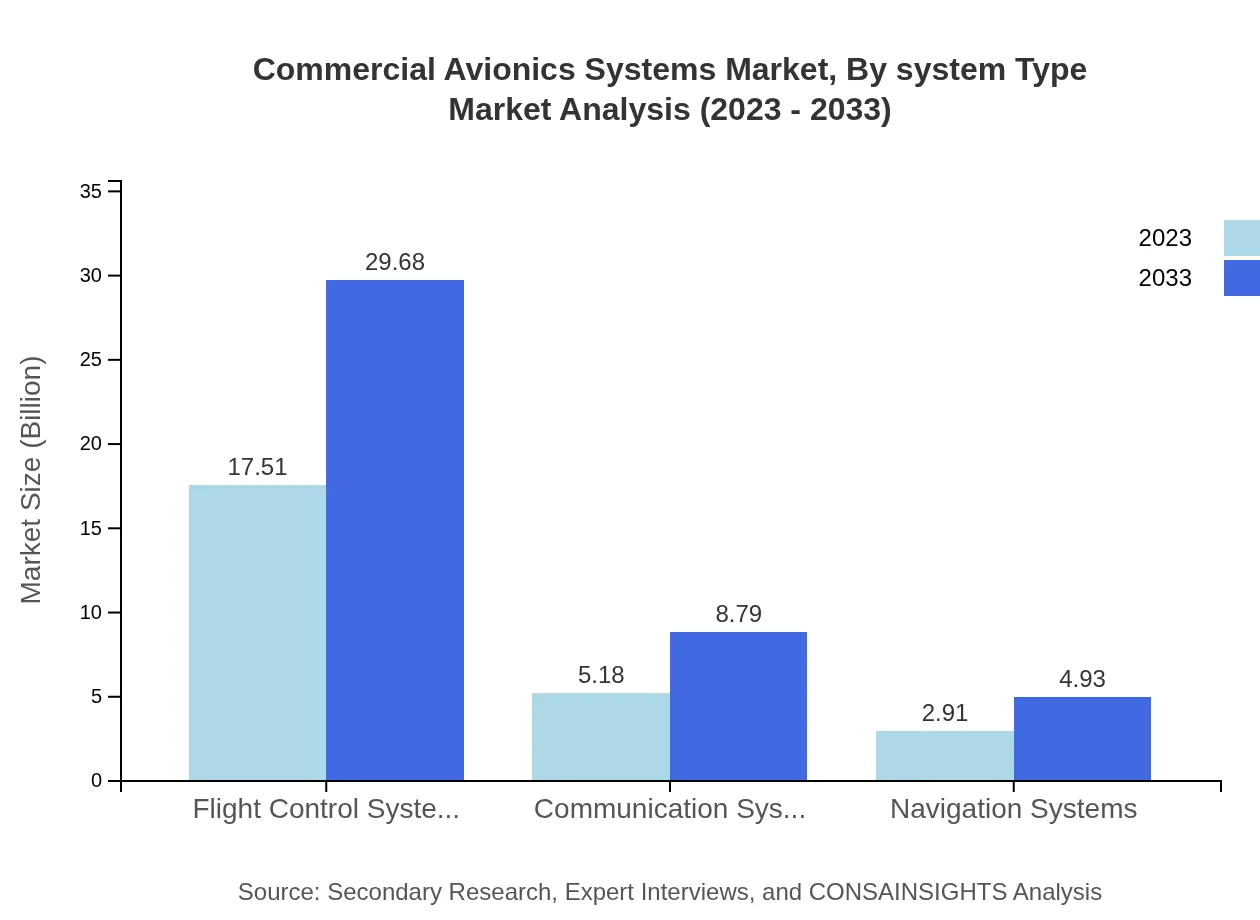

Commercial Avionics Systems Market Analysis By System Type

The Commercial Avionics Systems market is primarily segmented by system type including flight control systems, communication systems, and navigation systems. In 2023, flight control systems accounted for approximately $17.51 billion while projected growth indicates a market size of $29.68 billion by 2033. Communication systems were valued at $5.18 billion in 2023, expected to grow to $8.79 billion by 2033. Navigation systems are set to rise from $2.91 billion to $4.93 billion in the same timeframe, emphasizing the importance of these systems in contemporary aircraft design.

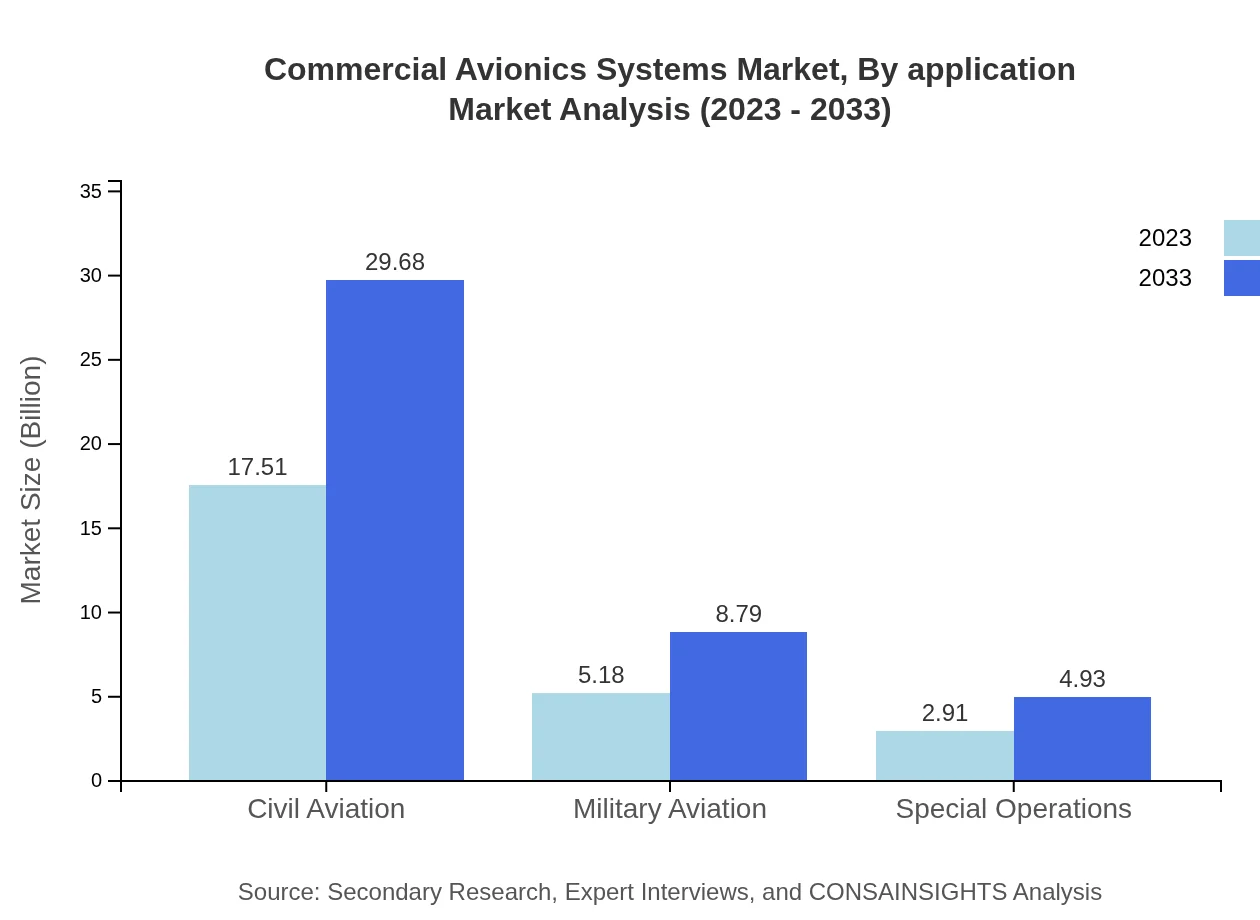

Commercial Avionics Systems Market Analysis By Application

The application segmentation consists of civil aviation, military aviation, and special operations. Civil aviation dominates the market with a share of 68.39%, and is predicted to grow from $17.51 billion in 2023 to $29.68 billion by 2033. Military aviation holds a 20.25% market share, projected to reach $8.79 billion by 2033, while special operations are growing steadily, expected to rise from $2.91 billion in 2023 to $4.93 billion by 2033, reflecting increasing demand for versatile aircraft capabilities.

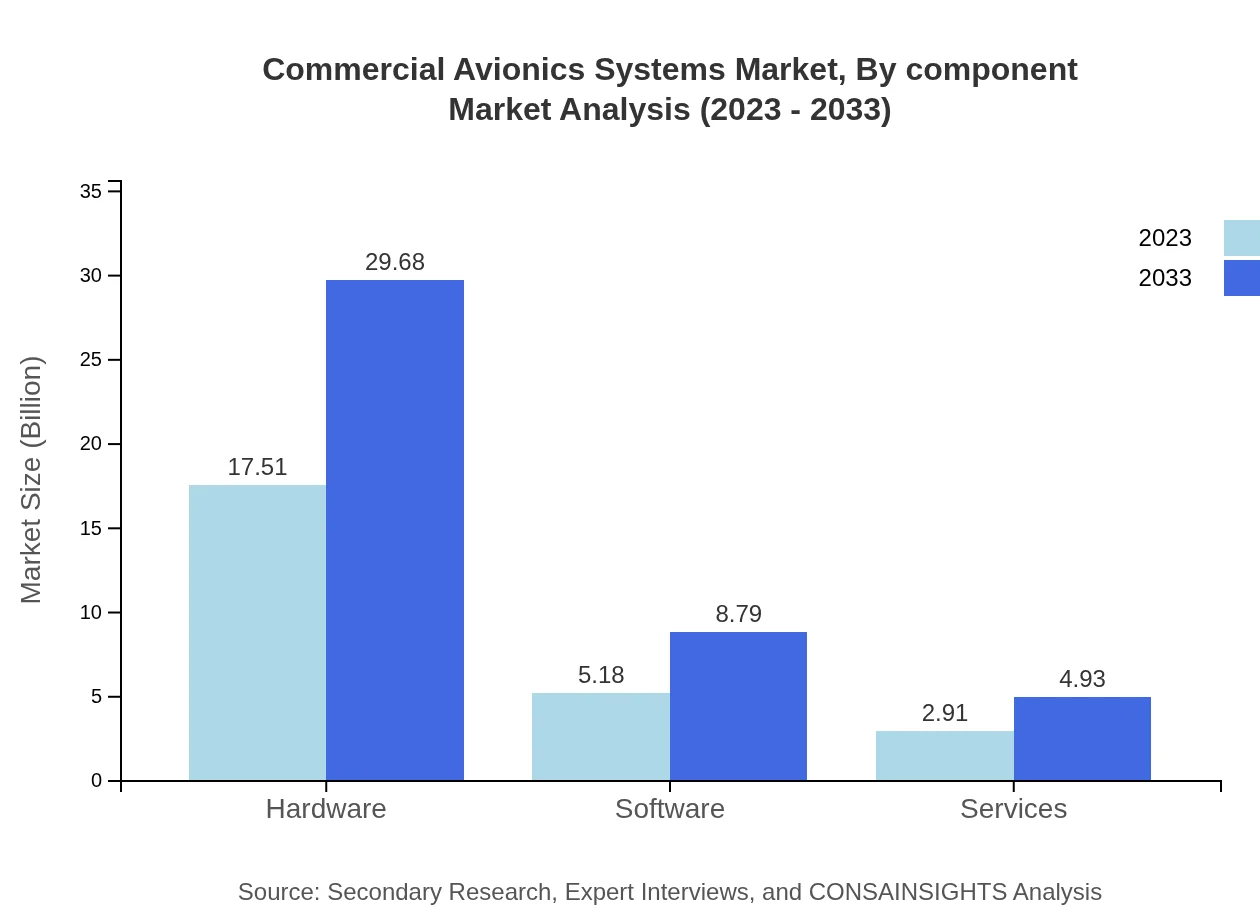

Commercial Avionics Systems Market Analysis By Component

Components of the Commercial Avionics Systems market include hardware, software, and services. Hardware remains the largest component with a market size of $17.51 billion in 2023 and anticipated growth to $29.68 billion by 2033. Software, valued at $5.18 billion in 2023, is expected to reach $8.79 billion. Services, although smaller, are projected to grow as ongoing support and updates are essential to maintaining competitive advancements in avionics technology.

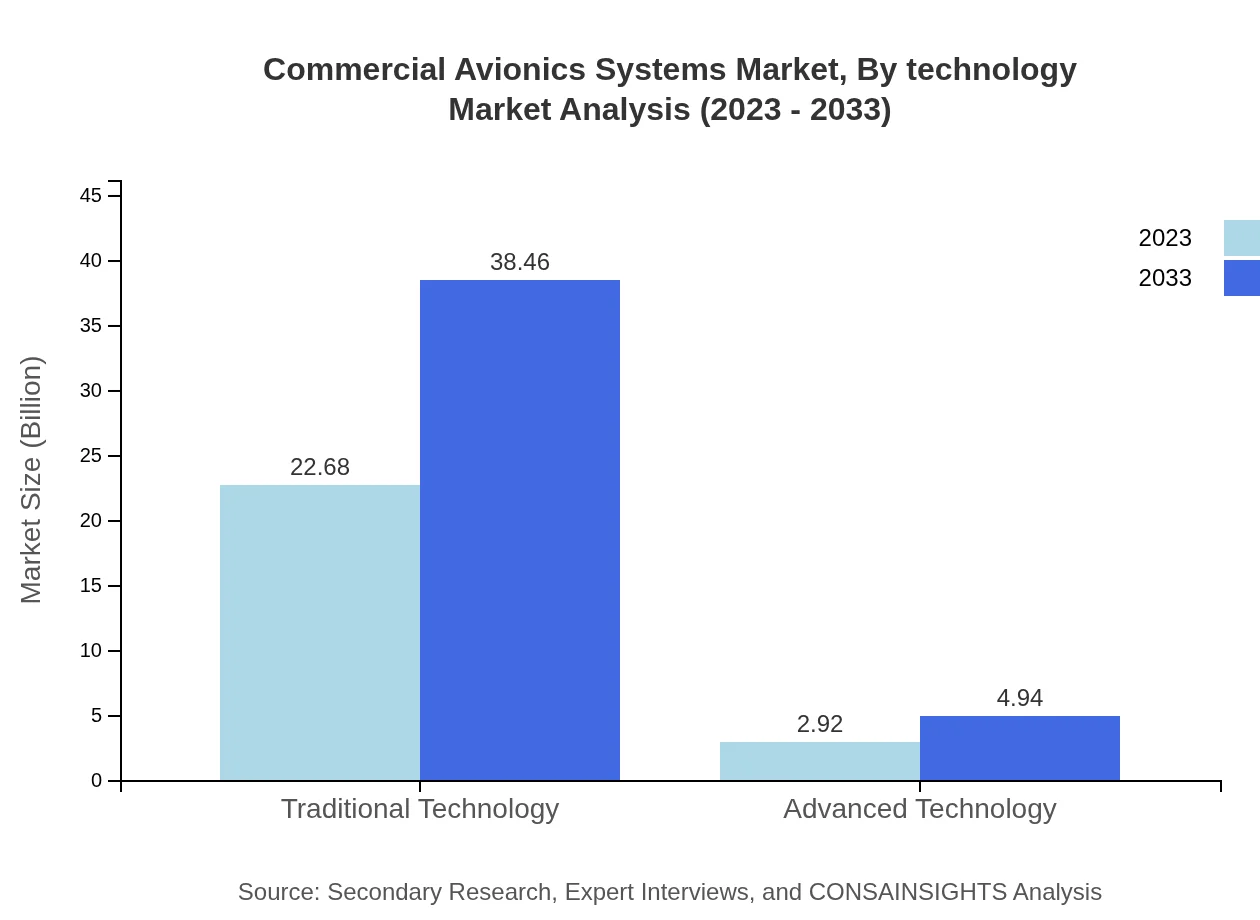

Commercial Avionics Systems Market Analysis By Technology

The technology perspective of the Commercial Avionics Systems market includes traditional and advanced technologies. Traditional technology accounted for $22.68 billion in 2023 and is predicted to reach $38.46 billion by 2033, maintaining an 88.61% market share due to established practices. Conversely, advanced technology, including AI applications and automated systems, is emerging with a market size quantum leap from $2.92 billion to $4.94 billion by 2033, reflecting the transition toward cutting-edge aircraft technology.

Commercial Avionics Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Commercial Avionics Systems Industry

Honeywell International Inc.:

Honeywell is a leader in avionics systems, providing a full range of equipment from flight control to navigation systems and holding substantial market share due to its innovative technology.Rockwell Collins (now a part of Raytheon Technologies):

A pioneer in aviation electronics, Rockwell Collins specializes in communication and information technology for commercial and military aerospace.Garmin Ltd.:

Garmin is a prominent player in navigation systems, offering innovative solutions that enhance safety and navigation reliability in aviation.Thales Group:

Thales provides advanced avionics systems with a focus on security and integration, contributing to both commercial and defense aviation markets.General Avionics:

General Avionics specializes in producing various avionics solutions, enhancing flight operations and safety for general aviation applications.We're grateful to work with incredible clients.

FAQs

What is the market size of commercial Avionics Systems?

The global commercial avionics systems market is currently valued at approximately $25.6 billion and is projected to grow at a CAGR of 5.3% from 2023 to 2033, driven by increasing demand for advanced aviation technology and safety.

What are the key market players or companies in this commercial Avionics Systems industry?

Key players in the commercial avionics systems industry include major aerospace companies like Honeywell, Rockwell Collins, Garmin, and Thales. These firms lead innovation in avionics technologies, contributing significantly to market dynamics and growth.

What are the primary factors driving the growth in the commercial Avionics Systems industry?

The growth in the commercial avionics systems industry is influenced by rising air travel demand, increasing integration of advanced technologies for safety and efficiency, and ongoing upgrades of existing aircraft fleets to include modern avionics systems.

Which region is the fastest Growing in the commercial Avionics Systems?

The North American region is currently the fastest-growing market for commercial avionics systems, expected to expand from $9.07 billion in 2023 to $15.38 billion by 2033. This growth is fueled by significant aerospace and defense investments.

Does ConsaInsights provide customized market report data for the commercial Avionics Systems industry?

Yes, ConsaInsights offers customized market research reports tailored to specific needs within the commercial avionics systems industry, accommodating unique queries about market trends, competitiveness, and technological advancements.

What deliverables can I expect from this commercial Avionics Systems market research project?

Expect comprehensive deliverables that include detailed market analysis, segmentation data, competitive landscape, growth forecasts, regional insights, and strategic recommendations to aid decision-making in the commercial avionics systems market.

What are the market trends of commercial Avionics Systems?

Market trends in the commercial avionics systems industry include the shift towards advanced technologies, rising focus on automation, increased demand for environmental sustainability, and the integration of AI and machine learning for enhanced operational efficiency.