Commercial Baggage Handling System Market Report

Published Date: 31 January 2026 | Report Code: commercial-baggage-handling-system

Commercial Baggage Handling System Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Commercial Baggage Handling System market, covering market dynamics, segmentation, and growth forecast from 2023 to 2033. Insights on regional developments, technology trends, and key industry players are also included.

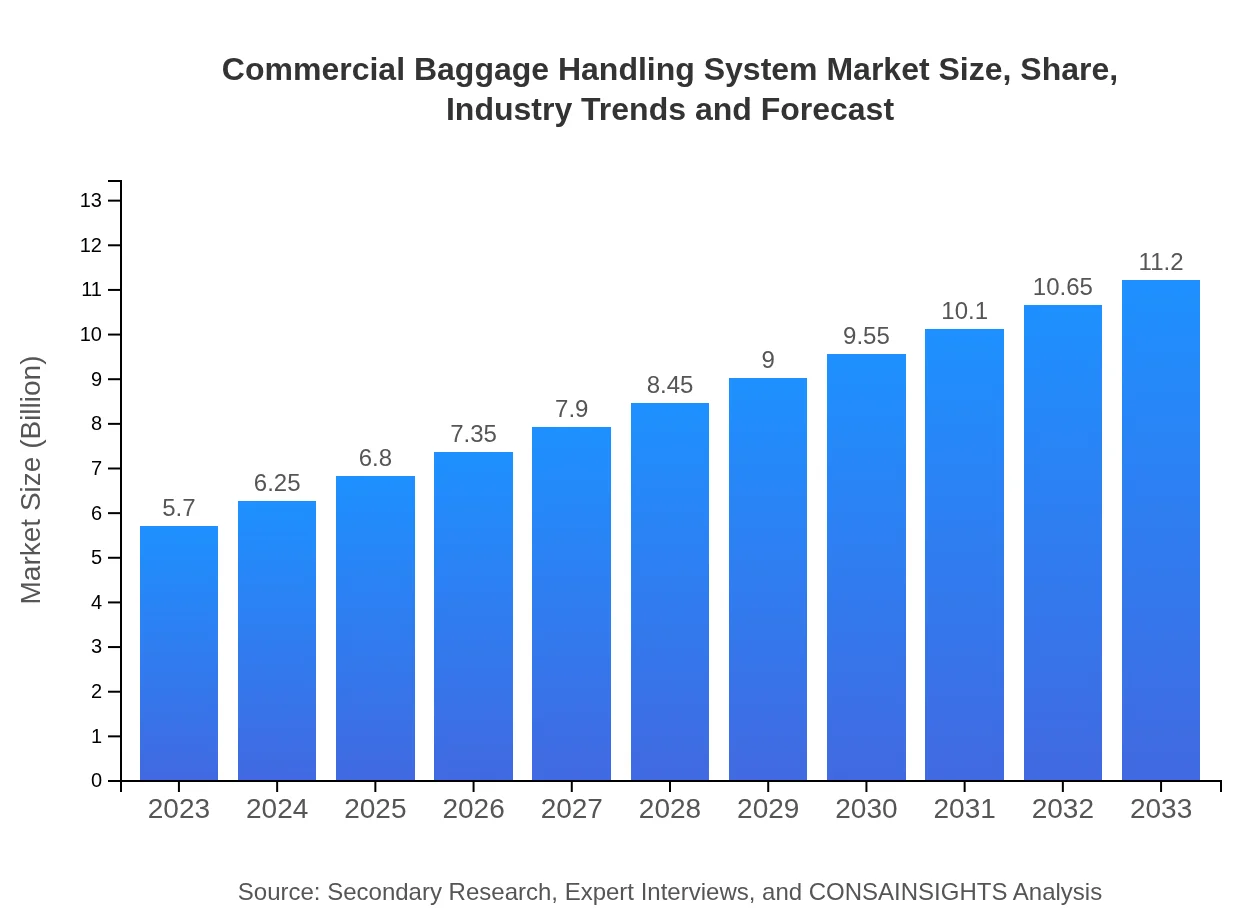

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.70 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.20 Billion |

| Top Companies | Siemens AG, Beumer Group, Daifuku Co., Ltd., Vanderlande Industries, MHS Global |

| Last Modified Date | 31 January 2026 |

Commercial Baggage Handling System Market Overview

Customize Commercial Baggage Handling System Market Report market research report

- ✔ Get in-depth analysis of Commercial Baggage Handling System market size, growth, and forecasts.

- ✔ Understand Commercial Baggage Handling System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Commercial Baggage Handling System

What is the Market Size & CAGR of Commercial Baggage Handling System market in 2023 and 2033?

Commercial Baggage Handling System Industry Analysis

Commercial Baggage Handling System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Commercial Baggage Handling System Market Analysis Report by Region

Europe Commercial Baggage Handling System Market Report:

Europe's market is valued at USD 1.69 billion in 2023 and expected to double to USD 3.32 billion by 2033. The region is characterized by the presence of established market players and a strong focus on sustainability and innovative baggage handling technologies.Asia Pacific Commercial Baggage Handling System Market Report:

The Asia Pacific region holds a significant share of the Commercial Baggage Handling System market, valued at USD 1.07 billion in 2023, projected to grow to USD 2.11 billion by 2033. Key drivers include rapid urbanization, increased air travel, and infrastructure investments in countries such as China and India, making it a vital region for growth.North America Commercial Baggage Handling System Market Report:

North America leads the market with a valuation of USD 2.09 billion in 2023, anticipated to grow to USD 4.11 billion by 2033. The region's advanced airport facilities and high investments in technology adoption are key factors contributing to this growth trajectory.South America Commercial Baggage Handling System Market Report:

In South America, the market is valued at USD 0.44 billion in 2023 and expected to reach USD 0.87 billion by 2033. Growth is driven by developing airport infrastructure and increasing passenger traffic, particularly in Brazil and Argentina, where there are major airport enhancement projects underway.Middle East & Africa Commercial Baggage Handling System Market Report:

The Middle East and Africa market, though smaller, is projected to see growth from USD 0.41 billion in 2023 to USD 0.80 billion by 2033. This growth is fueled by increasing investments in airport expansions and developments across the region, particularly in the UAE and South Africa.Tell us your focus area and get a customized research report.

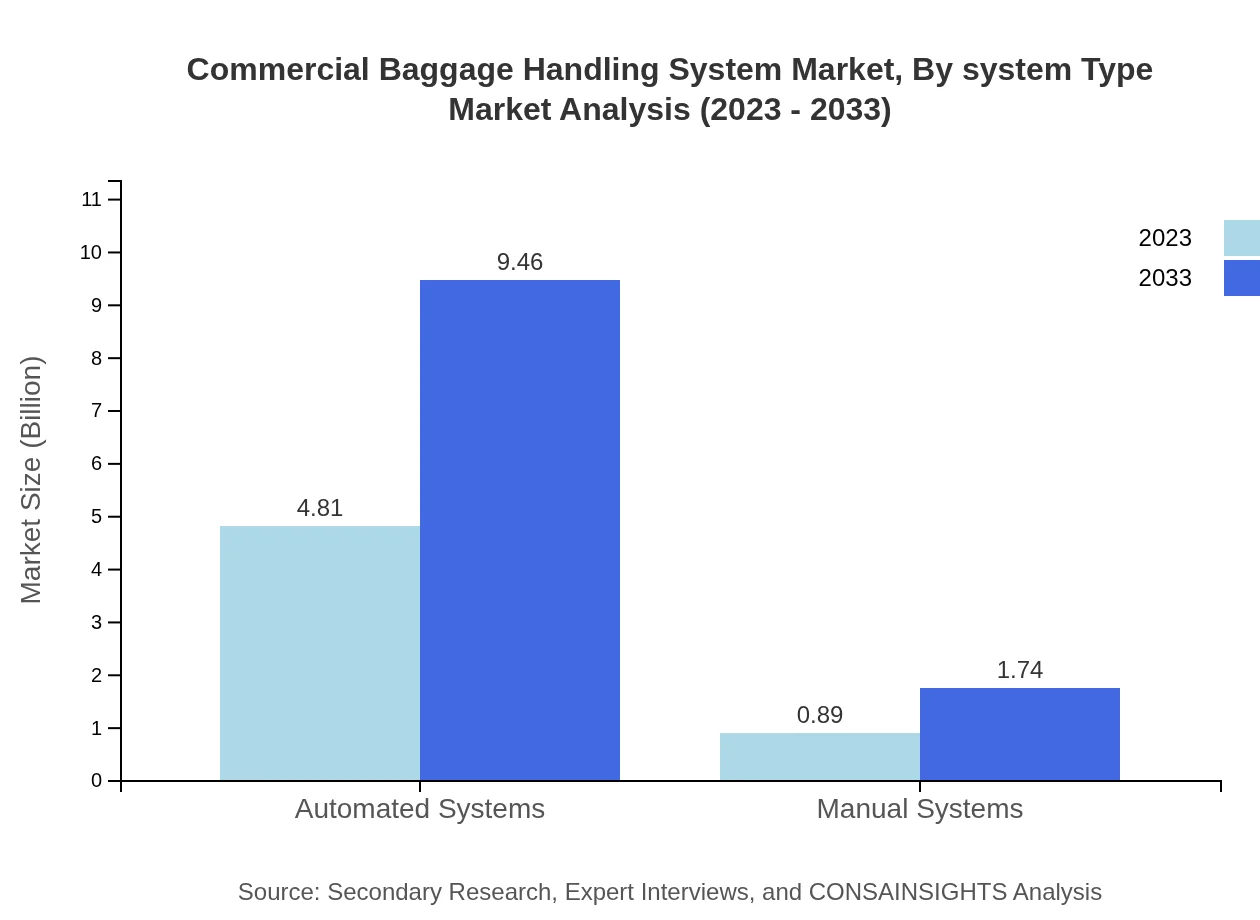

Commercial Baggage Handling System Market Analysis By System Type

The market by system type includes Automated Systems and Manual Systems. Automated systems are dominant, expected to grow from USD 4.81 billion in 2023 to USD 9.46 billion in 2033, holding an 84.47% market share due to increased efficiency and reduced labor costs. Manual systems will grow from USD 0.89 billion to USD 1.74 billion, maintaining a share of 15.53%.

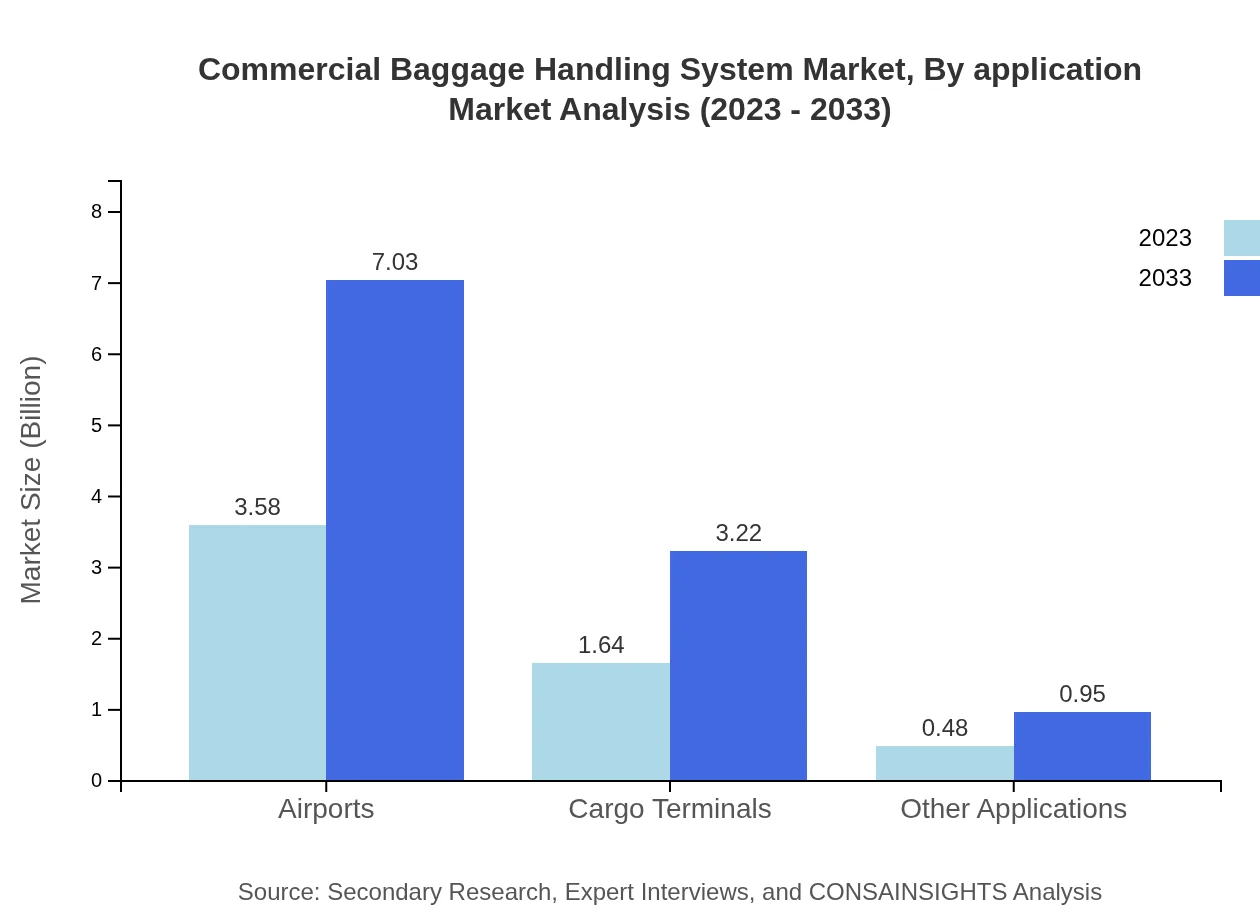

Commercial Baggage Handling System Market Analysis By Application

The market by application includes Airports, Cargo Terminals, and Other Applications. Airports lead the segment, projected to grow from USD 3.58 billion to USD 7.03 billion, maintaining a 62.79% share, driven by the rising passenger demand and the need for operational efficiencies. Cargo terminals, growing from USD 1.64 billion to USD 3.22 billion, hold a 28.73% market share due to rising air freight activity.

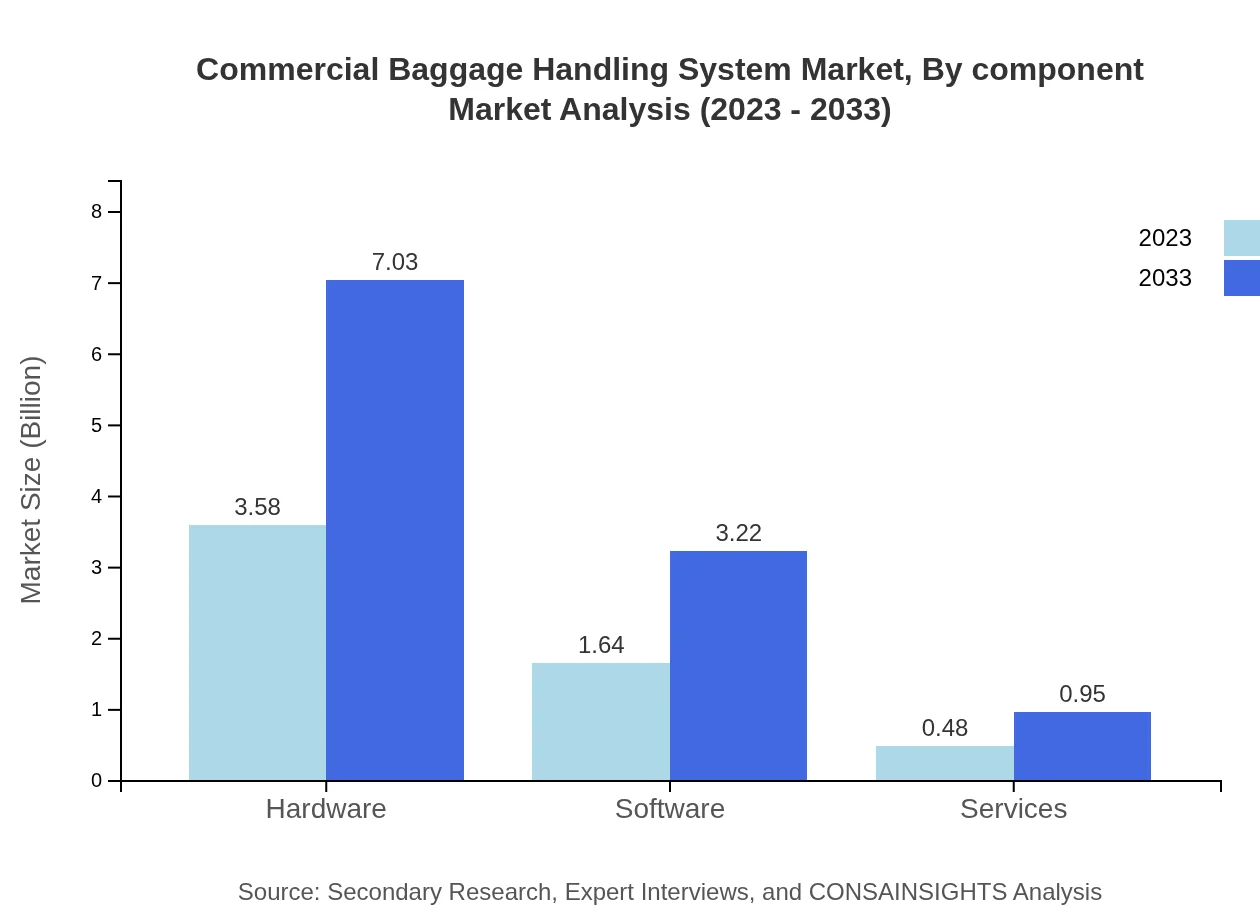

Commercial Baggage Handling System Market Analysis By Component

The market by component consists of Hardware, Software, and Services. Hardware leads with an expected growth from USD 3.58 billion in 2023 to USD 7.03 billion by 2033, contributing 62.79% to the market. Software will grow from USD 1.64 billion to USD 3.22 billion, representing 28.73% market share, while Services will grow from USD 0.48 billion to USD 0.95 billion, accounting for 8.48%.

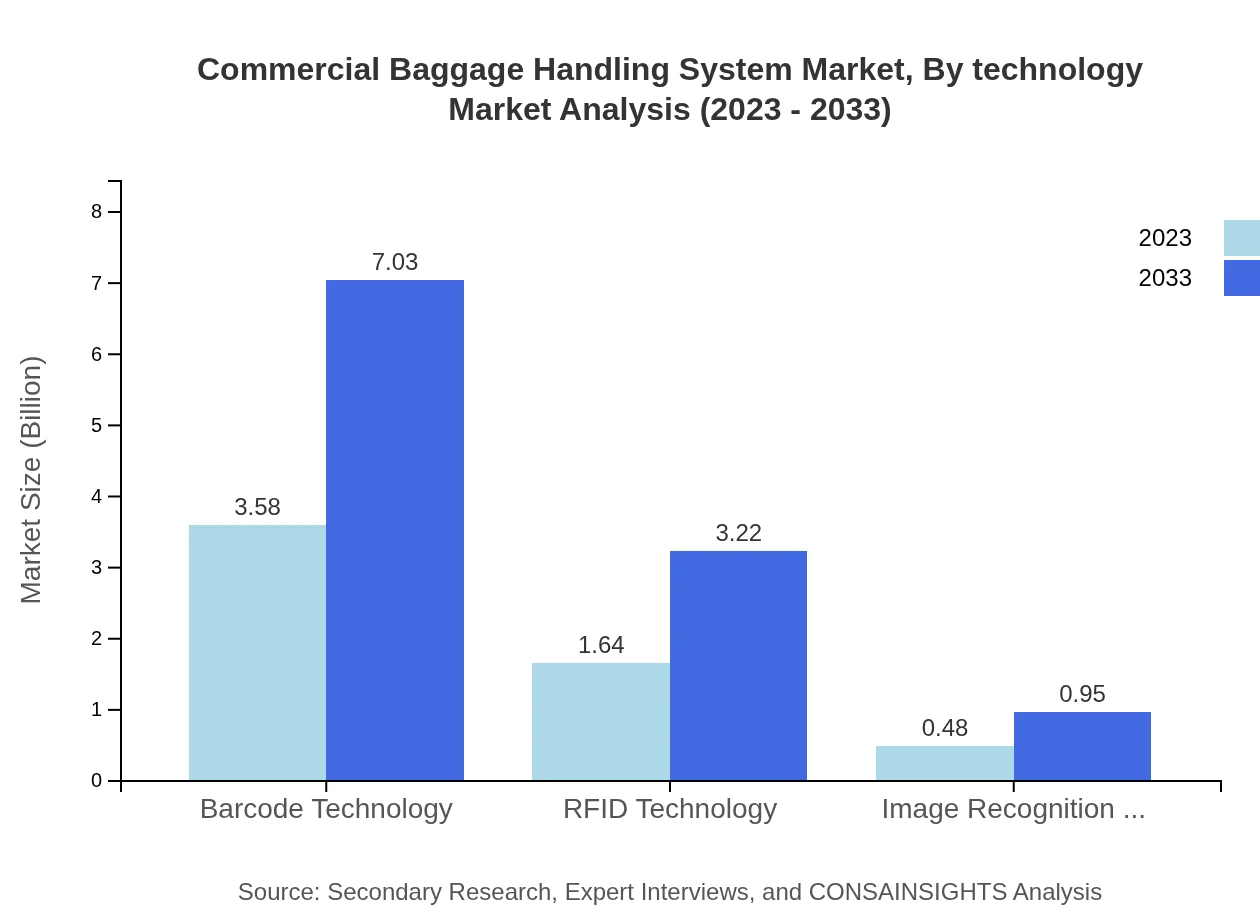

Commercial Baggage Handling System Market Analysis By Technology

The technology segment includes Barcode Technology, RFID Technology, and Image Recognition Technology. Barcode Technology dominates the market, with a size of USD 3.58 billion in 2023, expected to grow to USD 7.03 billion by 2033 at a share of 62.79%. RFID Technology is projected to rise from USD 1.64 billion to USD 3.22 billion, holding 28.73%. Image Recognition Technology will grow from USD 0.48 billion to USD 0.95 billion, accounting for 8.48% of the market.

Commercial Baggage Handling System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Commercial Baggage Handling System Industry

Siemens AG:

Siemens AG is a global leader in automation and digitalization, offering sophisticated baggage handling solutions across numerous airports worldwide, enhancing efficiency and reliability in operations.Beumer Group:

Beumer Group specializes in the design and implementation of baggage handling systems and is known for its innovative and sustainable solutions that meet the requirements of the aviation industry.Daifuku Co., Ltd.:

Daifuku is a major player in the conveyor and baggage handling sectors, renowned for advanced technology and system integration that optimize airport operations.Vanderlande Industries:

Vanderlande provides comprehensive baggage handling solutions, leveraging automation and robotics to improve speed and efficiency in airports globally.MHS Global:

MHS Global is focused on providing advanced baggage handling and material handling systems, with a commitment to innovation and customer service excellence.We're grateful to work with incredible clients.

FAQs

What is the market size of commercial Baggage Handling System?

The market size of the commercial baggage handling system is projected to reach approximately $5.7 billion by 2033, growing at a CAGR of 6.8% from its current value in 2023. This growth indicates increasing demand in the aviation sector.

What are the key market players or companies in this commercial Baggage Handling System industry?

Key players in the commercial baggage handling system market include SITA, Siemens AG, Vanderlande Industries, Airport Technologies, and Knapp AG. They dominate through technological innovation and strategic partnerships to enhance system efficiency.

What are the primary factors driving the growth in the commercial Baggage Handling System industry?

Growth drivers in the commercial baggage handling system industry include rising air travel demand, advancements in automation technology, increased investment in airport infrastructure, and the emphasis on efficiency and security in baggage handling processes.

Which region is the fastest Growing in the commercial Baggage Handling System?

The Asia Pacific region is expected to be the fastest-growing market for commercial baggage handling systems, with market growth from $1.07 billion in 2023 to $2.11 billion by 2033, reflecting robust airport expansions and rising passenger traffic.

Does ConsaInsights provide customized market report data for the commercial Baggage Handling System industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the commercial baggage handling system industry, ensuring that clients receive insights pertinent to their strategic planning and operational requirements.

What deliverables can I expect from this commercial Baggage Handling System market research project?

Deliverables from the market research project will include comprehensive reports detailing market size estimates, growth forecasts, competitive landscape analysis, regional insights, and segmentation data relevant to the commercial baggage handling system industry.

What are the market trends of commercial Baggage Handling System?

Current market trends in the commercial baggage handling system industry include increased automation, implementation of advanced technologies like RFID and image recognition, and a shift toward IoT-enabled baggage tracking systems, adding efficiency and security.