Commercial Drones Market Report

Published Date: 02 February 2026 | Report Code: commercial-drones

Commercial Drones Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Commercial Drones market, providing insights on market size, trends, and forecasts from 2023 to 2033. It covers a comprehensive analysis of the industry, key market players, regional dynamics, and future growth opportunities.

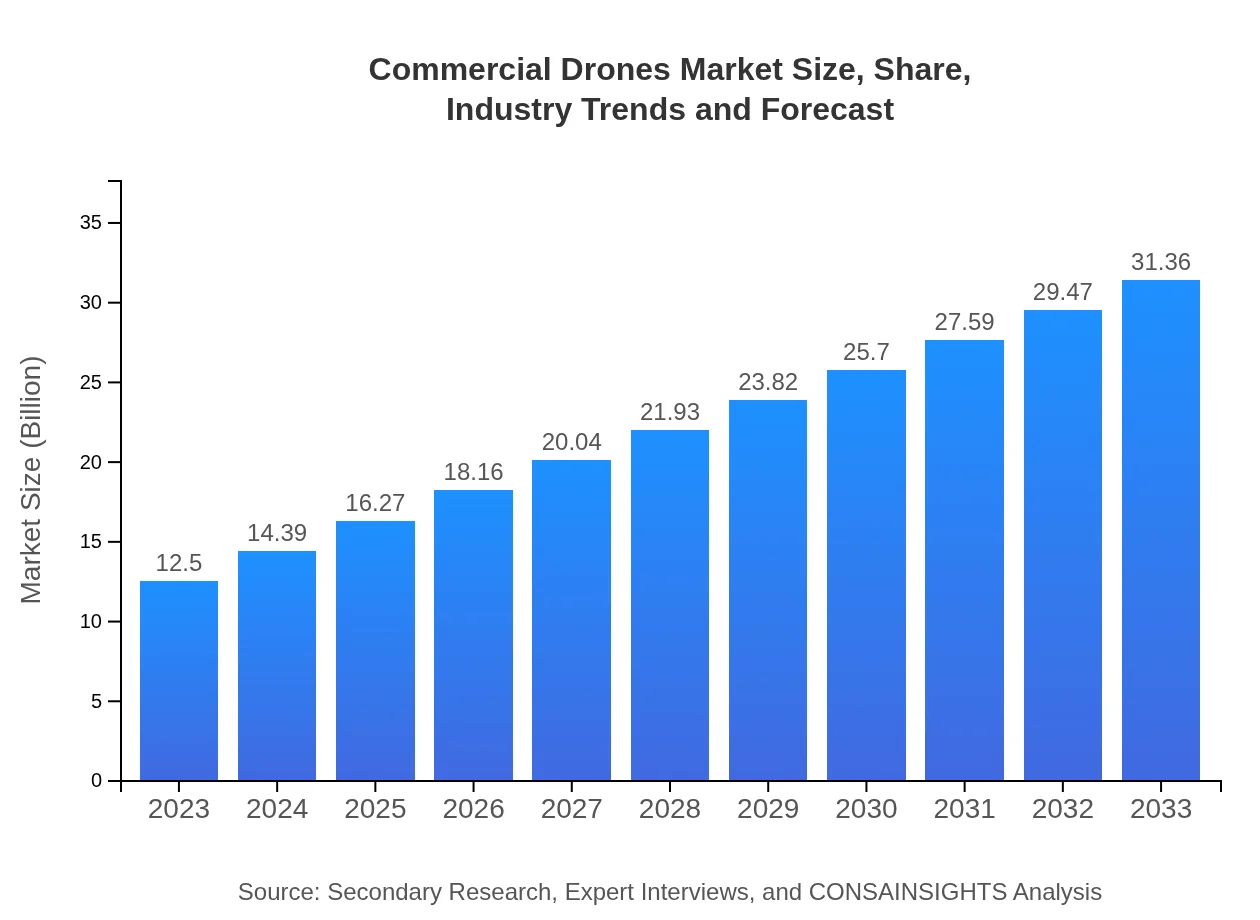

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 9.3% |

| 2033 Market Size | $31.36 Billion |

| Top Companies | DJI, Parrot Drones, senseFly, Skydio, 3D Robotics |

| Last Modified Date | 02 February 2026 |

Commercial Drones Market Overview

Customize Commercial Drones Market Report market research report

- ✔ Get in-depth analysis of Commercial Drones market size, growth, and forecasts.

- ✔ Understand Commercial Drones's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Commercial Drones

What is the Market Size & CAGR of Commercial Drones market in 2023?

Commercial Drones Industry Analysis

Commercial Drones Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Commercial Drones Market Analysis Report by Region

Europe Commercial Drones Market Report:

Europe's market is currently valued at $3.06 billion in 2023, with projections estimating a rise to $7.69 billion by 2033. Increasing investments in drone manufacturing and favorable regulations promoting usage across industries are key drivers for growth in this region.Asia Pacific Commercial Drones Market Report:

The Asia Pacific region is experiencing rapid growth, with a market value of $2.61 billion in 2023, projected to reach $6.54 billion by 2033. This growth is spurred by increasing investments in drone technology, coupled with a strong adoption for applications in agriculture and inspections, particularly in countries like China and India.North America Commercial Drones Market Report:

North America holds the largest market share with a value of $4.14 billion in 2023 and is projected to reach $10.38 billion by 2033. Major advancements in technology, coupled with robust regulatory frameworks in the U.S. supporting commercial usage, bolster the market's growth.South America Commercial Drones Market Report:

South America's market is valued at approximately $0.95 billion in 2023, expected to grow to $2.38 billion by 2033. The region sees opportunities in agriculture and environmental monitoring, facilitating increased drone adoption despite varying regulatory challenges.Middle East & Africa Commercial Drones Market Report:

The Middle East and Africa region is evolving with a market size of $1.74 billion in 2023, set to grow to $4.37 billion by 2033. Predominantly focusing on infrastructure, oil & gas, and logistics, the regional market shows promising signs of growth despite ongoing challenges in regulatory approvals.Tell us your focus area and get a customized research report.

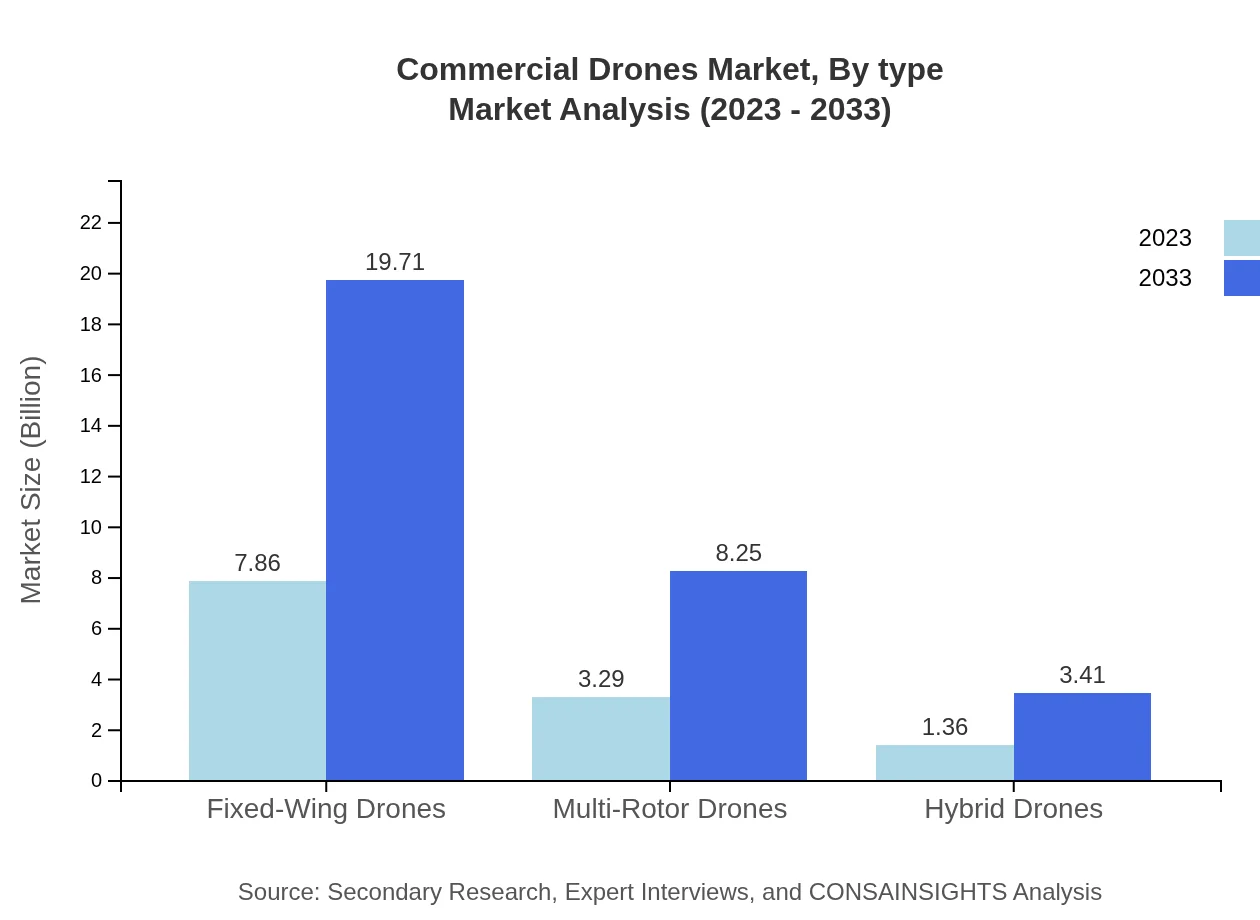

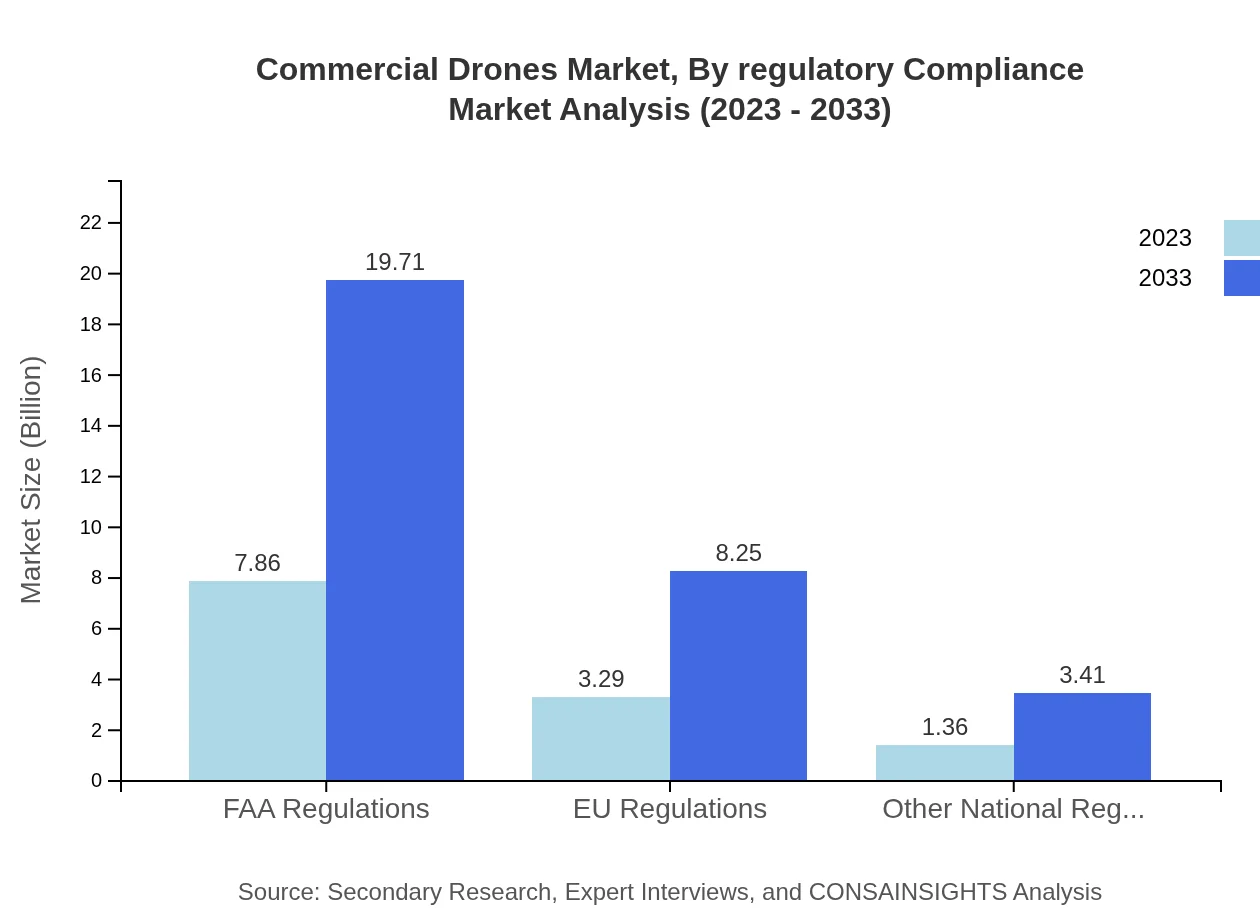

Commercial Drones Market Analysis By Type

The Commercial Drones market by type emphasizes Fixed-Wing Drones, Multi-Rotor Drones, and Hybrid Drones. Fixed-Wing Drones dominate the market with a forecasted size of $19.71 billion by 2033, driven by their endurance and range capabilities. In contrast, Multi-Rotor Drones are expected to grow to $8.25 billion, favored for their agility and versatility in various applications. Hybrid Drones, while smaller in market share, are anticipated to demonstrate significant growth, expected to reach $3.41 billion in 2033.

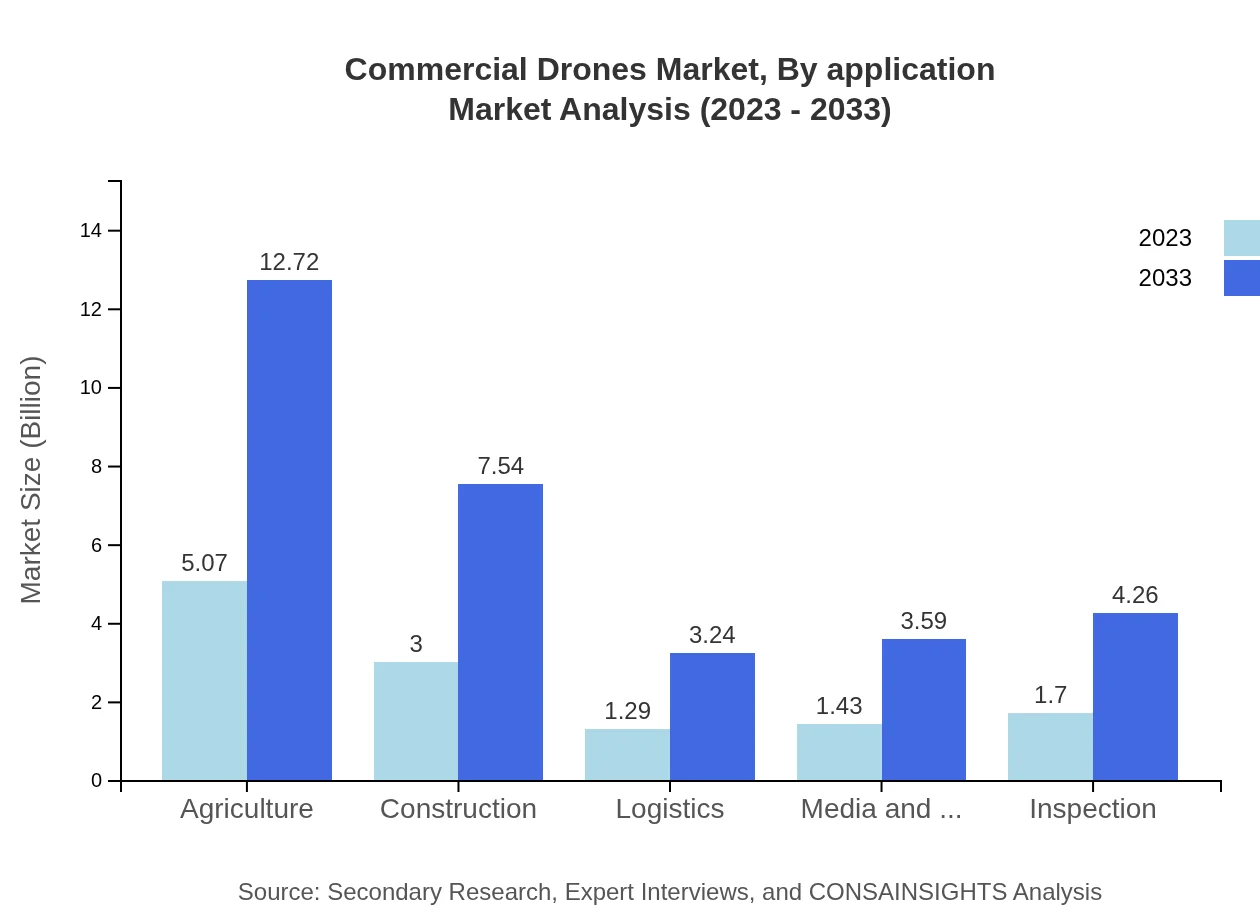

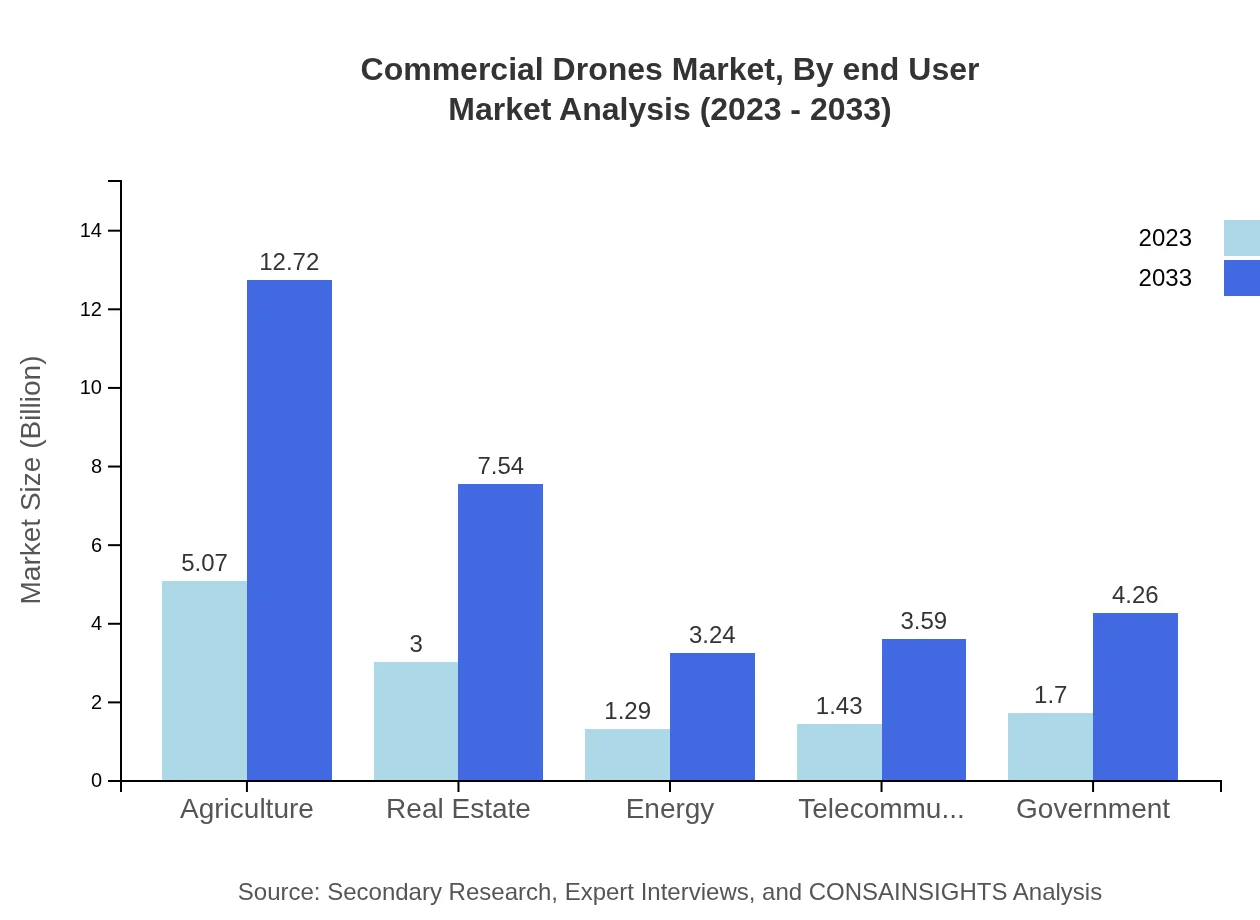

Commercial Drones Market Analysis By Application

Applications in the Commercial Drones market are diverse, with Agriculture leading at approximately $12.72 billion by 2033, leveraging drones for crop monitoring and treatment. Real Estate follows closely, with a growth forecast of $7.54 billion, as drones are increasingly used for property surveys and marketing. Other significant applications include Energy, Telecommunications, and Construction, each demonstrating considerable growth potential in the coming years.

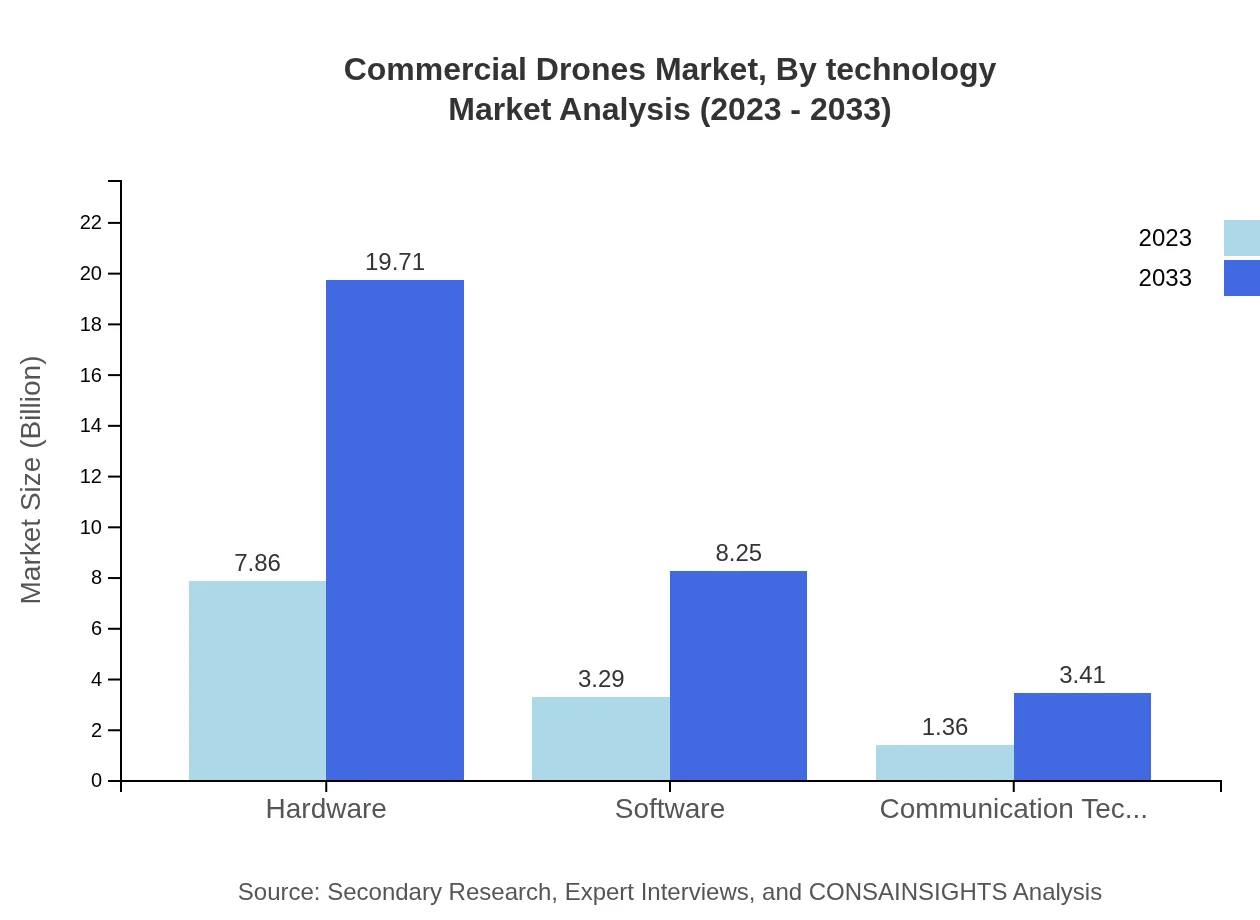

Commercial Drones Market Analysis By Technology

Technical innovations in communication technology and hardware drive the Commercial Drones market, with hardware projected to maintain a significant market share of 62.84% in 2033. Software solutions are also crucial, expected to expand significantly, facilitating data collection and operational management in drone applications. Communication technology plays an increasing role, with expectations of reaching $3.41 billion by 2033.

Commercial Drones Market Analysis By End User

End-user industries for Commercial Drones include agriculture, construction, logistics, and media among others. These segments play pivotal roles, with agriculture accounting for roughly 40.57% of the overall market share, heavily reliant on drones for efficiency. Construction and logistics follow, along with government entities, emphasizing regulatory compliance and safety in operations.

Commercial Drones Market Analysis By Regulatory Compliance

Regulatory compliance drives significant market dynamics, with FAA Regulations comprising 62.84% of the compliance framework in the U.S. European Union regulations also play a vital role, contributing 26.3% to the regulatory backdrop. As regulations evolve, they ensure safe operations while impacting market adoption rates and technological advancements.

Commercial Drones Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Commercial Drones Industry

DJI:

DJI is a leading global producer of commercial drones, renowned for its innovative products and applications in aerial photography and agricultural monitoring.Parrot Drones:

Parrot offers a wide range of drones that cater to both consumer and commercial applications, focusing on agricultural and surveying markets.senseFly:

senseFly specializes in fixed-wing drones for mapping and surveying, providing advanced solutions for industries such as agriculture and construction.Skydio:

Skydio is known for its autonomous drones, emphasizing AI technology to enhance operational capabilities across various applications.3D Robotics:

3D Robotics focuses on robust drone solutions for surveying and mapping, catering primarily to professional users.We're grateful to work with incredible clients.

FAQs

What is the market size of commercial Drones?

The commercial drones market is valued at approximately $12.5 billion in 2023, with a compound annual growth rate (CAGR) of 9.3%. This growth is expected to continue until 2033 as various sectors increasingly adopt drone technology.

What are the key market players or companies in this commercial Drones industry?

Key players in the commercial drone market include DJI, Parrot Drones, 3DR, and FLIR Systems, among others. These companies are instrumental in driving innovation and developing new applications across various industries.

What are the primary factors driving the growth in the commercial drones industry?

The growth of the commercial drones industry is driven by technological advancements, increased demand for aerial surveillance, and the efficiency of drone delivery systems. Additionally, regulations favoring drone use contribute to market expansion.

Which region is the fastest Growing in the commercial drones?

North America is the fastest-growing region in the commercial drones market, expected to rise from $4.14 billion in 2023 to $10.38 billion by 2033. This growth is fueled by technological investments and a robust regulatory framework.

Does ConsaInsights provide customized market report data for the commercial drones industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the commercial drones industry. This service provides detailed insights, allowing businesses to make data-driven decisions.

What deliverables can I expect from this commercial drones market research project?

You can expect comprehensive market reports, including regional analyses, segment data, competitor profiles, and growth forecasts. These deliverables are designed to equip stakeholders with actionable insights.

What are the market trends of commercial drones?

Current market trends in commercial drones include increasing use in agriculture and real estate, advancements in drone technology, and growing interest in regulatory frameworks that promote safe drone operations.