Commercial Pumps Market Report

Published Date: 22 January 2026 | Report Code: commercial-pumps

Commercial Pumps Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Commercial Pumps market from 2023 to 2033, including detailed insights on market size, growth forecasts, trends, and key players shaping the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

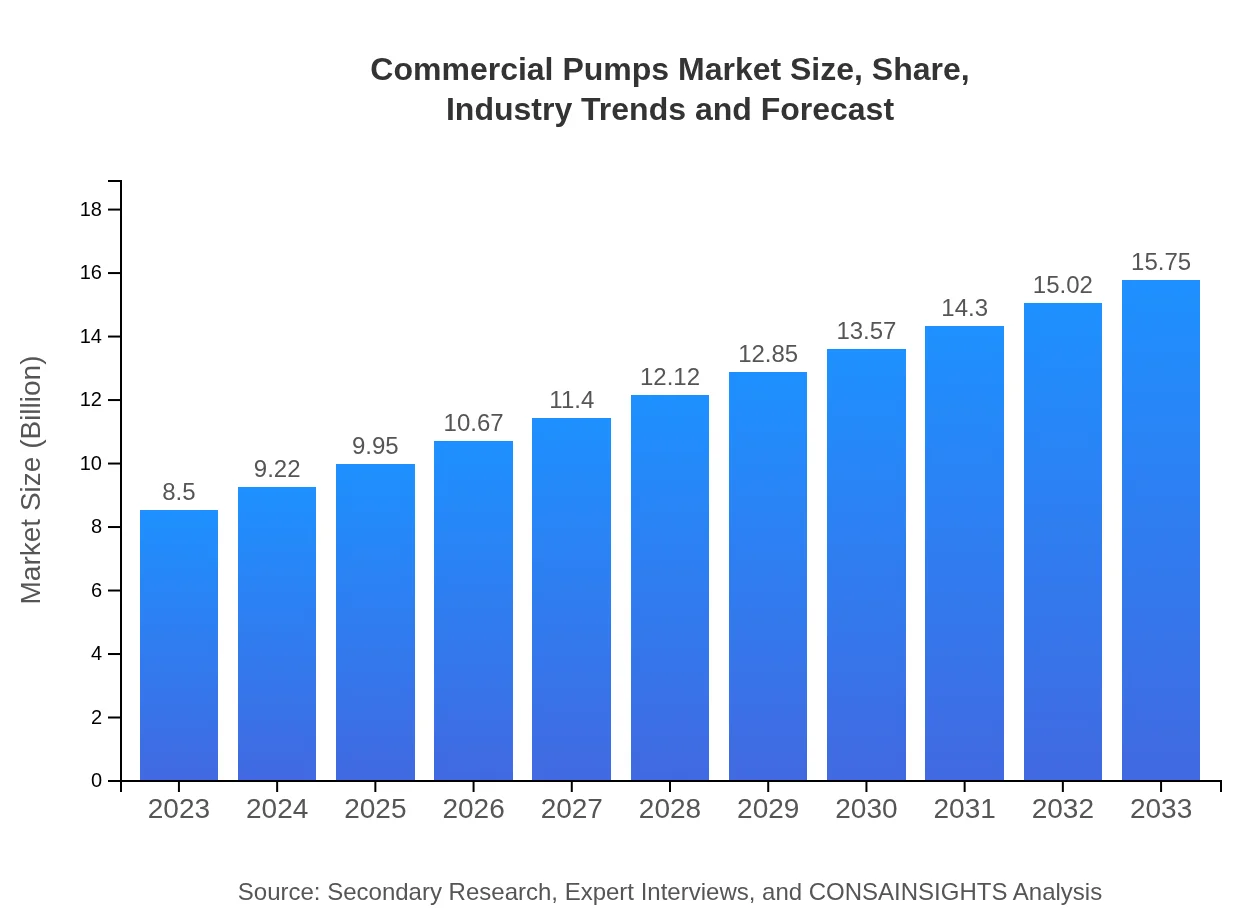

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $15.75 Billion |

| Top Companies | Grundfos, Xylem Inc., KSB SE & Co. KGaA, Flowserve Corporation, Ebara Corporation |

| Last Modified Date | 22 January 2026 |

Commercial Pumps Market Overview

Customize Commercial Pumps Market Report market research report

- ✔ Get in-depth analysis of Commercial Pumps market size, growth, and forecasts.

- ✔ Understand Commercial Pumps's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Commercial Pumps

What is the Market Size & CAGR of Commercial Pumps market in 2023?

Commercial Pumps Industry Analysis

Commercial Pumps Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Commercial Pumps Market Analysis Report by Region

Europe Commercial Pumps Market Report:

Europe experienced a market size of $2.99 billion in 2023, predicted to rise to $5.53 billion by 2033. The region emphasizes sustainability and regulatory compliance, providing fertile ground for the adoption of innovative and efficient pumping solutions.Asia Pacific Commercial Pumps Market Report:

The Asia Pacific region, valued at $1.41 billion in 2023, is expected to reach $2.61 billion by 2033, reflecting a significant growth trajectory driven by rapid industrialization, urbanization, and infrastructure development. Emerging markets in countries like India and China are slated for substantial demand increases, particularly in sectors like HVAC and agriculture.North America Commercial Pumps Market Report:

North America holds a pronounced market presence, with a value of $2.86 billion in 2023 anticipated to increase to $5.29 billion by 2033. The growth is driven by advancements in technology and an increasing focus on energy-efficient solutions across multiple sectors, particularly in commercial and municipal water management.South America Commercial Pumps Market Report:

In South America, the market is forecasted to grow from $0.19 billion in 2023 to $0.35 billion by 2033. The relatively modest growth can be attributed to economic fluctuations but is nonetheless expected to gain momentum as investments in water supply and sanitation infrastructure are prioritized in government agendas.Middle East & Africa Commercial Pumps Market Report:

The Middle East and Africa market is expected to grow from $1.06 billion in 2023 to $1.97 billion by 2033. The growth is largely influenced by ongoing projects in water scarcity solutions and energy resource management, which have become critical due to environmental concerns.Tell us your focus area and get a customized research report.

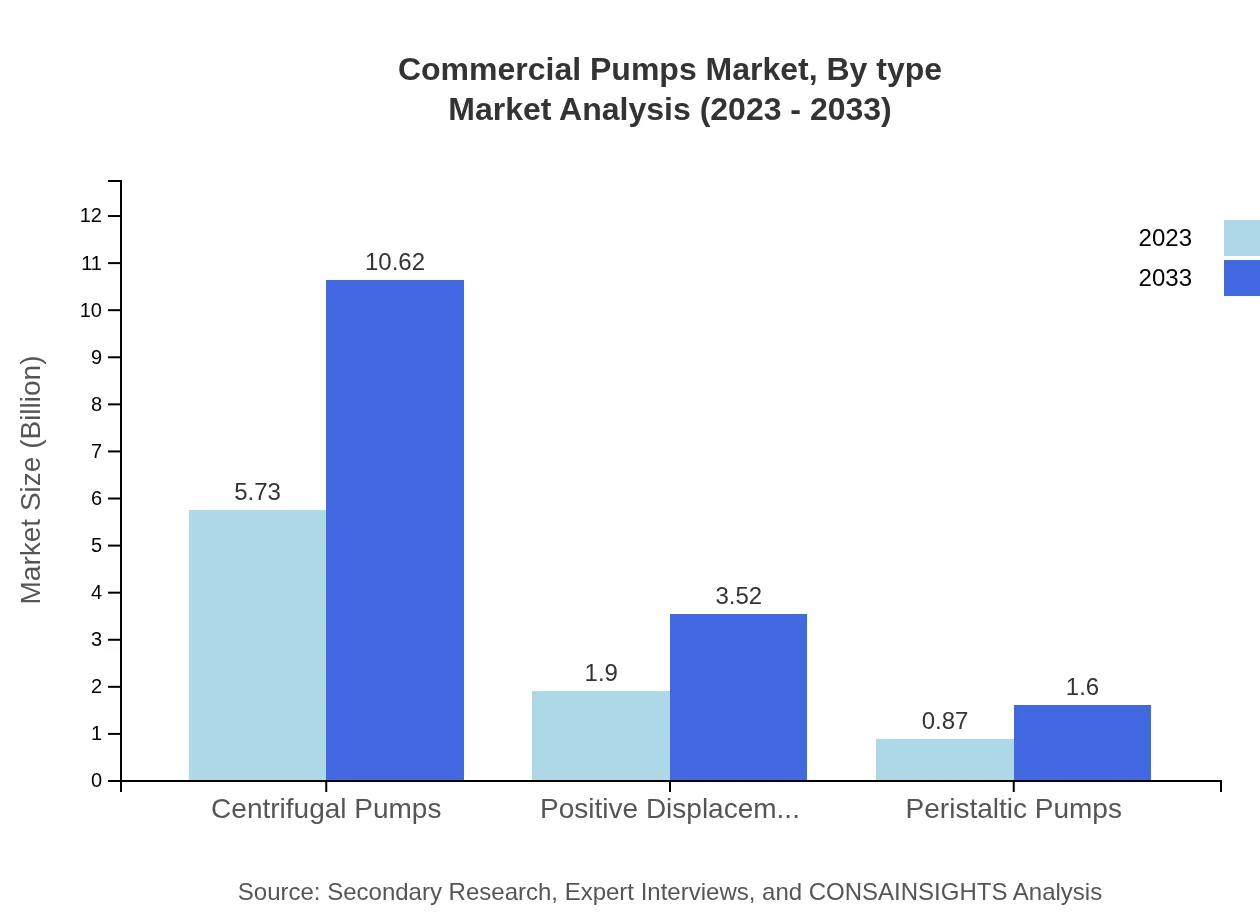

Commercial Pumps Market Analysis By Type

In 2023, the centrifugal pumps segment leads the Commercial Pumps market with a size of $5.73 billion, anticipated to grow to $10.62 billion by 2033, holding a steady 67.46% market share. Positive displacement pumps follow, with a market size of $1.90 billion in 2023, growing to $3.52 billion by 2033, capturing a 22.36% share. Peristaltic pumps, valued at $0.87 billion in 2023, are expected to reach $1.60 billion by 2033, holding a 10.18% share.

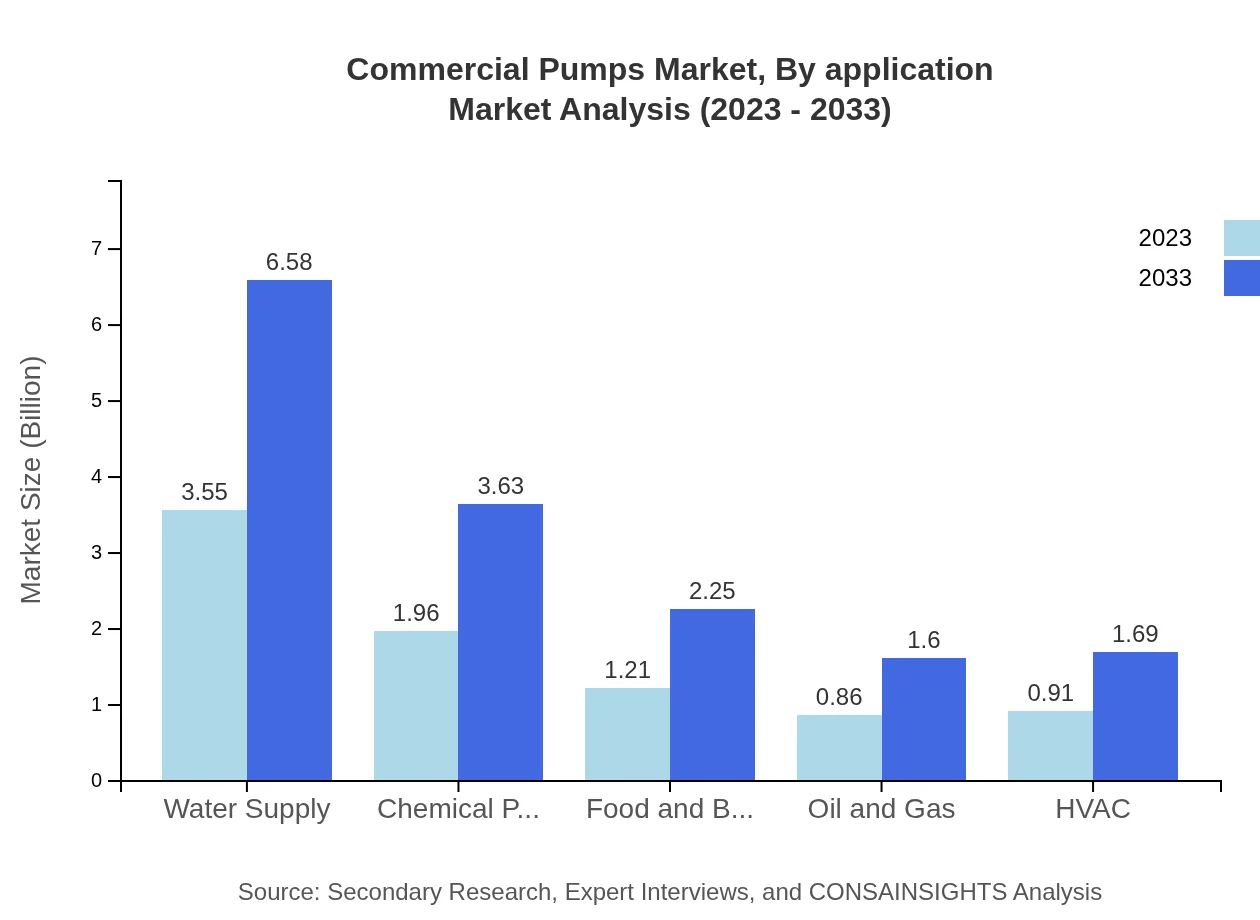

Commercial Pumps Market Analysis By Application

The By Application segment shows significant division among industries. The water supply segment alone is estimated at $3.55 billion in 2023, increasing to $6.58 billion by 2033, representing a 41.77% market share. Following this, the chemical processing application is valued at $1.96 billion in 2023 and is projected to reach $3.63 billion by 2033, making up 23.07% of the market.

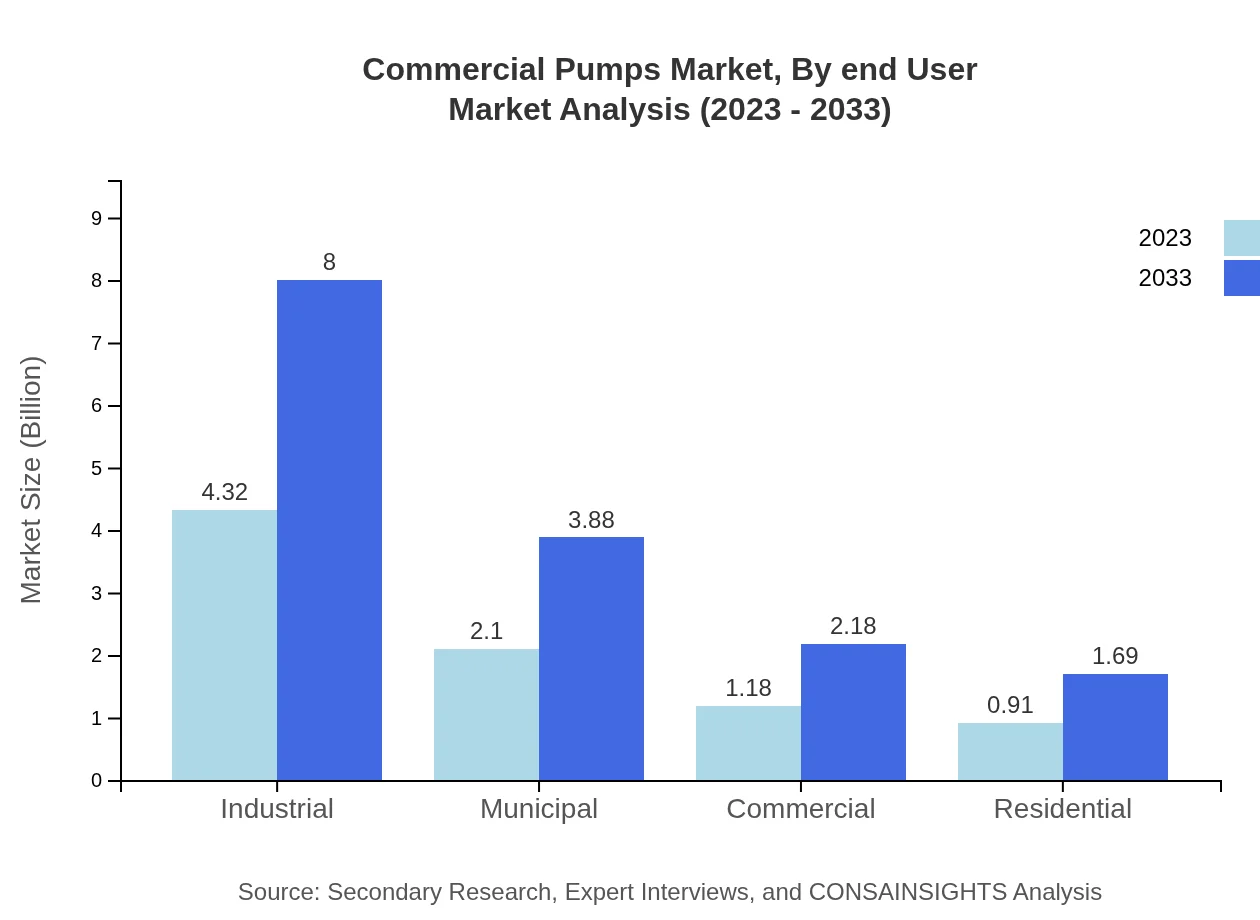

Commercial Pumps Market Analysis By End User

The Commercial sector represents a vital end-user segment, valued at $1.18 billion in 2023 and expected to rise to $2.18 billion by 2033, making up 13.86% of the market. Industrial applications lead the market share, valued at $4.32 billion in 2023, growing to $8.00 billion in 2033, holding approximately 50.78% of the overall market.

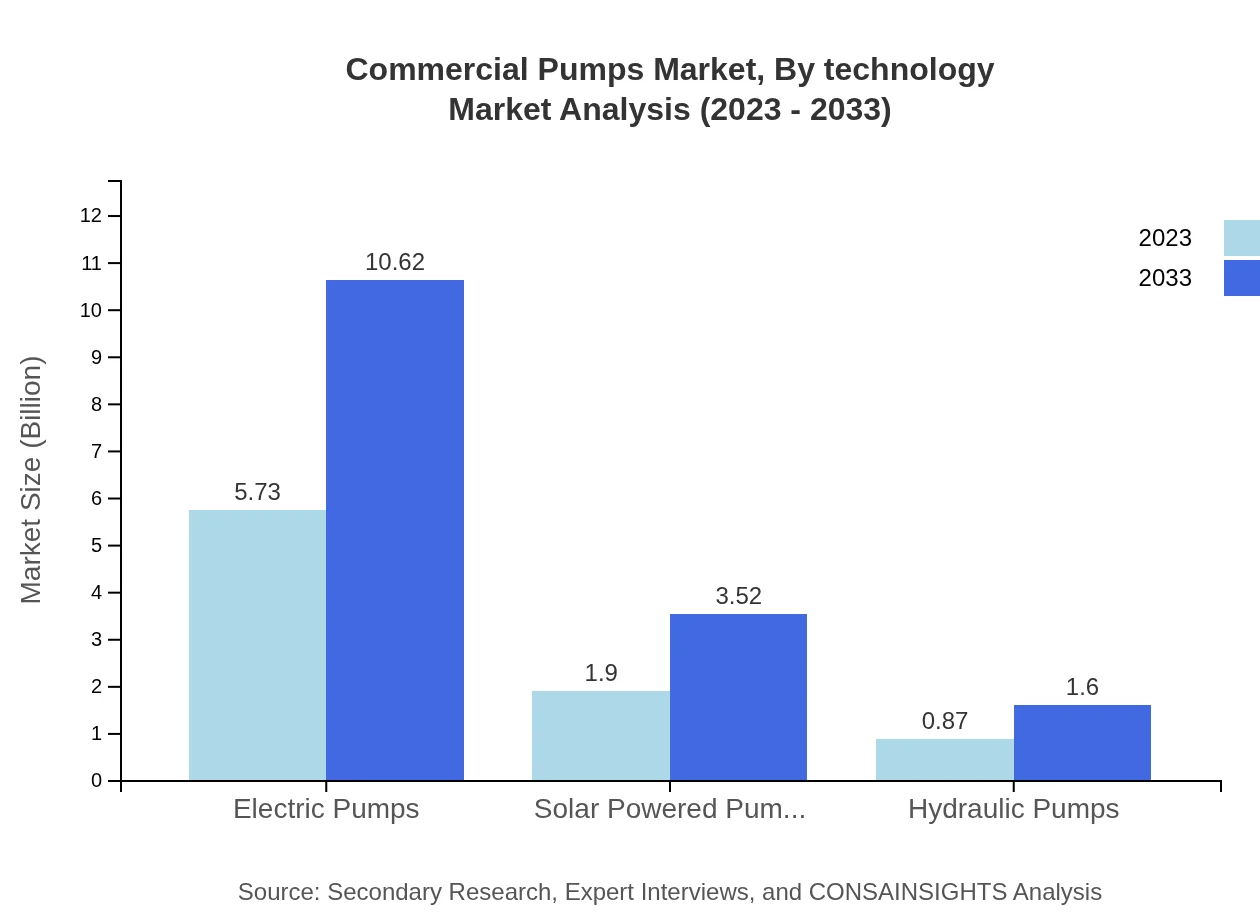

Commercial Pumps Market Analysis By Technology

Electric pumps dominate the technology segment, valued at $5.73 billion in 2023, with a projected size of $10.62 billion by 2033, maintaining a 67.46% market share. Meanwhile, solar-powered pumps are gaining traction, anticipated to grow from $1.90 billion to $3.52 billion during the same period, capturing a 22.36% share in the market.

Commercial Pumps Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Commercial Pumps Industry

Grundfos:

Grundfos is renowned for its innovative and sustainable pumping solutions, providing a wide array of products for commercial applications, including energy-efficient pumps.Xylem Inc.:

Xylem Inc. specializes in advanced water technologies and provides solutions across the water utility, industrial, and commercial sectors, focusing on improving efficiency.KSB SE & Co. KGaA:

KSB manufactures pumps and valves and is known for its commitment to cutting-edge technology and sustainable practices within the Commercial Pumps sector.Flowserve Corporation:

Flowserve provides fluid motion control products, including a variety of pumps used across diverse commercial industries, emphasizing reliability and quality.Ebara Corporation:

Ebara is recognized for its pumps and systems catering to commercial applications, especially within water supply systems, with a strong commitment to environmental sustainability.We're grateful to work with incredible clients.

FAQs

What is the market size of commercial pumps?

The commercial pumps market is currently valued at $8.5 billion and is expected to grow at a CAGR of 6.2%. By 2033, the market size is projected to significantly increase, driven by rising demand across various sectors.

What are the key market players or companies in the commercial pumps industry?

Key players in the commercial pumps industry include major manufacturers and suppliers known for their innovative pump technologies. These companies play a critical role in advancing pump efficiency and developing solutions tailored to diverse industrial applications.

What are the primary factors driving the growth in the commercial pumps industry?

Growth drivers in the commercial pumps segment include increasing demand for automation, advancements in pump technology, and rising investments in infrastructure. Additionally, the expansion of industries such as construction and water supply greatly contributes to market growth.

Which region is the fastest Growing in the commercial pumps?

The fastest-growing region in the commercial pumps market is Europe, with a market size projected to grow from $2.99 billion in 2023 to $5.53 billion by 2033. North America and Asia Pacific also show significant growth, driven by infrastructural investments.

Does ConsaInsights provide customized market report data for the commercial pumps industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the commercial pumps industry. This service includes in-depth analysis and insights to equip businesses with strategic knowledge for informed decision-making.

What deliverables can I expect from this commercial pumps market research project?

Deliverables from the commercial pumps market research project include comprehensive market analysis reports, detailed segmentation studies, growth forecasts, and competitive landscape insights. These deliverables aim to provide actionable intelligence for stakeholders.

What are the market trends of commercial pumps?

Key market trends in commercial pumps include increasing adoption of energy-efficient pumps, growth in smart pumping technologies, and expanding applications across various sectors. These trends highlight an industry shift towards sustainability and innovation.