Commercial Real Estate Market Report

Published Date: 22 January 2026 | Report Code: commercial-real-estate

Commercial Real Estate Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Commercial Real Estate market, covering insights on industry size, segmentation, regional performance, technology impacts, and future forecasts from 2023 to 2033.

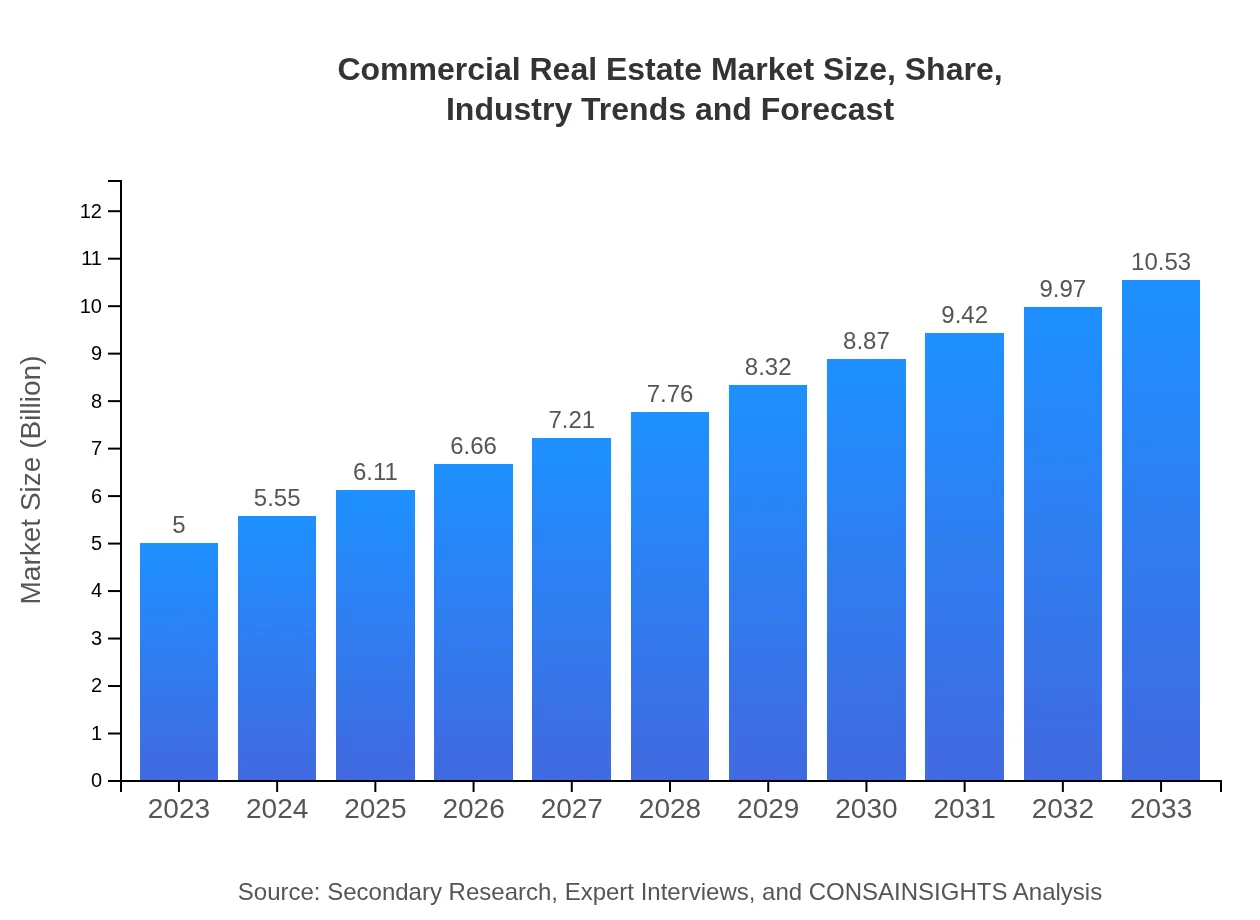

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $10.53 Billion |

| Top Companies | CBRE Group, Inc., JLL (Jones Lang LaSalle), Cushman & Wakefield, Colliers International, Savills |

| Last Modified Date | 22 January 2026 |

Commercial Real Estate Market Overview

Customize Commercial Real Estate Market Report market research report

- ✔ Get in-depth analysis of Commercial Real Estate market size, growth, and forecasts.

- ✔ Understand Commercial Real Estate's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Commercial Real Estate

What is the Market Size & CAGR of Commercial Real Estate market in 2023?

Commercial Real Estate Industry Analysis

Commercial Real Estate Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Commercial Real Estate Market Analysis Report by Region

Europe Commercial Real Estate Market Report:

The European Commercial Real Estate market is projected at $1.59 trillion in 2023, with expectations to reach $3.36 trillion by 2033. Key drivers include sustainable building initiatives and increasing demand for office spaces post-pandemic, particularly in major cities like London, Frankfurt, and Paris.Asia Pacific Commercial Real Estate Market Report:

In the Asia Pacific region, the Commercial Real Estate market is estimated at $0.77 trillion in 2023, projected to grow to $1.63 trillion by 2033. The growth is fueled by rapid urbanization, increasing foreign investments, and burgeoning e-commerce activities, particularly in China and India.North America Commercial Real Estate Market Report:

North America holds the largest share of the CRE market, with a size of $1.89 trillion in 2023, anticipated to reach $3.97 trillion by 2033. The market is driven by strong demand for logistics and multifamily housing, influenced by remote working and urbanization trends.South America Commercial Real Estate Market Report:

The South American Commercial Real Estate market is valued at around $0.12 trillion in 2023, expecting growth to $0.26 trillion in 2033. The region faces challenges such as economic instability, but key markets like Brazil and Argentina are witnessing a slow recovery driven by local investments.Middle East & Africa Commercial Real Estate Market Report:

In the Middle East and Africa, the market is valued at $0.62 trillion in 2023, expected to grow to $1.31 trillion by 2033. This growth is supported by government initiatives promoting urban development and foreign investments in real estate projects.Tell us your focus area and get a customized research report.

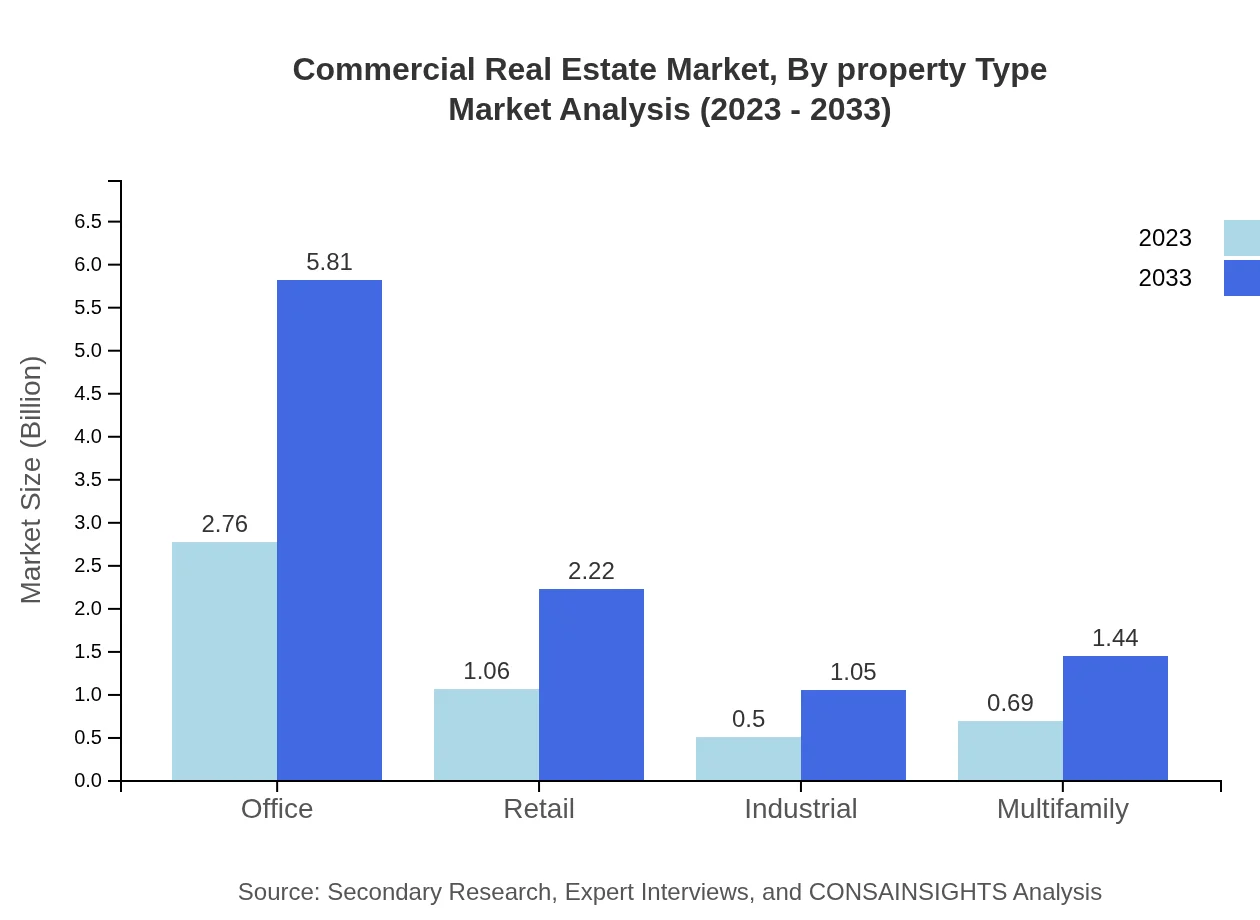

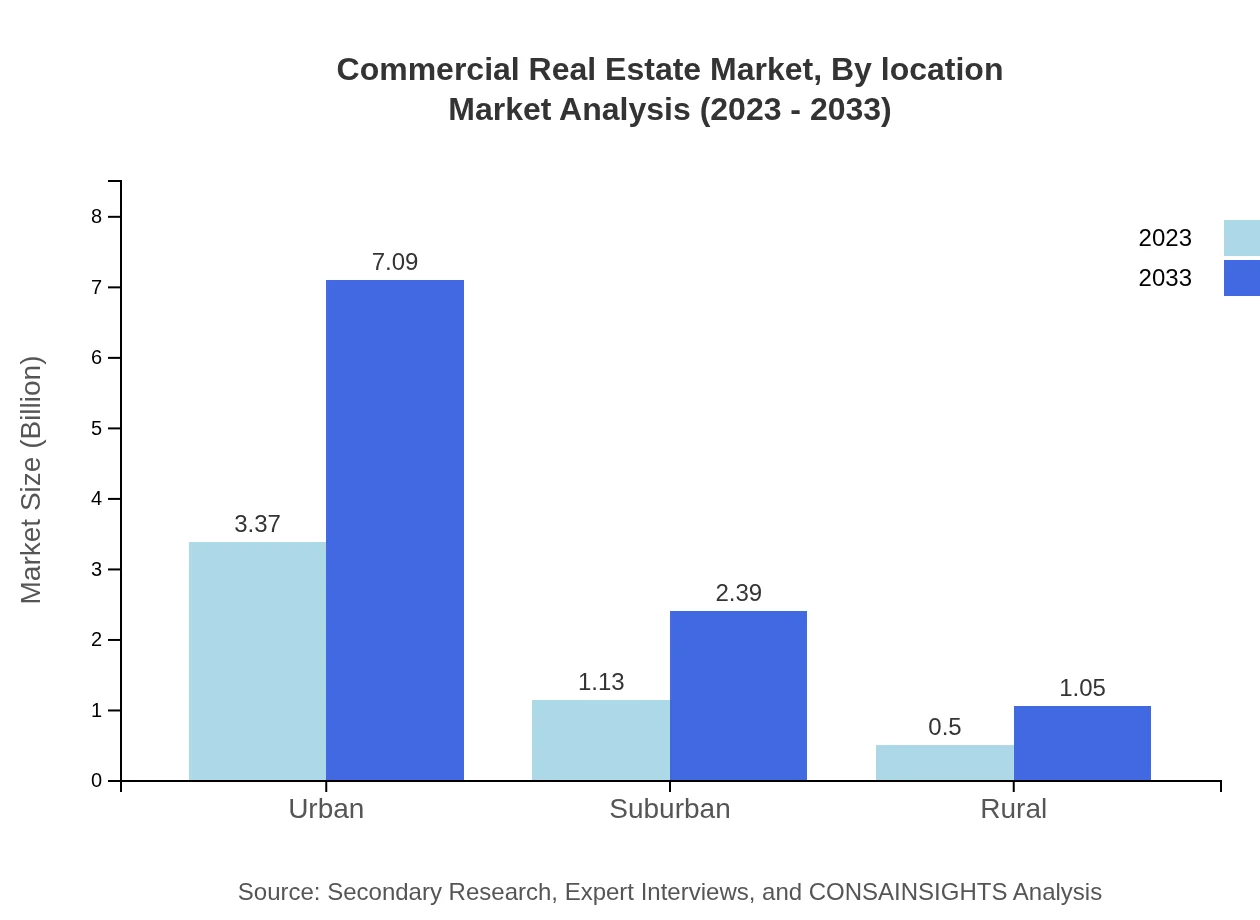

Commercial Real Estate Market Analysis By Property Type

The analysis of the Commercial Real Estate market by property type indicates a significant focus on urban spaces. For instance, in 2023, urban properties' market size is approximately $3.37 trillion, expected to grow to $7.09 trillion by 2033, showcasing a market share of around 67.36%. In contrast, suburban properties are valued at $1.13 trillion now, likely increasing to $2.39 trillion by 2033. Rural properties are smaller segments, estimated at $0.50 trillion in 2023, growing to $1.05 trillion.

Commercial Real Estate Market Analysis By Market Sector

The market analysis by sector reveals diversified growth opportunities within corporate, government, and non-profit segments. Corporate real estate, valued at $1.06 trillion in 2023, is expected to reach $2.22 trillion by 2033, while government and non-profit sectors hold market sizes of $0.50 trillion and $0.69 trillion, respectively, both projected to witness significant growth.

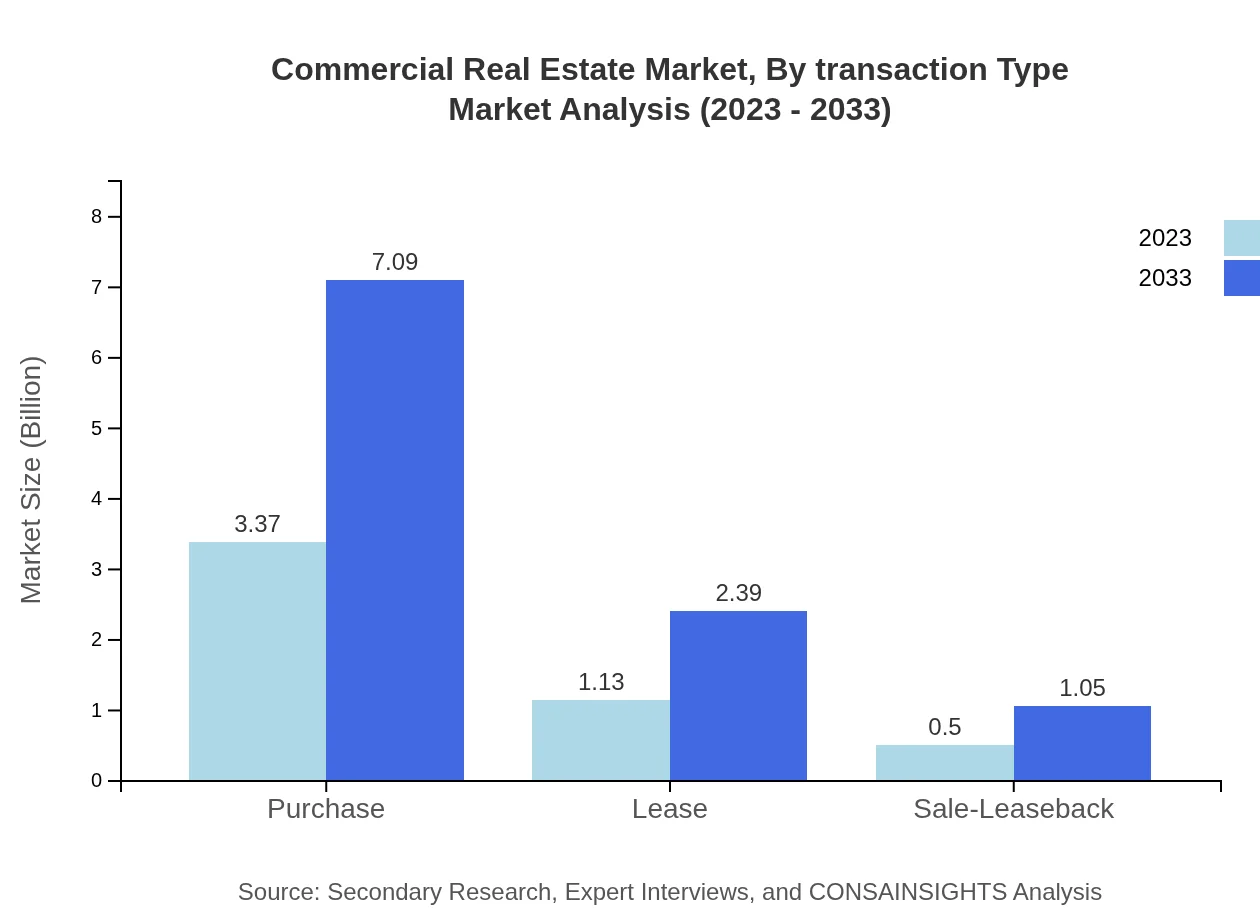

Commercial Real Estate Market Analysis By Transaction Type

The Commercial Real Estate market segment by transaction type indicates that purchases dominate, accounting for $3.37 trillion in 2023, with expectations of reaching $7.09 trillion by 2033. In contrast, leasing transactions stand at $1.13 trillion, set to grow to $2.39 trillion, reflecting a growing trend in flexible workspaces.

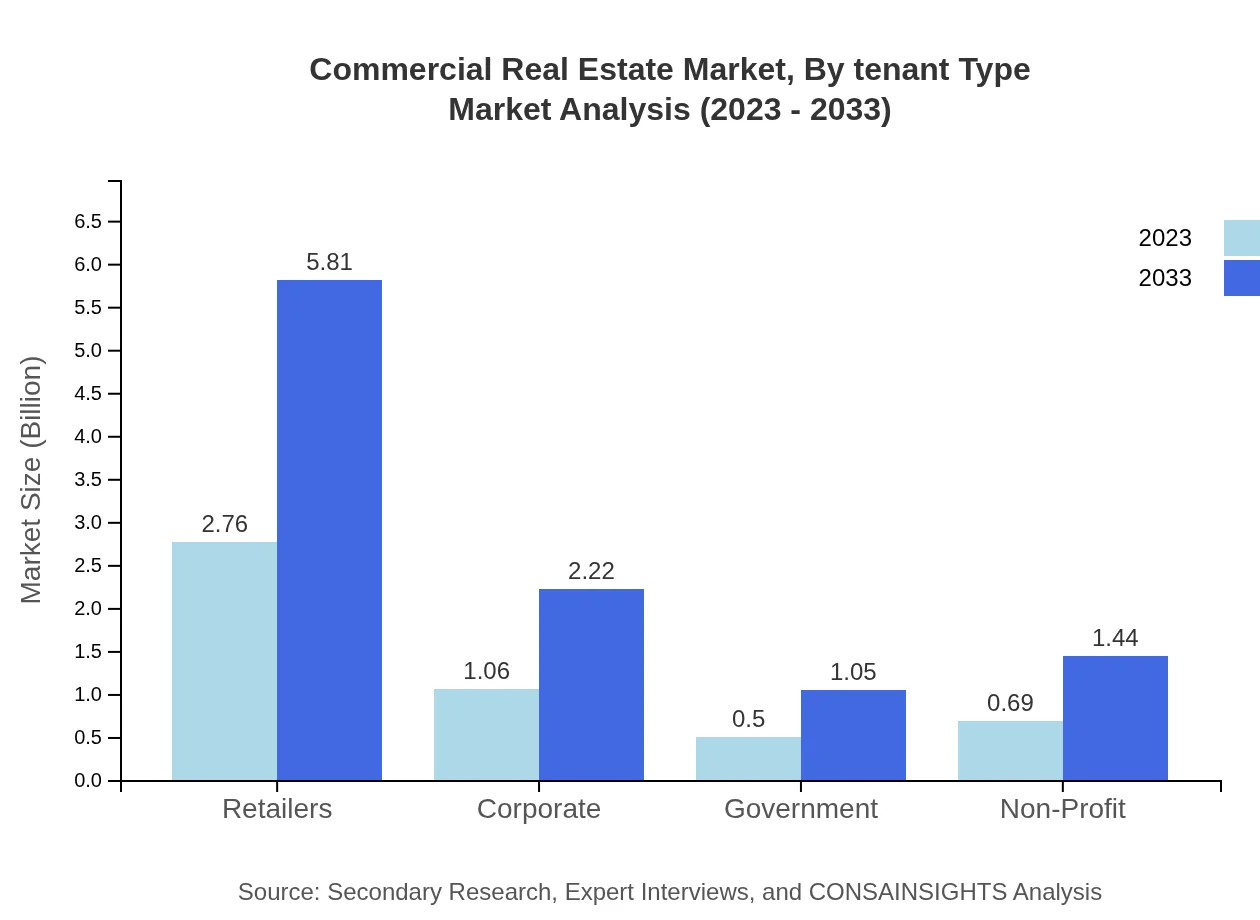

Commercial Real Estate Market Analysis By Tenant Type

Analysis by tenant type shows a robust market share for retailers, with a size of $2.76 trillion in 2023, growing to $5.81 trillion in 2033, reflecting ongoing demand despite e-commerce shifts. Corporate tenants contribute significantly, while non-profit organizations explore stable leases amidst rising demand.

Commercial Real Estate Market Analysis By Location

Location-based analysis indicates urban areas dominate, with projections showing urban properties growing from $3.37 trillion in 2023 to $7.09 trillion by 2033, maintaining a share of 67.36%. Suburban and rural locations show significant opportunities, albeit at smaller proportions, making urban environments central to future investment.

Commercial Real Estate Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Commercial Real Estate Industry

CBRE Group, Inc.:

A global leader in commercial real estate services and investment, CBRE offers a full suite of integrated services to clients worldwide, encompassing leasing, property management, and investment sales.JLL (Jones Lang LaSalle):

JLL is a leading professional services firm providing comprehensive real estate and investment management services to clients, supported by a deep understanding of property markets and trends.Cushman & Wakefield:

Cushman & Wakefield is a global leader in commercial real estate services, providing expert advice, strategic solutions, and innovative services across all property sectors.Colliers International:

Colliers International is one of the worlds’ leading commercial real estate firms providing a range of services including leasing, investment, management, and advisory services.Savills:

Savills is an international real estate service provider, helping clients around the world buy, sell, and lease commercial properties while providing market-leading advice and analyses.We're grateful to work with incredible clients.

FAQs

What is the market size of commercial real estate?

The commercial real estate market is projected to reach approximately $5 billion by 2033, with a CAGR of 7.5% from 2023. This growth reflects a recovering economy and increasing demand for commercial space.

What are the key market players or companies in the commercial real estate industry?

Key players in the commercial real estate industry include major firms like CBRE Group, JLL, and Colliers International, which dominate the market through their extensive portfolios, innovative solutions, and global reach.

What are the primary factors driving the growth in the commercial real estate industry?

The growth in the commercial real estate industry is driven by urbanization, increasing demand for office and retail spaces, rising investments from institutional investors, and advancements in technology enhancing property management.

Which region is the fastest Growing in the commercial real estate?

North America is the fastest-growing region in the commercial real estate market, expected to increase from $1.89 billion in 2023 to $3.97 billion by 2033, showcasing a robust demand across sectors.

Does ConsaInsights provide customized market report data for the commercial real estate industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the commercial real estate industry, ensuring relevant insights based on individual business requirements.

What deliverables can I expect from this commercial real estate market research project?

Deliverables from the commercial real estate market research project include detailed market analysis, regional insights, competitive landscapes, and actionable recommendations to inform strategic decisions.

What are the market trends of commercial real estate?

Market trends in commercial real estate indicate a growing preference for urban developments, sustainability in building designs, increased e-commerce demand shaping retail spaces, and adaptive reuse of properties.