Commercial Satellite Imaging Market Report

Published Date: 31 January 2026 | Report Code: commercial-satellite-imaging

Commercial Satellite Imaging Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Commercial Satellite Imaging market, covering key insights, current trends, and future forecasts for 2023 to 2033. Detailed data on market size, segmentation, and regional assessments are included to aid decision-making.

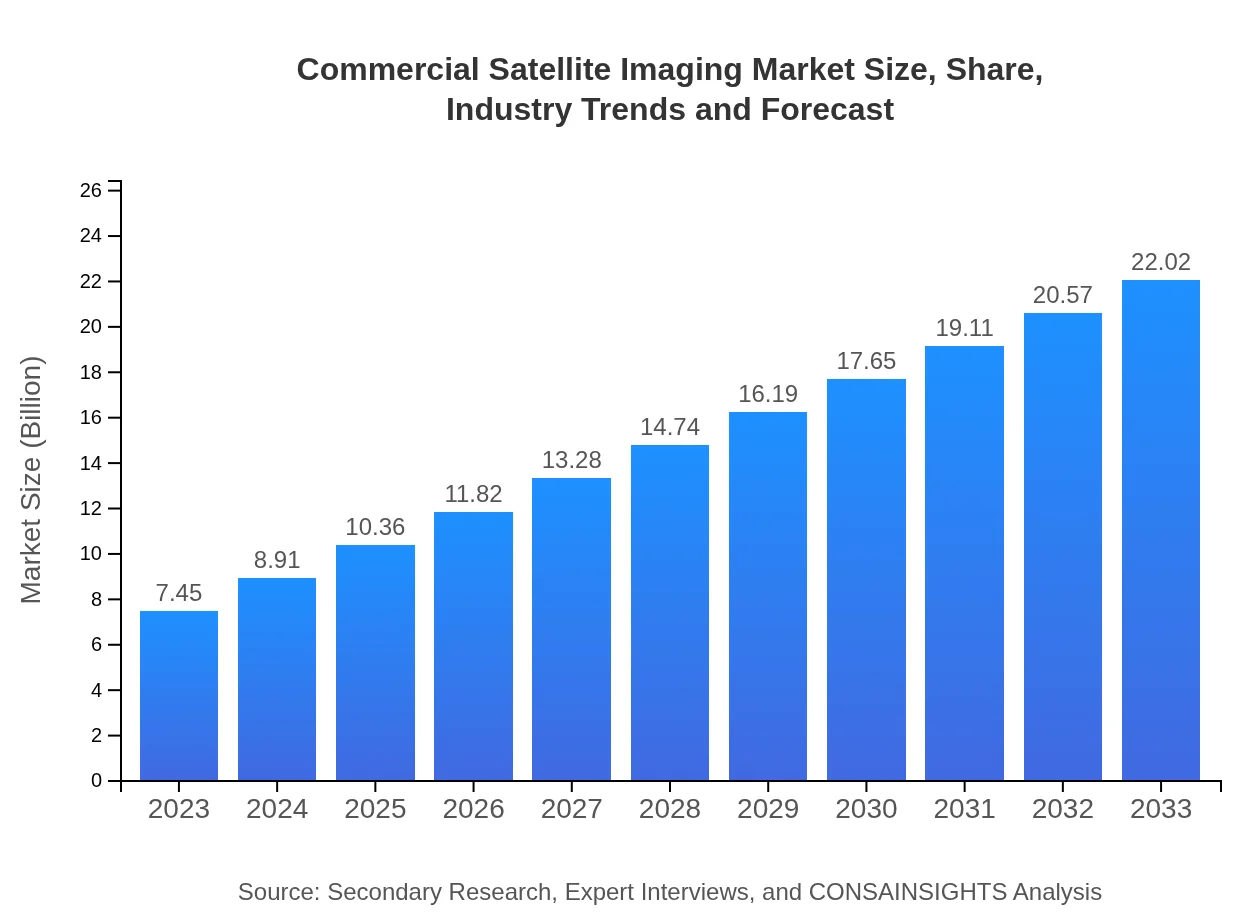

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.45 Billion |

| CAGR (2023-2033) | 11% |

| 2033 Market Size | $22.02 Billion |

| Top Companies | Maxar Technologies, Planet Labs Inc., Airbus Defence and Space, Boeing |

| Last Modified Date | 31 January 2026 |

Commercial Satellite Imaging Market Overview

Customize Commercial Satellite Imaging Market Report market research report

- ✔ Get in-depth analysis of Commercial Satellite Imaging market size, growth, and forecasts.

- ✔ Understand Commercial Satellite Imaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Commercial Satellite Imaging

What is the Market Size & CAGR of Commercial Satellite Imaging market in 2023?

Commercial Satellite Imaging Industry Analysis

Commercial Satellite Imaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Commercial Satellite Imaging Market Analysis Report by Region

Europe Commercial Satellite Imaging Market Report:

In Europe, the market size is forecasted to grow from $1.79 billion in 2023 to $5.30 billion by 2033. Increased focus on environmental monitoring and sustainable development practices, coupled with substantial investments in satellite communications, are key growth drivers.Asia Pacific Commercial Satellite Imaging Market Report:

The Asia Pacific region is witnessing substantial growth in the Commercial Satellite Imaging market, with a market size projected to grow from $1.63 billion in 2023 to $4.83 billion by 2033. Factors contributing to this growth include increasing investments in satellite technology, the rising use of satellite imagery in agriculture and disaster management, and supportive governmental policies aimed at promoting space technologies.North America Commercial Satellite Imaging Market Report:

North America dominates the Commercial Satellite Imaging market, with an anticipated increase from $2.83 billion in 2023 to $8.37 billion by 2033. The region's growth is fueled by high demand from defense and security sectors, widespread use in agriculture, and advanced technology integration across various applications.South America Commercial Satellite Imaging Market Report:

The South American market is expected to increase from $0.32 billion in 2023 to $0.95 billion by 2033. This growth is driven by the adoption of satellite imagery in environmental monitoring and agriculture, as well as an increase in demand for urban planning solutions amid rapid urbanization in major cities.Middle East & Africa Commercial Satellite Imaging Market Report:

The Middle East and Africa market is projected to grow from $0.87 billion in 2023 to $2.57 billion by 2033. The growth trajectory is supported by the need for advanced surveillance technologies and the demand for satellite imagery in oil and gas exploration and agriculture.Tell us your focus area and get a customized research report.

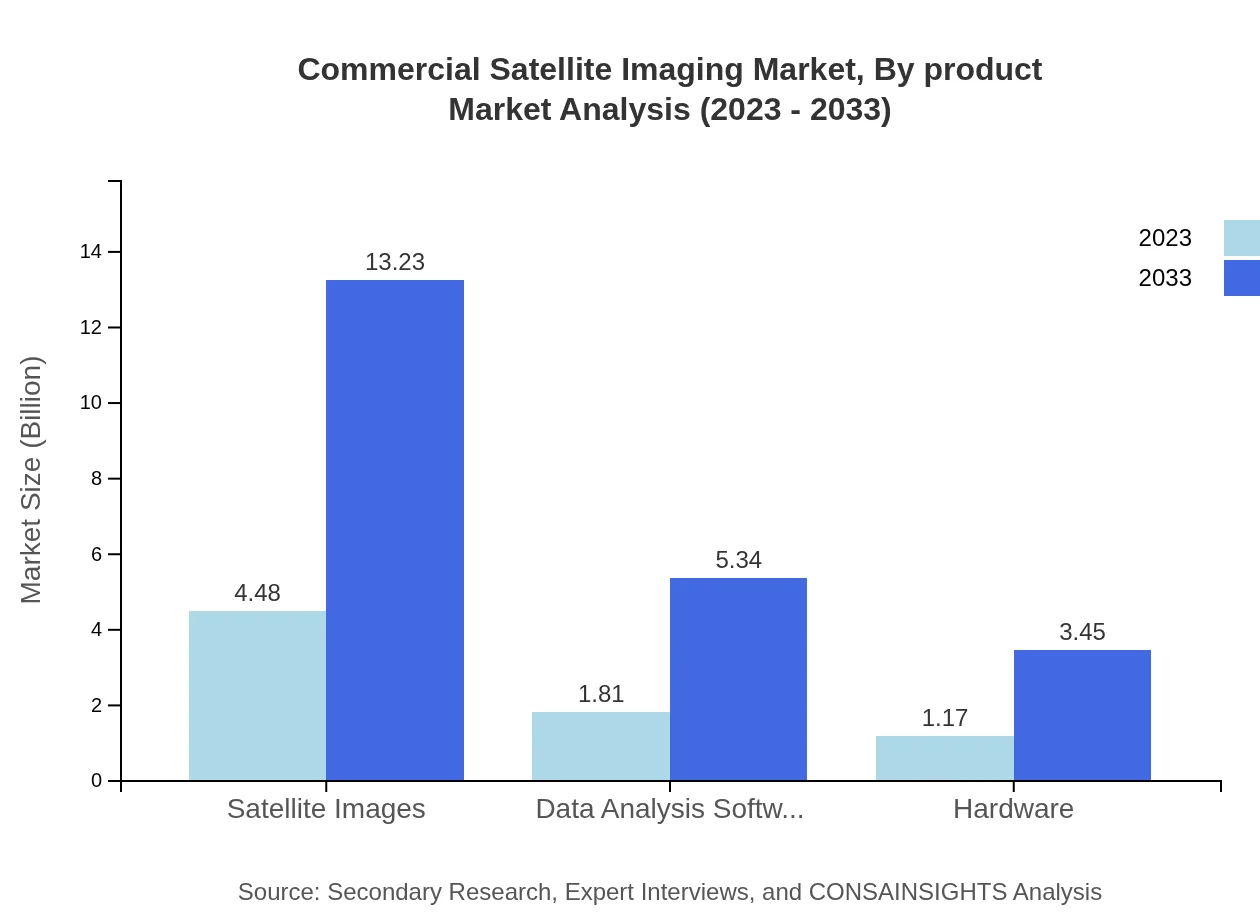

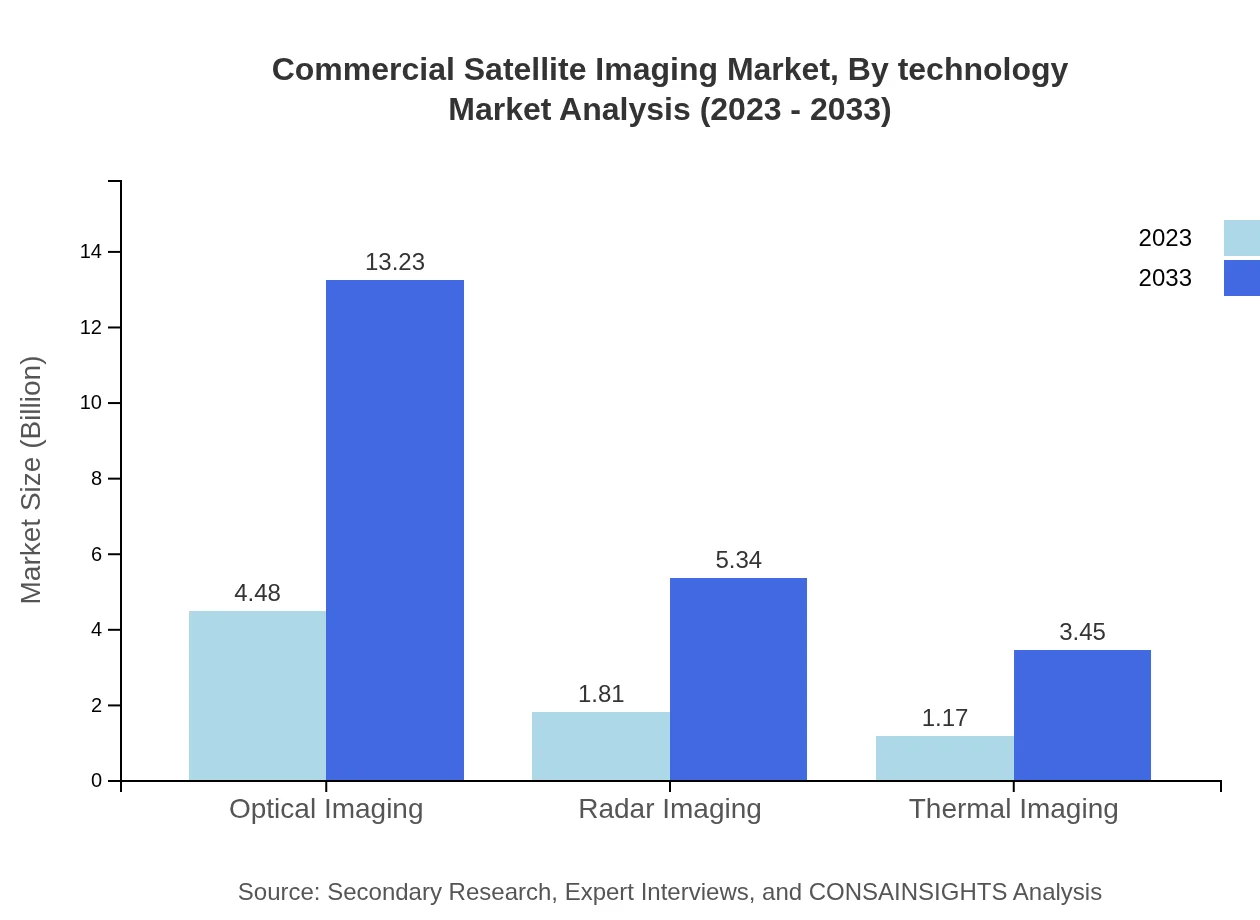

Commercial Satellite Imaging Market Analysis By Product

The product segment is dominated by optical imaging providing $4.48 billion in 2023 and expected to reach $13.23 billion by 2033, highlighting its critical role in various applications. Radar imaging, accounting for $1.81 billion in 2023, is projected to grow to $5.34 billion, benefiting industries needing all-weather surveillance.

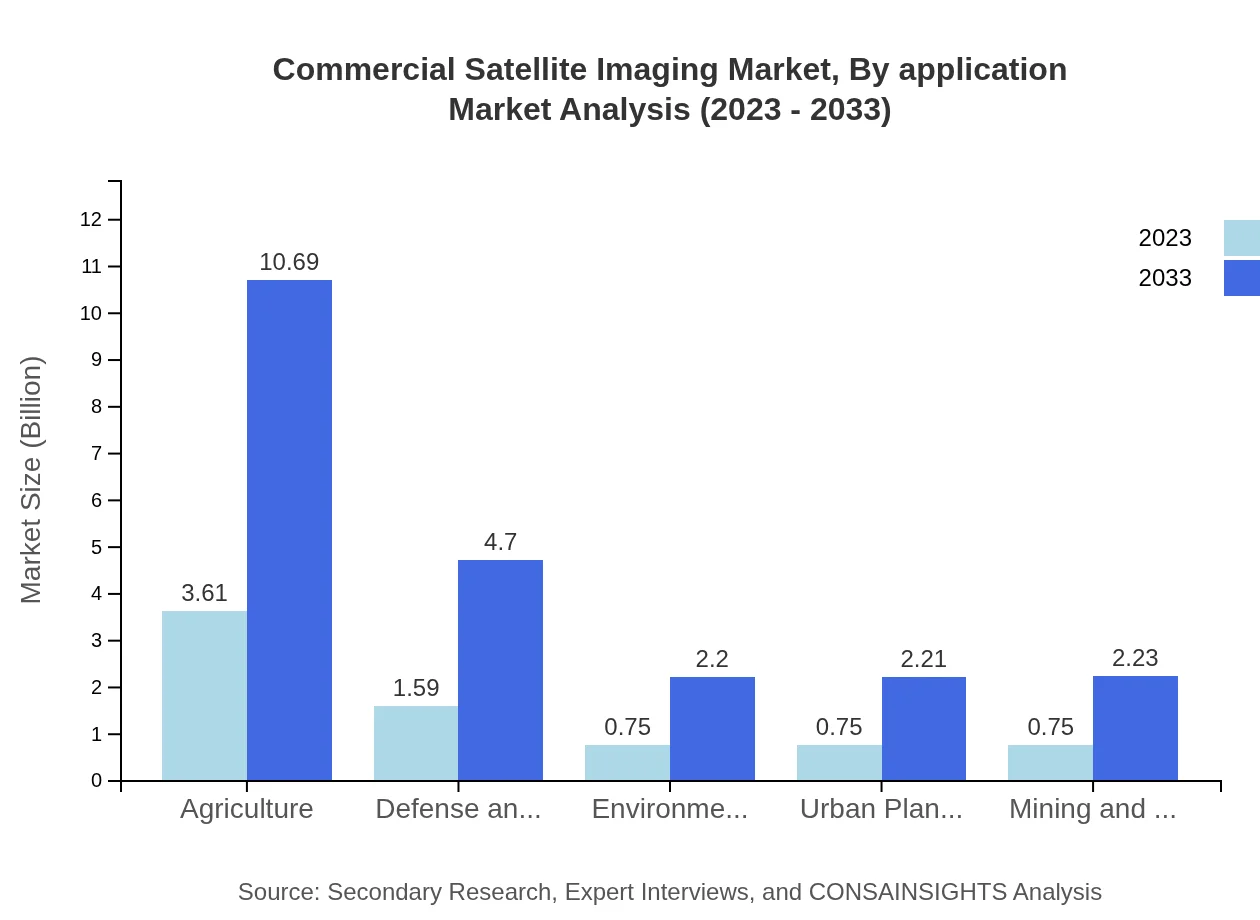

Commercial Satellite Imaging Market Analysis By Application

Key applications, such as Agriculture show significant growth, rising from $3.61 billion in 2023 to $10.69 billion by 2033, driven by precision farming needs. The Defense & Security application is also notable, expected to expand from $1.59 billion to $4.70 billion, indicating sustained military investment in satellite capabilities.

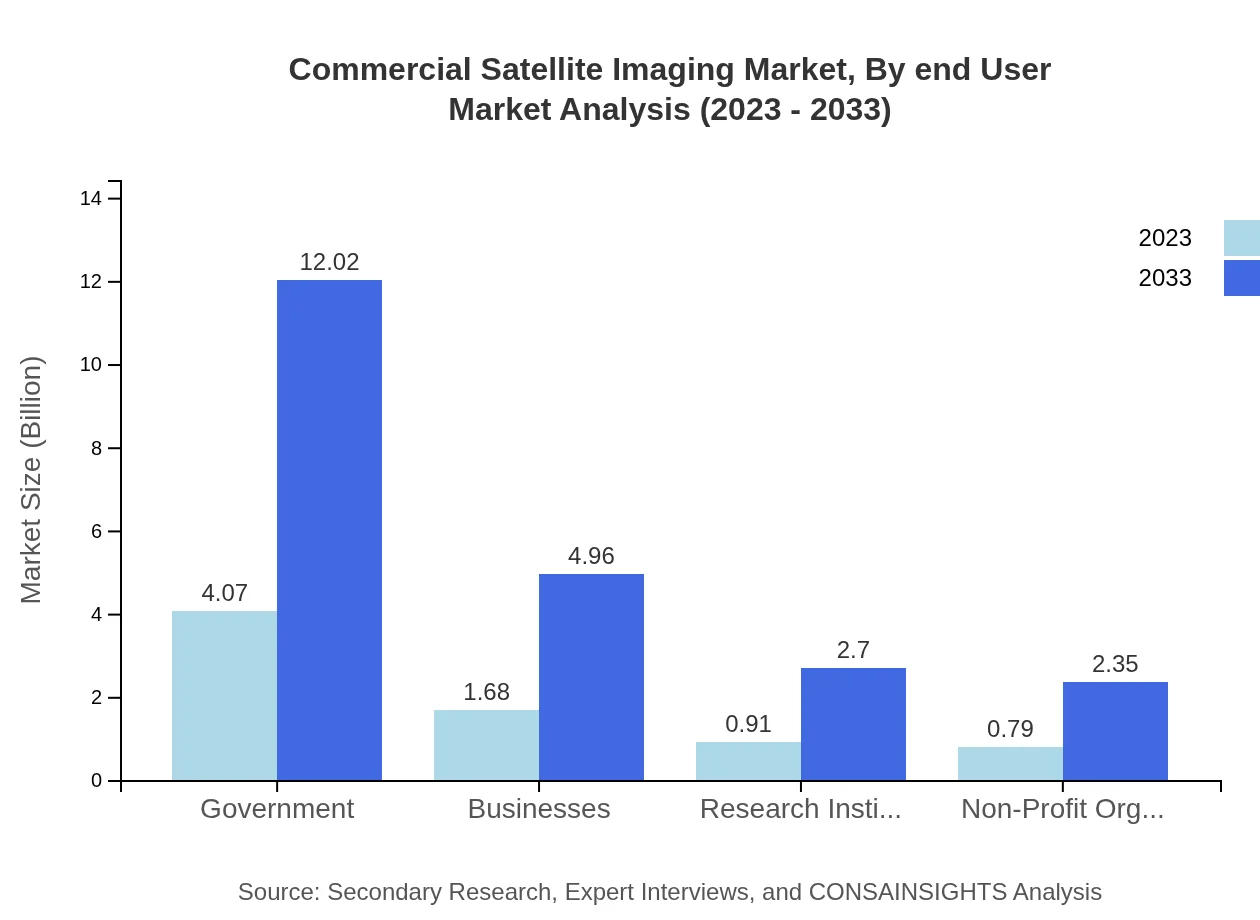

Commercial Satellite Imaging Market Analysis By End User

Government agencies are major players in the Commercial Satellite Imaging market, contributing $4.07 billion in 2023 and anticipated to grow to $12.02 billion by 2033. Businesses, representing another critical end-user segment, are likewise projected to increase from $1.68 billion to $4.96 billion, reflecting growing corporate interests in data analytics.

Commercial Satellite Imaging Market Analysis By Technology

Technological advancements such as improved imaging sensors and platforms significantly contribute to market growth. Innovations in AI and machine learning are also reshaping how data is processed, enhancing the quality of insights derived from satellite imagery.

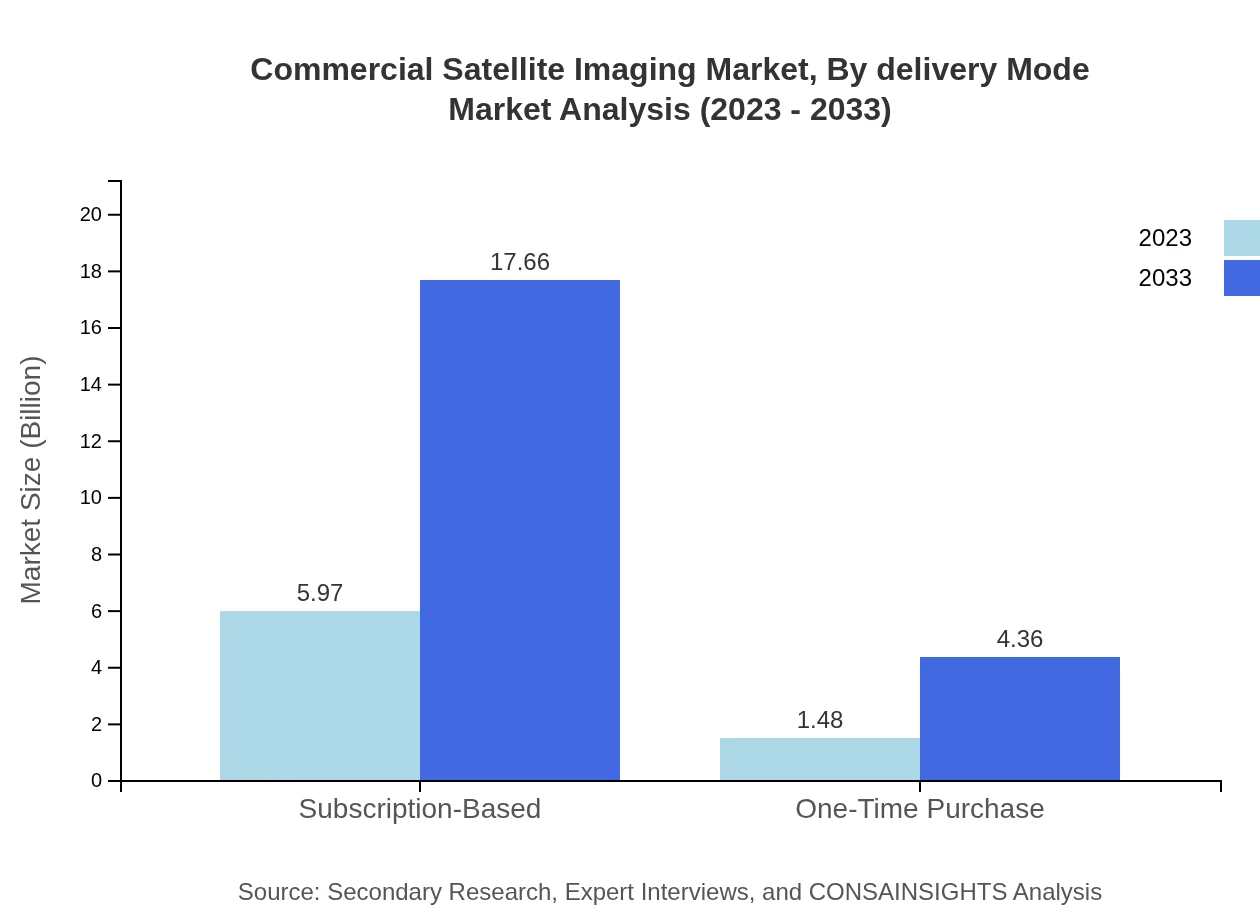

Commercial Satellite Imaging Market Analysis By Delivery Mode

Subscription-based models are prevalent in the market, expected to grow from $5.97 billion in 2023 to $17.66 billion by 2033, demonstrating the shift towards pay-as-you-go services. One-time purchase models will continue to exist but are forecasted to grow at a slower rate.

Commercial Satellite Imaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Commercial Satellite Imaging Industry

Maxar Technologies:

A leading provider of Earth imagery and satellite data solutions, specializing in providing high-resolution images for governmental and commercial applications.Planet Labs Inc.:

Innovators in satellite imaging technology, deploying a fleet of small satellites for daily Earth observation and monitoring.Airbus Defence and Space:

A major player in the aerospace sector, providing high-quality satellite imaging services across various applications.Boeing :

In addition to its aerospace interests, Boeing is significant in satellite technology and data analytics, contributing to market advancements.We're grateful to work with incredible clients.

FAQs

What is the market size of commercial Satellite Imaging?

The commercial satellite imaging market is valued at approximately $7.45 billion in 2023, with an expected CAGR of 11% through 2033, indicating robust growth in satellite services and technologies.

What are the key market players or companies in this commercial Satellite Imaging industry?

Key players in the commercial satellite imaging industry include Maxar Technologies, Planet Labs, Airbus Defense and Space, and DigitalGlobe, leading innovations in imaging technology, and providing critical data services.

What are the primary factors driving the growth in the commercial Satellite Imaging industry?

Growth drivers in the commercial satellite imaging market encompass increasing demand for geographical information, advancements in imaging technology, and the rising need for surveillance in national security and environment management.

Which region is the fastest Growing in the commercial Satellite Imaging?

North America is the fastest-growing region in the commercial satellite imaging market, projected to expand from $2.83 billion in 2023 to $8.37 billion in 2033, driven by technological advancements and military applications.

Does ConsaInsights provide customized market report data for the commercial Satellite Imaging industry?

Yes, ConsaInsights offers customized market reports tailored to client needs, focusing on specific regions, technology trends, and segment data to ensure comprehensive insights into the commercial satellite imaging industry.

What deliverables can I expect from this commercial Satellite Imaging market research project?

Deliverables from the market research project include detailed analysis reports, trend assessments, regional market insights, segmented data, and strategic recommendations tailored to stakeholders in the commercial satellite imaging sector.

What are the market trends of commercial Satellite Imaging?

Current trends in the commercial satellite imaging market highlight a shift towards subscription-based models, increased use of artificial intelligence in data analysis, and growing applications in agriculture, urban planning, and disaster management.