Communication Satellite Market Report

Published Date: 03 February 2026 | Report Code: communication-satellite

Communication Satellite Market Size, Share, Industry Trends and Forecast to 2033

This report comprehensively analyzes the Communication Satellite market, offering insights into market dynamics, trends, segmentation, regional analyses, and forecasts up to 2033. The report provides valuable data and insights for stakeholders looking to understand market growth and opportunities.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

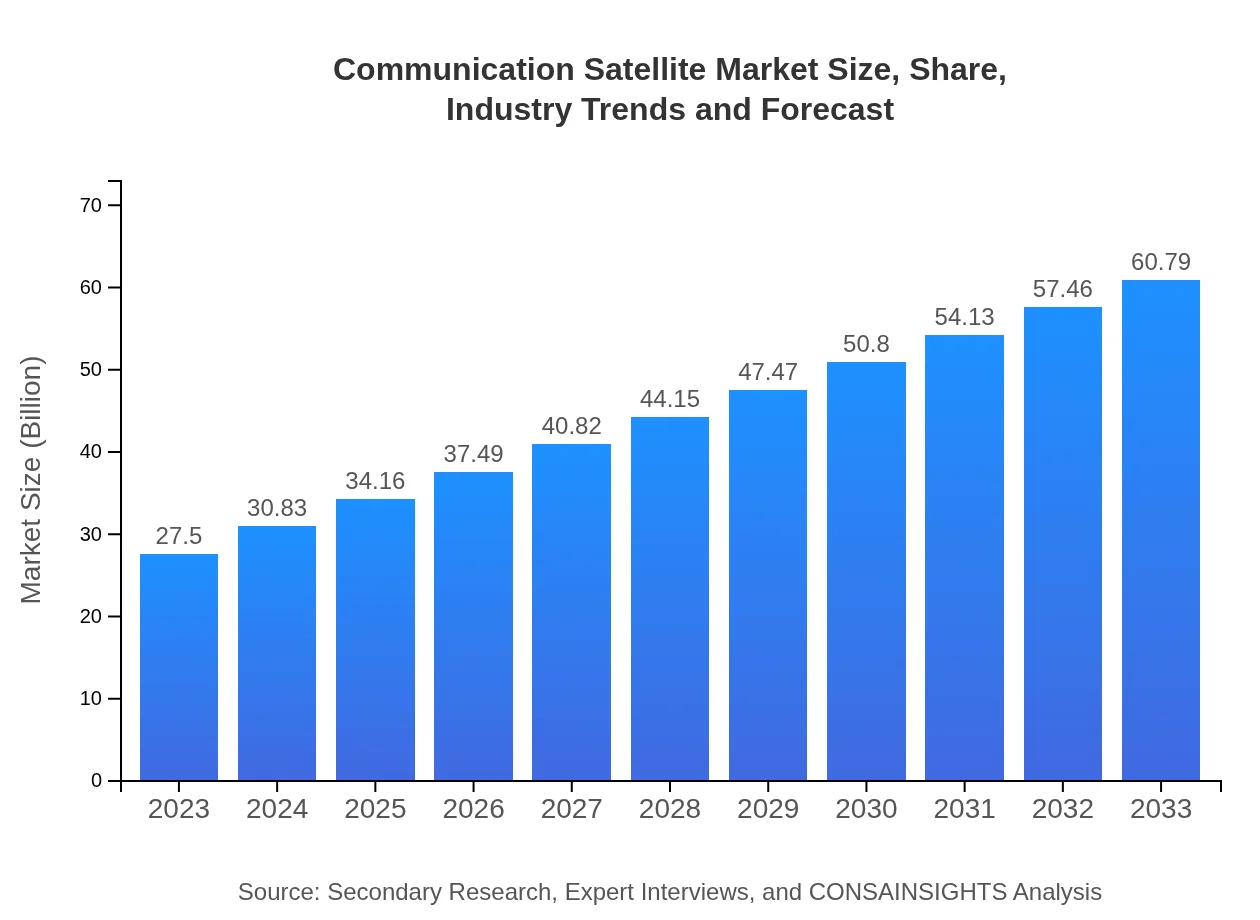

| 2023 Market Size | $27.50 Billion |

| CAGR (2023-2033) | 8% |

| 2033 Market Size | $60.79 Billion |

| Top Companies | Intelsat, SES S.A., Eutelsat, Telesat |

| Last Modified Date | 03 February 2026 |

Communication Satellite Market Overview

Customize Communication Satellite Market Report market research report

- ✔ Get in-depth analysis of Communication Satellite market size, growth, and forecasts.

- ✔ Understand Communication Satellite's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Communication Satellite

What is the Market Size & CAGR of Communication Satellite market in 2023?

Communication Satellite Industry Analysis

Communication Satellite Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Communication Satellite Market Analysis Report by Region

Europe Communication Satellite Market Report:

Europe's market size was about $7.36 billion in 2023, projected to increase to $16.26 billion by 2033. Growth in this region is propelled by the rising demand for broadband internet, particularly in rural areas, and a strong defense sector that emphasizes secure satellite communications.Asia Pacific Communication Satellite Market Report:

The Asia Pacific region is poised for significant growth, with a market size of approximately $5.55 billion in 2023, expected to reach around $12.26 billion by 2033. The increasing demand for satellite broadcasting and internet services, alongside growing investments in satellite infrastructure, is driving this expansion. Countries such as India and China are major contributors to this growth, leveraging satellite technology for telecommunications and disaster management.North America Communication Satellite Market Report:

North America represents the largest market for Communication Satellites, with a sizable growth from $10.20 billion in 2023 to approximately $22.55 billion by 2033. The extensive telecommunications infrastructure and the prevalence of satellite television services in the U.S. drive this growth, alongside ongoing innovations in satellite technology.South America Communication Satellite Market Report:

In South America, the Communication Satellite market is projected to flourish from $2.33 billion in 2023 to approximately $5.14 billion by 2033. The region's underserved connectivity needs prompt increased satellite deployments for broadband services. Major investments from regional governments in satellite technology also highlight the potential for market growth.Middle East & Africa Communication Satellite Market Report:

The Middle East and Africa market is expected to grow from $2.07 billion in 2023 to $4.58 billion by 2033. The demand for emergency response communications and the security of data transmissions across borders are key growth factors here. Nations are increasingly investing in satellite capabilities to support social and economic development.Tell us your focus area and get a customized research report.

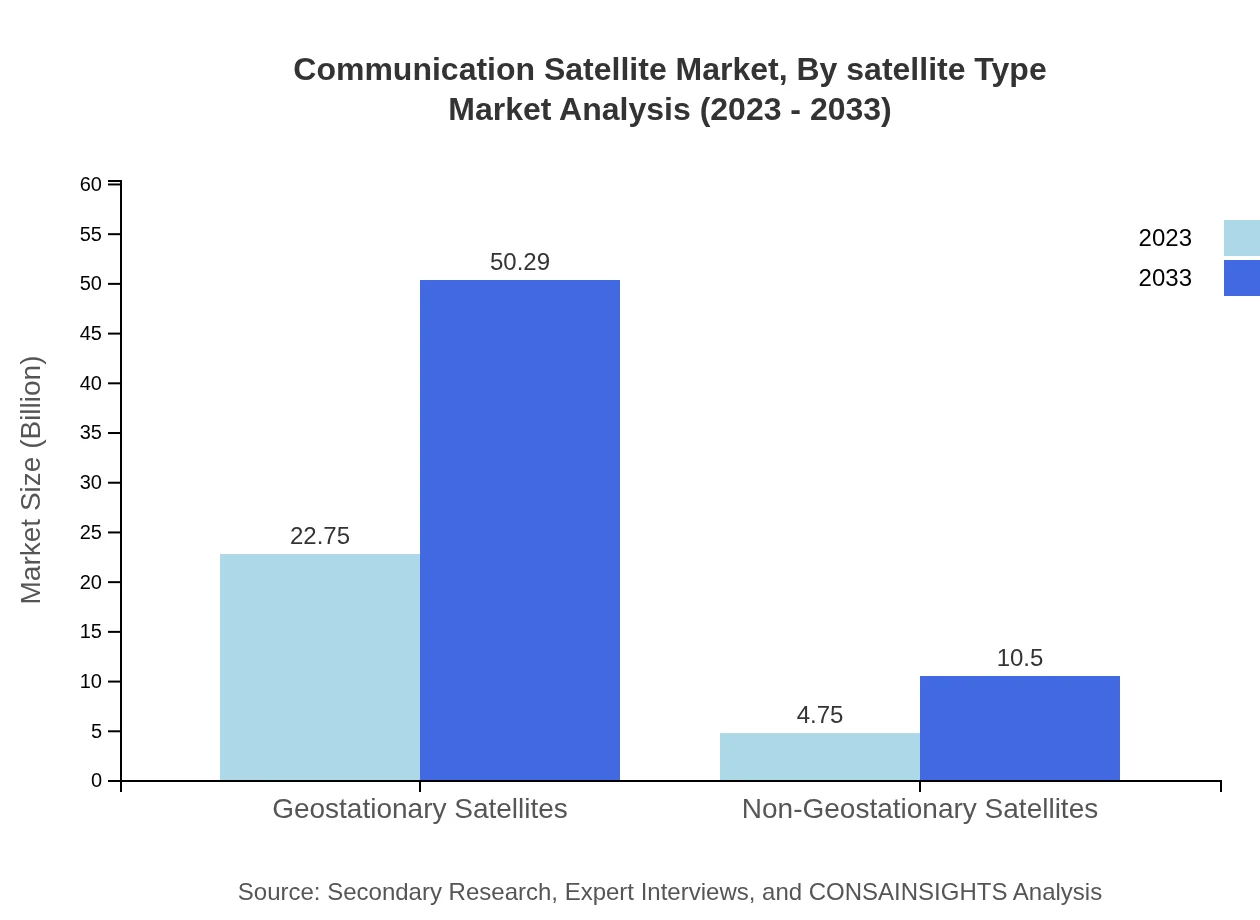

Communication Satellite Market Analysis By Satellite Type

The market is predominantly composed of Geostationary Satellites, commanding a market size of $22.75 billion in 2023, expanding to $50.29 billion by 2033, with a consistent share of 82.73%. Meanwhile, Non-Geostationary Satellites are gaining traction, with sizes projected to grow from $4.75 billion in 2023 to $10.50 billion by 2033, capturing 17.27% share.

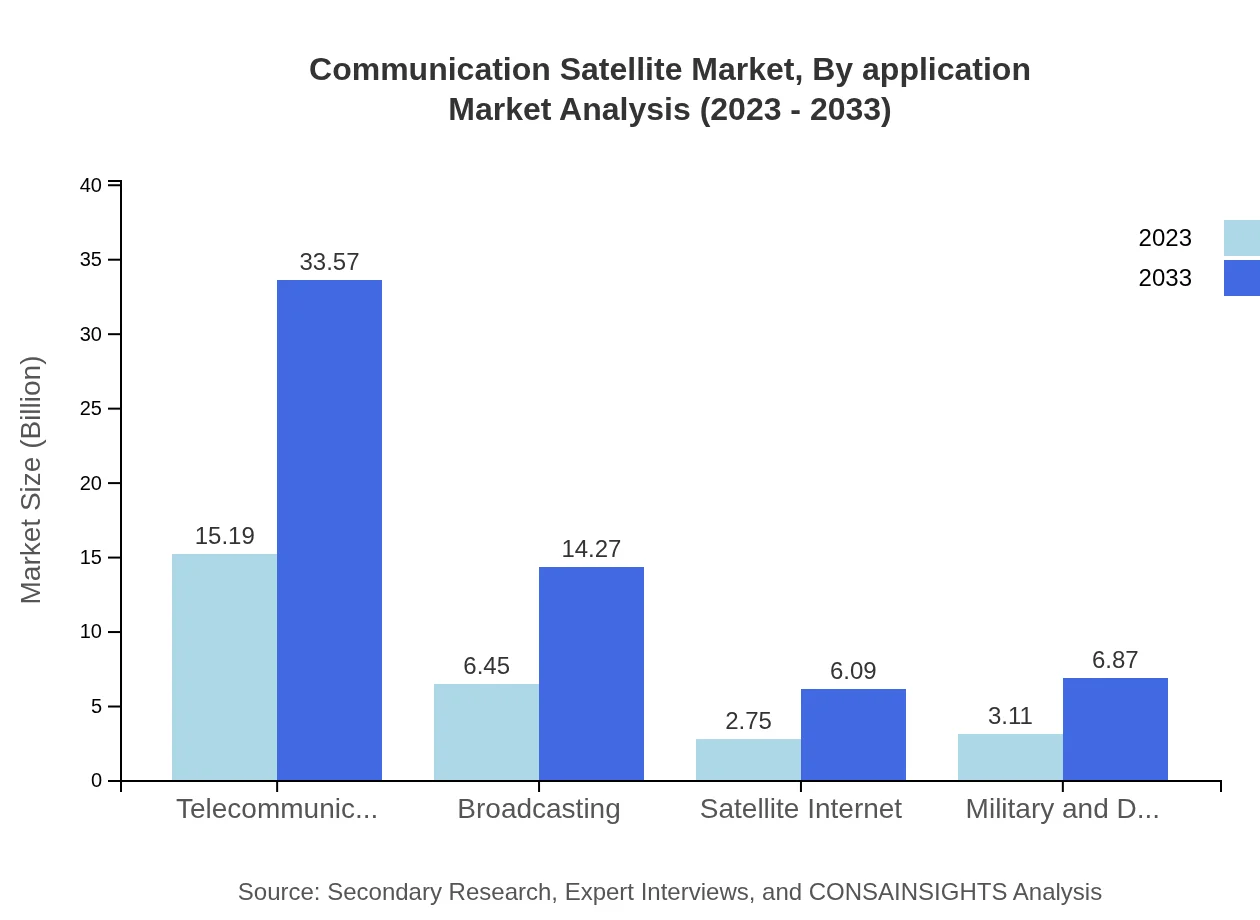

Communication Satellite Market Analysis By Application

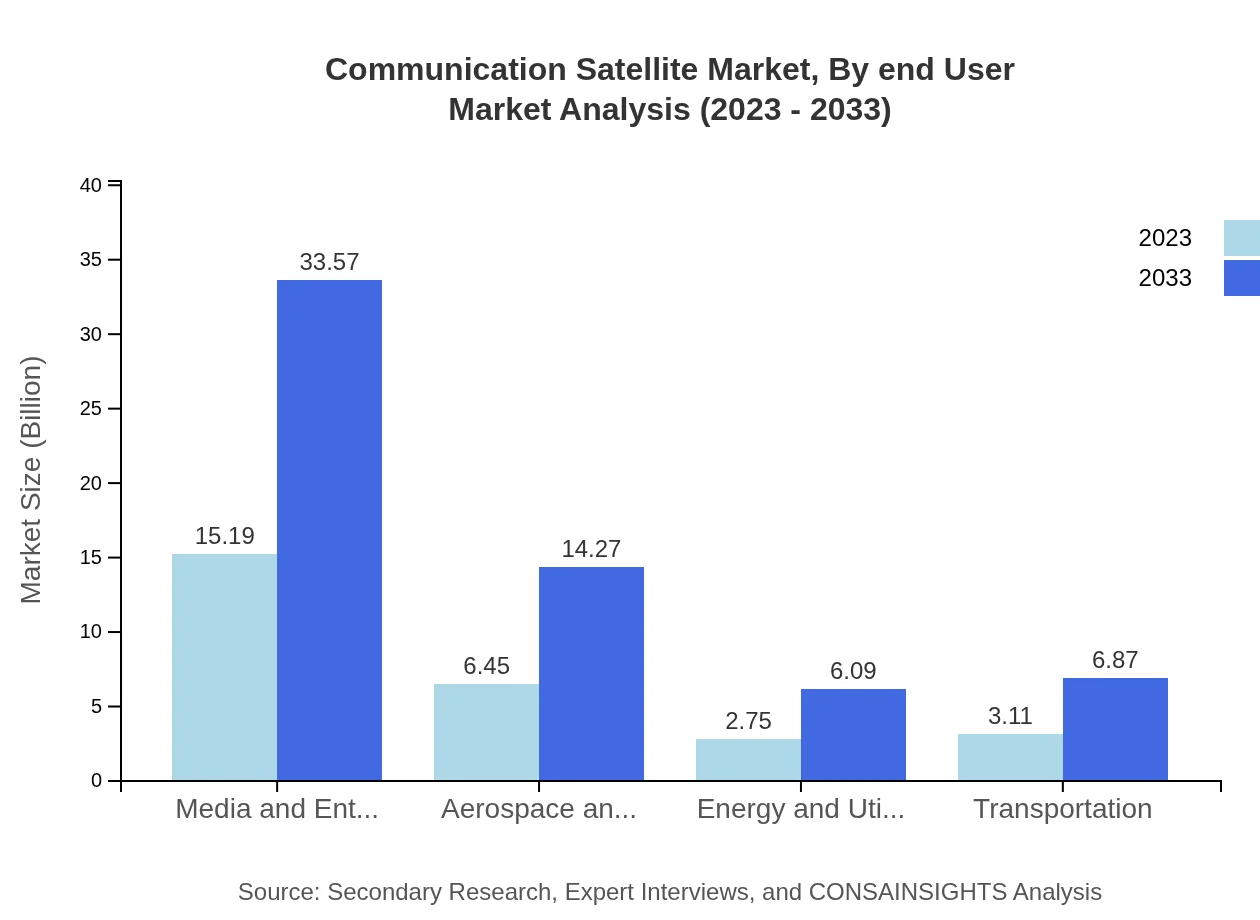

The Media and Entertainment sector dominates application usage with a market size of $15.19 billion in 2023 to $33.57 billion by 2033, holding 55.22% share. Telecommunications also represents a significant application, similar in size trends. The Aerospace and Defense sector shows notable growth from $6.45 billion to $14.27 billion.

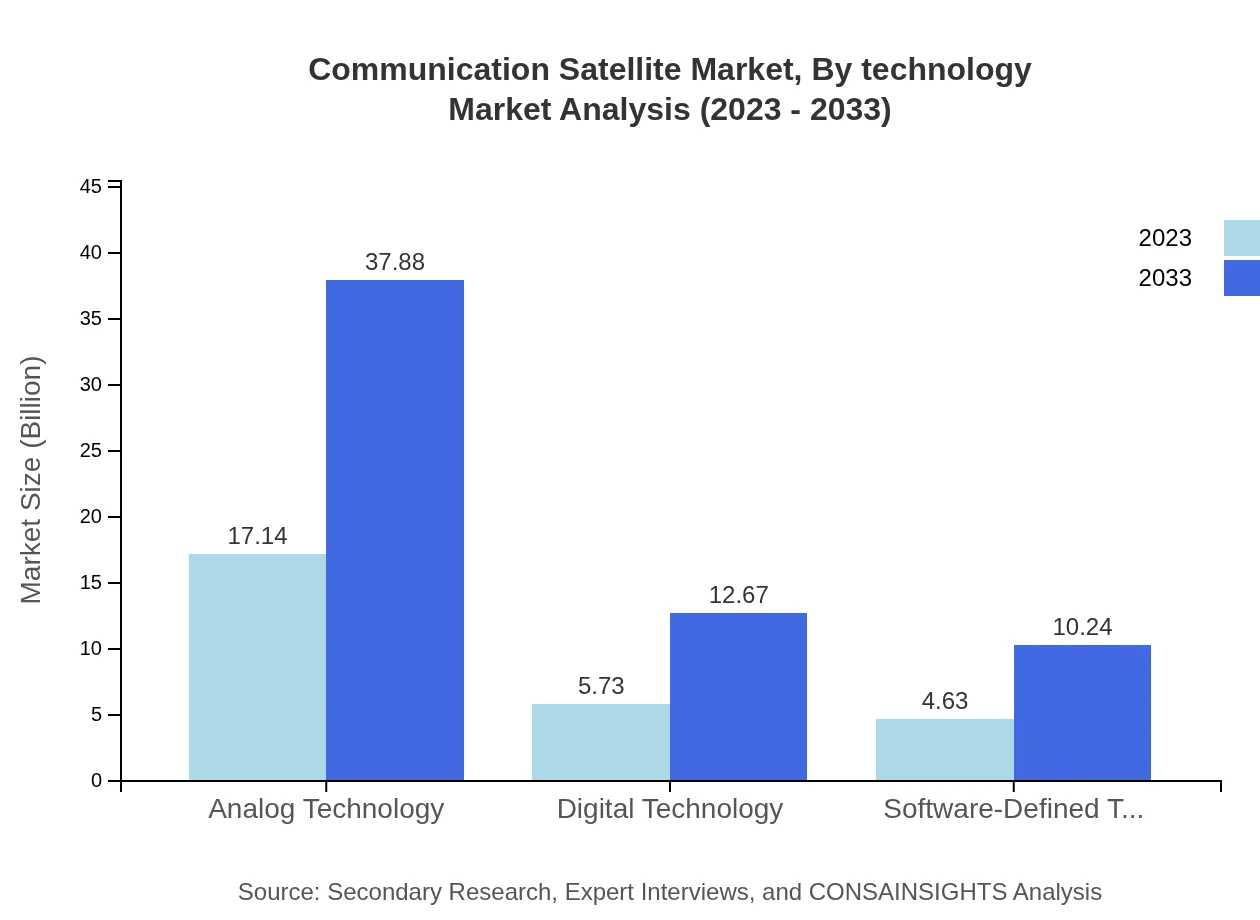

Communication Satellite Market Analysis By Technology

Analog Technology remains prevalent, particularly in broadcasting, with $17.14 billion in 2023 and projected to hit $37.88 billion by 2033, representing 62.32% share. Digital Technology and Software-Defined Technology are emerging but need substantial advancements, with digital transitioning from $5.73 billion to $12.67 billion.

Communication Satellite Market Analysis By End User

The market is largely driven by Commercial end-users, which will account for a significant portion of growth through 2033, while Government and Civil sectors continue to invest heavily in technology to foster communication improvements.

Communication Satellite Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Communication Satellite Industry

Intelsat:

A prominent global provider of satellite services, Intelsat operates a fleet of satellites and provides data and broadband connectivity solutions across various sectors.SES S.A.:

SES operates satellites that provide communication services for direct-to-home TV, broadband, and other telecommunications applications globally.Eutelsat:

Eutelsat is a leading satellite operator providing telecommunications solutions and broadcasting services, leveraging their extensive satellite infrastructure.Telesat:

Telesat is known for its innovative satellite technology and services in the communication sector, focusing on enterprise, media, and government markets.We're grateful to work with incredible clients.

FAQs

What is the market size of communication Satellite?

The communication satellite market is valued at $27.5 billion in 2023, with an expected CAGR of 8% during the forecast period. Projections indicate substantial growth, reaching approximately $60 billion by 2033.

What are the key market players or companies in this communication Satellite industry?

Key market players in the communication satellite sector include major companies such as SpaceX, Intelsat, SES, and Eutelsat, as well as emerging startups innovating in satellite technology and services.

What are the primary factors driving the growth in the communication satellite industry?

Rapid advancements in satellite technology, increasing demand for broadband connectivity, and the growth of mobile internet services are primary factors driving market growth. Additionally, the expansion of satellite-based IoT applications contributes significantly.

Which region is the fastest Growing in the communication satellite market?

The Asia Pacific region is the fastest-growing market for communication satellites, projected to expand from $5.55 billion in 2023 to $12.26 billion by 2033, leveraging increased telecommunications and internet services.

Does ConsaInsights provide customized market report data for the communication Satellite industry?

Yes, ConsaInsights offers customized market reports tailored to specific requirements, providing detailed insights and analytics for stakeholders in the communication satellite industry.

What deliverables can I expect from this communication Satellite market research project?

Deliverables include comprehensive market analysis reports, trends analysis, competitor benchmarking, growth forecasts, regional insights, and segmentation data, tailored to meet specific client needs.

What are the market trends of communication satellites?

Current trends include the growth of geostationary and non-geostationary satellite systems, increased investment in satellite-based IoT services, and the rising demand for enhanced satellite internet connectivity across regions.