Compact Camera Module Market Report

Published Date: 31 January 2026 | Report Code: compact-camera-module

Compact Camera Module Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Compact Camera Module market, including market dynamics, size forecast for 2023-2033, segmentation, regional insights, industry trends, and key players in the market.

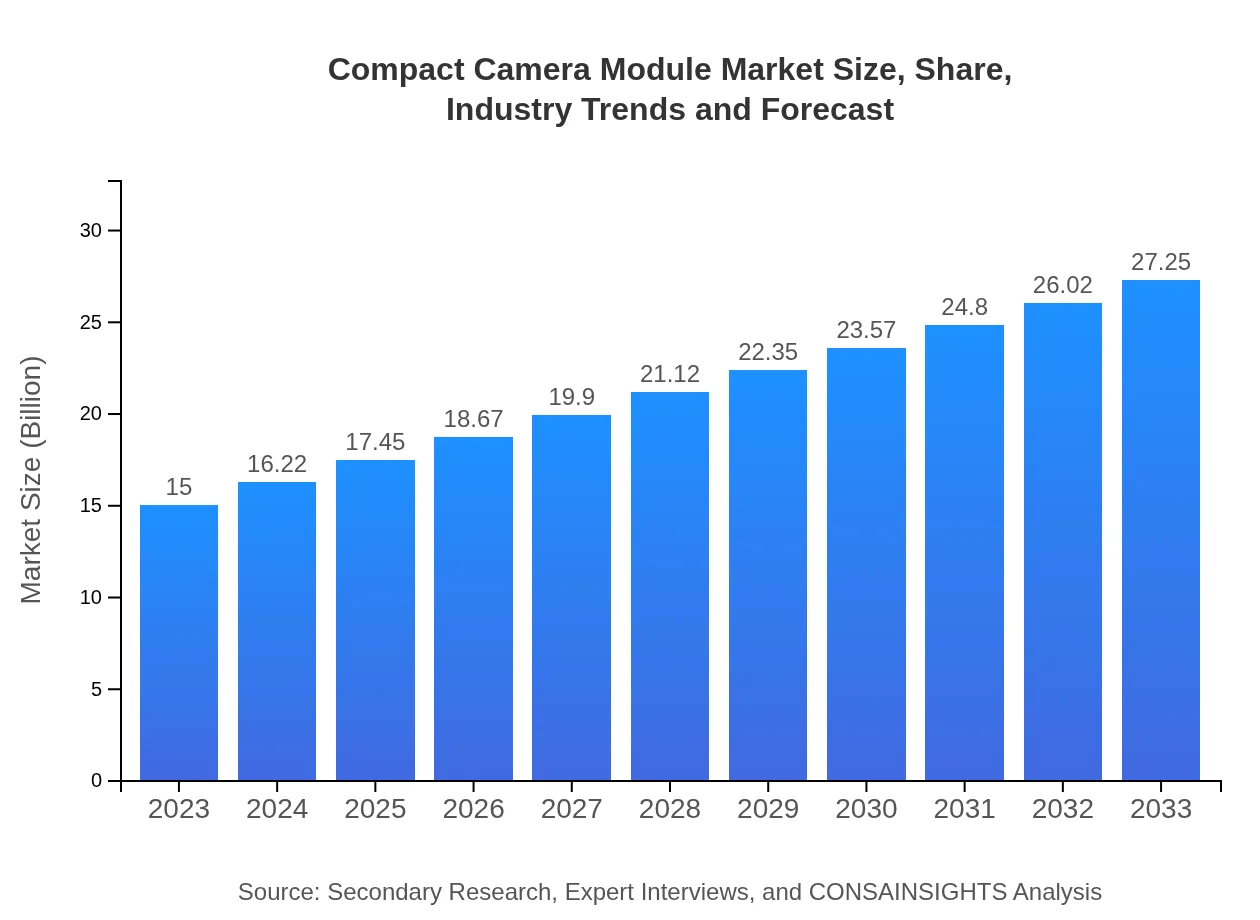

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $27.25 Billion |

| Top Companies | Sony Corporation, OmniVision Technologies, Samsung Electronics, STMicroelectronics, Canon Inc. |

| Last Modified Date | 31 January 2026 |

Compact Camera Module Market Overview

Customize Compact Camera Module Market Report market research report

- ✔ Get in-depth analysis of Compact Camera Module market size, growth, and forecasts.

- ✔ Understand Compact Camera Module's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Compact Camera Module

What is the Market Size & CAGR of Compact Camera Module market in 2023?

Compact Camera Module Industry Analysis

Compact Camera Module Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Compact Camera Module Market Analysis Report by Region

Europe Compact Camera Module Market Report:

Europe's Compact Camera Module market is currently valued at $4.13 billion in 2023, anticipating growth to $7.50 billion by 2033. The region emphasizes developing high-resolution cameras for security and automotive applications, contributing to its growth.Asia Pacific Compact Camera Module Market Report:

In 2023, the Asia Pacific region is estimated to hold a market size of $3.07 billion, projected to grow to $5.59 billion by 2033. This growth is fueled by the booming smartphone market and the presence of major electronic manufacturers in countries like China, Japan, and South Korea.North America Compact Camera Module Market Report:

North America is one of the leading markets for Compact Camera Modules, with a size of $5.24 billion in 2023, expected to rise to $9.52 billion by 2033. The region benefits from technological advancements and a strong presence of key players in the electronics market.South America Compact Camera Module Market Report:

South America, while a smaller market segment, shows potential growth from $0.49 billion in 2023 to $0.88 billion in 2033, largely driven by increasing smartphone penetration and demand for affordable camera modules in consumer electronics.Middle East & Africa Compact Camera Module Market Report:

The market in the Middle East and Africa stands at $2.07 billion in 2023, projected to reach $3.76 billion by 2033. The region is experiencing growth due to rising disposable incomes and increasing smartphone adoption.Tell us your focus area and get a customized research report.

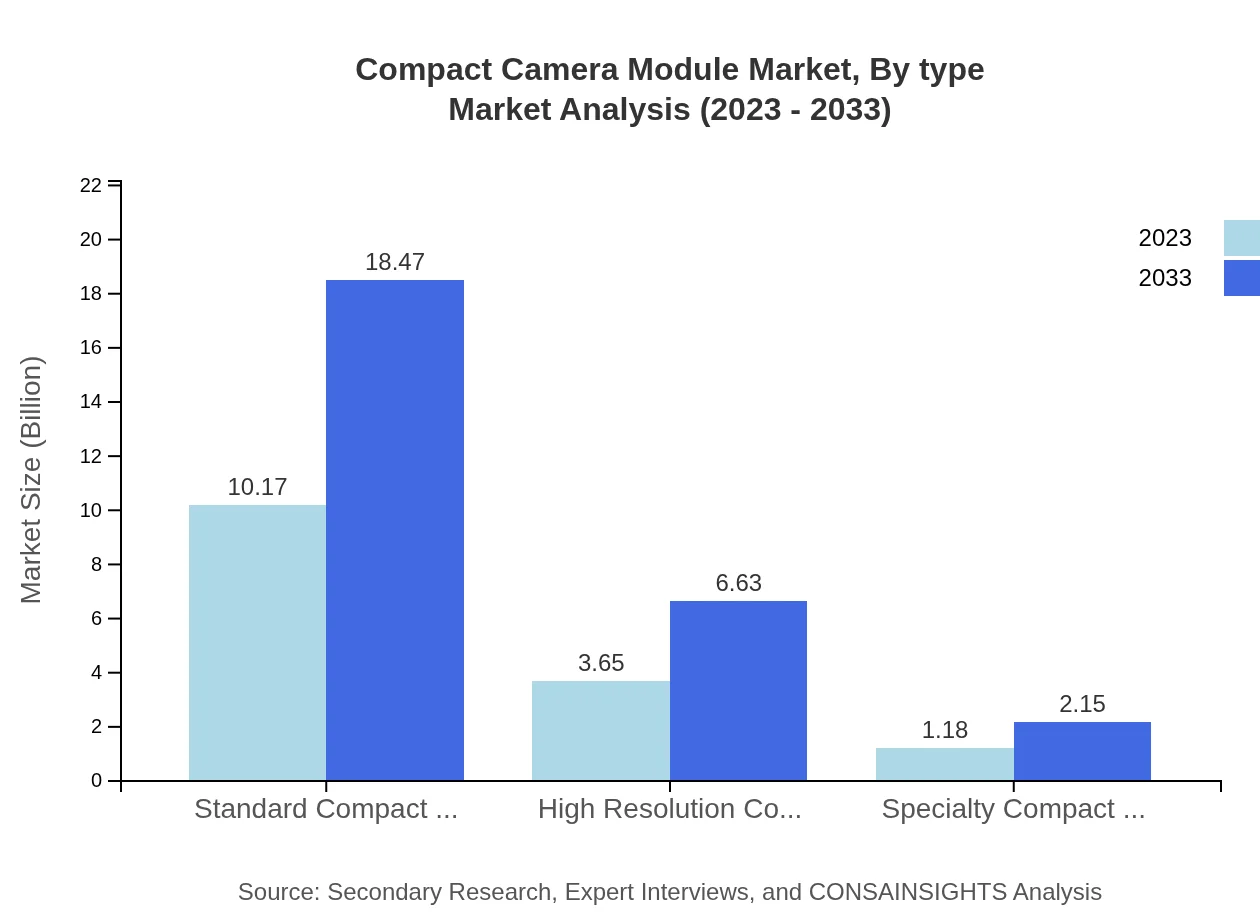

Compact Camera Module Market Analysis By Type

The Compact Camera Module market is segmented by type, with Standard Compact Camera Modules leading the market at $10.17 billion in 2023, expected to grow to $18.47 billion by 2033. High Resolution Compact Camera Modules follow, growing from $3.65 billion in 2023 to $6.63 billion by 2033, while Specialty Compact Camera Modules are projected to grow from $1.18 billion to $2.15 billion in the same period.

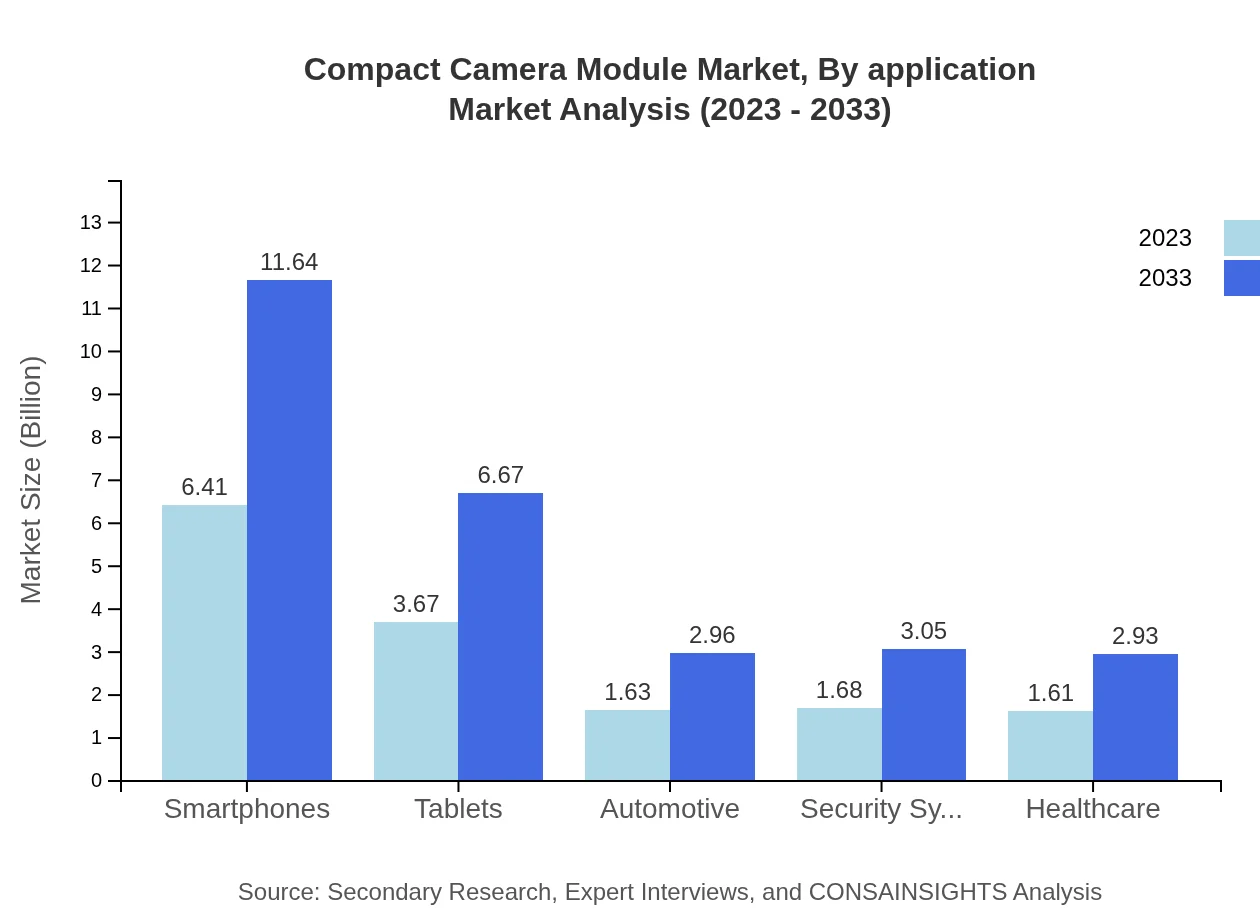

Compact Camera Module Market Analysis By Application

In terms of application, smartphones dominate the Compact Camera Module market share at 42.73% in 2023, growing to 42.73% in 2033. Tablets hold a 24.46% share, expected to remain constant, while automotive applications present significant growth potential, increasing from $1.63 billion in 2023 to $2.96 billion by 2033.

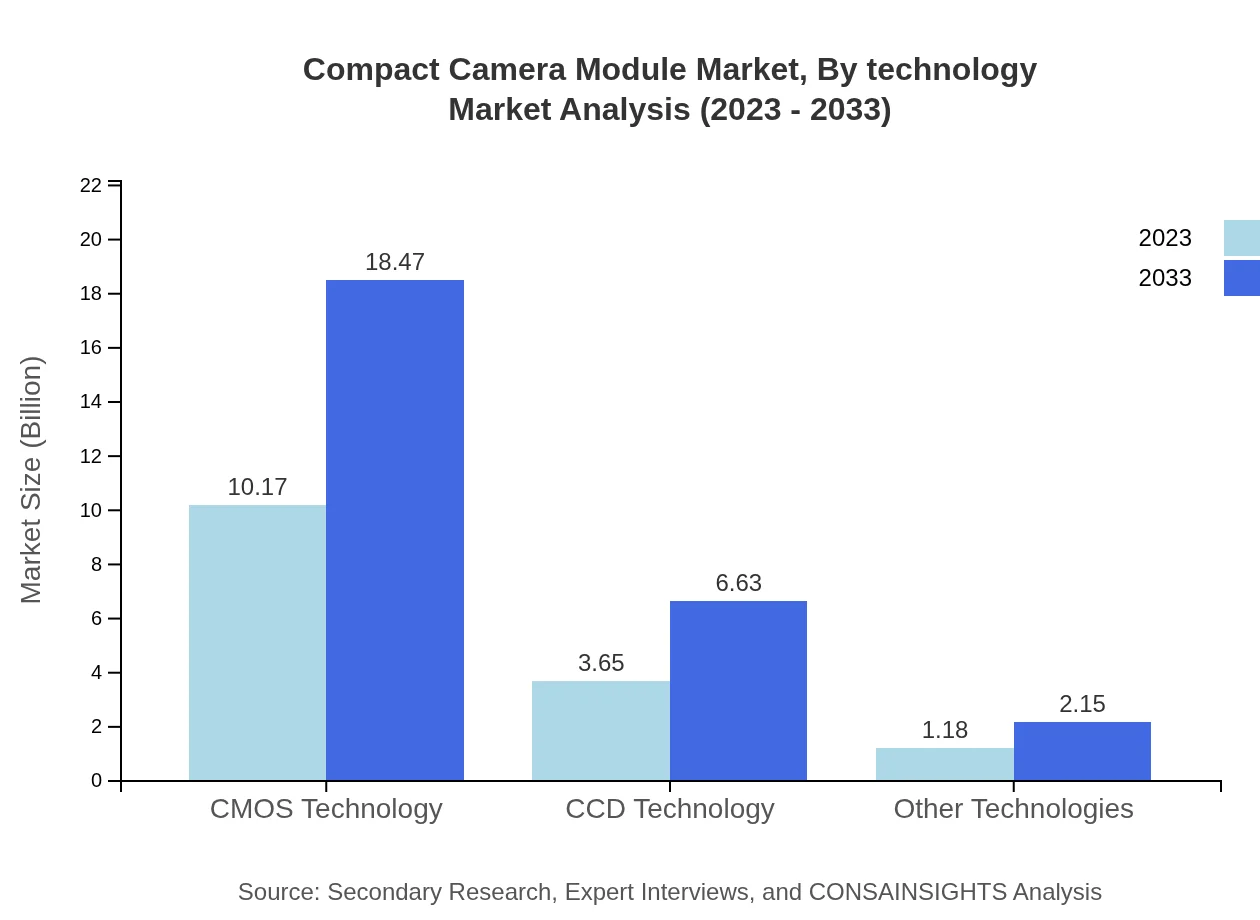

Compact Camera Module Market Analysis By Technology

The technology segmentation shows that CMOS technology retains a dominant market share with 67.77% in both 2023 and 2033, while CCD technology commands 24.34%. Emerging technologies are pushing innovation in features like AI capabilities and image processing efficiency, reshaping consumer expectations in the process.

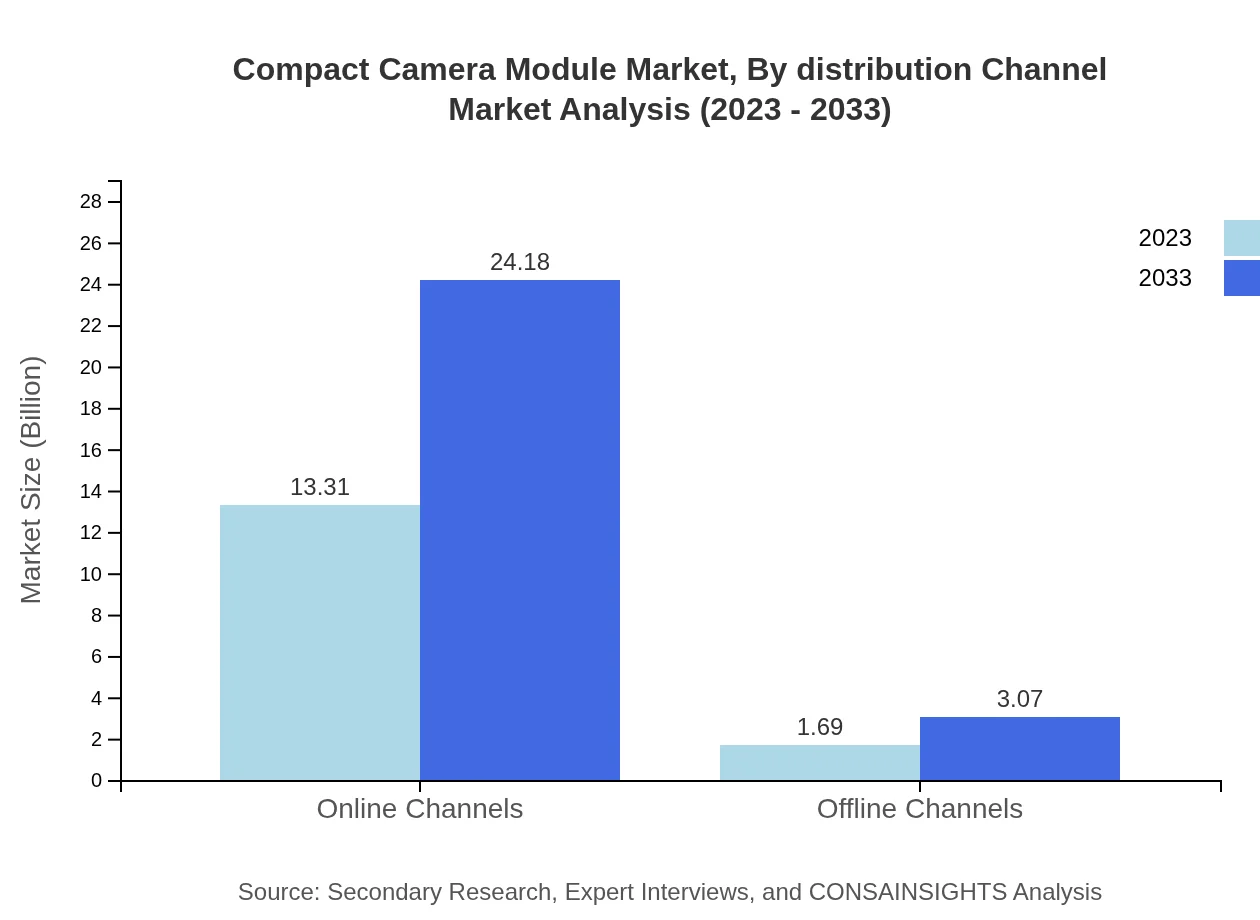

Compact Camera Module Market Analysis By Distribution Channel

The distribution landscape is divided between online and offline channels, with online channels leading at $13.31 billion in 2023, set to reach $24.18 billion by 2033. Offline channel sales contribute significantly to the market but are expected to grow at a slower pace due to the increasing digitalization of shopping experiences.

Compact Camera Module Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Compact Camera Module Industry

Sony Corporation:

Sony is a global leader in imaging and sensing technologies, providing innovative solutions in Compact Camera Modules for various applications, especially in consumer electronics.OmniVision Technologies:

OmniVision specializes in high-performance image sensors and has a strong portfolio of Compact Camera Modules tailored to meet the demands of mobile devices and automotive applications.Samsung Electronics:

Samsung is at the forefront of camera technology, focusing on integrating advanced camera systems into smartphones, enhancing overall user experience with high-quality imaging.STMicroelectronics:

STMicroelectronics is renowned for its advanced technology in image sensors and has expanded its presence in the Compact Camera Module market through innovative product offerings.Canon Inc.:

Canon is well-known for its imaging products and technologies designed for a diverse range of applications including high-resolution Compact Camera Modules for professional use.We're grateful to work with incredible clients.

FAQs

What is the market size of Compact Camera Module?

The Compact Camera Module market is currently valued at $15 billion and is projected to grow at a CAGR of 6% over the next decade, indicating robust growth in demand for imaging solutions globally.

What are the key market players or companies in the Compact Camera Module industry?

Key players in the Compact Camera Module market include major companies such as Sony, Samsung, OmniVision Technologies, and STMicroelectronics, which are at the forefront of technological advancements in imaging solutions.

What are the primary factors driving the growth in the Compact Camera Module industry?

Growth in the Compact Camera Module industry is primarily driven by increasing demand for high-quality imaging in smartphones and tablets, advancements in CMOS and CCD technologies, and a rising trend towards automation in various sectors.

Which region is the fastest Growing in the Compact Camera Module market?

The Asia Pacific region is currently the fastest-growing market for Compact Camera Modules, expected to grow from $3.07 billion in 2023 to $5.59 billion by 2033, driven by rising smartphone penetration and increased manufacturing in this region.

Does ConsaInsights provide customized market report data for the Compact Camera Module industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements in the Compact Camera Module industry, ensuring that clients receive relevant insights based on their unique needs.

What deliverables can I expect from this Compact Camera Module market research project?

Deliverables from the Compact Camera Module market research project include detailed reports, market trend analysis, competitive landscape evaluation, and forecasts that encompass regional and segment-specific insights.

What are the market trends of Compact Camera Module?

Current trends in the Compact Camera Module market include an increasing shift towards high-resolution imaging solutions, growing adoption of online sales channels, and advancements in integrated camera technologies.