Compact Construction Equipment Market Report

Published Date: 22 January 2026 | Report Code: compact-construction-equipment

Compact Construction Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report offers an in-depth analysis of the Compact Construction Equipment market, covering market size, growth trends, segmentation, regional analysis, and leading companies from 2023 to 2033. Key insights and forecasts will help stakeholders make informed decisions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

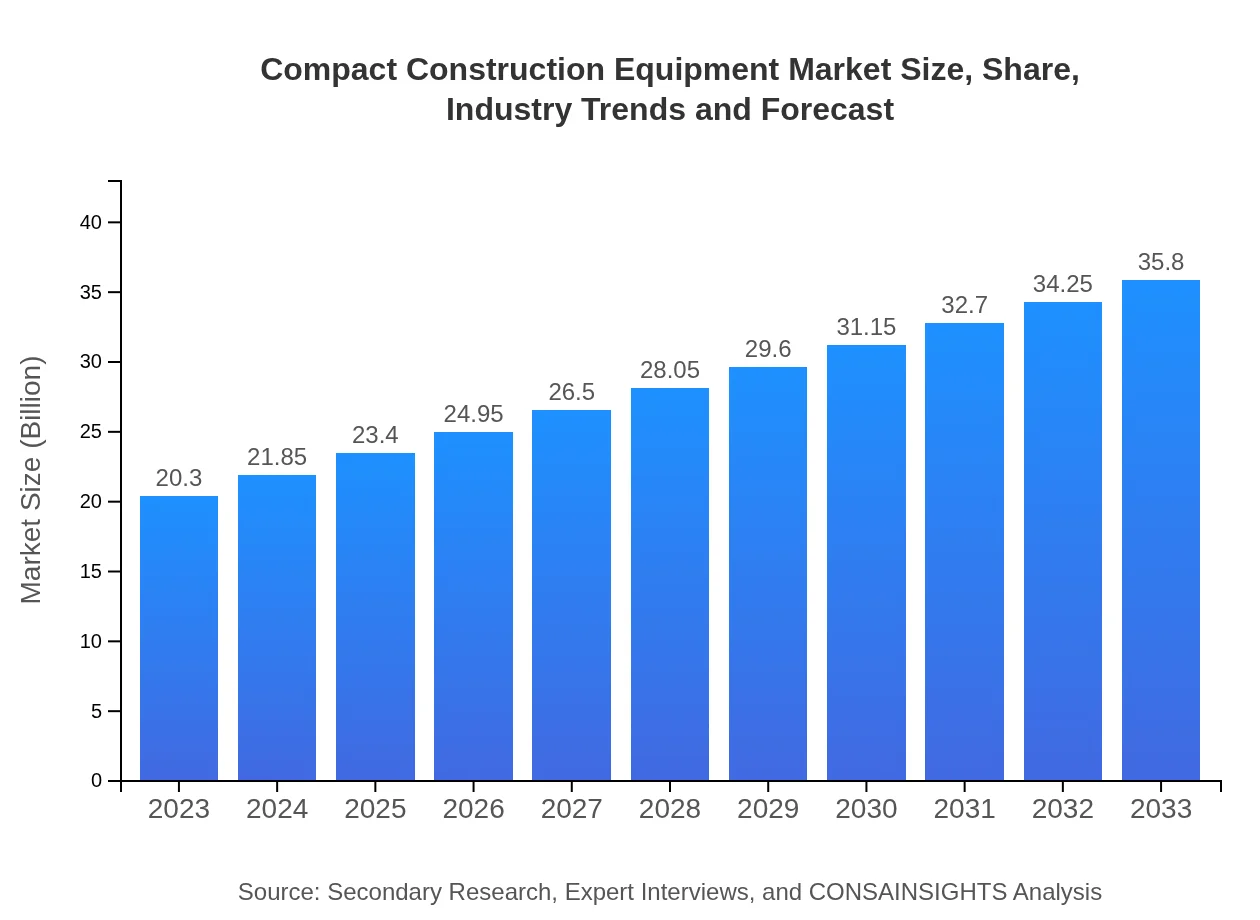

| 2023 Market Size | $20.30 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $35.80 Billion |

| Top Companies | Caterpillar Inc., Komatsu Ltd., Bobcat Company, John Deere, JCB Ltd. |

| Last Modified Date | 22 January 2026 |

Compact Construction Equipment Market Overview

Customize Compact Construction Equipment Market Report market research report

- ✔ Get in-depth analysis of Compact Construction Equipment market size, growth, and forecasts.

- ✔ Understand Compact Construction Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Compact Construction Equipment

What is the Market Size & CAGR of Compact Construction Equipment market in 2023?

Compact Construction Equipment Industry Analysis

Compact Construction Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Compact Construction Equipment Market Analysis Report by Region

Europe Compact Construction Equipment Market Report:

Europe is characterized by a mature market; in 2023, the market value stands at $6.50 billion, with expected growth to $11.46 billion by 2033. The region emphasizes sustainable practices in construction, enhancing the demand for energy-efficient compact equipment. Countries such as Germany, France, and the UK are at the forefront of this transition.Asia Pacific Compact Construction Equipment Market Report:

The Asia Pacific region is a significant player in the Compact Construction Equipment market, with a market size of $3.20 billion in 2023, expected to reach $5.64 billion by 2033. Rapid urbanization, government initiatives for smart city projects, and the rise of construction activities in countries like Japan and India are primary growth drivers. Additionally, infrastructure investments are set to sustain high demand in this region.North America Compact Construction Equipment Market Report:

North America showcased a substantial market size of $7.71 billion in 2023, projected to nearly double to $13.59 billion by 2033. The United States, being a key contributor, leads in technological advancements and innovations in compact equipment, driven predominantly by construction demands and environmental standards pushing for eco-friendly options.South America Compact Construction Equipment Market Report:

In South America, the market for Compact Construction Equipment is anticipated to grow from $0.74 billion in 2023 to $1.31 billion by 2033. This growth can be attributed to increased infrastructural developments and rising demand in the agricultural sector, particularly in Brazil and Argentina. However, economic fluctuations might pose challenges in certain areas.Middle East & Africa Compact Construction Equipment Market Report:

The Middle East and Africa region recorded a market size of $2.16 billion in 2023 and is projected to grow to $3.81 billion by 2033. The market growth is underpinned by increasing investments in infrastructure and ongoing development projects in the GCC region, fostering demand for compact construction equipment.Tell us your focus area and get a customized research report.

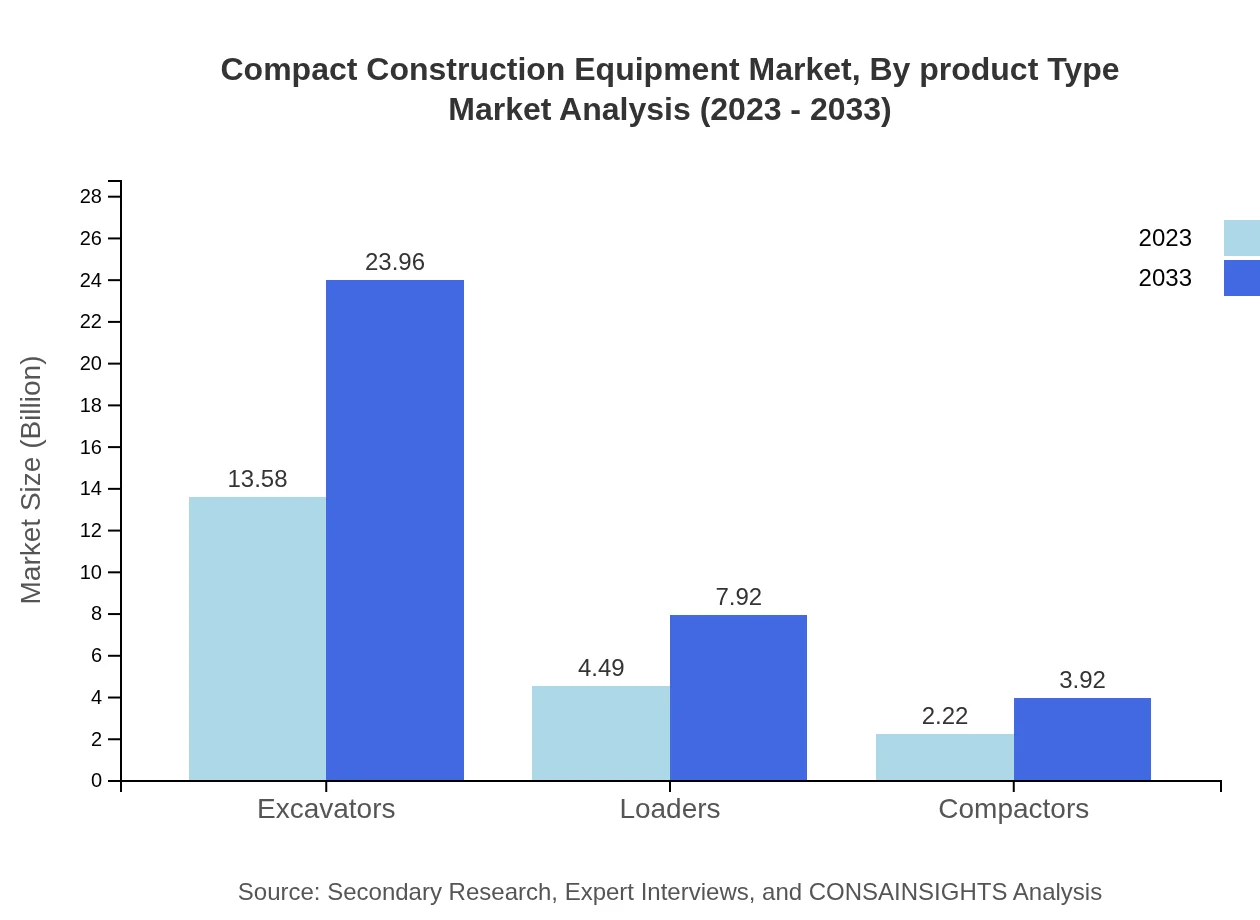

Compact Construction Equipment Market Analysis By Product Type

The CCE market is significantly influenced by product types, including excavators, loaders, and compactors. In 2023, the excavators segment leads with a market size of $13.58 billion and a share of 66.91%, projected to grow to $23.96 billion by 2033. Loaders follow with a market of $4.49 billion in 2023, representing 22.13% market share, and expected to reach $7.92 billion by 2033. Compactors contribute a market size of $2.22 billion with a share of 10.96%, anticipated to grow to $3.92 billion.

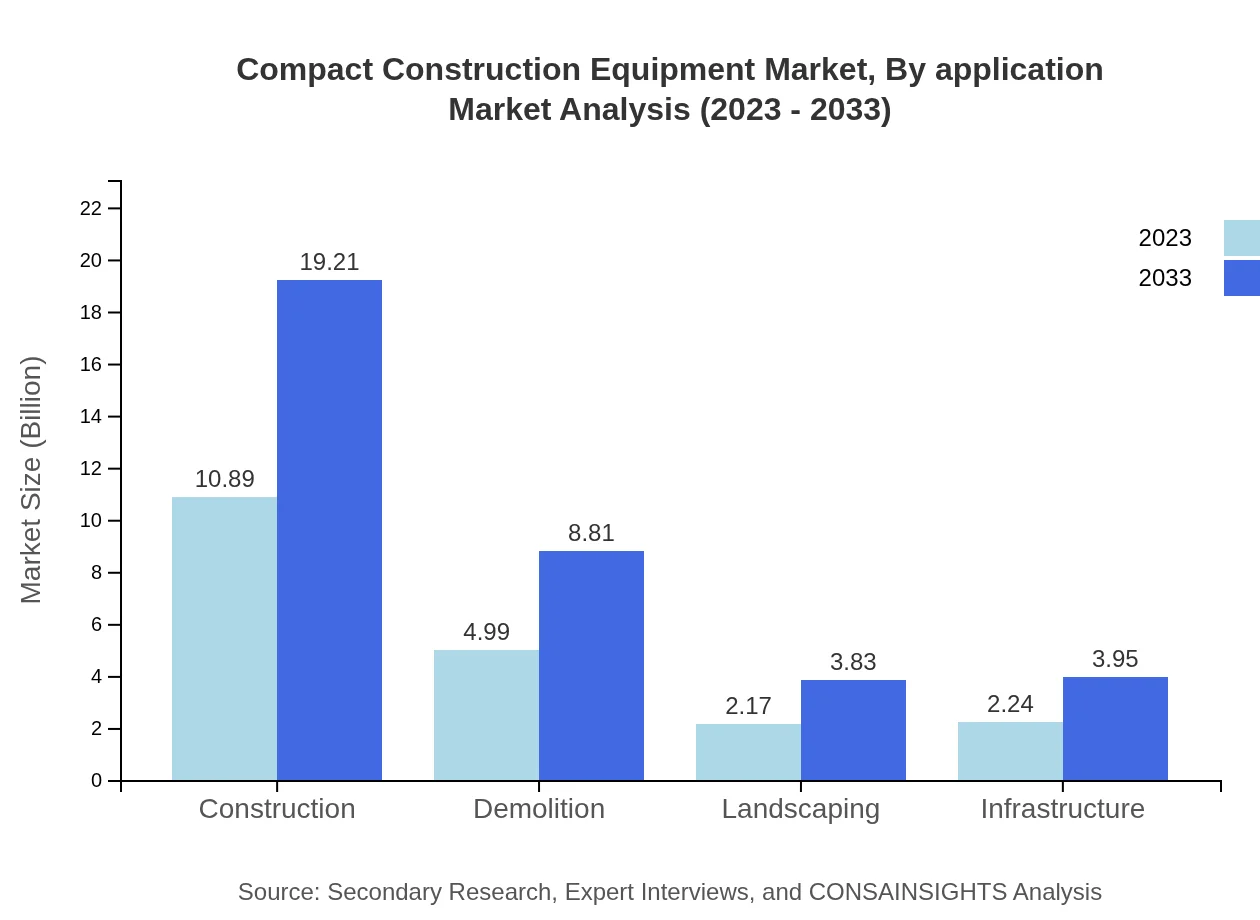

Compact Construction Equipment Market Analysis By Application

In terms of application, the construction segment holds a substantial market share of 53.66% in 2023, valued at $10.89 billion, and is expected to grow to $19.21 billion by 2033. The demolition sector contributes a market of $4.99 billion with a 24.6% share, projected to reach $8.81 billion. Landscaping and Infrastructure sectors, while smaller, retain market values of $2.17 billion and $2.24 billion respectively, with sustainable growth anticipated.

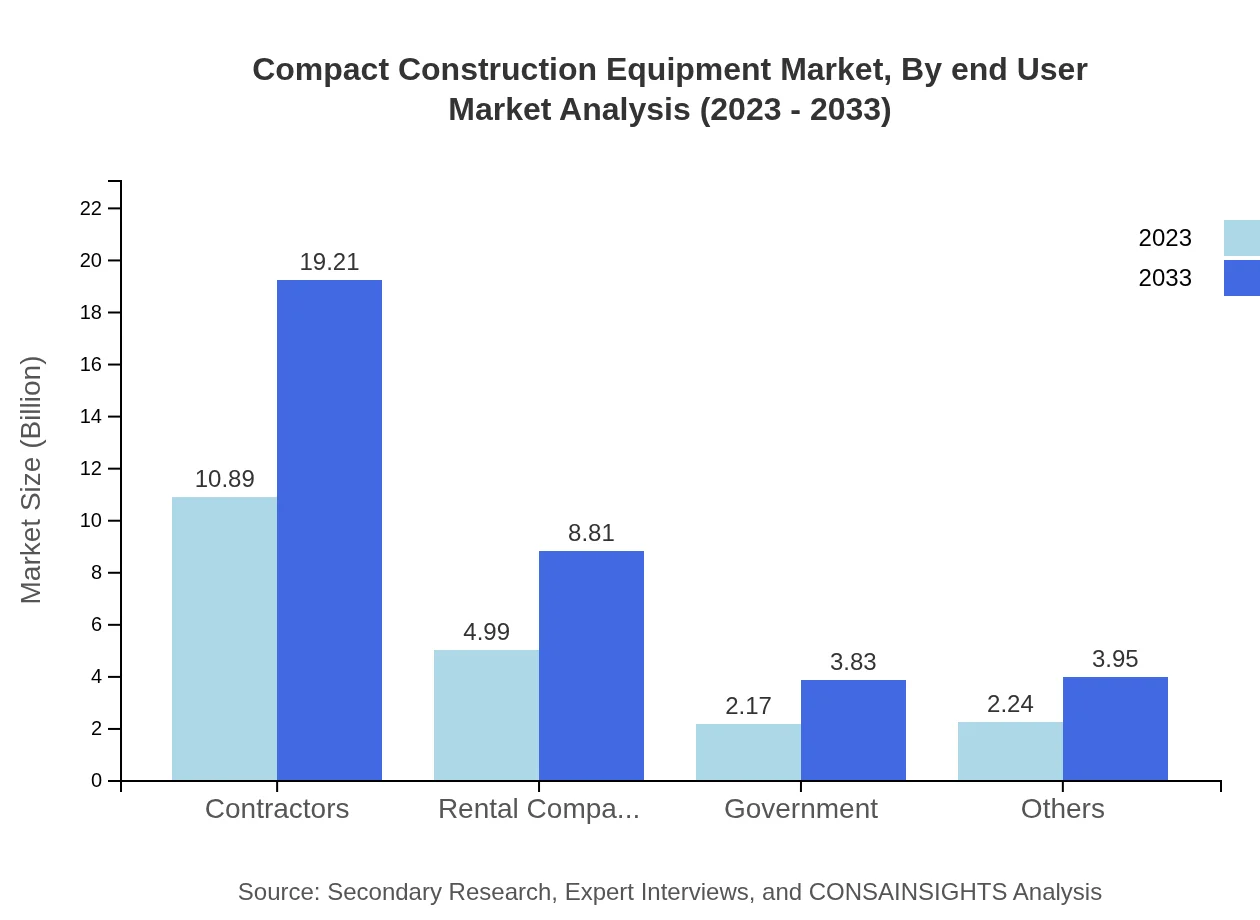

Compact Construction Equipment Market Analysis By End User

Contractors dominate the Compact Construction Equipment market with a size of $10.89 billion in 2023, holding a share of 53.66%. Rental companies trail with a market size of $4.99 billion (24.6% share). Government and other end-users exhibit smaller yet significant sizes of $2.17 billion and $2.24 billion respectively, with each segment poised for growth driven by shifting trends towards rental services.

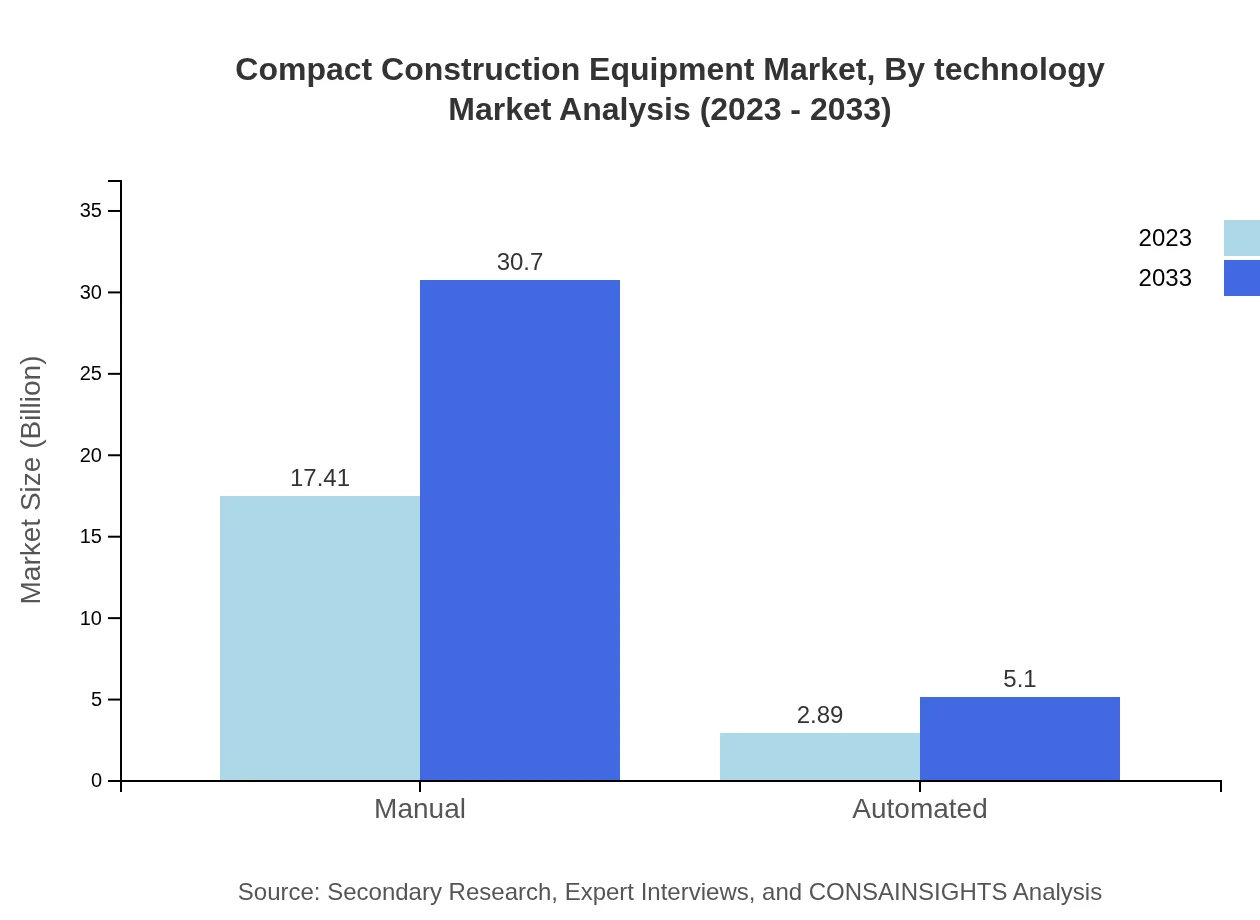

Compact Construction Equipment Market Analysis By Technology

The Compact Construction Equipment market can also be distinguished by technology, highlighting the shift towards automation. In 2023, manual equipment constitutes a remarkable $17.41 billion and a share of 85.76%, while automated systems capture $2.89 billion (14.24% share). Growth in automated equipment is expected, driven by technological advancements that enhance productivity and safety in operations.

Compact Construction Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Compact Construction Equipment Industry

Caterpillar Inc.:

Caterpillar Inc. is a leading manufacturer of construction and mining equipment, known for its durable and innovative compact equipment solutions designed for diverse applications.Komatsu Ltd.:

Komatsu Ltd. is renowned for its advanced machinery and construction equipment, with a focus on sustainable technologies and efficiency in compact equipment production.Bobcat Company:

Bobcat Company specializes in compact construction equipment, offering a range of loaders and excavators that are compact yet powerful, catering to contractors' needs.John Deere:

John Deere is a major player in the agricultural and construction equipment sectors, recognized for its pioneering equipment that balances performance with environmental sustainability.JCB Ltd.:

JCB Ltd. is globally recognized for its innovative compact construction machinery, continuously evolving product lines to meet growing global demand.We're grateful to work with incredible clients.

FAQs

What is the market size of compact Construction Equipment?

The compact construction equipment market is projected to reach approximately $20.3 billion by 2033, growing at a CAGR of 5.7%. This robust growth reflects increasing demand for efficient construction solutions.

What are the key market players or companies in this compact Construction Equipment industry?

Key players in the compact construction equipment industry include manufacturers like Caterpillar, JCB, and Kubota. These companies dominate various segments through innovation in product design and advanced technologies.

What are the primary factors driving the growth in the compact construction equipment industry?

Driving factors include the rising demand for construction activities, urbanization, and the need for efficient equipment. Technological advancements in machinery are also enhancing productivity, further fueling market growth.

Which region is the fastest Growing in the compact construction equipment?

North America is the fastest-growing region, with its market expanding from $7.71 billion in 2023 to $13.59 billion by 2033. This growth is driven by infrastructure development and rising construction projects.

Does ConsaInsights provide customized market report data for the compact Construction Equipment industry?

Yes, ConsaInsights offers customized market report data tailored to your needs in the compact construction equipment industry, ensuring you get relevant information for strategic decision-making.

What deliverables can I expect from this compact Construction Equipment market research project?

Expect comprehensive deliverables, including detailed market analysis, competitive landscape insights, regional data, segments analysis, and future growth forecast reports for informed decision-making.

What are the market trends of compact Construction Equipment?

Current trends include increased adoption of automated equipment and rising demand for rentals. A shift towards eco-friendly machinery also reflects growing environmental concerns in the construction sector.