Companion Animal Diagnostics Market Report

Published Date: 31 January 2026 | Report Code: companion-animal-diagnostics

Companion Animal Diagnostics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Companion Animal Diagnostics market from 2023 to 2033, detailing market growth, segmentation, regional insights, and key industry trends affecting the sector.

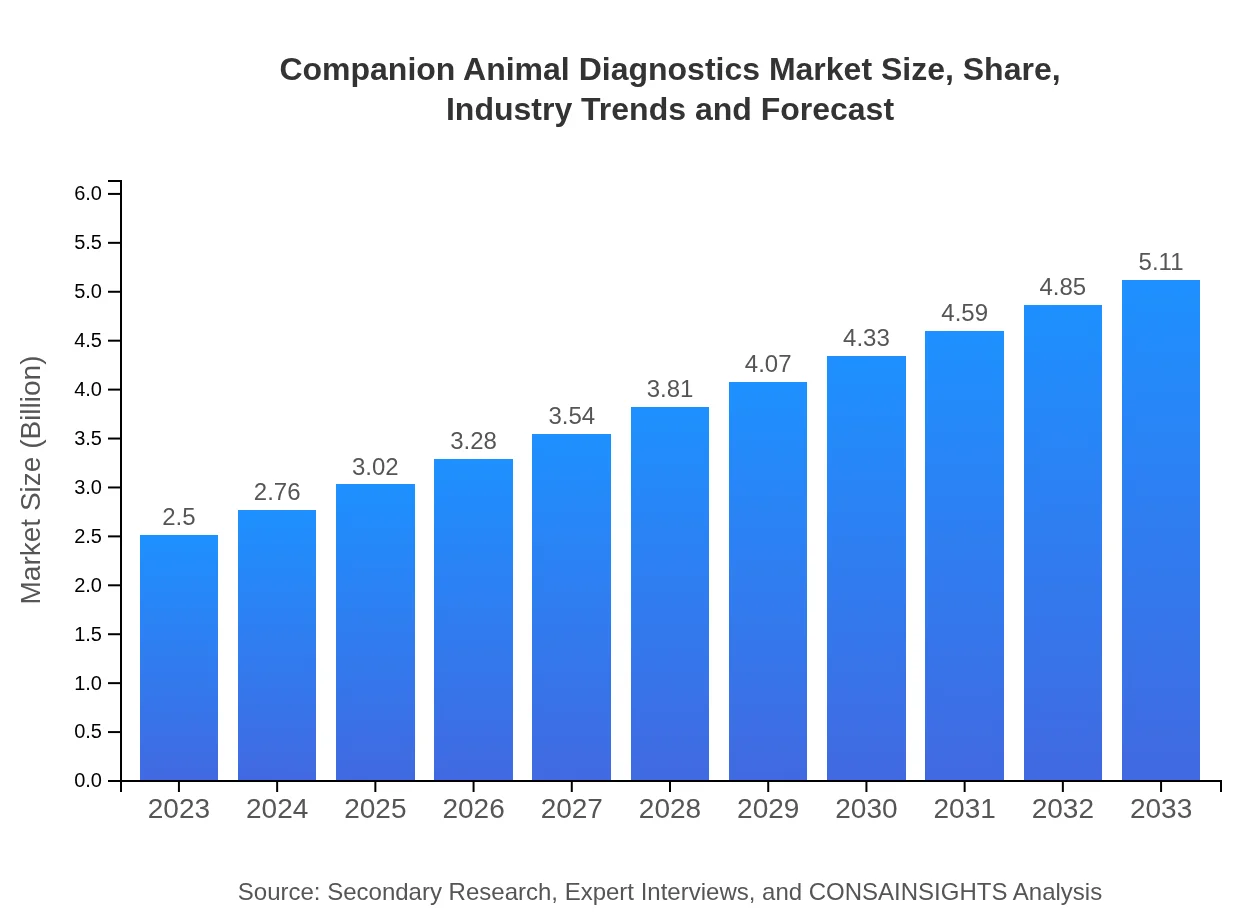

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $5.11 Billion |

| Top Companies | Idexx Laboratories, Inc., Virbac, Zoetis Inc., Neogen Corporation |

| Last Modified Date | 31 January 2026 |

Companion Animal Diagnostics Market Overview

Customize Companion Animal Diagnostics Market Report market research report

- ✔ Get in-depth analysis of Companion Animal Diagnostics market size, growth, and forecasts.

- ✔ Understand Companion Animal Diagnostics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Companion Animal Diagnostics

What is the Market Size & CAGR of Companion Animal Diagnostics market in 2023?

Companion Animal Diagnostics Industry Analysis

Companion Animal Diagnostics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Companion Animal Diagnostics Market Analysis Report by Region

Europe Companion Animal Diagnostics Market Report:

Europe's Companion Animal Diagnostics market is set to expand from USD 850 million in 2023 to USD 1.73 billion by 2033, driven by a well-established veterinary industry, increasing pet health awareness, and collaborative initiatives among veterinary professionals.Asia Pacific Companion Animal Diagnostics Market Report:

The Asia Pacific region is expected to witness significant growth, with the market forecasted to grow from USD 450 million in 2023 to USD 920 million by 2033. Factors contributing to this include rising pet ownership rates, increasing investments in veterinary infrastructures, and promoting awareness of pet healthcare.North America Companion Animal Diagnostics Market Report:

The North American market is the largest, with a valuation of USD 900 million in 2023, expected to grow to USD 1.84 billion by 2033. The region's strong performance is attributed to high disposable incomes, advanced veterinary services, and a profound cultural emphasis on pet wellness and health.South America Companion Animal Diagnostics Market Report:

In South America, the market value is projected to rise from USD 30 million in 2023 to USD 50 million by 2033, supported by growth in pet adoption and a growing inclination towards preventive care among pet owners.Middle East & Africa Companion Animal Diagnostics Market Report:

The market in the Middle East and Africa is projected to increase from USD 280 million in 2023 to USD 560 million by 2033, fueled by the growing acceptance of pets in homes and rising investments in veterinary healthcare infrastructure.Tell us your focus area and get a customized research report.

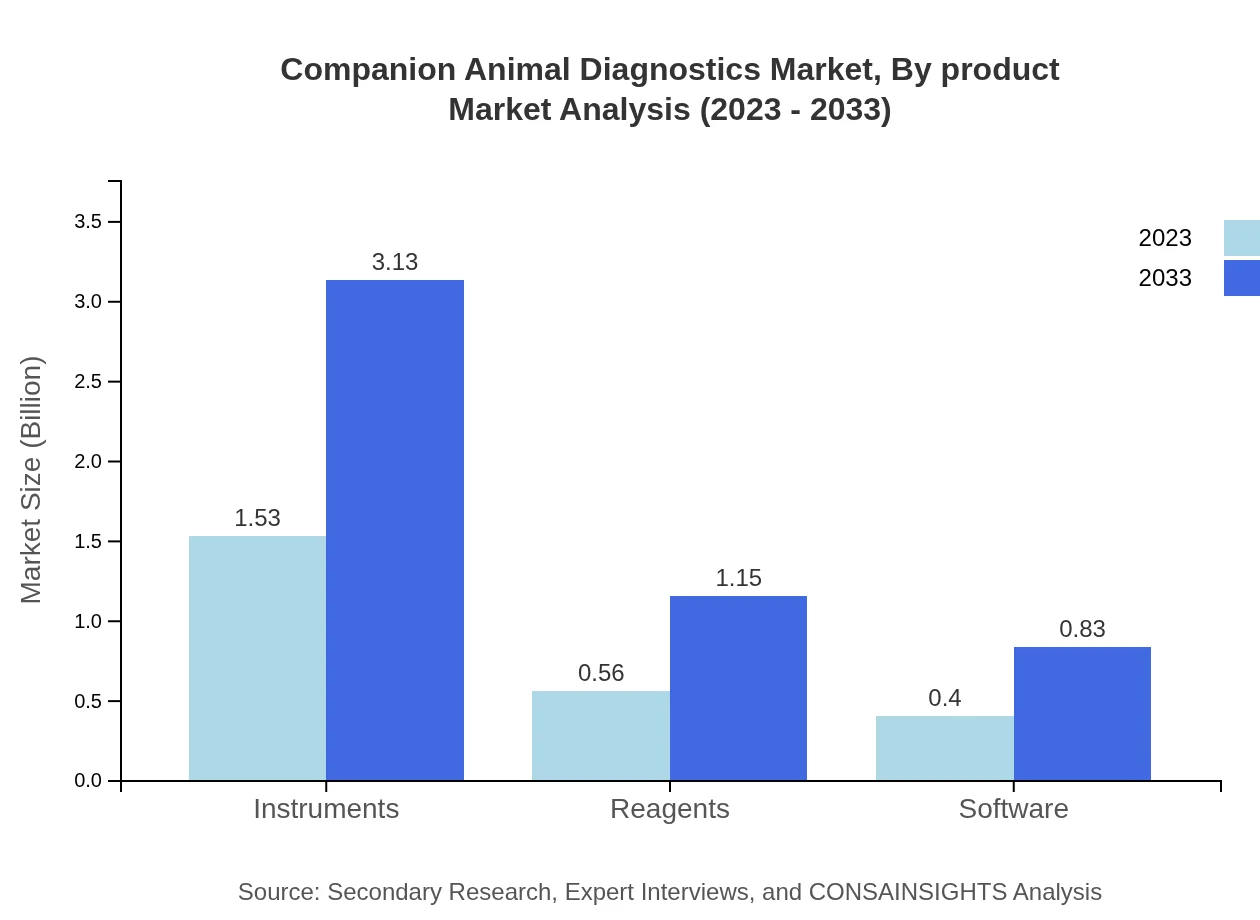

Companion Animal Diagnostics Market Analysis By Product

Instruments are the largest segment, valued at USD 1.53 billion in 2023, and expected to reach USD 3.13 billion by 2033. Reagents hold a significant market share, valued at USD 560 million in 2023 with growth projections to USD 1.15 billion. Software solutions account for USD 400 million currently, projected to grow to USD 830 million. Each product type plays a critical role in diagnostics, facilitating effective disease management and prevention.

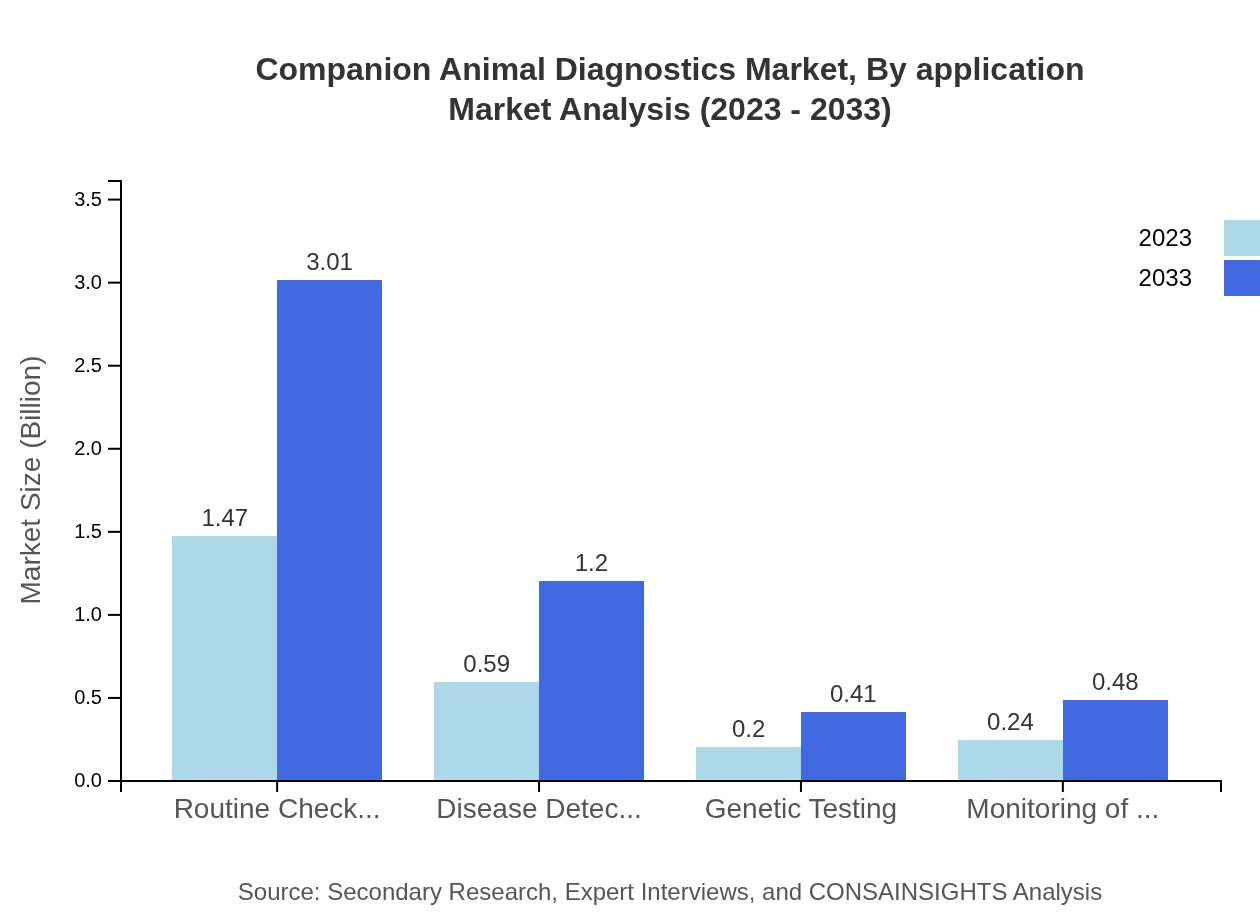

Companion Animal Diagnostics Market Analysis By Application

The application segment indicates that routine checkups dominate with USD 1.47 billion in 2023 and anticipated growth to USD 3.01 billion by 2033. Disease detection follows closely, projected from USD 590 million to USD 1.20 billion during the same period. Genetic testing and chronic disease monitoring remain integral, as an increasing focus on preventive health strategies takes precedence among pet owners.

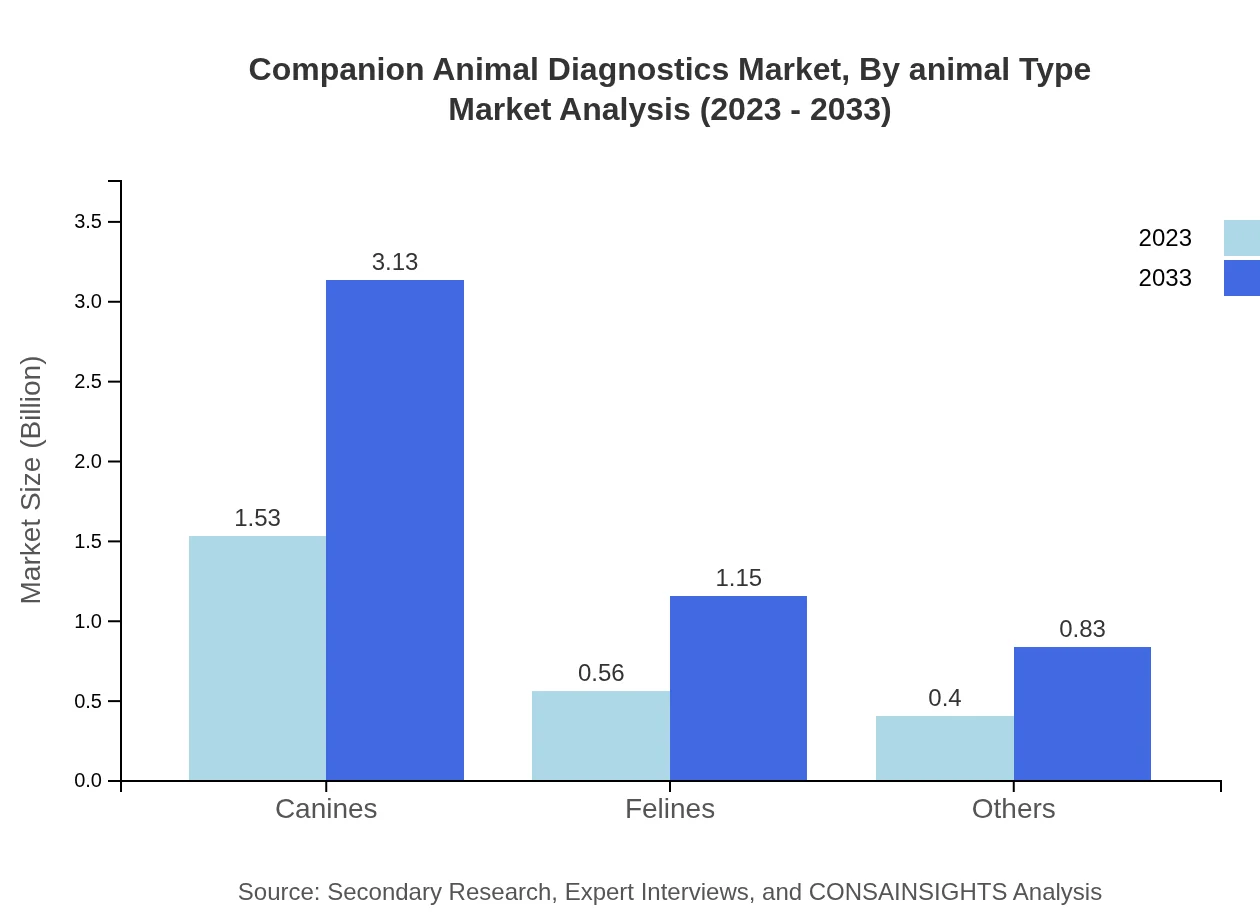

Companion Animal Diagnostics Market Analysis By Animal Type

In 2023, canines represent USD 1.53 billion of the market, expected to reach USD 3.13 billion by 2033. Felines constitute a sizable segment at USD 560 million, projected to grow to USD 1.15 billion. Other small pet diagnostics are also emerging as new trends in the sector, targeting niche markets as awareness of pet health continues to evolve.

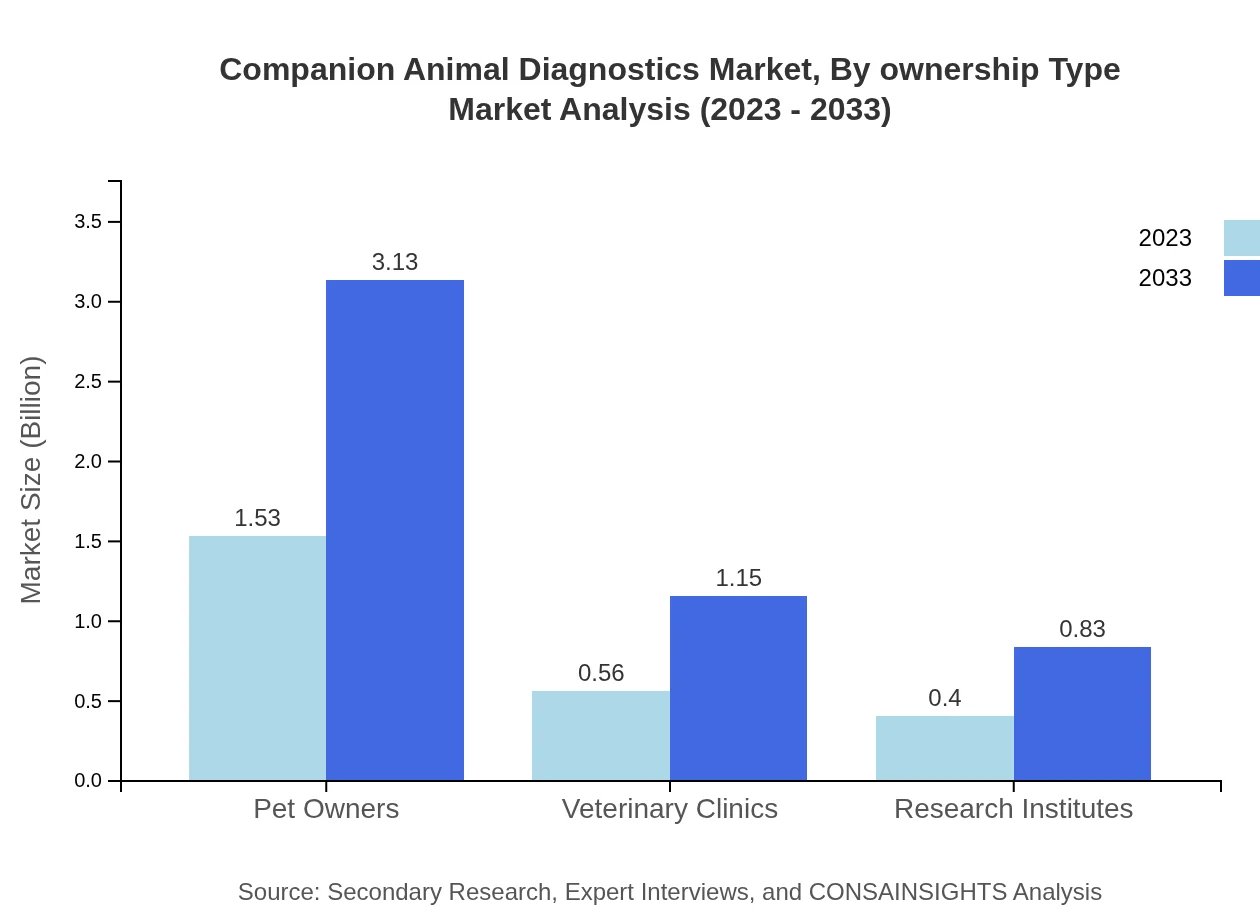

Companion Animal Diagnostics Market Analysis By Ownership Type

The pet owners segment dominates with USD 1.53 billion in 2023, expected to expand to USD 3.13 billion over the forecast years. Veterinary clinics contribute significantly to the sector, starting at USD 560 million and projected to reach USD 1.15 billion, as they increasingly offer advanced diagnostic solutions in response to client demands.

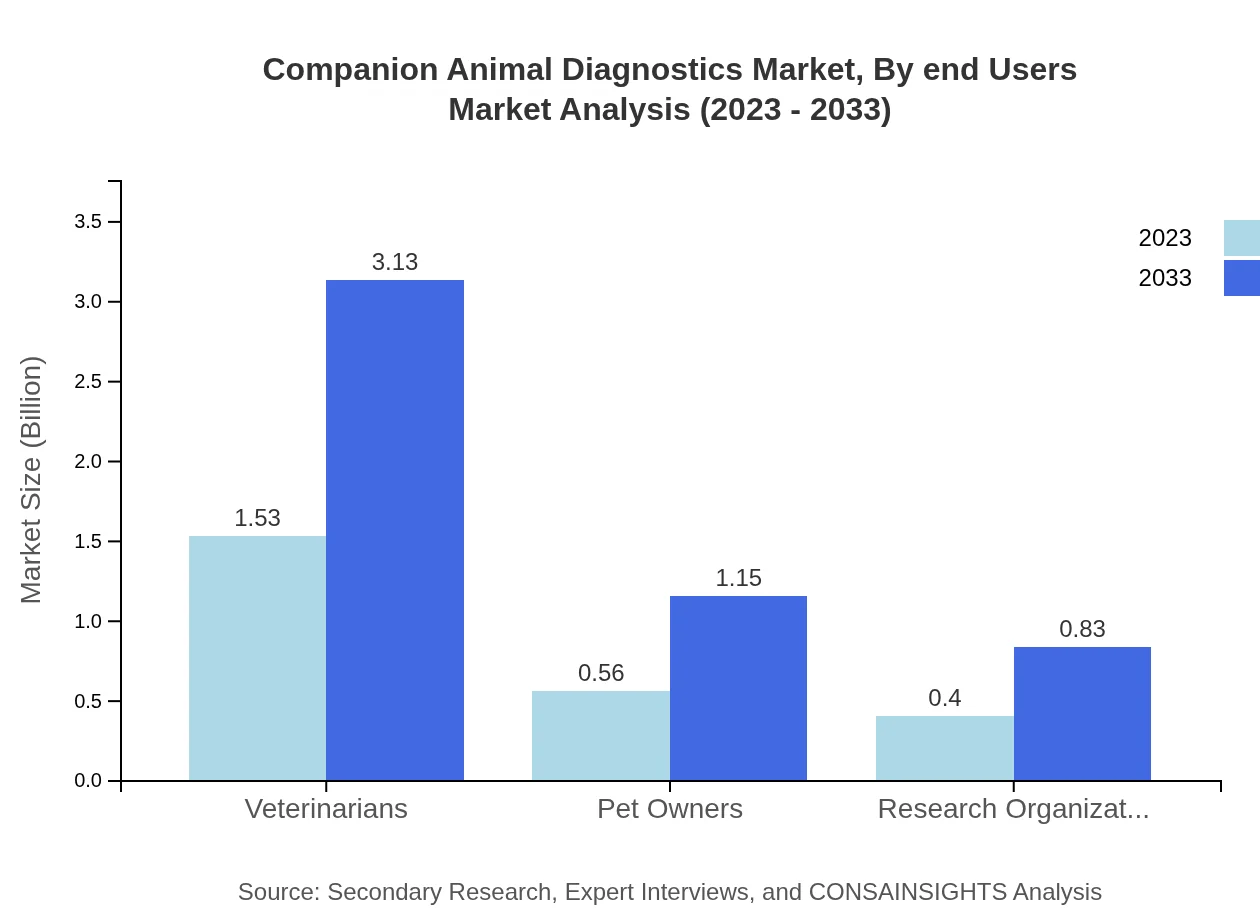

Companion Animal Diagnostics Market Analysis By End Users

Veterinarians are crucial stakeholders, with their segment valued at USD 1.53 billion in 2023 and expected to grow substantially. Pet owners also represent a significant portion, emphasizing the importance of building awareness around diagnostic options. Research institutions are equally important, reflecting the role of academia in developing innovative diagnostic tools.

Companion Animal Diagnostics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Companion Animal Diagnostics Industry

Idexx Laboratories, Inc.:

A leading company in veterinary diagnostics, Idexx offers comprehensive diagnostic and monitoring solutions for pets, enhancing veterinary practices globally.Virbac:

Virbac provides innovative diagnostics and pharmaceuticals uniquely dedicated to animal health, catering to the diverse needs of pet owners and veterinarians.Zoetis Inc.:

Known for its extensive range of products and services in animal health, Zoetis is a prominent player in the diagnostics space, focused on enhancing pet health outcomes.Neogen Corporation:

Specializing in food and animal safety products, Neogen develops essential diagnostic solutions for the veterinary market, ensuring effective disease management.We're grateful to work with incredible clients.

FAQs

What is the market size of companion Animal Diagnostics?

The global companion animal diagnostics market is valued at approximately $2.5 billion in 2023, and it is projected to grow at a CAGR of 7.2% over the next decade, indicating significant expansion and demand in the industry.

What are the key market players or companies in this companion Animal Diagnostics industry?

Key players in the companion-animal diagnostics industry include major companies such as IDEXX Laboratories, Zoetis Inc., and Neogen Corporation, contributing to advancements in diagnostic technology and expanding their product portfolios for both veterinarians and pet owners.

What are the primary factors driving the growth in the companion Animal Diagnostics industry?

The growth in the companion-animal diagnostics industry is primarily driven by increasing pet ownership, rising awareness of animal health, advancements in diagnostic technologies, and the growing prevalence of zoonotic diseases that necessitate regular health checks for pets.

Which region is the fastest Growing in the companion Animal Diagnostics?

North America is the fastest-growing region in the companion animal diagnostics market, with a market value projected to increase from $0.90 billion in 2023 to $1.84 billion by 2033, reflecting robust demand and investment in veterinary healthcare.

Does ConsaInsights provide customized market report data for the companion Animal Diagnostics industry?

Yes, ConsaInsights offers customized market report data tailored to the needs of stakeholders in the companion-animal diagnostics industry, allowing clients to obtain specific insights relevant to their strategic objectives and market positioning.

What deliverables can I expect from this companion Animal Diagnostics market research project?

From the companion-animal diagnostics market research project, clients can expect detailed insights, segment analysis, market forecasts, competitor profiling, and actionable recommendations to support informed decision-making in their business strategies.

What are the market trends of companion Animal Diagnostics?

Current trends in the companion-animal diagnostics market include increasing use of point-of-care testing, the rise of telemedicine for veterinary care, growth in genetic testing for pets, and an overall shift towards personalized veterinary diagnostics and preventive healthcare.