Companion Diagnostics Market Report

Published Date: 31 January 2026 | Report Code: companion-diagnostics

Companion Diagnostics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Companion Diagnostics market from 2023 to 2033, showcasing trends, market size, industry dynamics, regional insights, and leading players to inform strategic decision-making.

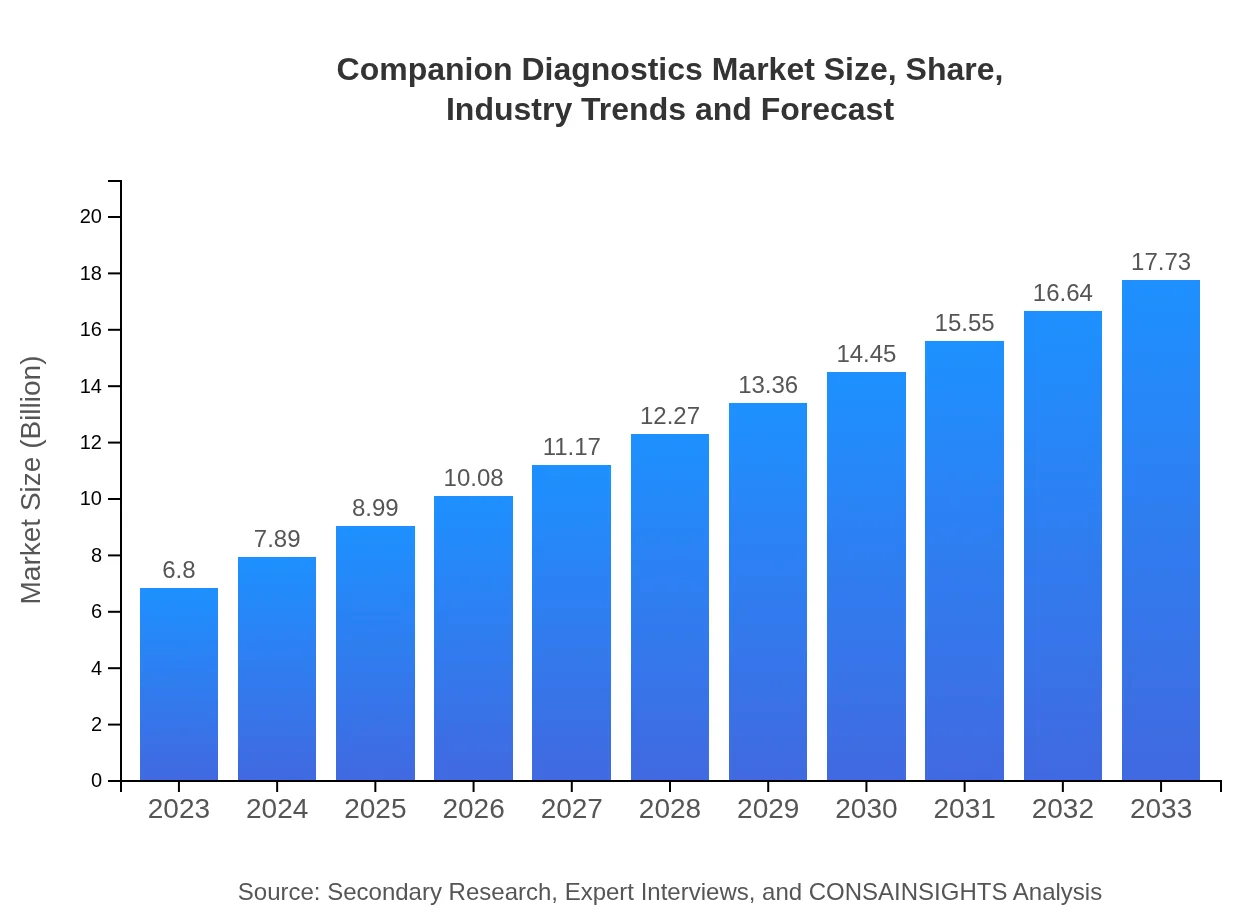

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.80 Billion |

| CAGR (2023-2033) | 9.7% |

| 2033 Market Size | $17.73 Billion |

| Top Companies | Roche Diagnostics, Agilent Technologies, Thermo Fisher Scientific, Illumina, Inc., Foundation Medicine |

| Last Modified Date | 31 January 2026 |

Companion Diagnostics Market Overview

Customize Companion Diagnostics Market Report market research report

- ✔ Get in-depth analysis of Companion Diagnostics market size, growth, and forecasts.

- ✔ Understand Companion Diagnostics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Companion Diagnostics

What is the Market Size & CAGR of Companion Diagnostics market in 2023?

Companion Diagnostics Industry Analysis

Companion Diagnostics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Companion Diagnostics Market Analysis Report by Region

Europe Companion Diagnostics Market Report:

The Companion Diagnostics market in Europe is forecast to expand significantly, growing from USD 2.00 billion in 2023 to USD 5.22 billion in 2033. The presence of well-established healthcare systems, along with widespread adoption of personalized medicine among clinicians, drives the demand for advanced diagnostic solutions.Asia Pacific Companion Diagnostics Market Report:

The Asia-Pacific region is anticipated to see substantial growth in the Companion Diagnostics market, with the market projected to reach USD 3.27 billion by 2033, up from USD 1.25 billion in 2023. Factors contributing to this growth include increasing investments in healthcare infrastructure, rising awareness of personalized medicine, and ongoing collaborations between local and global players.North America Companion Diagnostics Market Report:

North America remains the leading market for Companion Diagnostics, with a projected increase from USD 2.55 billion in 2023 to USD 6.66 billion by 2033. Continued technological advancements, a robust regulatory framework, and significant investments in R&D are fueling the market growth in this region.South America Companion Diagnostics Market Report:

In South America, the market is expected to grow from USD 0.39 billion in 2023 to approximately USD 1.01 billion by 2033. With high demand for advanced diagnostic tools amid rising healthcare expenditures, accompanied by favorable governmental policies advocating personalized medicine, this region shows promising potential for CDx adoption.Middle East & Africa Companion Diagnostics Market Report:

The Middle East and Africa's Companion Diagnostics market is projected to grow from USD 0.60 billion in 2023 to USD 1.57 billion by 2033. Enhanced focus on improving healthcare access and the growing prevalence of chronic diseases are propelling the need for specialized diagnostics in this region.Tell us your focus area and get a customized research report.

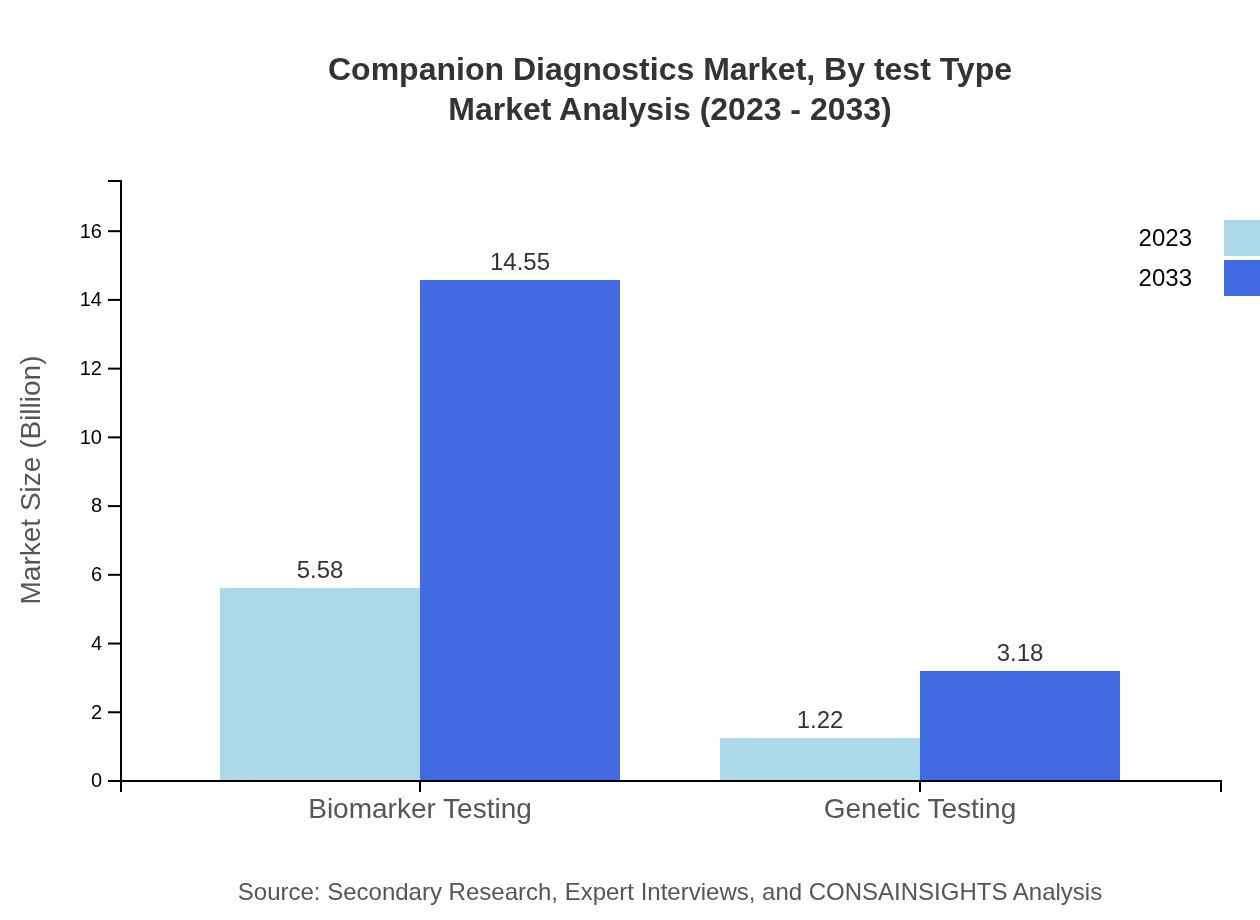

Companion Diagnostics Market Analysis By Test Type

The Biomarker Testing segment leads the Companion Diagnostics market, expected to reach USD 14.55 billion by 2033 from USD 5.58 billion in 2023. Genetic Testing is also significant, projected to grow from USD 1.22 billion to USD 3.18 billion over the same period. The dominance of these segments underscores the critical role of biomarker and genetic tests in patient-specific therapeutic regimens.

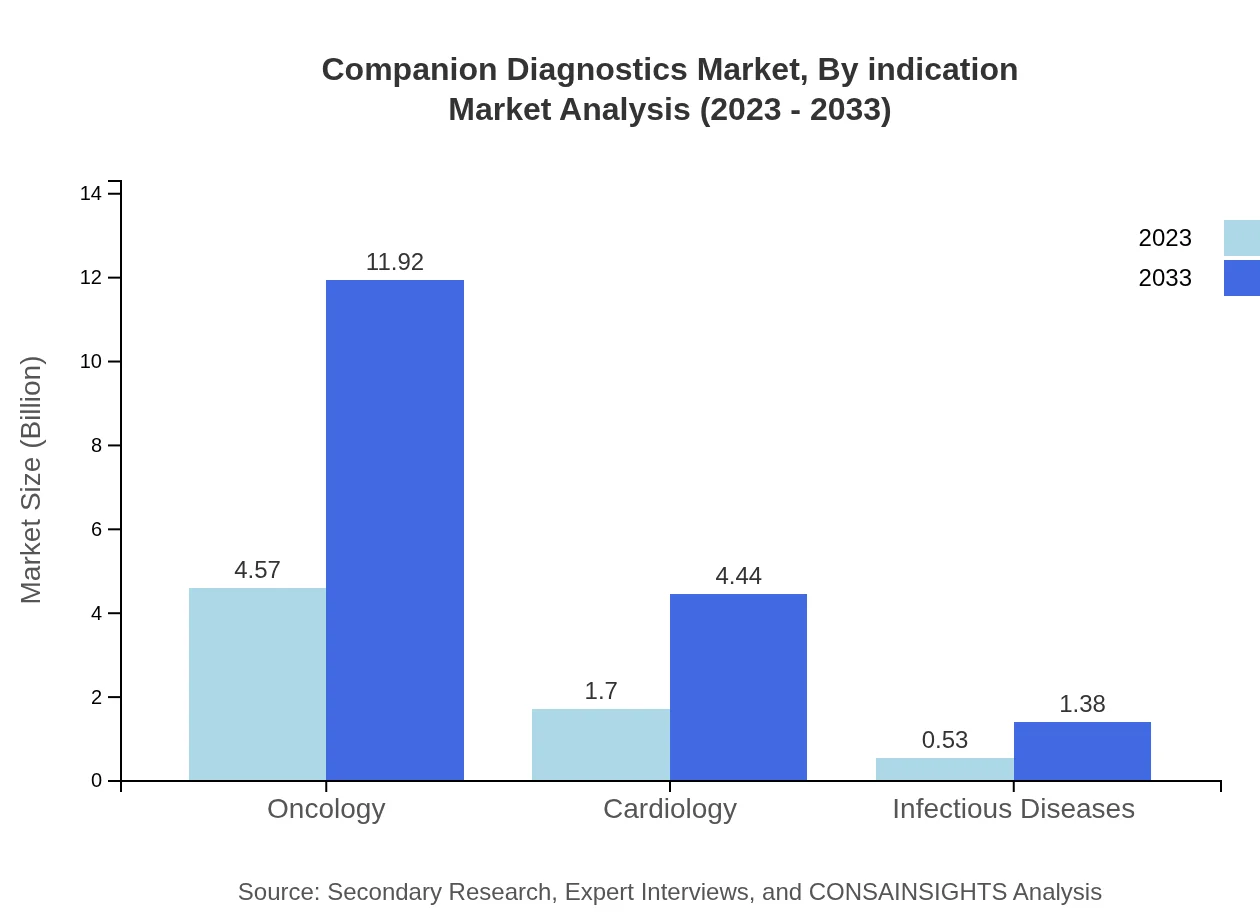

Companion Diagnostics Market Analysis By Indication

Oncology remains the primary indication for Companion Diagnostics, projected to expand from USD 4.57 billion in 2023 to USD 11.92 billion by 2033. Cardiology and Infectious Diseases are also vital segments, reflecting the increasing diagnostic needs for specialized treatment pathways.

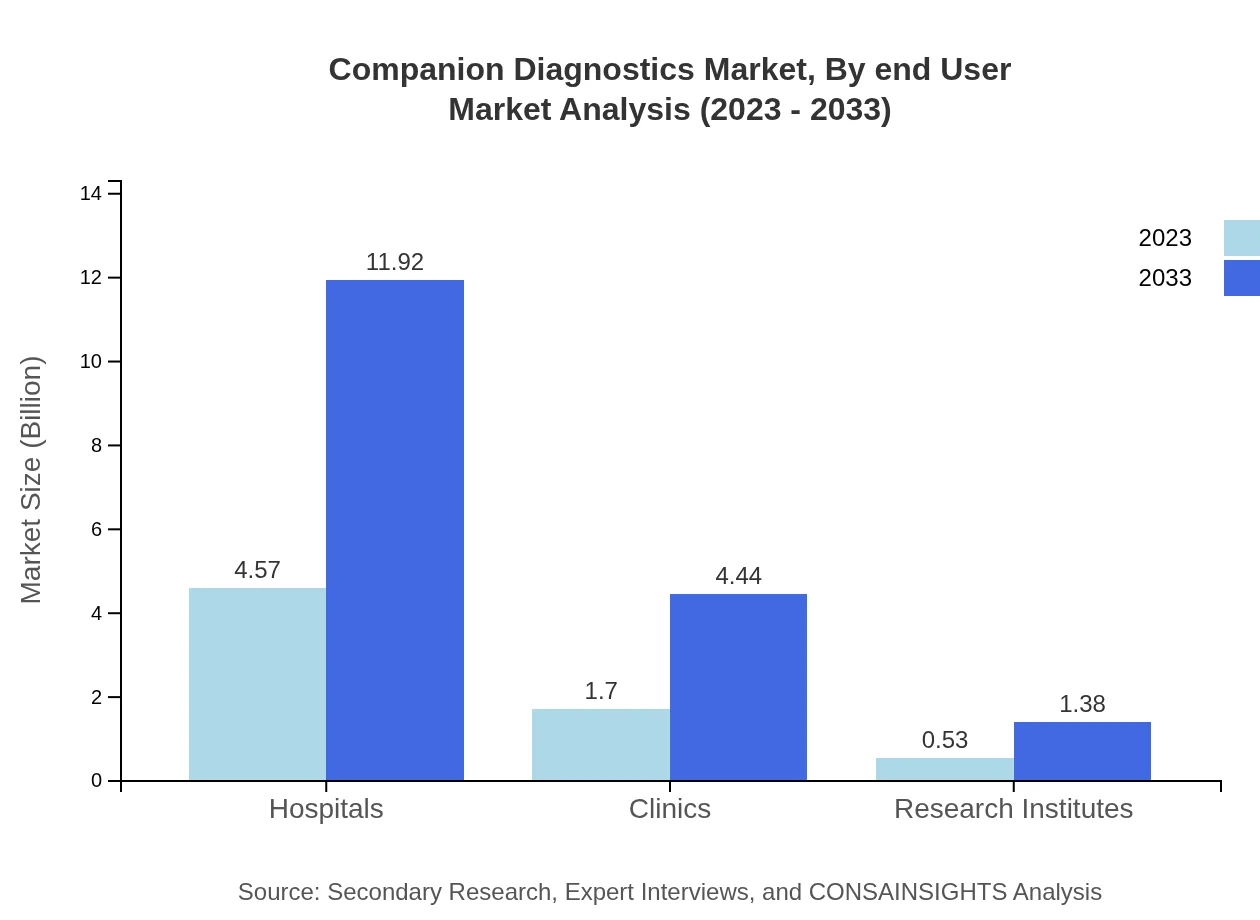

Companion Diagnostics Market Analysis By End User

Hospitals lead the market as the primary end-user, expected to grow from USD 4.57 billion in 2023 to USD 11.92 billion by 2033, retaining a market share of 67.21%. Clinics and Research Institutes also play essential roles but to a lesser extent, indicating the central role hospitals have in delivering personalized patient care.

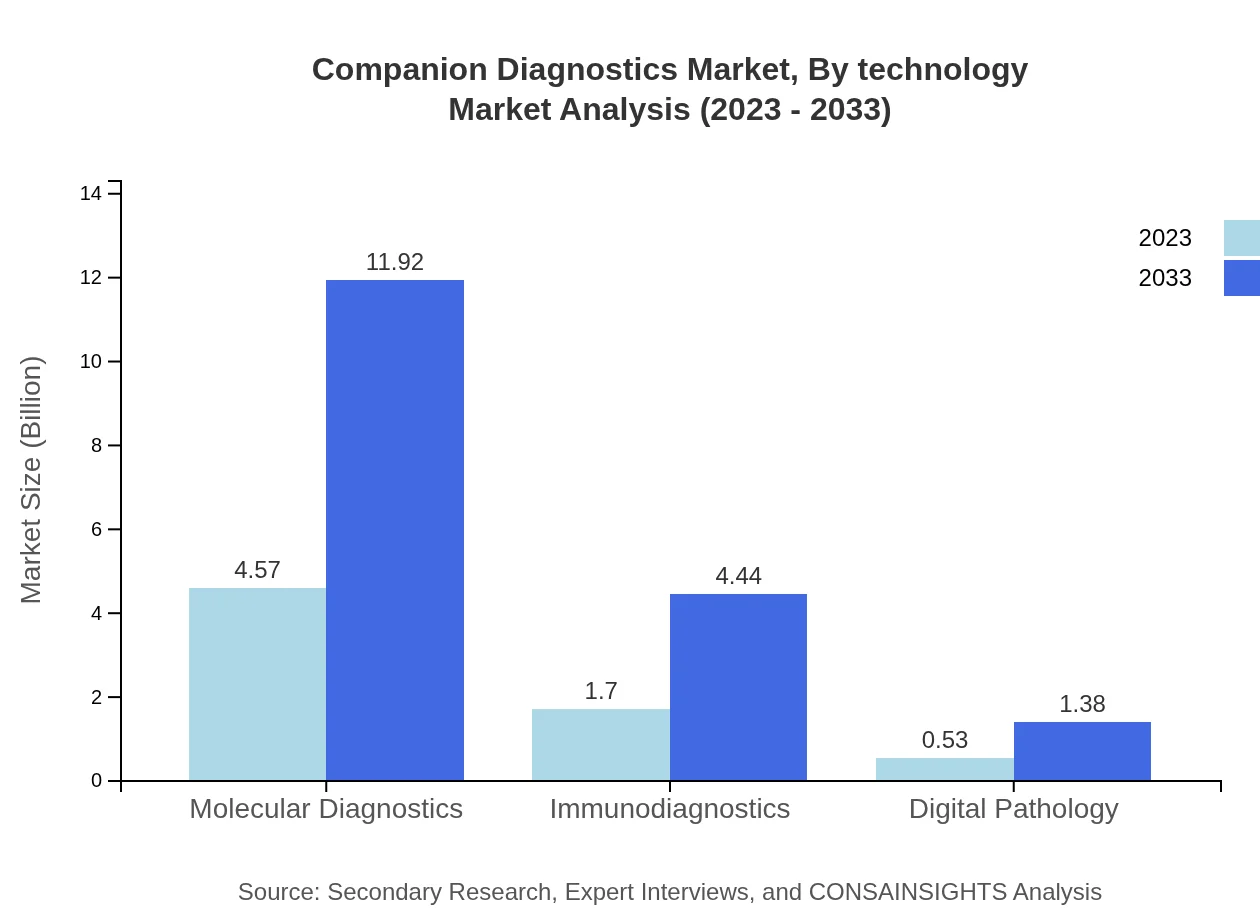

Companion Diagnostics Market Analysis By Technology

Recent advancements in molecular diagnostics and immunodiagnostics are influencing the Companion Diagnostics landscape. Molecular diagnostics is anticipated to continue its leading position, projected to account for a significant share due to its high accuracy in detecting targeted diseases. Immunodiagnostics, with their application in oncology and infectious diseases, are also expanding rapidly.

Companion Diagnostics Market Analysis By Region Needless

Global Companion Diagnostics Market, By Region (Omitted as per instructions) Market Analysis (2023 - 2033)

This segment would typically provide insights about regional market characteristics and variations, but it has been omitted as per the request.

Companion Diagnostics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Companion Diagnostics Industry

Roche Diagnostics:

A pioneer in diagnostics and a leader in Companion Diagnostics, Roche provides innovative solutions integrating diagnostics to enhance personalized healthcare, with a focus on oncology biomarkers.Agilent Technologies:

Known for their advanced diagnostic technologies, Agilent focuses on enhancing precision medicine through cutting-edge biomarker discovery and providing a comprehensive suite of diagnostic solutions.Thermo Fisher Scientific:

Thermo Fisher offers a range of Companion Diagnostics solutions, striving to facilitate personalized treatment decisions through robust testing methodologies and a broad product portfolio.Illumina, Inc.:

Illumina is highly regarded for its genomic sequencing technologies, playing a crucial role in enabling genomic profiling for personalized medicines in the market.Foundation Medicine:

Specializing in genomic profiling of cancer, Foundation Medicine offers comprehensive tests that aid in identifying targeted therapies for patients, reinforcing the role of CDx in oncology.We're grateful to work with incredible clients.

FAQs

What is the market size of companion Diagnostics?

The companion diagnostics market is valued at approximately $6.8 billion in 2023, with a projected compound annual growth rate (CAGR) of 9.7%. It is expected to experience significant growth over the coming years, reflecting the increasing integration of diagnostics in personalized medicine.

What are the key market players or companies in this companion Diagnostics industry?

Key players in the companion diagnostics market include major biotechnology firms, pharmaceutical companies, as well as diagnostic manufacturers. These companies are continuously innovating and collaborating to enhance diagnostic accuracy, thereby ensuring optimal patient treatment outcomes, which is crucial for market growth.

What are the primary factors driving the growth in the companion diagnostics industry?

The growth in the companion diagnostics industry is primarily driven by the increasing demand for personalized medicine, advancements in genomic technology, and a rising focus on targeted therapies. Additionally, supportive regulatory frameworks and heightened awareness among healthcare professionals contribute to market expansion.

Which region is the fastest Growing in the companion diagnostics?

The North American region is anticipated to be the fastest-growing market in companion diagnostics, with growth projections indicating an increase from $2.55 billion in 2023 to $6.66 billion by 2033. This growth is fueled by advanced healthcare infrastructure and a strong emphasis on research and development.

Does ConsaInsights provide customized market report data for the companion diagnostics industry?

Yes, ConsaInsights offers customized market report data tailored to individual client needs within the companion diagnostics industry. Clients can access specific data segments, regional insights, and market analytics to support strategic planning and decision-making.

What deliverables can I expect from this companion diagnostics market research project?

Deliverables from the companion diagnostics market research project include comprehensive market analysis reports, segmented data insights, competitive landscape evaluations, regional forecasts, and actionable recommendations to inform future strategies and investment decisions.

What are the market trends of companion diagnostics?

Market trends in companion diagnostics include rising adoption of biomarker and genetic testing, increased collaboration between diagnostics and pharmaceutical companies, and a growing emphasis on molecular diagnostics. Innovations in technology are further paving the way for improved diagnostic procedures and personalized treatment plans.