Completion Equipment And Services Market Report

Published Date: 22 January 2026 | Report Code: completion-equipment-and-services

Completion Equipment And Services Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Completion Equipment and Services market, covering industry insights, trends, and competitive landscape for the forecast period from 2023 to 2033. It includes market size, CAGR, regional insights, and profiles of key players.

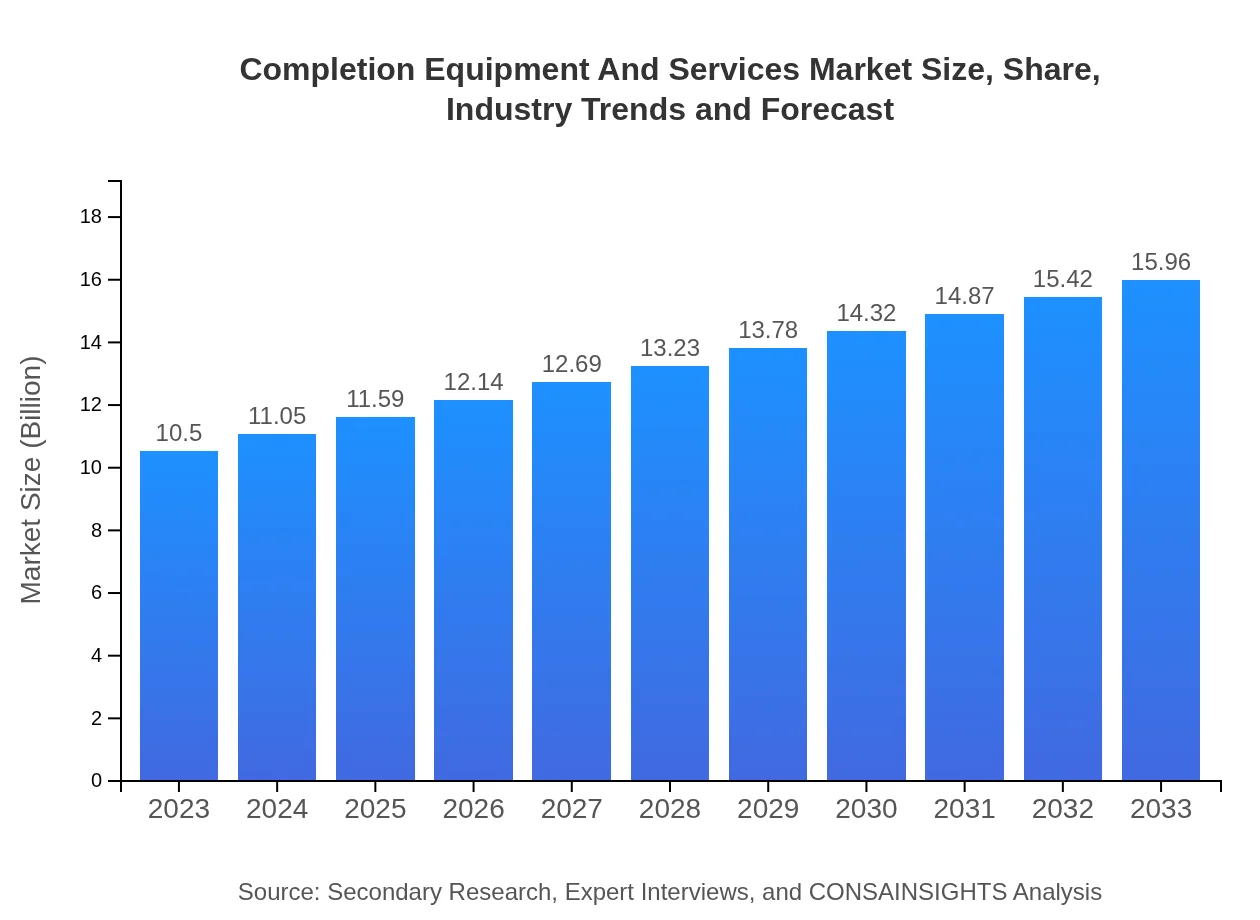

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $15.96 Billion |

| Top Companies | Schlumberger, Halliburton, Baker Hughes, Weatherford International |

| Last Modified Date | 22 January 2026 |

Completion Equipment And Services Market Overview

Customize Completion Equipment And Services Market Report market research report

- ✔ Get in-depth analysis of Completion Equipment And Services market size, growth, and forecasts.

- ✔ Understand Completion Equipment And Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Completion Equipment And Services

What is the Market Size & CAGR of Completion Equipment And Services market in 2023?

Completion Equipment And Services Industry Analysis

Completion Equipment And Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Completion Equipment And Services Market Analysis Report by Region

Europe Completion Equipment And Services Market Report:

Europe's market, valued at $3.81 billion in 2023, is anticipated to reach $5.79 billion by 2033. Enhanced investments in renewable energy, alongside oil and gas exploration activities, contribute to this growth, focusing on sustainability amid tightening regulations.Asia Pacific Completion Equipment And Services Market Report:

In 2023, the Asia Pacific Completion Equipment and Services market is valued at $1.82 billion, projected to grow to $2.77 billion by 2033. The region is witnessing significant investments in infrastructure and energy projects, particularly in emerging economies, driving demand for completion equipment and services.North America Completion Equipment And Services Market Report:

North America is a key player in the Completion Equipment and Services market, projected to increase from $3.51 billion in 2023 to $5.34 billion in 2033. The rebound in shale oil production and the drive for energy independence bolster the demand for advanced completion technologies.South America Completion Equipment And Services Market Report:

The South America market is expected to grow from $0.34 billion in 2023 to $0.51 billion in 2033. The growth is supported by Brazil's increased offshore exploration activities and collaborations with international oil companies investing in local projects.Middle East & Africa Completion Equipment And Services Market Report:

Middle East and Africa's market is expected to grow from $1.03 billion in 2023 to $1.56 billion by 2033. The region continues to invest heavily in oil and gas infrastructure despite facing socio-political challenges that sometimes hinder rapid progress.Tell us your focus area and get a customized research report.

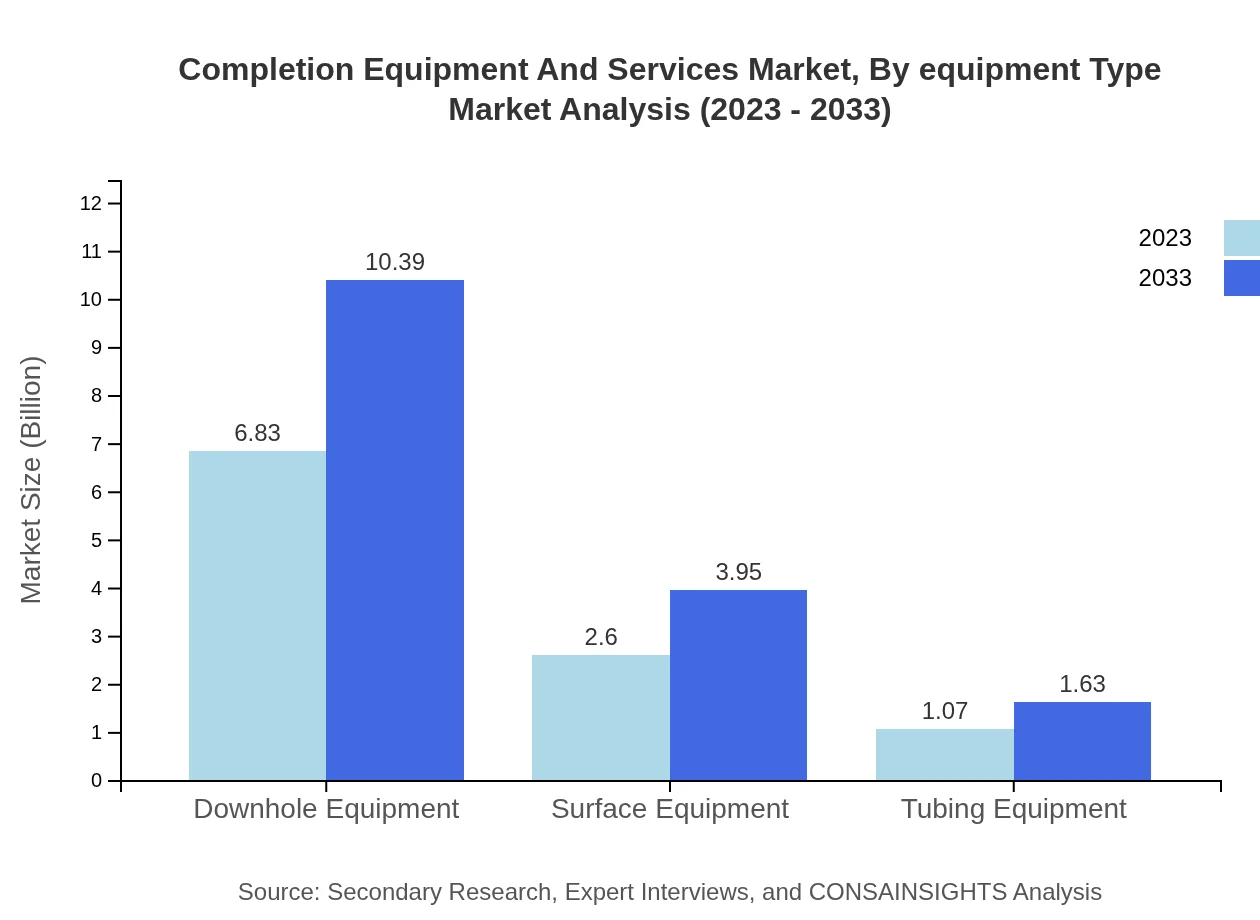

Completion Equipment And Services Market Analysis By Equipment Type

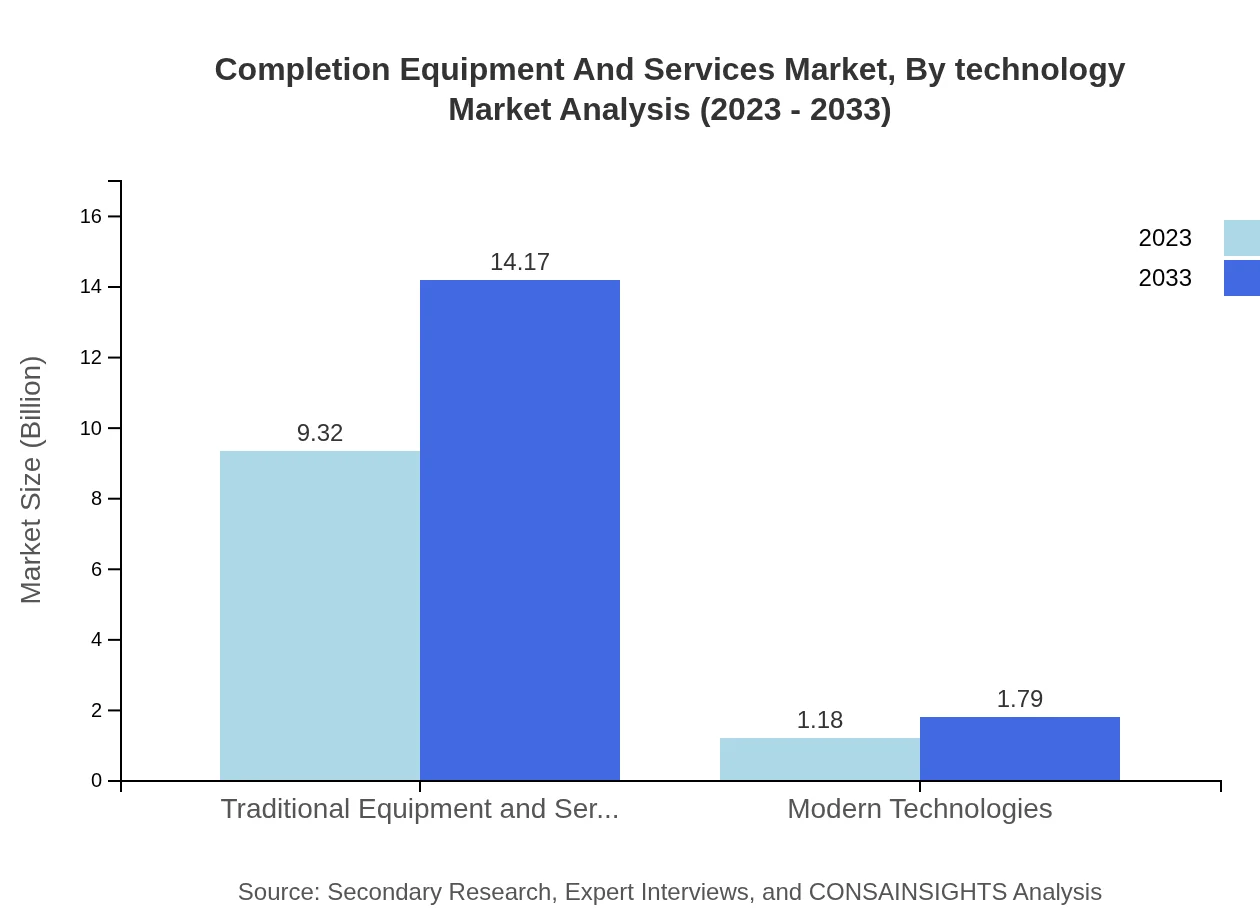

The market for Completion Equipment predominantly features traditional equipment, accounting for approximately $9.32 billion in 2023, with expectations to rise to $14.17 billion by 2033. This segment reflects an 88.77% market share in 2023 and is projected to maintain the same share by 2033, indicative of its reliability. Modern technologies, while smaller at $1.18 billion in 2023 and expected to grow to $1.79 billion, represent 11.23% of the market in both years, highlighting a gradual shift towards innovation.

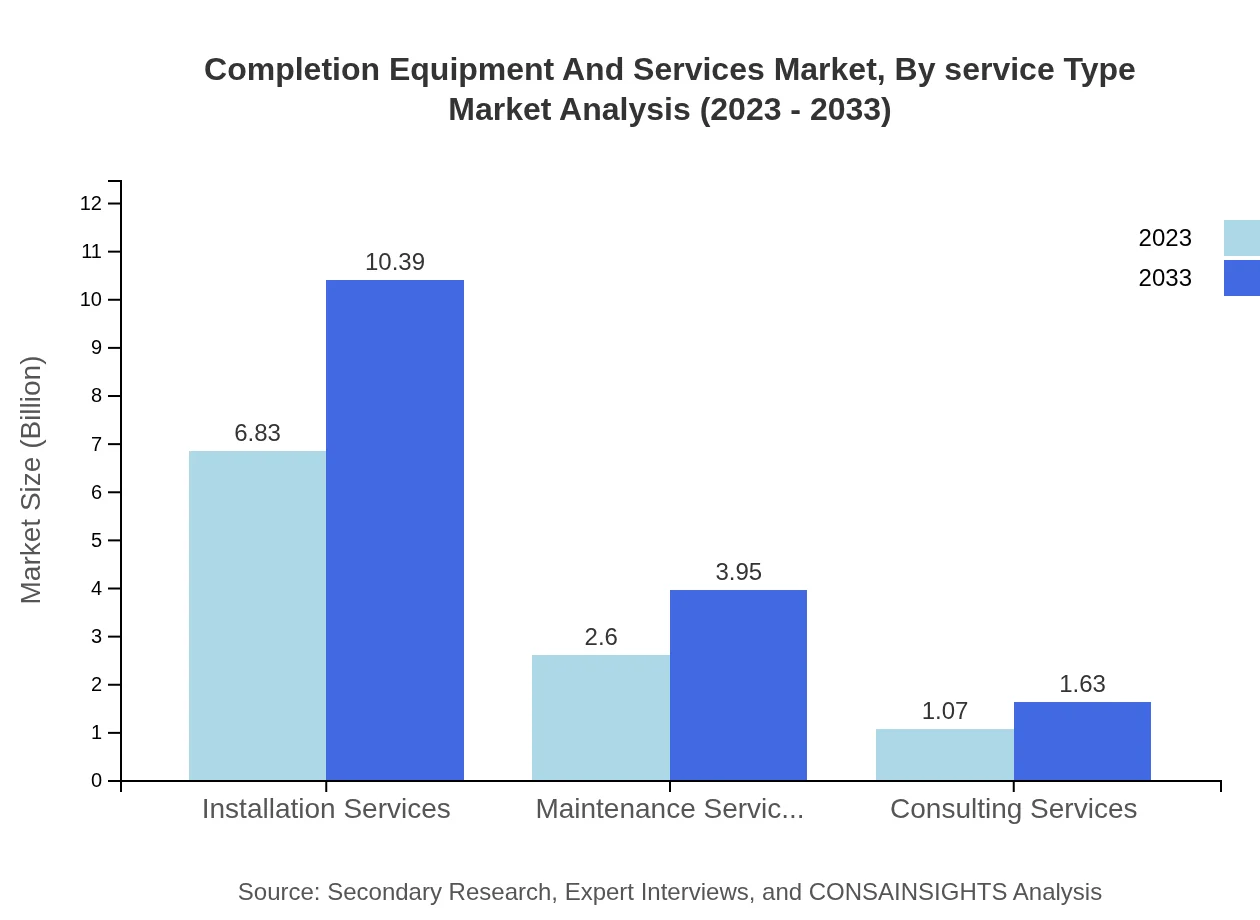

Completion Equipment And Services Market Analysis By Service Type

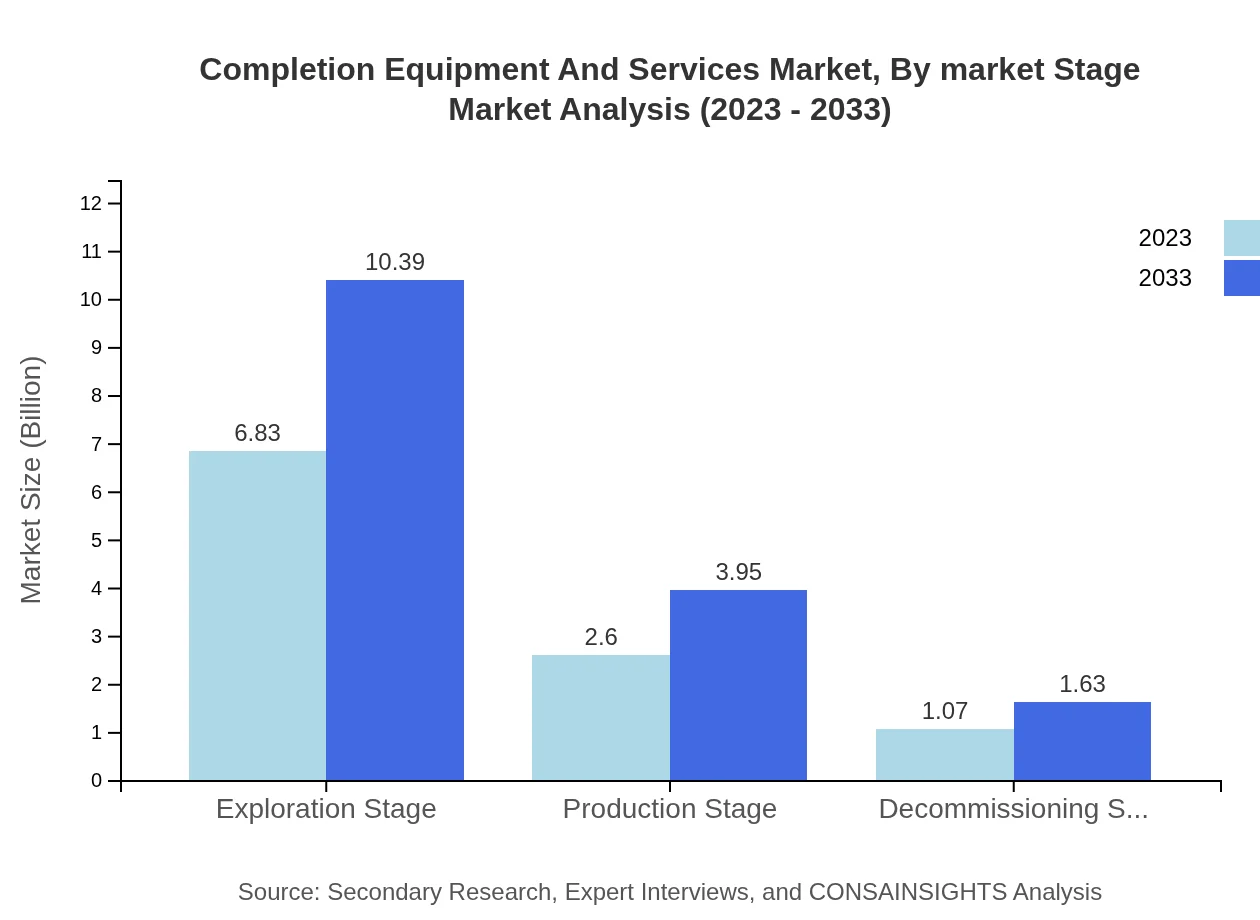

Installation and maintenance services dominate the market, with the installation segment valued at $6.83 billion in 2023, expecting to grow to $10.39 billion by 2033, retaining a robust 65.07% share. Similarly, the maintenance services segment will grow from $2.60 billion to $3.95 billion, comprising 24.73% of the market, illustrating how essential these services are across production stages.

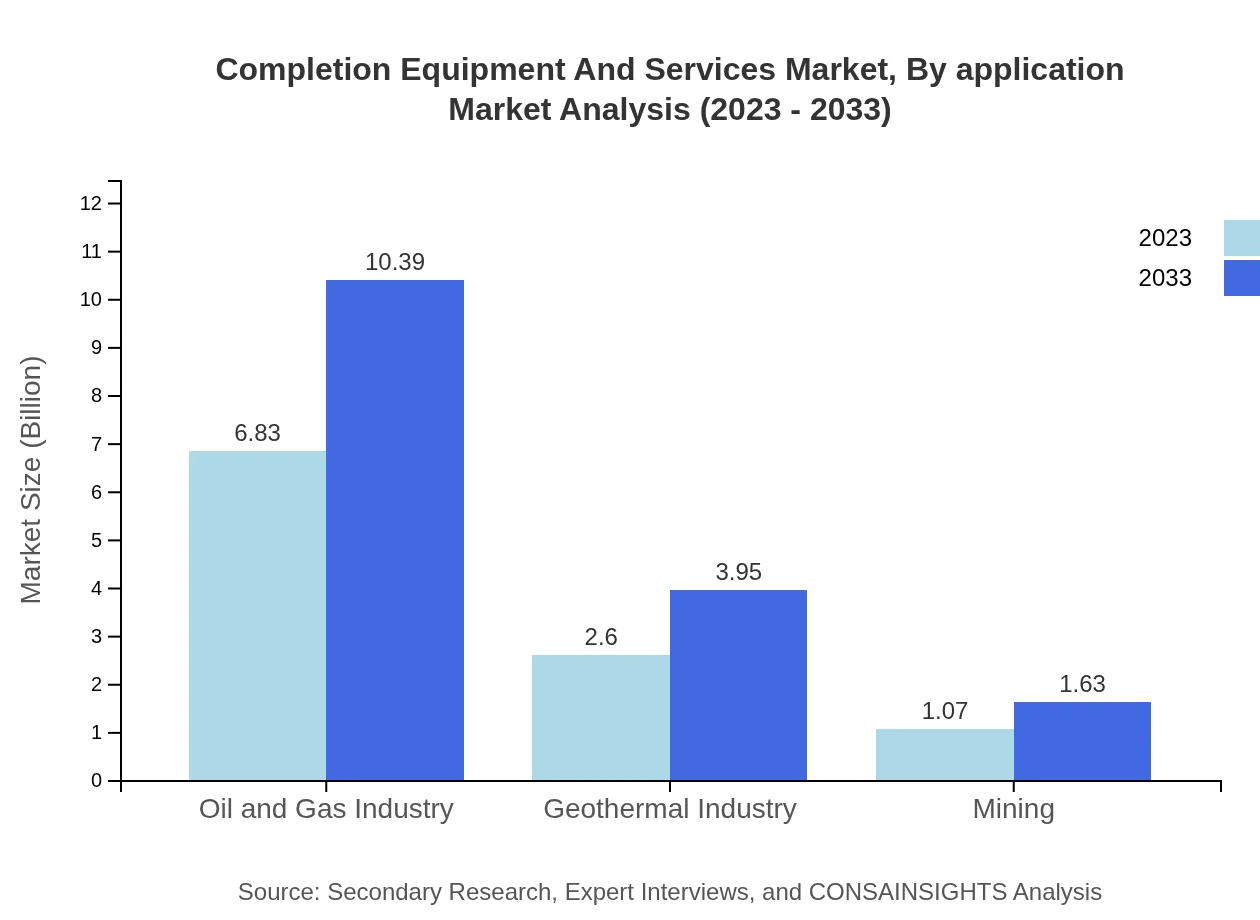

Completion Equipment And Services Market Analysis By Application

In applications, the oil and gas industry is significant, capturing a market size of $6.83 billion in 2023, projected to reach $10.39 billion by 2033 with a consistent 65.07% market share. The geothermal industry also plays a pivotal role, projected to grow from $2.60 billion to $3.95 billion by 2033, maintaining a 24.73% share.

Completion Equipment And Services Market Analysis By Technology

As technology advances, completion equipment and services leveraging AI and IoT are increasingly integrated, enhancing efficiency in drilling and completion processes. This segment is emerging steadily, presenting growth potential as companies shift towards automated systems.

Completion Equipment And Services Market Analysis By Market Stage

The market demonstrates a significant focus on exploration (65.07% market share) and production stages, projecting growth across these segments. The decommissioning stage shows moderate growth, fueled by aging fields and the need for responsible closure practices.

Completion Equipment And Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Completion Equipment And Services Industry

Schlumberger:

A leading global provider of technology for reservoir characterization, drilling, production, and processing to the oil and gas industry.Halliburton:

One of the world's largest provider of products and services to the energy industry, renowned for its innovative technologies in completion services.Baker Hughes:

A fullstream energy technology company that provides integrated oilfield products, data analytics, and advanced completion techniques.Weatherford International:

Known for its expertise in providing equipment and services for drilling, evaluation, completion, production, and intervention.We're grateful to work with incredible clients.

FAQs

What is the market size of completion equipment and services?

The completion equipment and services market is valued at approximately $10.5 billion in 2023, with an anticipated CAGR of 4.2% from 2023 to 2033, indicating steady growth in demand for these services as the industry evolves.

What are the key market players or companies in the completion equipment and services industry?

Key players in the completion equipment and services market include leading oil and gas firms, equipment manufacturers, and service providers dedicated to enhancing drilling efficiency, optimizing resource production, and leveraging innovational technologies to outperform market competitors.

What are the primary factors driving the growth in the completion equipment and services industry?

Growth drivers include rising global energy demand, technological advancements in drilling and completion techniques, enhanced operational efficiencies, and increased investments in oil and gas exploration and production activities contributing to sustaining market expansion.

Which region is the fastest Growing in the completion equipment and services?

The fastest-growing region is projected to be Europe, increasing from $3.81 billion in 2023 to $5.79 billion by 2033, reflecting significant investments and expansion in completion services across diverse energy projects in the region.

Does ConsaInsights provide customized market report data for the completion equipment and services industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, allowing stakeholders to gain insights into market dynamics, competitive landscape, and opportunities relevant to the completion equipment and services industry.

What deliverables can I expect from this completion equipment and services market research project?

Deliverables include detailed market analysis, forecasts, comprehensive reports on regional trends, competitive intelligence, and segmented data across various completion service stages, providing a holistic understanding of market dynamics.

What are the market trends of completion equipment and services?

Current trends indicate a shift towards modern technologies, increased focus on sustainability, rapid digital transformation, and a growing emphasis on customized solutions for diverse sectors, prominently in oil and gas and geothermal industries.