Complex Percutaneous Coronary Intervention Market Report

Published Date: 31 January 2026 | Report Code: complex-percutaneous-coronary-intervention

Complex Percutaneous Coronary Intervention Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Complex Percutaneous Coronary Intervention market, offering a detailed analysis of market size, growth, segmentation, and competitive landscape from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

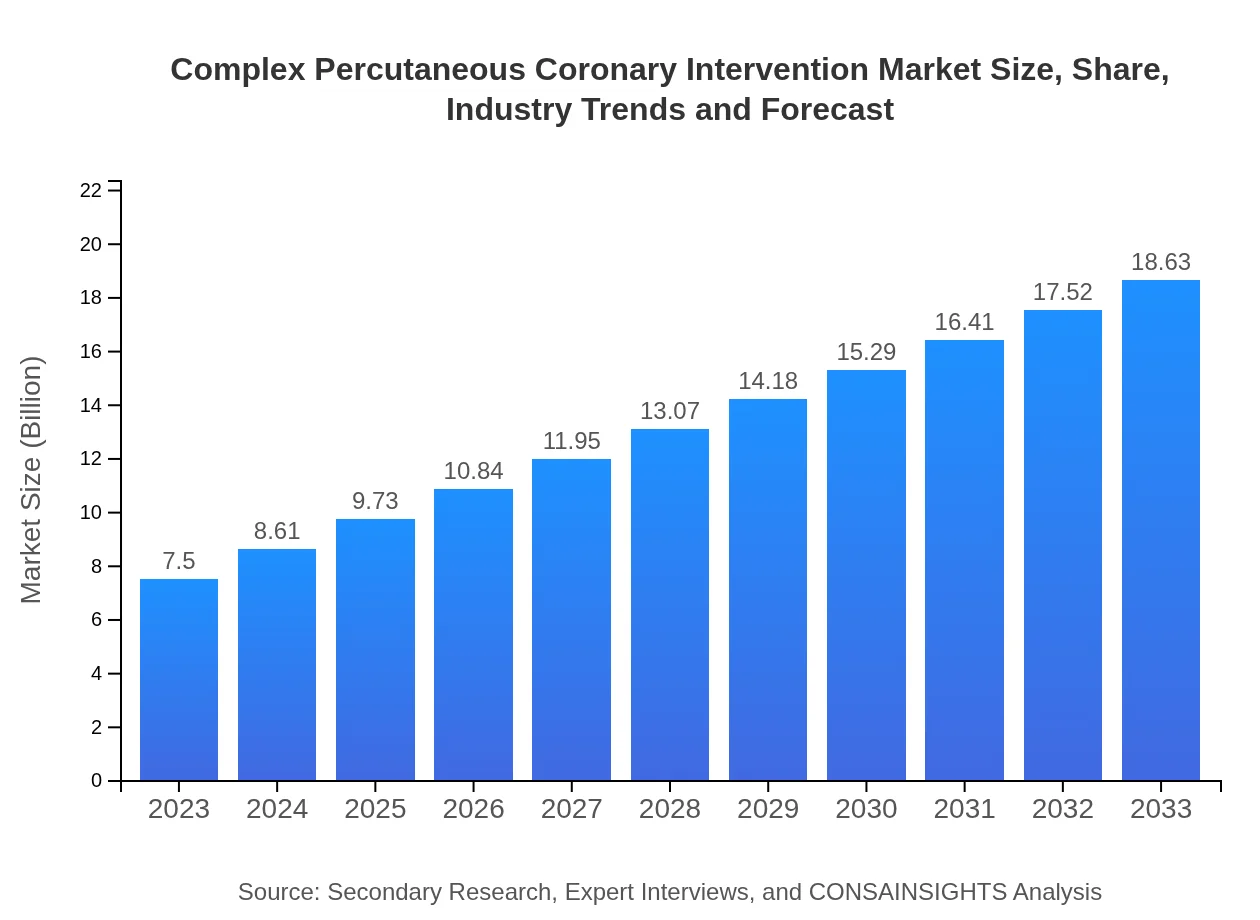

| 2023 Market Size | $7.50 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $18.63 Billion |

| Top Companies | Medtronic , Boston Scientific, Abbott Laboratories, B. Braun Melsungen AG, Terumo Corporation |

| Last Modified Date | 31 January 2026 |

Complex Percutaneous Coronary Intervention Market Overview

Customize Complex Percutaneous Coronary Intervention Market Report market research report

- ✔ Get in-depth analysis of Complex Percutaneous Coronary Intervention market size, growth, and forecasts.

- ✔ Understand Complex Percutaneous Coronary Intervention's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Complex Percutaneous Coronary Intervention

What is the Market Size & CAGR of Complex Percutaneous Coronary Intervention market in 2023?

Complex Percutaneous Coronary Intervention Industry Analysis

Complex Percutaneous Coronary Intervention Market Segmentation and Scope

Tell us your focus area and get a customized research report.

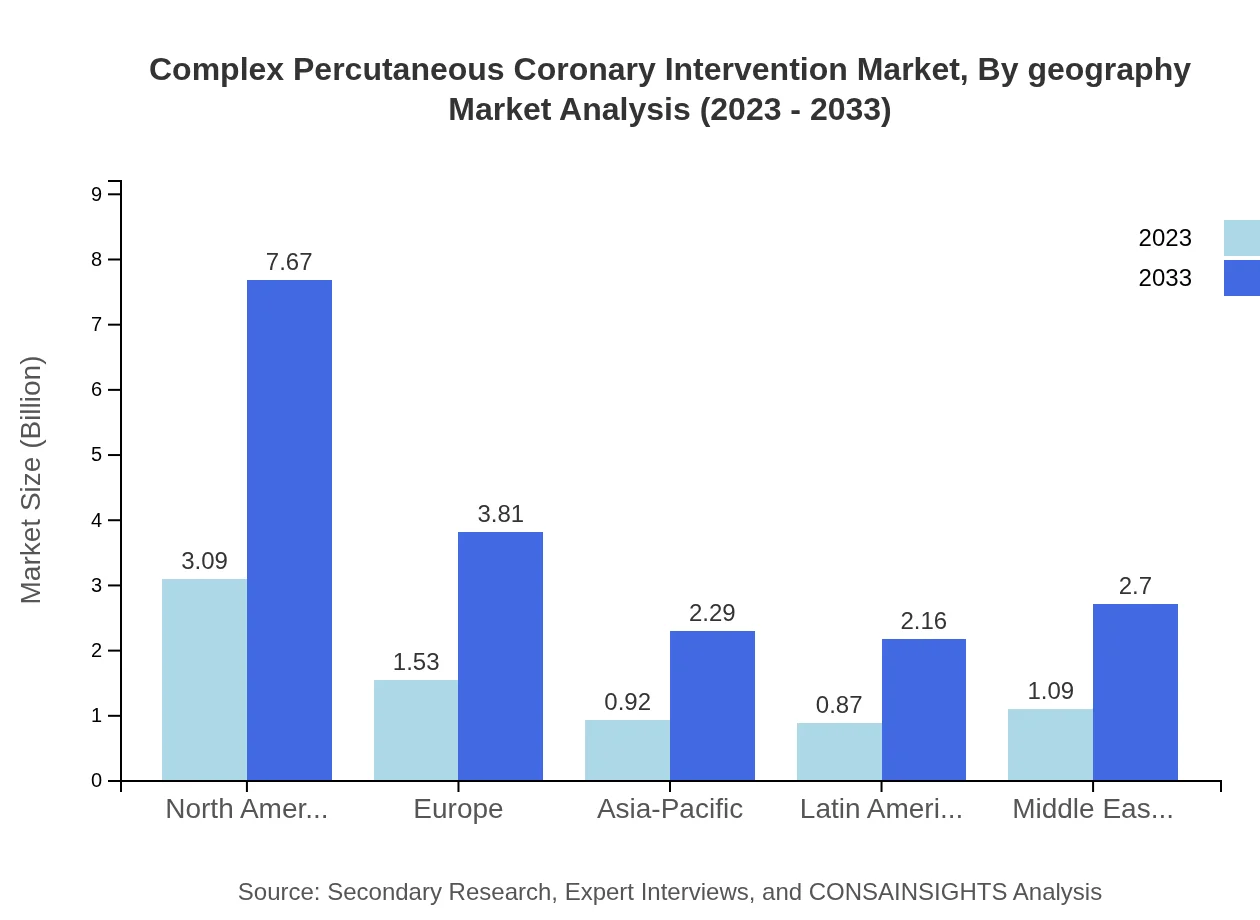

Complex Percutaneous Coronary Intervention Market Analysis Report by Region

Europe Complex Percutaneous Coronary Intervention Market Report:

The European CPCI market is anticipated to grow from USD 2.41 billion in 2023 to USD 5.98 billion by 2033. Health initiatives and increasing investments towards healthcare infrastructure in Eastern Europe are significant contributors to this growth.Asia Pacific Complex Percutaneous Coronary Intervention Market Report:

The Asia-Pacific region presents significant growth opportunities for the CPCI market, projected to expand from USD 1.48 billion in 2023 to USD 3.67 billion by 2033. Factors contributing to this growth include the rise of cardiovascular diseases, improved healthcare infrastructure, and increasing patient awareness about heart health.North America Complex Percutaneous Coronary Intervention Market Report:

North America remains the largest market for CPCI, with a forecasted increase from USD 2.45 billion in 2023 to USD 6.08 billion by 2033. This region benefits from high prevalence rates of cardiovascular diseases and robust reimbursement frameworks that facilitate access to high-quality care.South America Complex Percutaneous Coronary Intervention Market Report:

In South America, the CPCI market is also on the rise, expected to grow from USD 0.26 billion in 2023 to USD 0.65 billion by 2033. Growing access to advanced medical technologies and supportive government initiatives aimed at improving healthcare access are propelling this growth.Middle East & Africa Complex Percutaneous Coronary Intervention Market Report:

The CPCI market in the Middle East and Africa is projected to grow from USD 0.91 billion in 2023 to USD 2.25 billion by 2033, driven by increasing healthcare expenditure and modernization of healthcare facilities in the region.Tell us your focus area and get a customized research report.

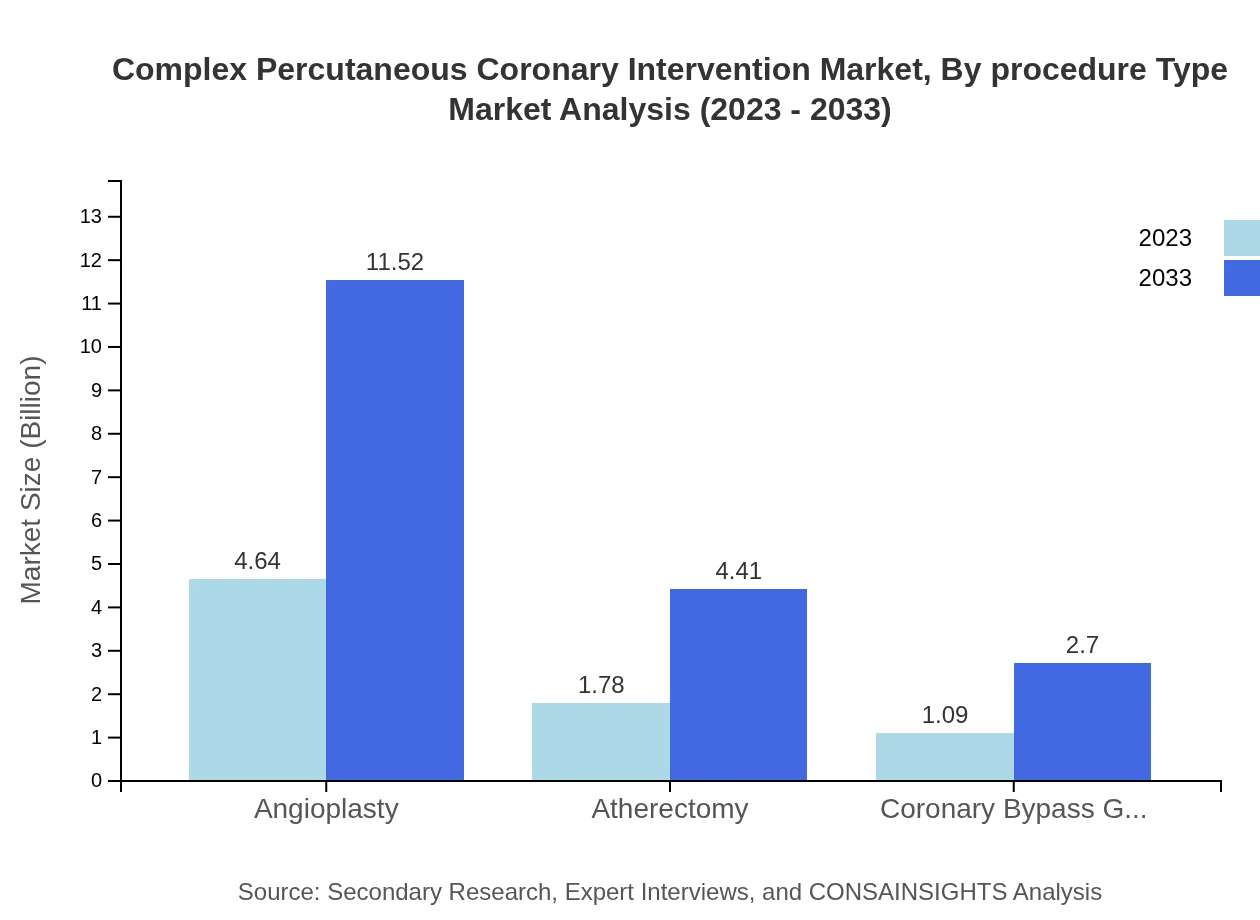

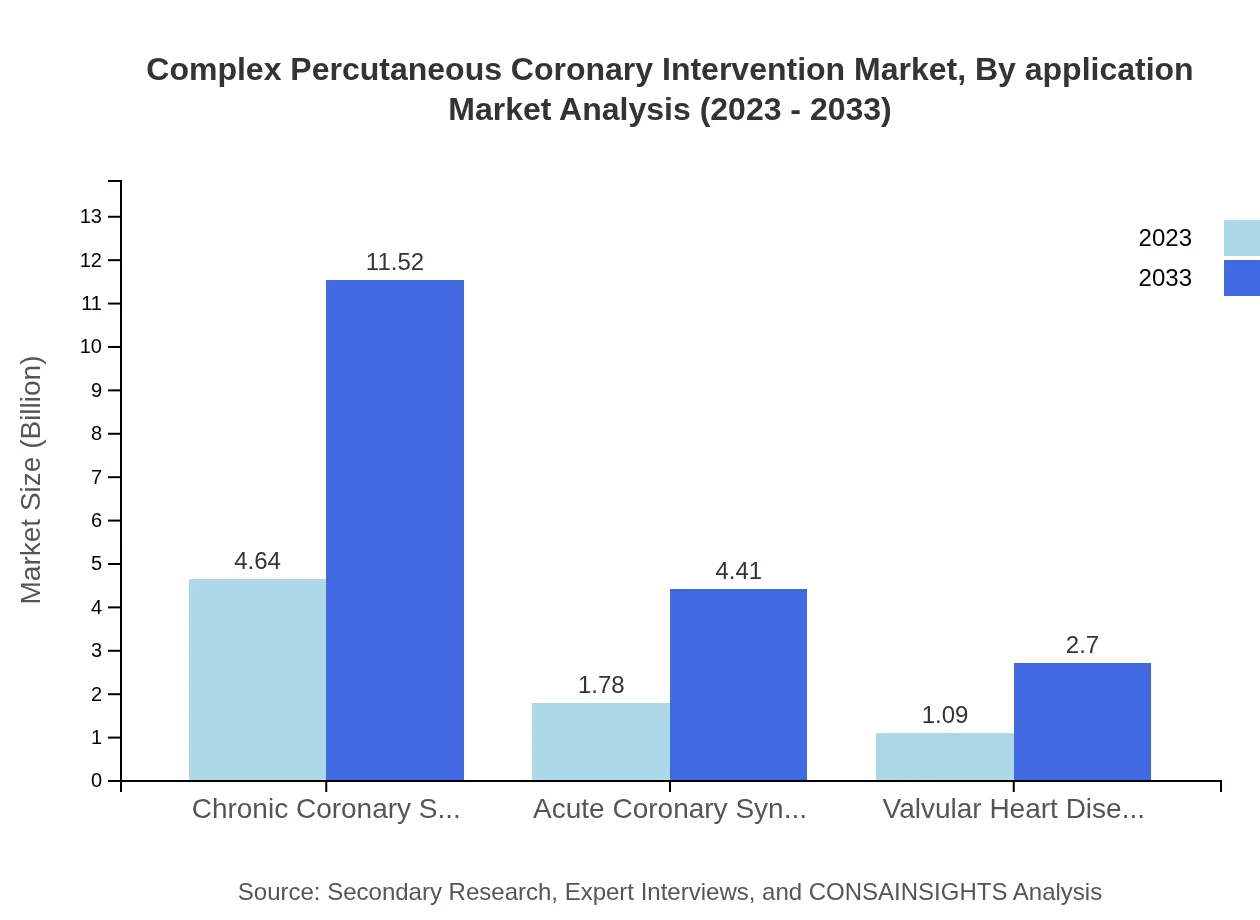

Complex Percutaneous Coronary Intervention Market Analysis By Procedure Type

The procedure type segment is dominated by Chronic Coronary Syndrome, valued at USD 4.64 billion in 2023 and expected to reach USD 11.52 billion by 2033, constituting 61.81% of the market share. Acute Coronary Syndrome follows, showing significant growth as awareness of acute medical interventions improves. Innovations in techniques such as angioplasty and atherectomy continue to drive this segment.

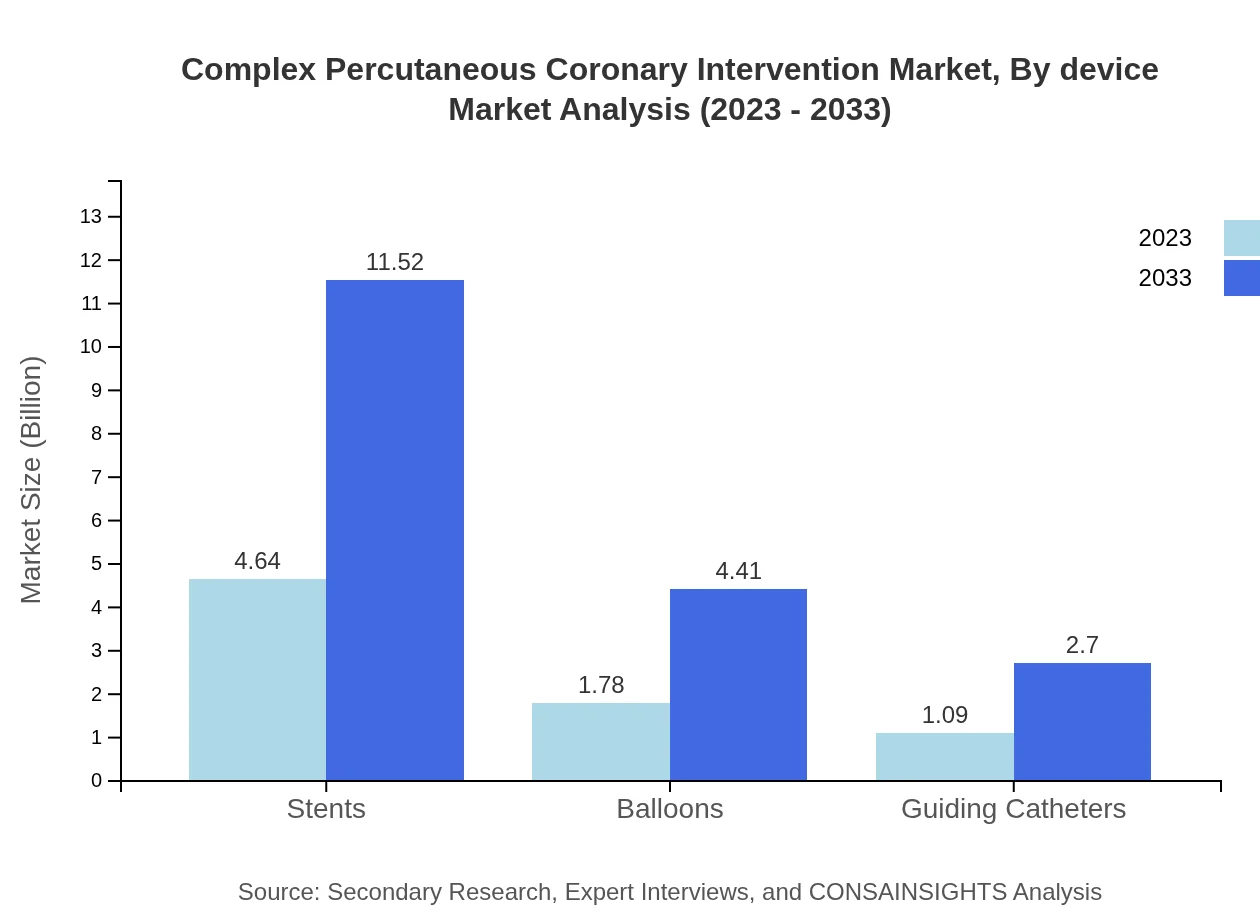

Complex Percutaneous Coronary Intervention Market Analysis By Device

In the device segment, stents hold the largest market value of USD 4.64 billion in 2023, projected to reach USD 11.52 billion by 2033, showcasing their critical role in CPCI. Balloons and guiding catheters also play significant roles, comprising substantial shares as the demand for effective and reliable devices rises within the industry.

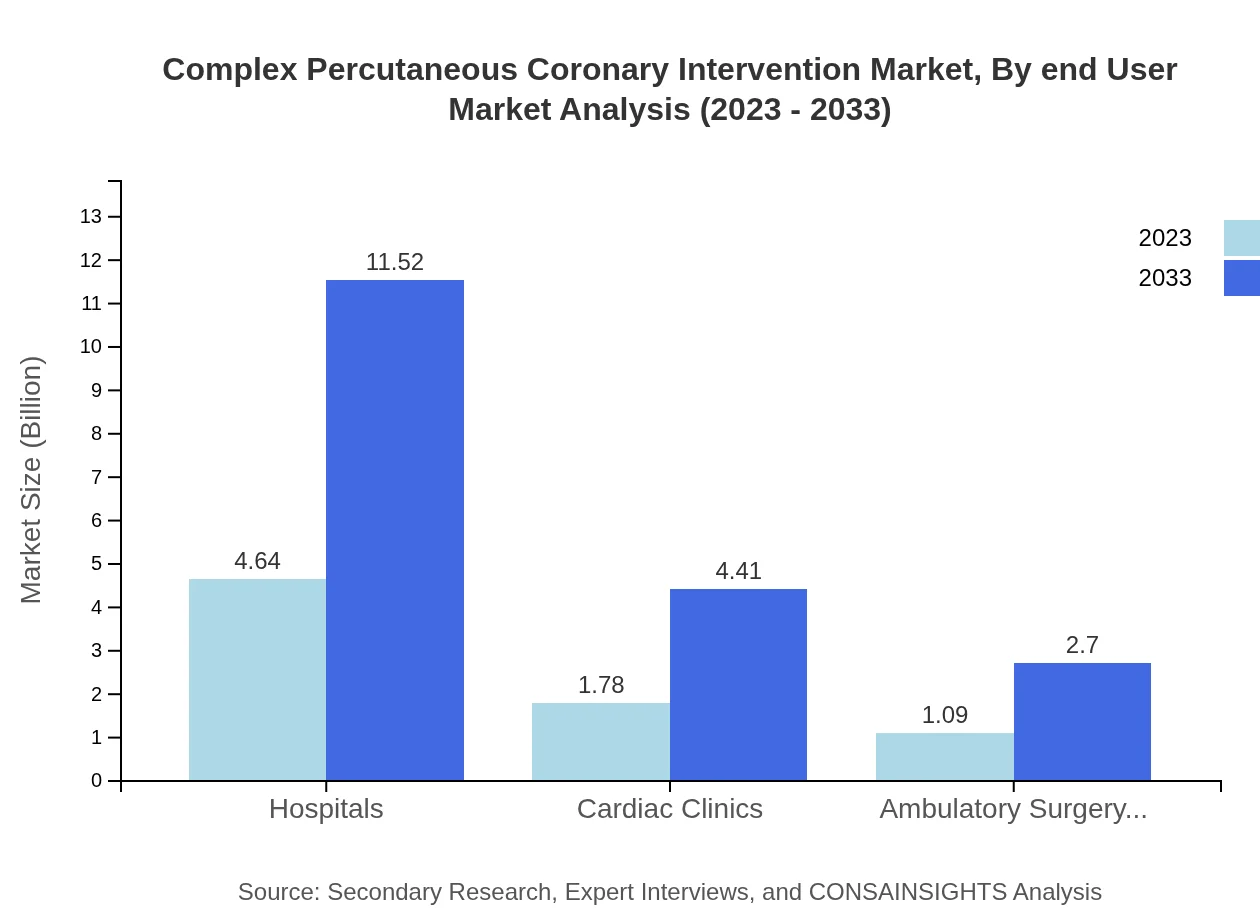

Complex Percutaneous Coronary Intervention Market Analysis By End User

The end-user segment, led by hospitals, is expected to account for USD 4.64 billion in 2023, with projections of USD 11.52 billion by 2033. Cardiac clinics and ambulatory surgery centers also occupy noteworthy positions in the market, reflecting trends towards specialized care and out-patient services.

Complex Percutaneous Coronary Intervention Market Analysis By Geography

Regional performances vary significantly, with North America dominating the market share. Europe and Asia-Pacific regions present robust growth opportunities driven by technological advancements and investments in healthcare infrastructure.

Complex Percutaneous Coronary Intervention Market Analysis By Application

Applications for CPCI include treating chronic and acute coronary syndromes. Each application showcases varying growth rates and market potential, with innovation being the primary driver for successful interventions.

Complex Percutaneous Coronary Intervention Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Complex Percutaneous Coronary Intervention Industry

Medtronic :

A leading provider of medical technology solutions, Medtronic is at the forefront of developing innovative devices for cardiovascular interventions.Boston Scientific:

A global leader in medical devices, Boston Scientific offers a range of advanced products and technologies for the treatment of heart diseases.Abbott Laboratories:

Abbott specializes in various healthcare products, including stents and diagnostic equipment crucial for complex percutaneous interventions.B. Braun Melsungen AG:

Known for its medical and pharmaceutical products, B. Braun is influential in cardiovascular therapy solutions.Terumo Corporation:

Focusing on innovative healthcare solutions, Terumo Corporation produces devices and products vital for complex coronary interventions.We're grateful to work with incredible clients.

FAQs

What is the market size of complex Percutaneous Coronary Intervention?

The global market for complex percutaneous coronary intervention is valued at approximately $7.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 9.2% during the forecast period, indicating robust growth and increasing demand.

What are the key market players or companies in this complex Percutaneous Coronary Intervention industry?

Key players in the complex percutaneous coronary intervention market include leading medical device manufacturers and healthcare organizations specializing in cardiac care, with a focus on innovation and improving patient outcomes in coronary interventions.

What are the primary factors driving the growth in the complex Percutaneous Coronary Intervention industry?

Growth in the complex percutaneous coronary intervention market is driven by an aging population, rising prevalence of cardiovascular diseases, technological advancements, and increased awareness and accessibility to advanced cardiac therapies.

Which region is the fastest Growing in the complex Percutaneous Coronary Intervention?

The Asia-Pacific region is identified as the fastest-growing area in the complex percutaneous coronary intervention market, expected to grow from $1.48 billion in 2023 to $3.67 billion by 2033, due to increasing healthcare investments and higher rates of heart diseases.

Does ConsaInsights provide customized market report data for the complex Percutaneous Coronary Intervention industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the complex percutaneous coronary intervention industry, focusing on detailed analysis, regional insights, and competitive landscapes.

What deliverables can I expect from this complex Percutaneous Coronary Intervention market research project?

Deliverables from the complex percutaneous coronary intervention market research project typically include comprehensive reports, market forecasts, segmentation analyses, competitive landscape studies, and actionable insights.”},{