Compound Chocolate Market Report

Published Date: 31 January 2026 | Report Code: compound-chocolate

Compound Chocolate Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Compound Chocolate market from 2023 to 2033. It includes insights into market size, growth rates, regional trends, industry analysis, and future forecasts, delivering valuable data for stakeholders in the chocolate industry.

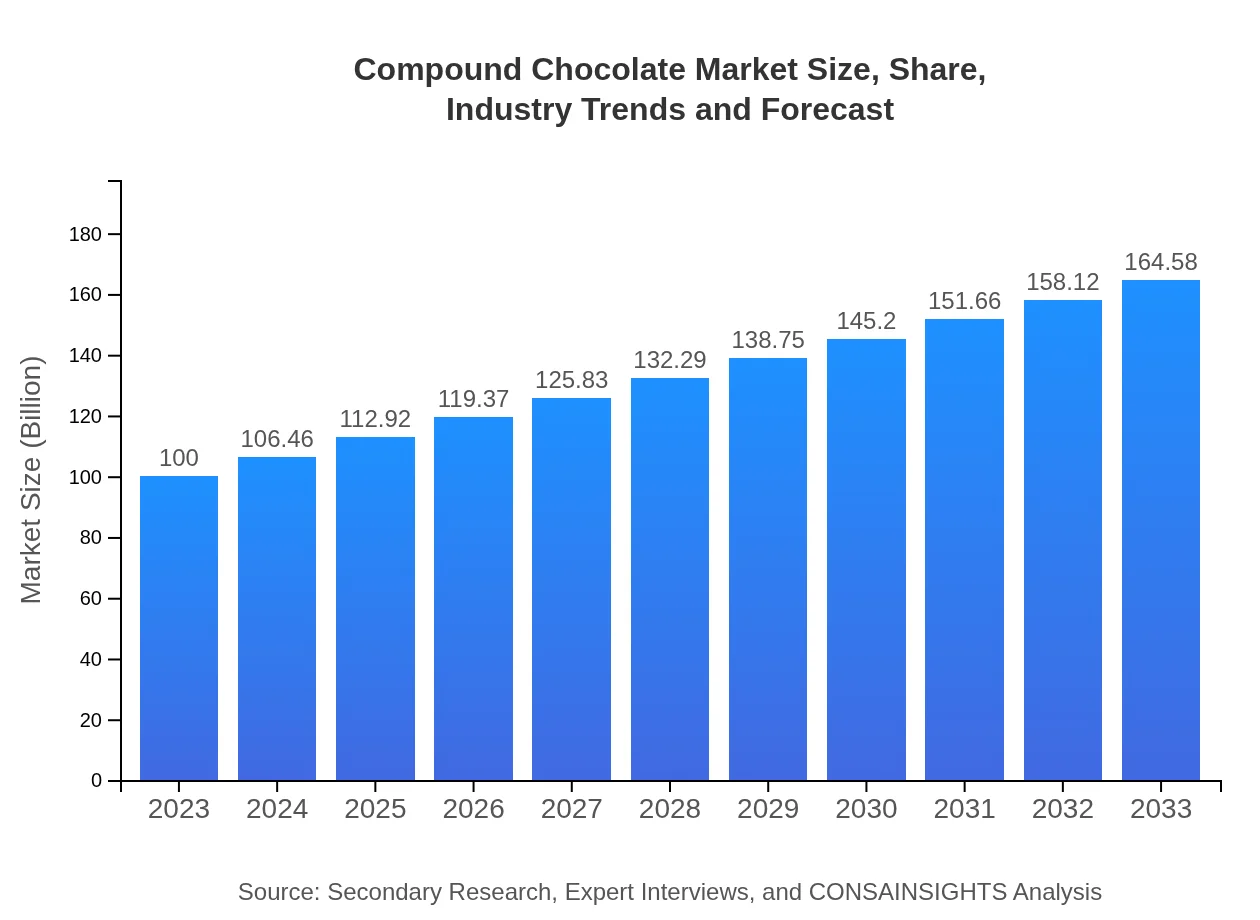

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Barry Callebaut, Cargill , Cocoa Supply, Nestlé |

| Last Modified Date | 31 January 2026 |

Compound Chocolate Market Overview

Customize Compound Chocolate Market Report market research report

- ✔ Get in-depth analysis of Compound Chocolate market size, growth, and forecasts.

- ✔ Understand Compound Chocolate's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Compound Chocolate

What is the Market Size & CAGR of Compound Chocolate market in 2023?

Compound Chocolate Industry Analysis

Compound Chocolate Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Compound Chocolate Market Analysis Report by Region

Europe Compound Chocolate Market Report:

Europe holds a significant share in the Compound Chocolate market, with a valuation of $30.29 million in 2023 and a forecast of $49.85 million by 2033. The demand is propelled by high consumption rates and a diverse portfolio of baked goods and confectionery. Trends toward premium chocolate products and sustainable sourcing practices are notable growth drivers.Asia Pacific Compound Chocolate Market Report:

In 2023, the Compound Chocolate market in Asia Pacific is valued at approximately $20.03 million, set to grow to $32.96 million by 2033. The region's growth is driven by a surge in confectionery product demand and a rapidly expanding retail sector. Increasing western influence on snacking habits and the rising preference for chocolate-based desserts further enhance the market's prospects.North America Compound Chocolate Market Report:

In North America, the Compound Chocolate market reached an estimated $34.54 million in 2023, projected to elevate to $56.84 million by 2033. The region shows strong preference for compound chocolate in confectionery and baking, coupled with an increase in health-conscious product offerings that drive innovative formulations. The rise of online sales further supports expansion.South America Compound Chocolate Market Report:

The South American market for Compound Chocolate in 2023 stands at around $6.84 million, with projections indicating an increase to $11.26 million by 2033. Factors such as enhancing bakery goods and the demand for affordable chocolate options contribute to this growth. Market entrants are focusing on localized preferences to achieve better penetration and acceptance.Middle East & Africa Compound Chocolate Market Report:

The Compound Chocolate market in the Middle East and Africa is expected to grow from $8.30 million in 2023 to $13.66 million by 2033. Increasing urbanization, rising disposable income, and changing dietary preferences are encouraging market growth. Expanding retail chains and the introduction of diverse products contribute positively to the regional dynamics.Tell us your focus area and get a customized research report.

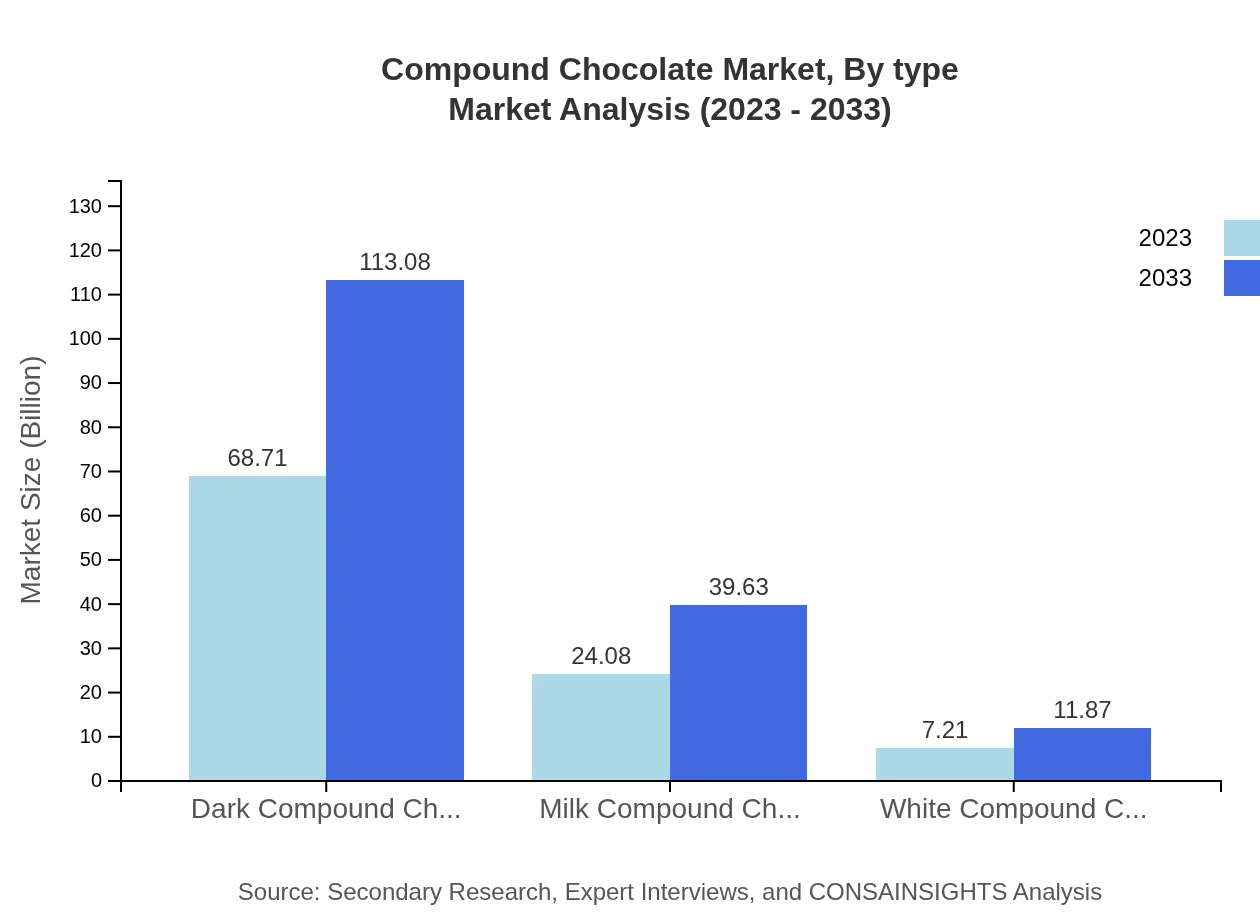

Compound Chocolate Market Analysis By Type

The Compound Chocolate market is segmented into dark, milk, and white types. Dark Compound Chocolate led the market with a size of $68.71 million in 2023, projected to reach $113.08 million by 2033, owing to its widespread use in gourmet and specialty products. Milk Compound Chocolate follows with a market size of $24.08 million in 2023, growing to $39.63 million by 2033, favored for its sweeter profile. White Compound Chocolate, despite being a niche, is also expected to increase from $7.21 million in 2023 to $11.87 million by 2033.

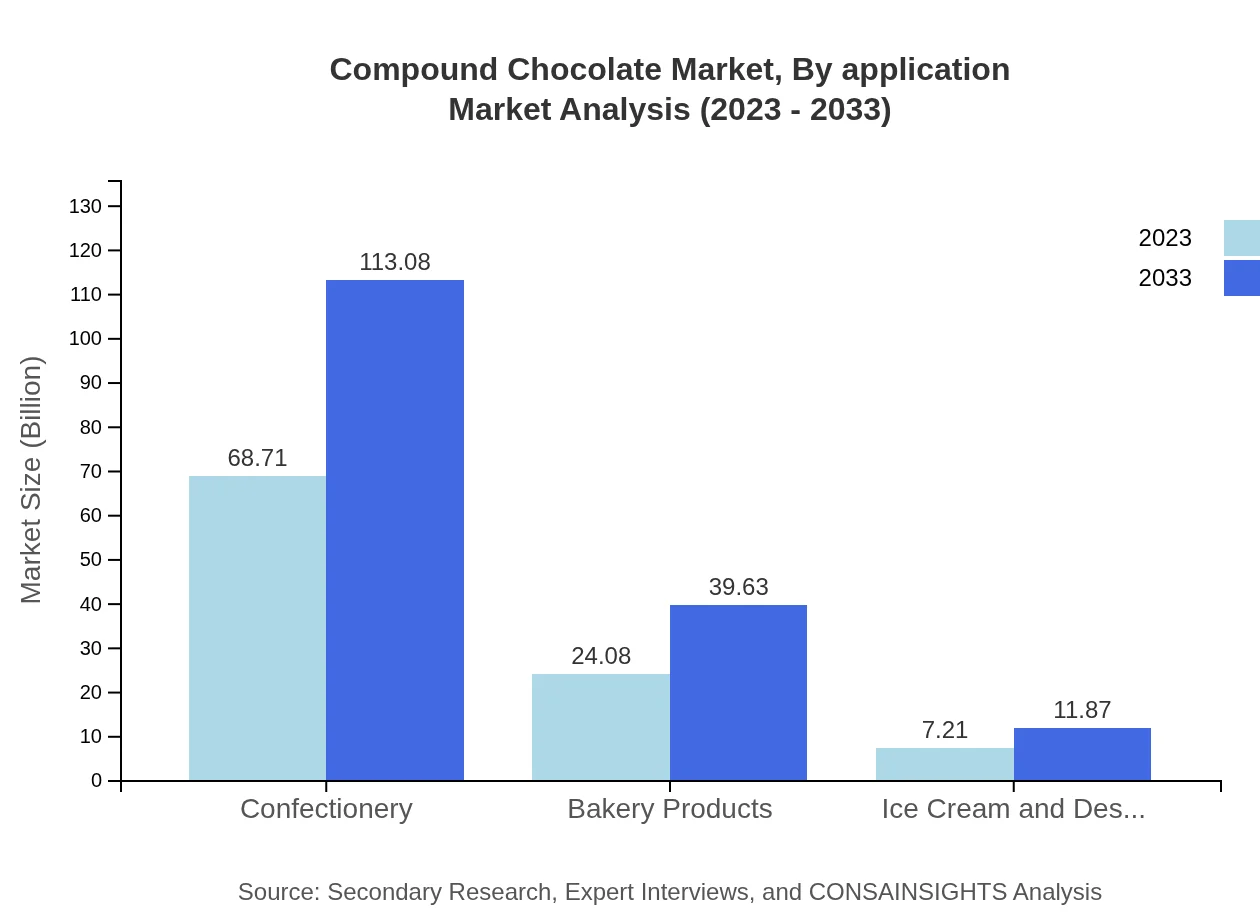

Compound Chocolate Market Analysis By Application

In terms of applications, the Compound Chocolate market primarily caters to confectionery, food service, bakery products, and ice cream. The confectionery segment dominates with a market size of $68.71 million in 2023, projected to grow to $113.08 million by 2033, signifying strong consumer preference for chocolate snacks. Bakery products represent another significant segment, moving from $24.08 million in 2023 to $39.63 million by 2033, driven by product innovations and seasonal demand.

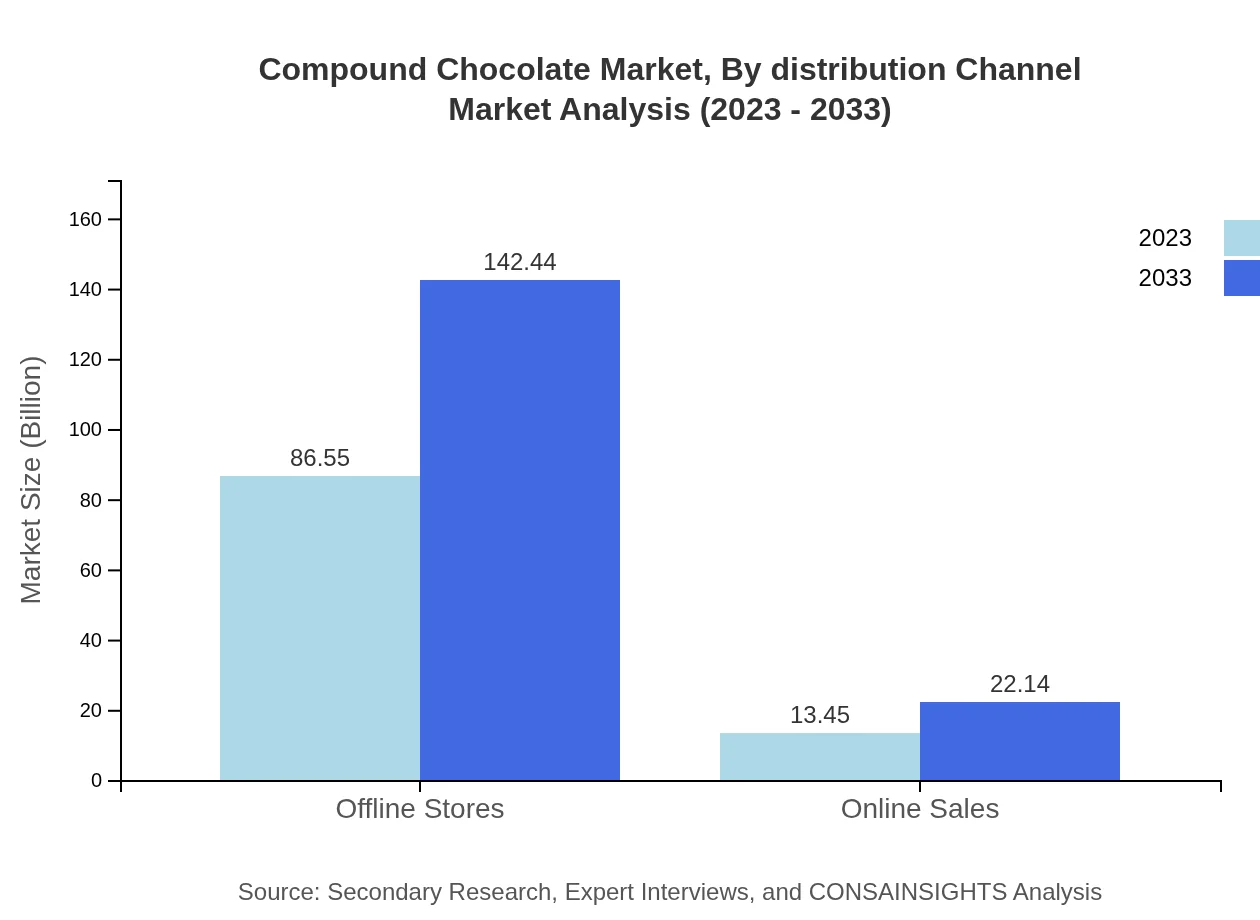

Compound Chocolate Market Analysis By Distribution Channel

The market is divided into online and offline distribution channels. Offline stores are significant, with a size of $86.55 million in 2023, expanding to $142.44 million by 2033, as consumers often prefer purchasing in-person. Online sales, although smaller, are growing fast, from $13.45 million in 2023 to $22.14 million by 2033, due to the increasing preference for convenience and variety.

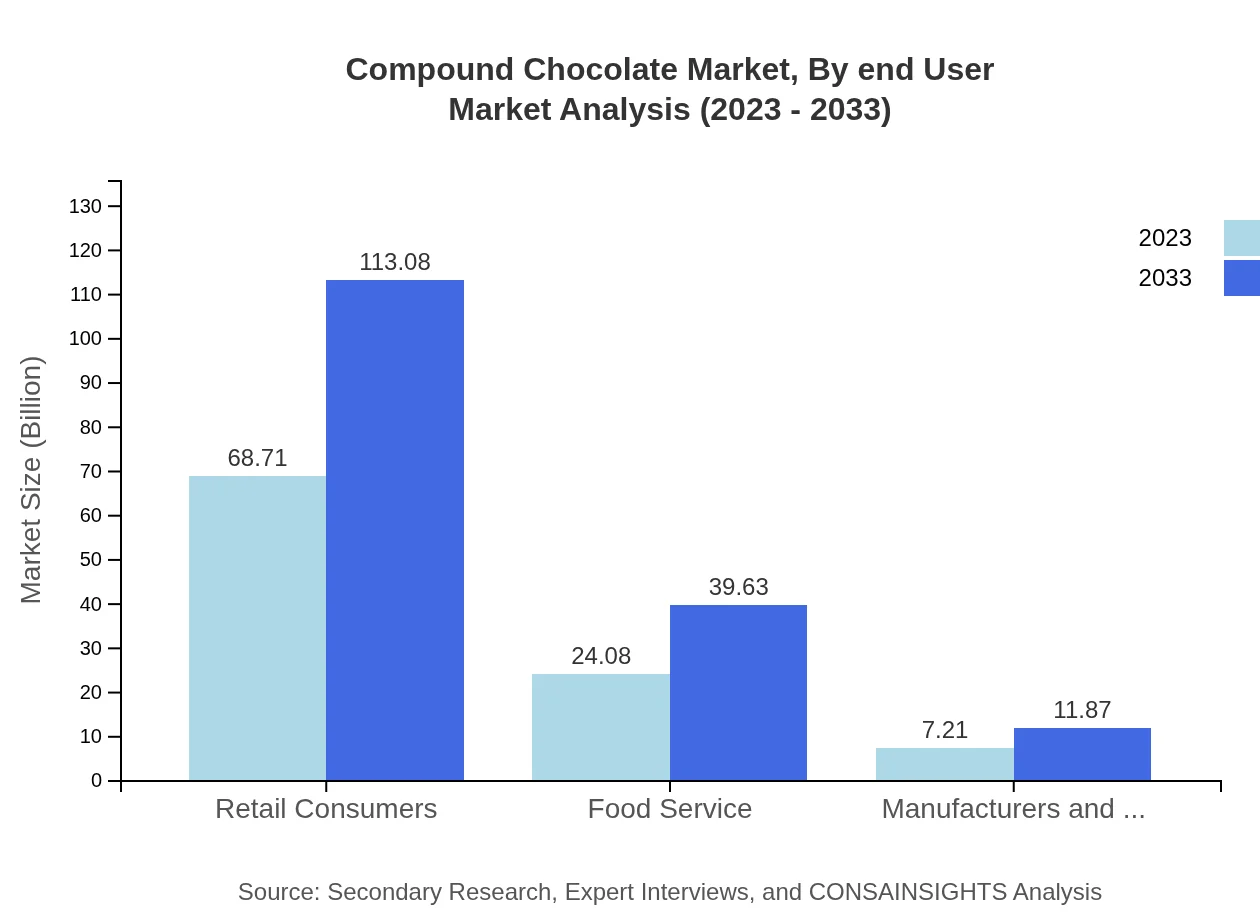

Compound Chocolate Market Analysis By End User

By end-user, the market serves retail consumers, food service providers, and manufacturers/processors. Retail consumers dominate with a size of $68.71 million in 2023 and projected growth to $113.08 million by 2033, driven by rising snacking trends. Food service follows, with a strong market of $24.08 million in 2023 set to expand to $39.63 million. Manufacturers and processors also contribute, starting at $7.21 million in 2023 and estimated at $11.87 million by 2033.

Compound Chocolate Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Compound Chocolate Industry

Barry Callebaut:

A leading global manufacturer of high-quality chocolate and cocoa products, Barry Callebaut is known for its commitment to sustainability and innovation in flavor and ingredient sourcing across its product lines.Cargill :

Cargill offers a comprehensive range of cocoa and chocolate products, emphasizing quality and sustainability. The company's commitment to cocoa farming initiatives greatly contributes to its reputation in the compound chocolate market.Cocoa Supply:

Cocoa Supply specializes in premium chocolate and cocoa products, serving the needs of artisan chocolate makers and food manufacturers, providing them with quality ingredients and expertise in the industry.Nestlé:

Nestlé ranks among the leading brands in confectionery and snacks, with a diverse portfolio that includes compound chocolate offerings meeting consumer preferences for quality and indulgence.We're grateful to work with incredible clients.

FAQs

What is the market size of compound Chocolate?

The global compound chocolate market is projected to reach $100 million in 2023, with a CAGR of 5% expected until 2033, signaling steady growth in demand and market expansion over the decade.

What are the key market players or companies in this compound Chocolate industry?

Key players in the compound chocolate market include major food manufacturers and confectionery brands that dominate the production and distribution of chocolate products, actively investing in new formulations and distribution channels.

What are the primary factors driving the growth in the compound chocolate industry?

Growth in the compound chocolate industry is propelled by increasing consumer demand for affordable chocolate alternatives, expanding applications in confectionery and bakery, and an overall shift towards innovative snack products.

Which region is the fastest Growing in the compound chocolate market?

North America is projected to be the fastest-growing region, with market size anticipated to increase from $34.54 million in 2023 to $56.84 million by 2033, reflecting a strong consumer preference for compound chocolate.

Does ConsaInsights provide customized market report data for the compound chocolate industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the compound chocolate industry, including detailed insights on market trends, consumer preferences, and competitive analysis.

What deliverables can I expect from this compound chocolate market research project?

Deliverables from the compound chocolate market research project include comprehensive reports, market forecasts, segmentation analysis, and regional insights, providing clients with actionable intelligence for strategic decisions.

What are the market trends of compound chocolate?

Current trends in the compound chocolate market include rising demand for dark and milk varieties, growth in online sales, and increasing use in food service and retail sectors, indicating evolving consumer preferences.